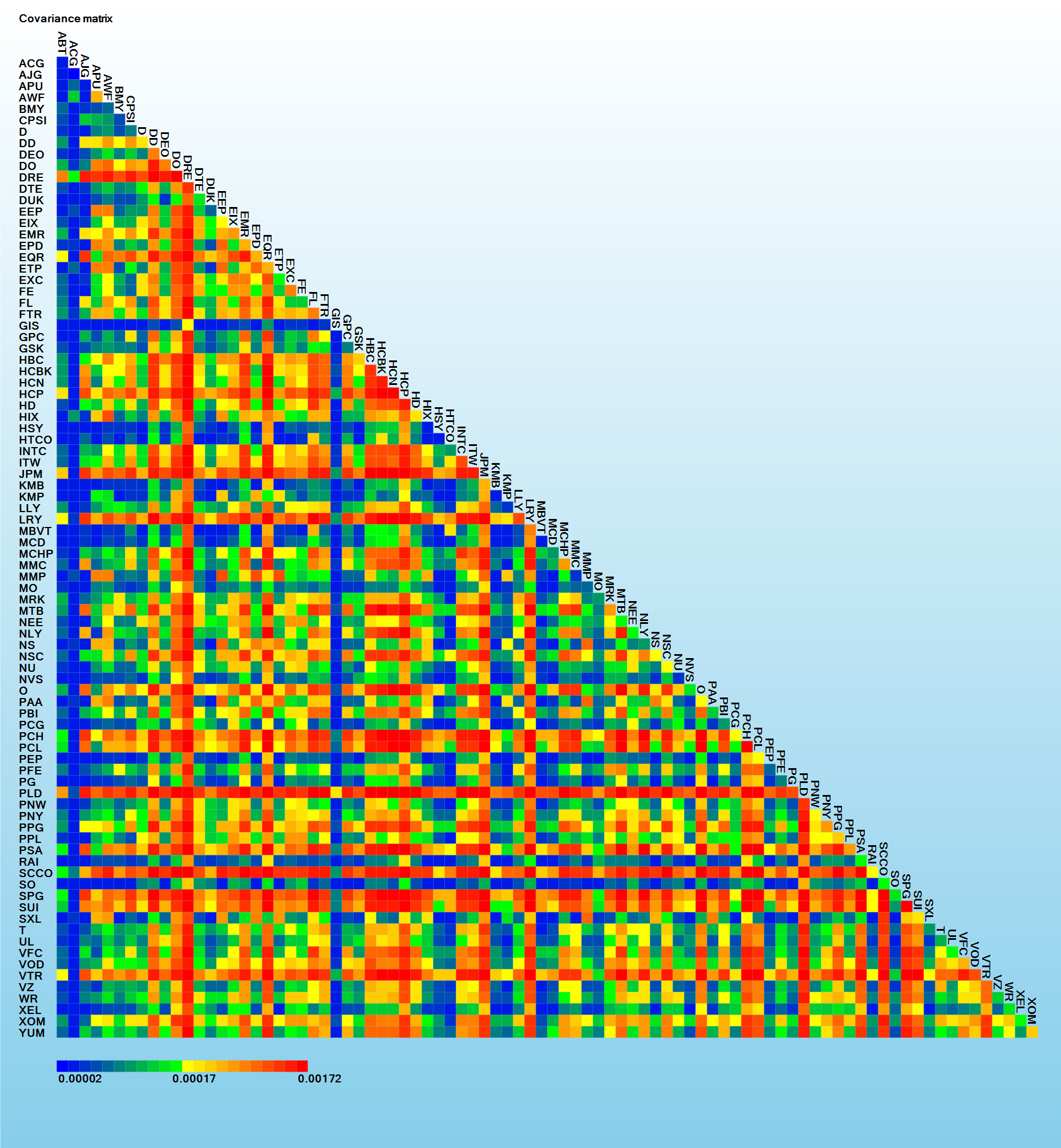

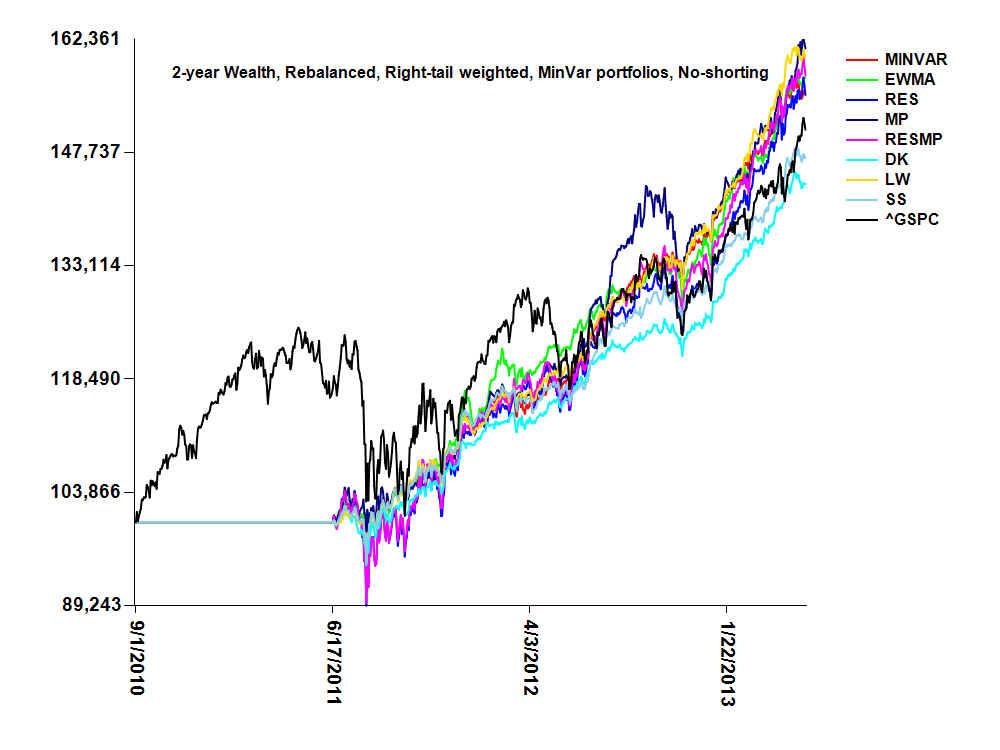

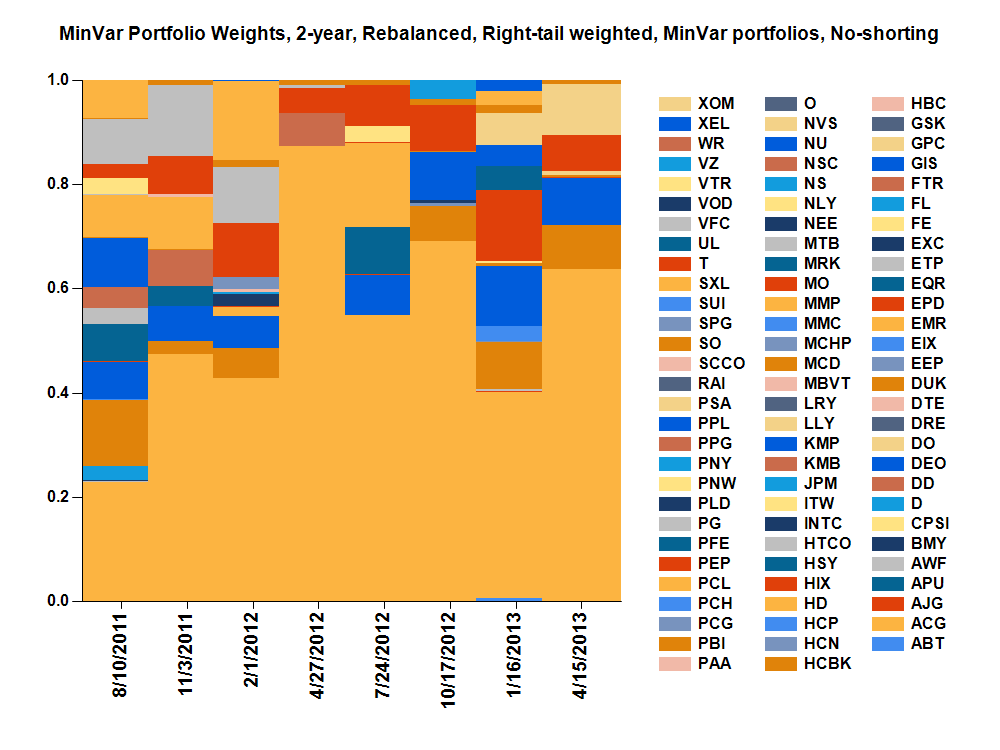

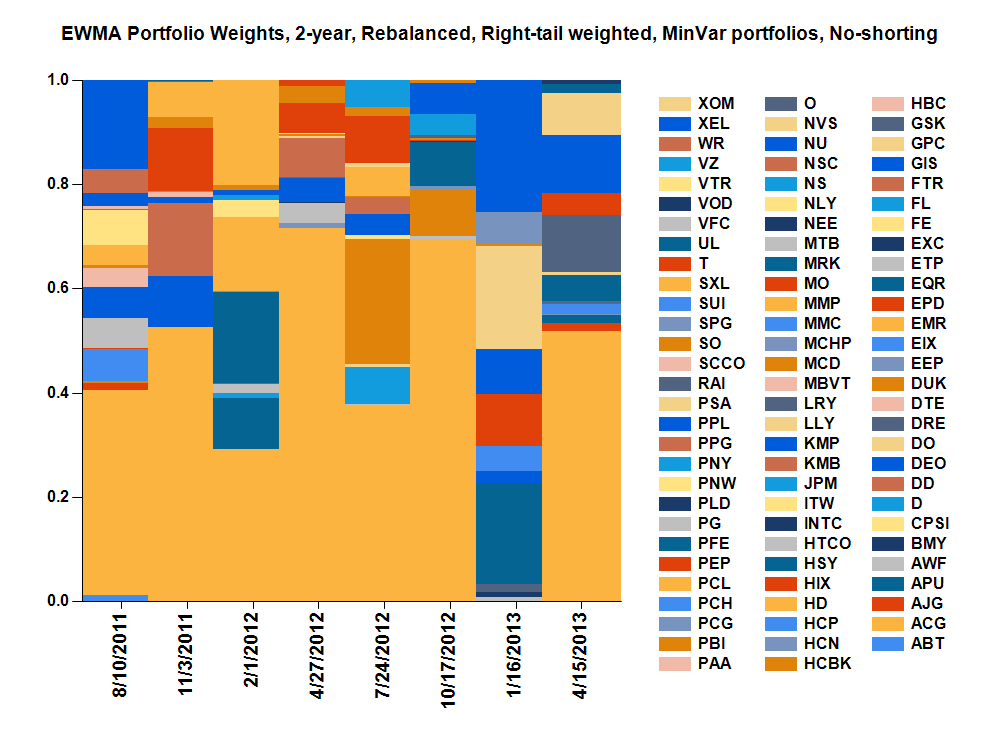

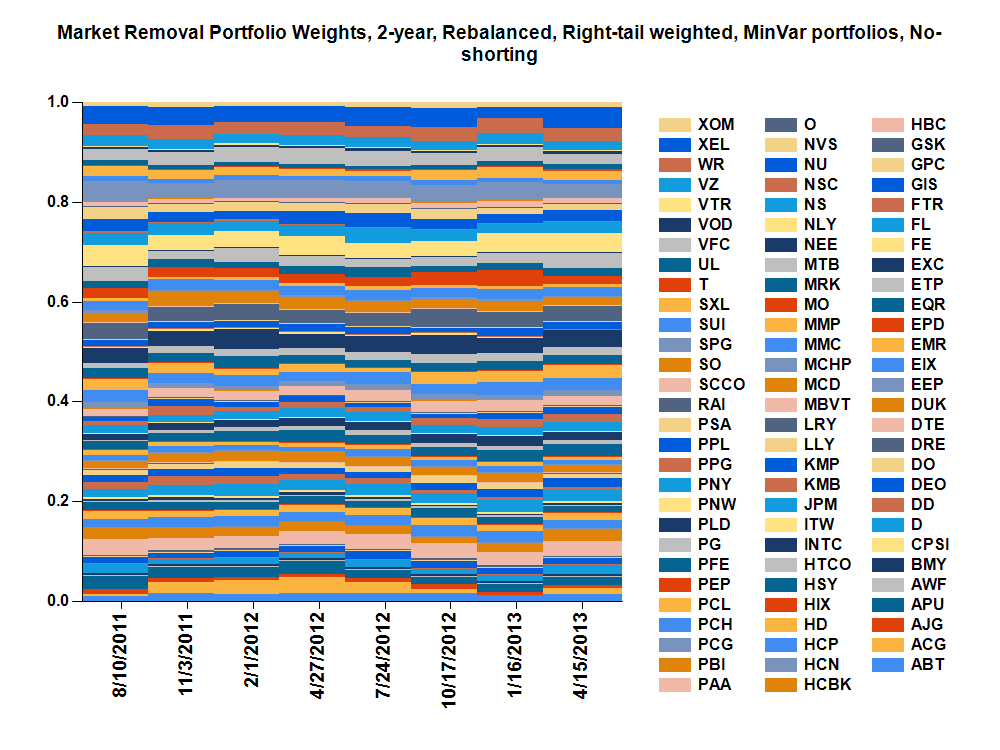

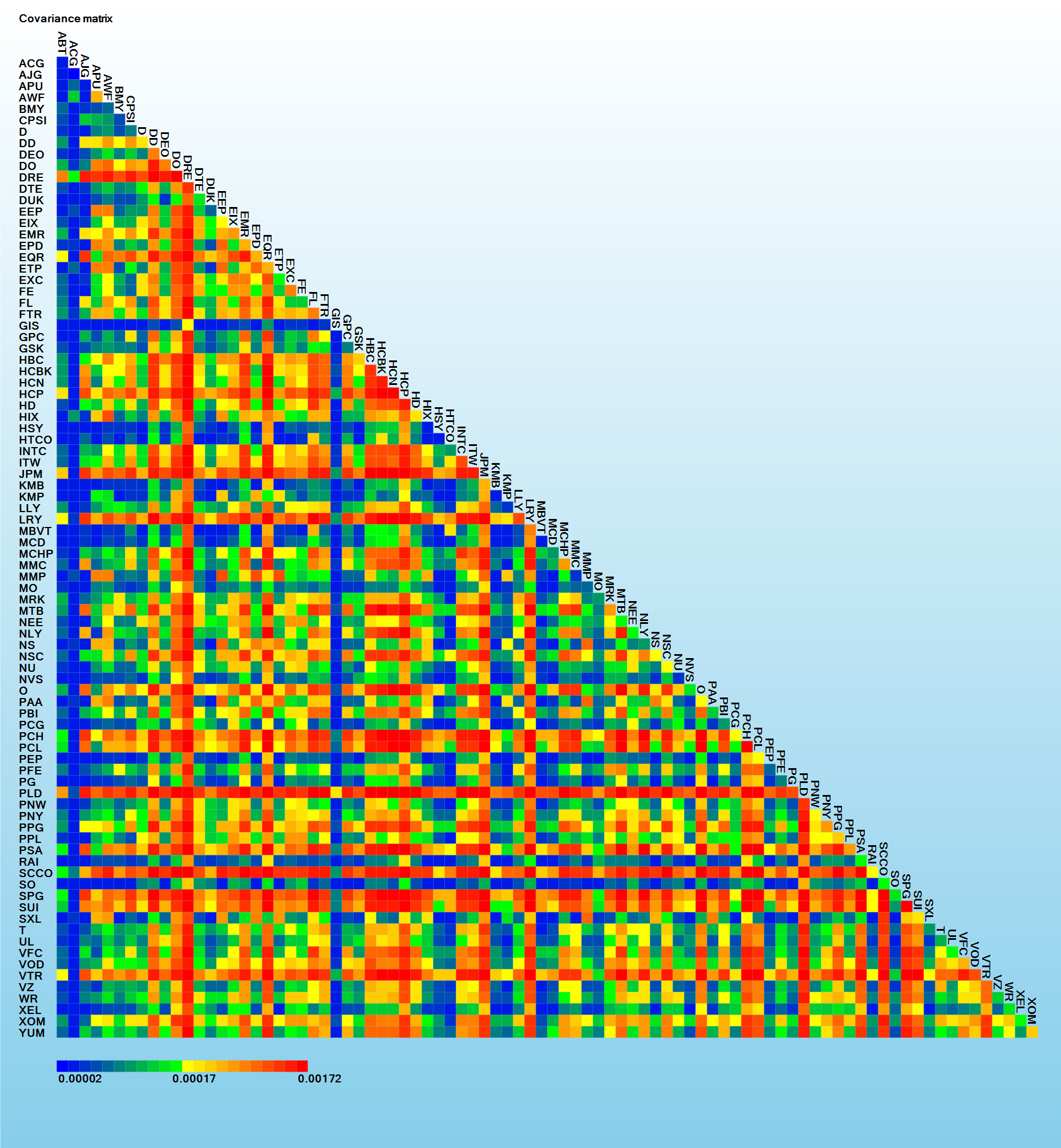

| Years | Rebalancing | Metrics | Matrices | MinVar | Right-tail weighted | Hurst exponent weighted | Right-tail-Hurst weighted |

|---|---|---|---|---|---|---|---|

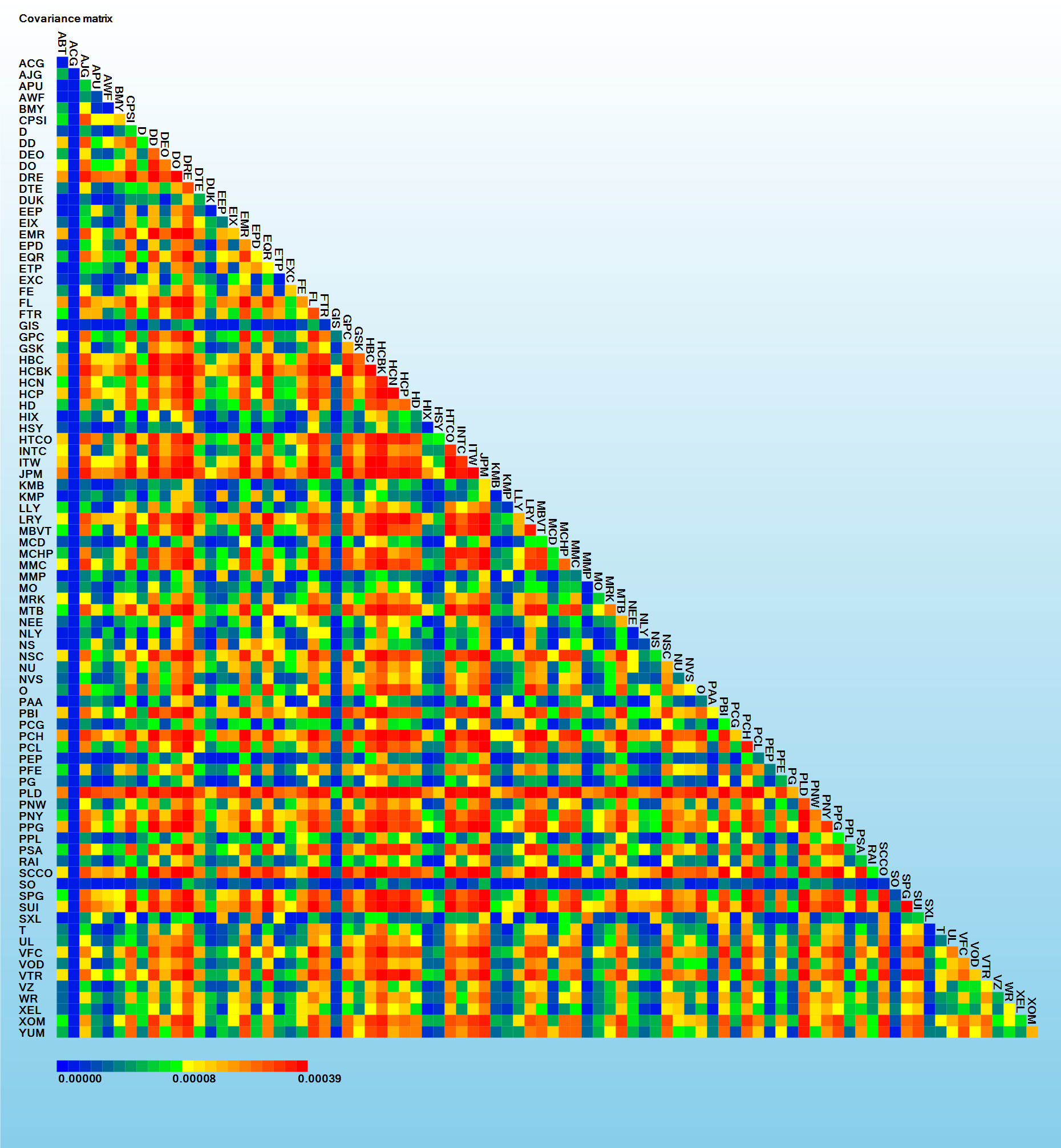

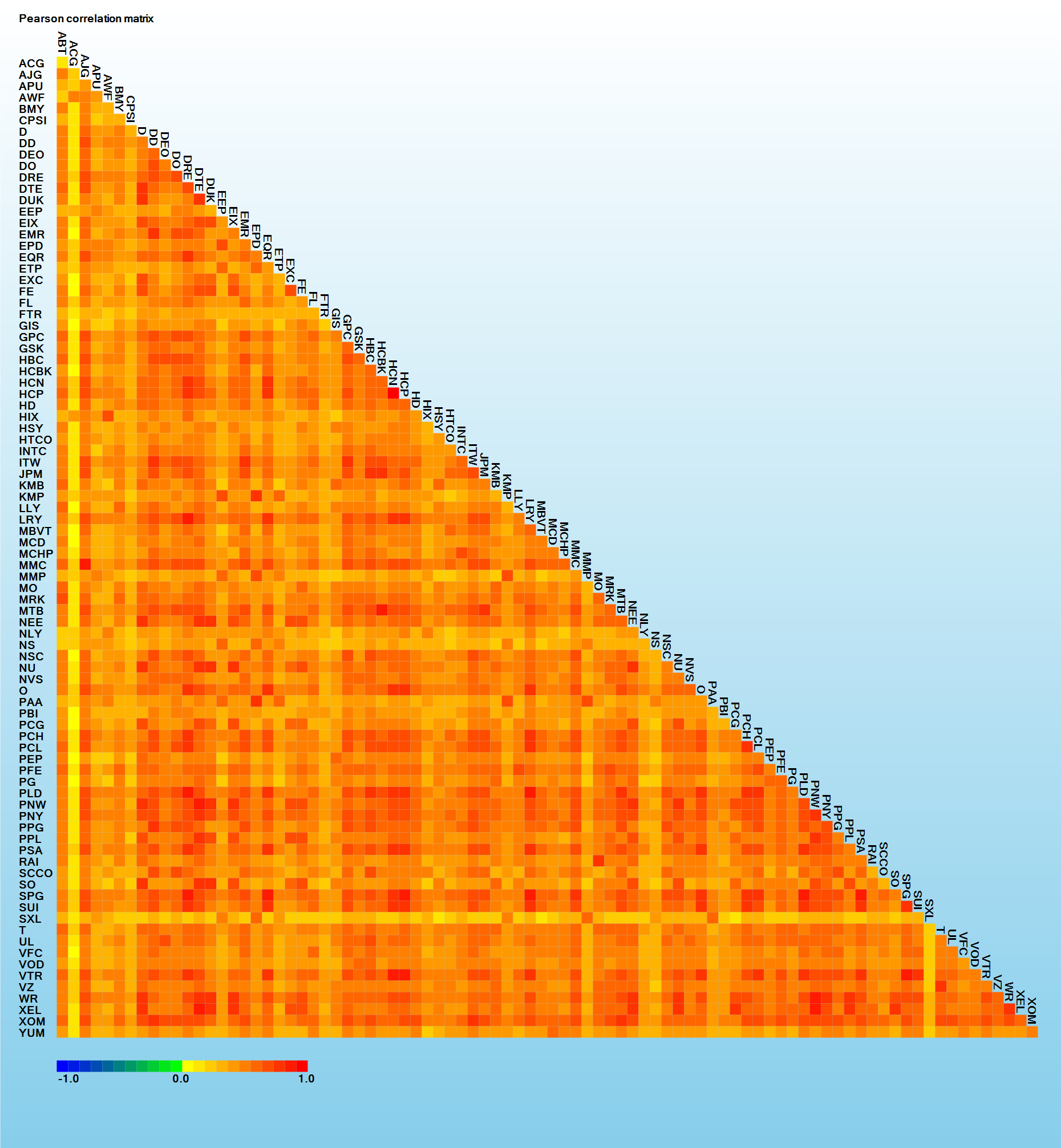

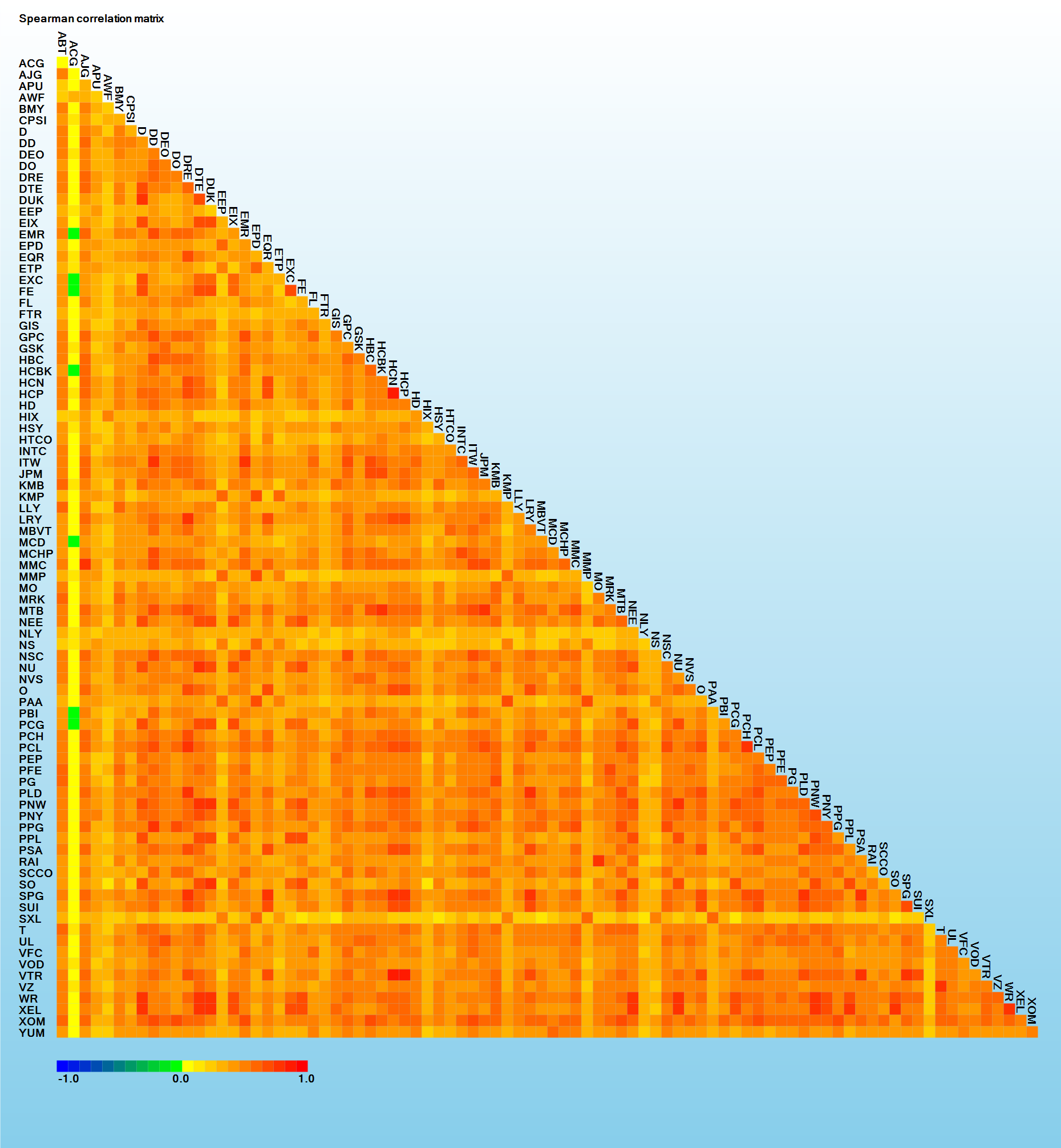

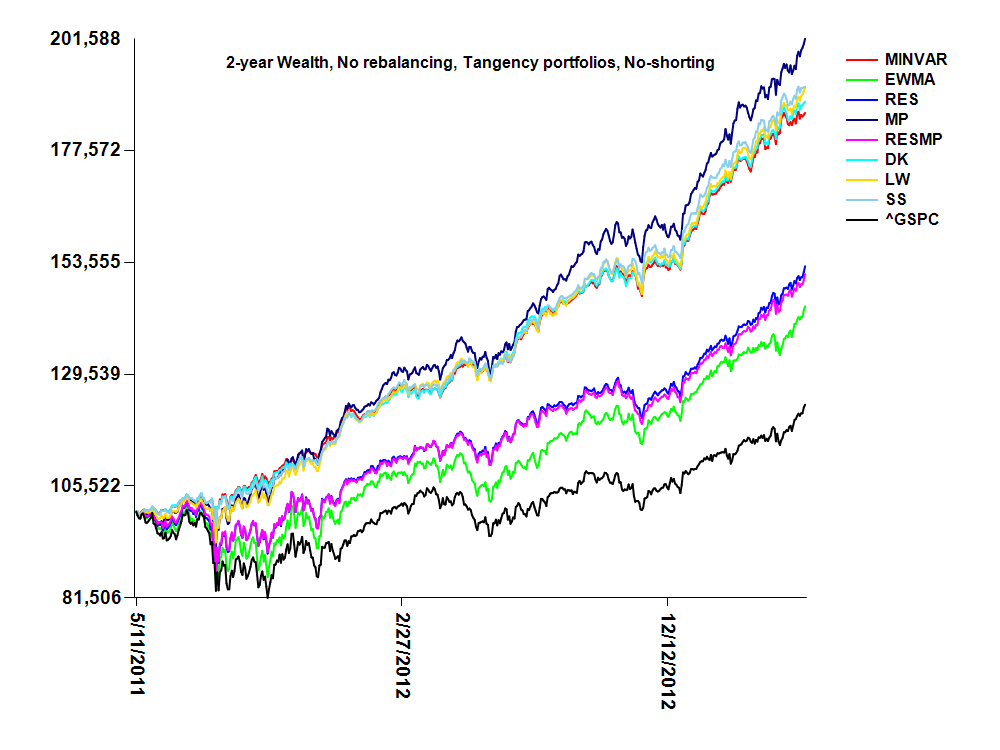

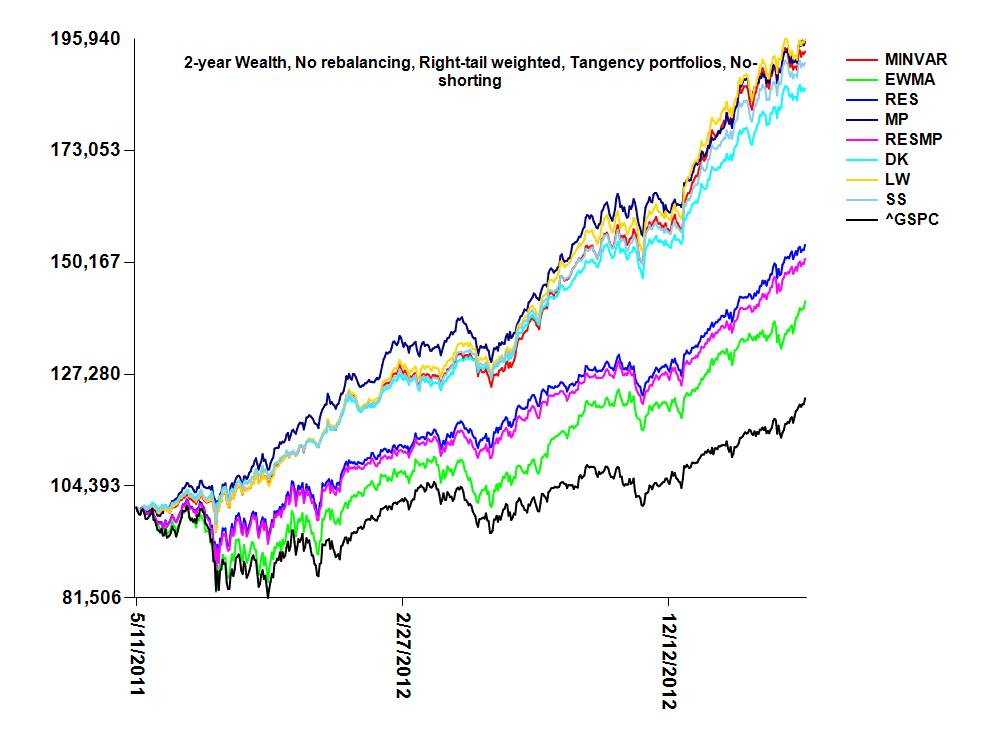

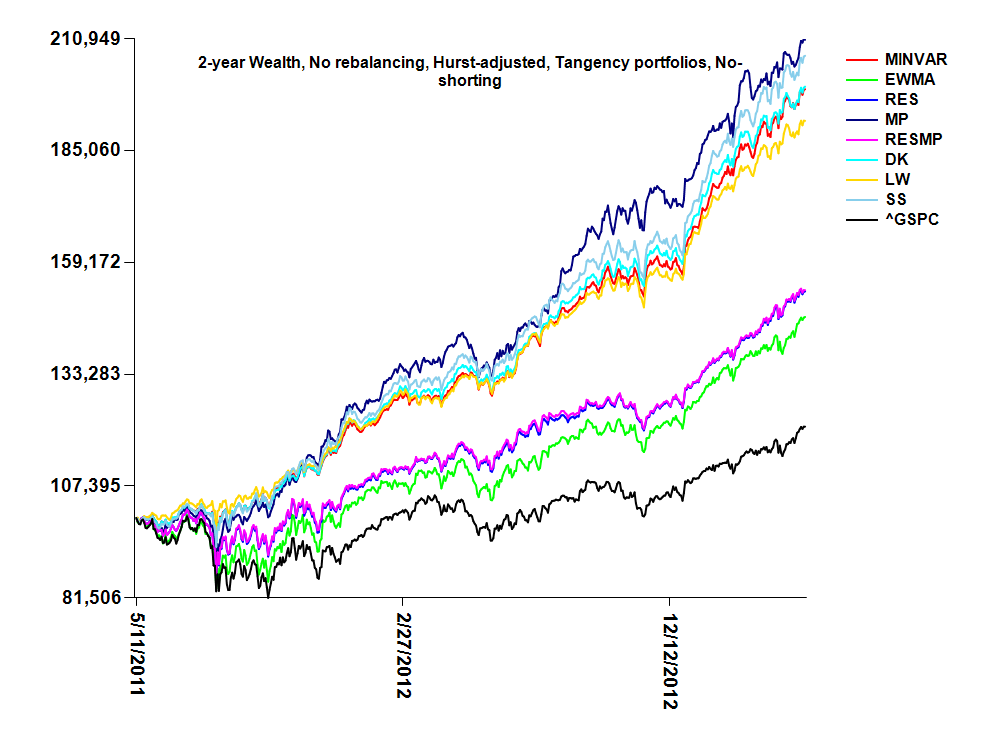

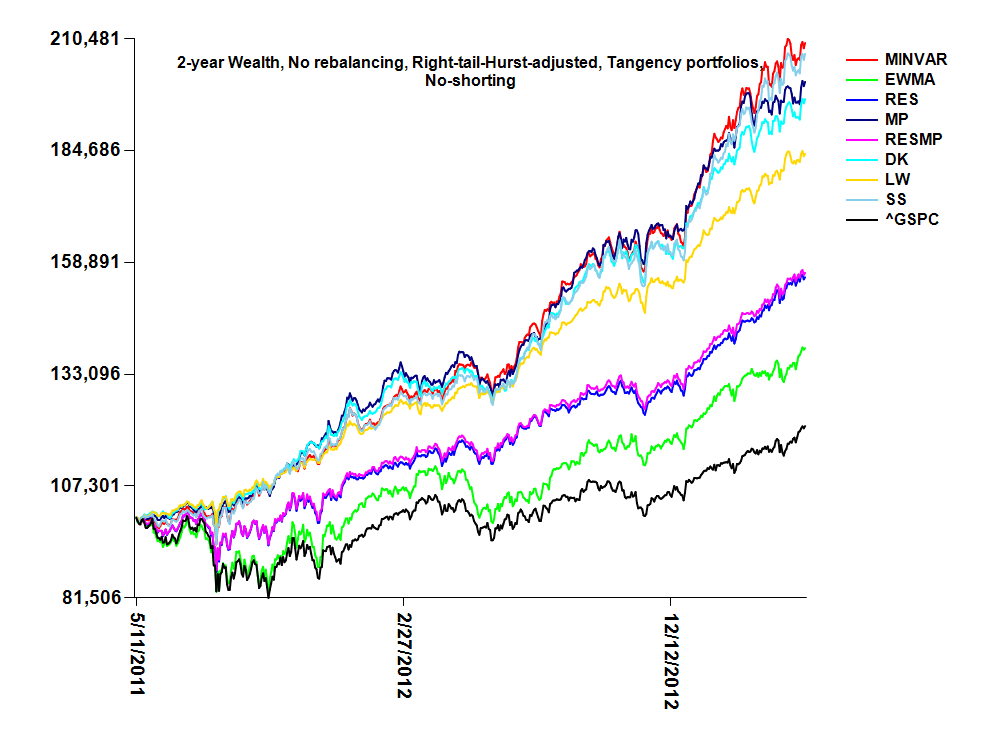

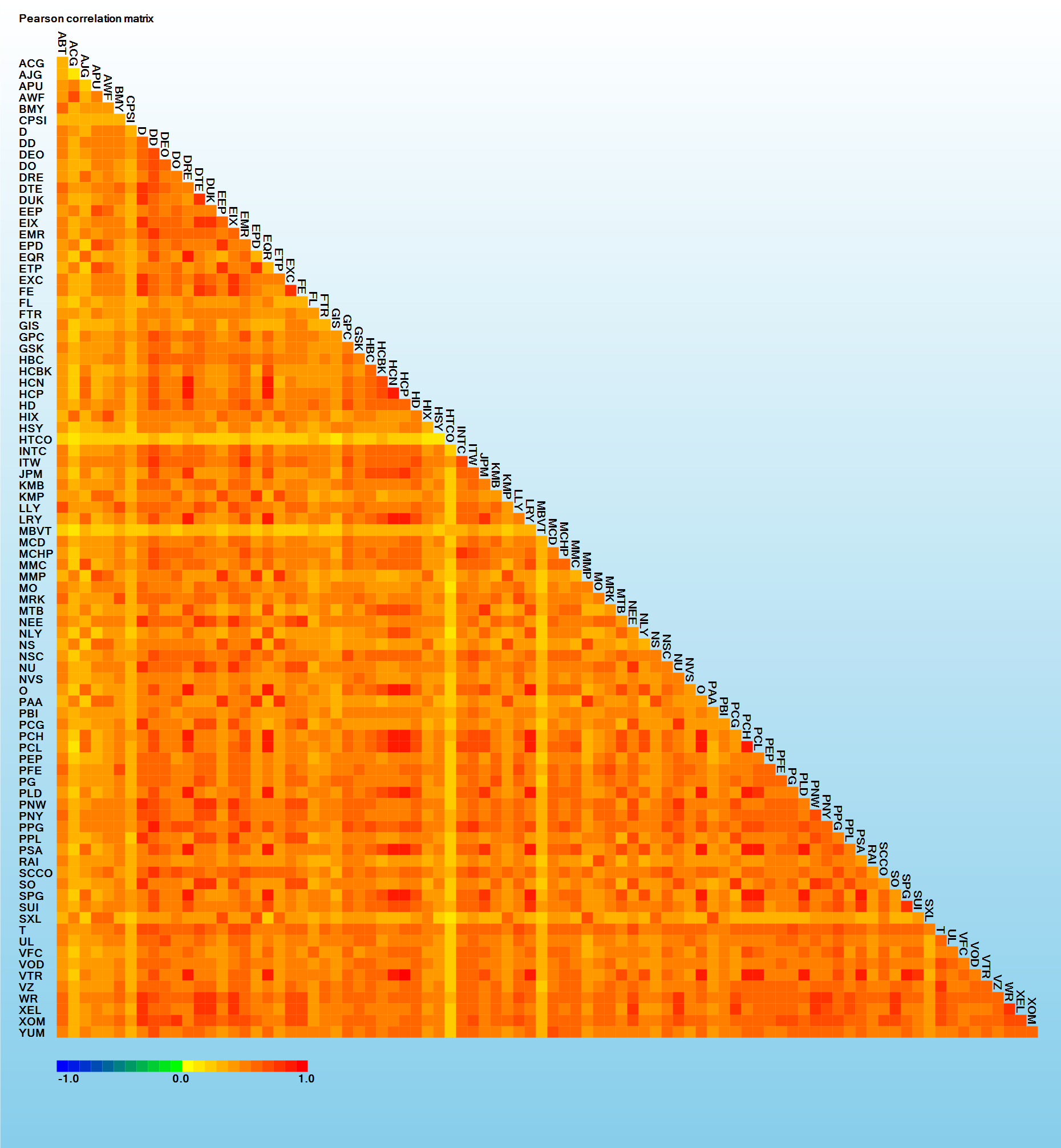

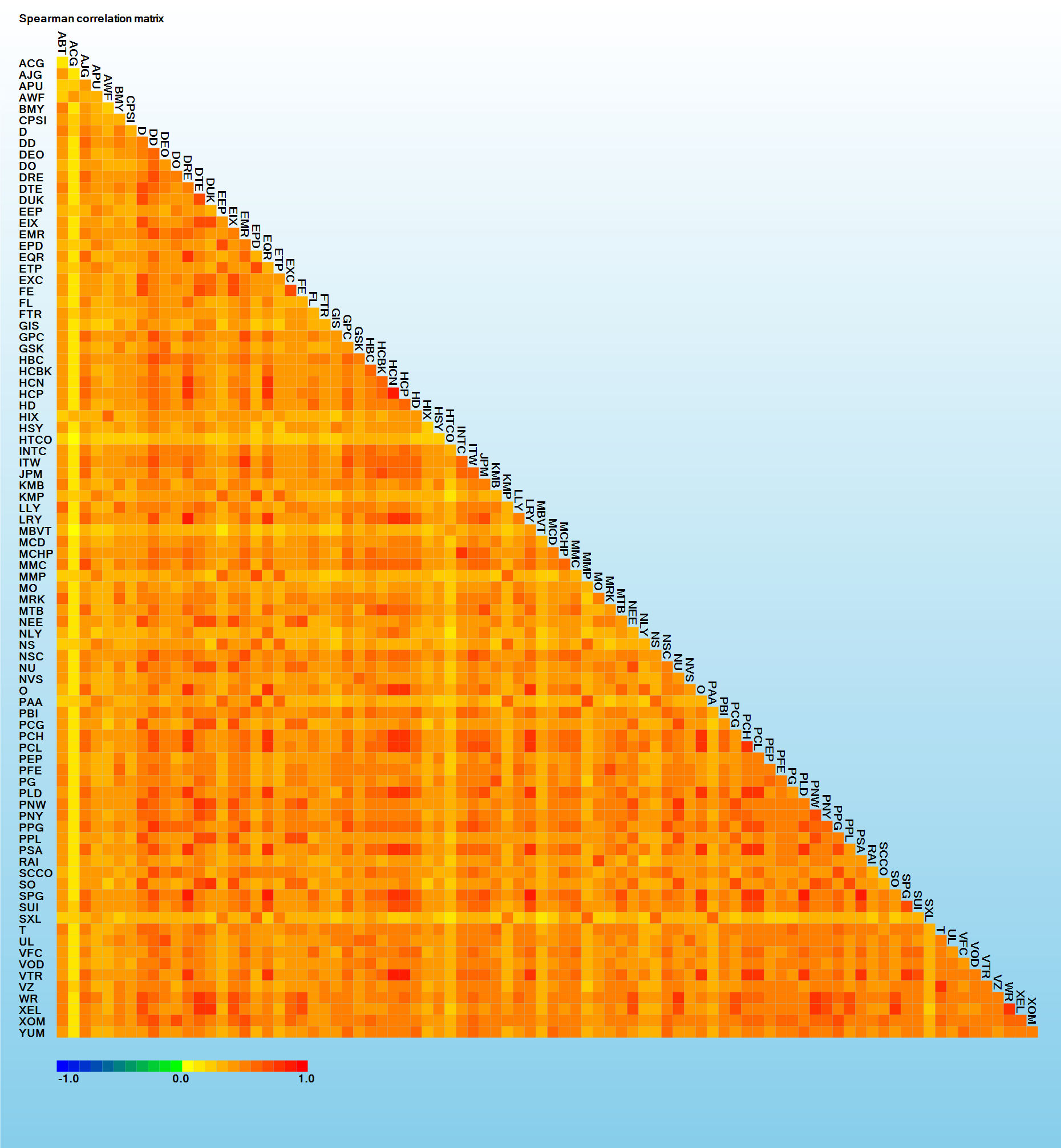

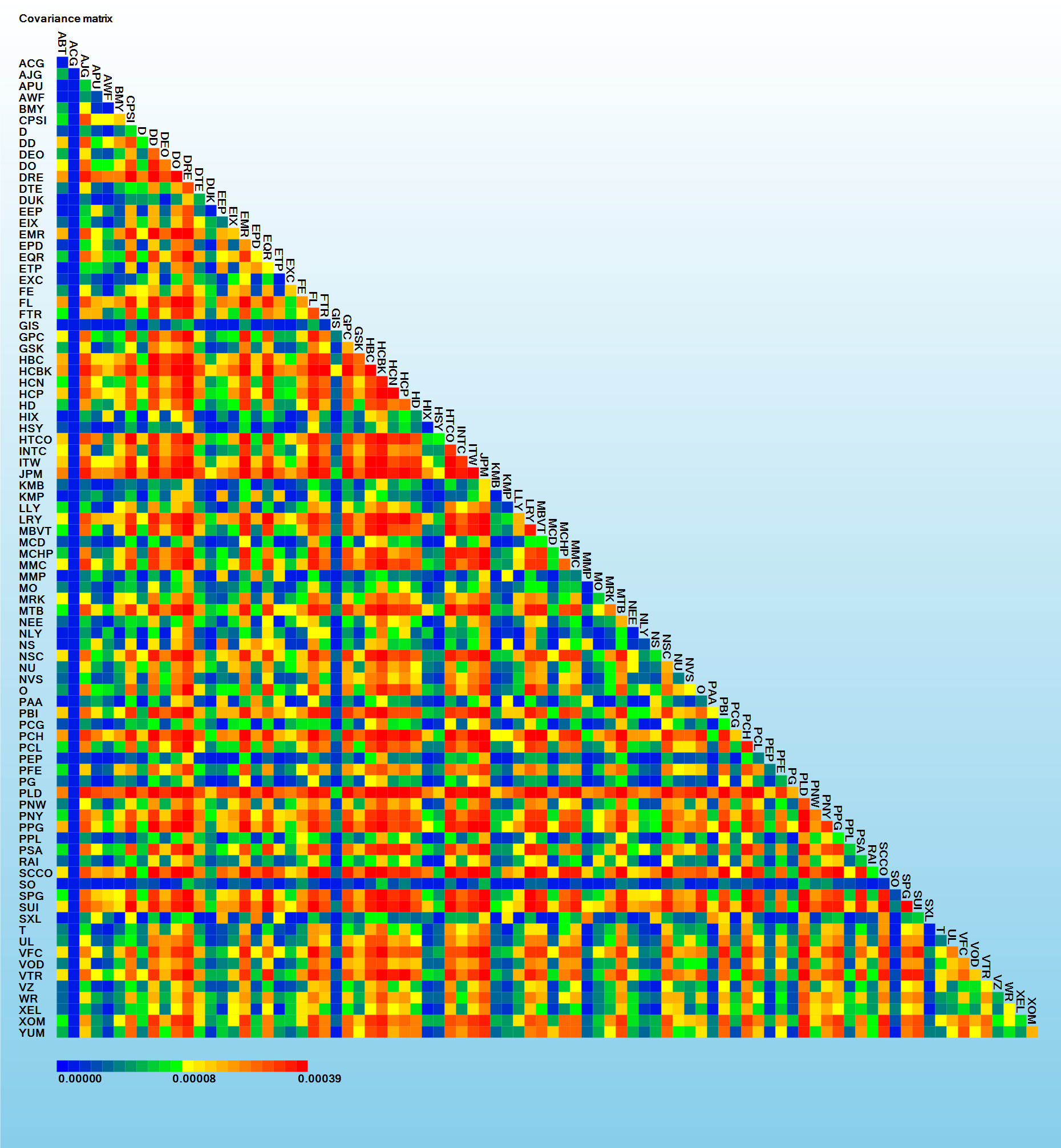

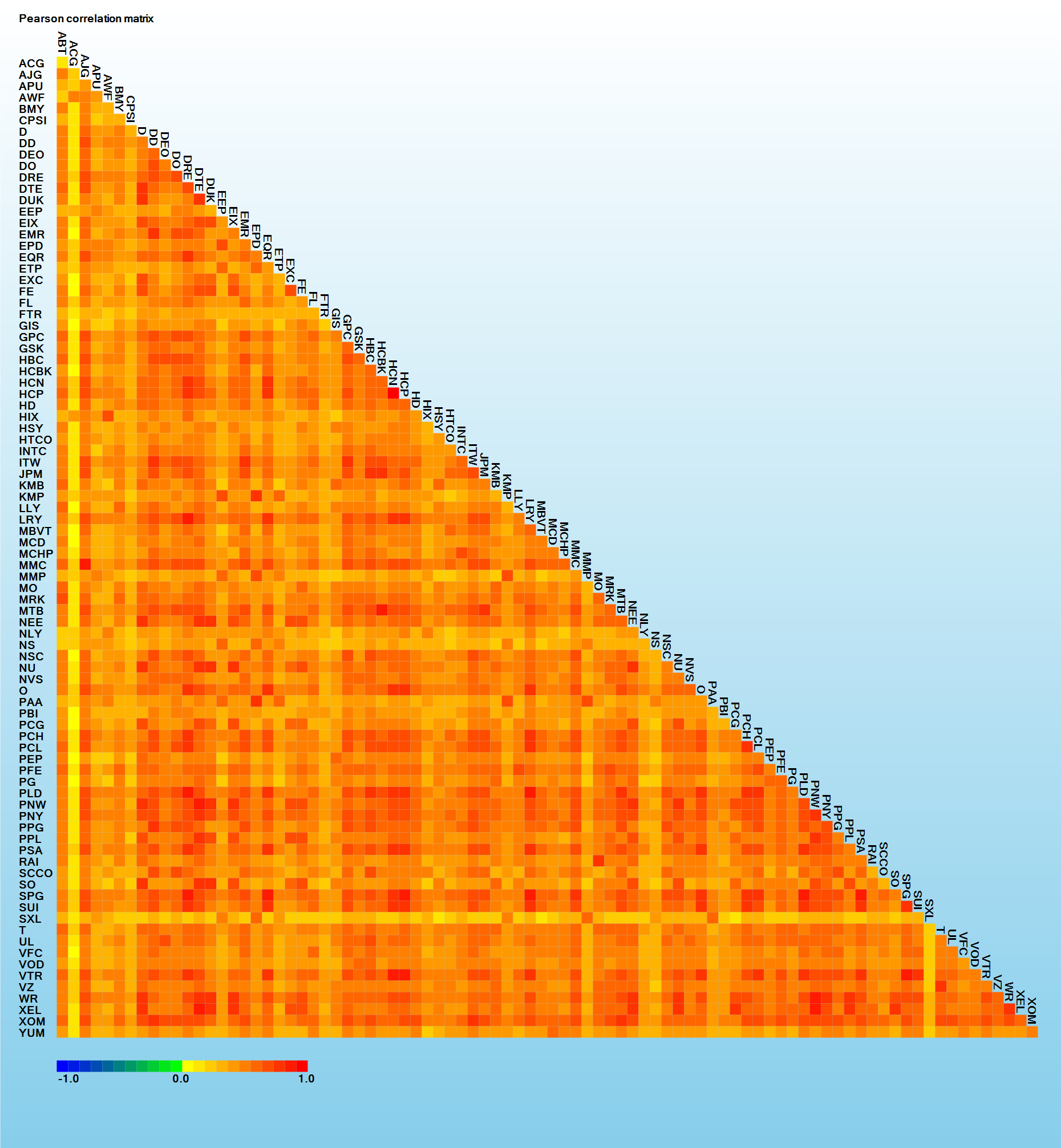

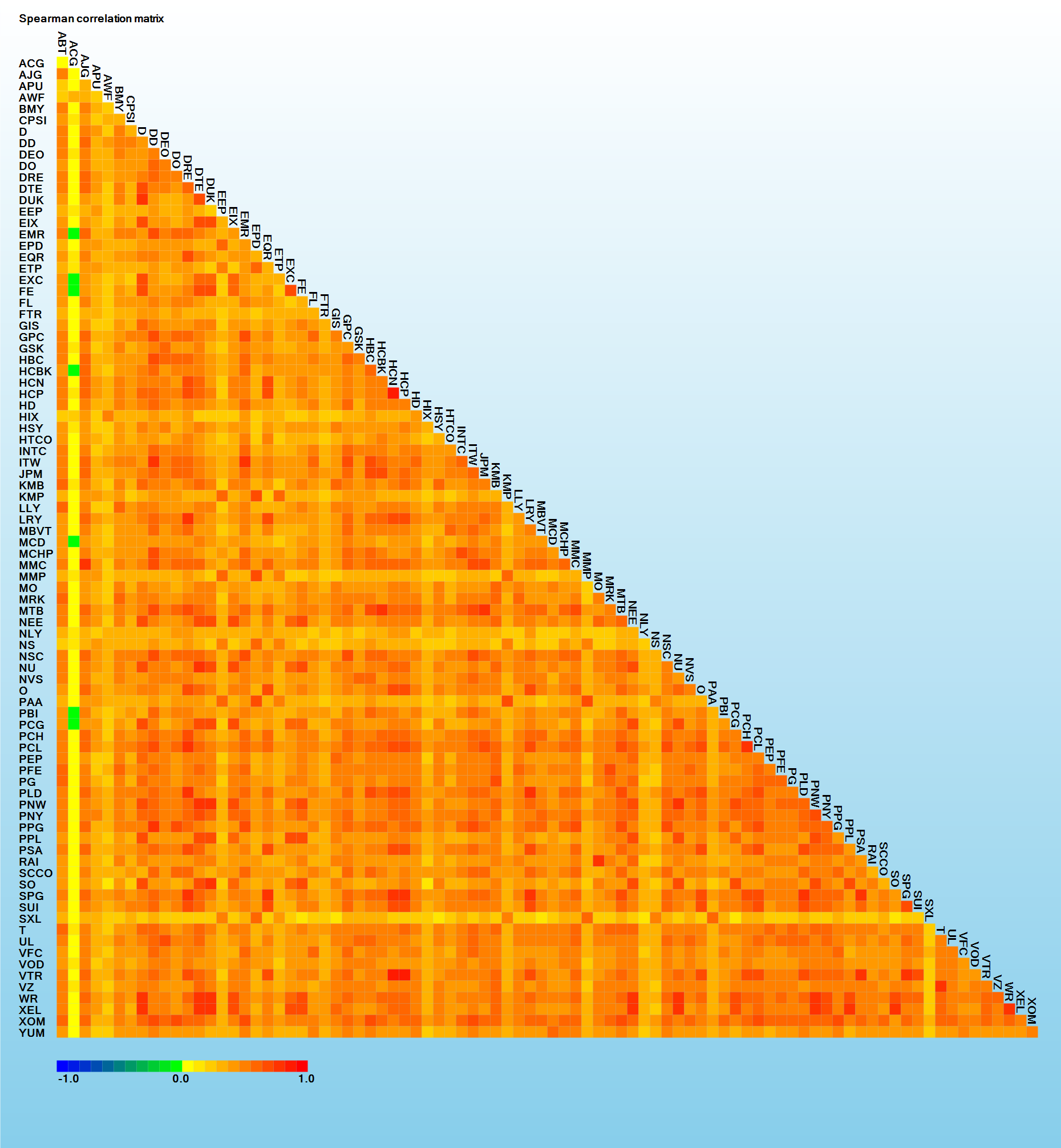

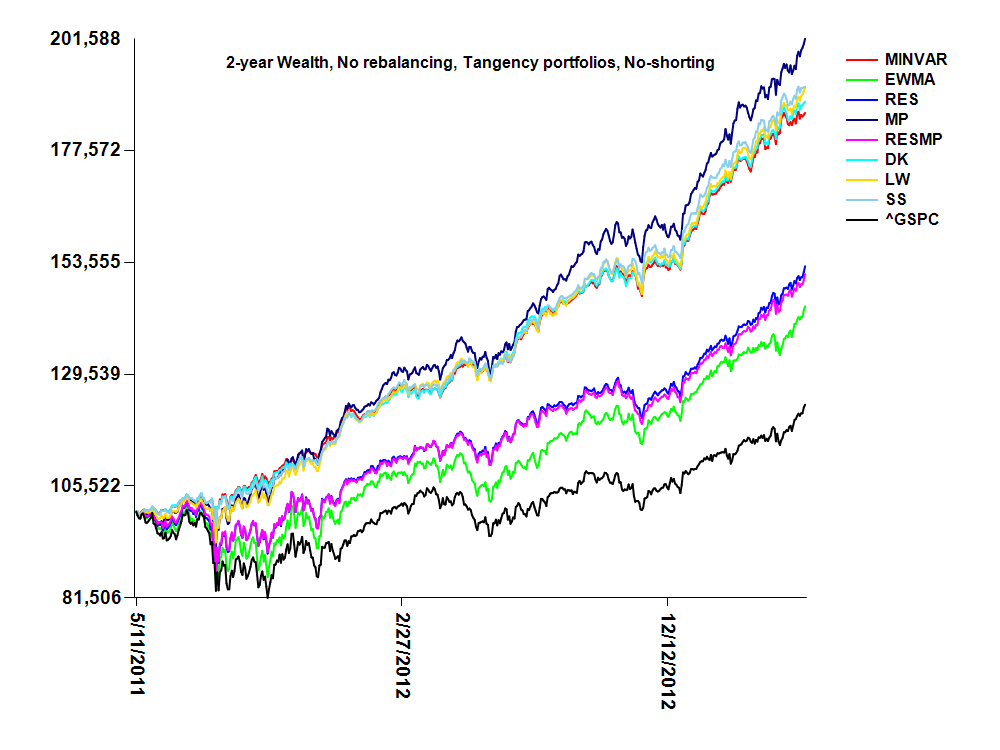

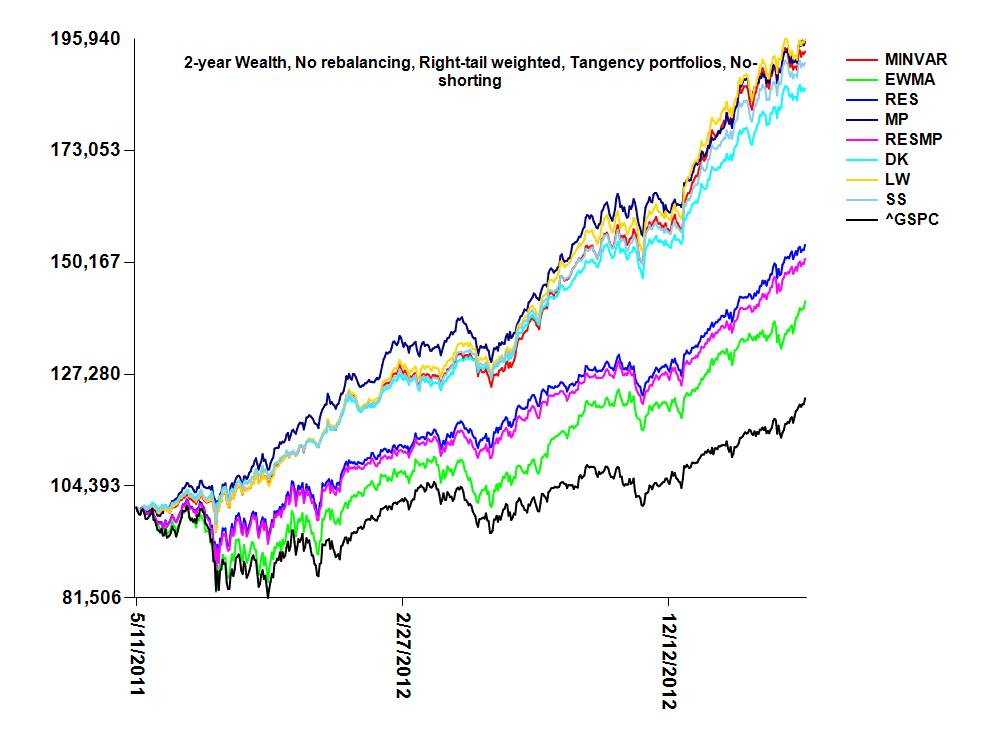

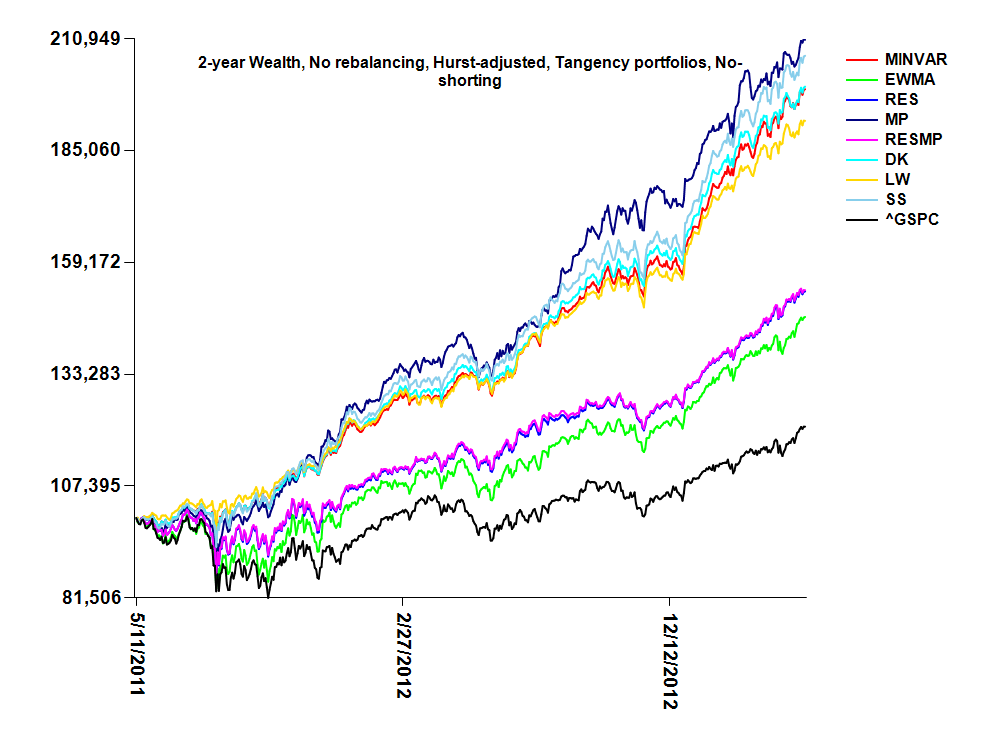

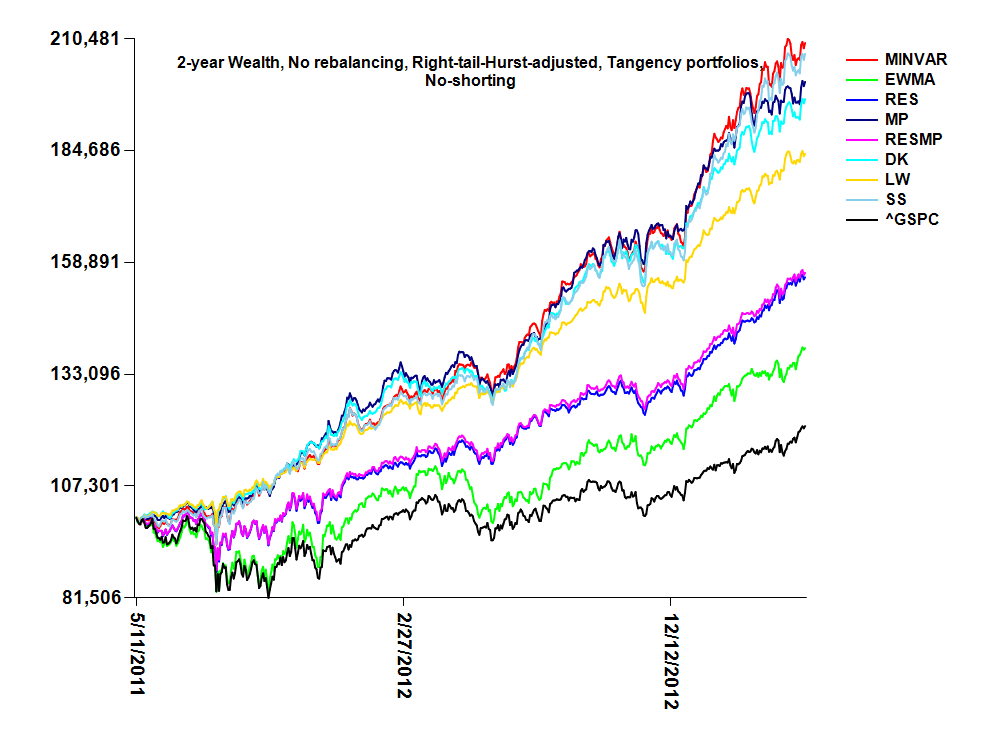

| 2 | No rebalancing | Log-return pdfs, fractal dimensions, tail risks, CVaR |

|

Returns,

Weights,

|

Returns,

Weights,

|

Returns,

Weights,

|

Returns,

Weights,

|

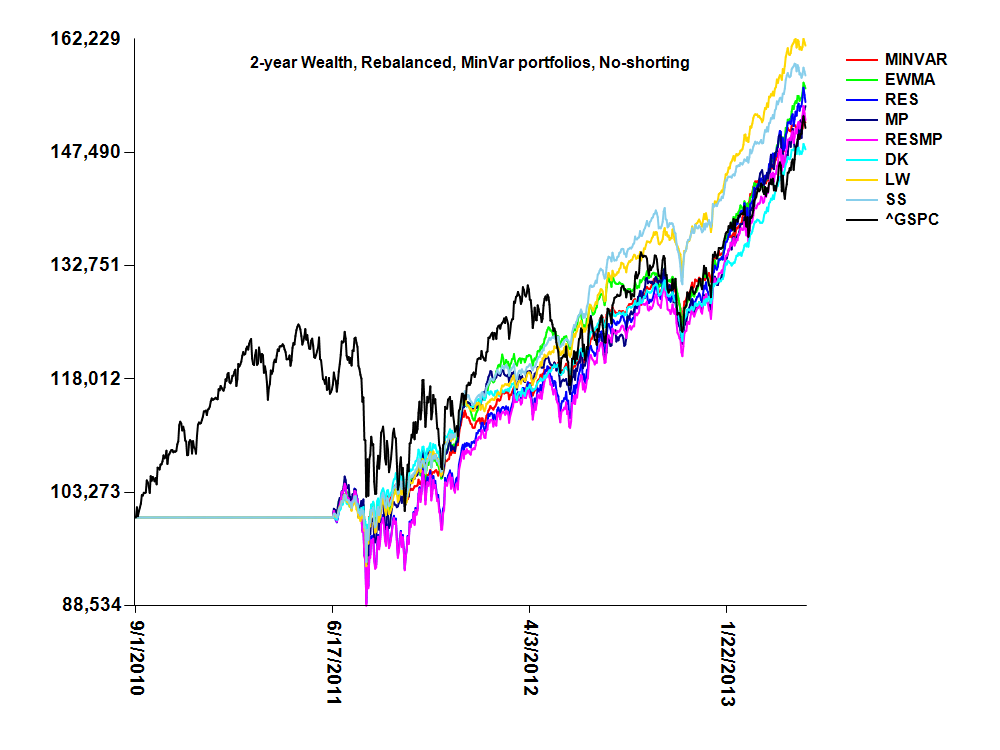

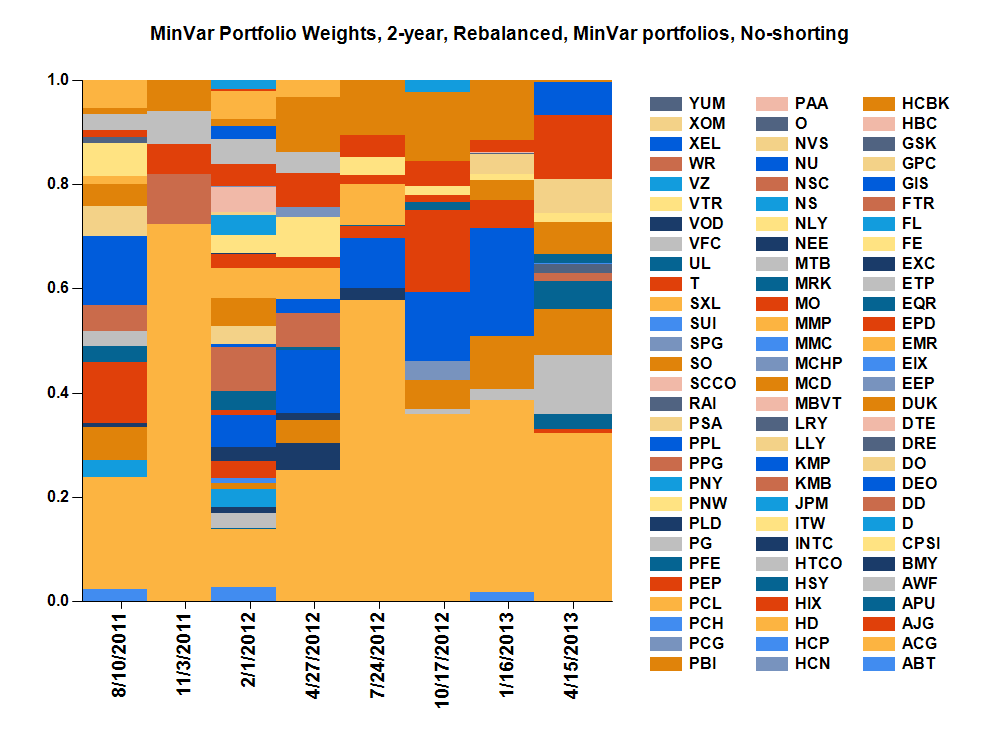

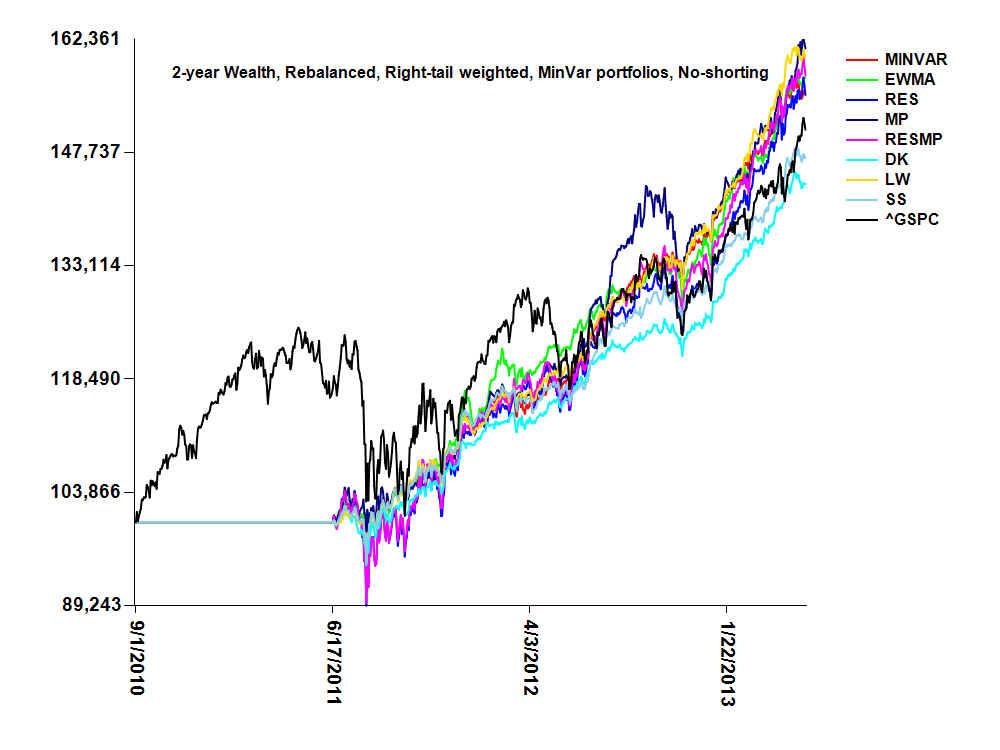

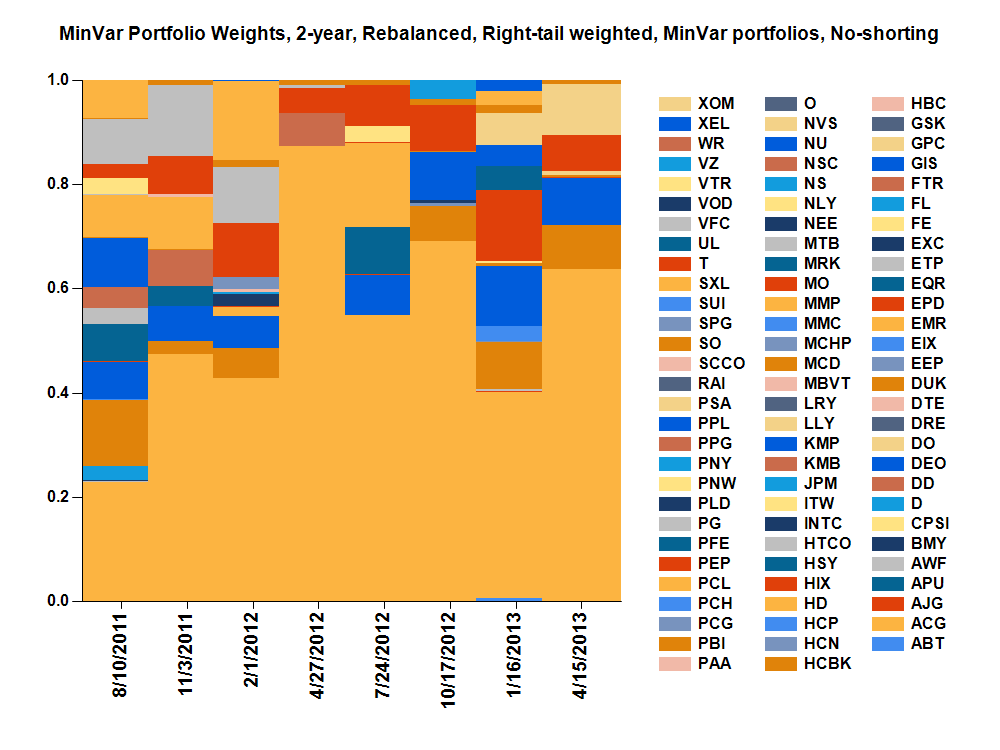

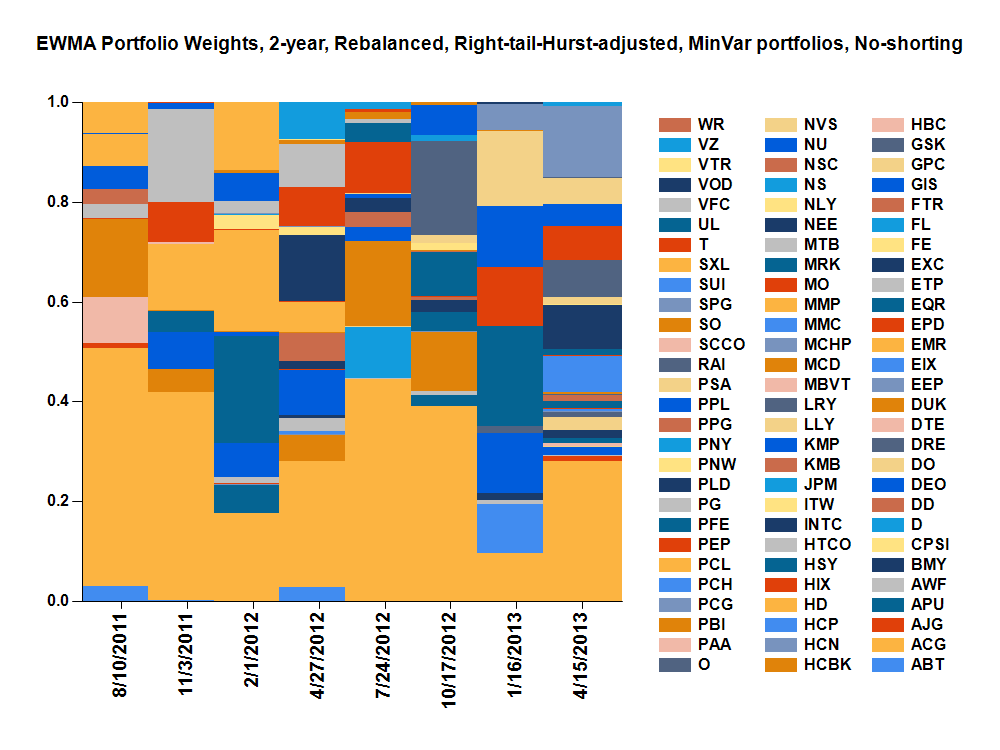

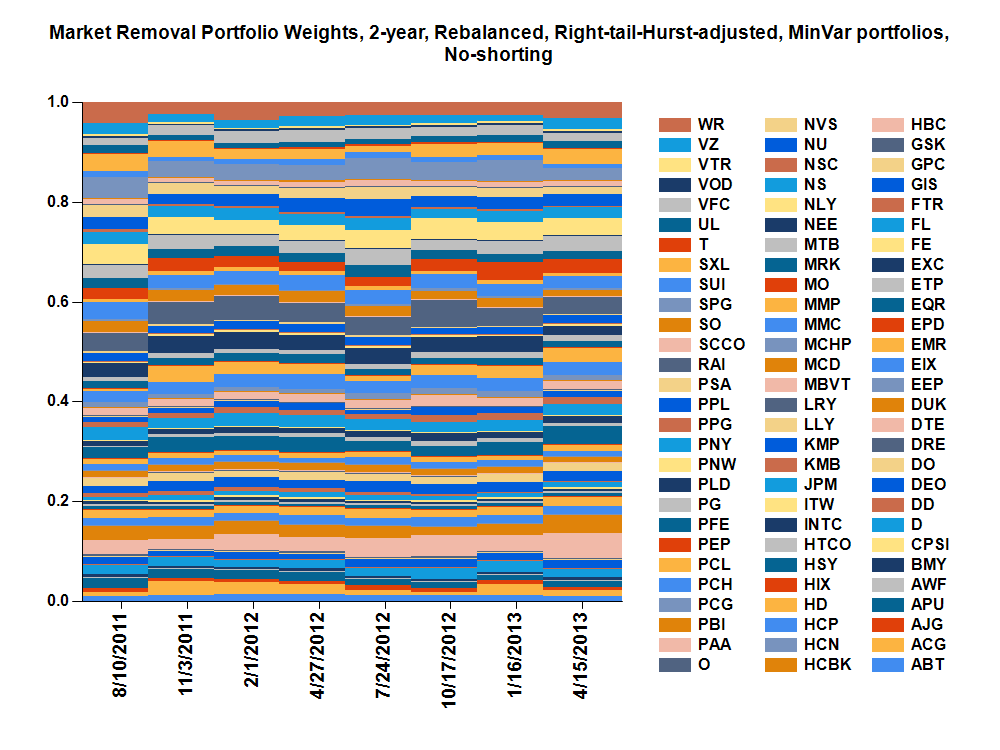

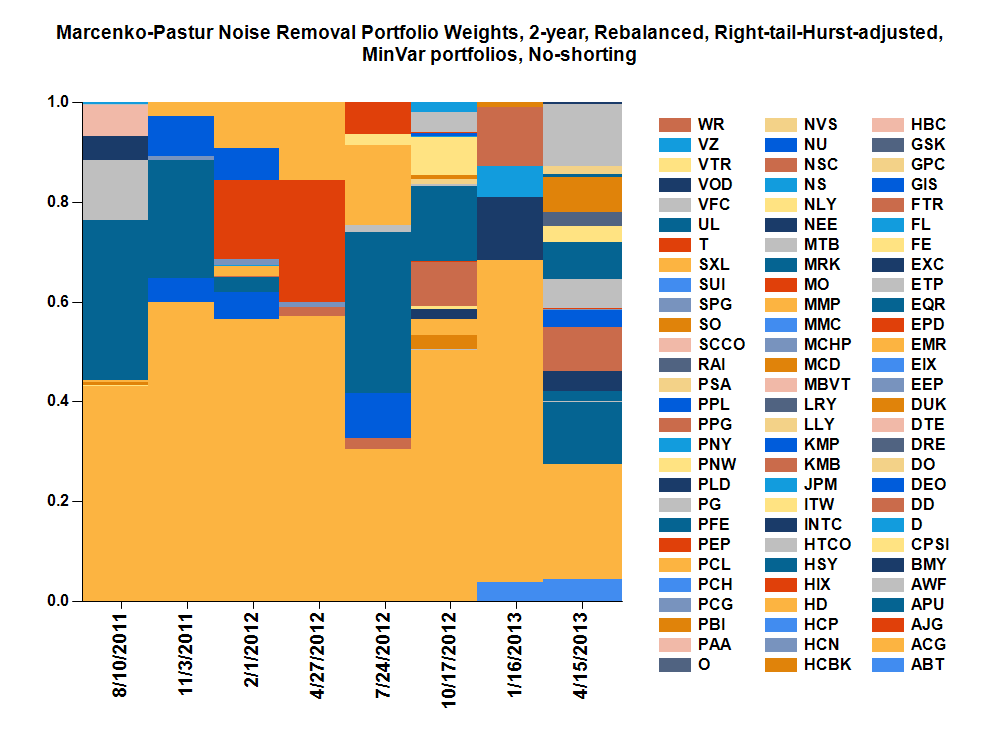

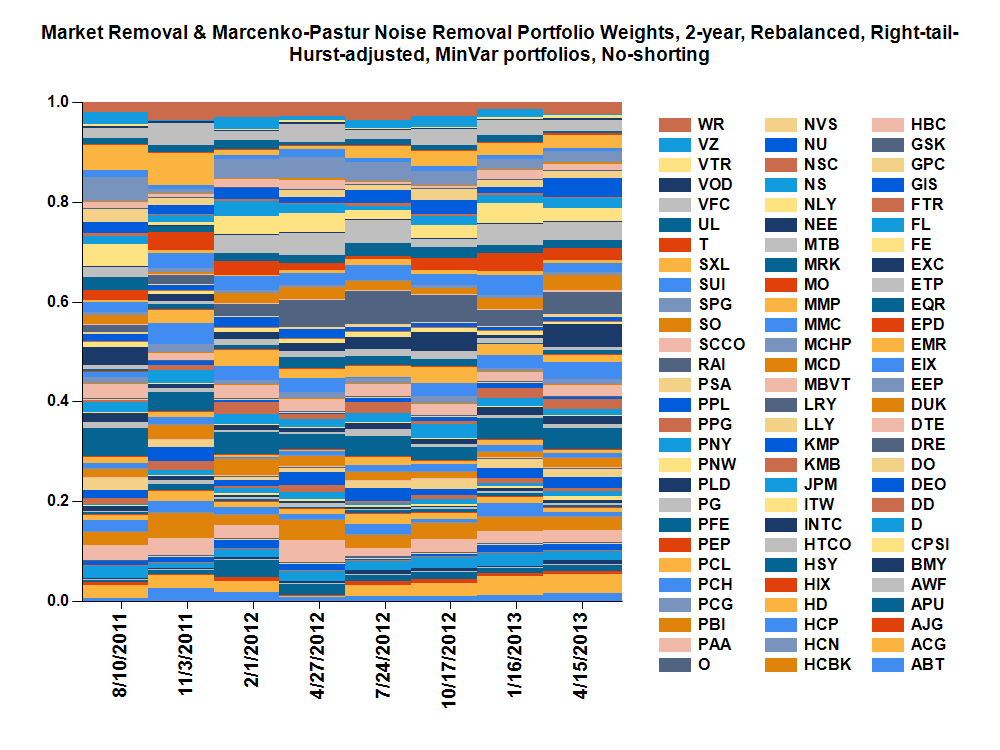

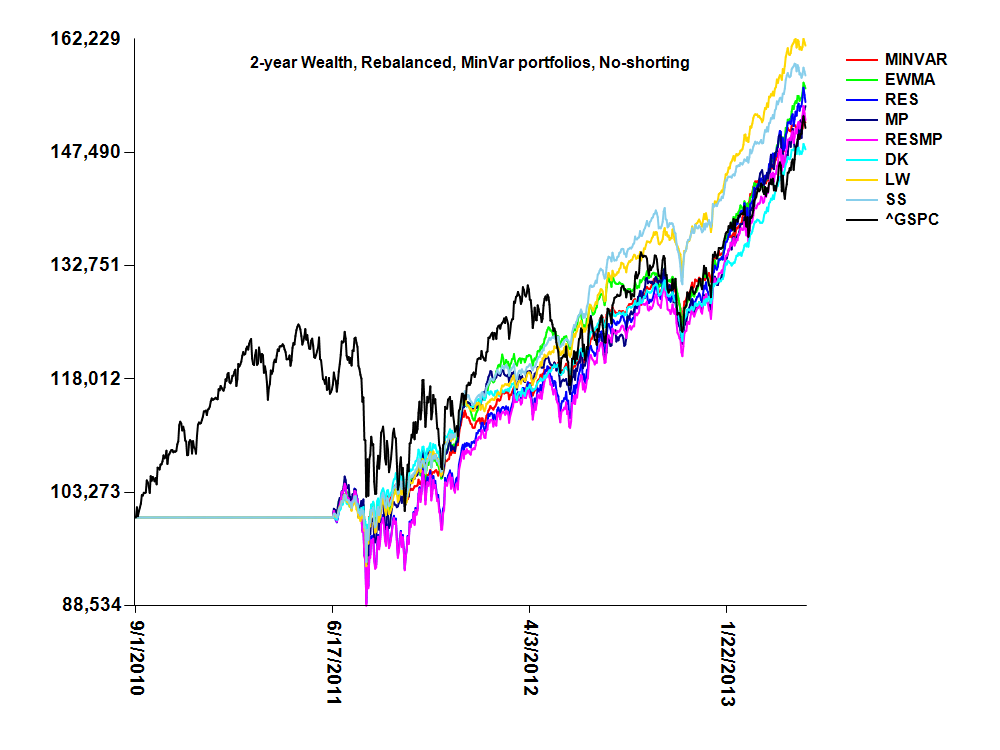

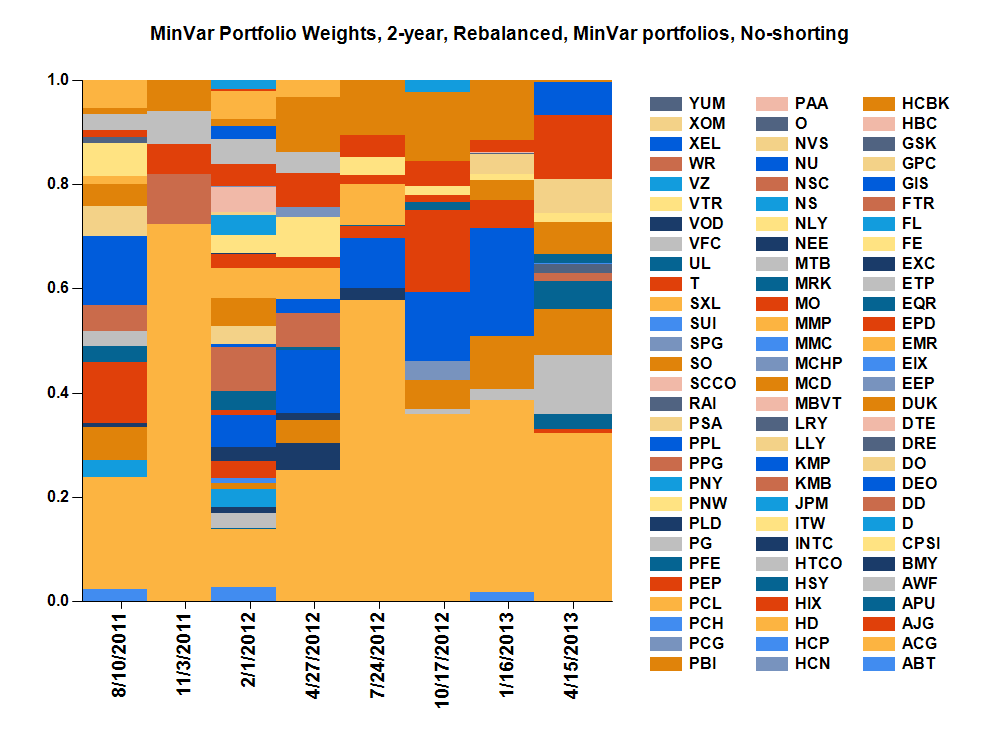

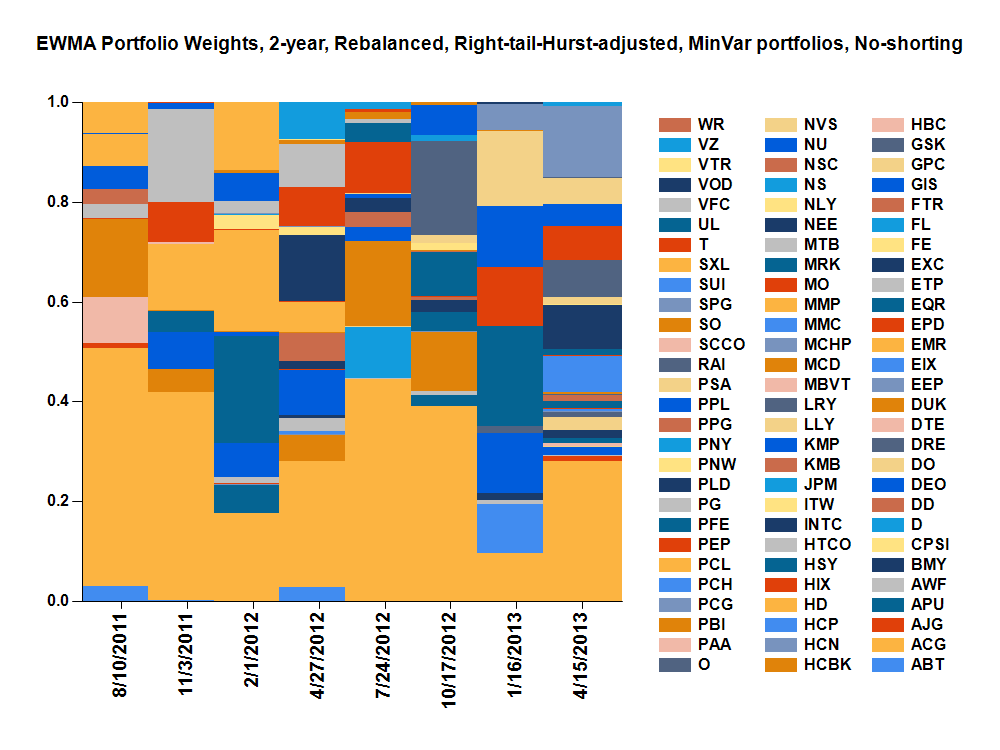

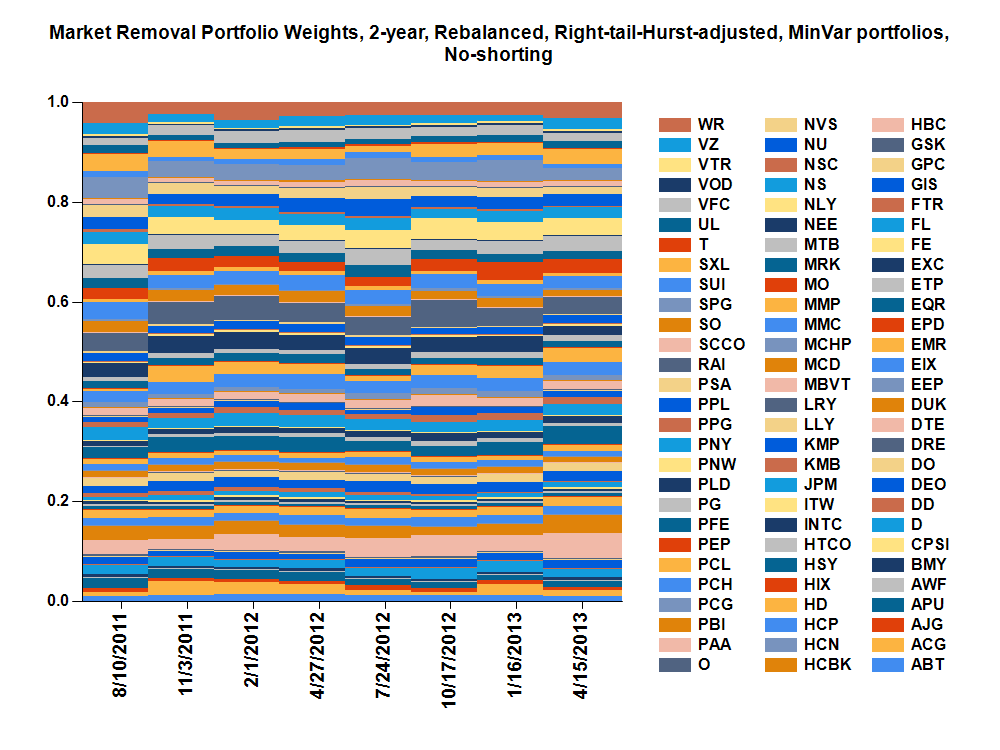

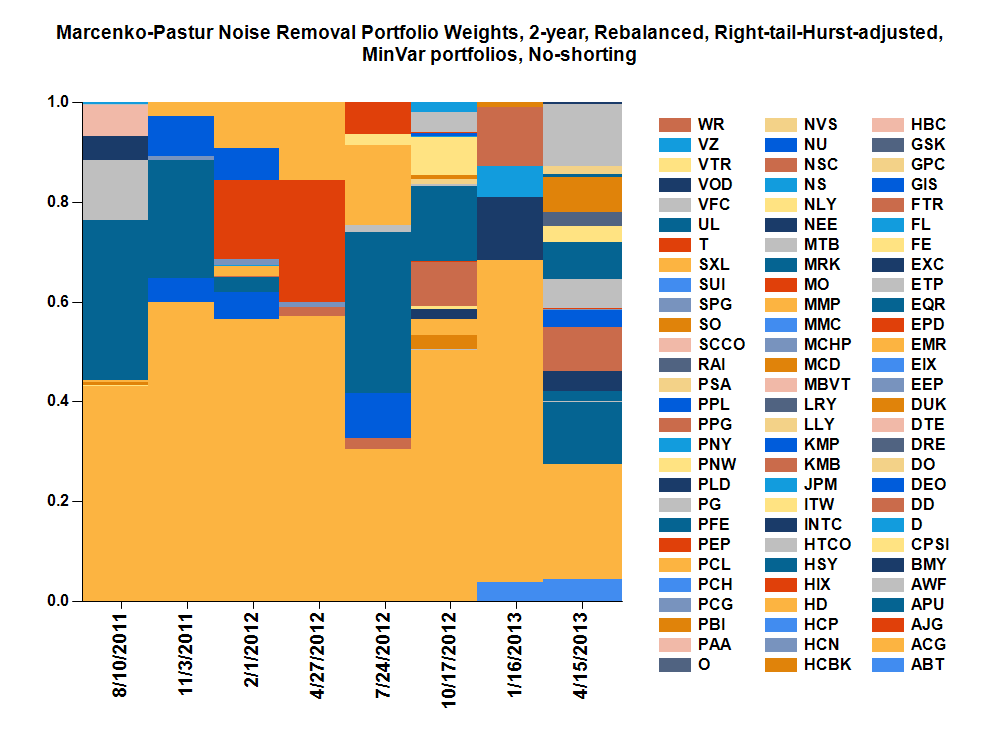

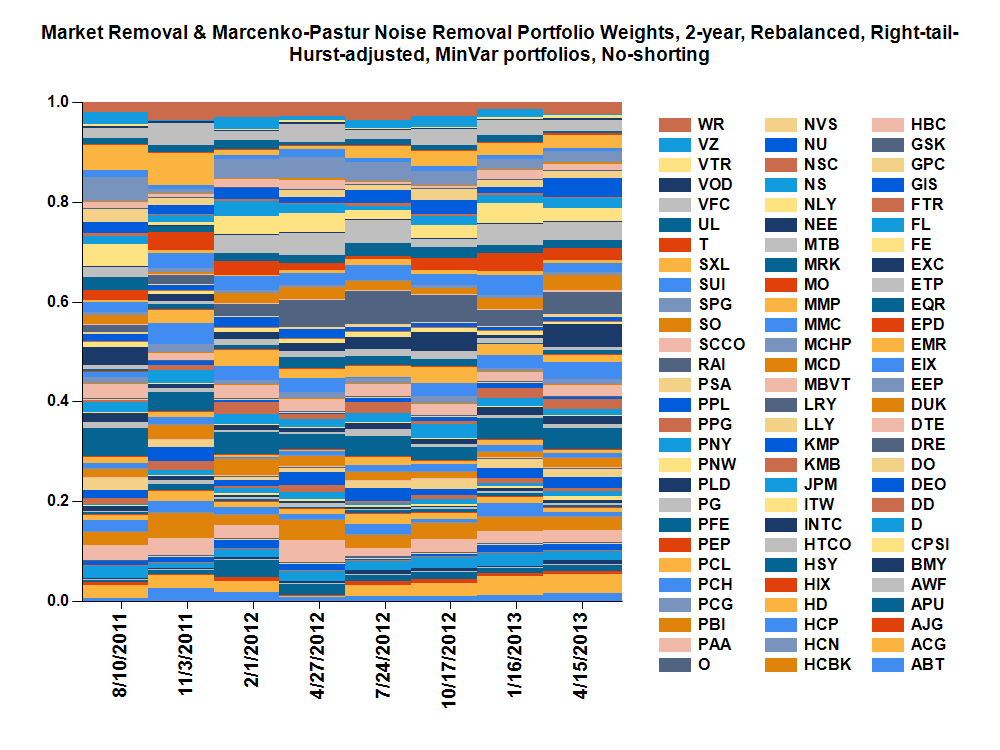

| 2 | Rebalanced quarterly | Returns,

Weights,

|

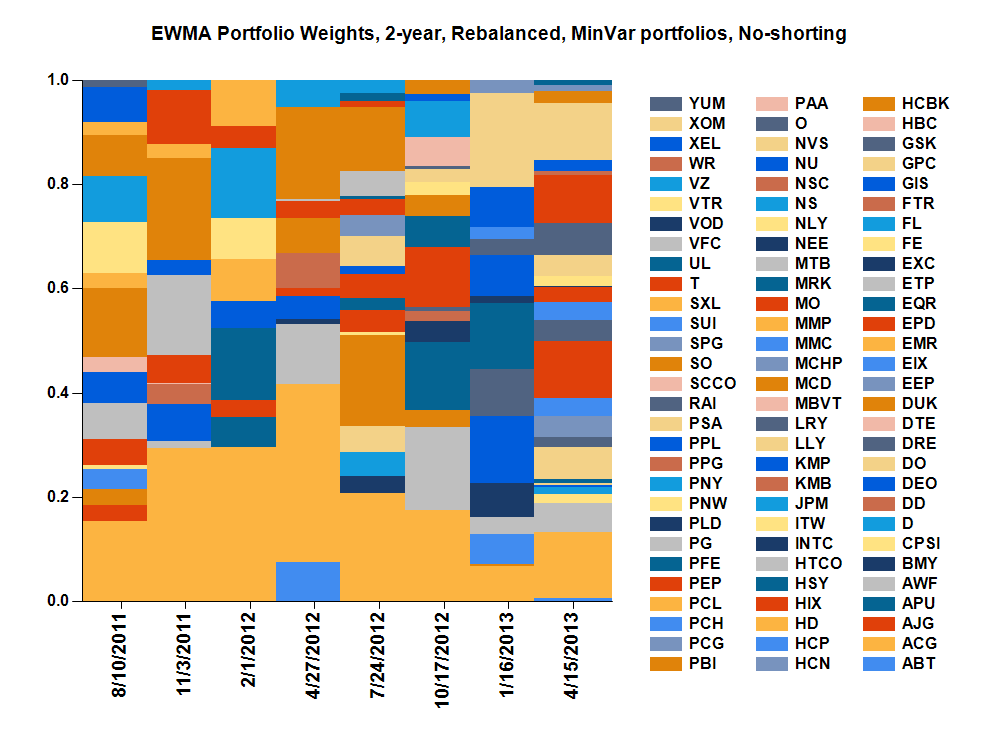

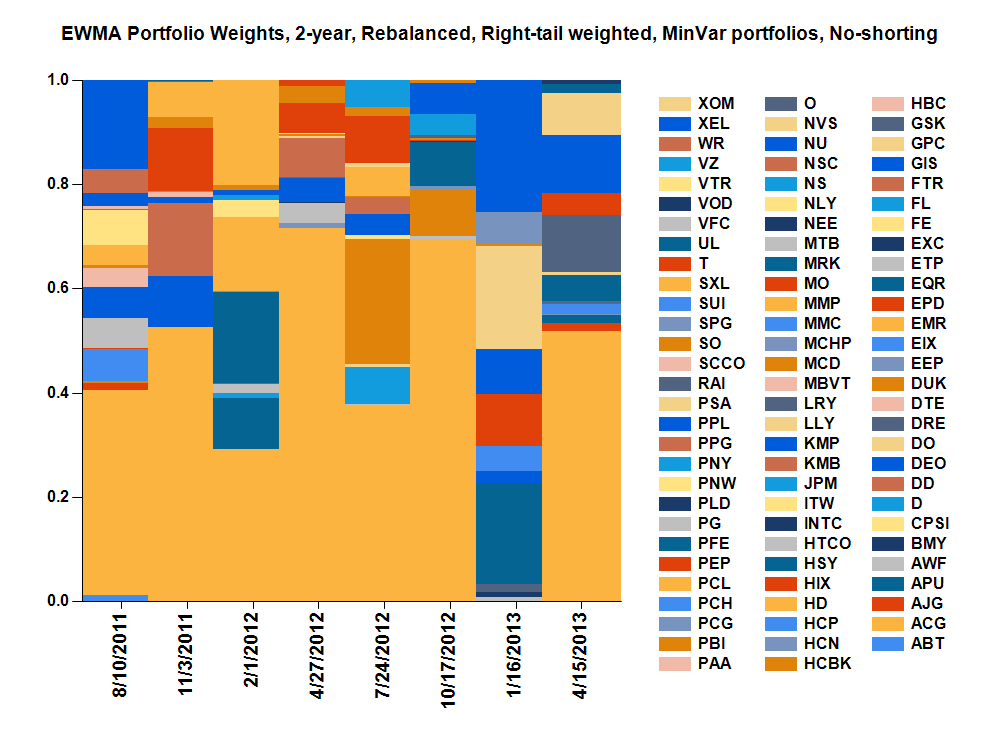

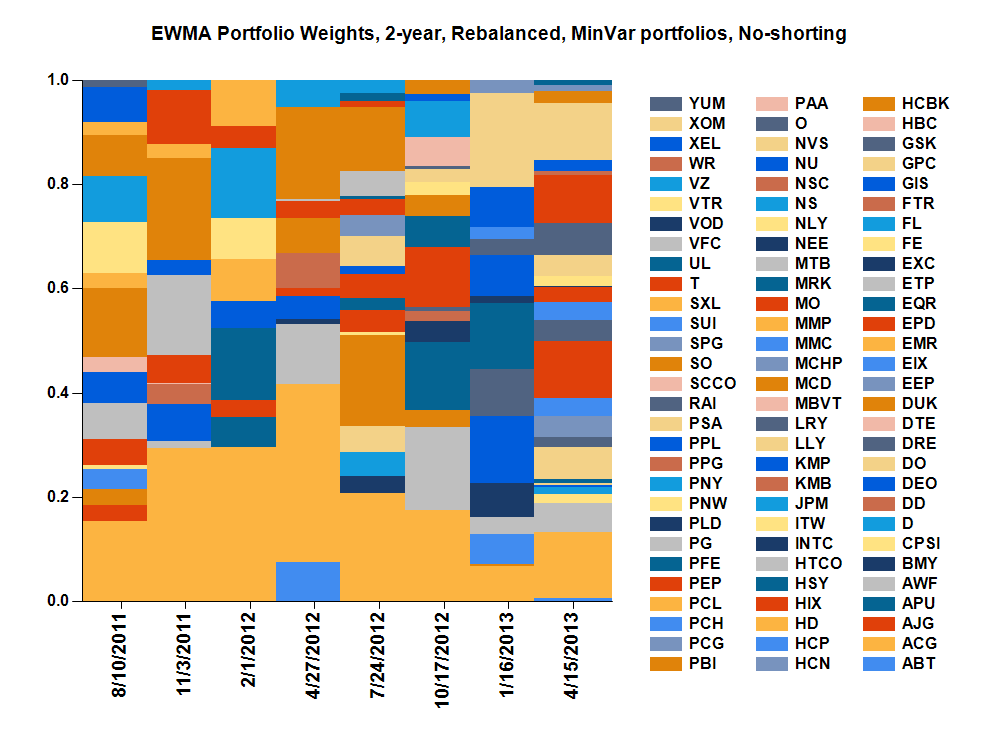

Returns,

Weights,

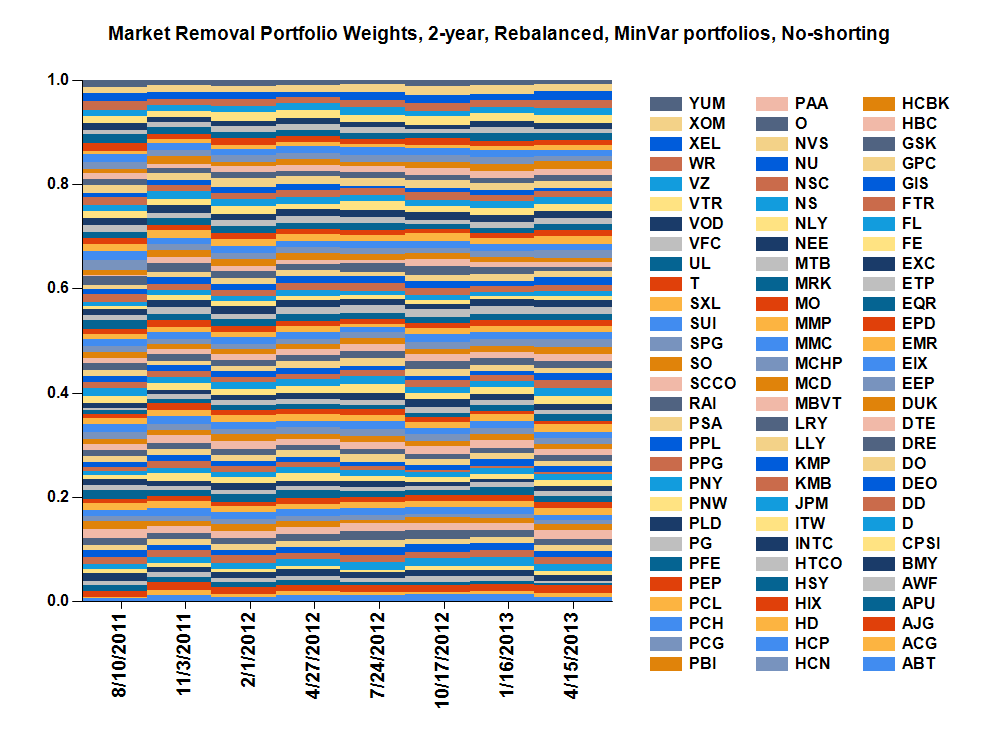

|

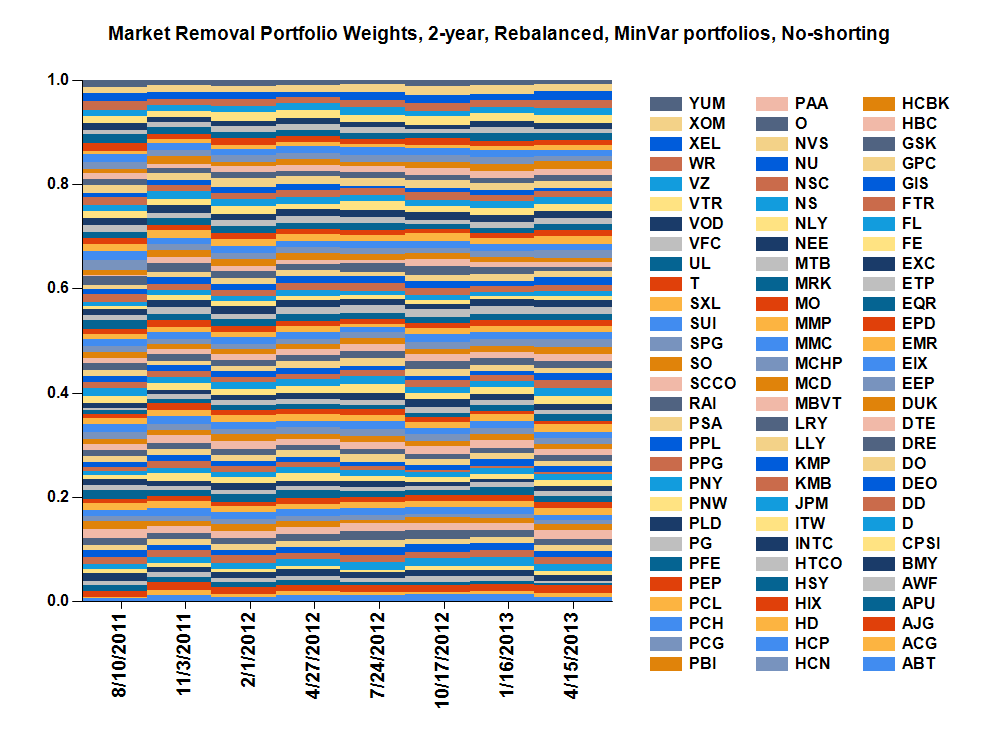

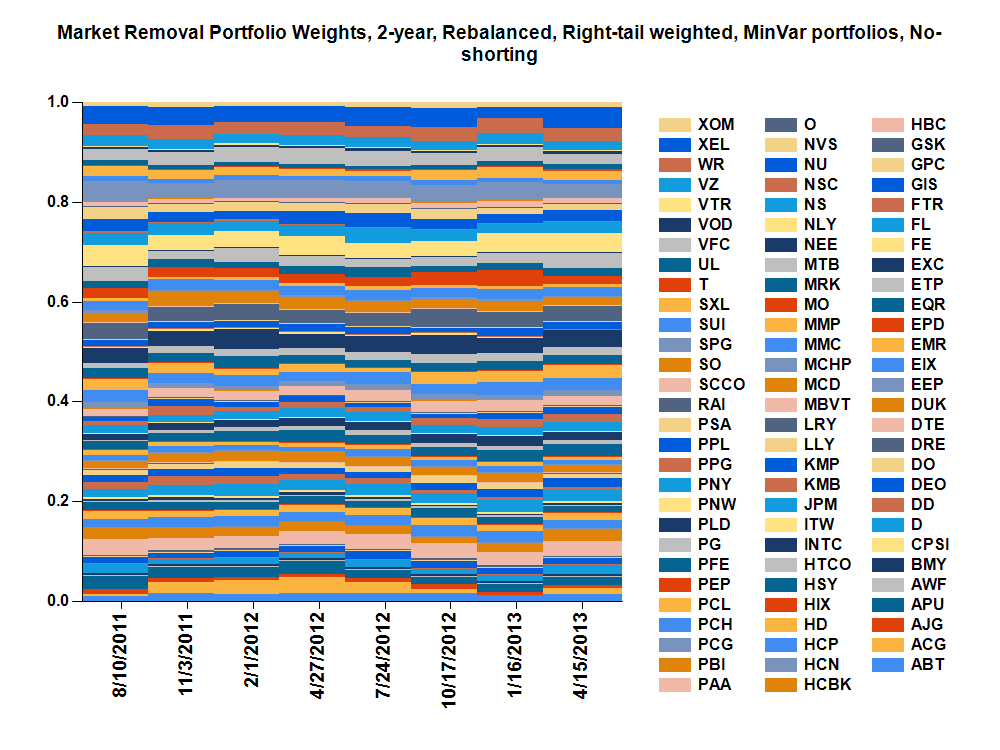

Returns,

Weights,

|

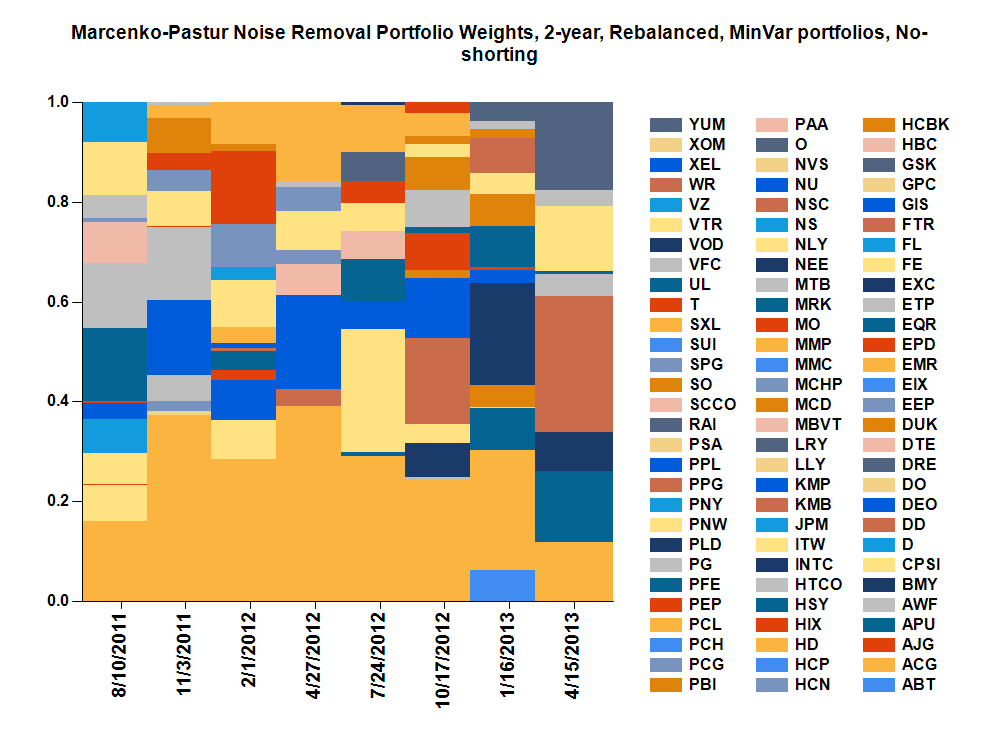

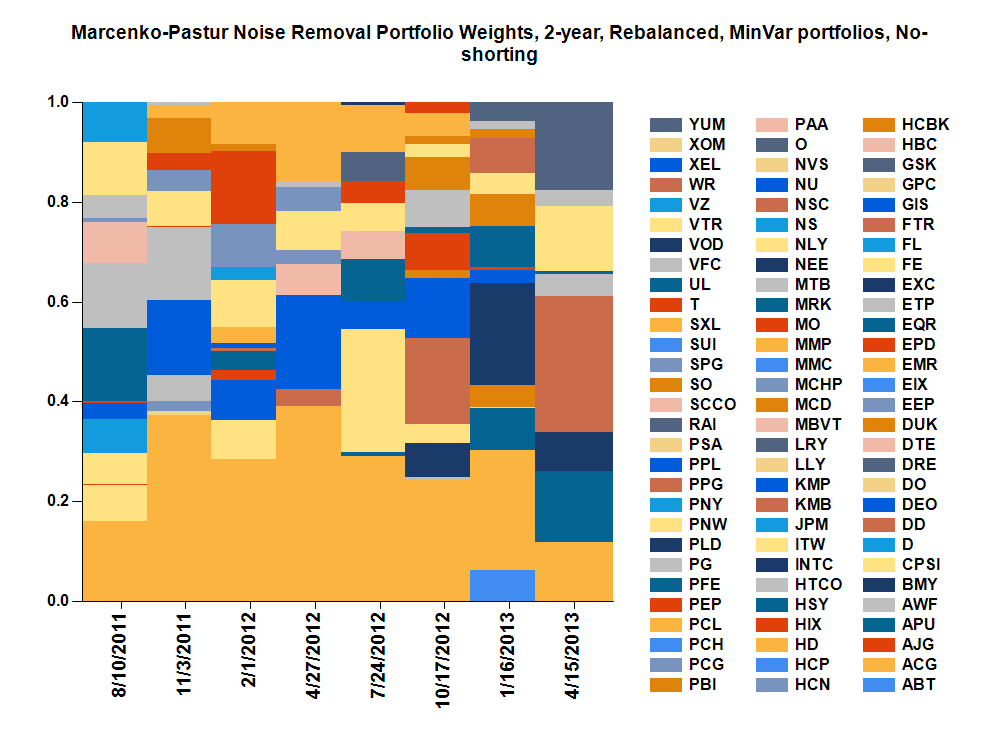

Returns,

Weights,

|

||

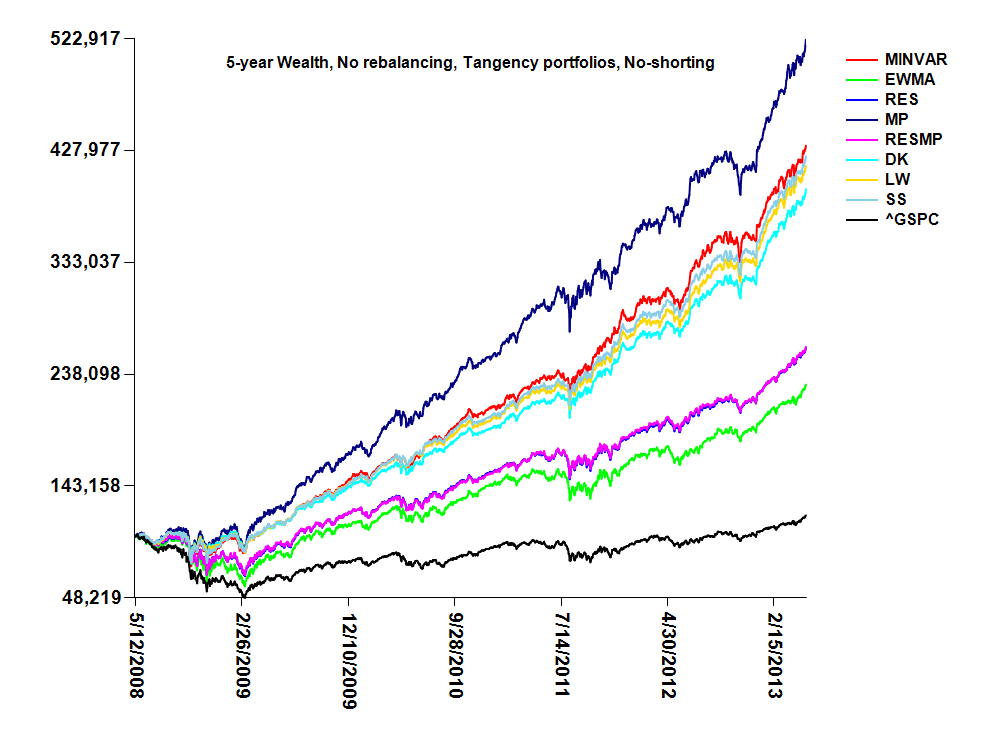

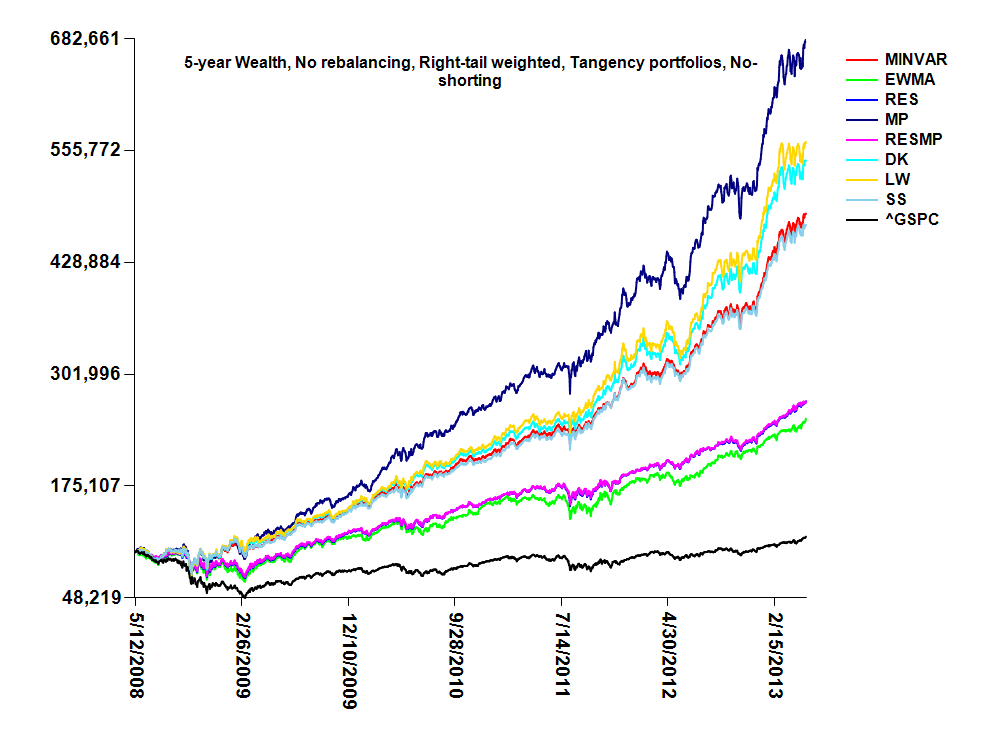

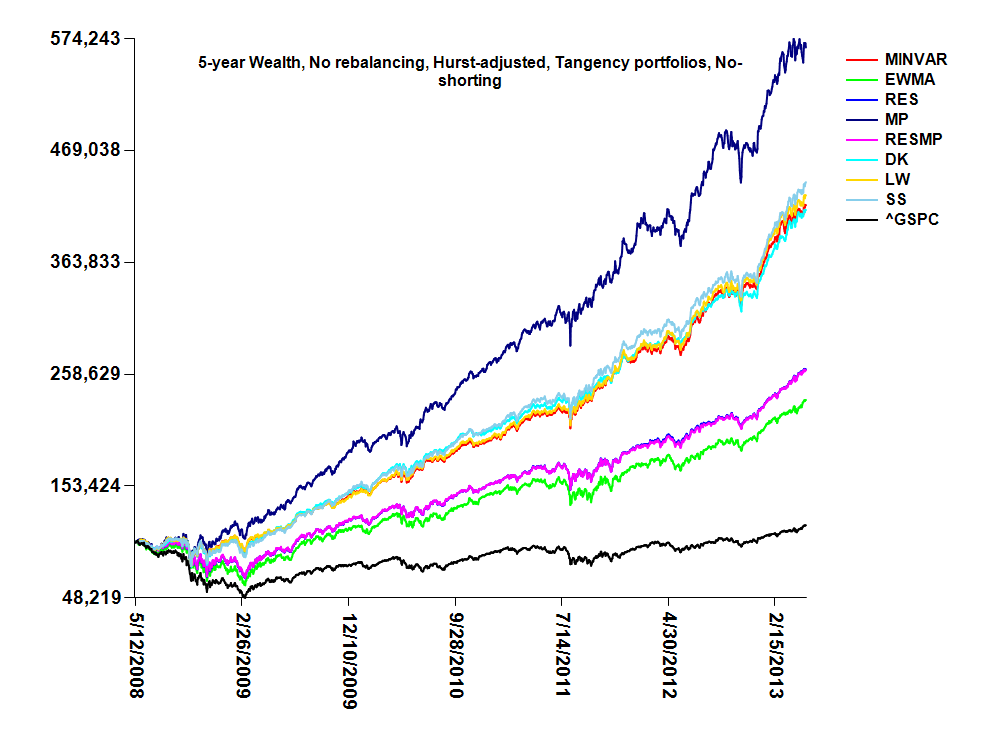

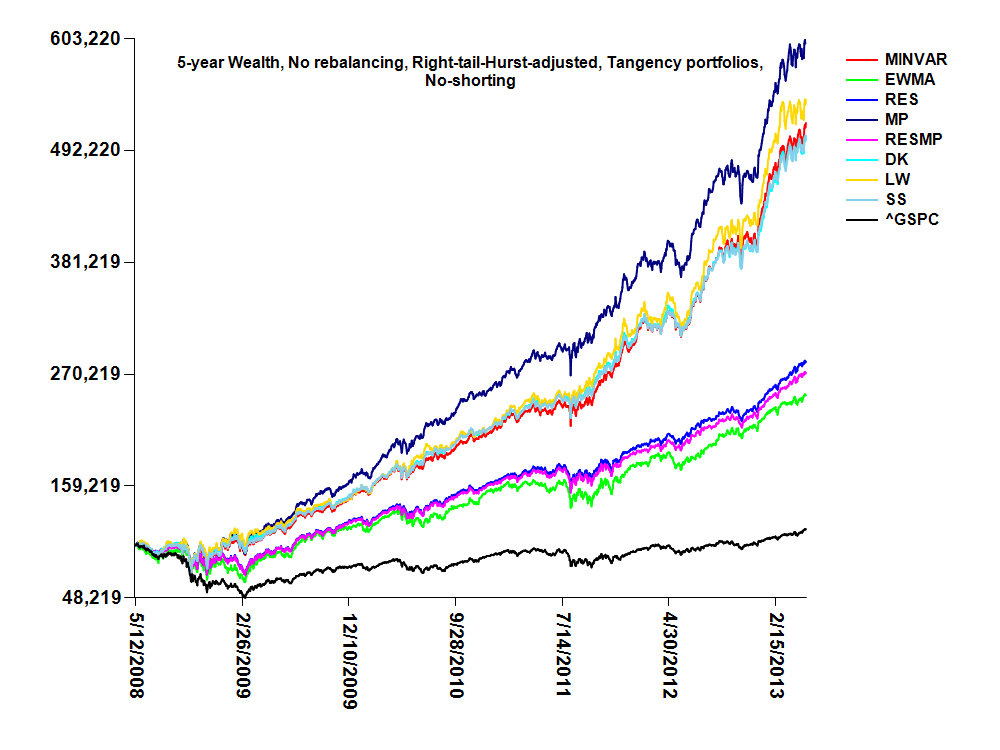

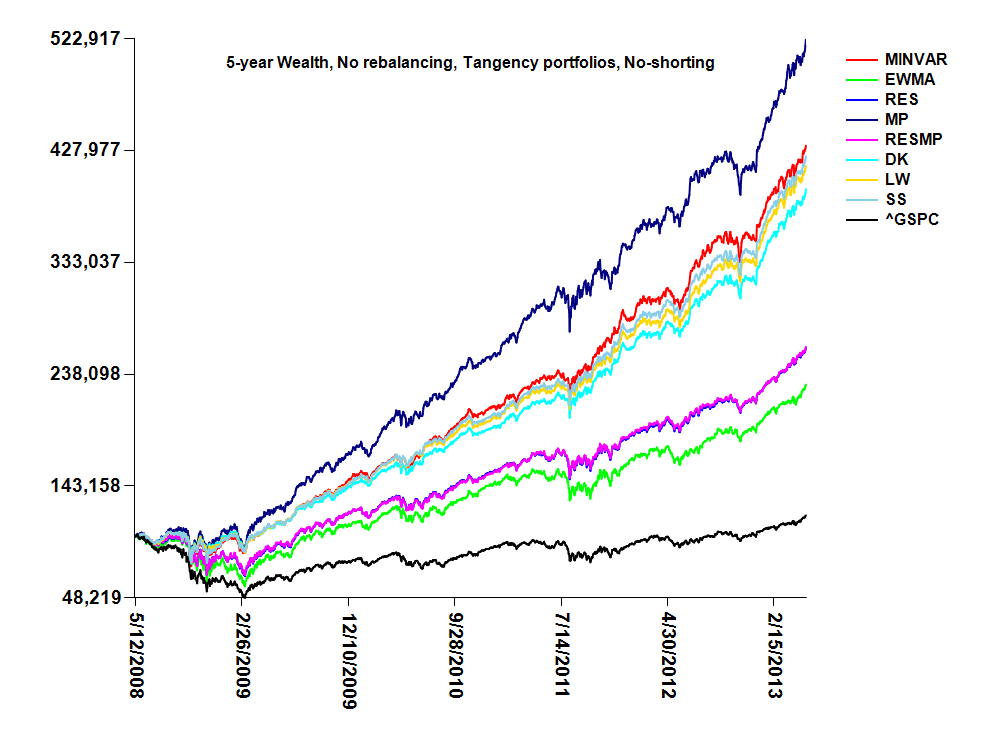

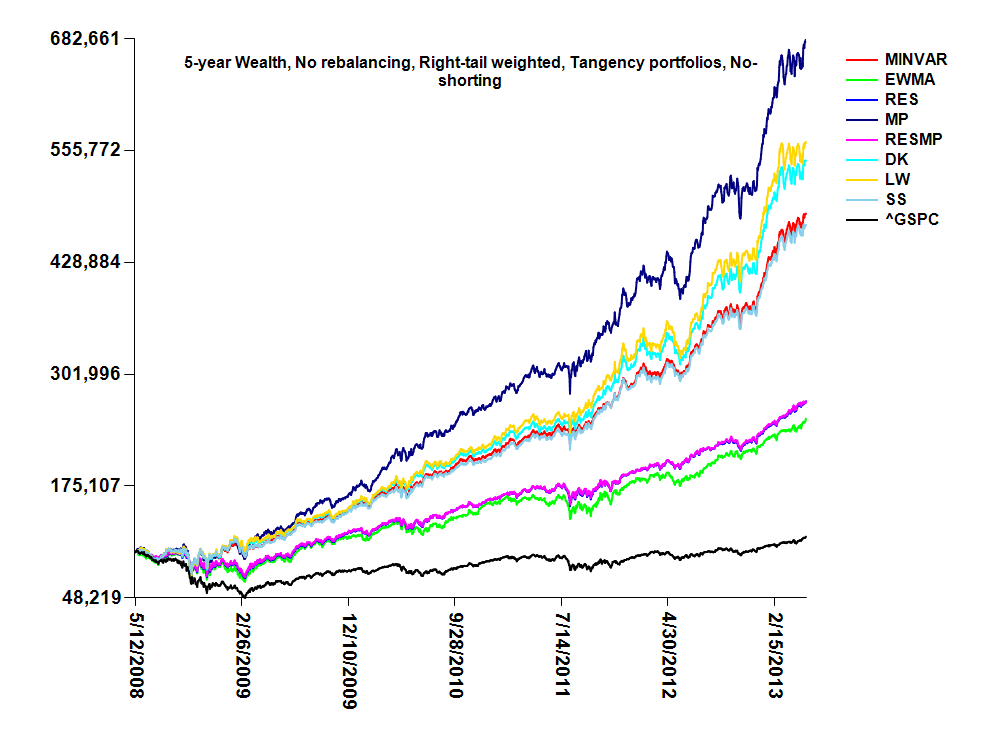

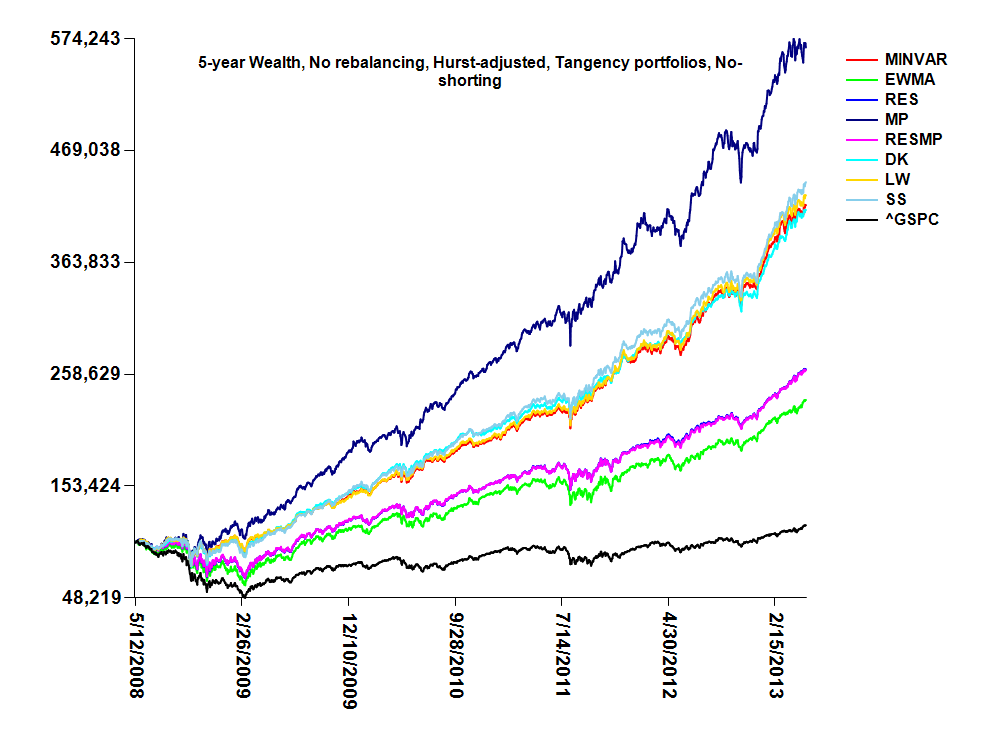

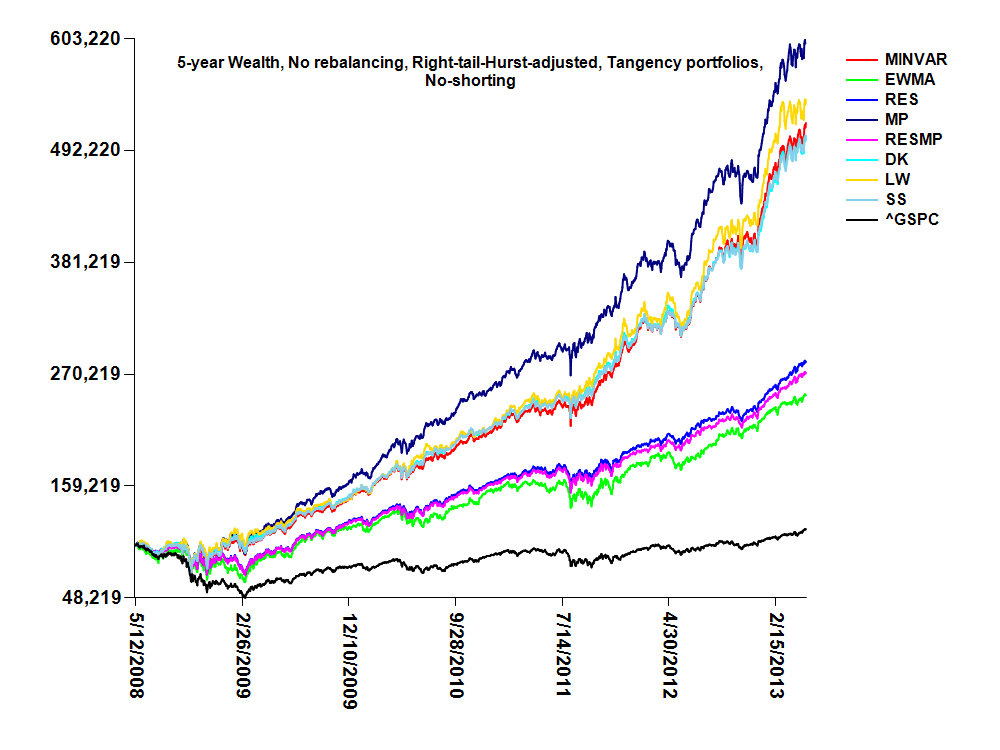

| 5 | No rebalancing | Log-return pdfs, fractal dimensions, tail risks, CVaR |

|

Returns,

Weights,

|

Returns,

Weights,

|

Returns,

Weights,

|

Returns,

Weights,

|

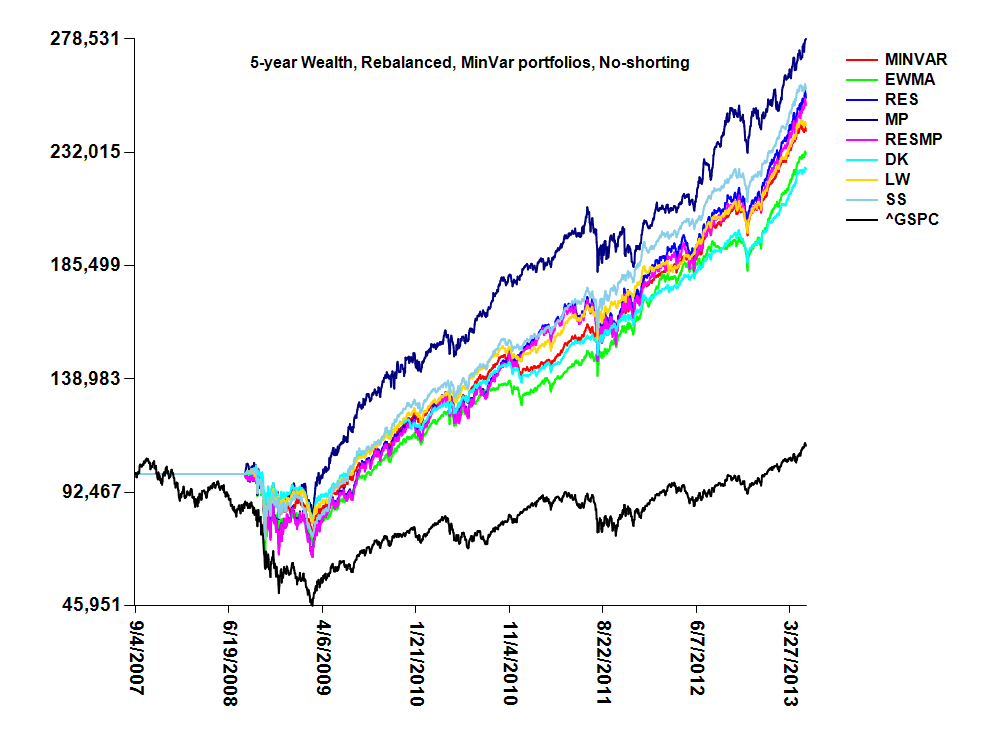

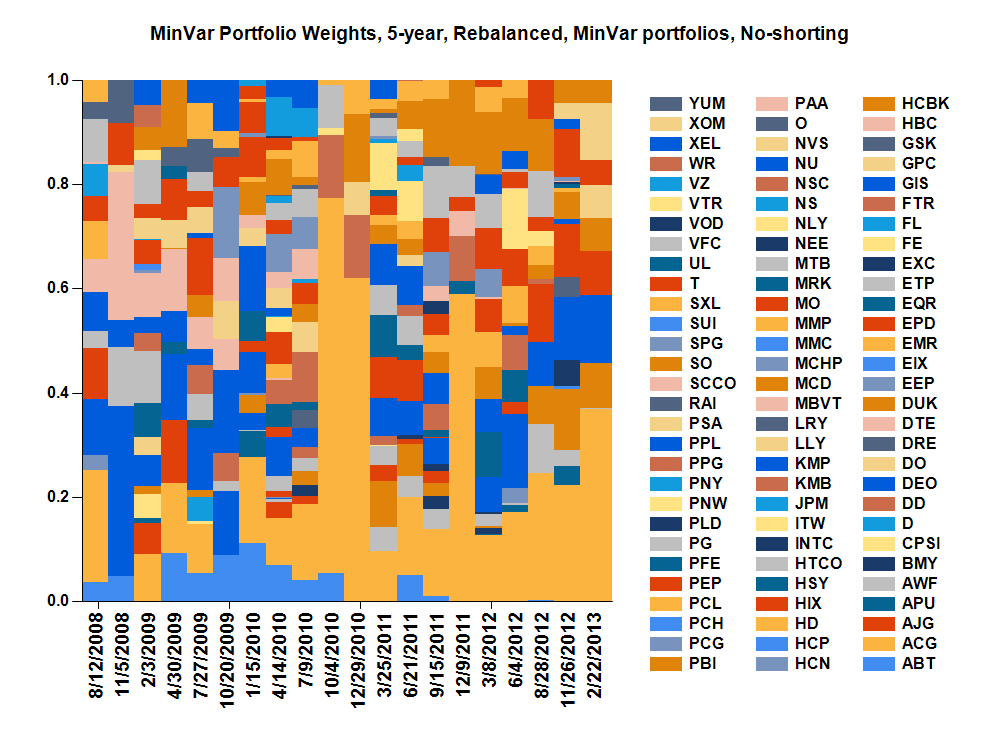

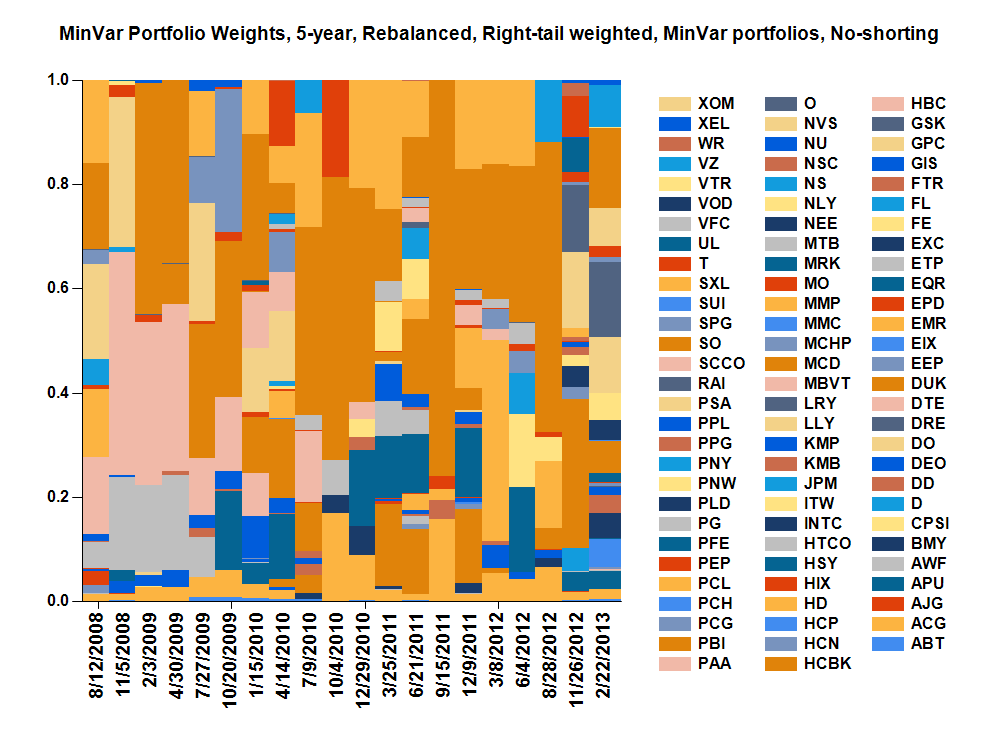

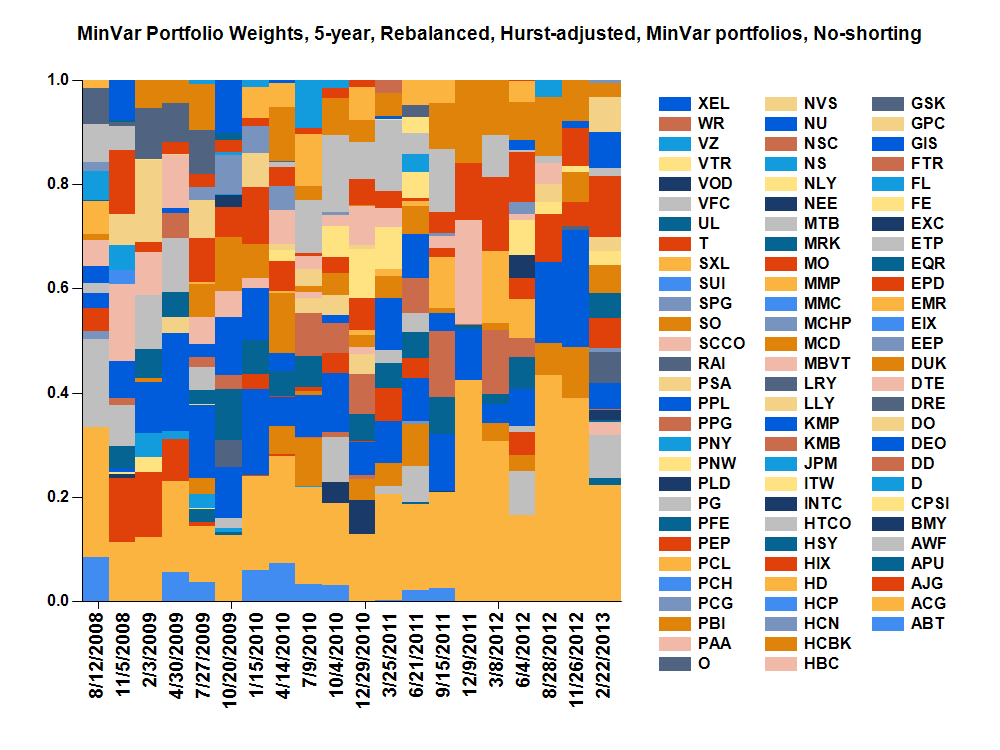

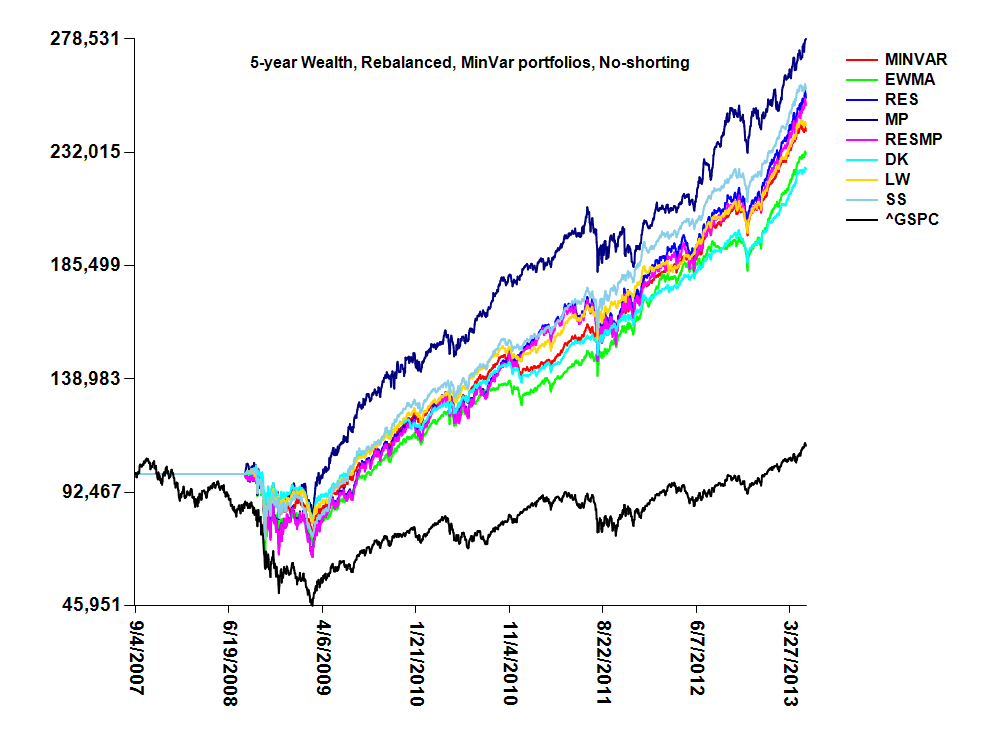

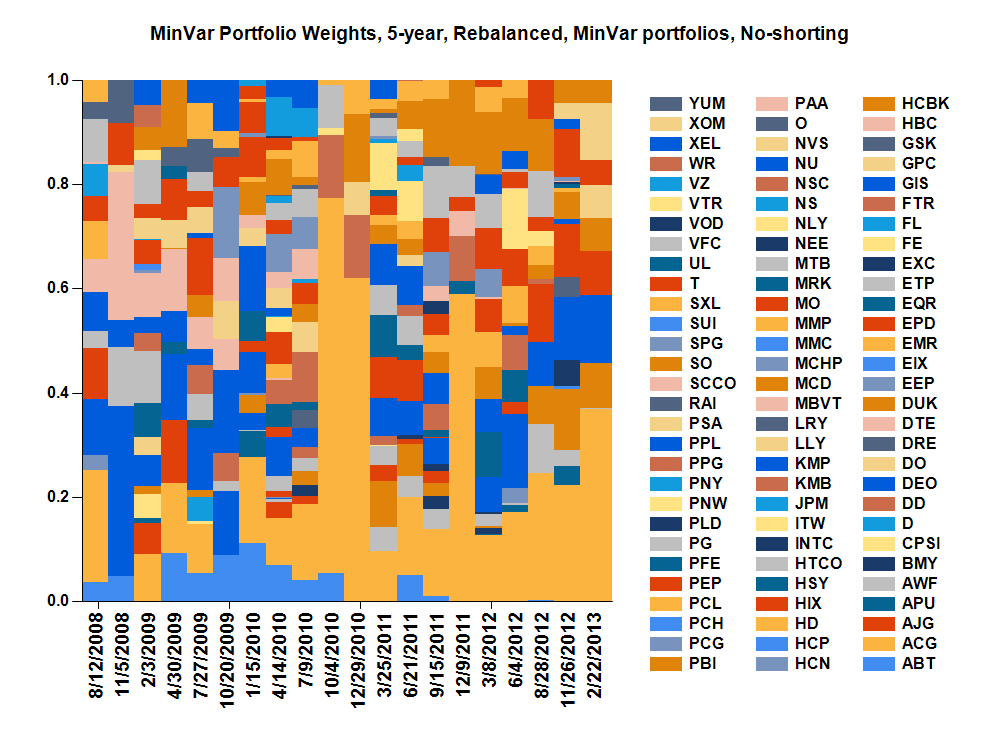

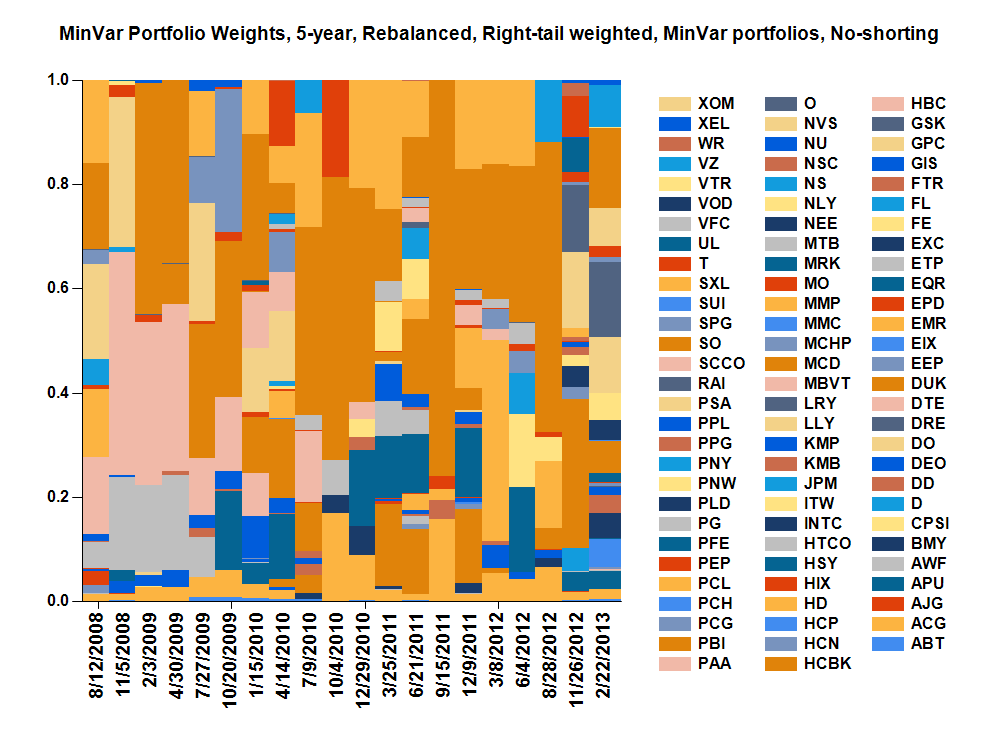

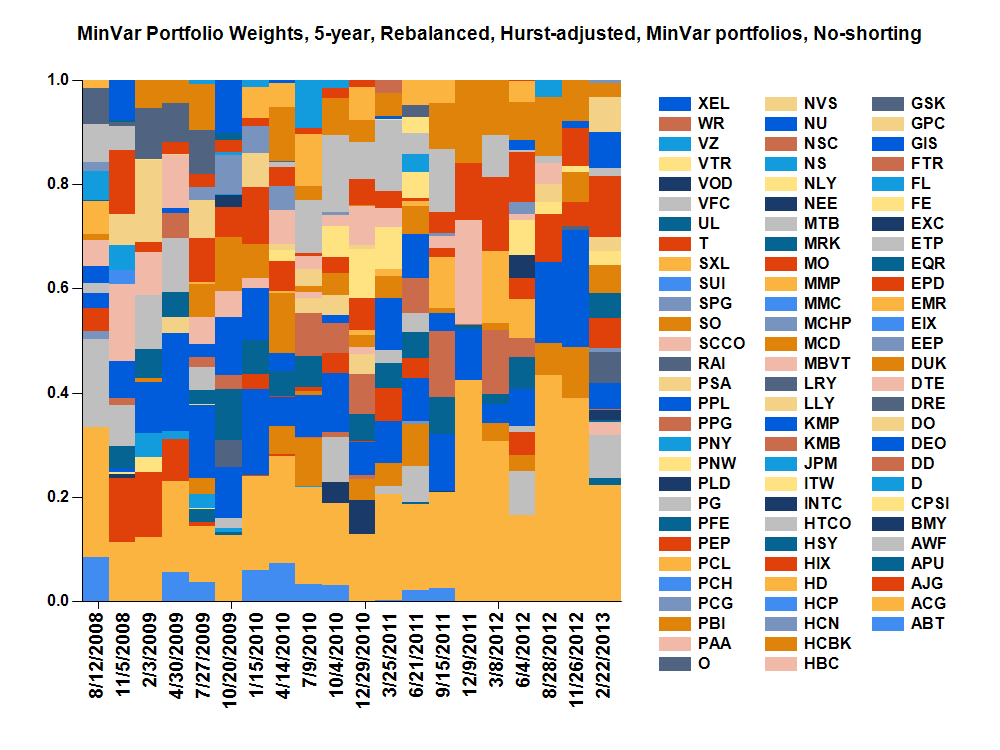

| 5 | Rebalanced quarterly | Returns,

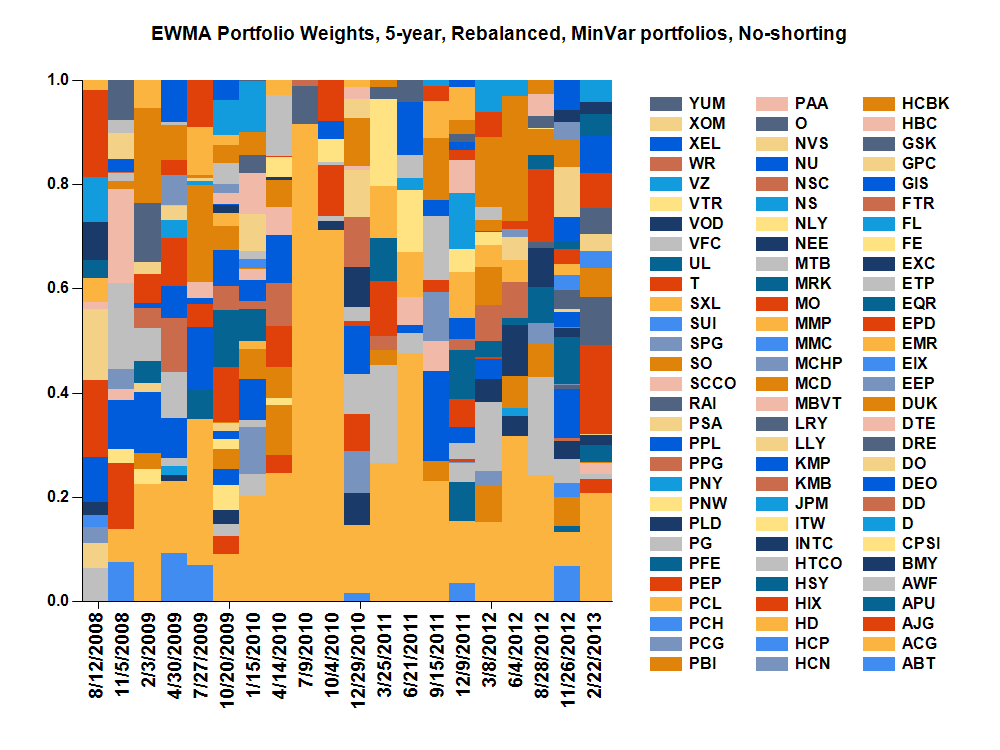

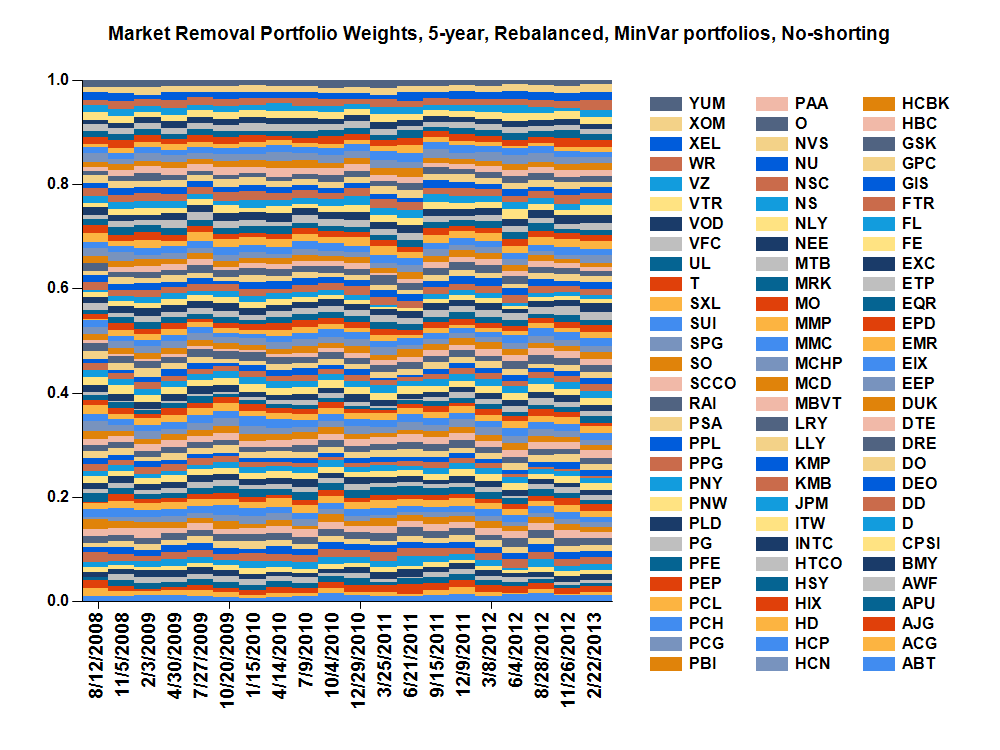

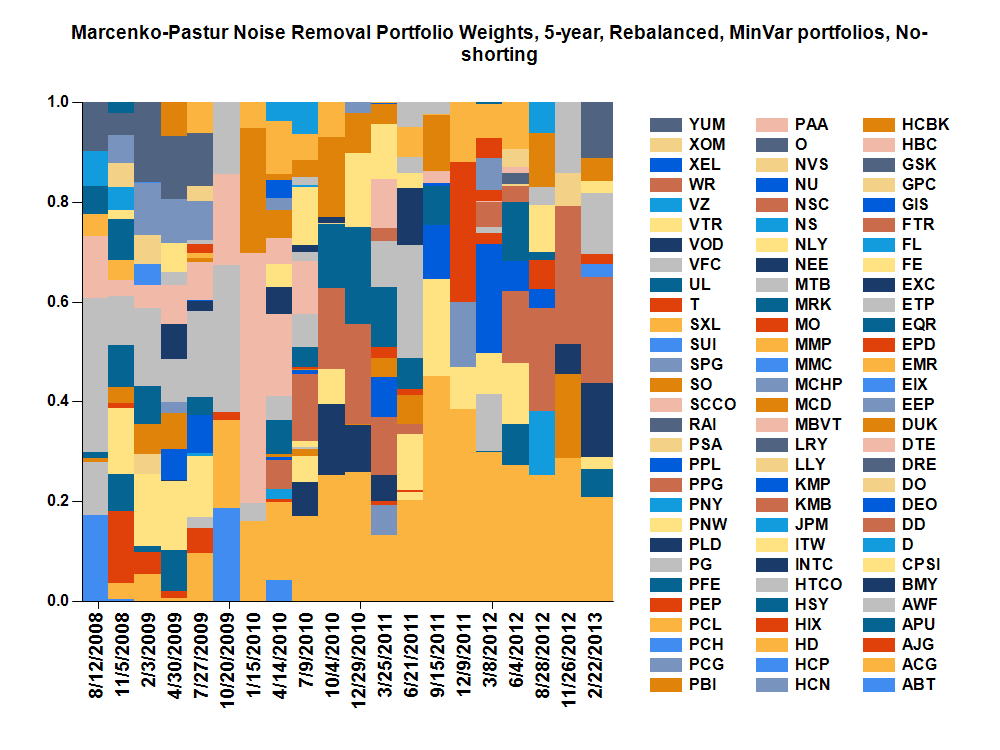

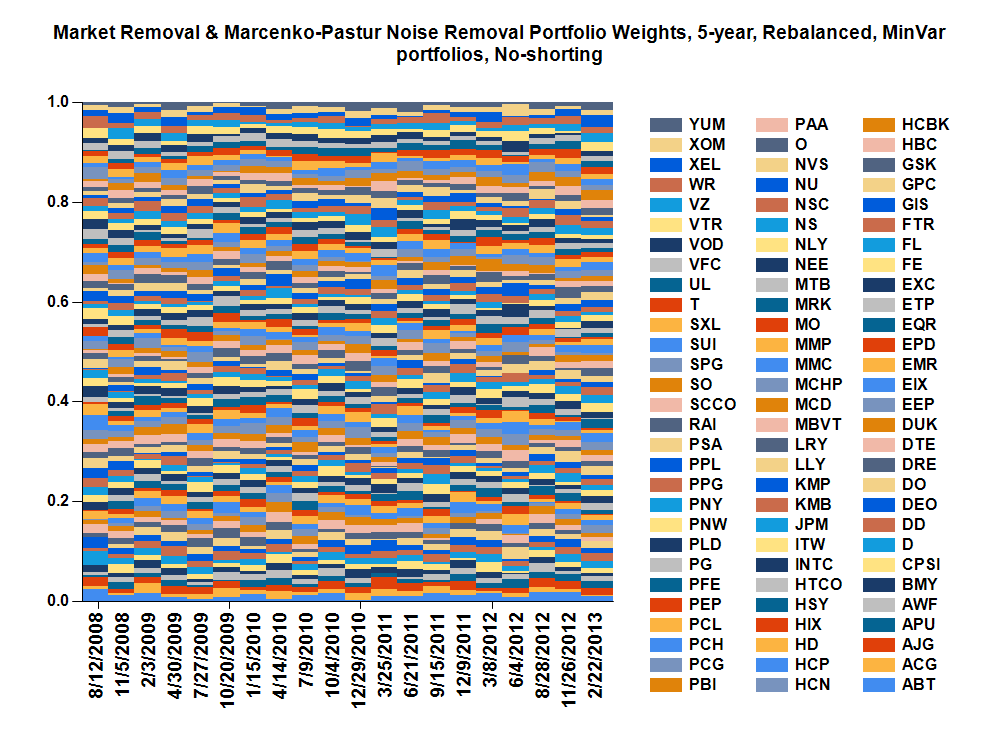

Weights,

|

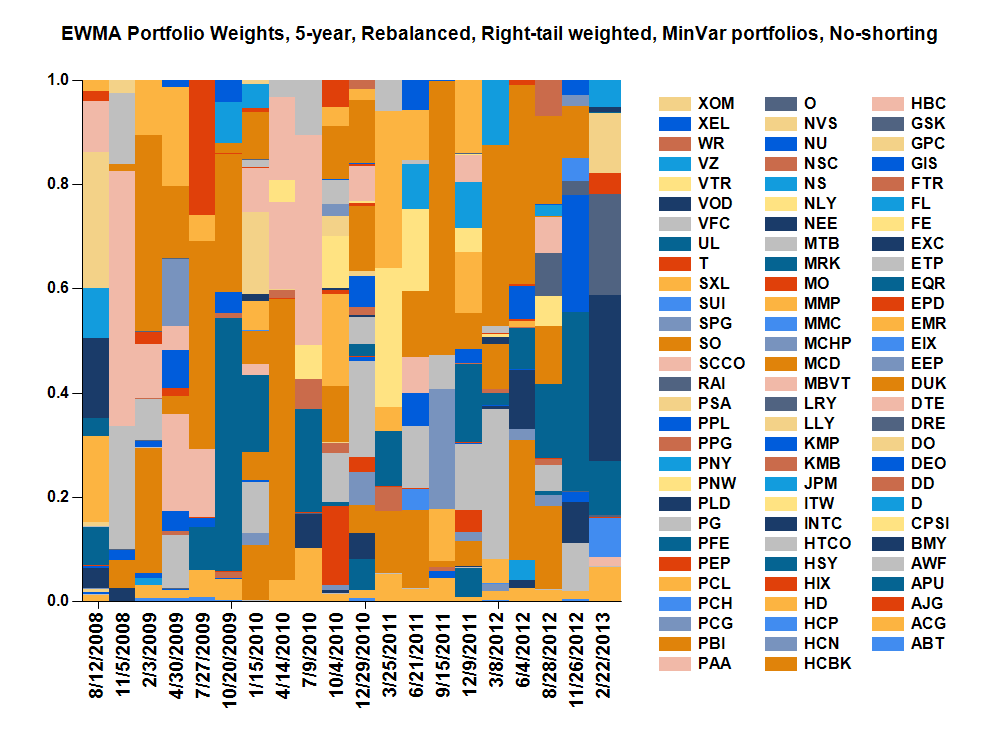

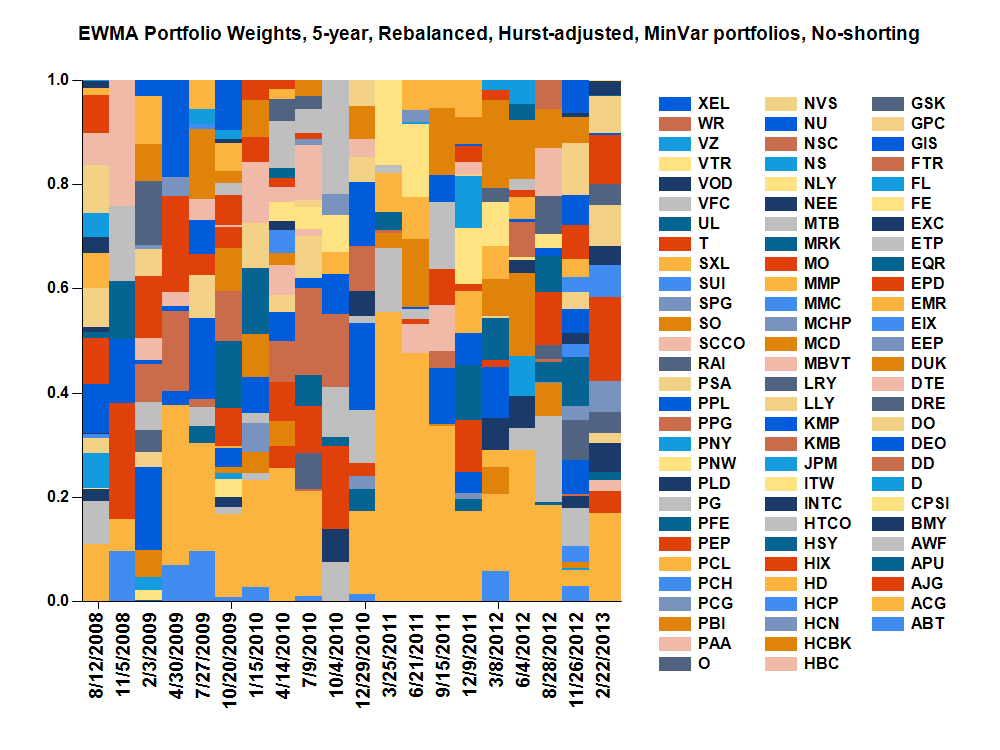

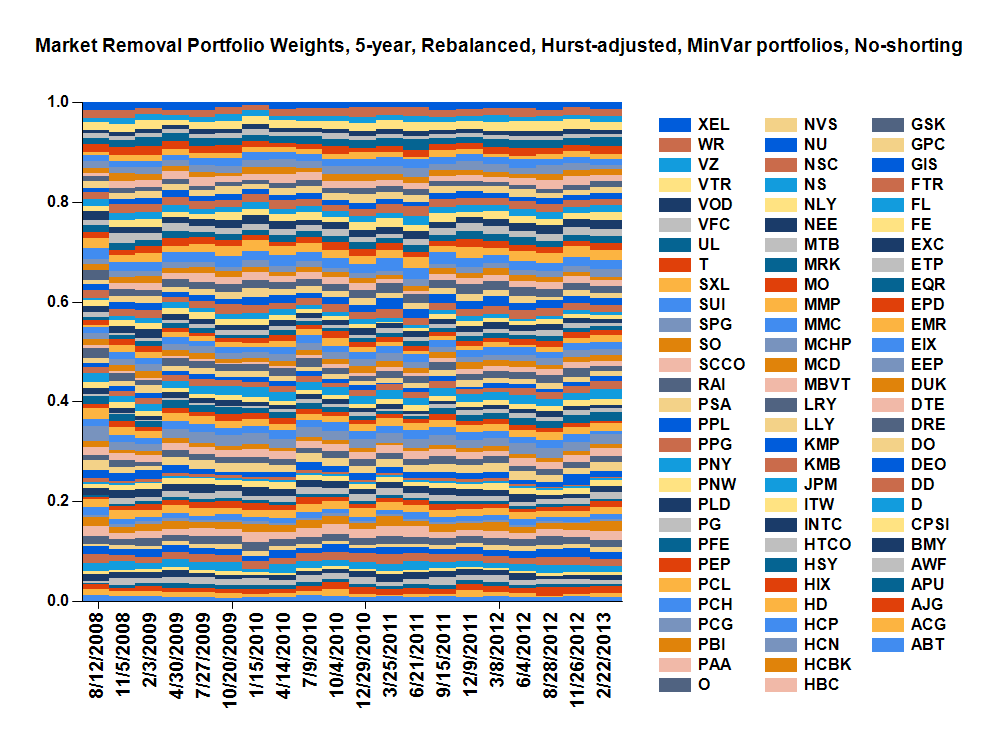

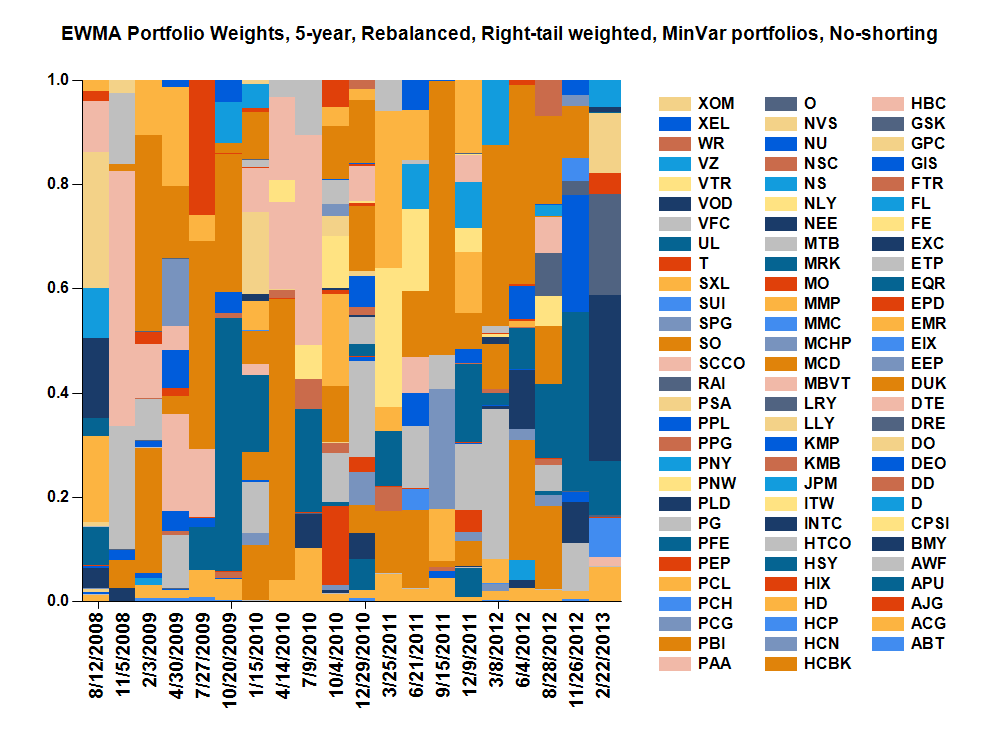

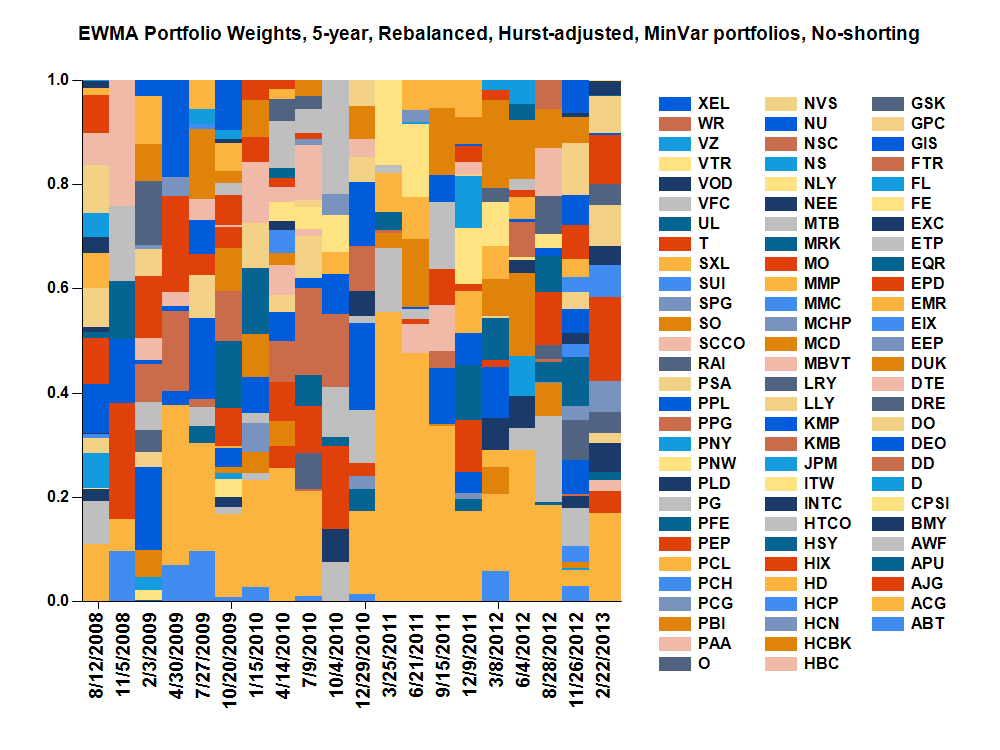

Returns,

Weights,

|

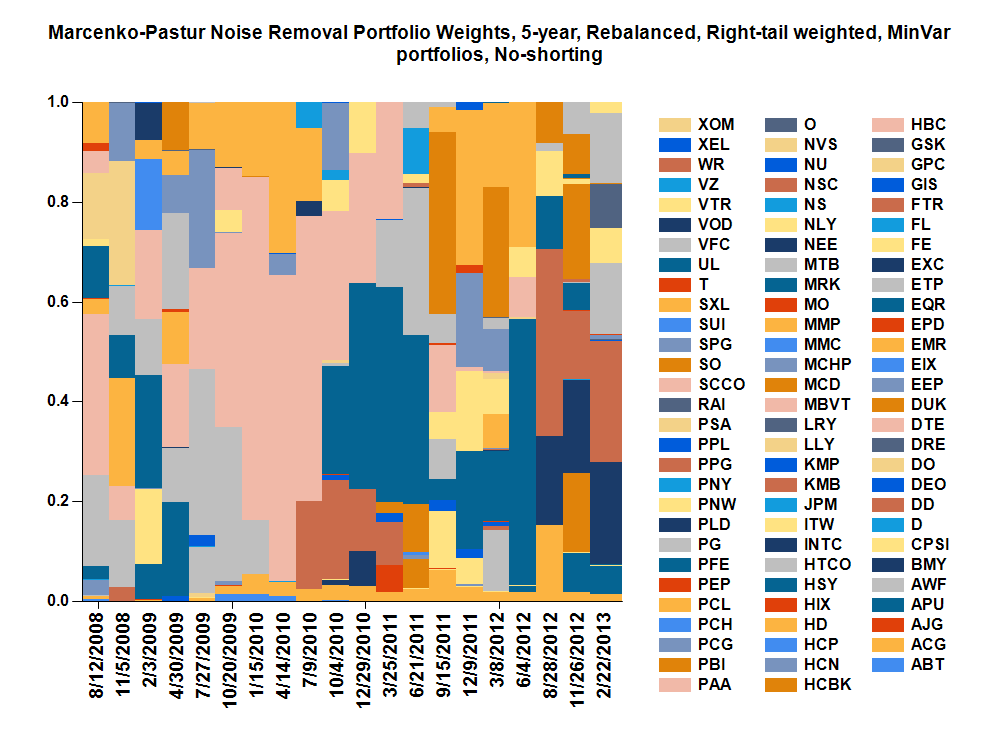

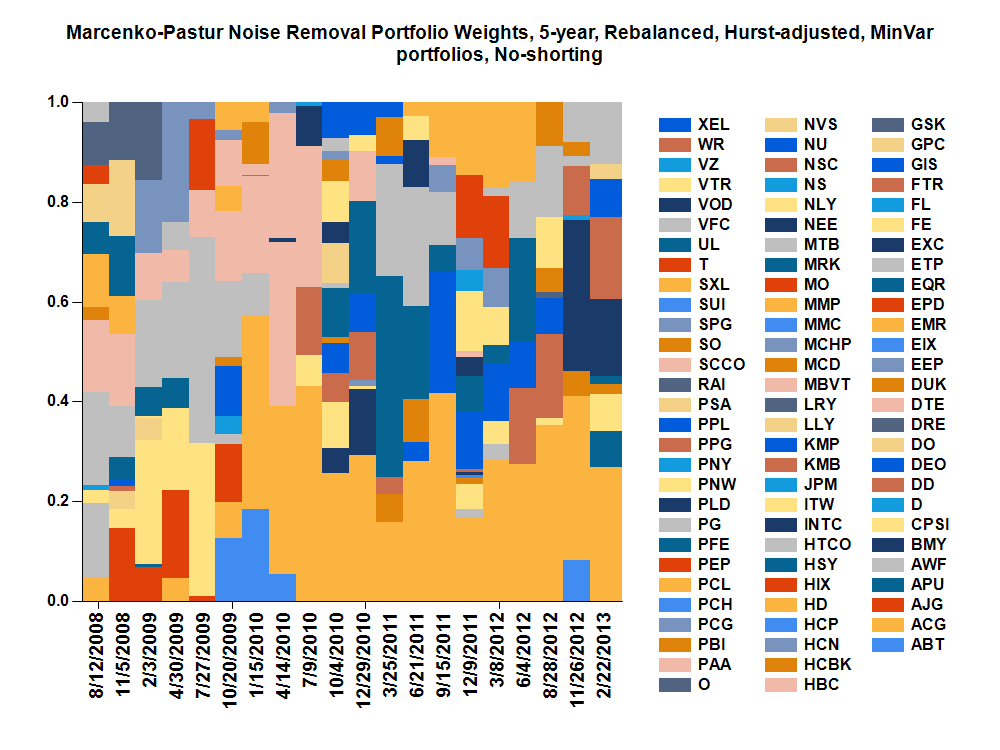

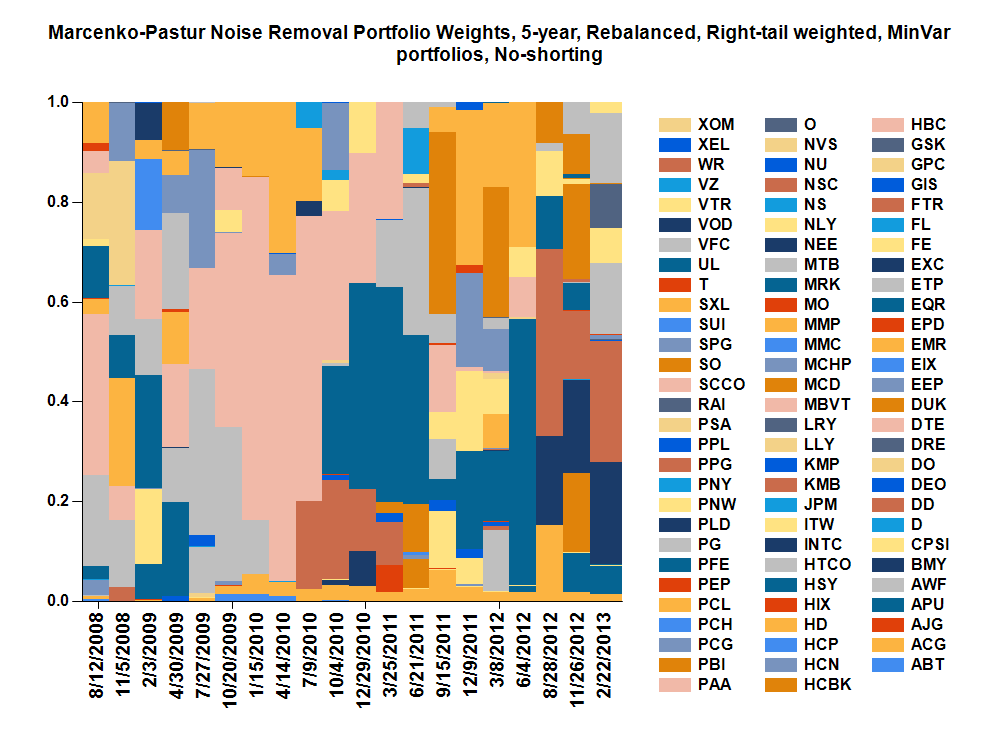

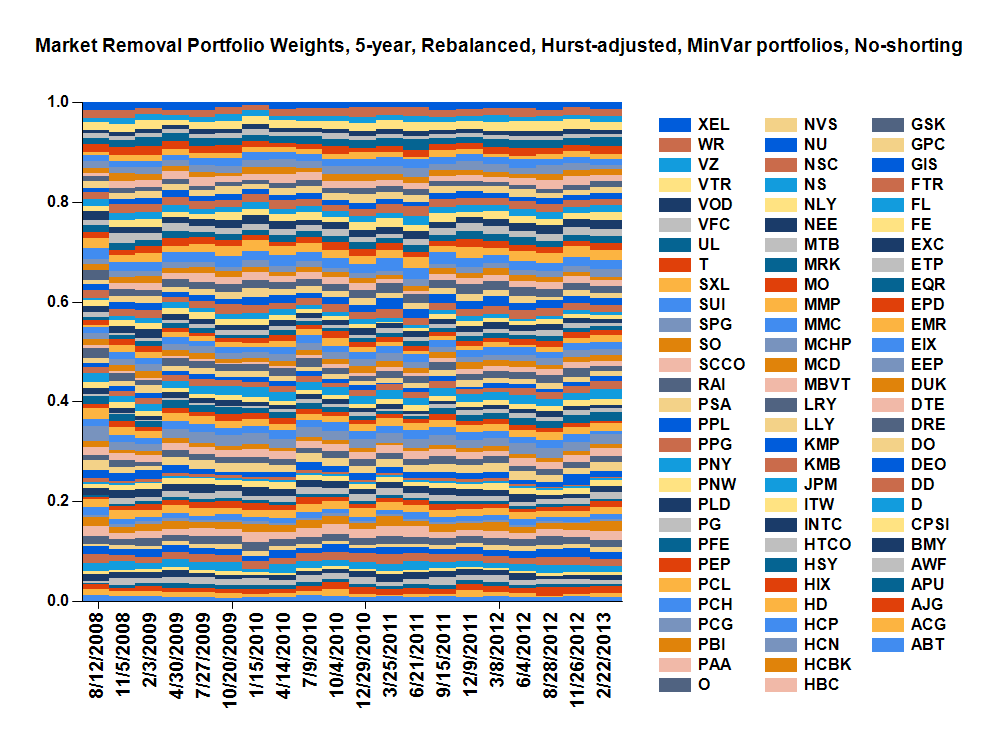

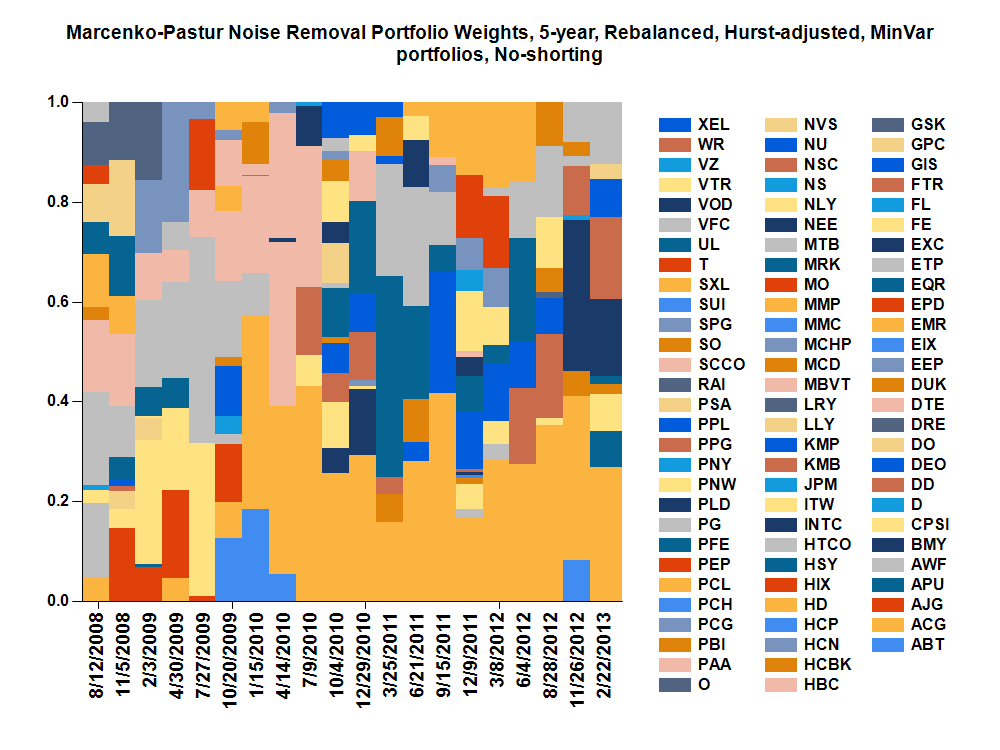

Returns,

Weights,

|

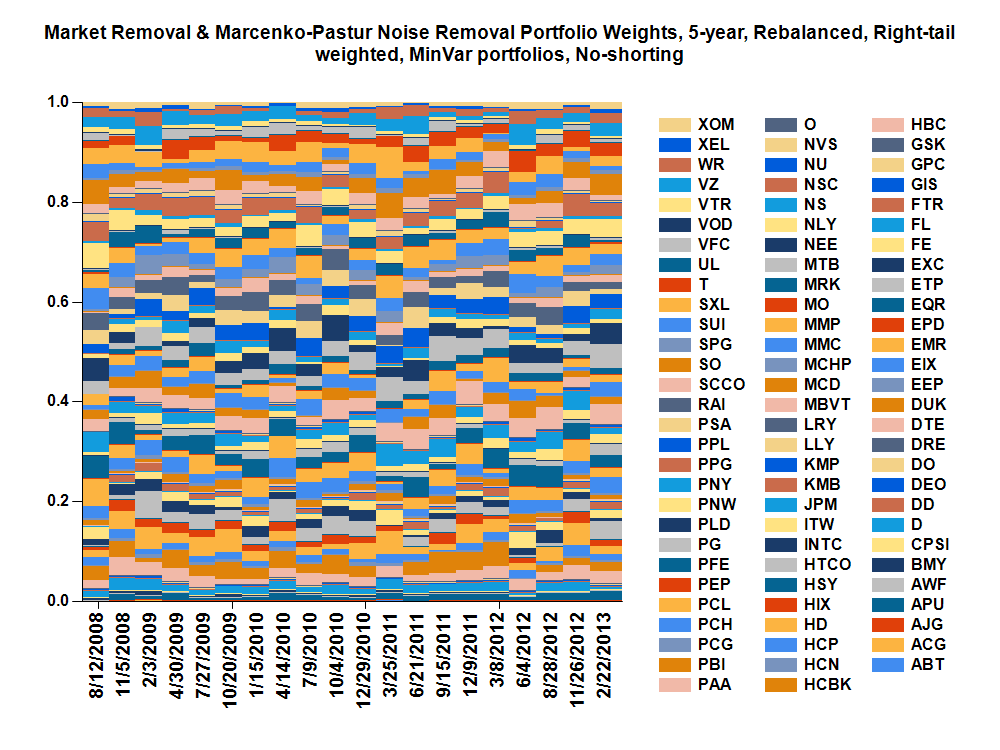

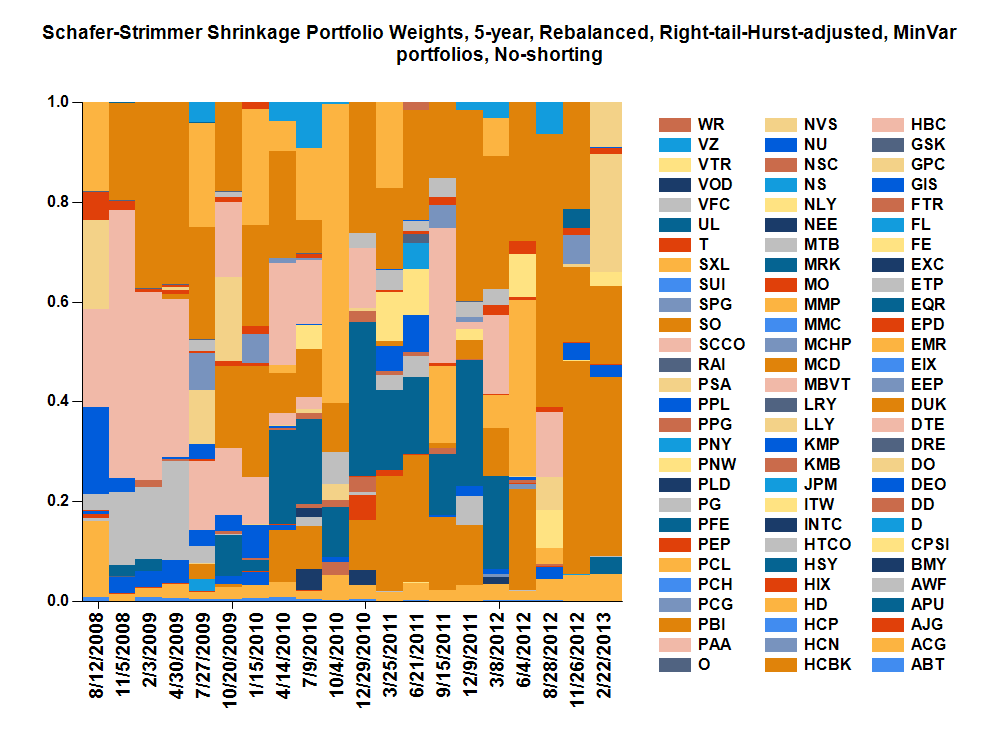

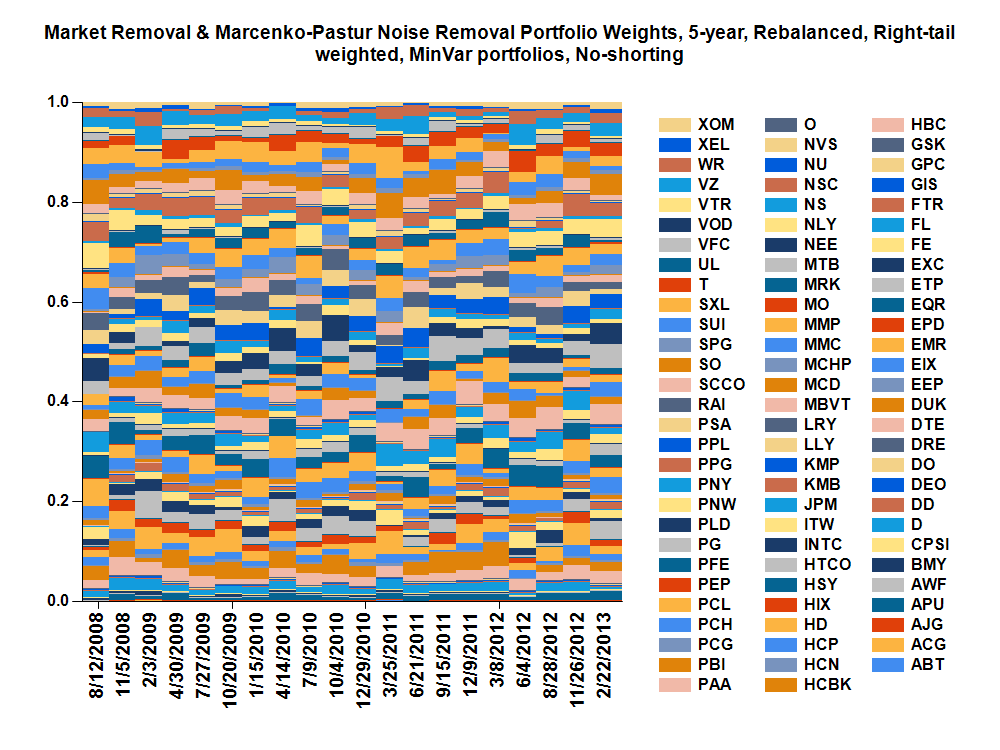

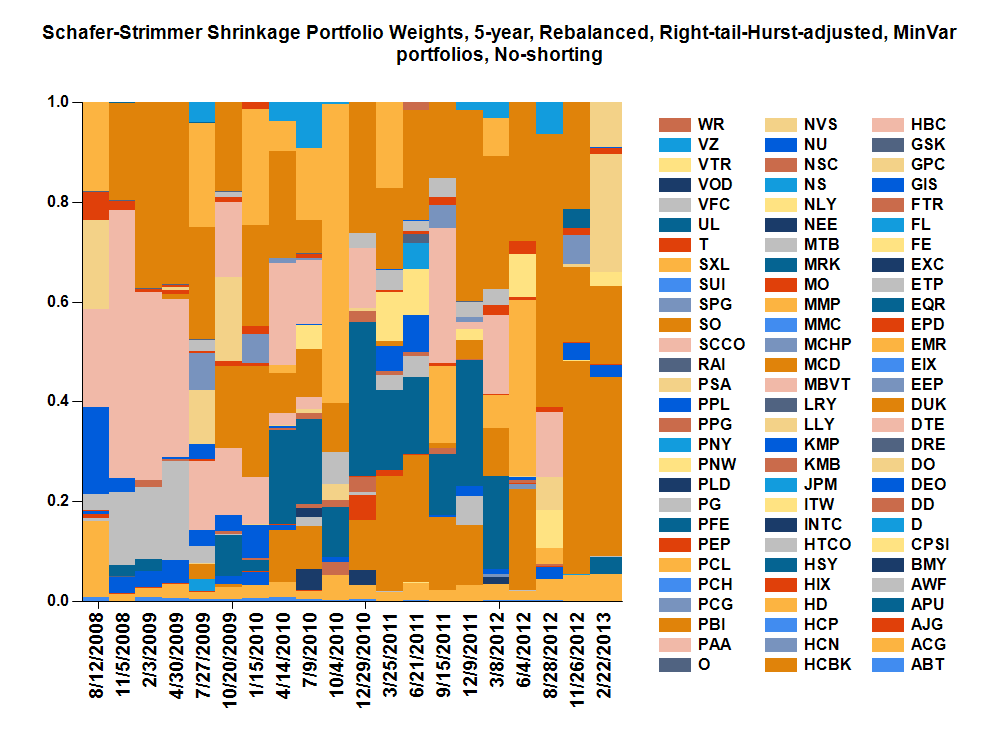

Returns,

Weights,

|

||

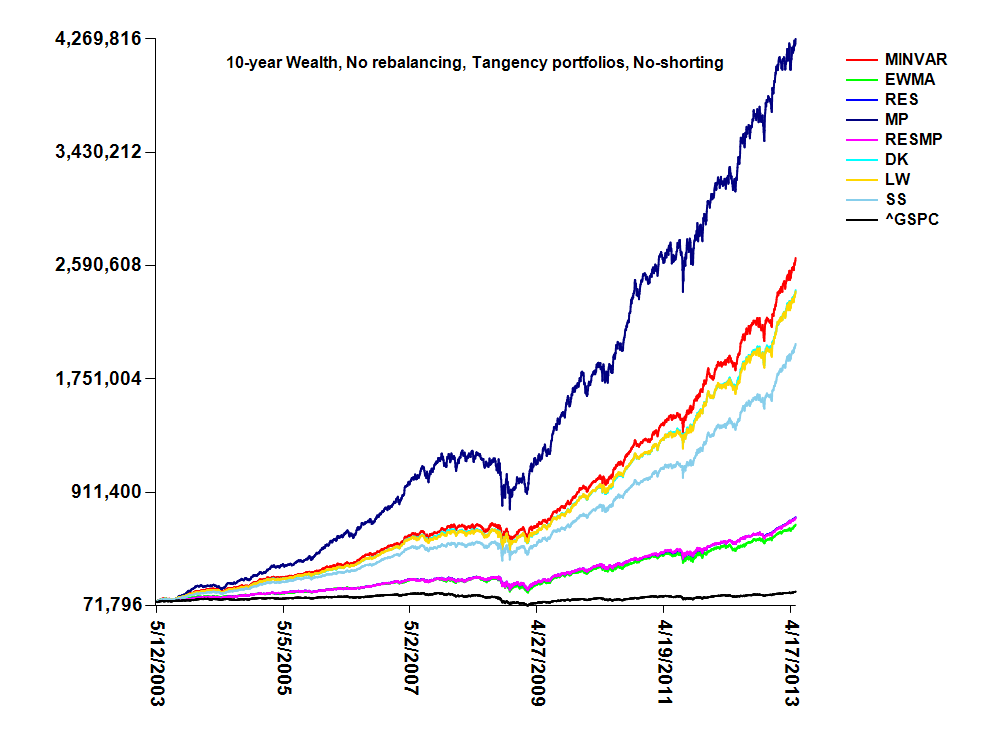

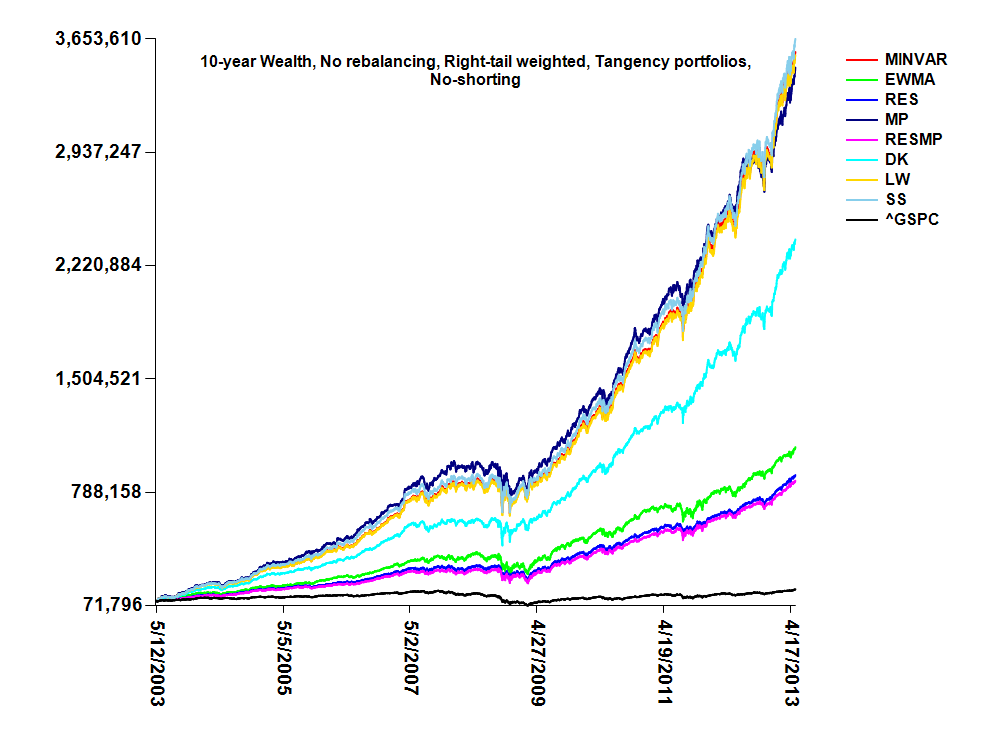

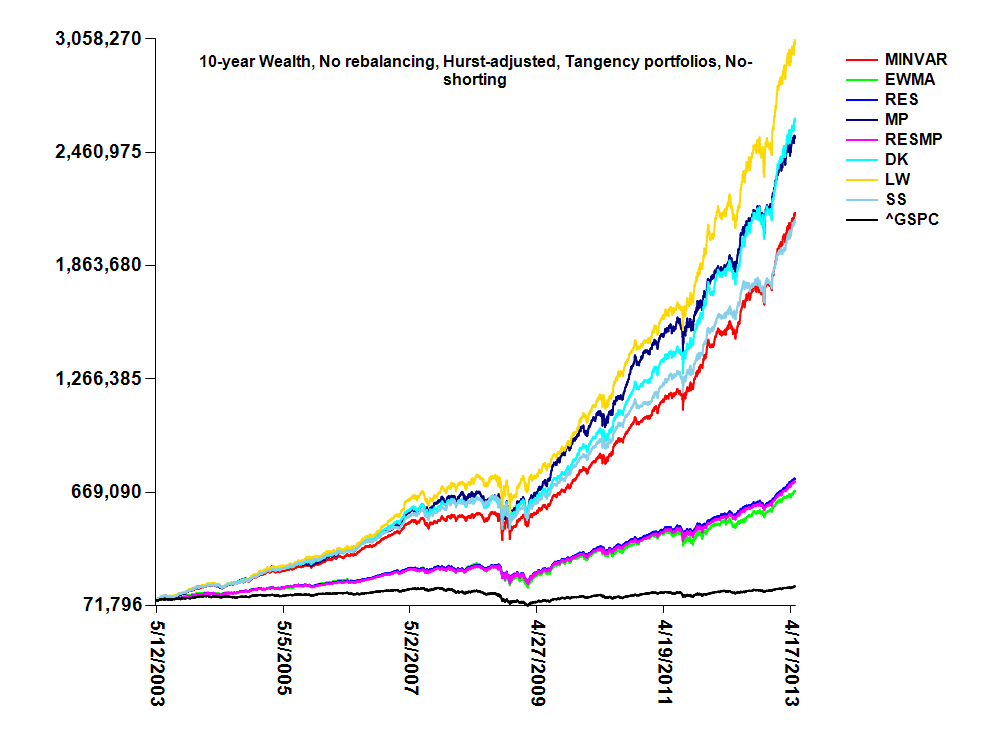

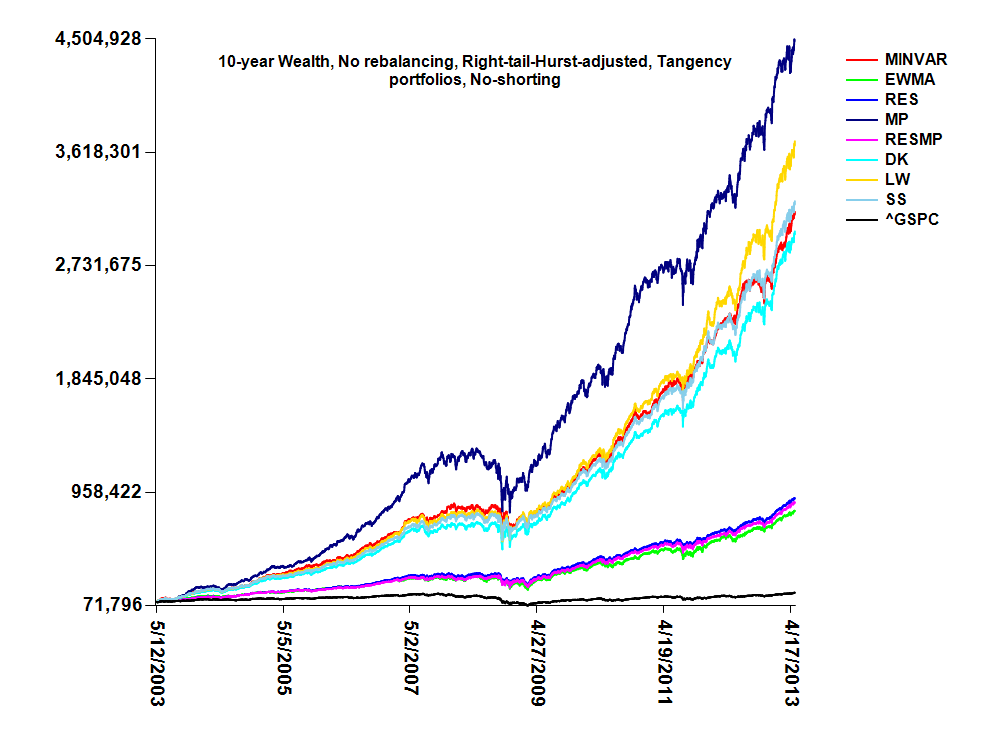

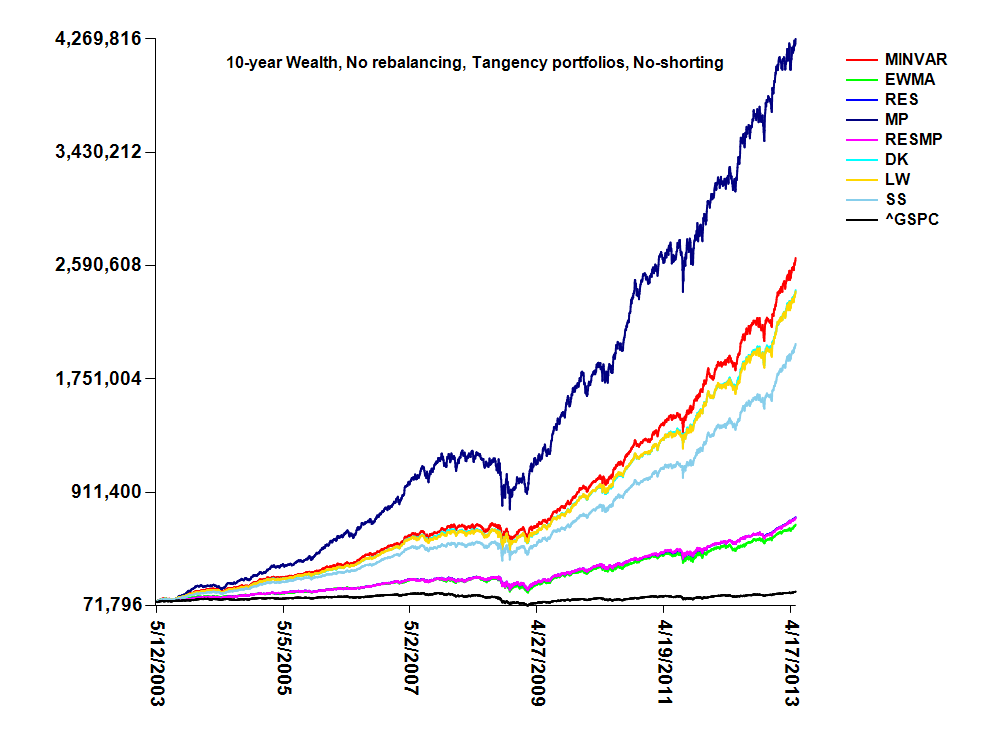

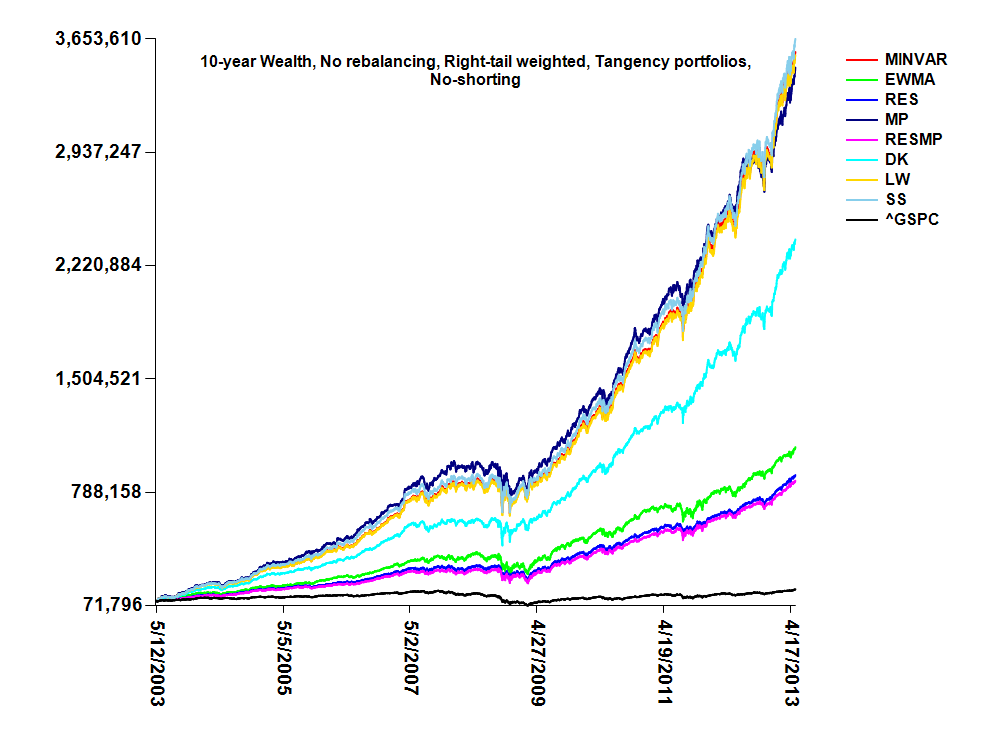

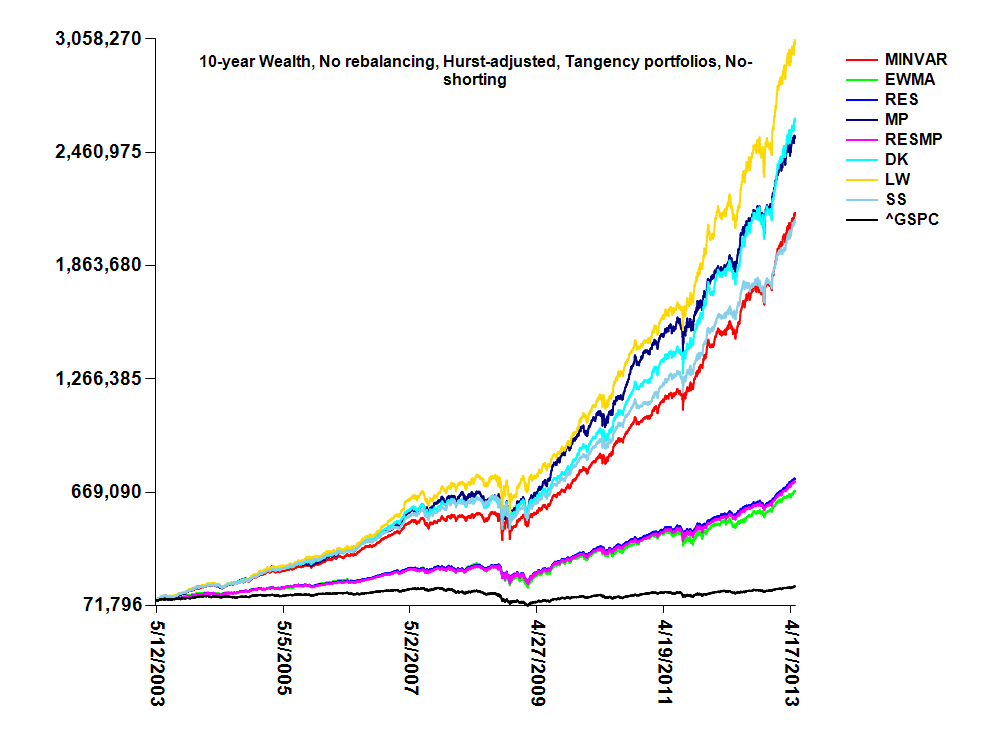

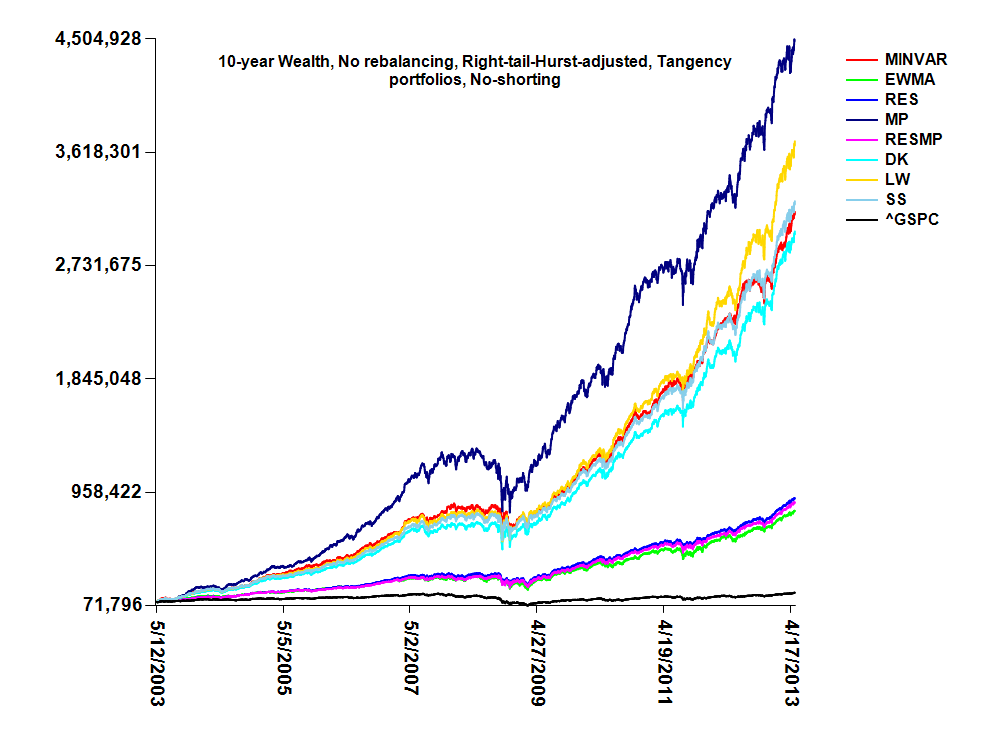

| 10 | No rebalancing | Log-return pdfs, fractal dimensions, tail risks, CVaR |

|

Returns,

Weights,

|

Returns,

Weights,

|

Returns,

Weights,

|

Returns,

Weights,

|

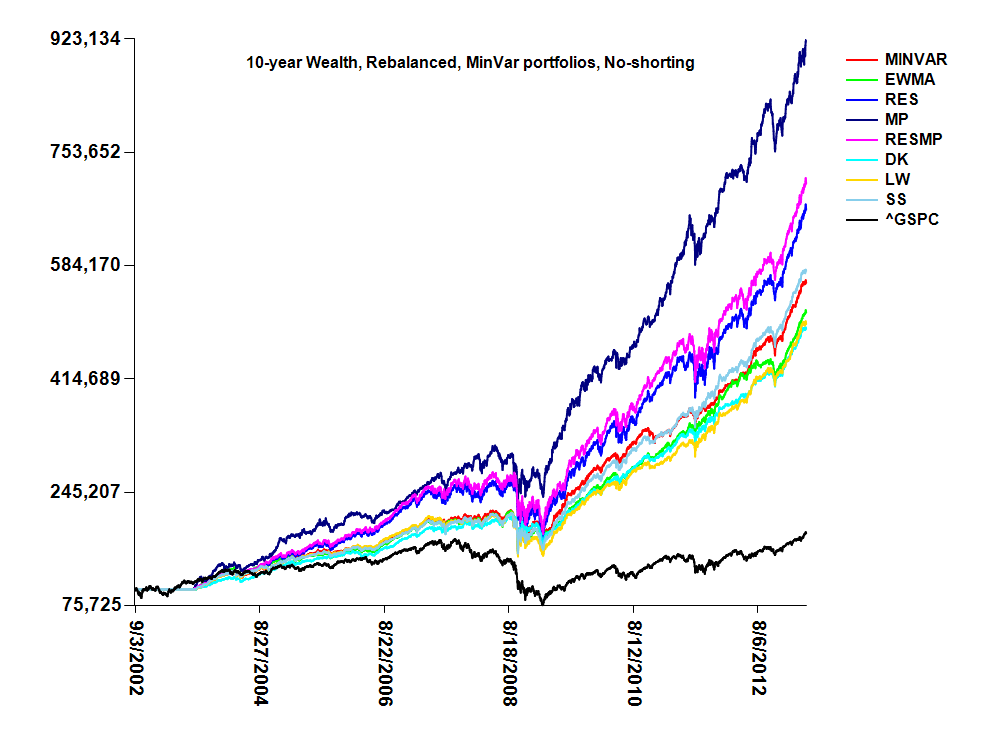

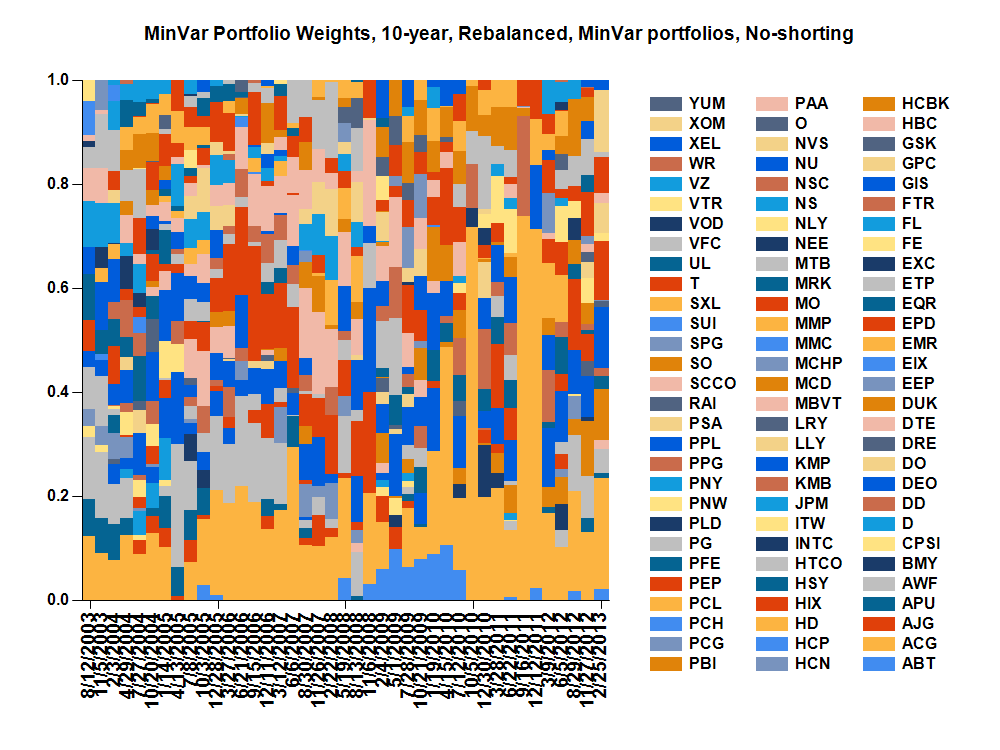

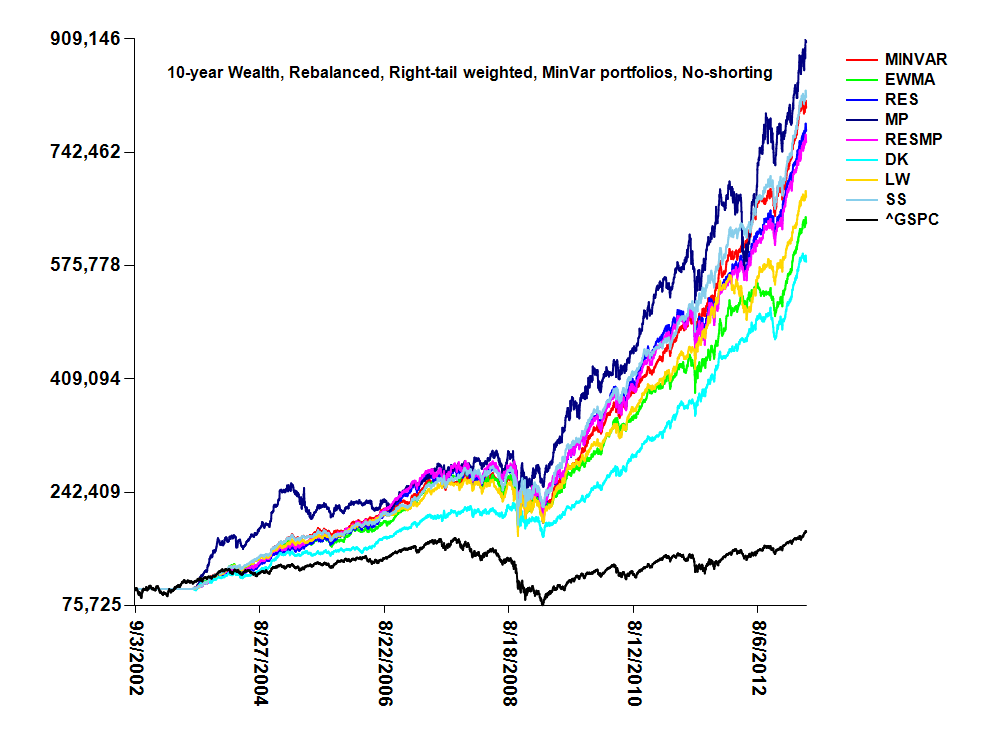

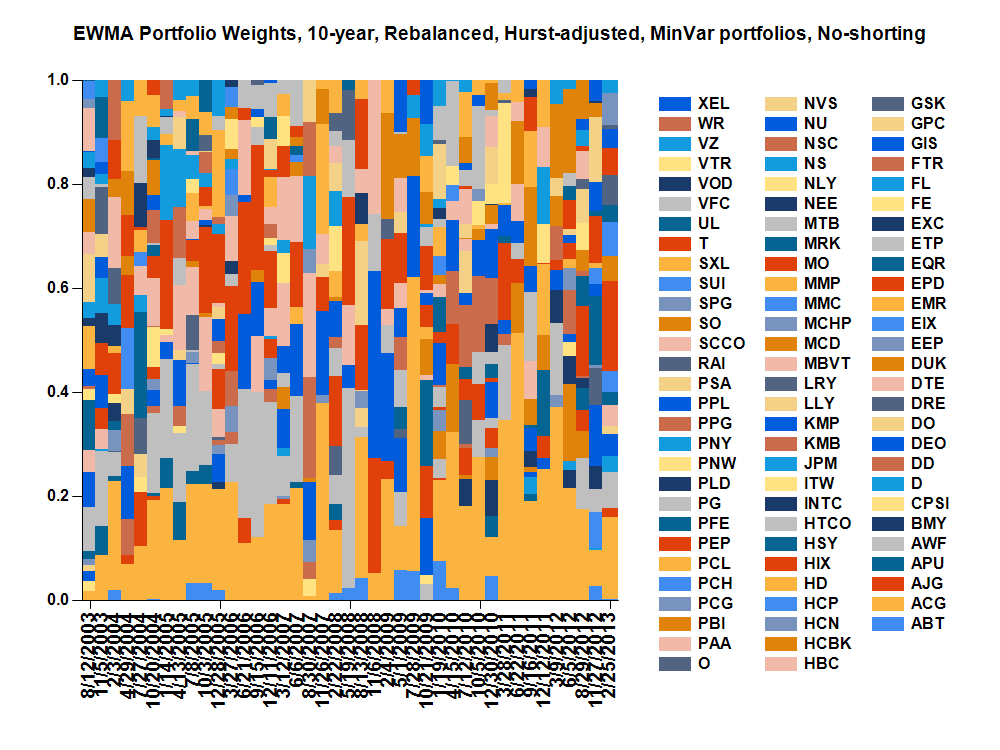

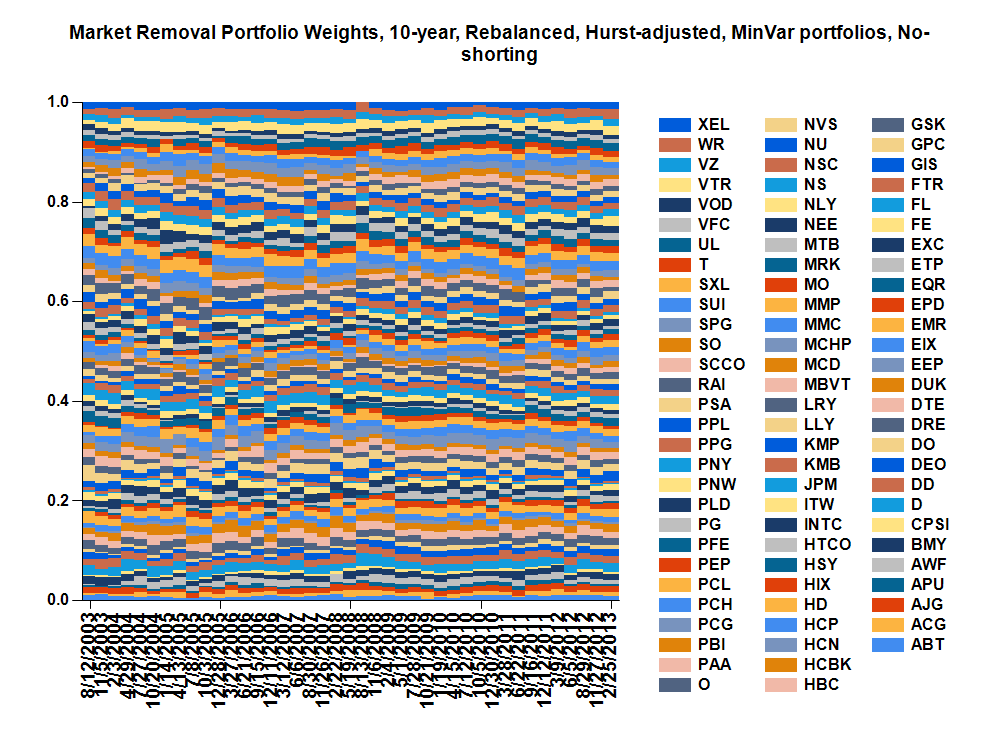

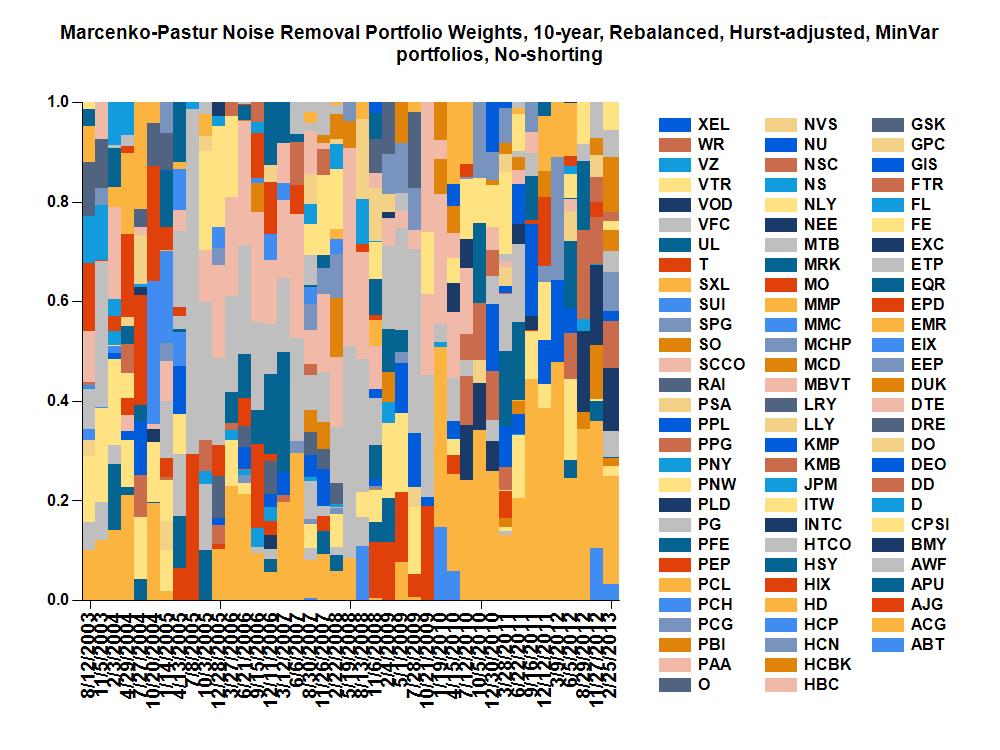

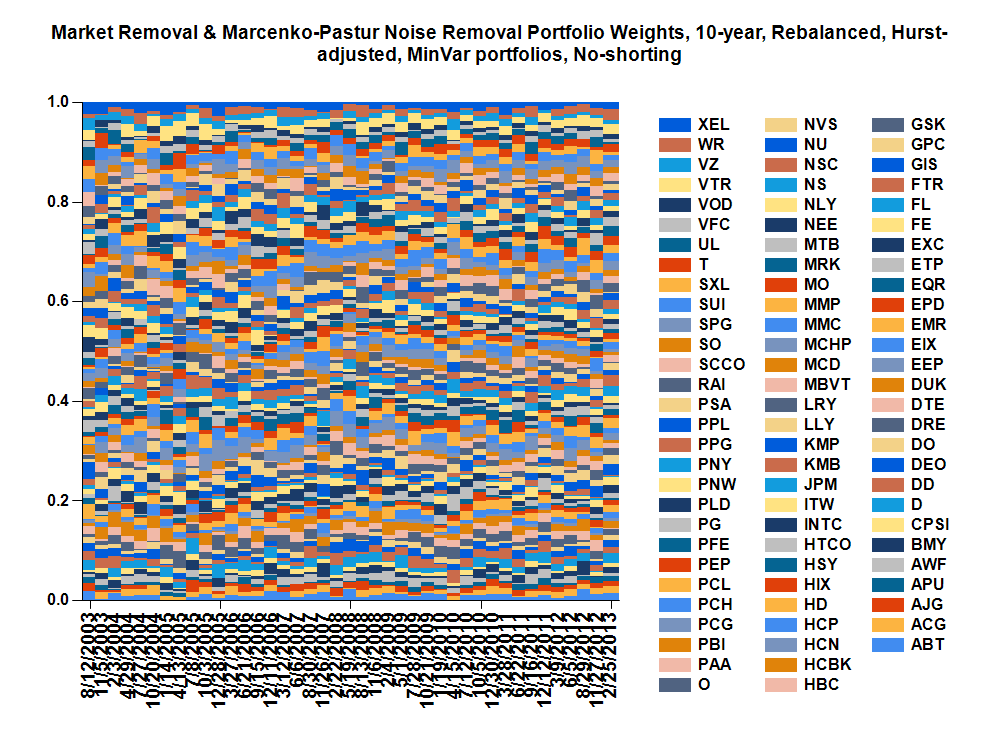

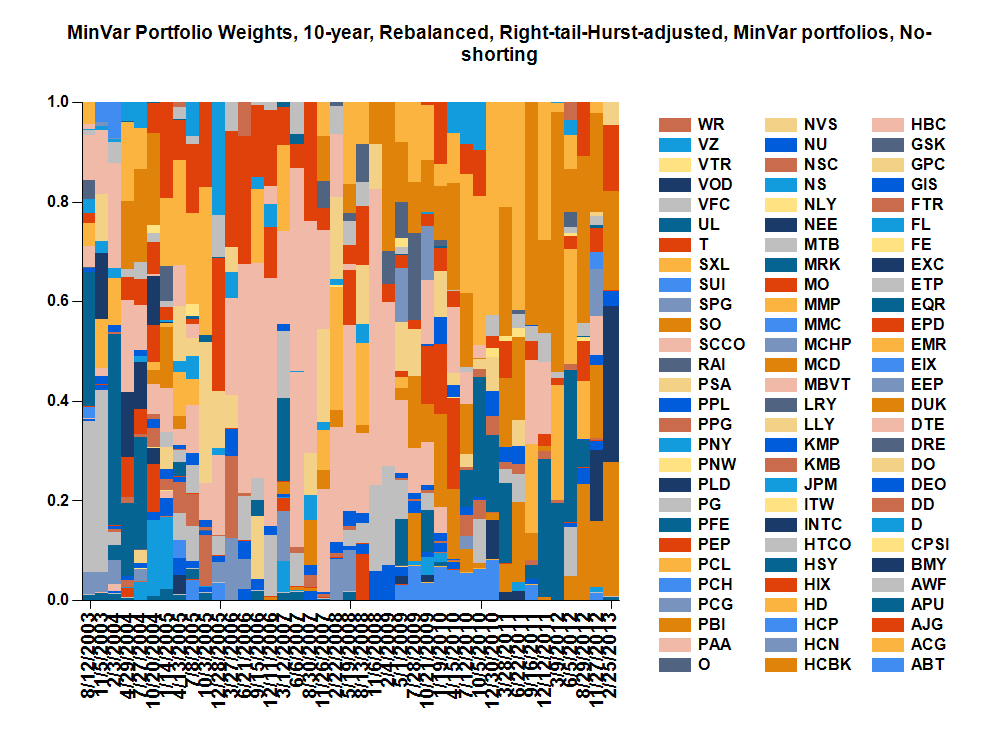

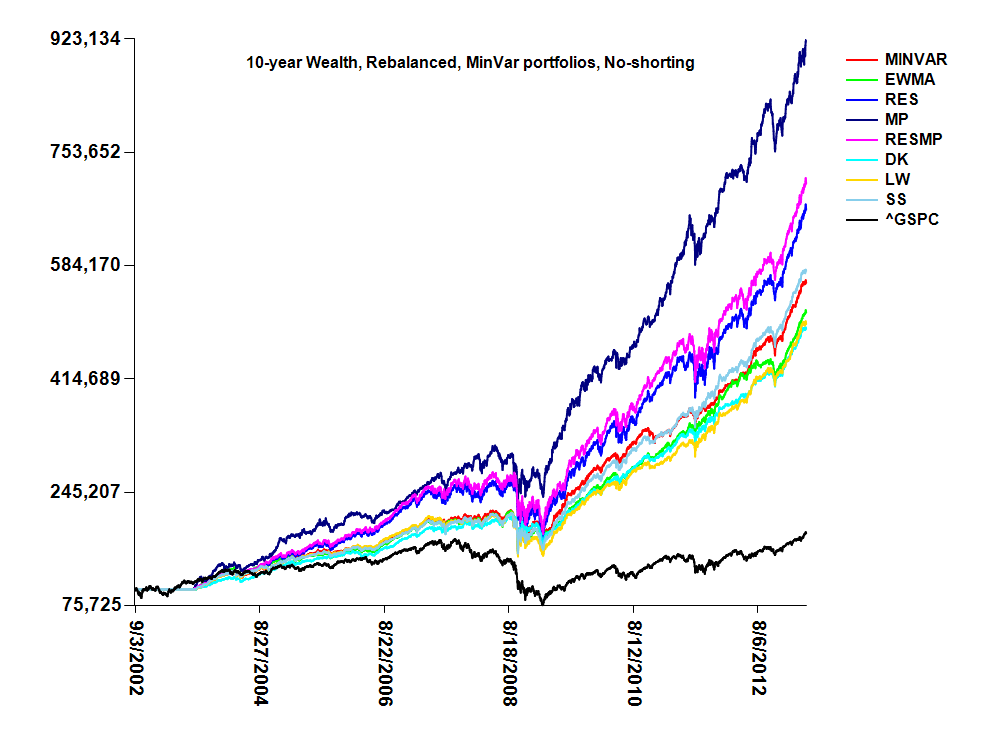

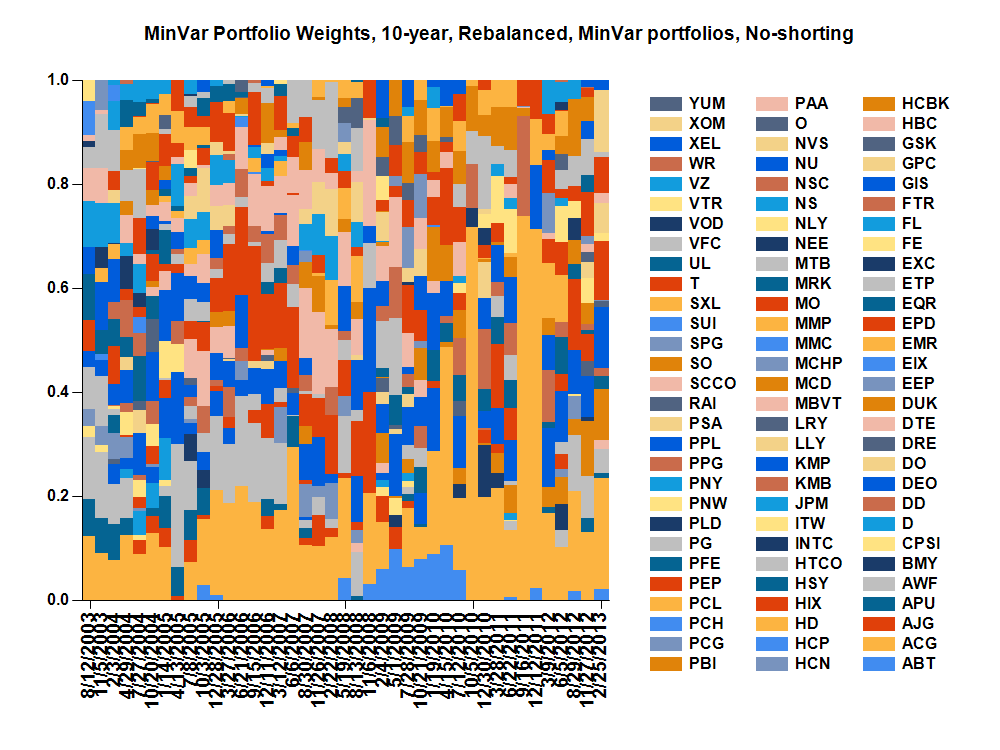

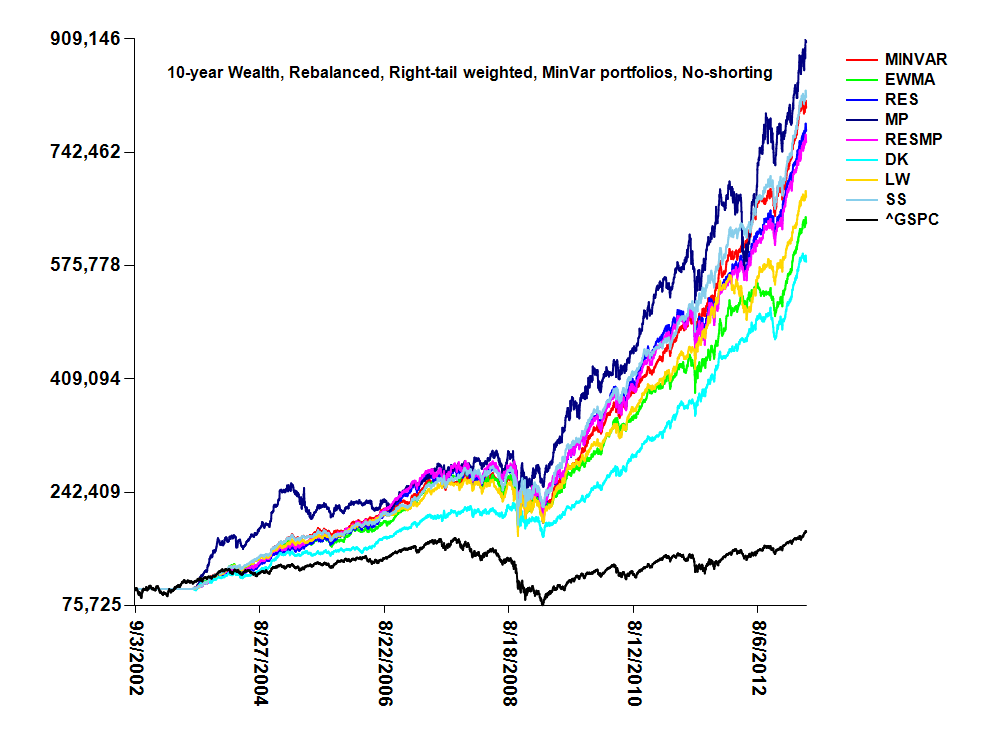

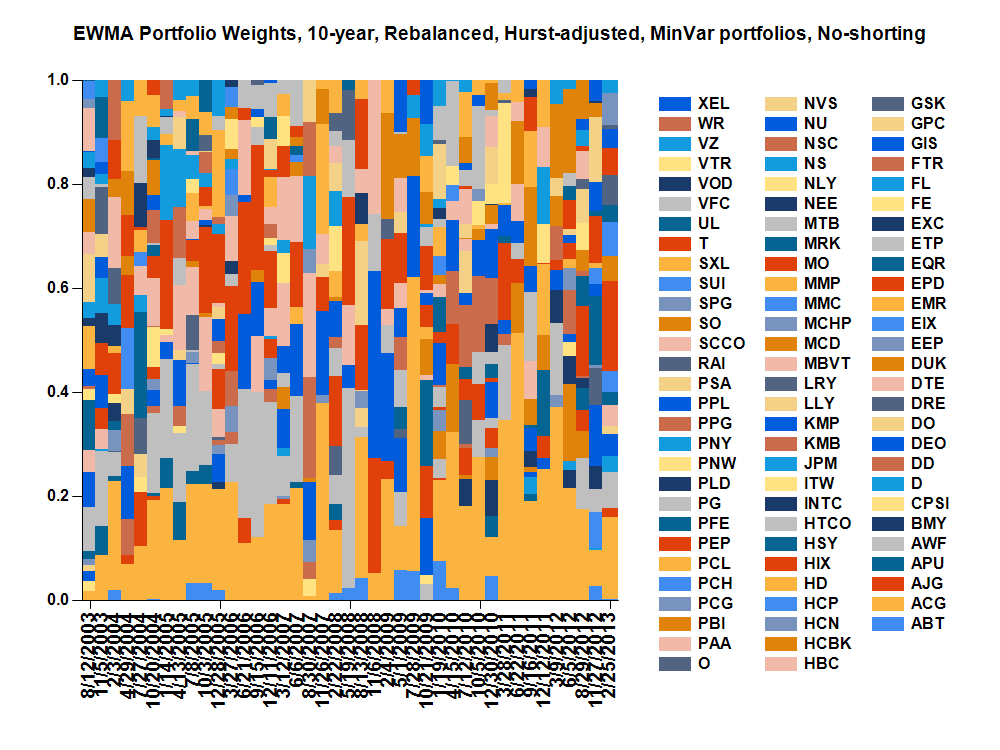

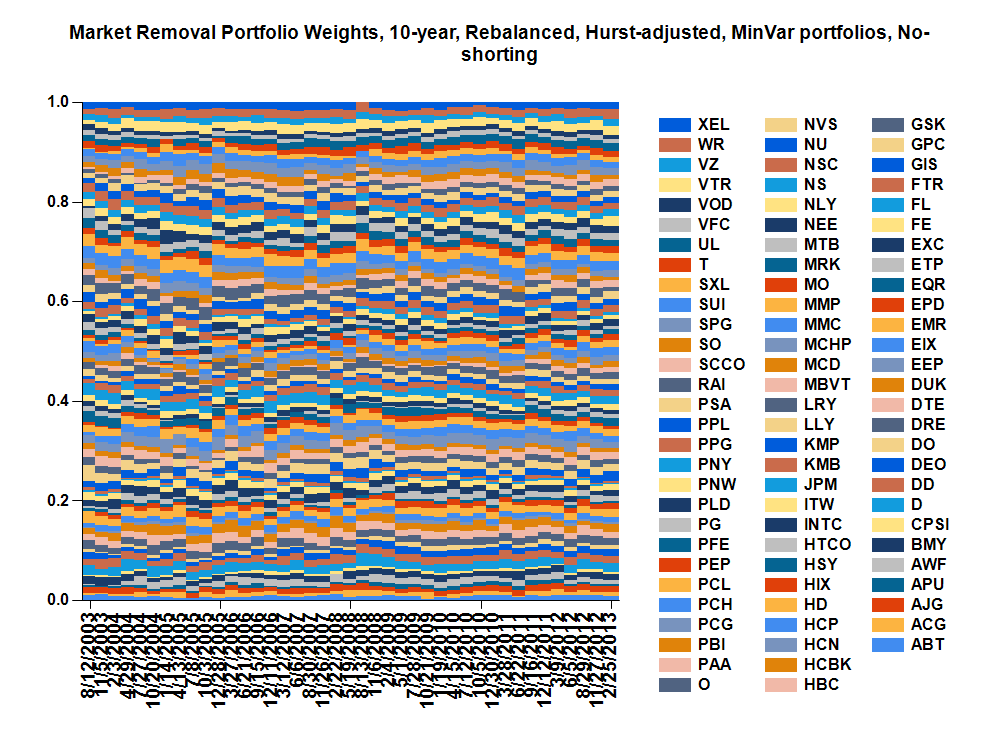

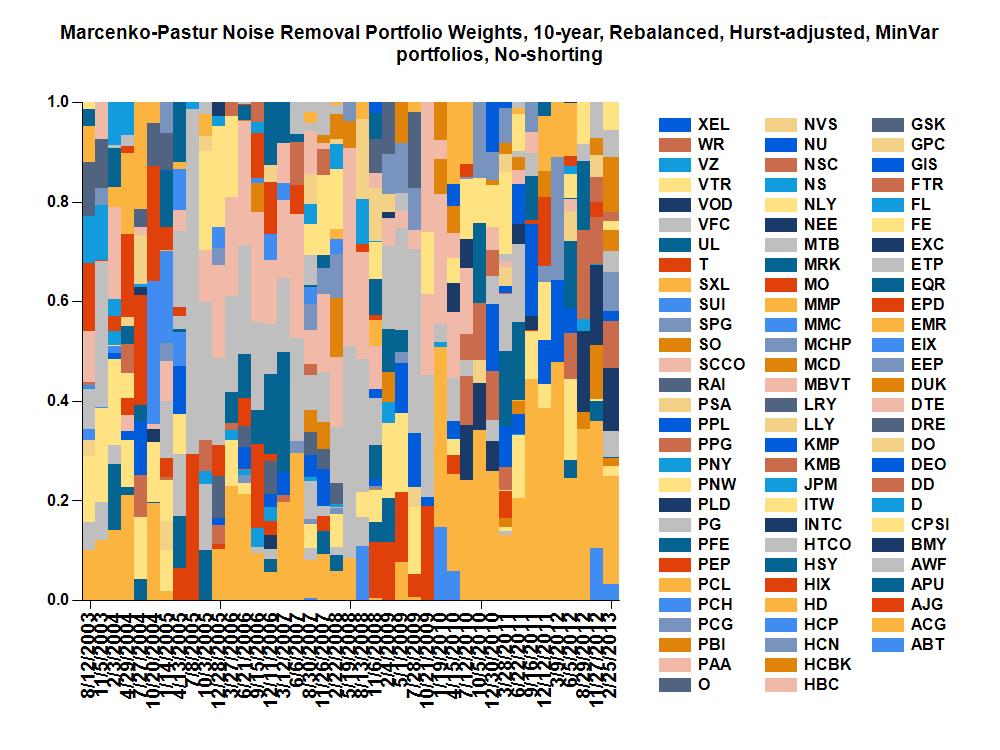

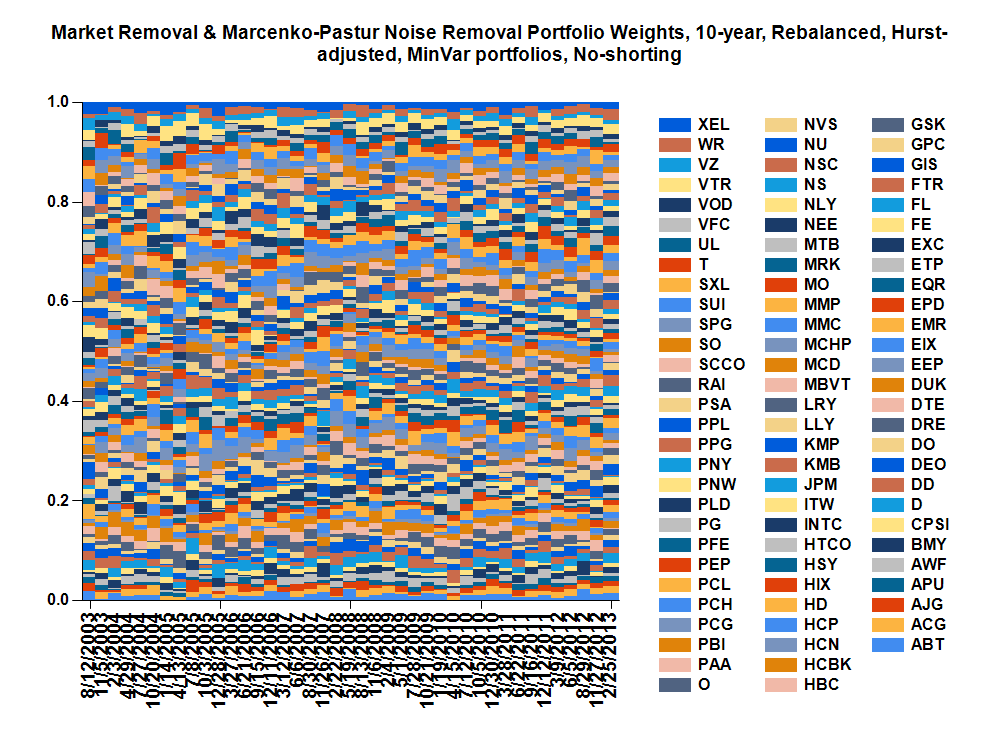

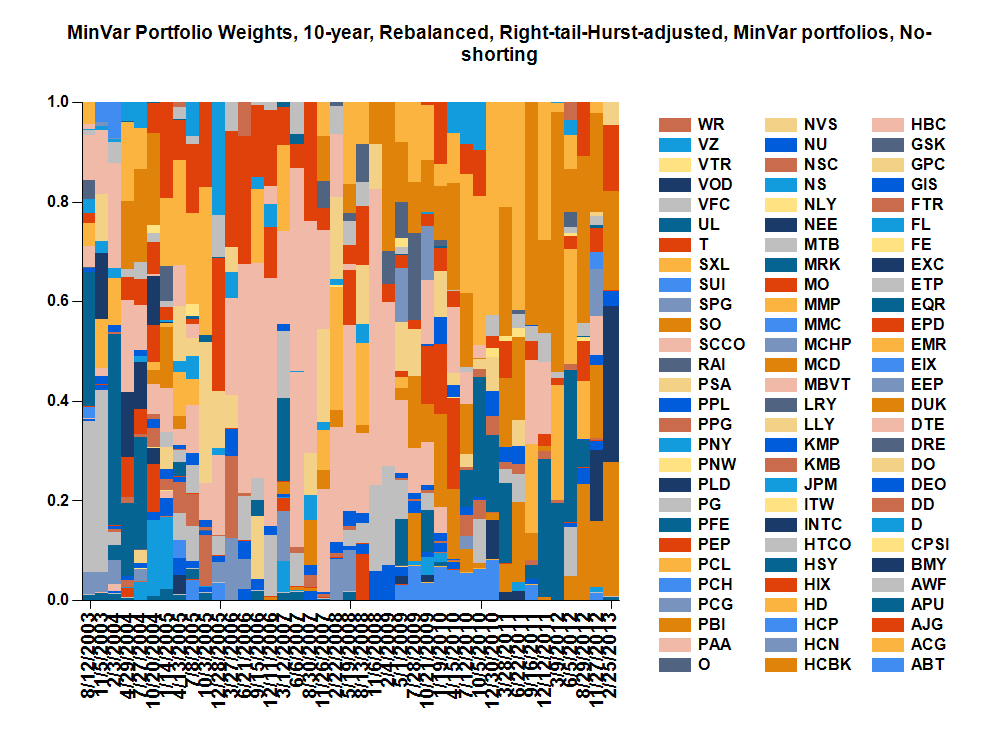

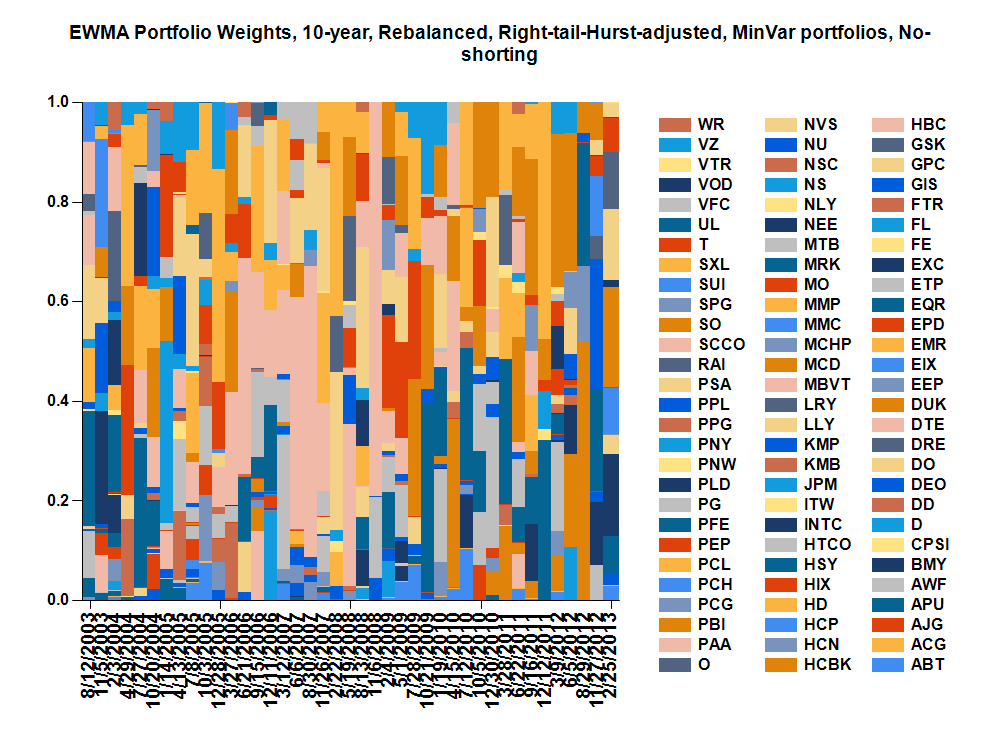

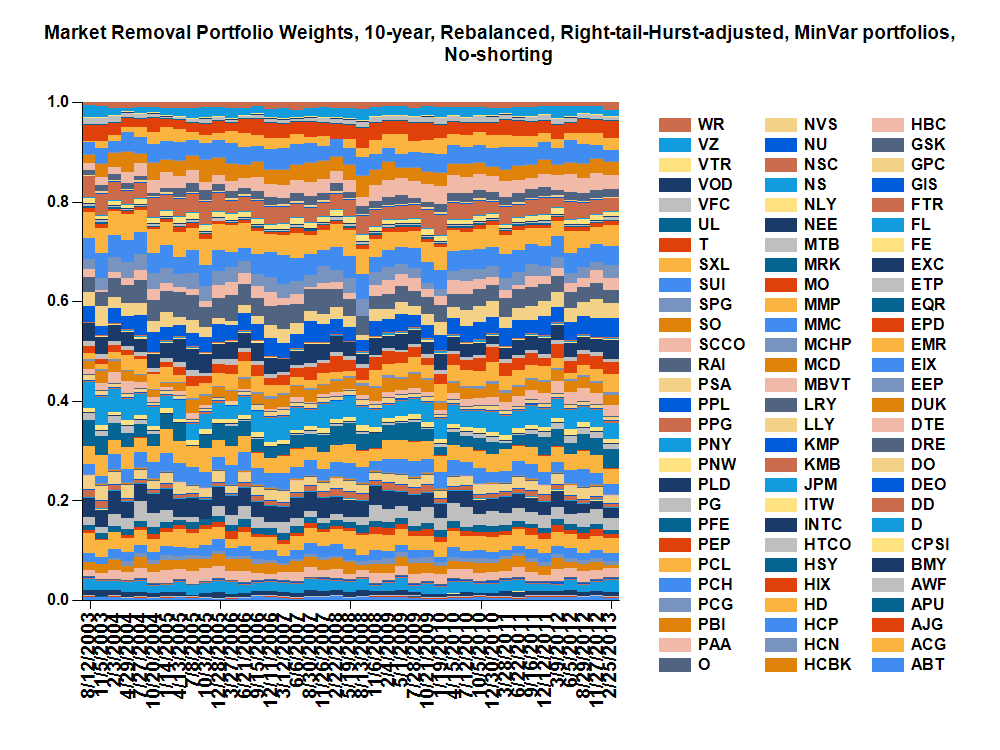

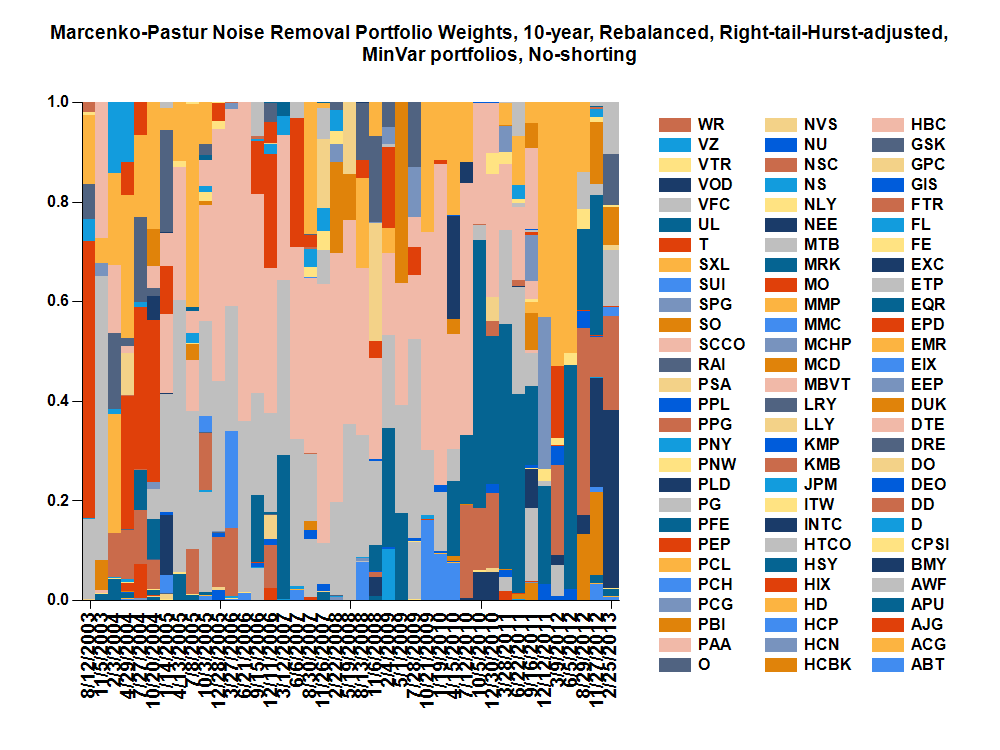

| 10 | Rebalanced quarterly | Returns,

Weights,

|

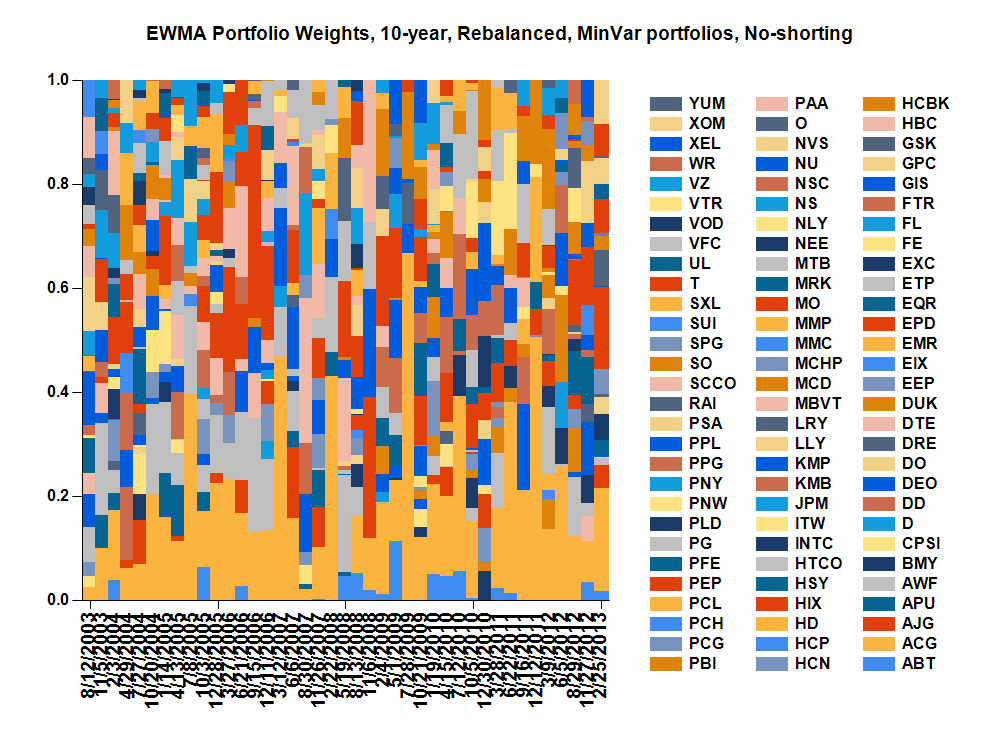

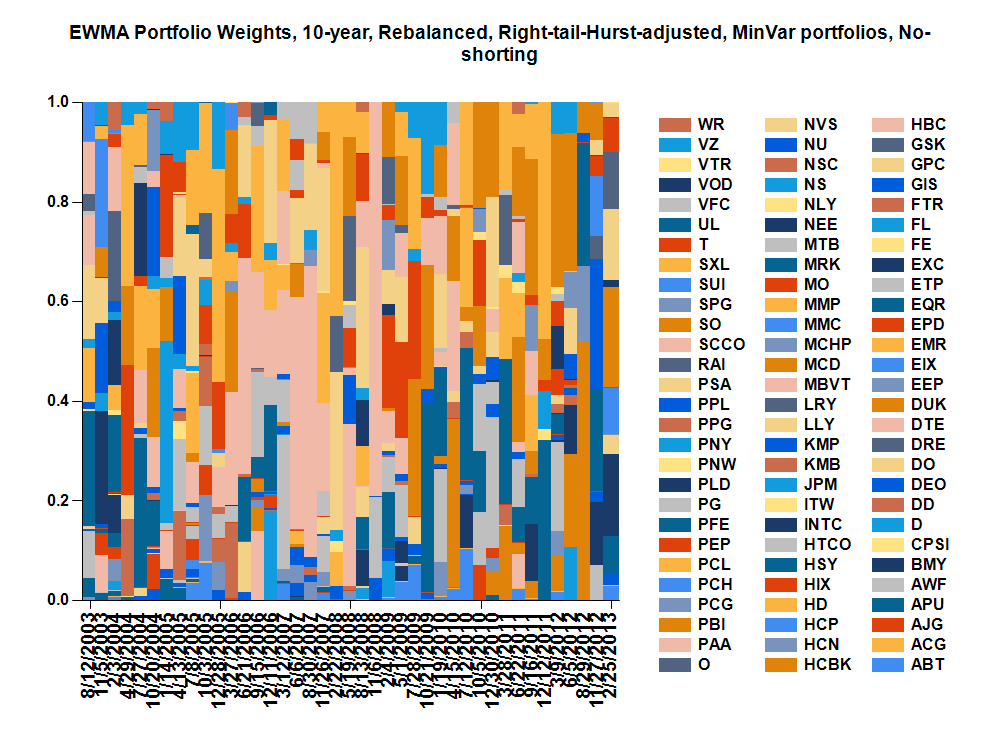

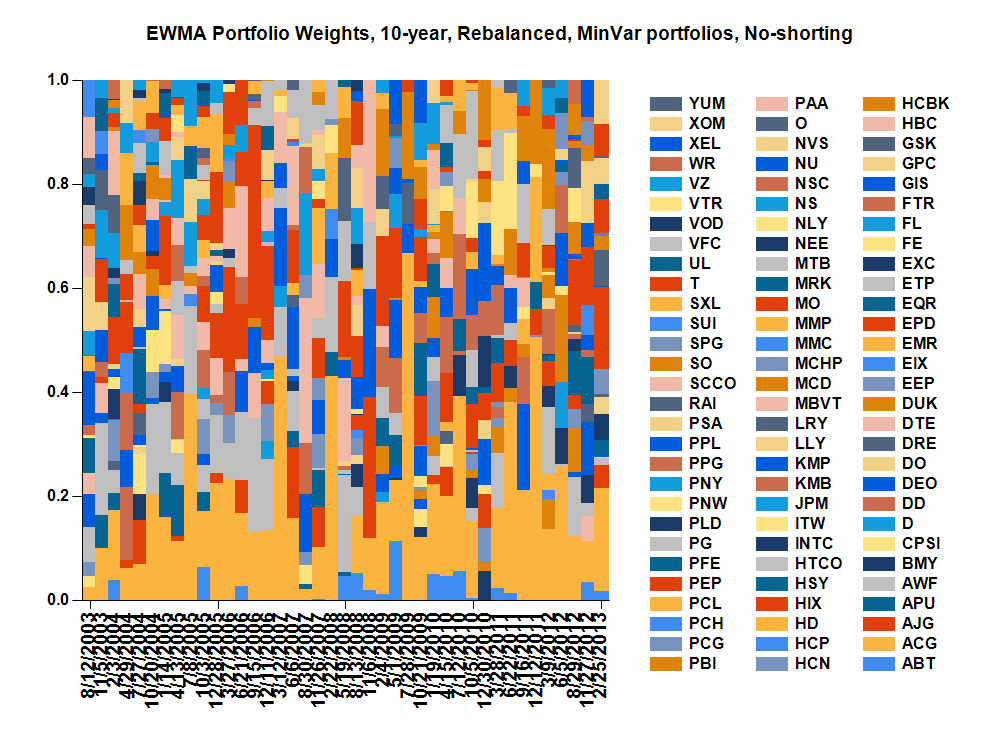

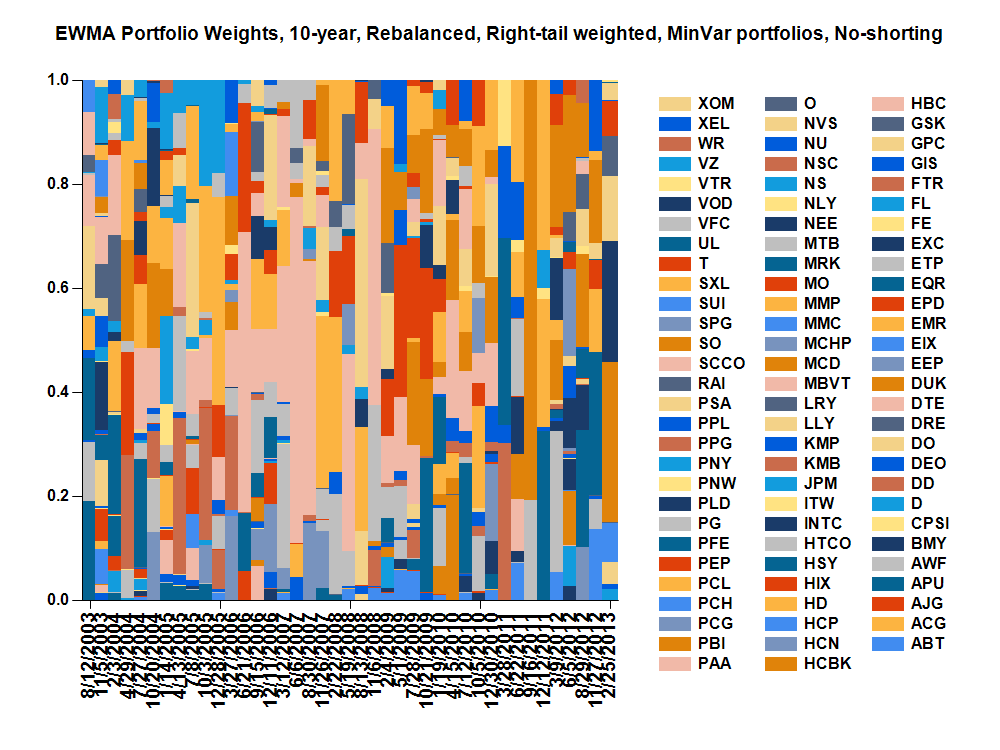

Returns,

Weights,

|

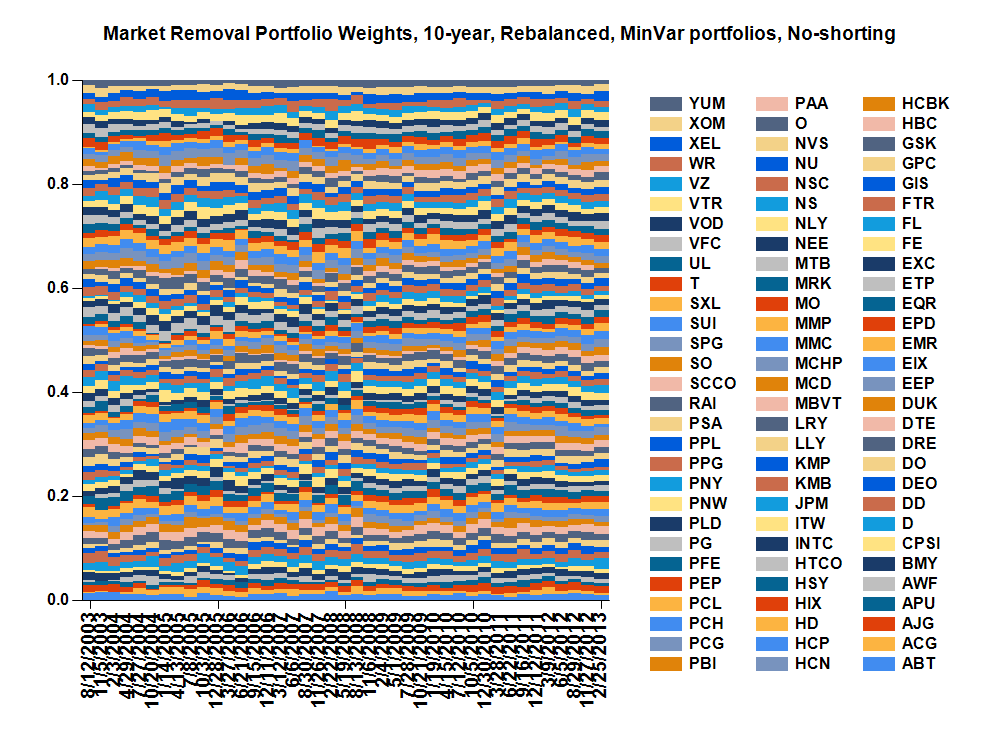

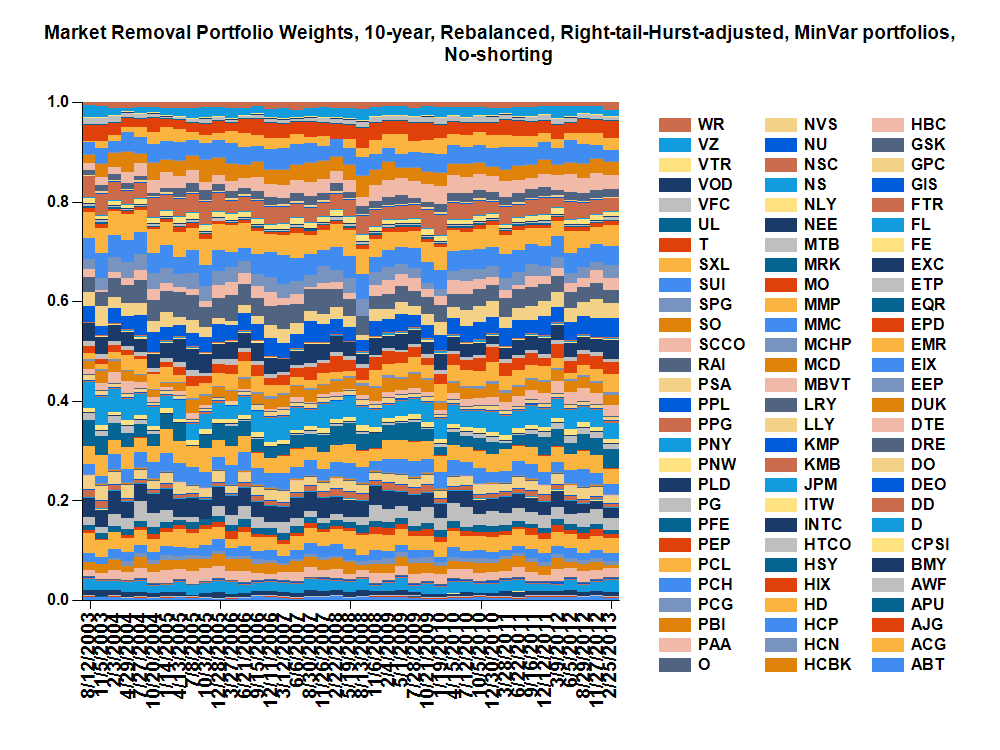

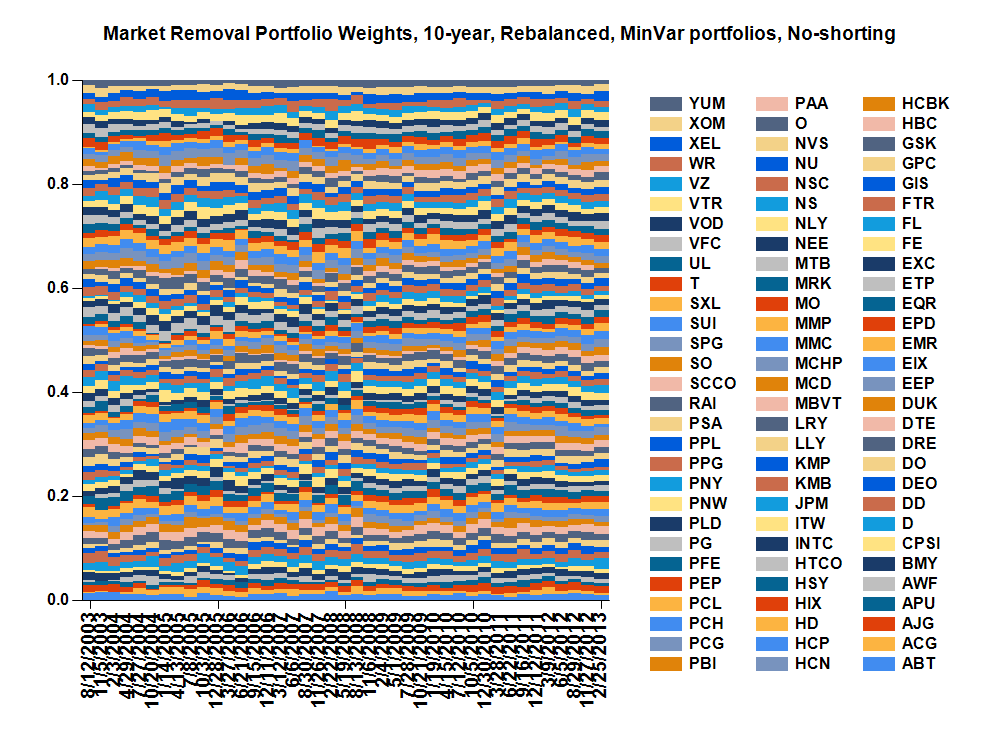

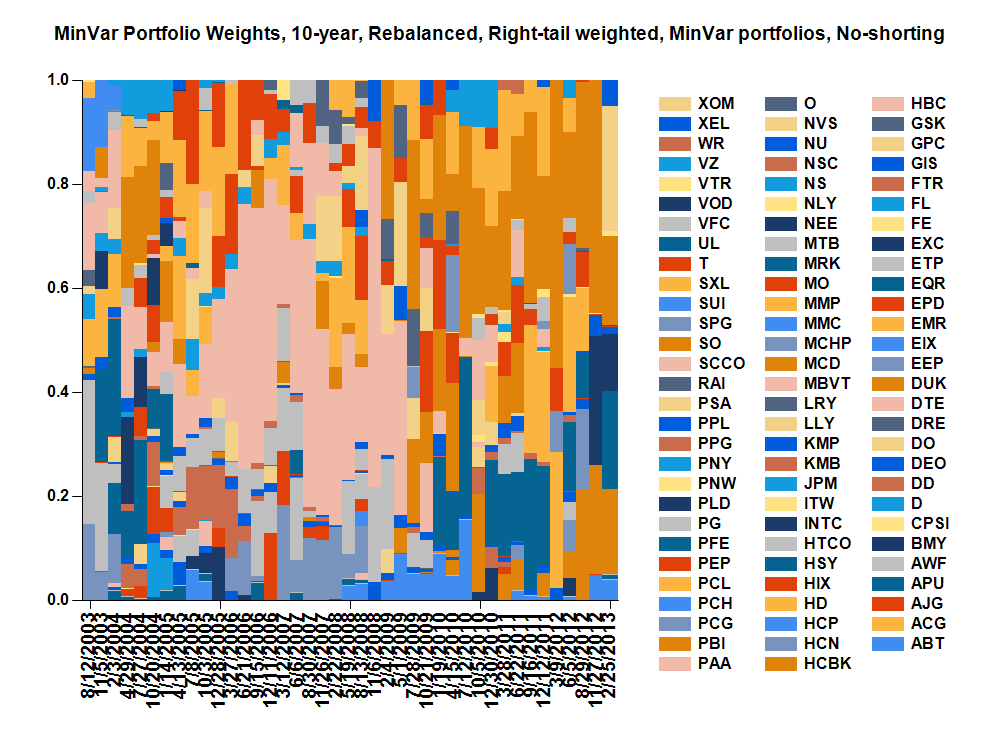

Returns,

Weights,

|

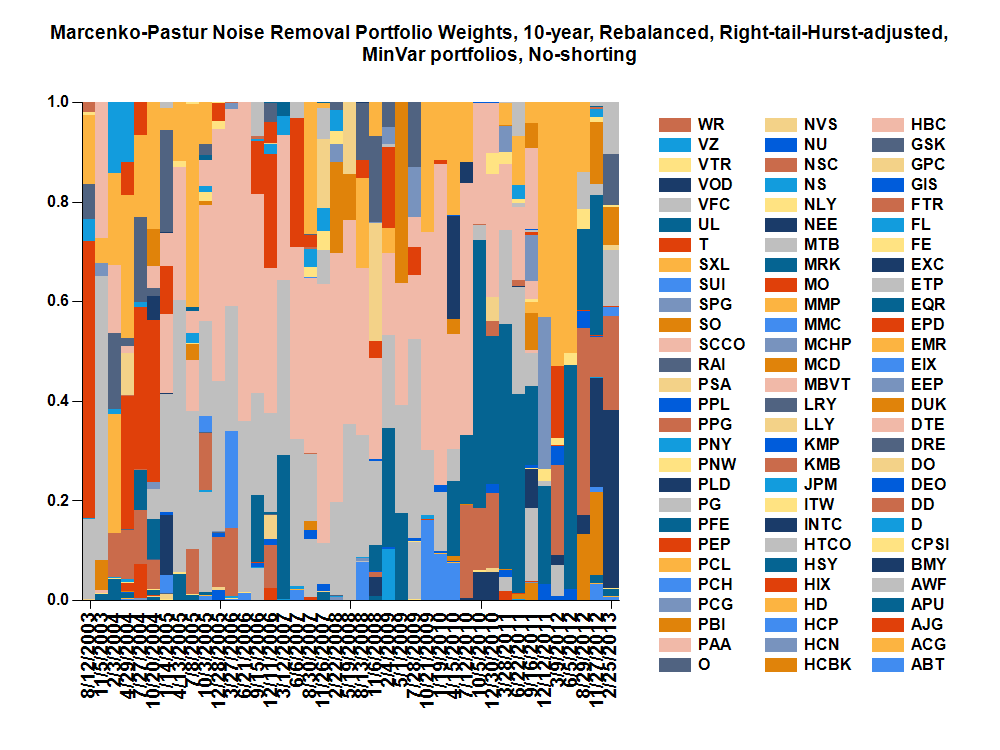

Returns,

Weights,

|

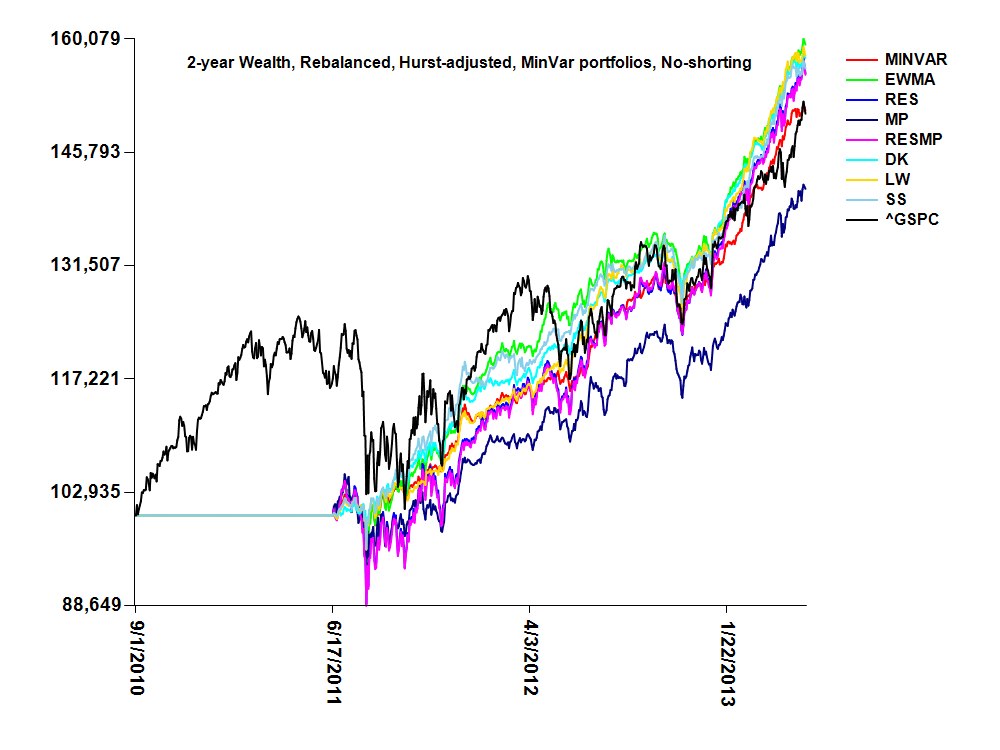

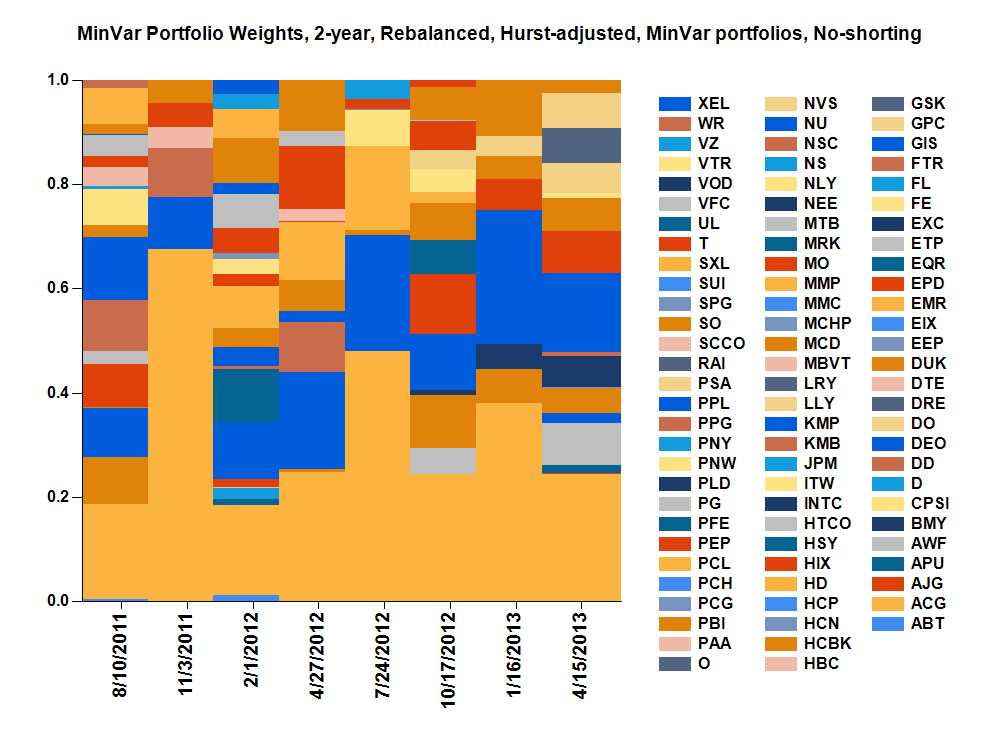

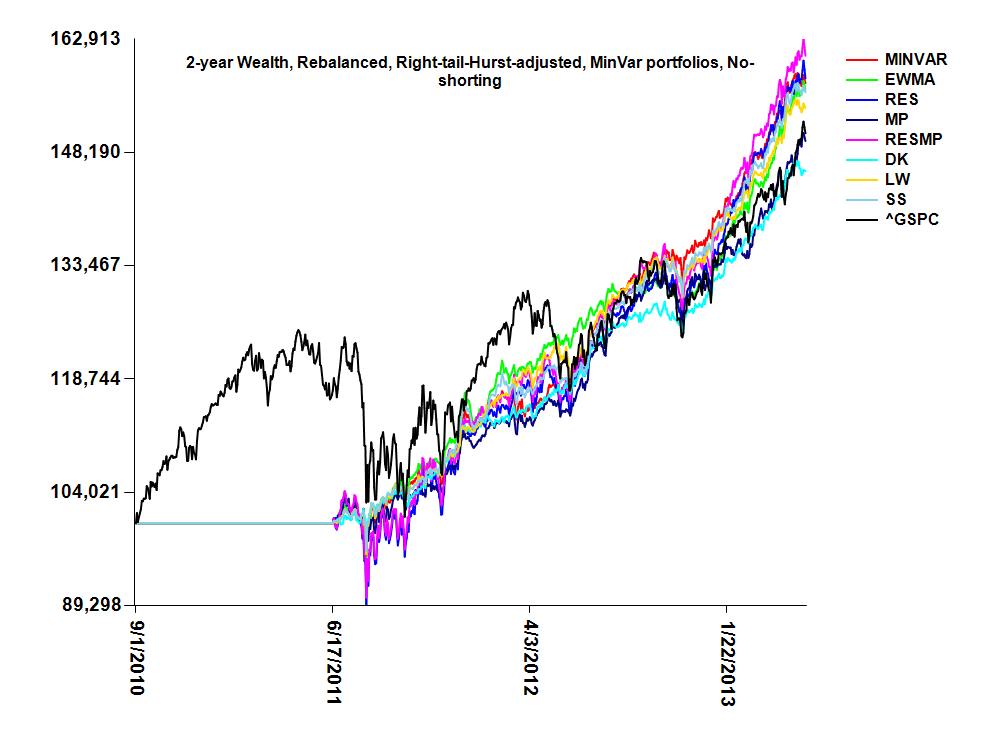

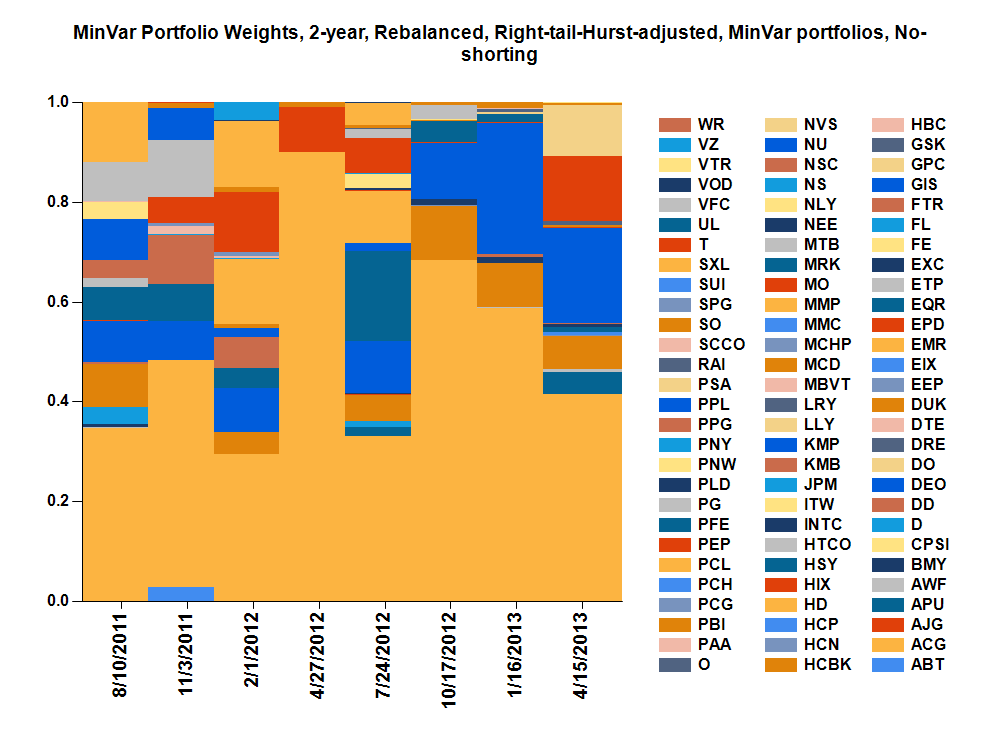

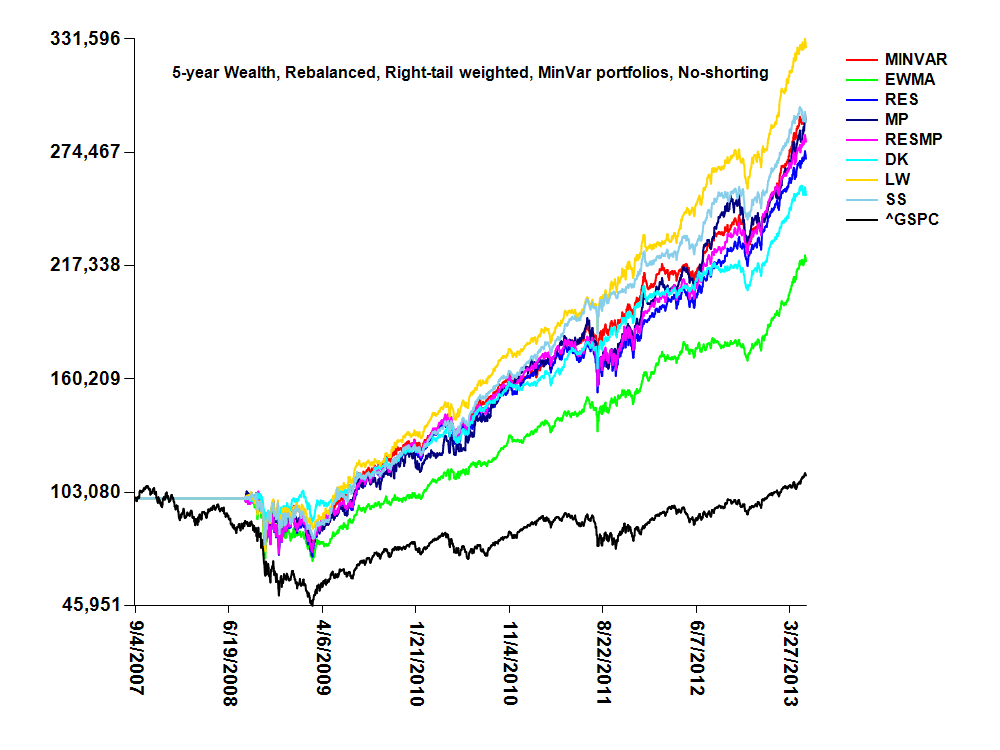

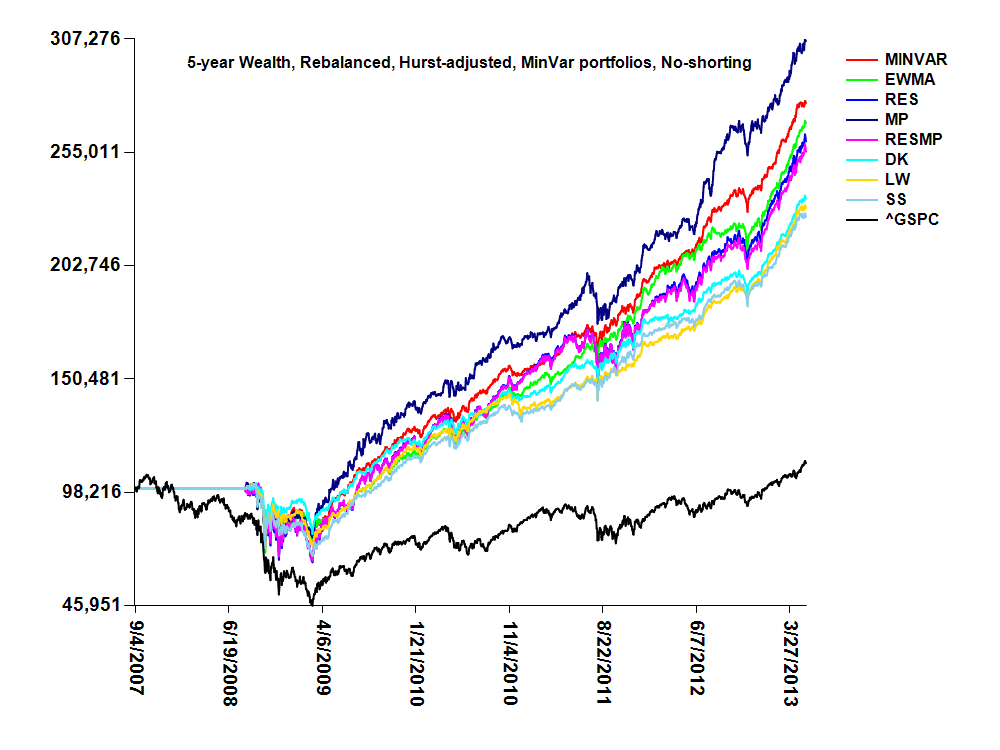

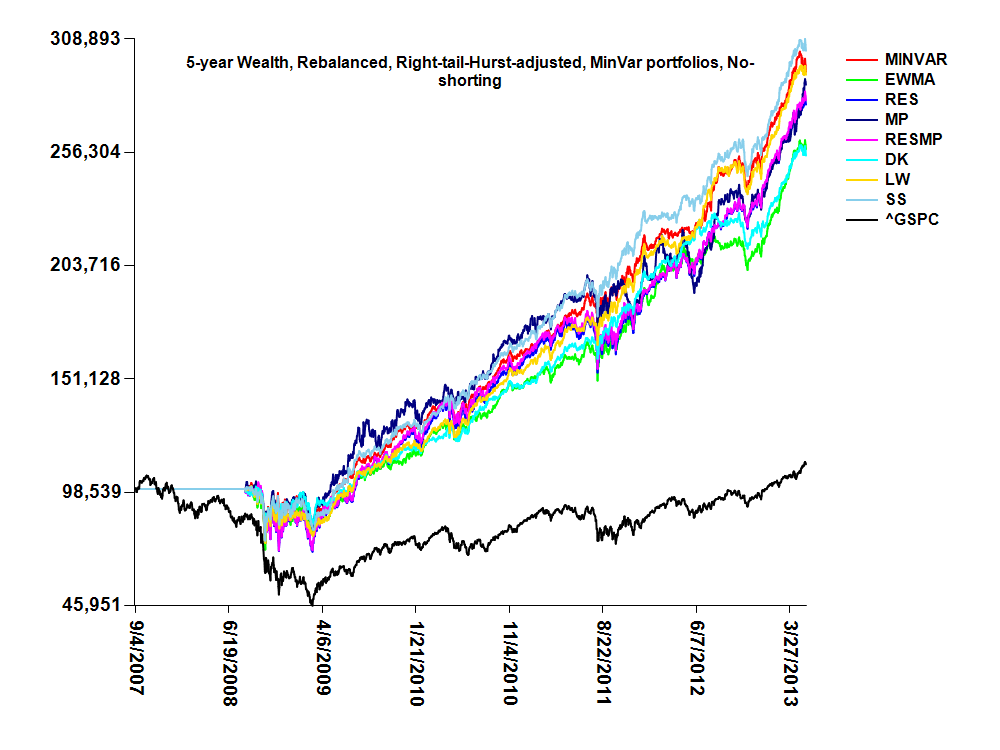

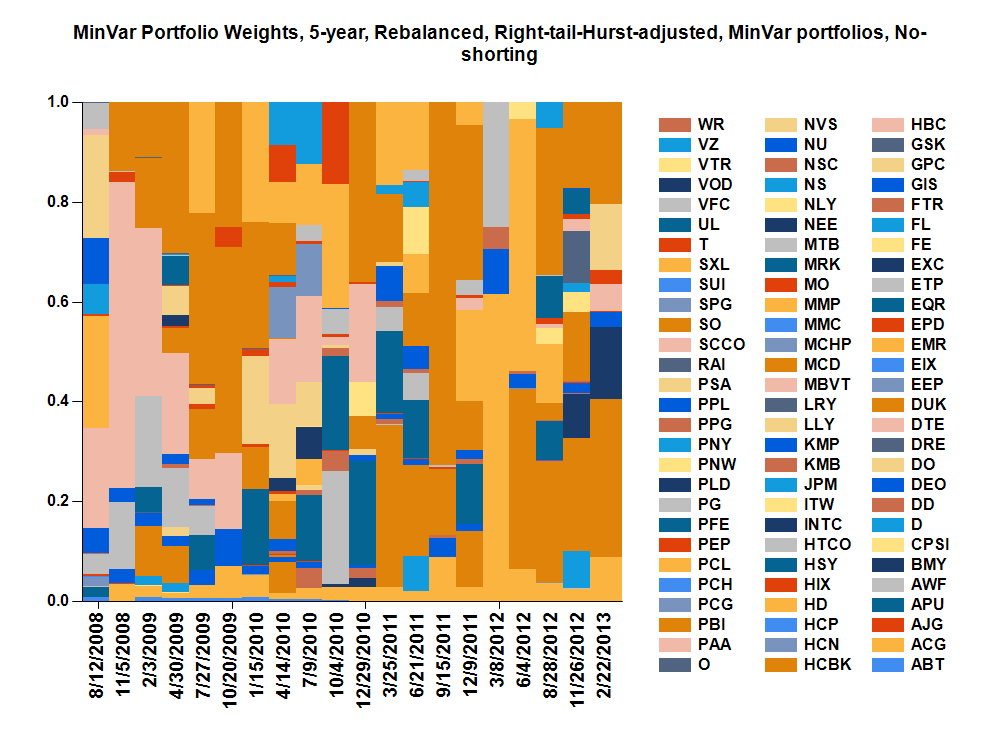

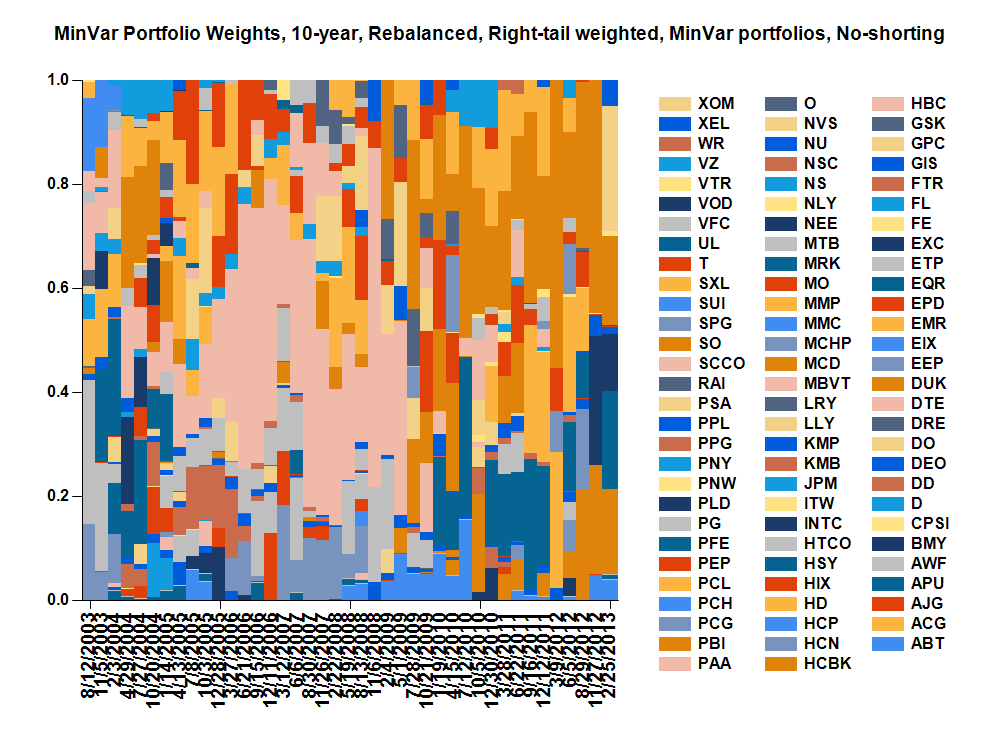

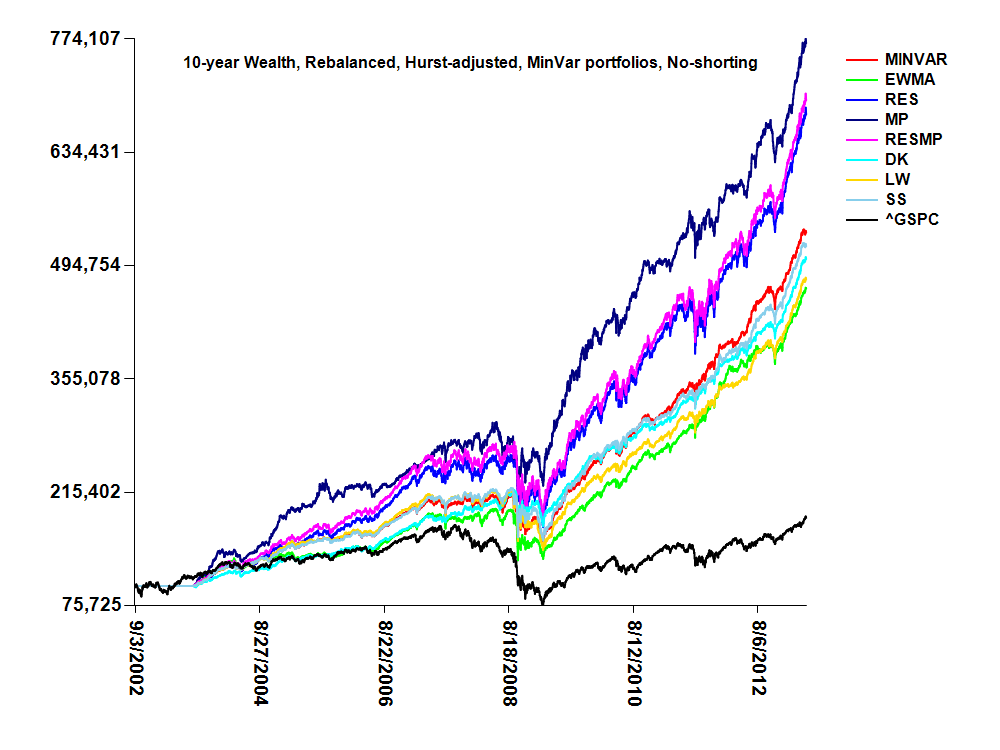

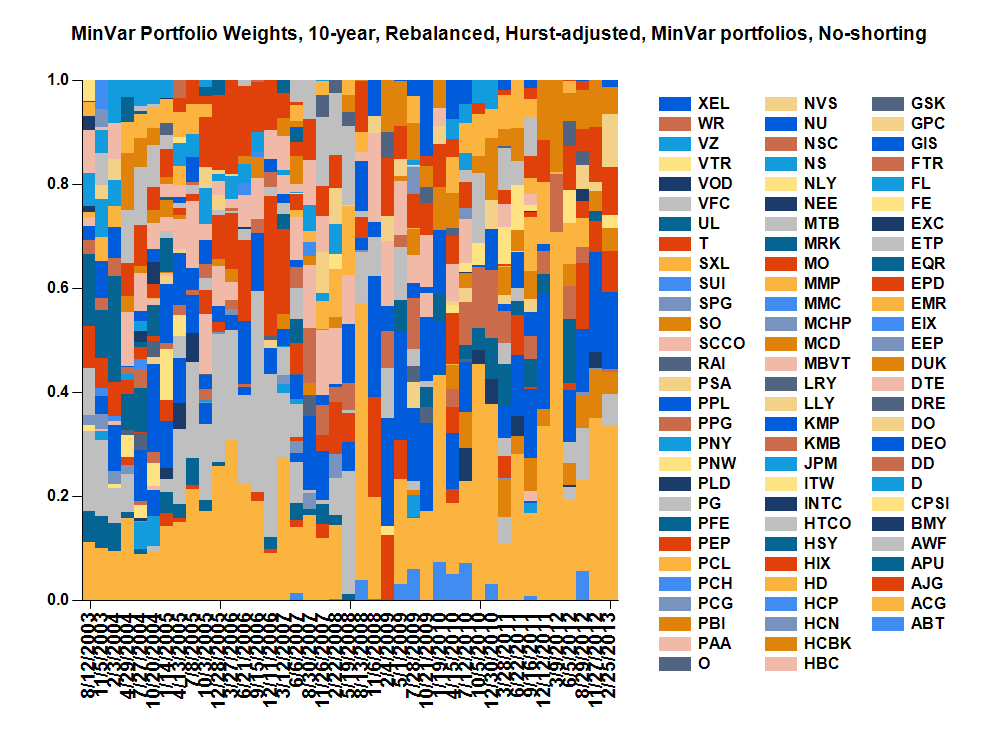

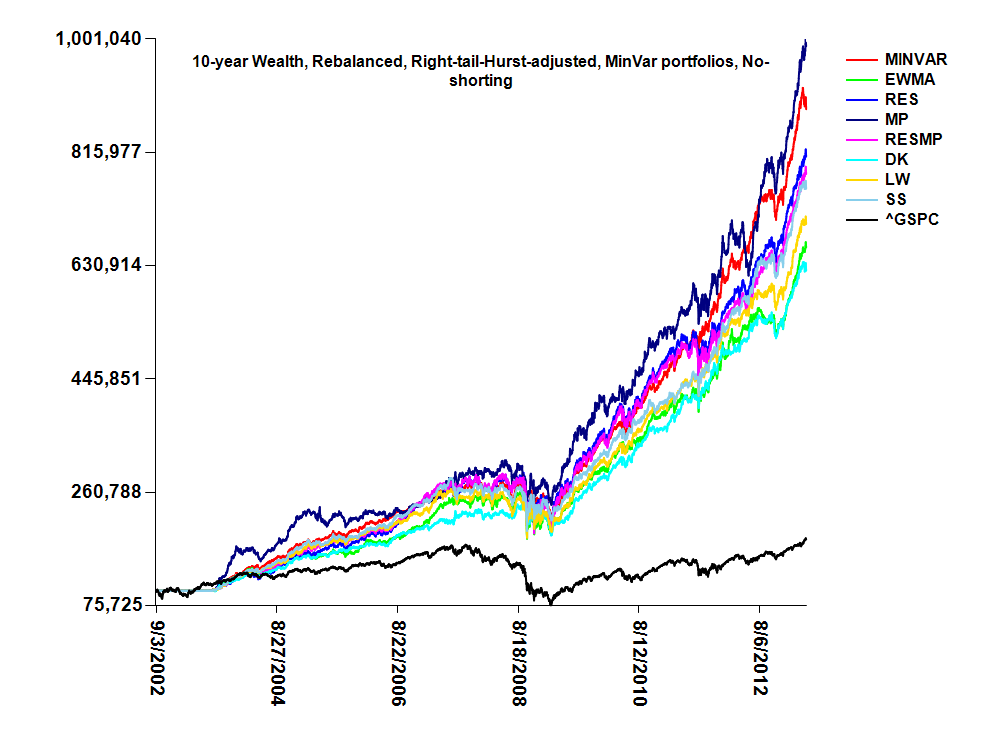

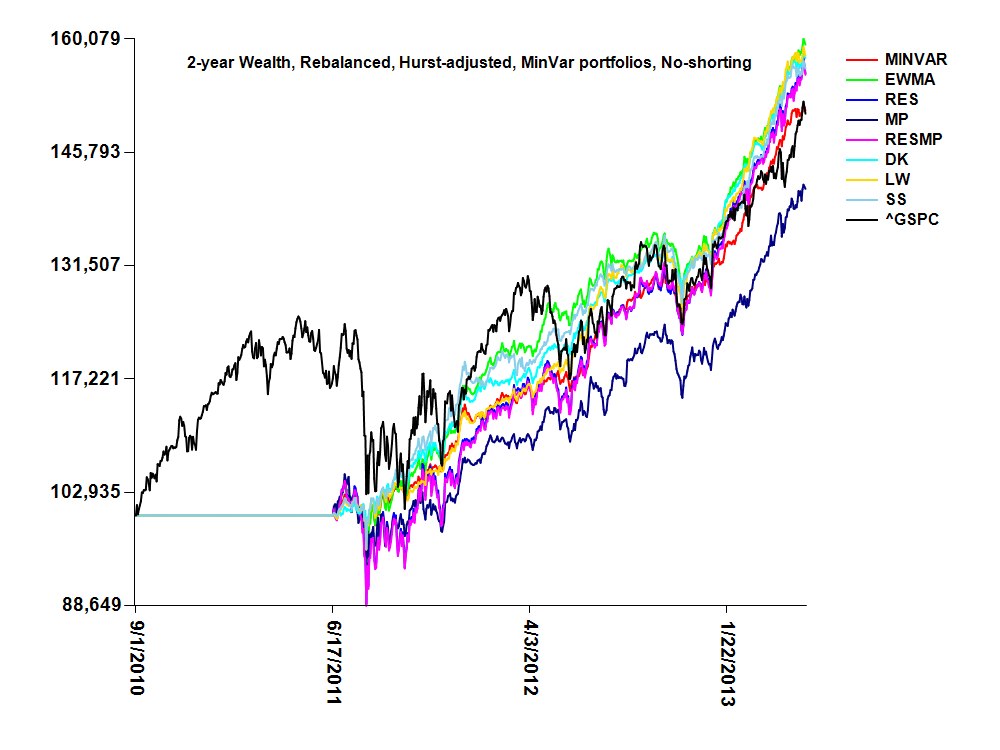

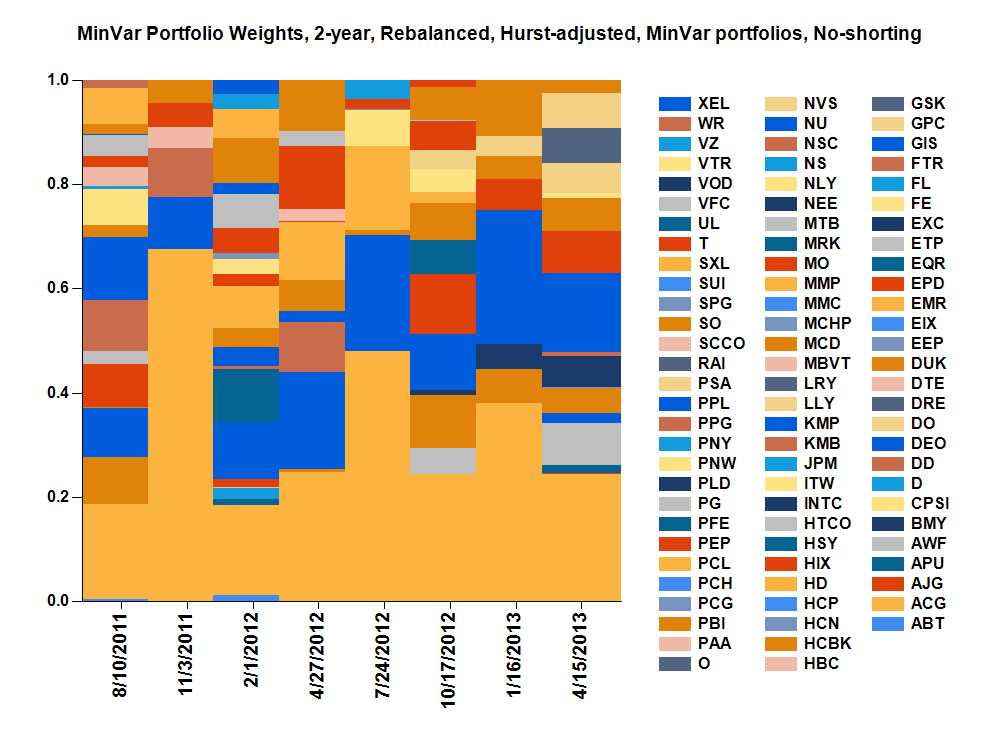

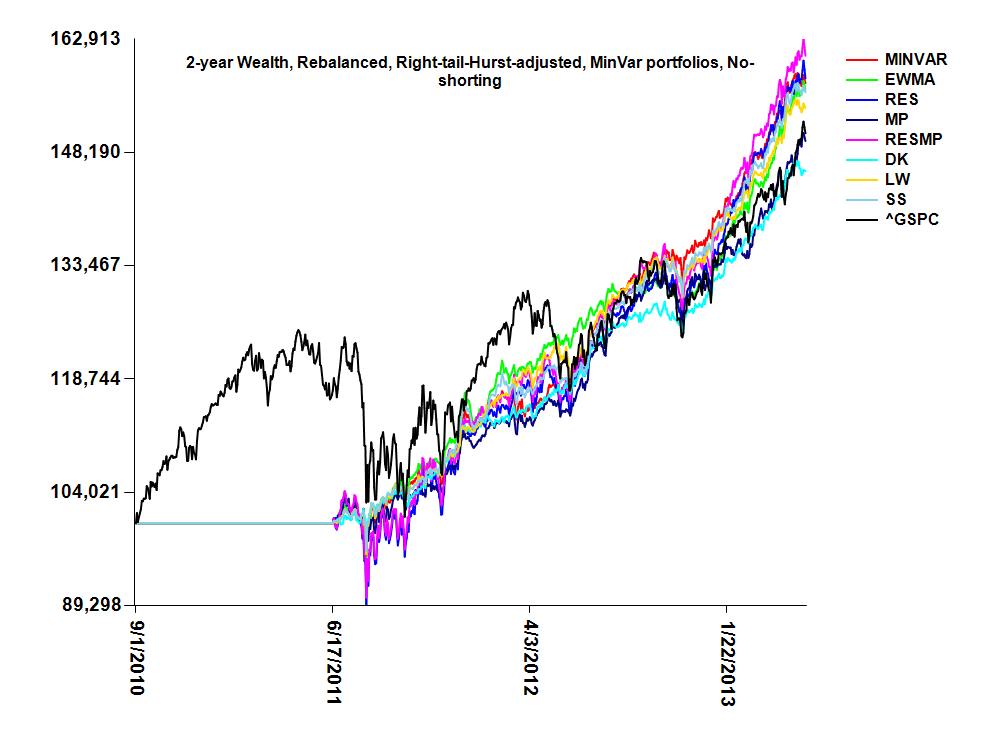

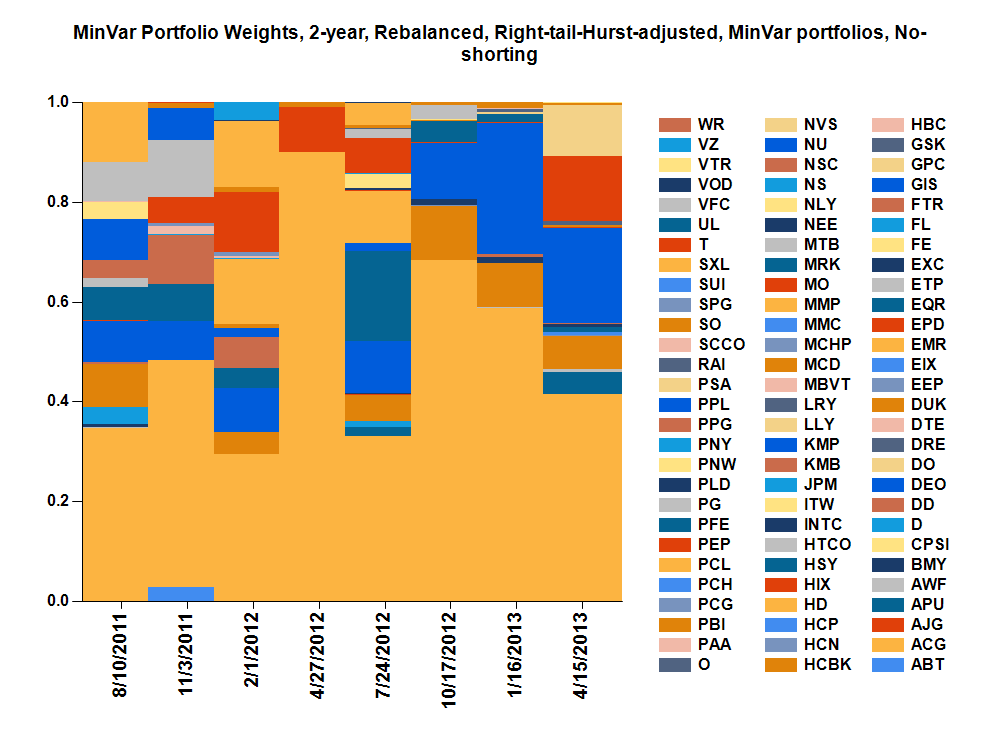

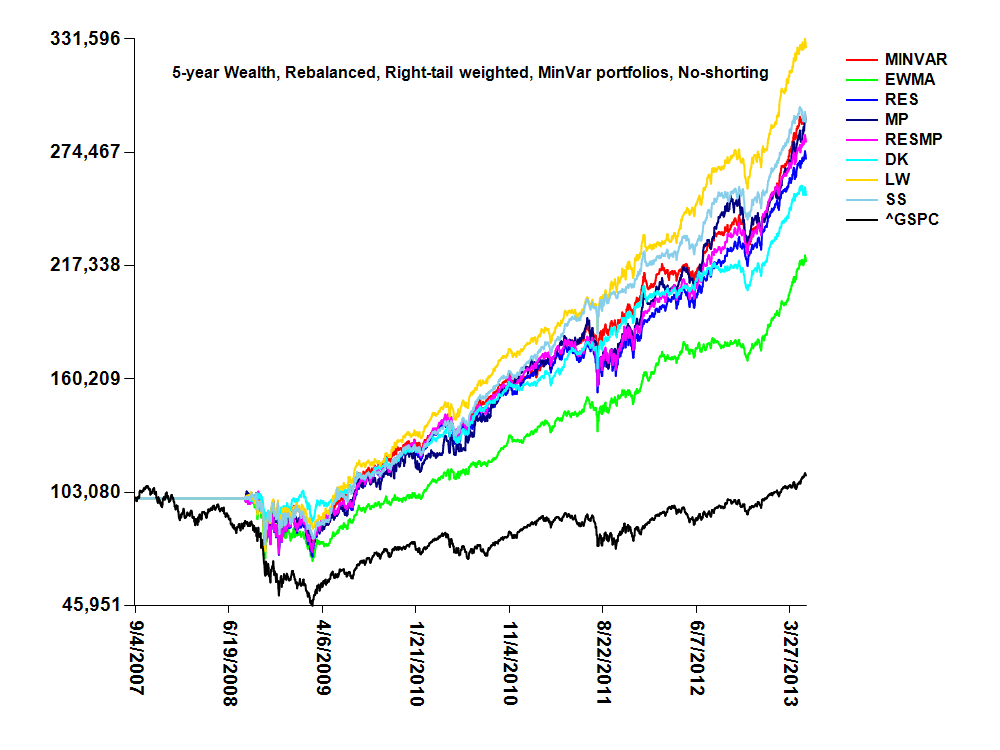

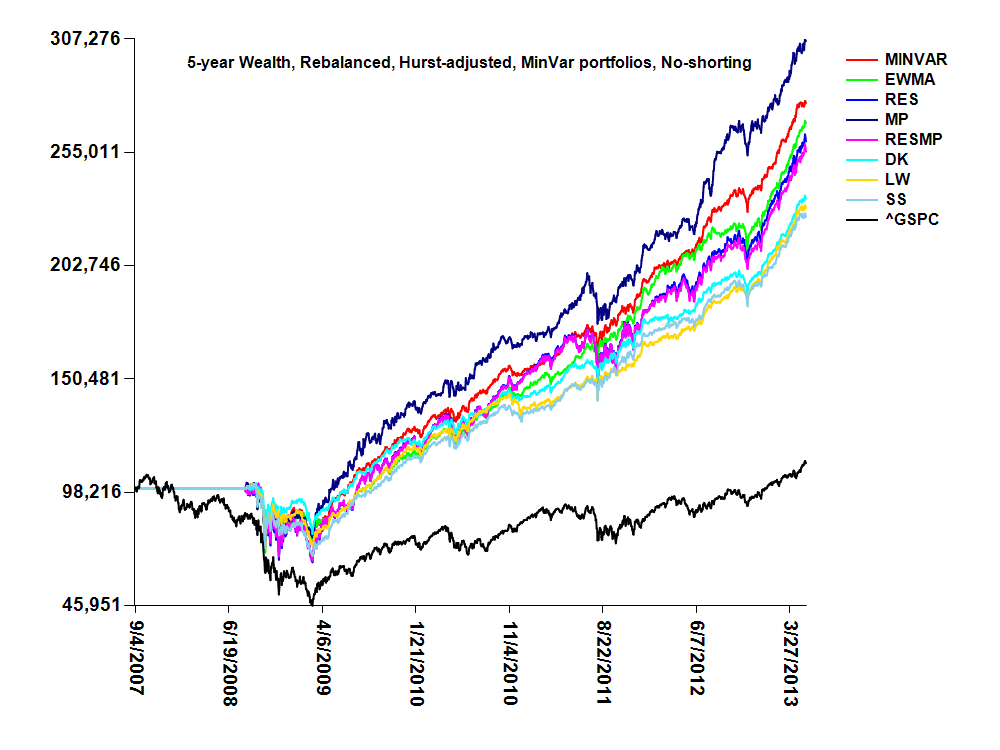

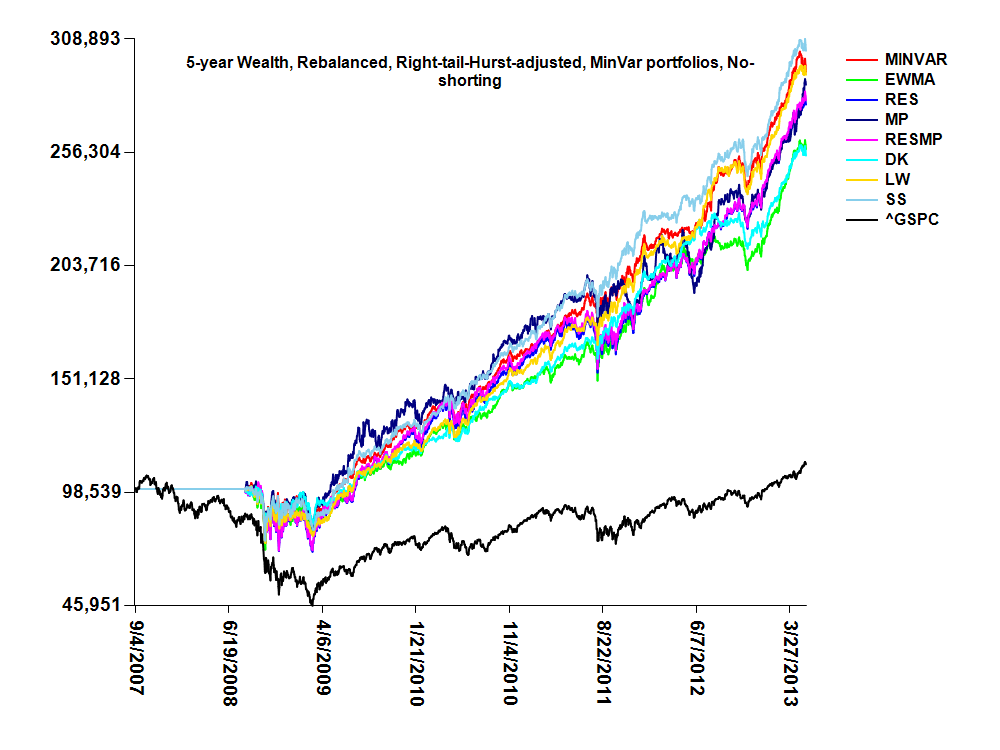

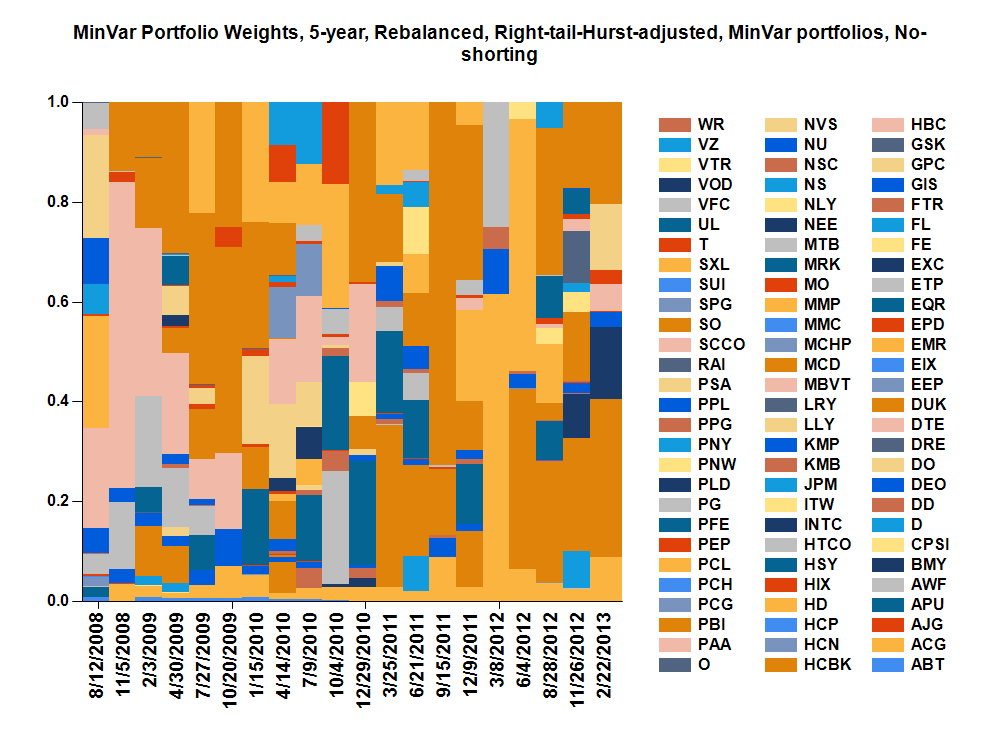

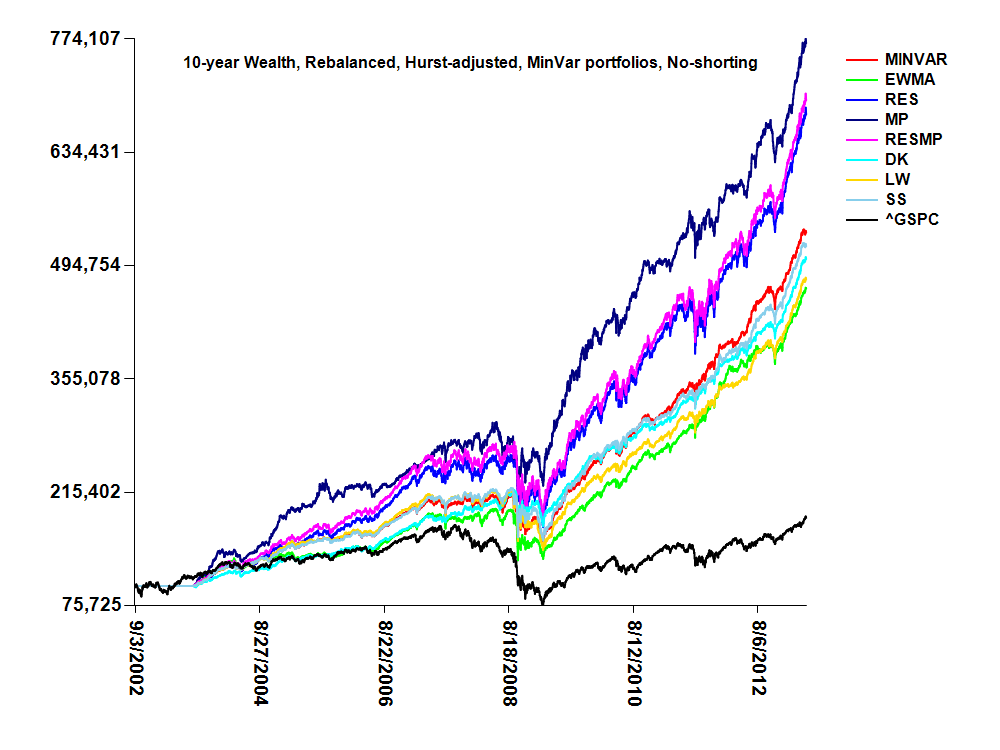

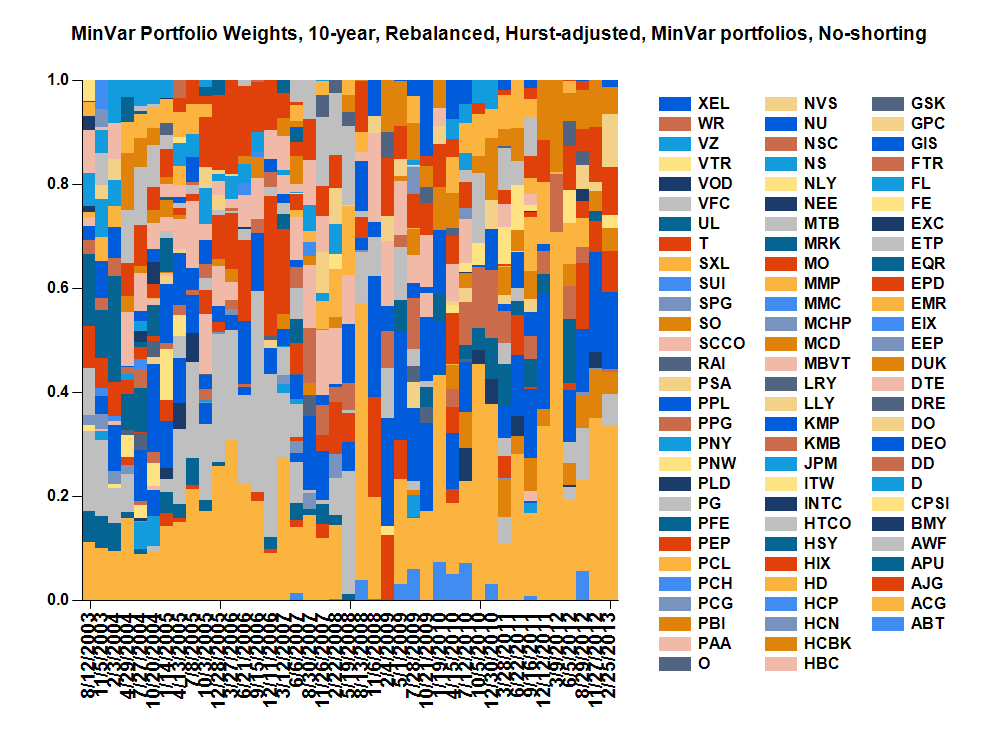

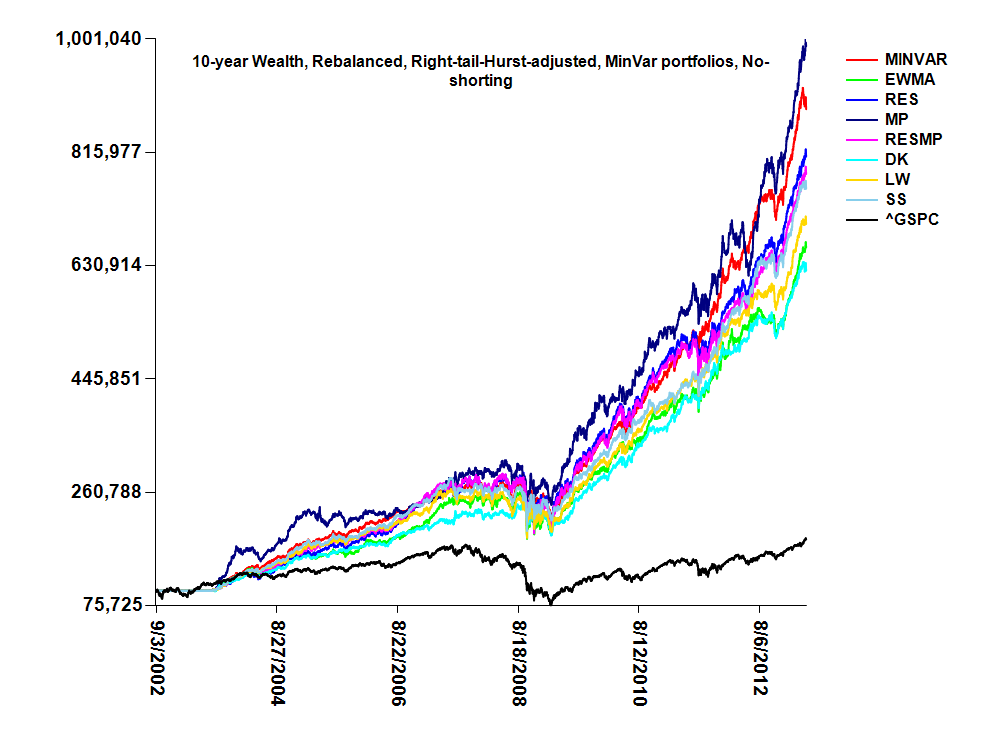

-MinVar - Minimum variance portofolio, tangency is used for unbalanced, whereas minimum variance is use for rebalanced portfolios.

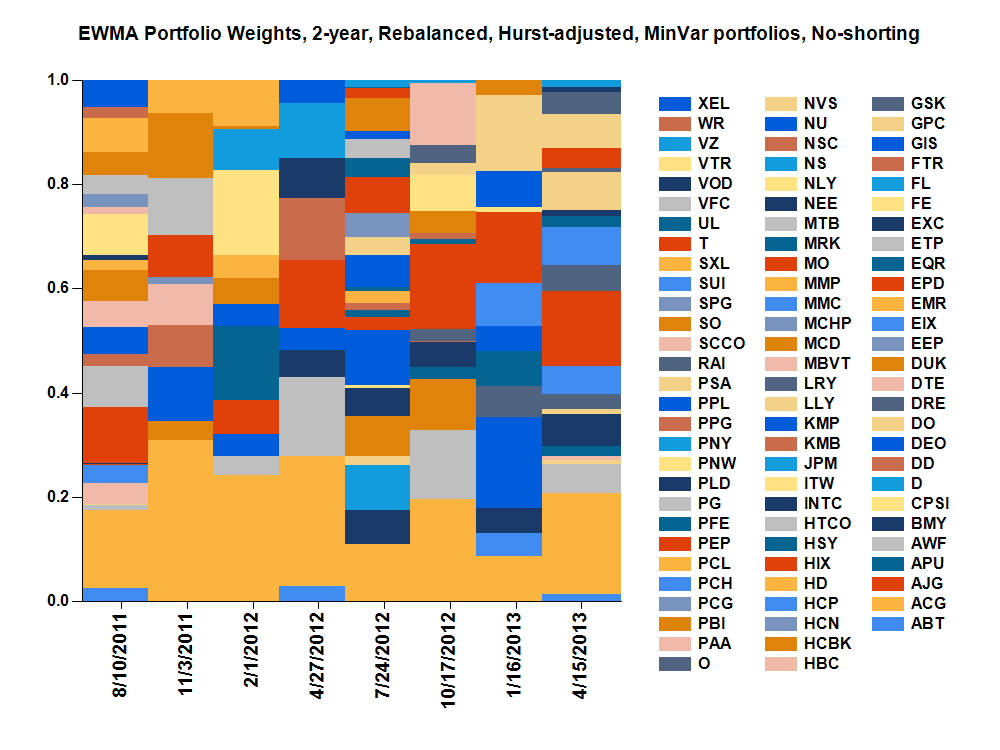

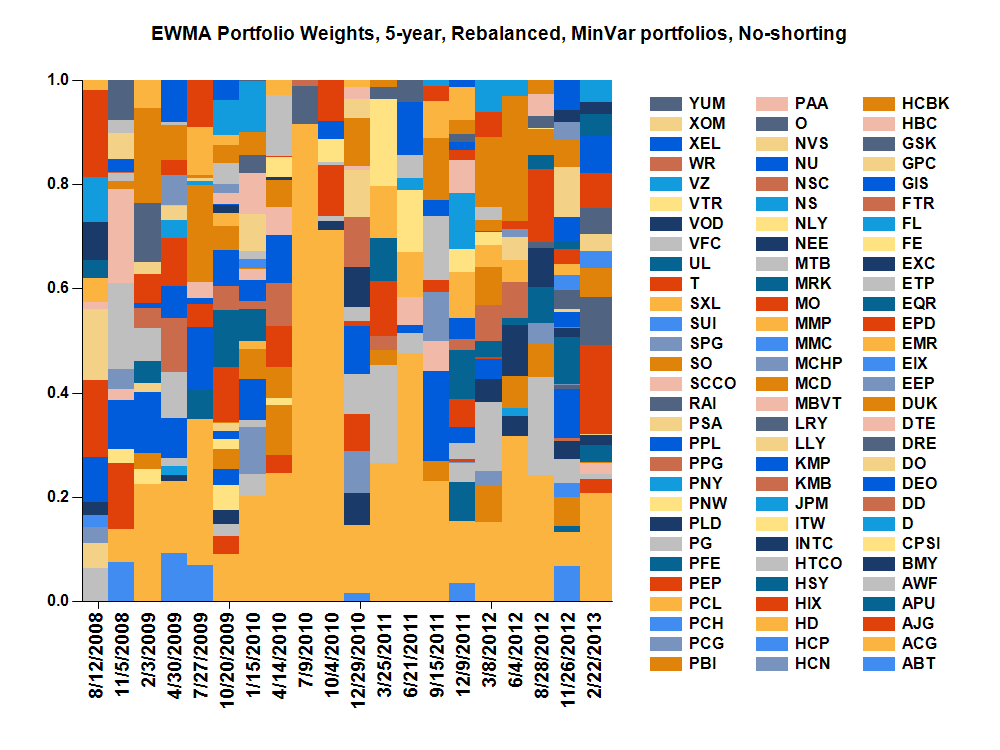

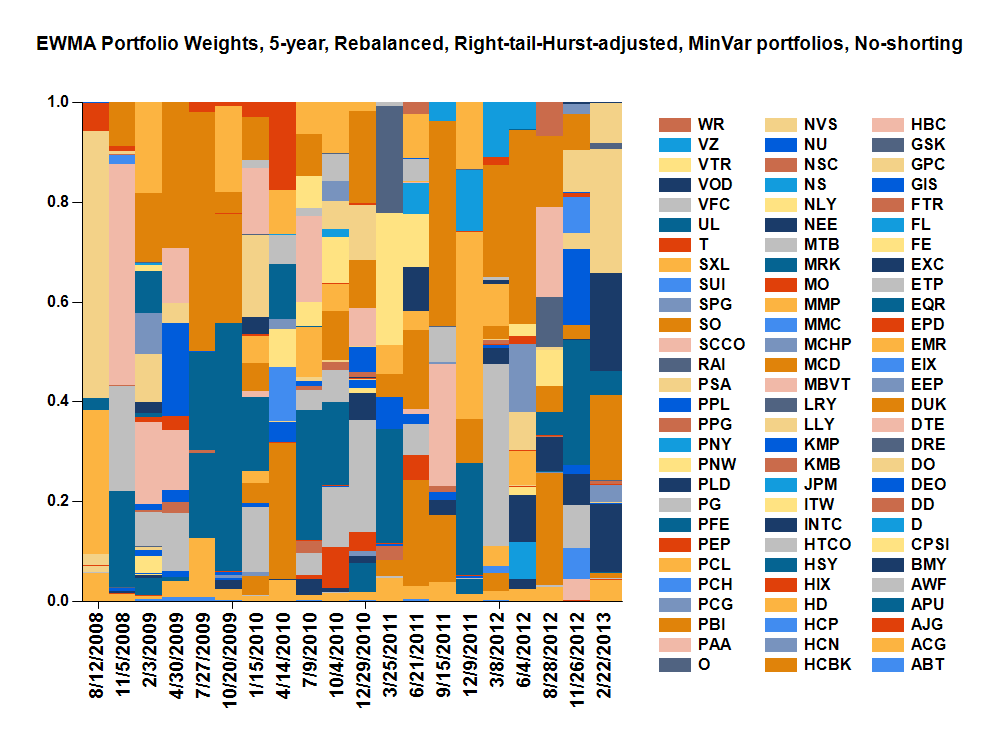

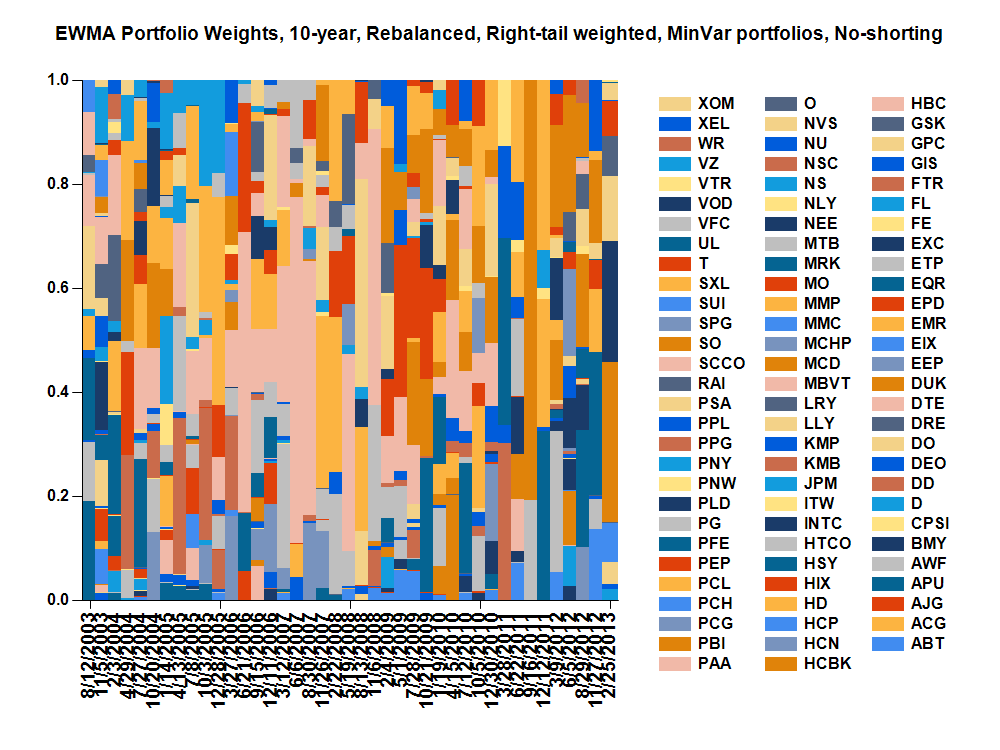

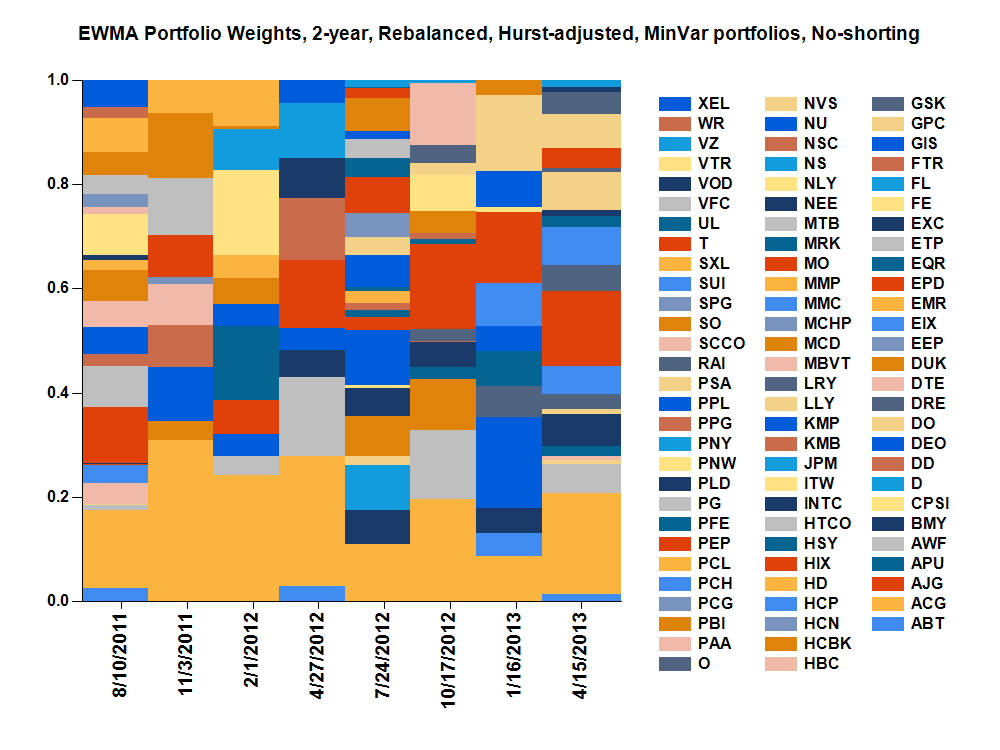

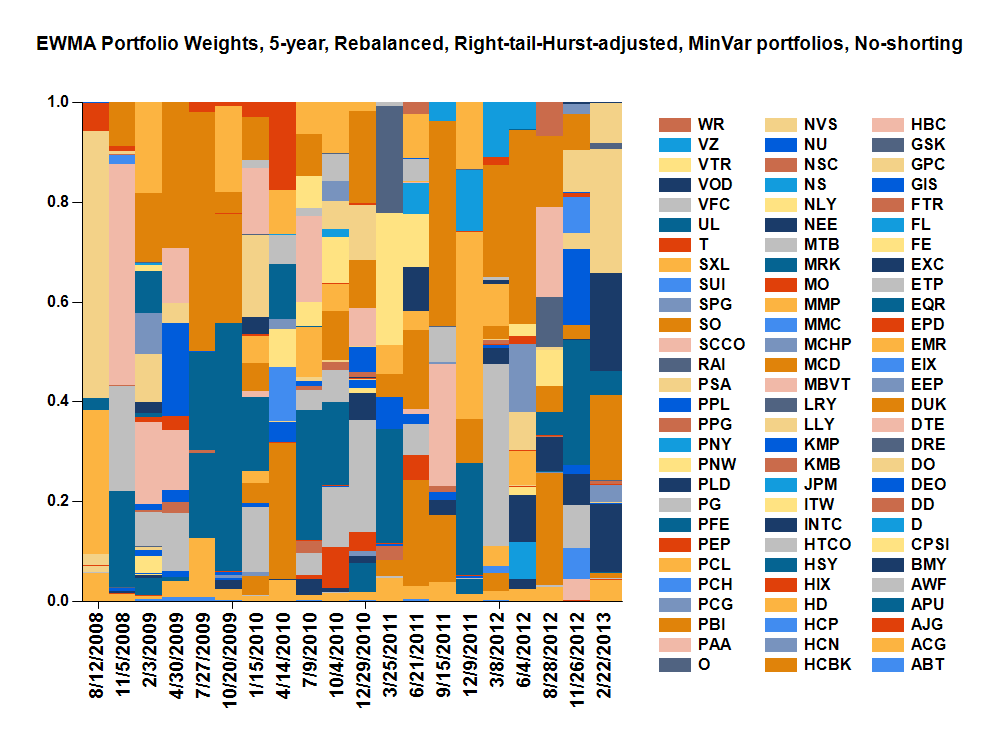

-EWMA - Exponential weighted moving average determination of returns and standard deviation.

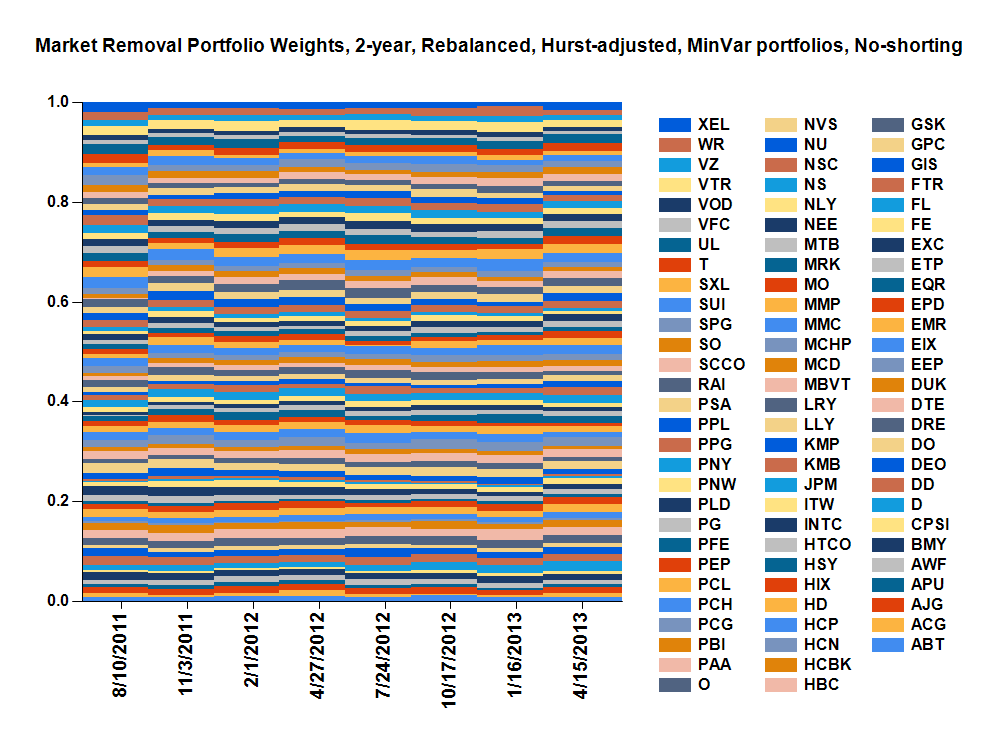

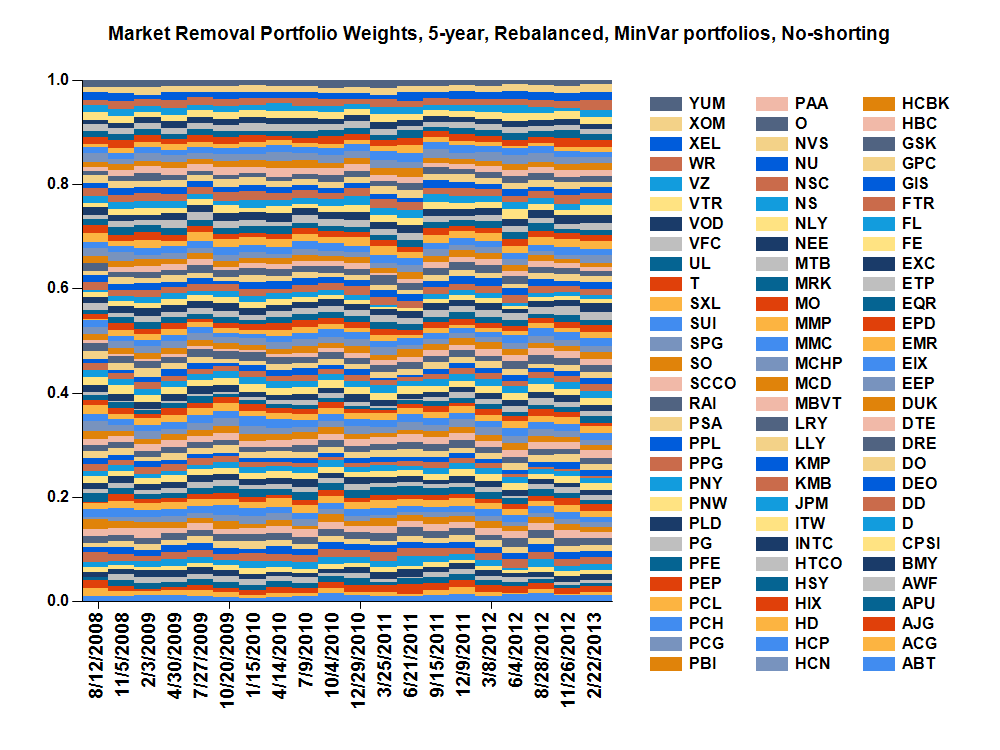

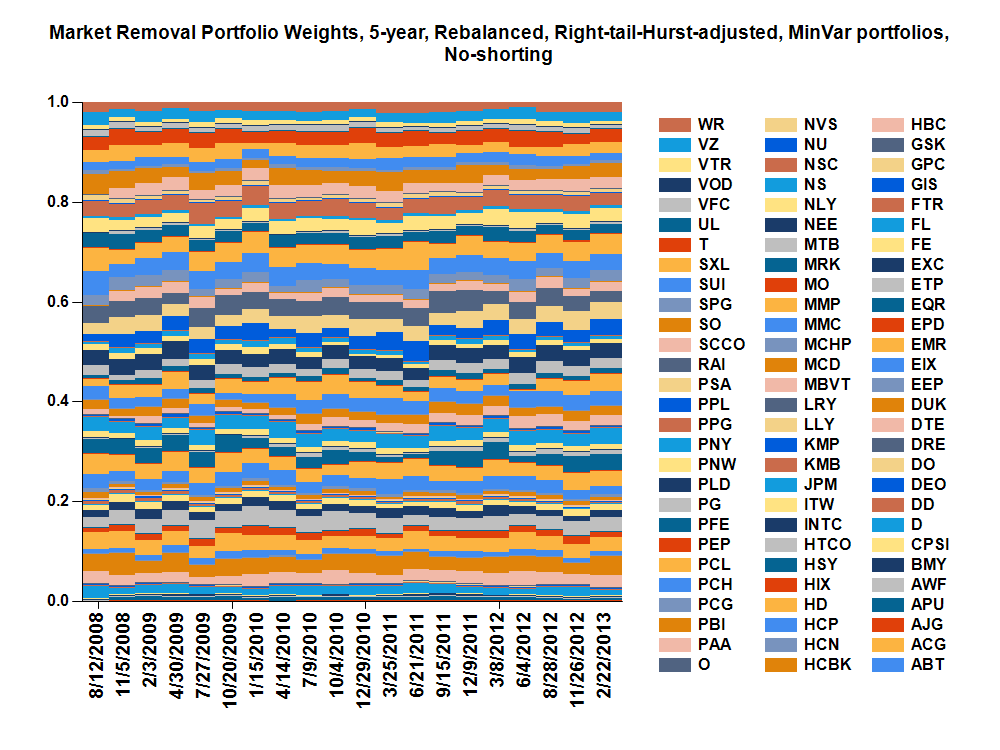

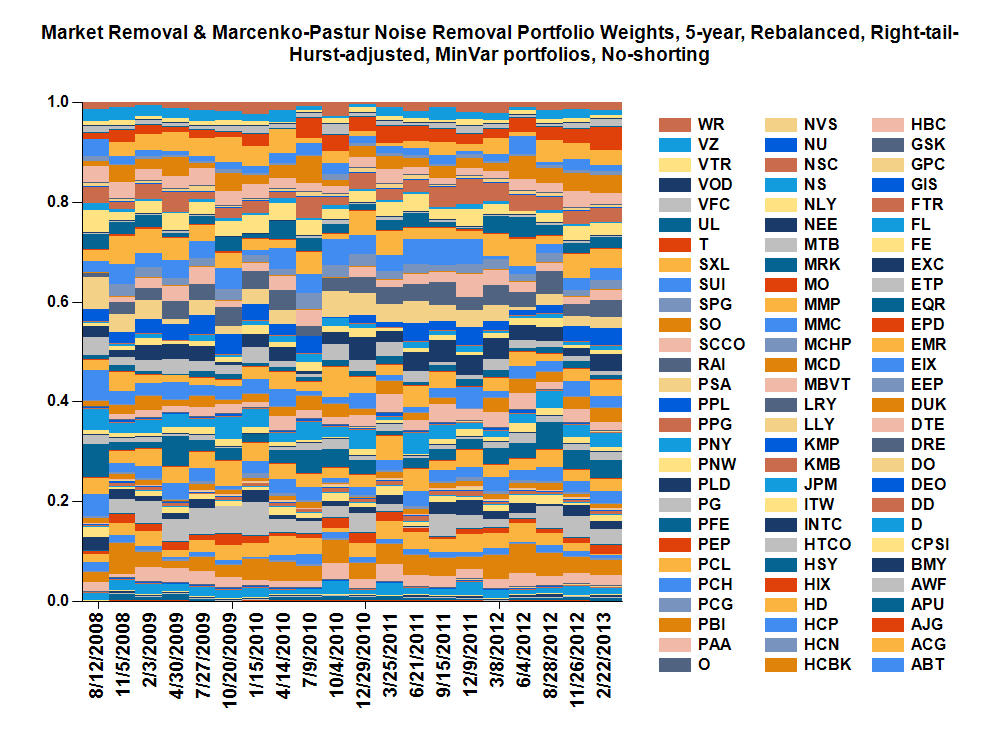

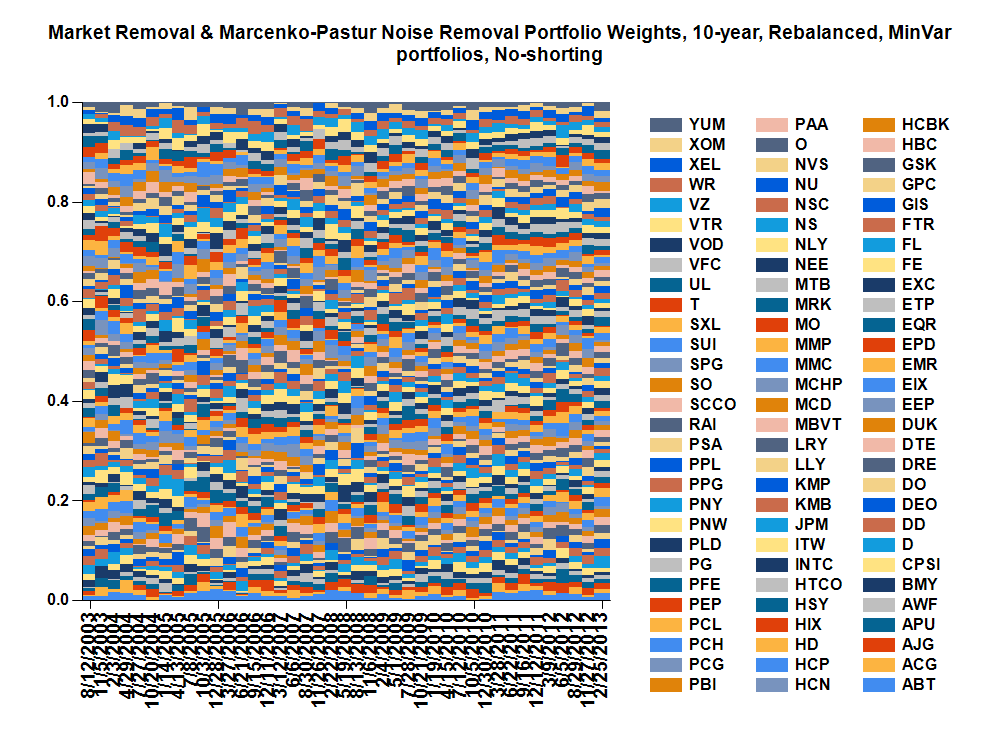

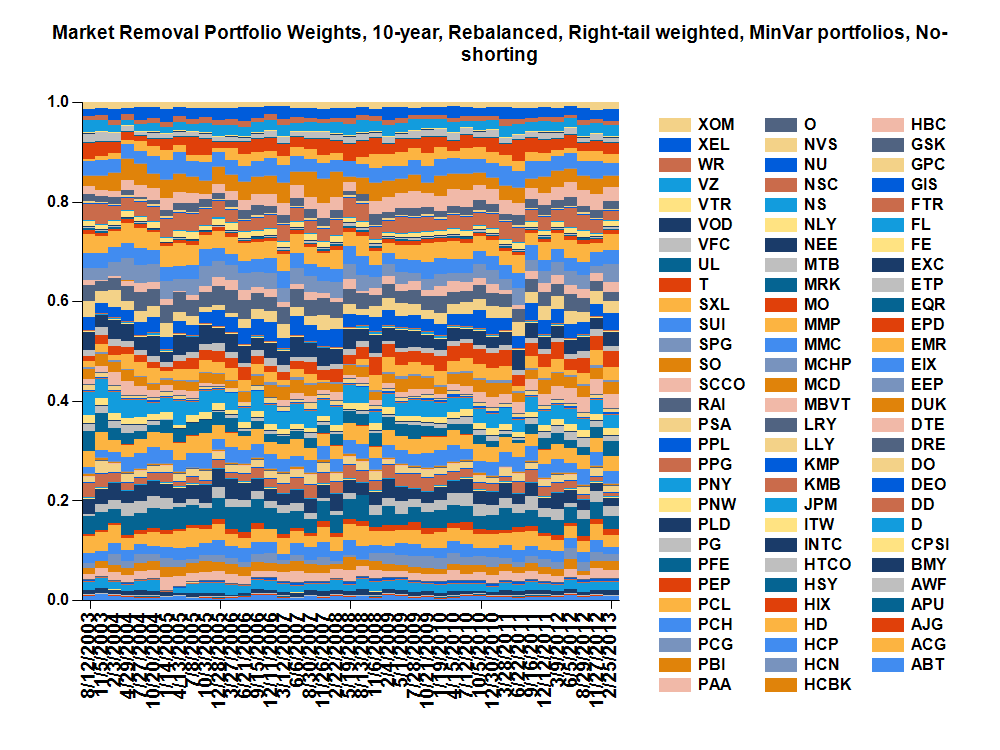

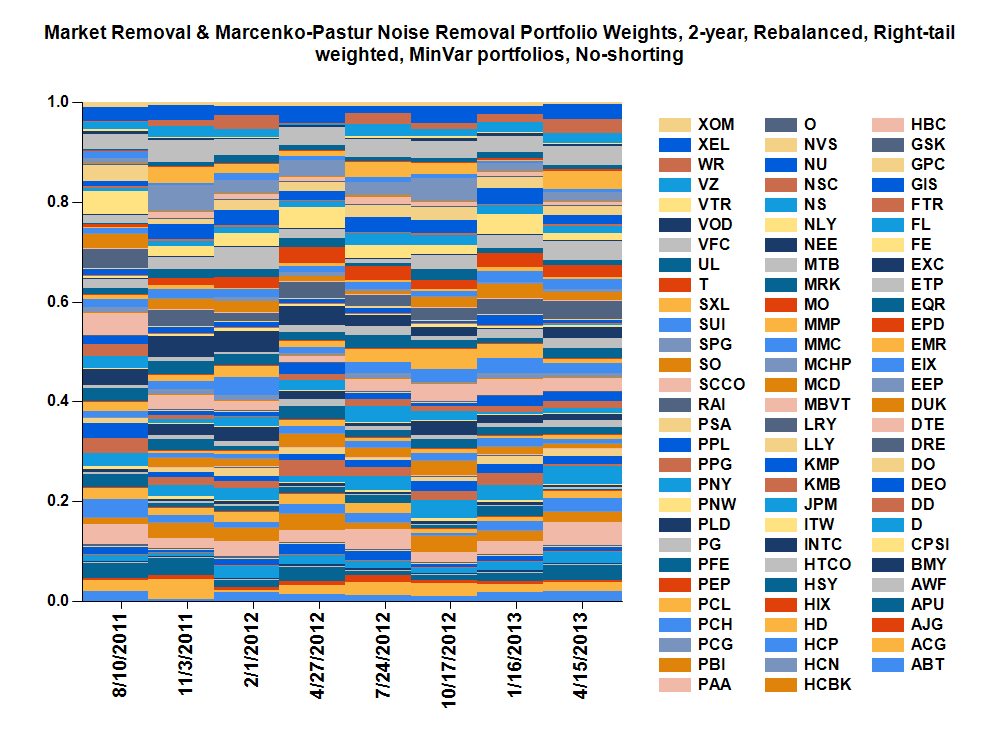

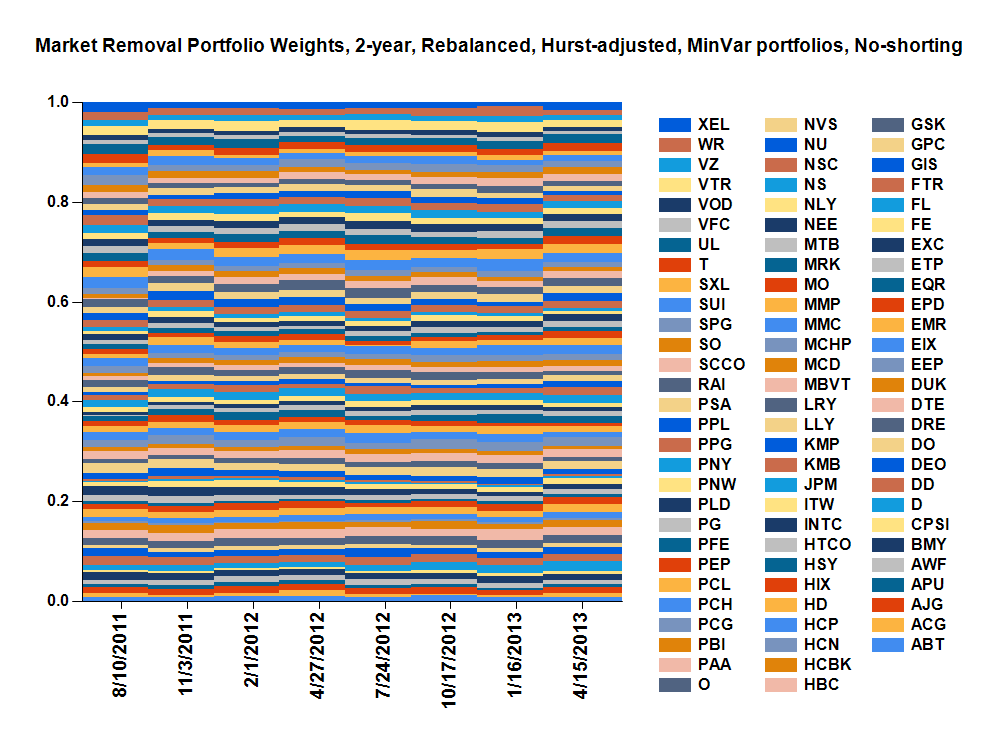

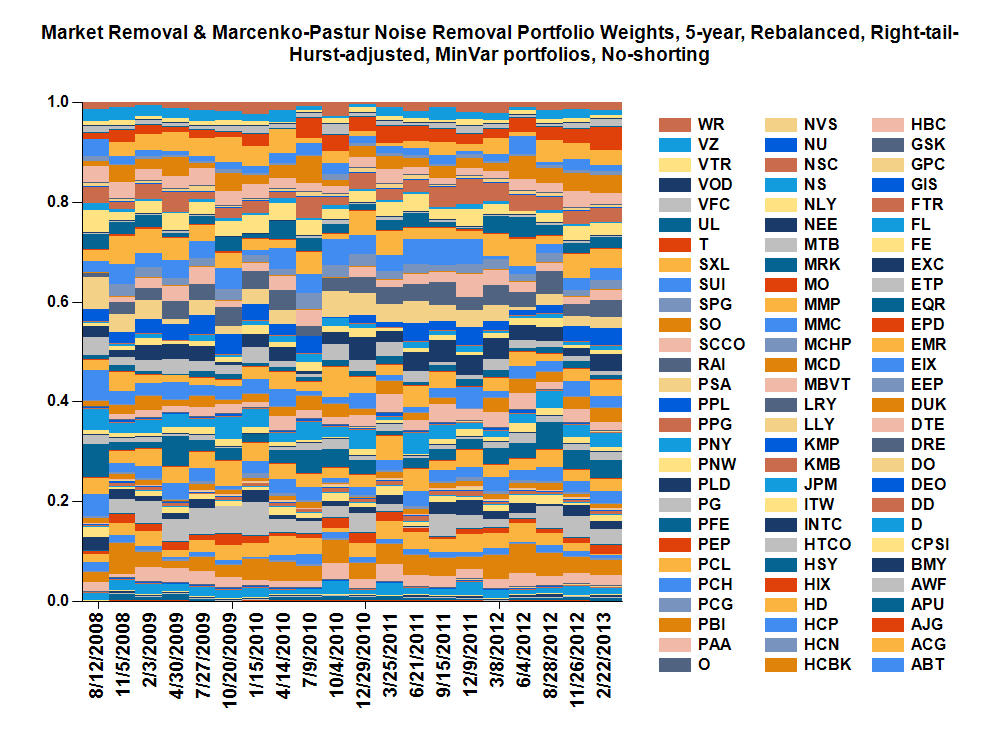

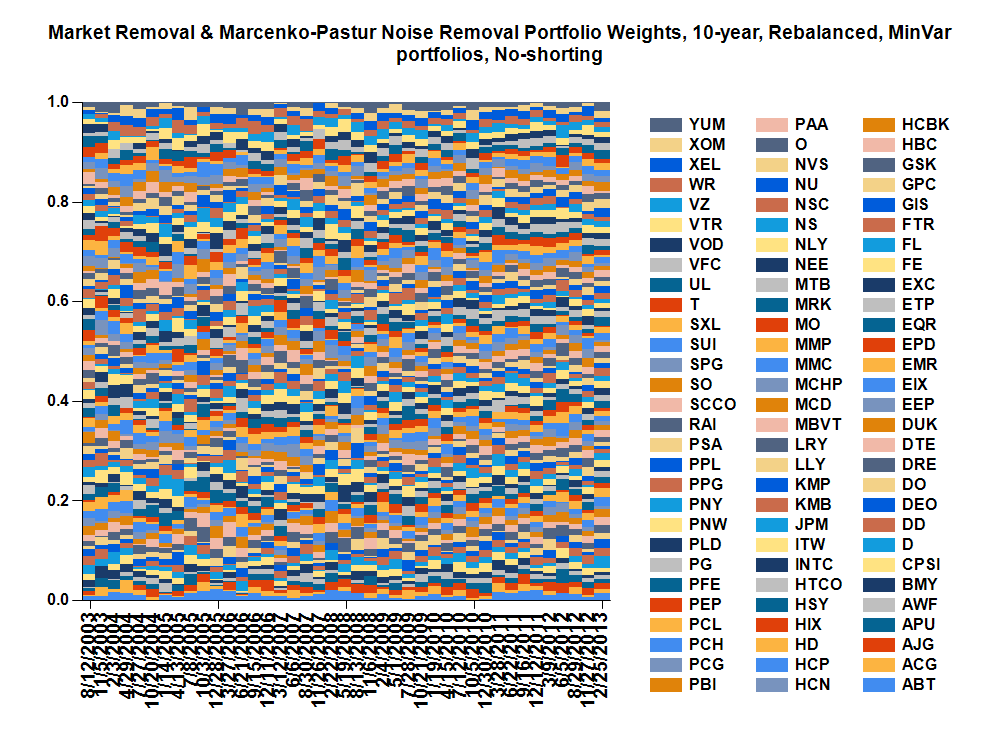

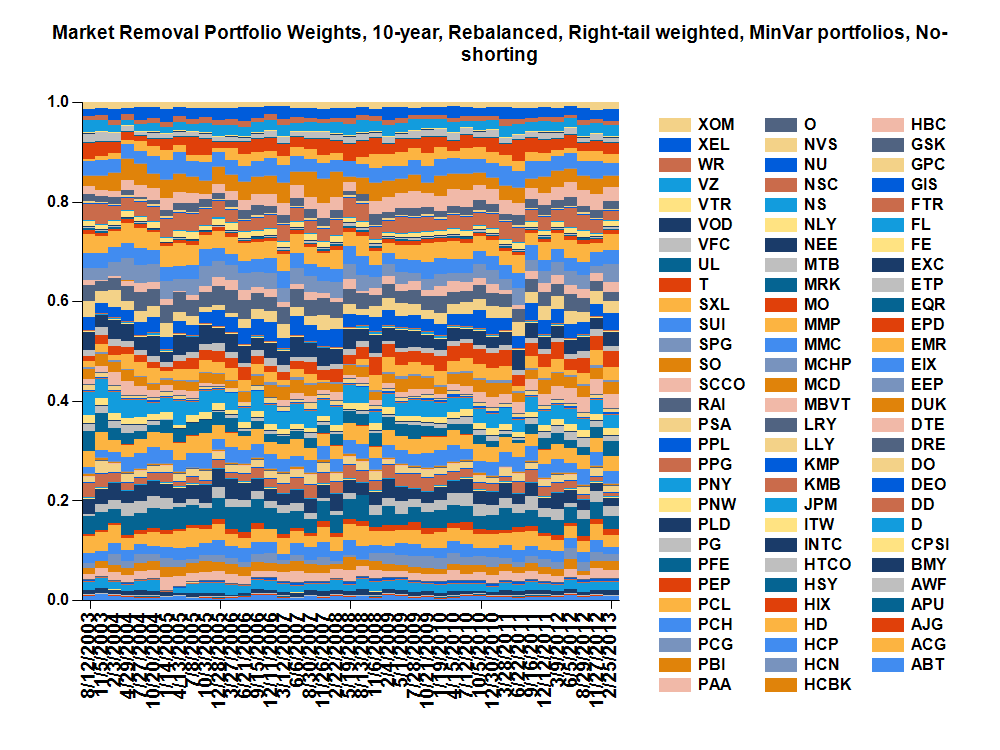

-RES - Component subtraction used to remove effect of the first principal component of the correlation matrix on returns.

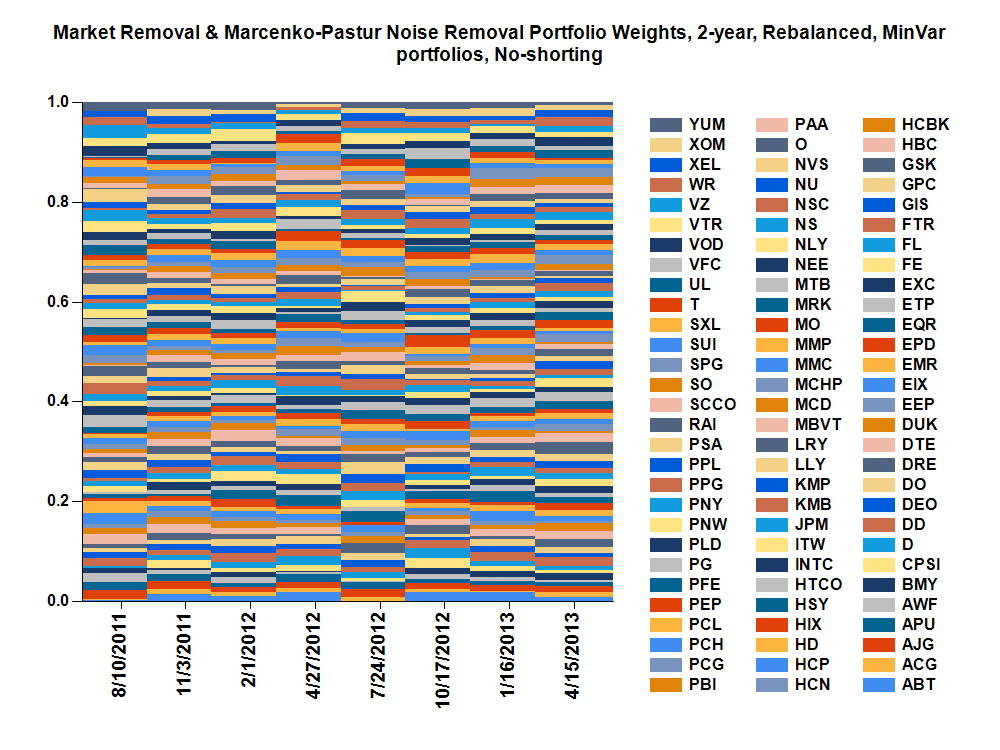

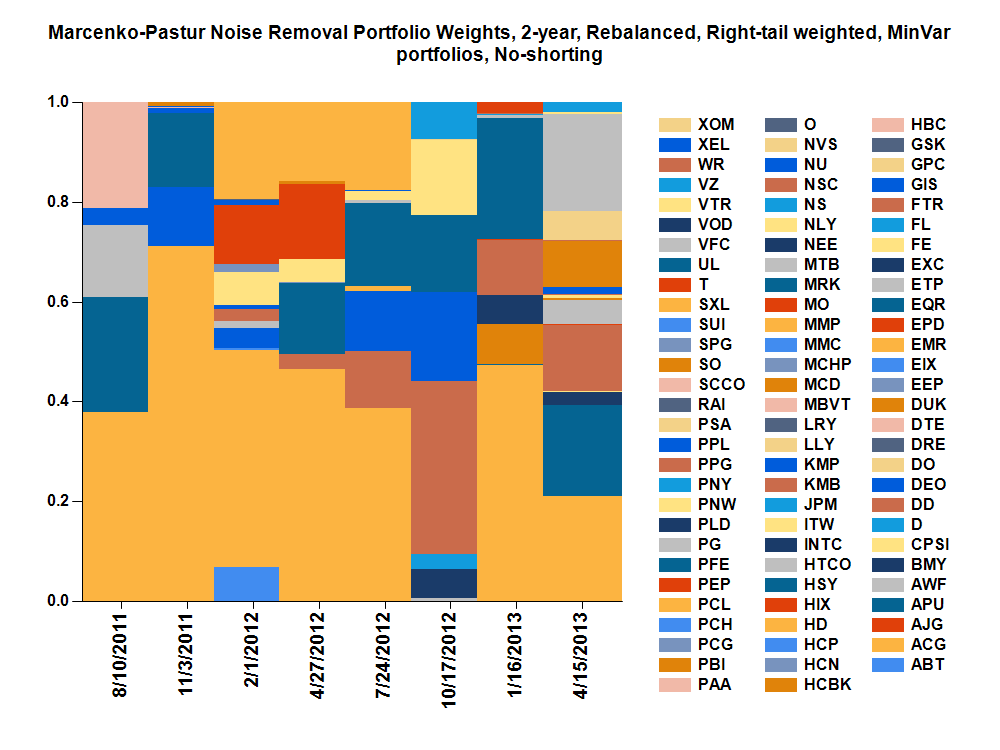

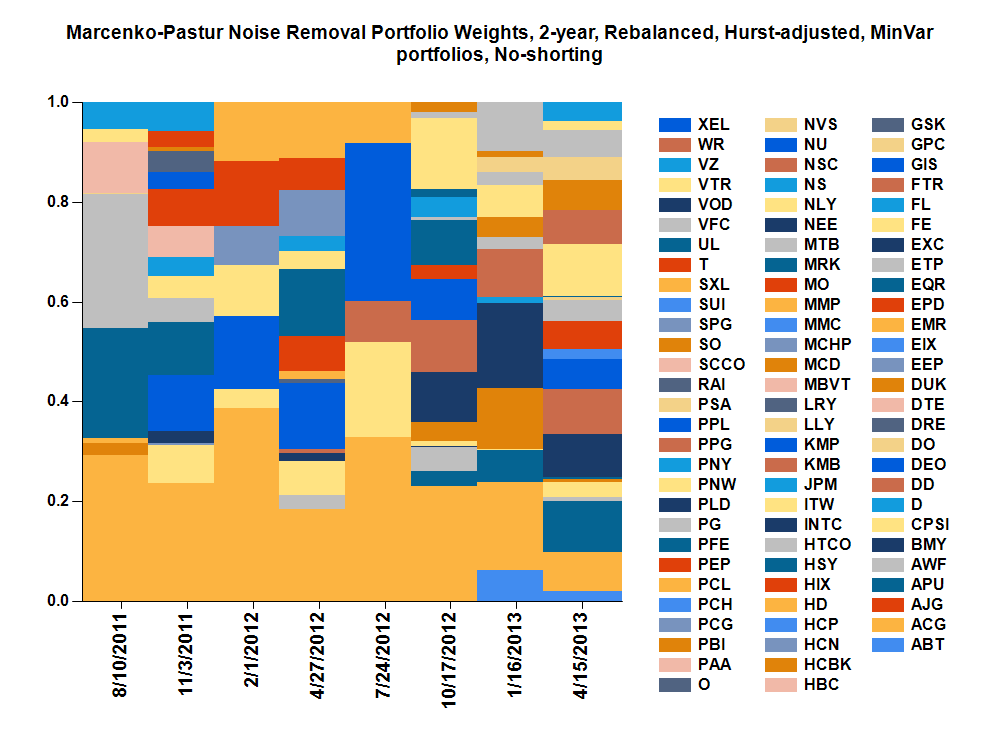

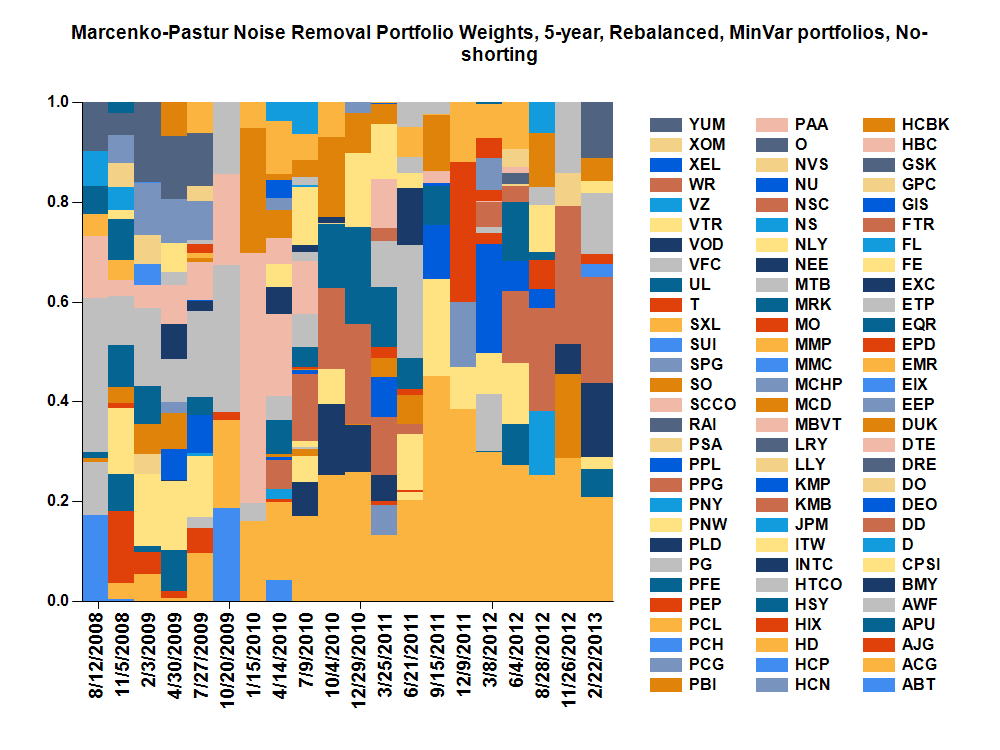

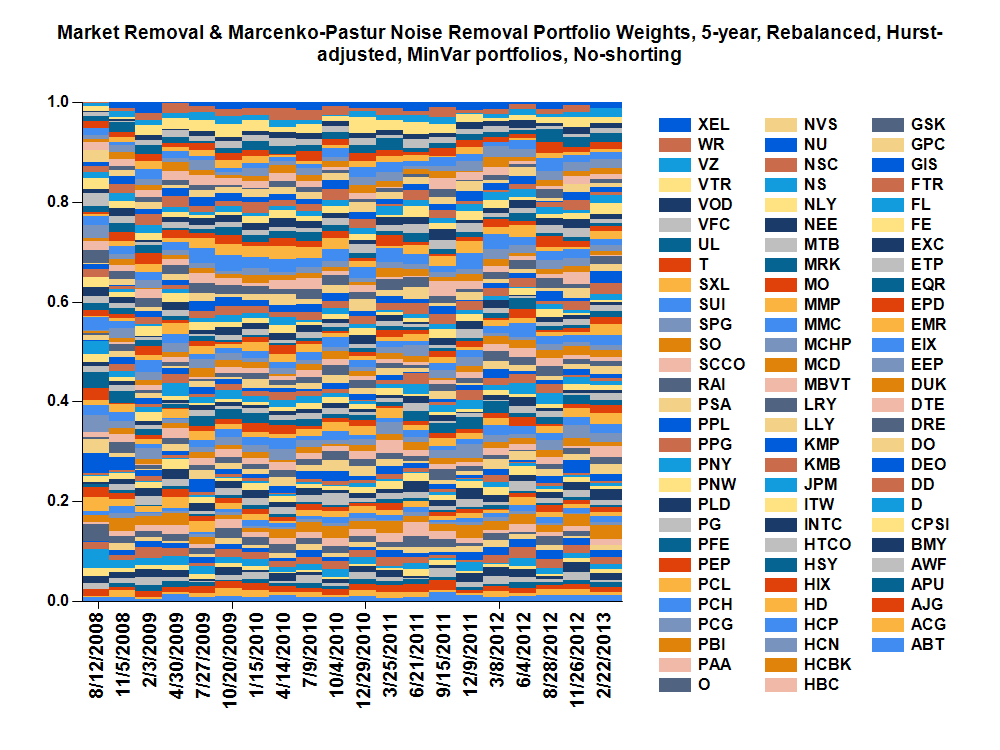

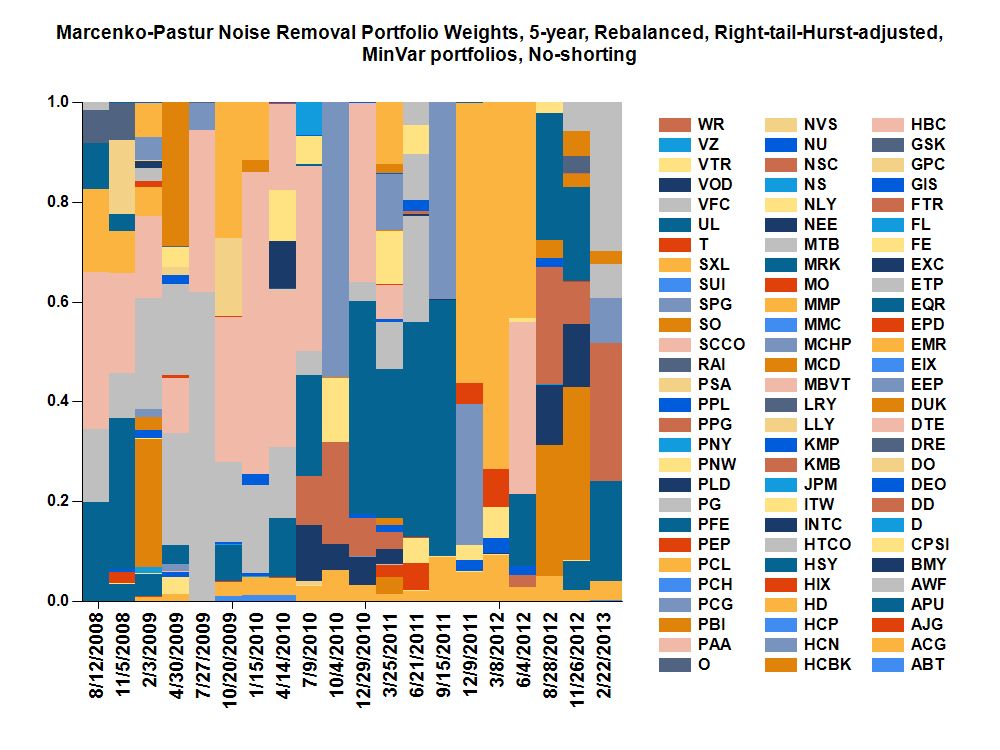

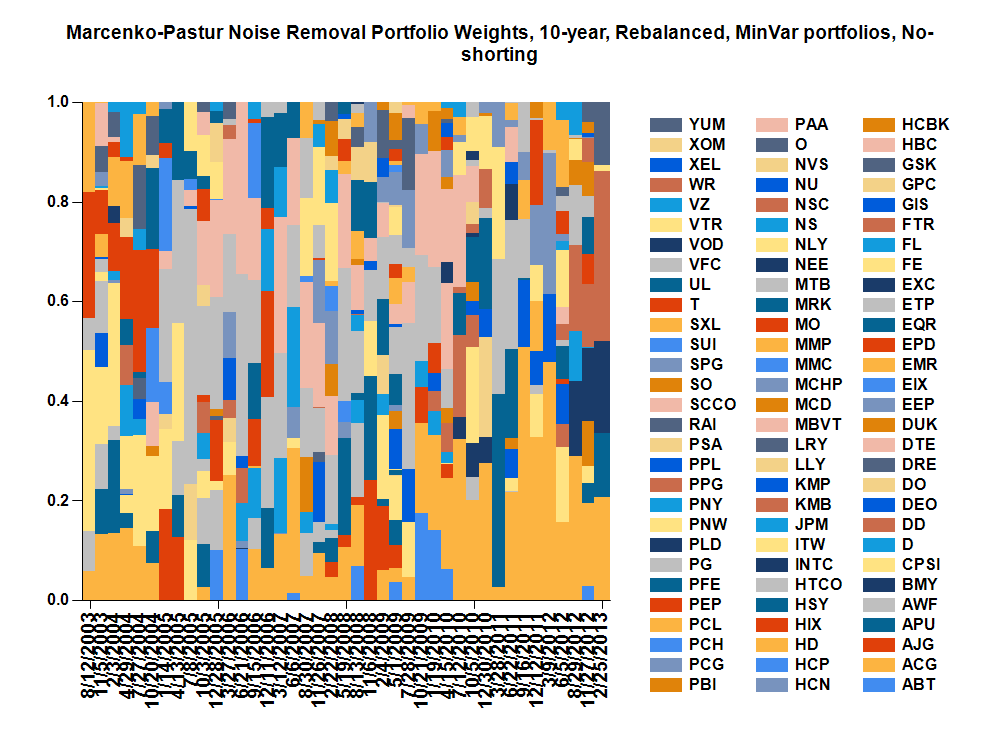

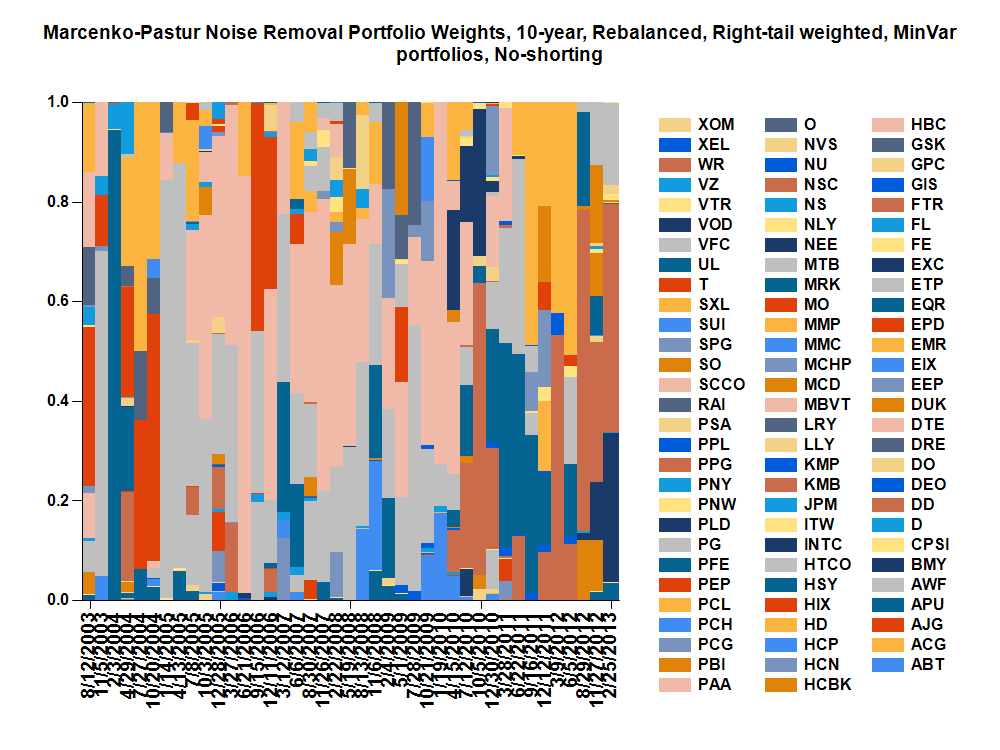

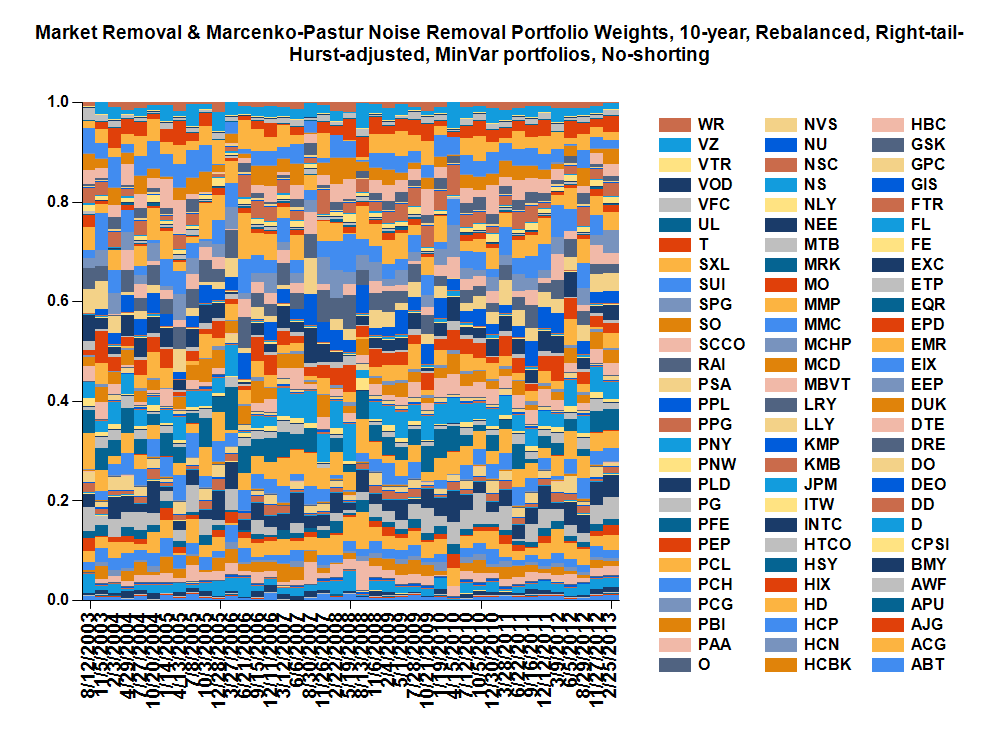

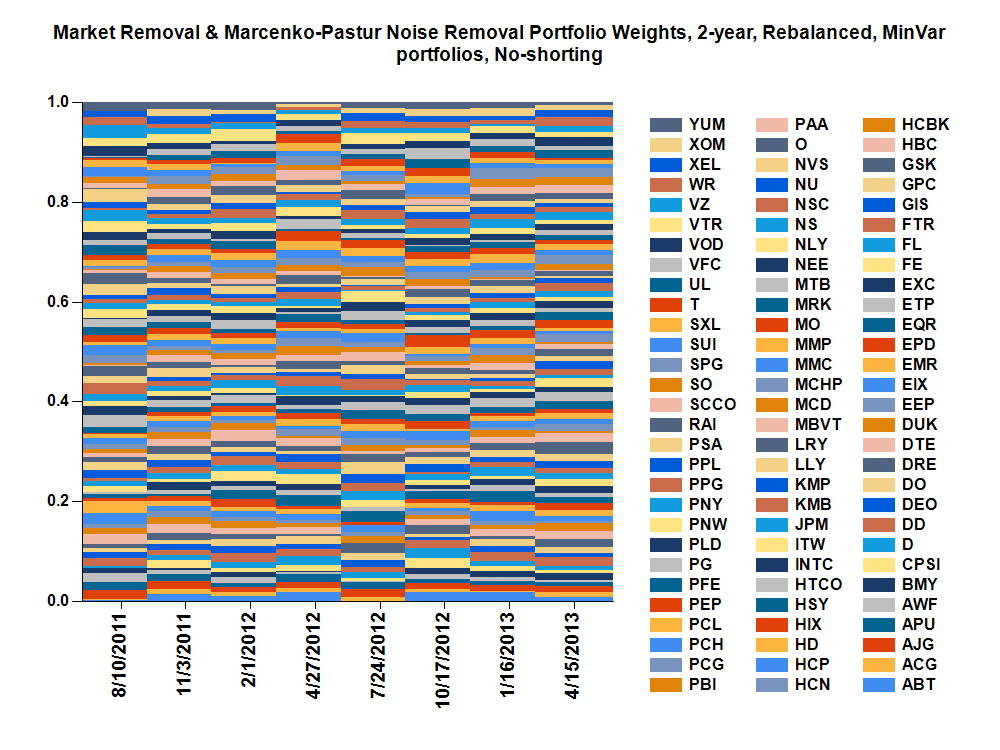

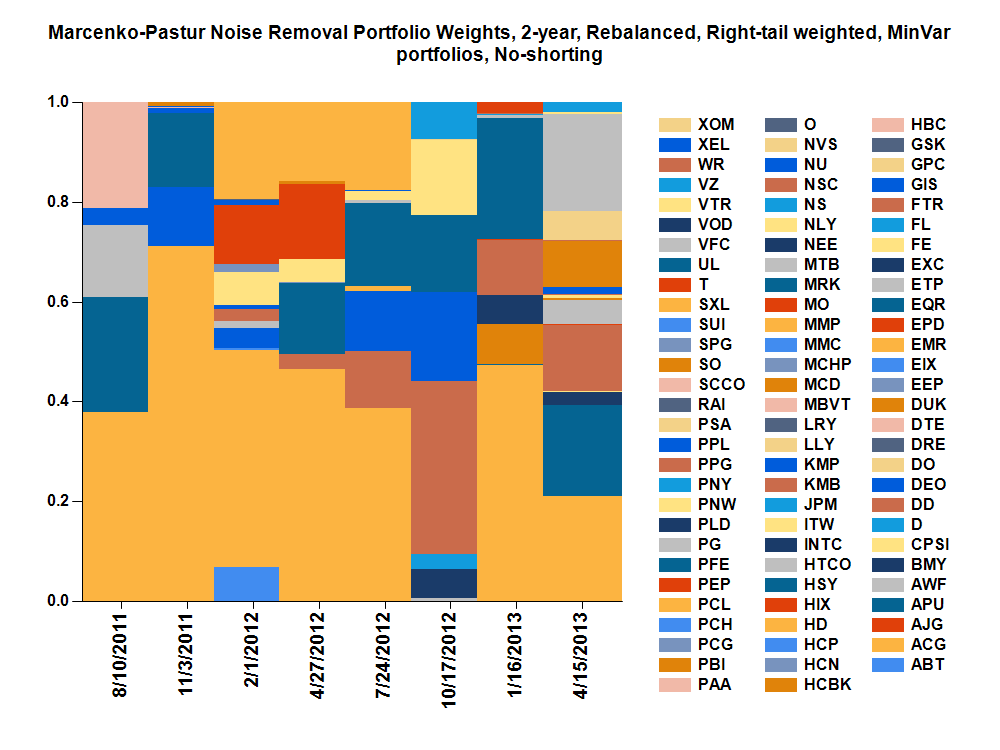

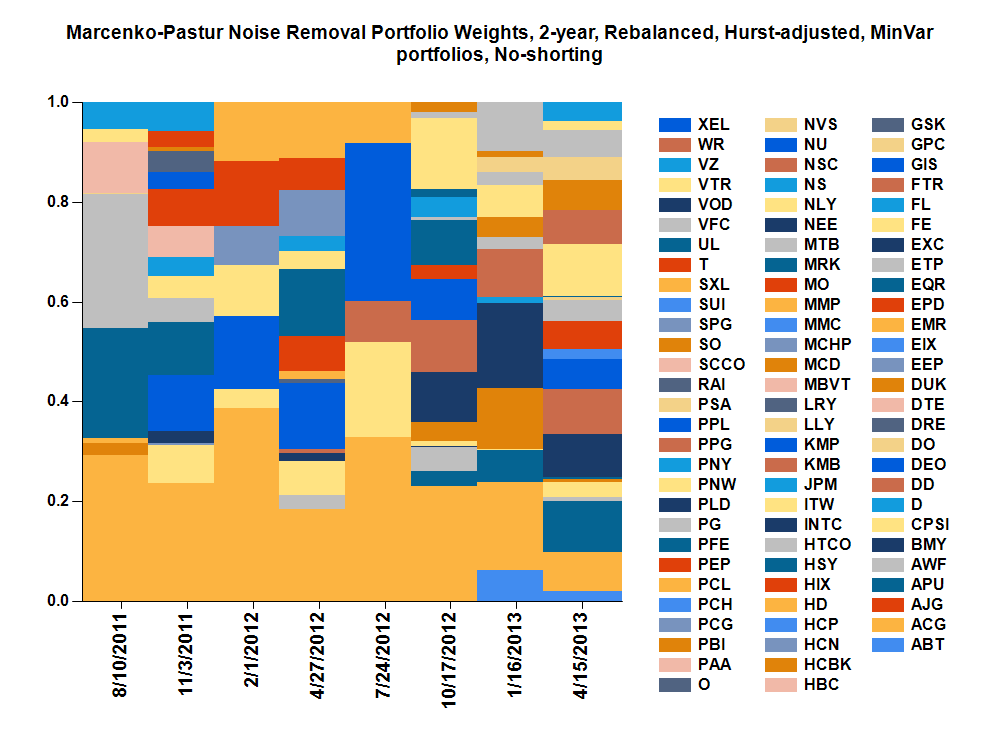

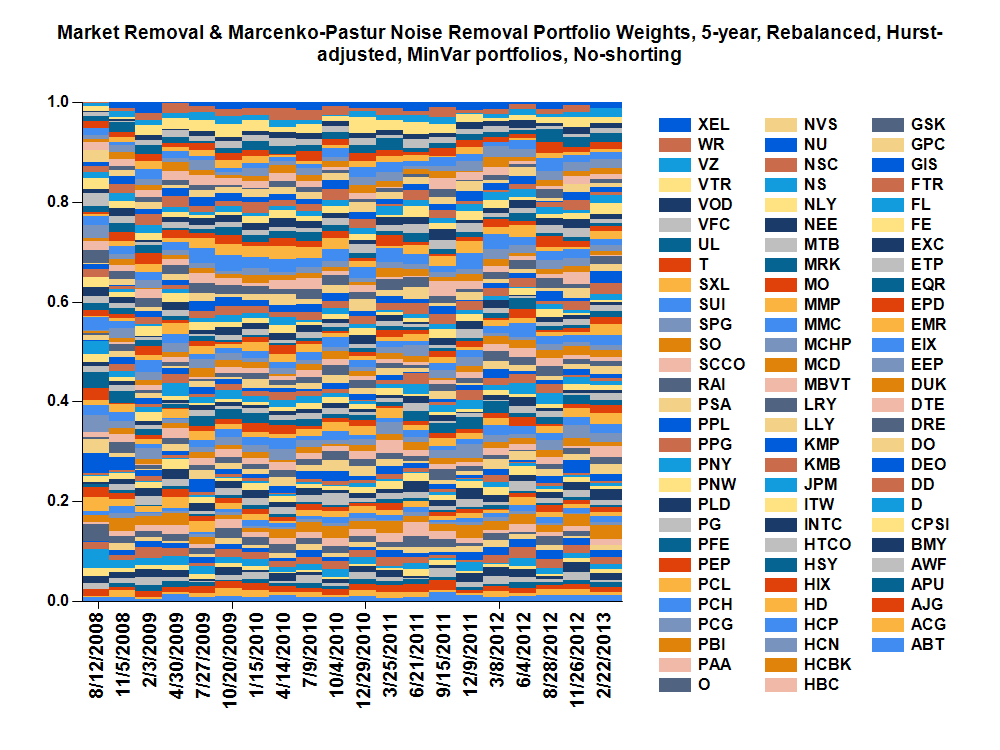

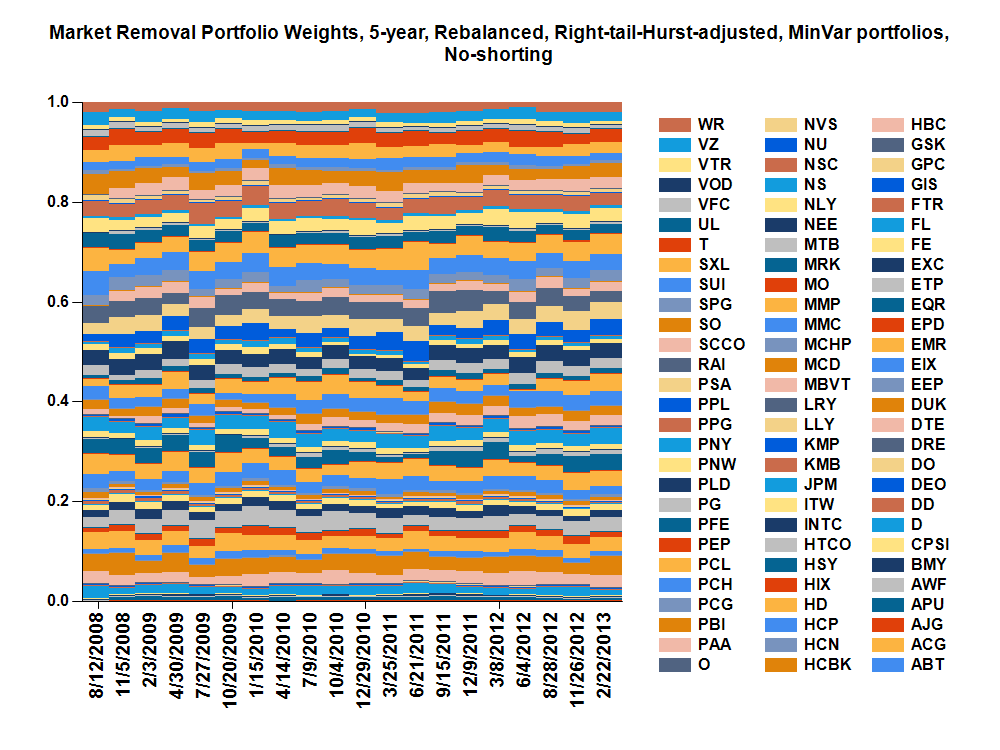

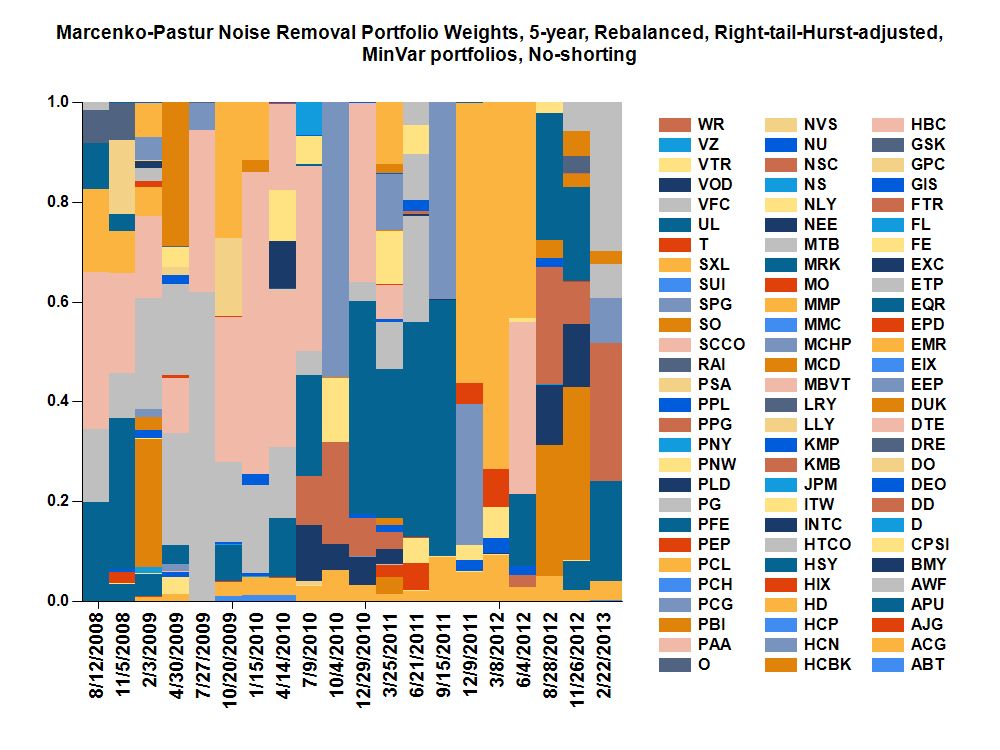

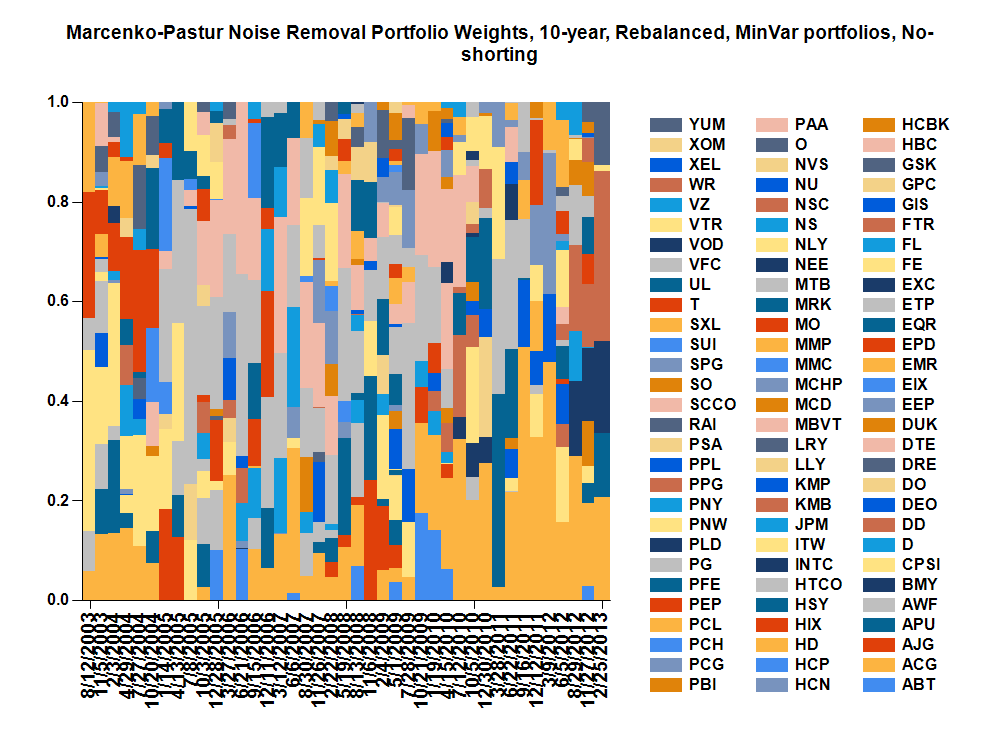

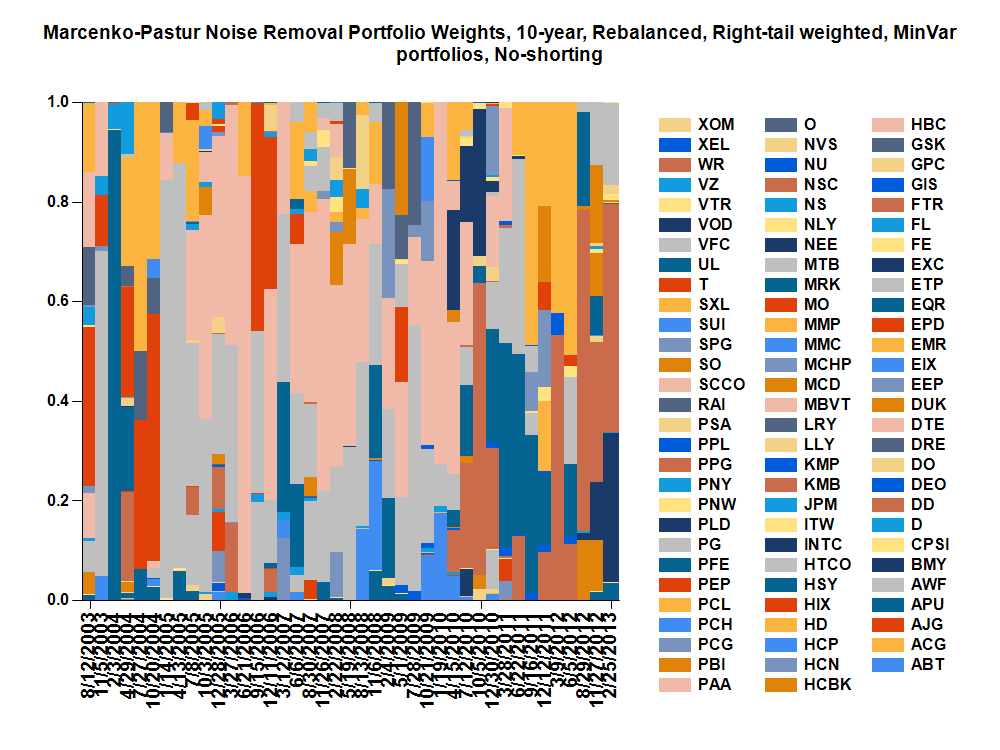

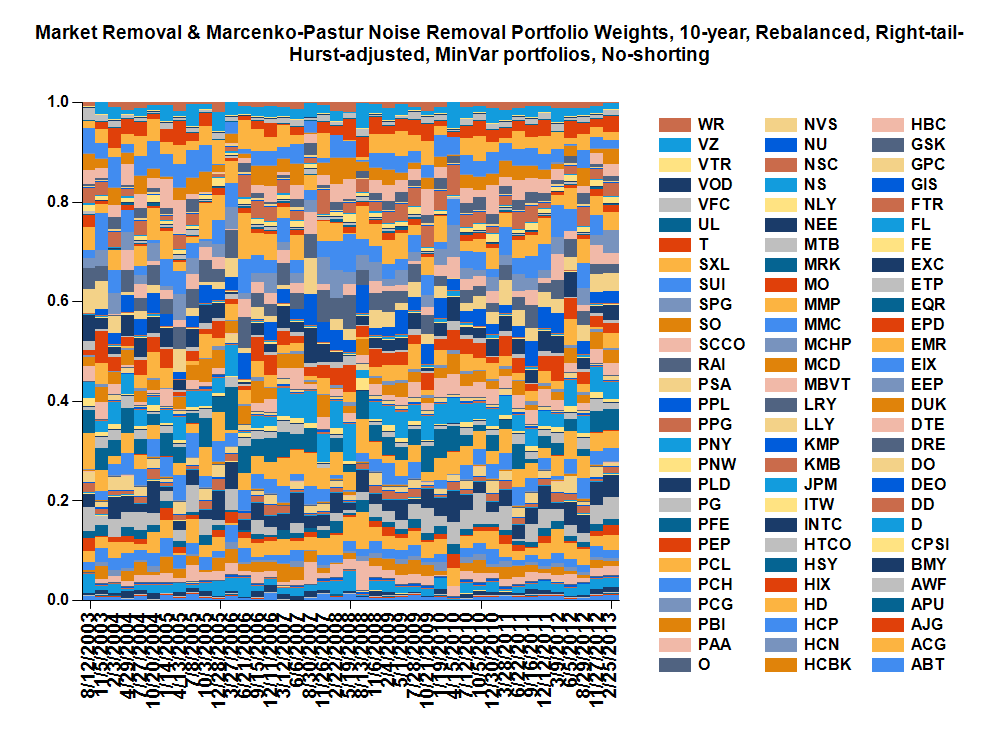

-MP - Component subtraction used to remove effect of noise eigenvectors (below Marcenko-Pastur cutoff, lambda+), on returns.

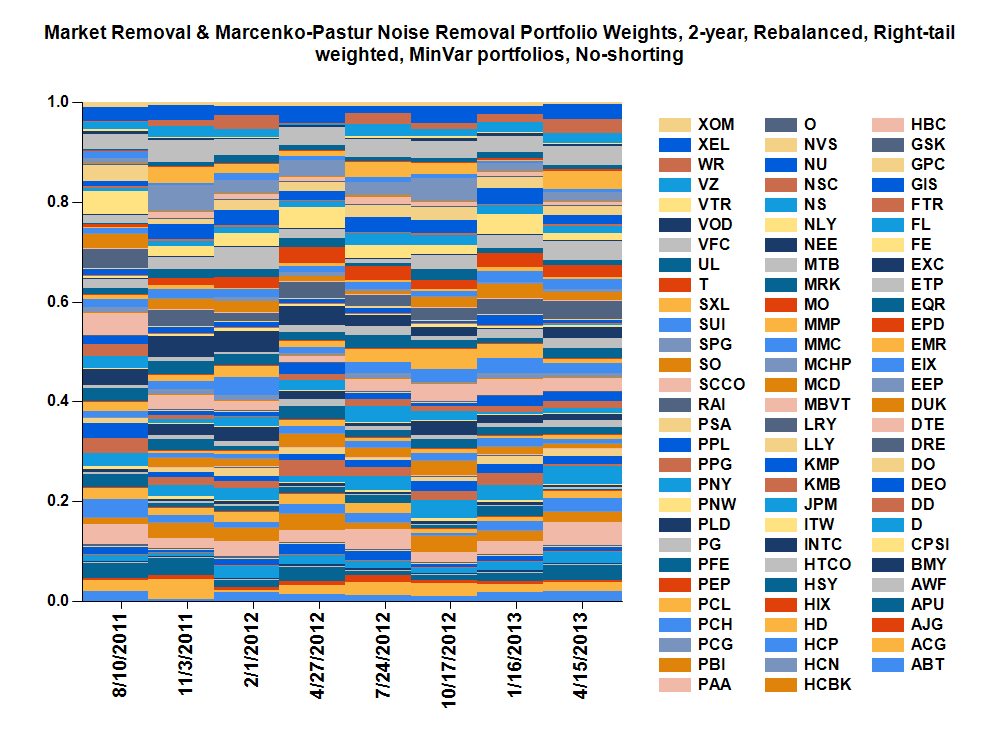

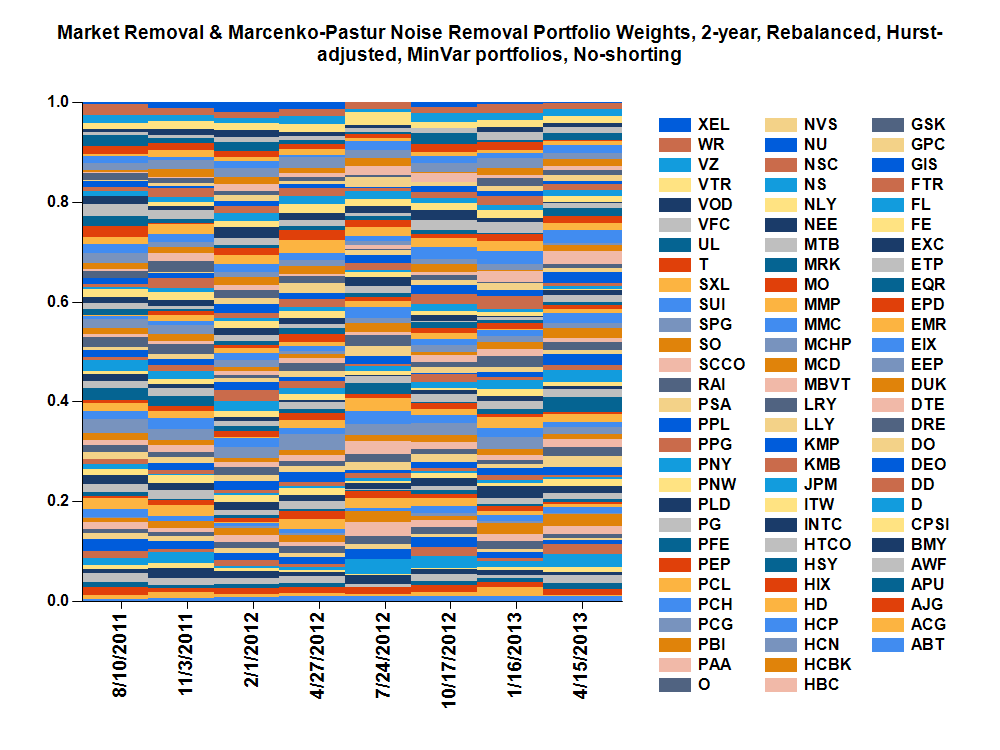

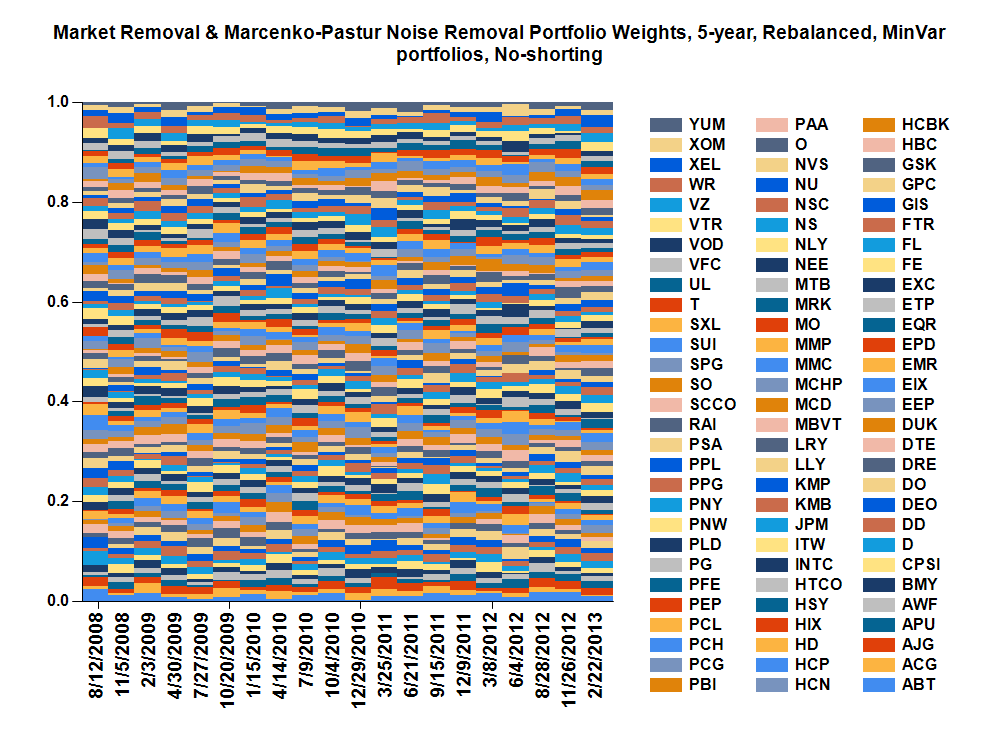

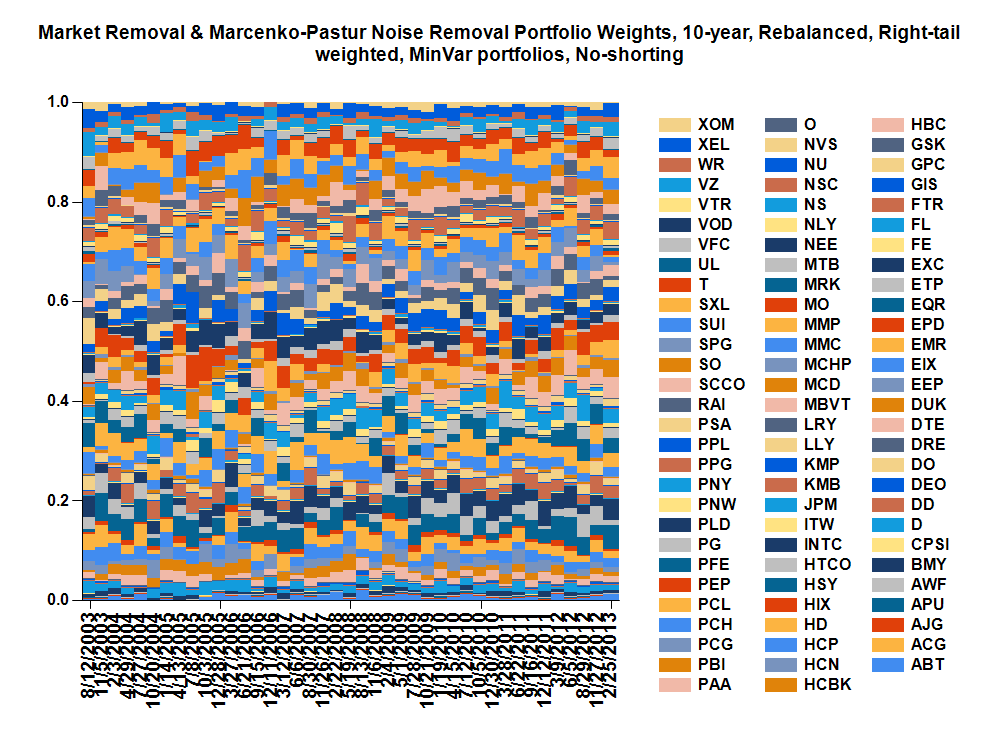

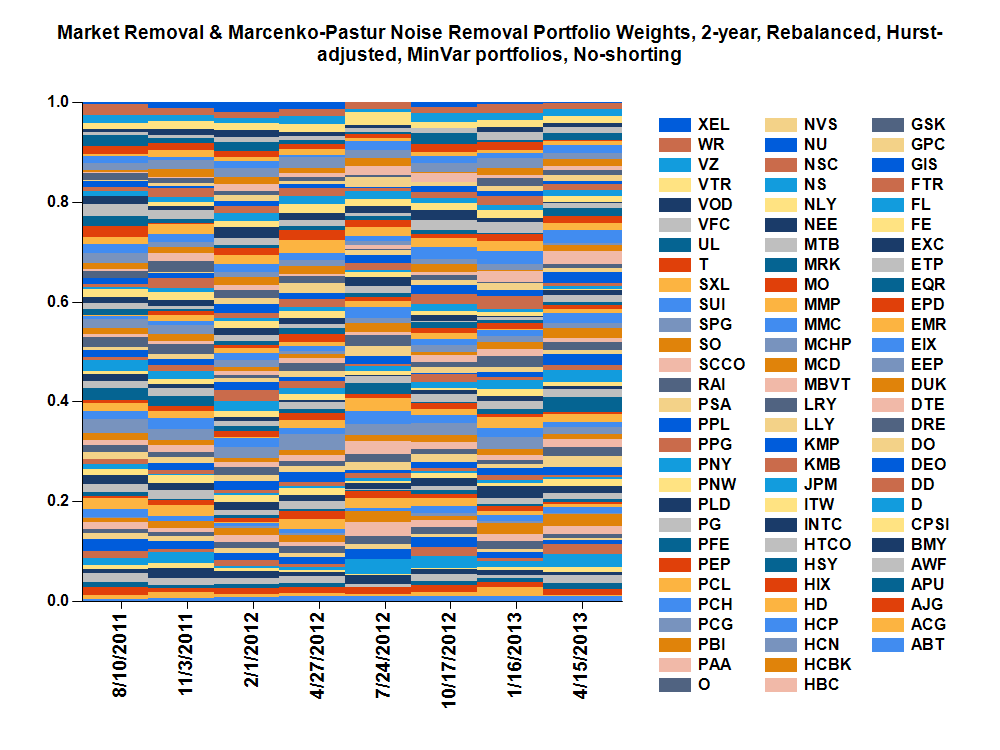

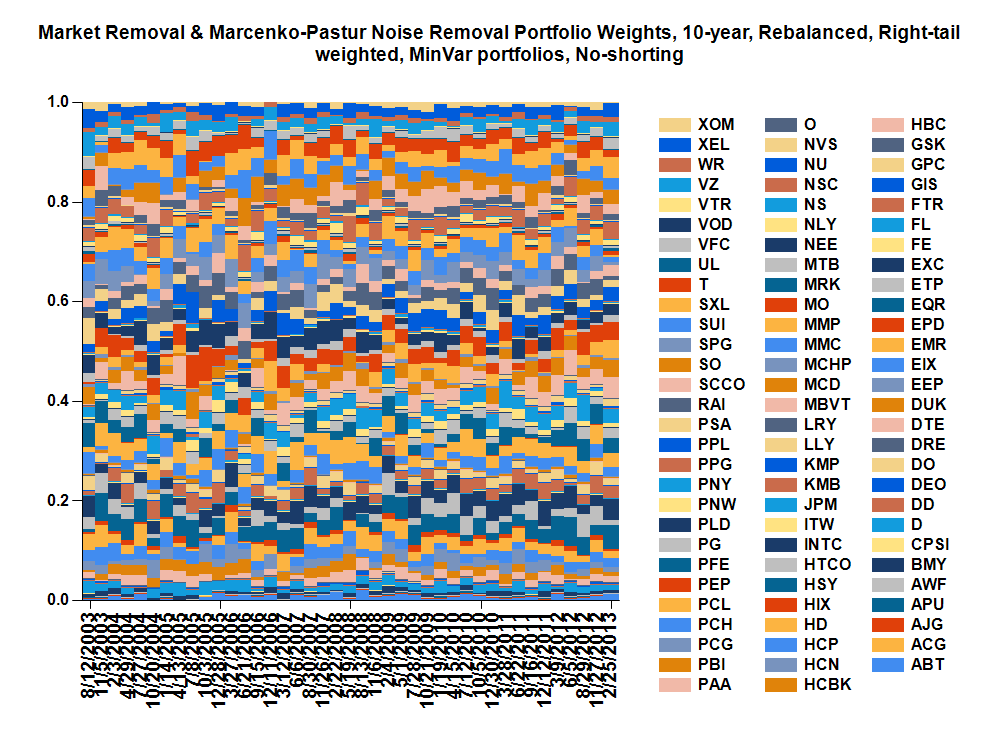

-RESMP - Component subtraction employed to remove effects of greatest principal component and noise eigenvectors below MP cutoff.

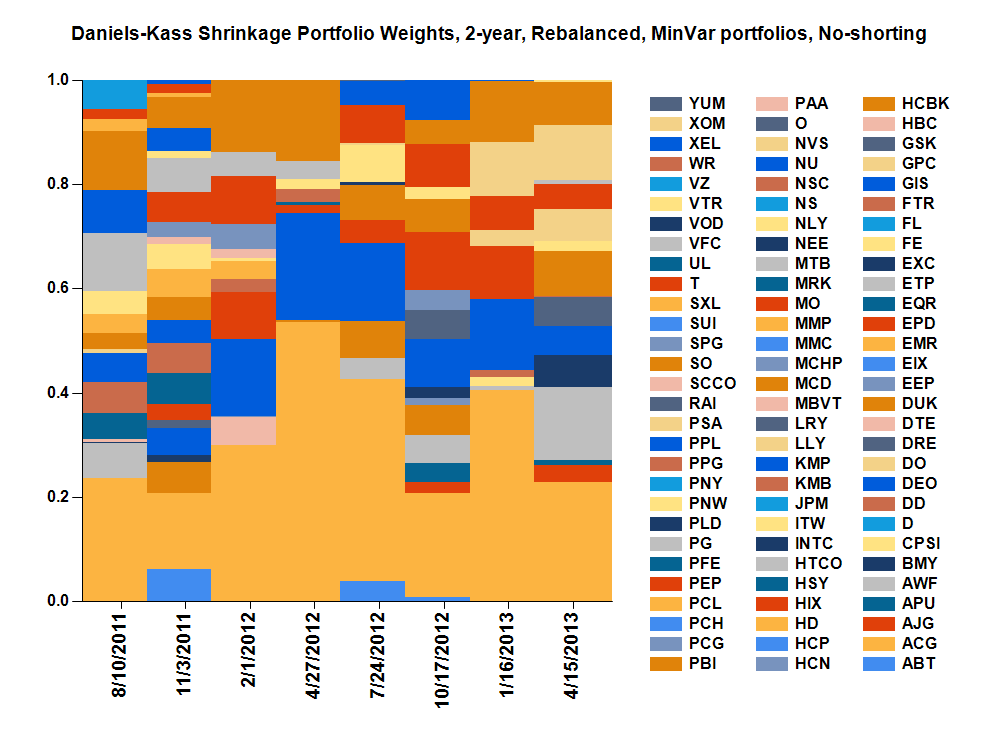

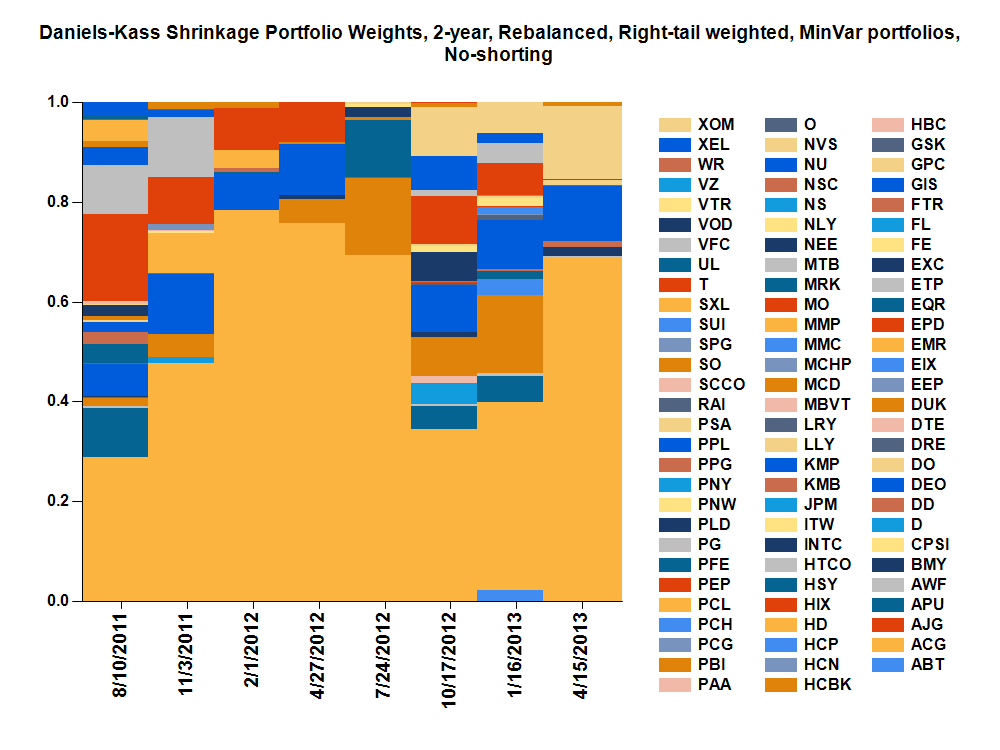

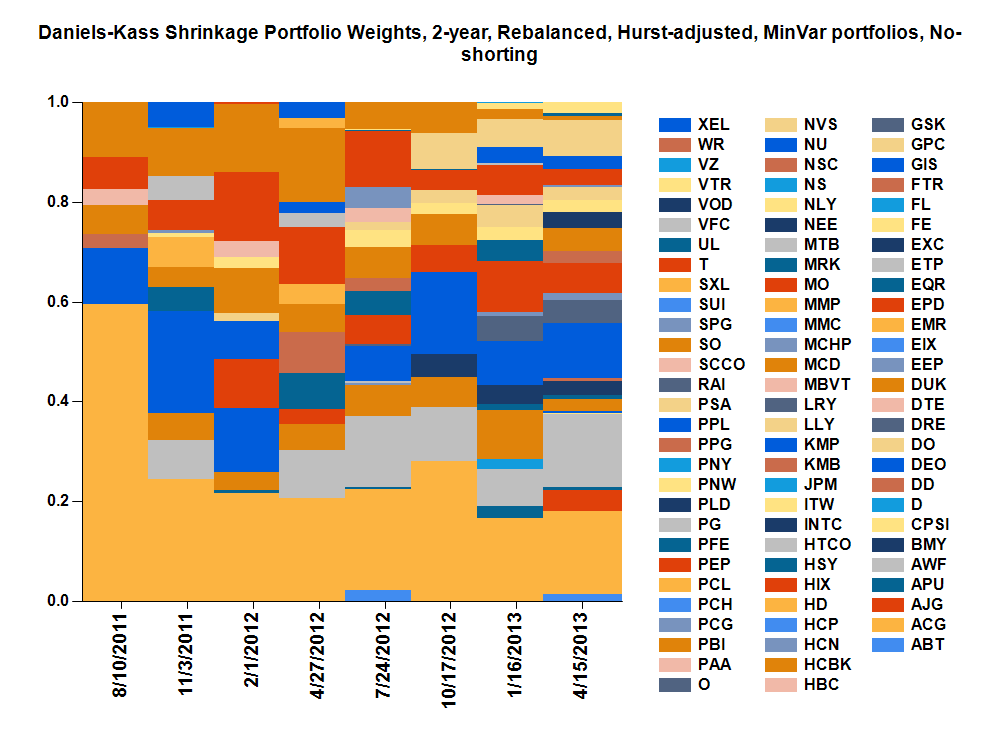

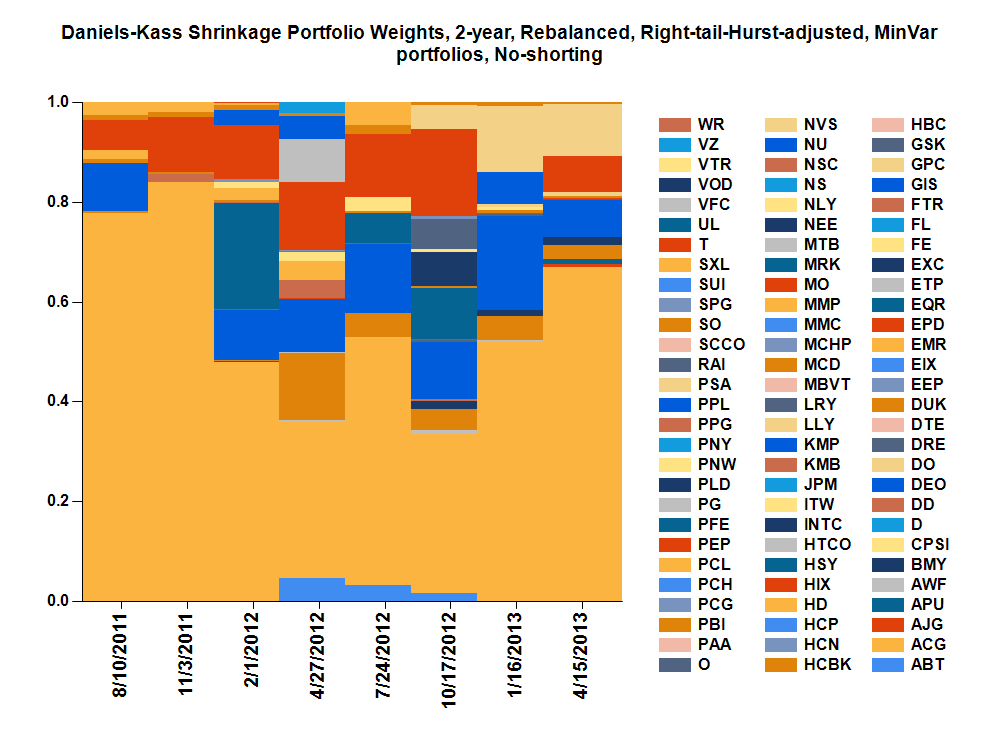

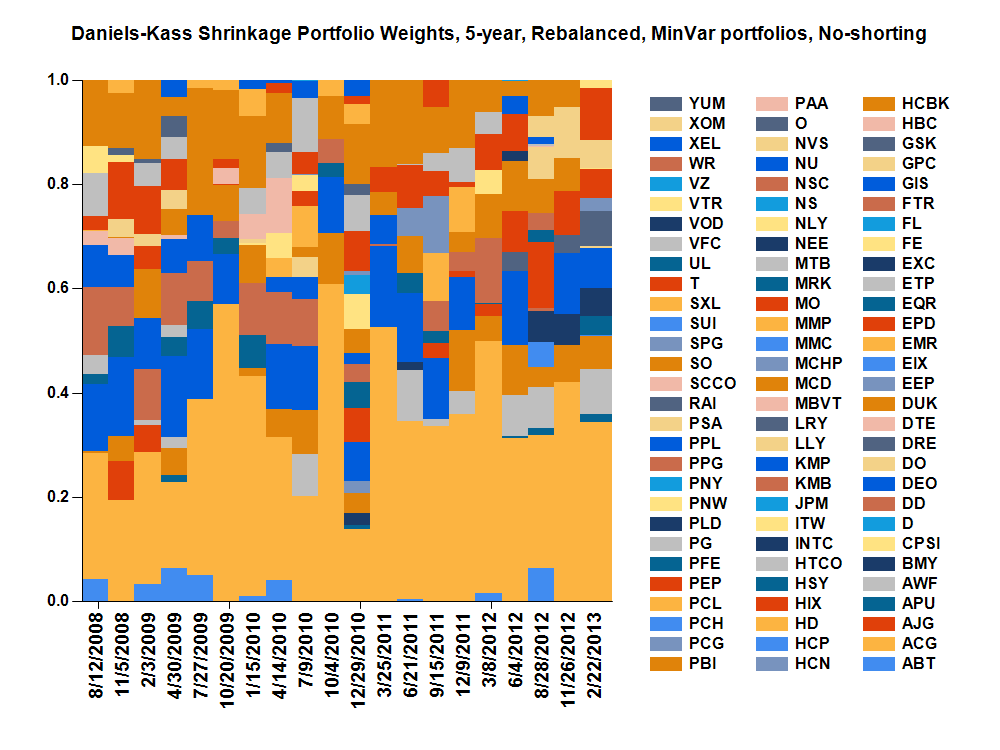

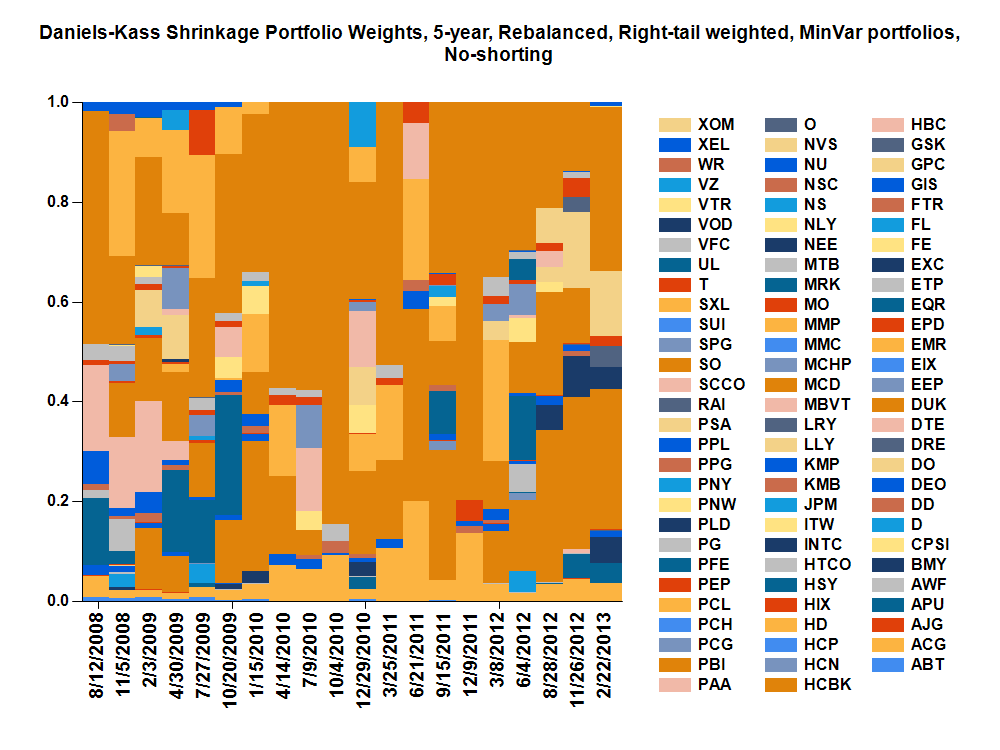

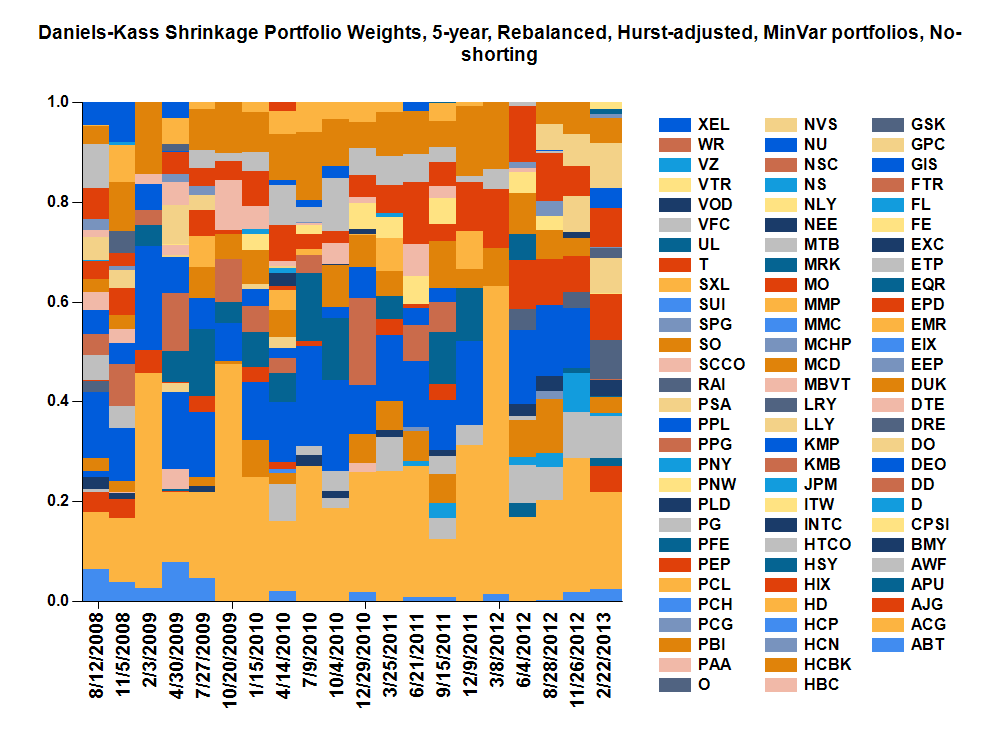

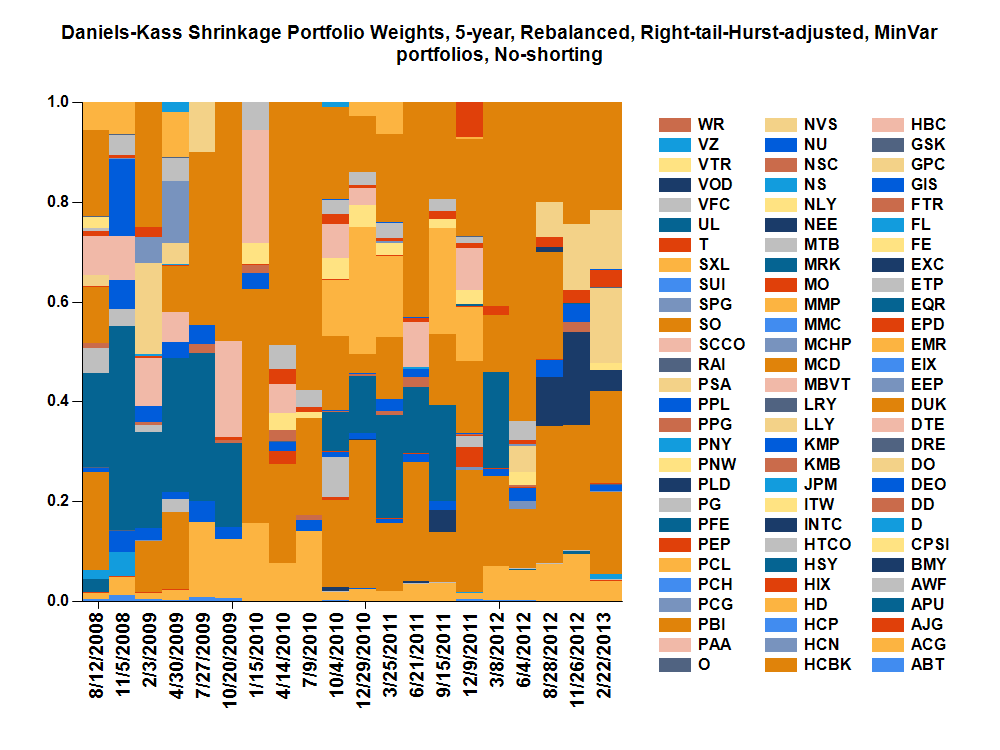

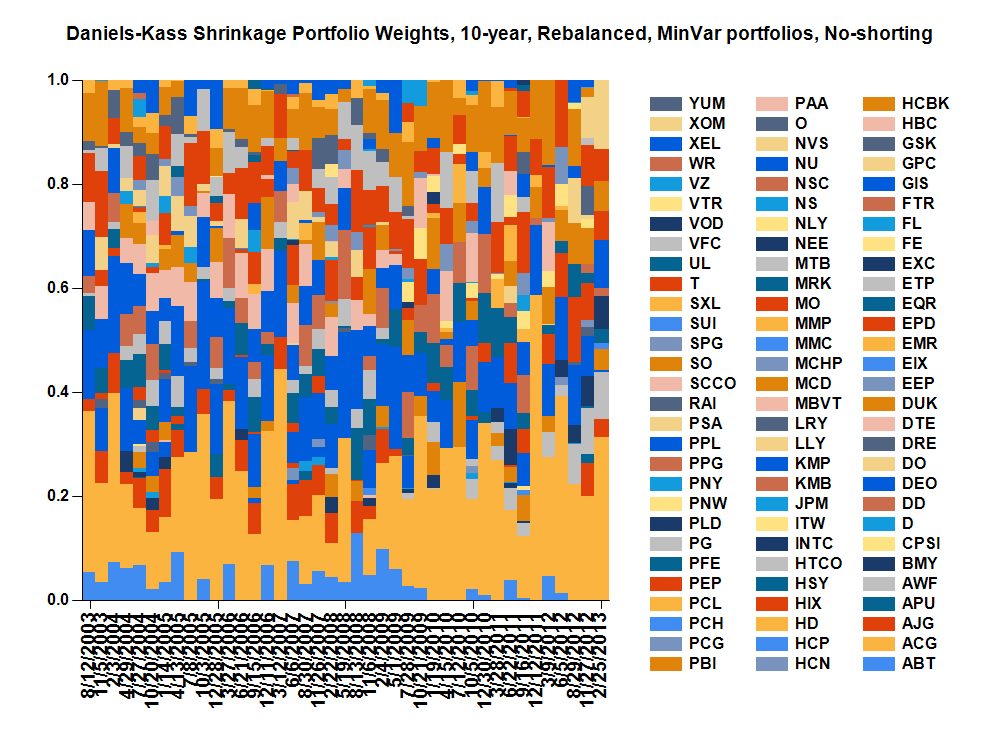

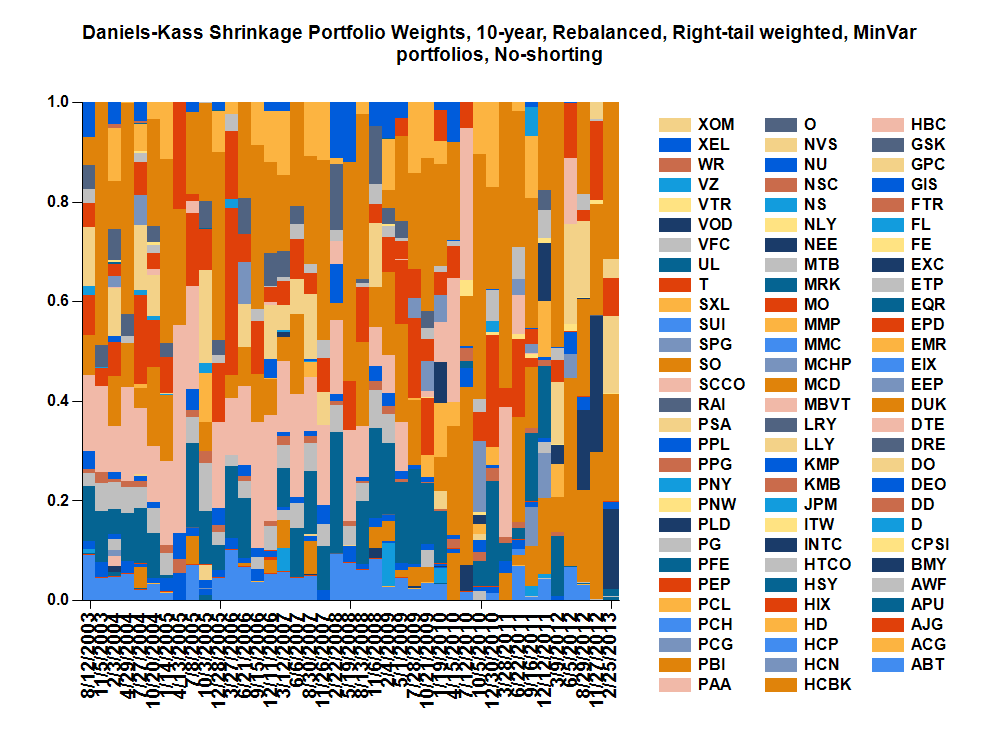

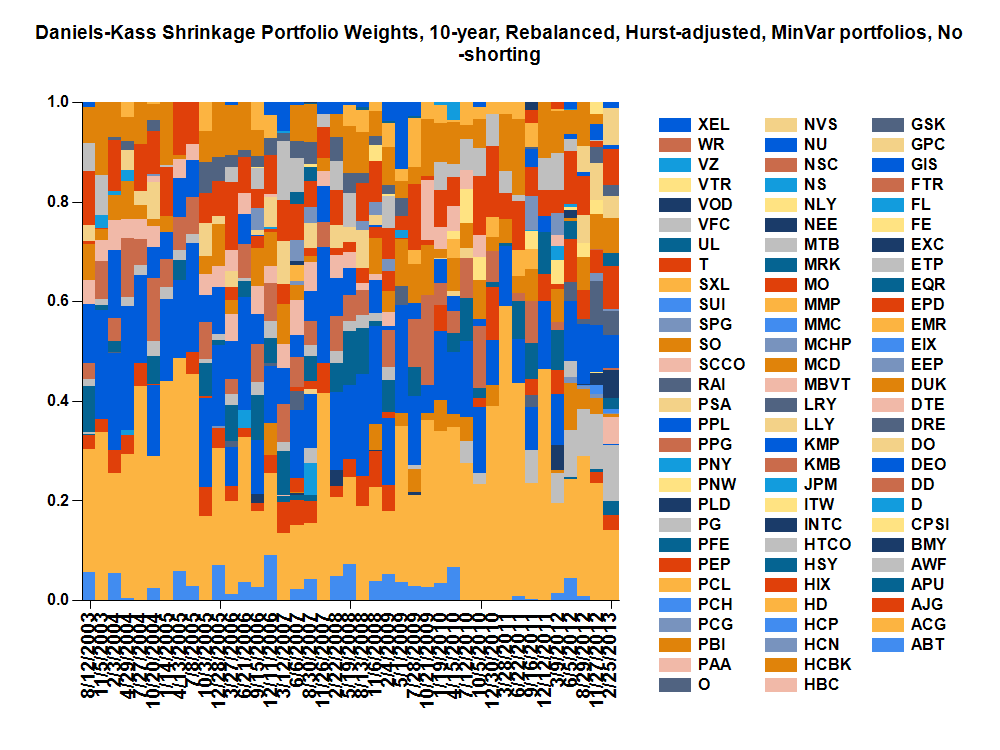

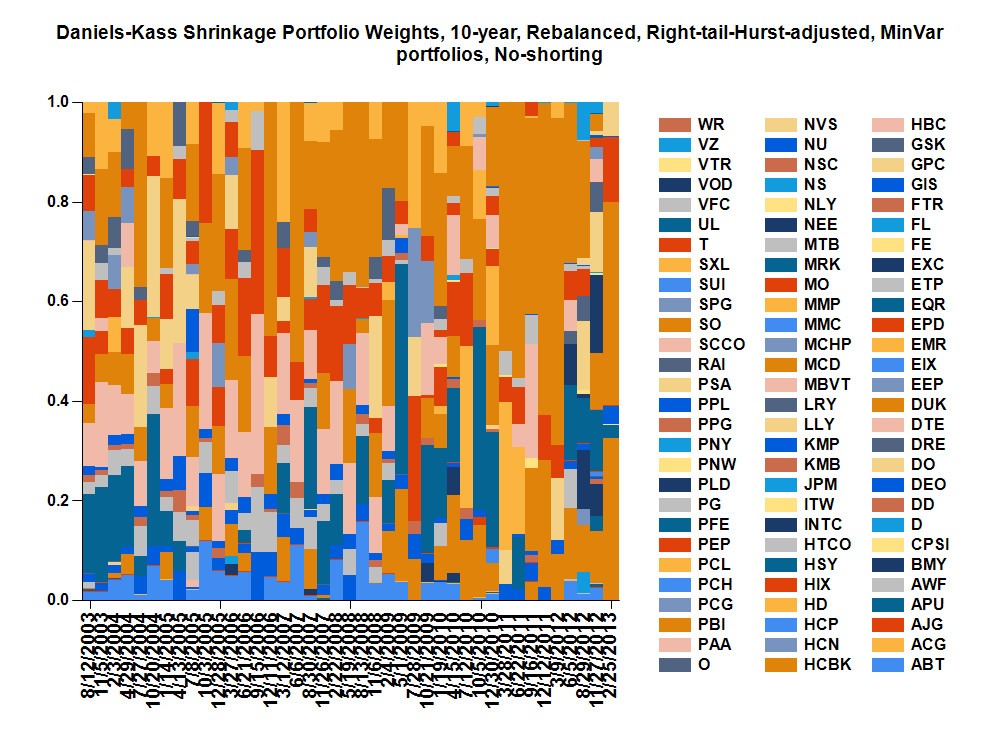

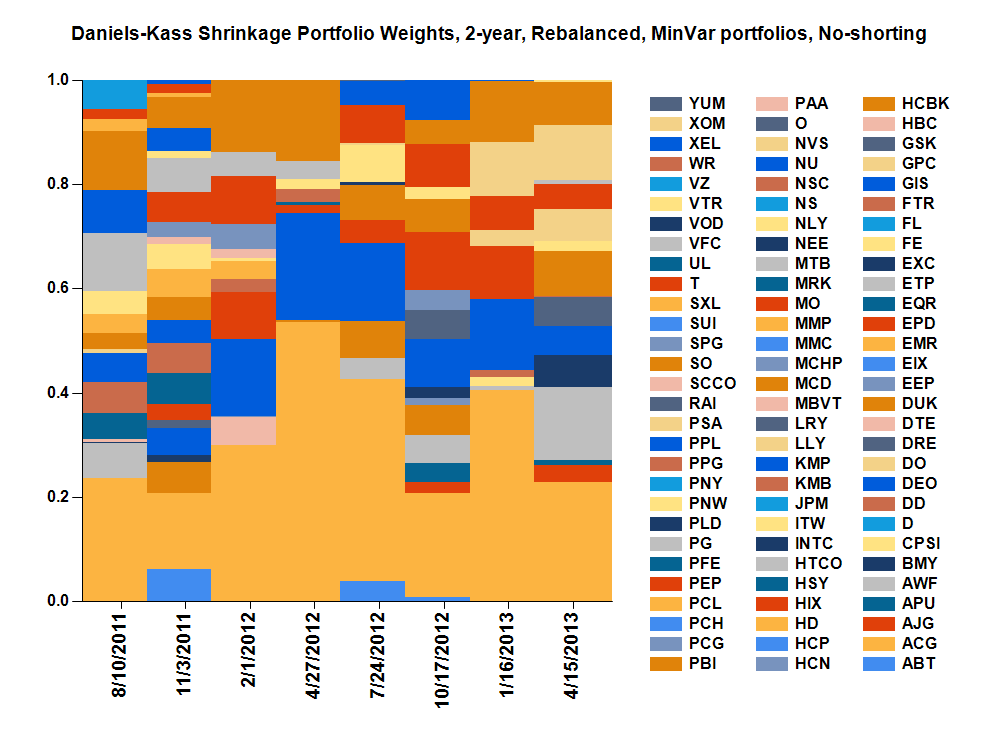

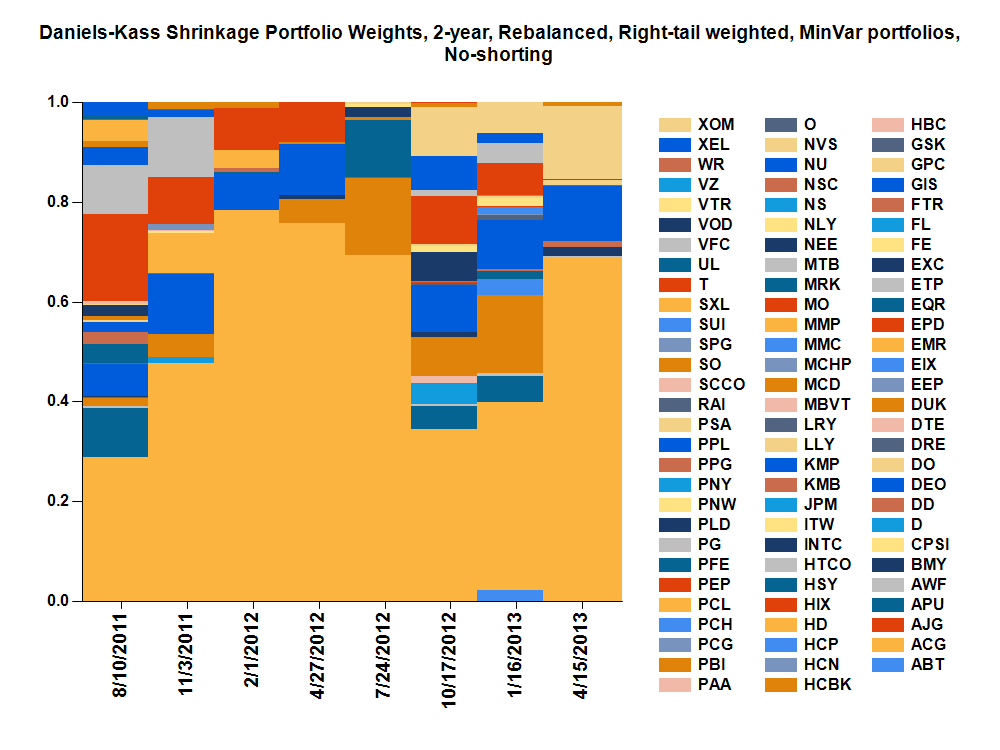

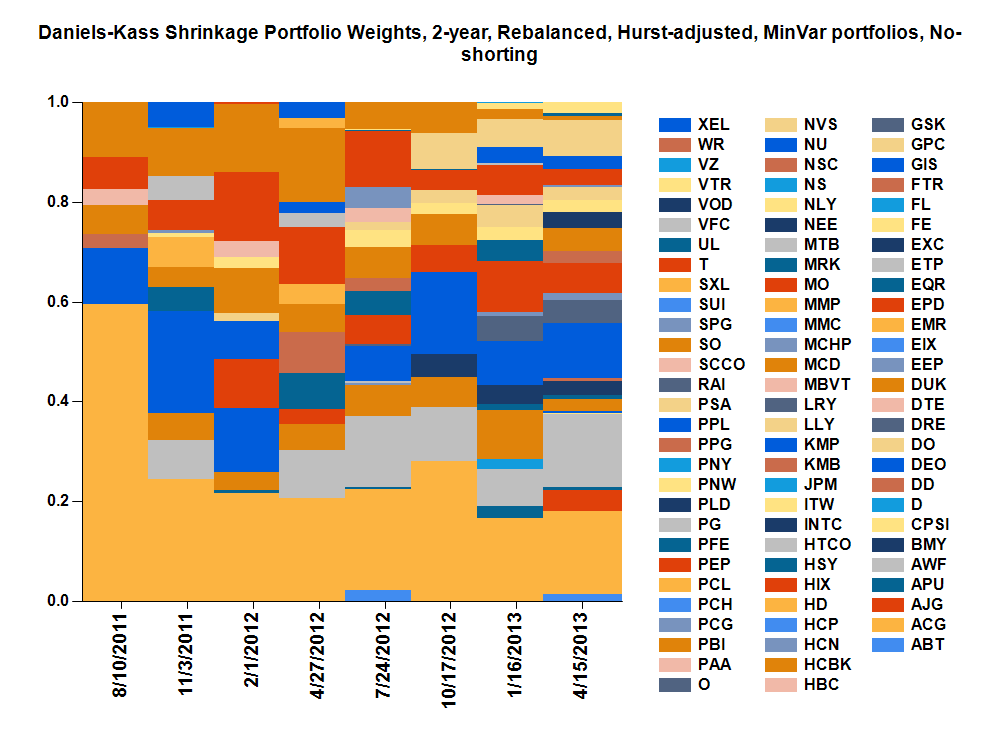

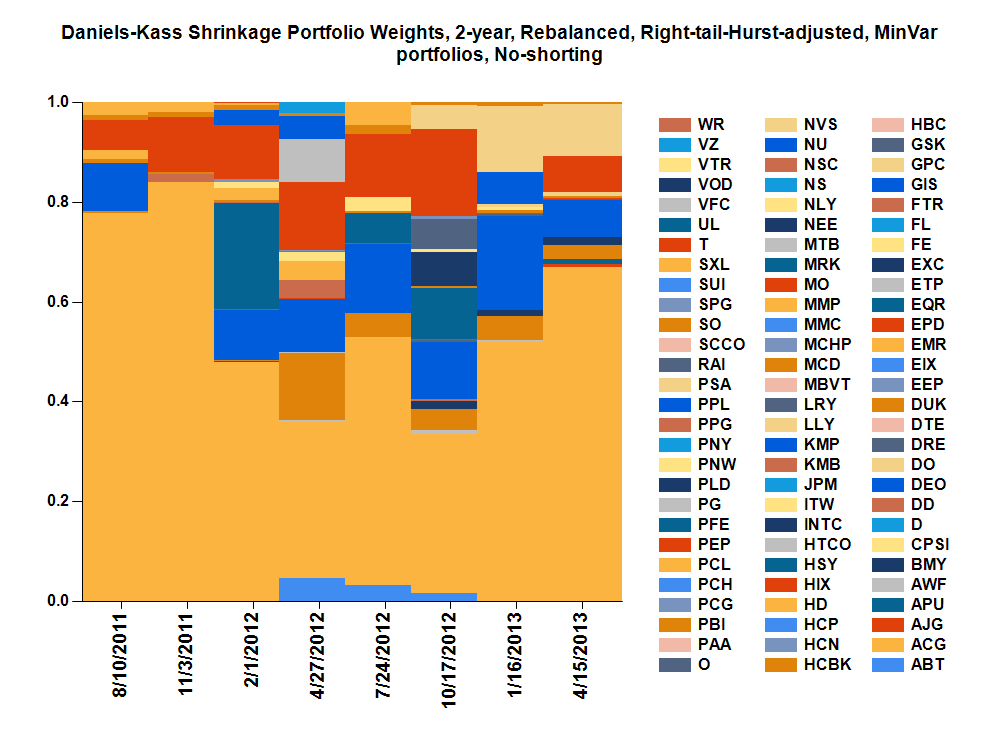

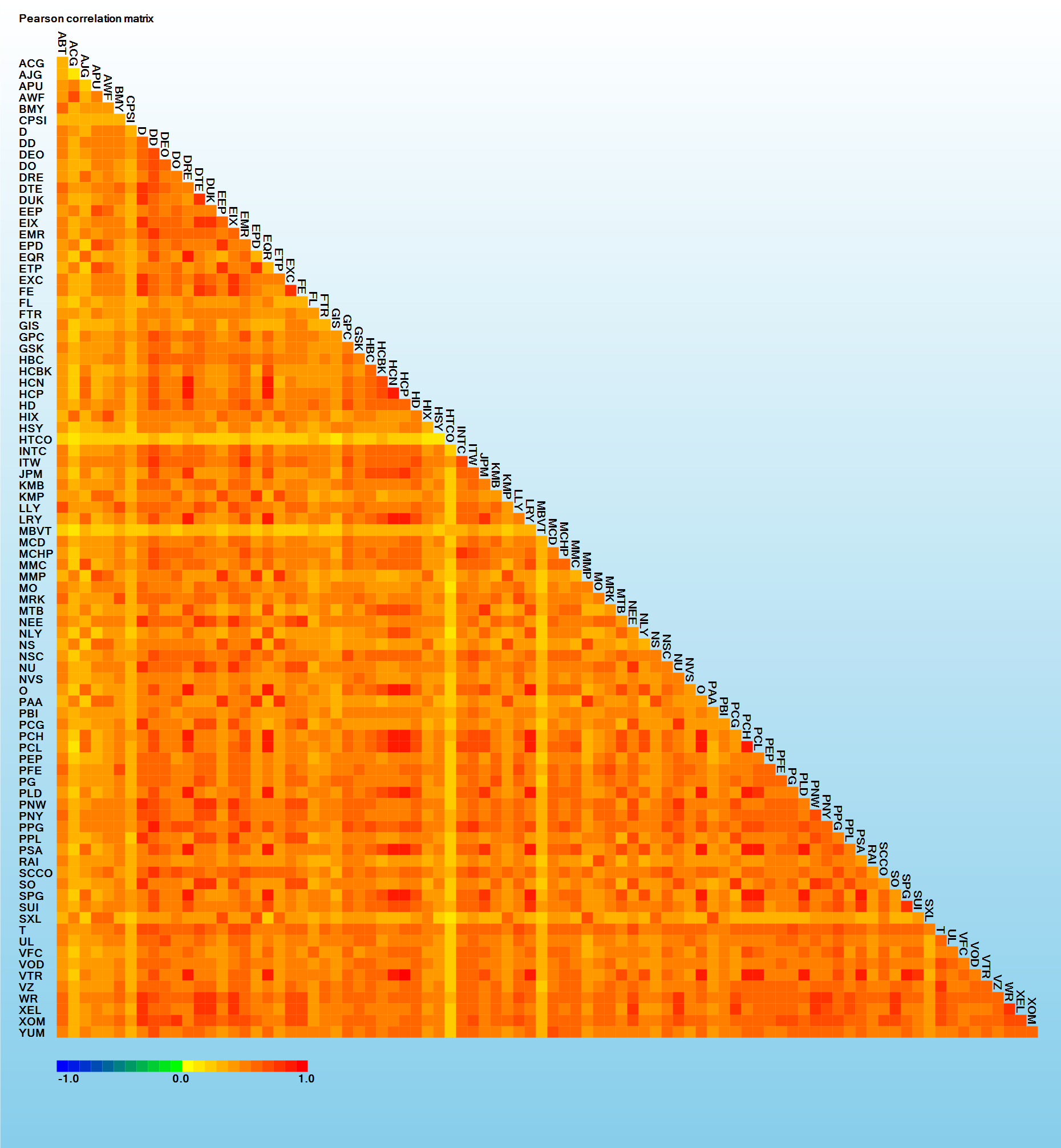

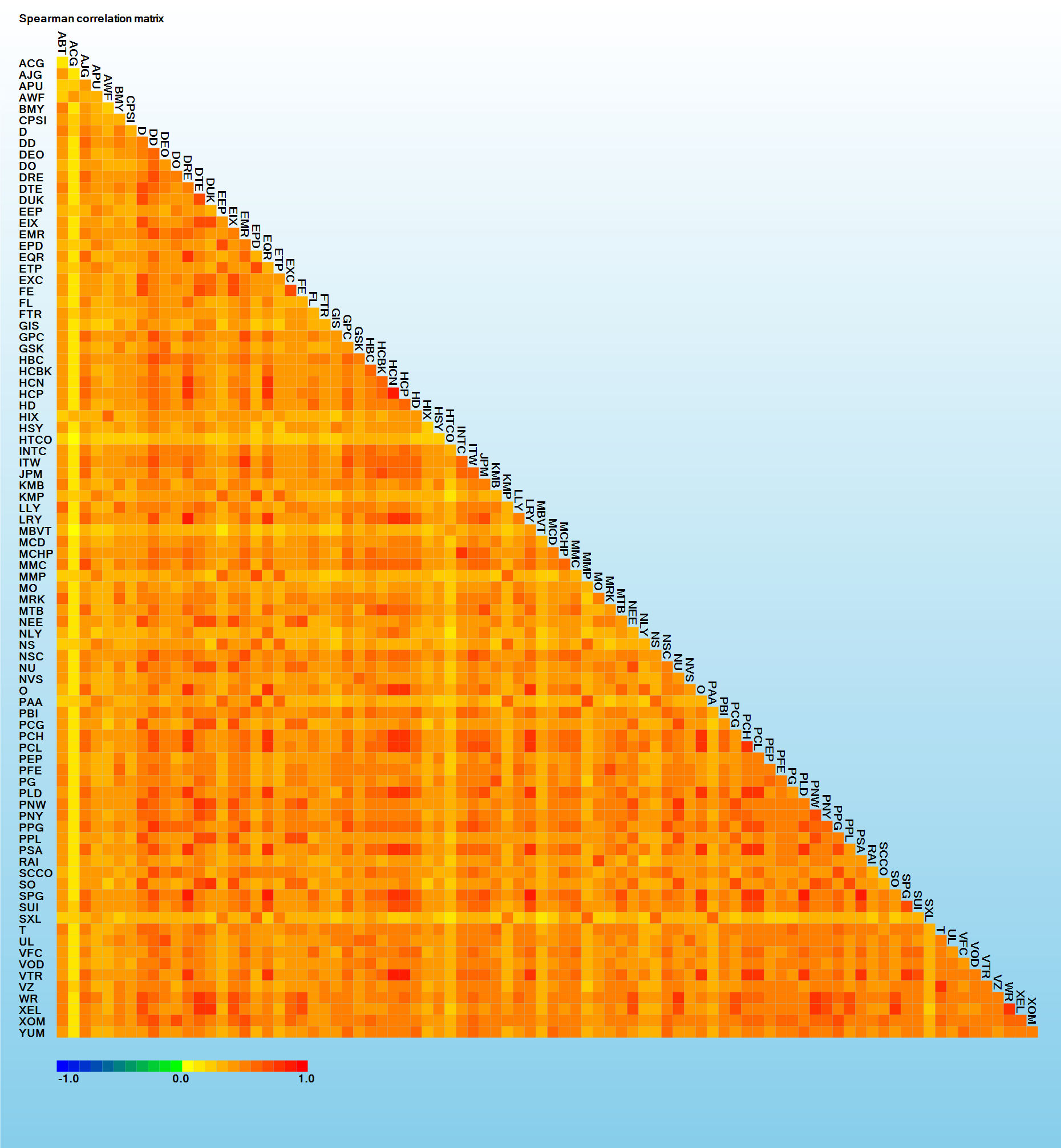

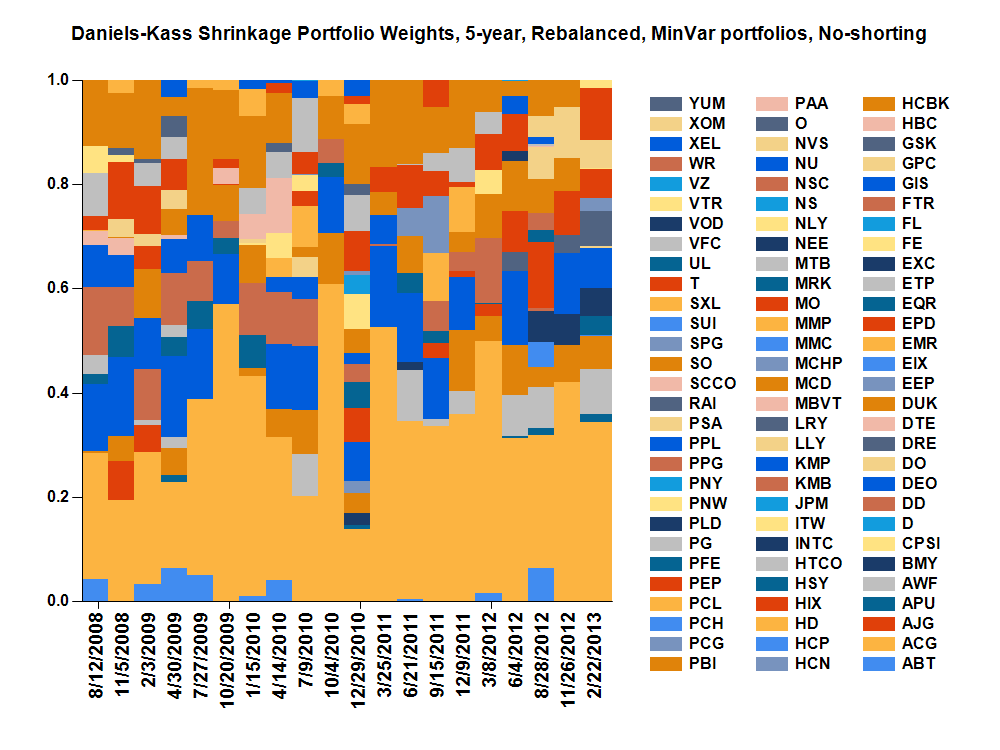

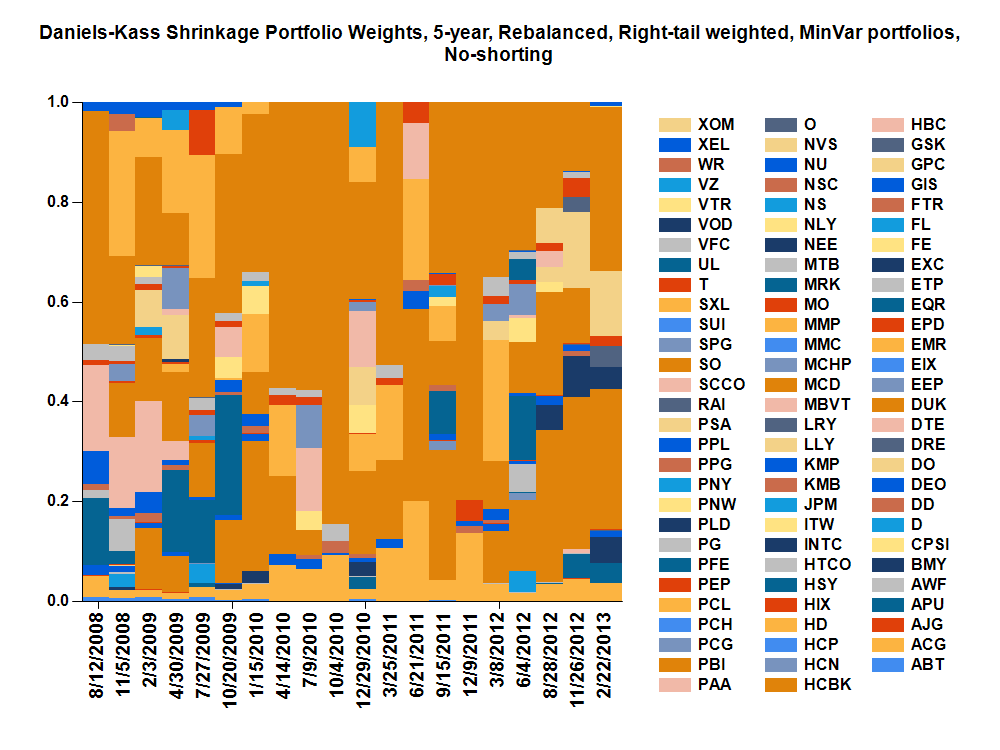

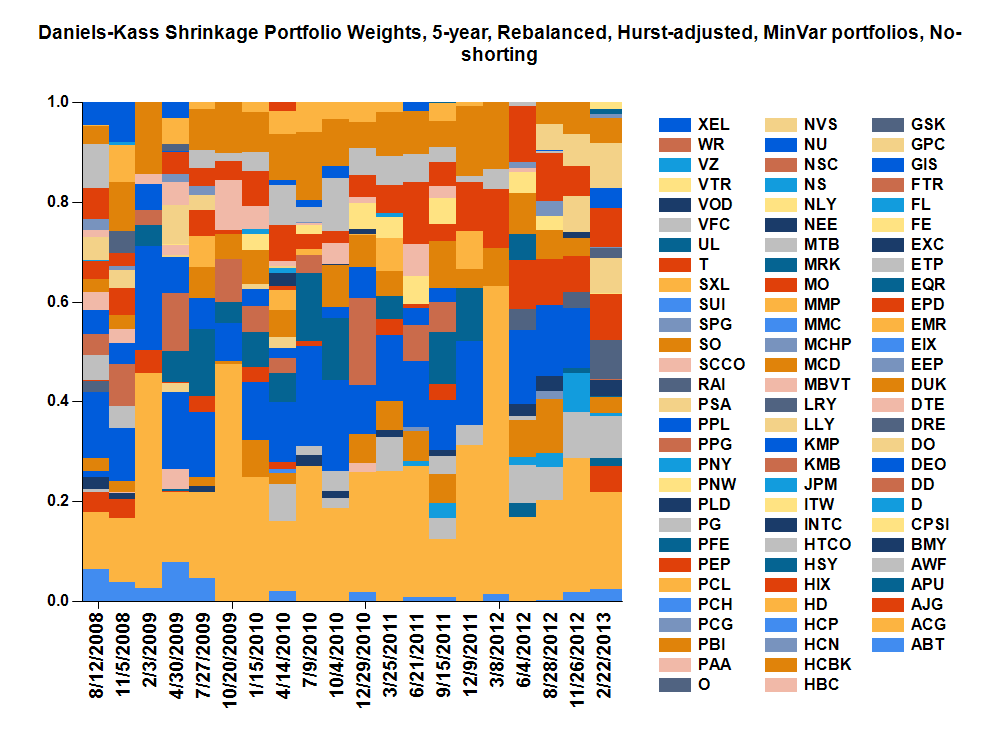

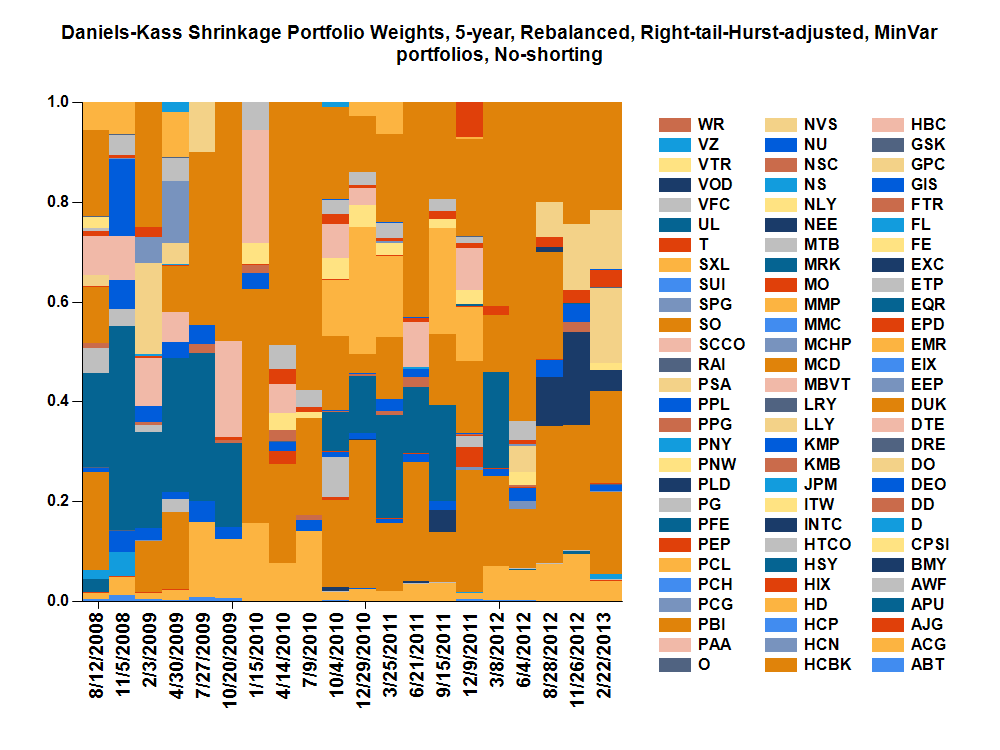

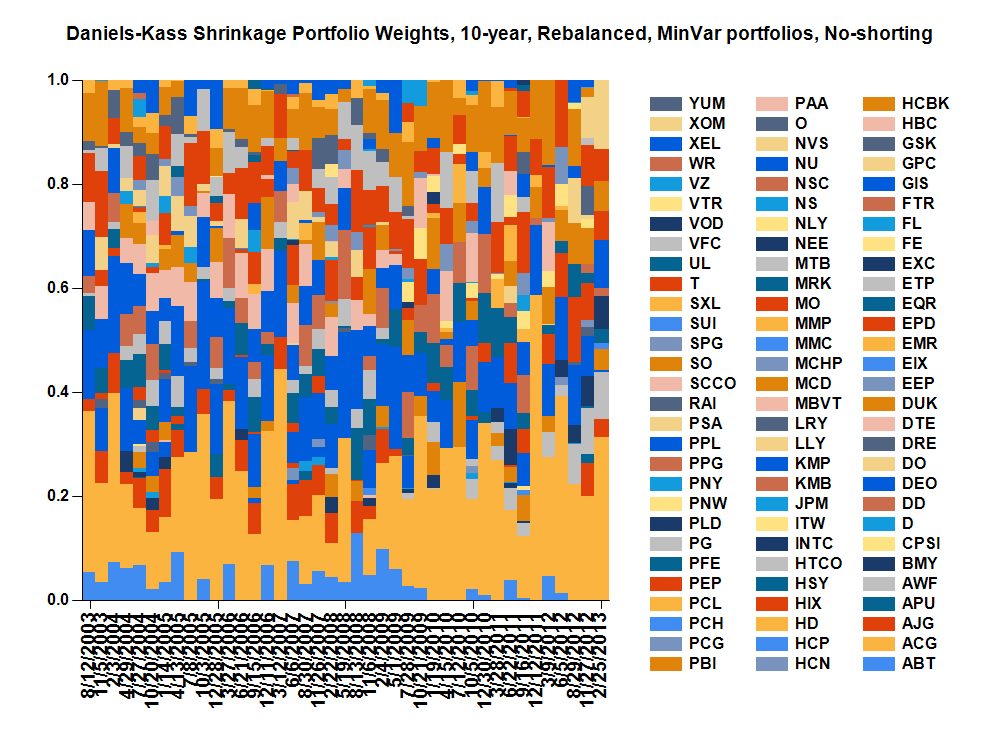

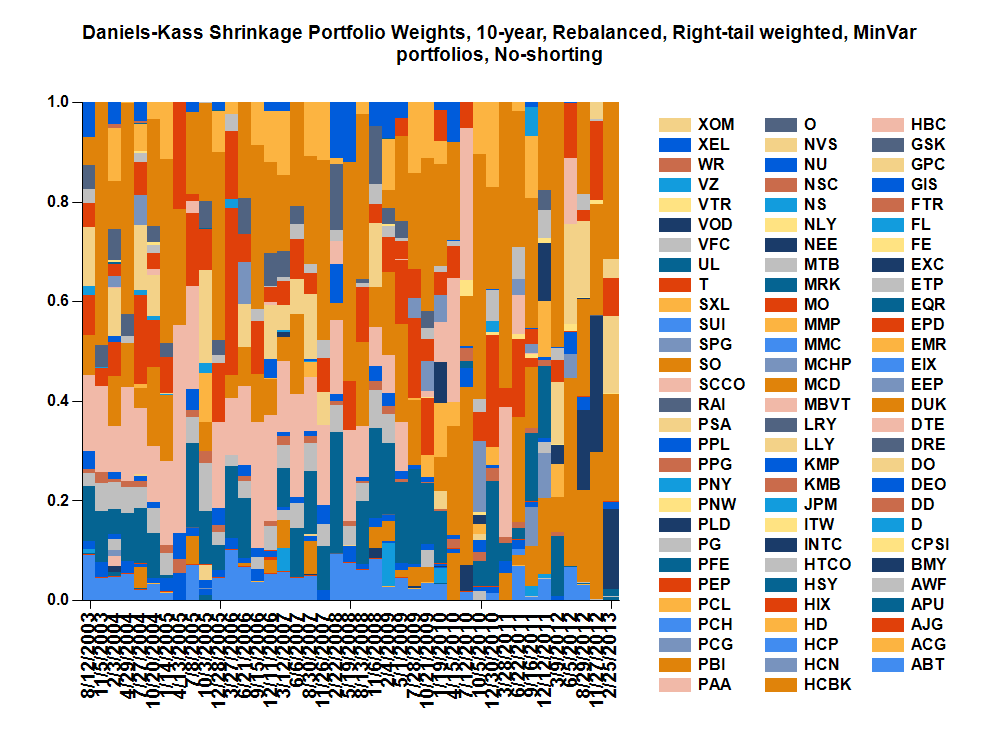

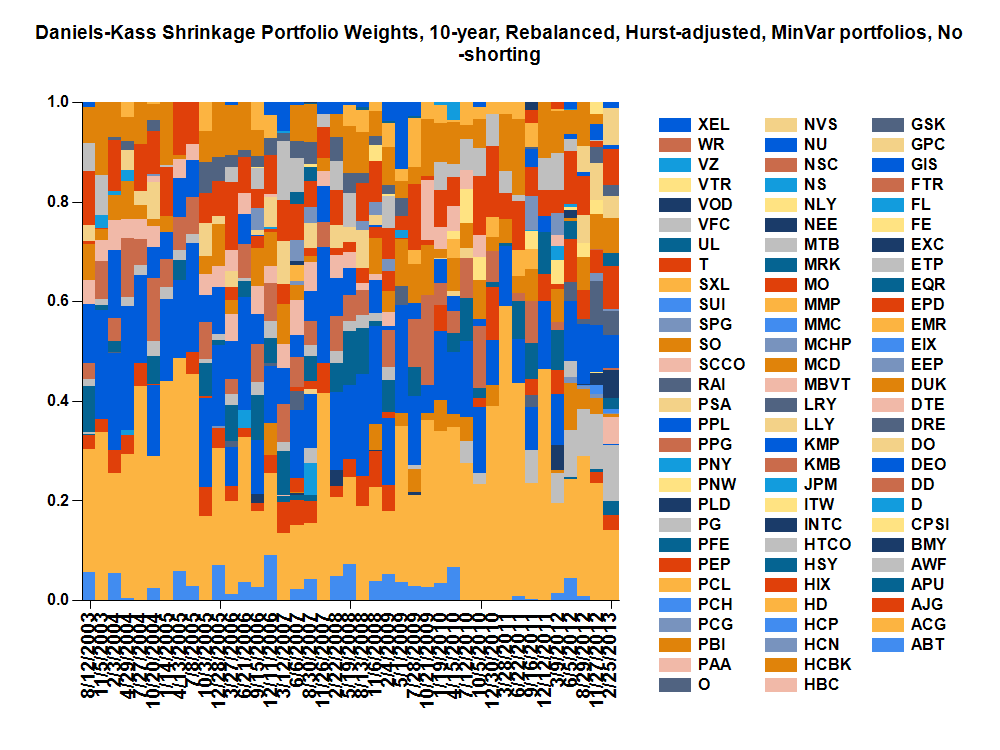

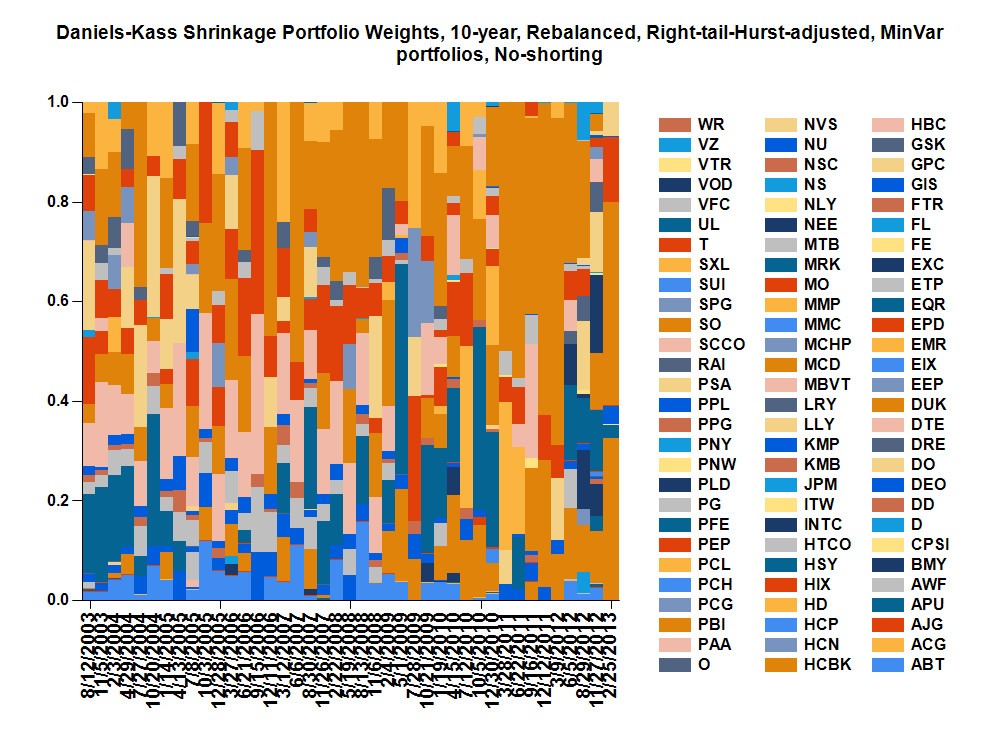

-DK - Daniels-Kass shrinkage of correlation matrix.

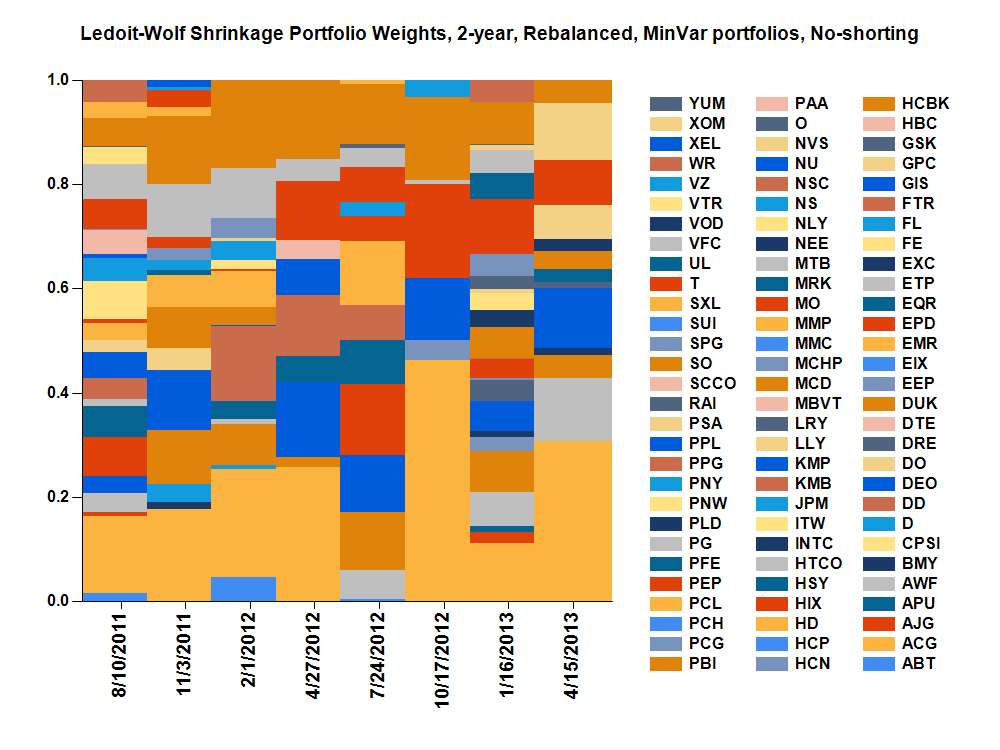

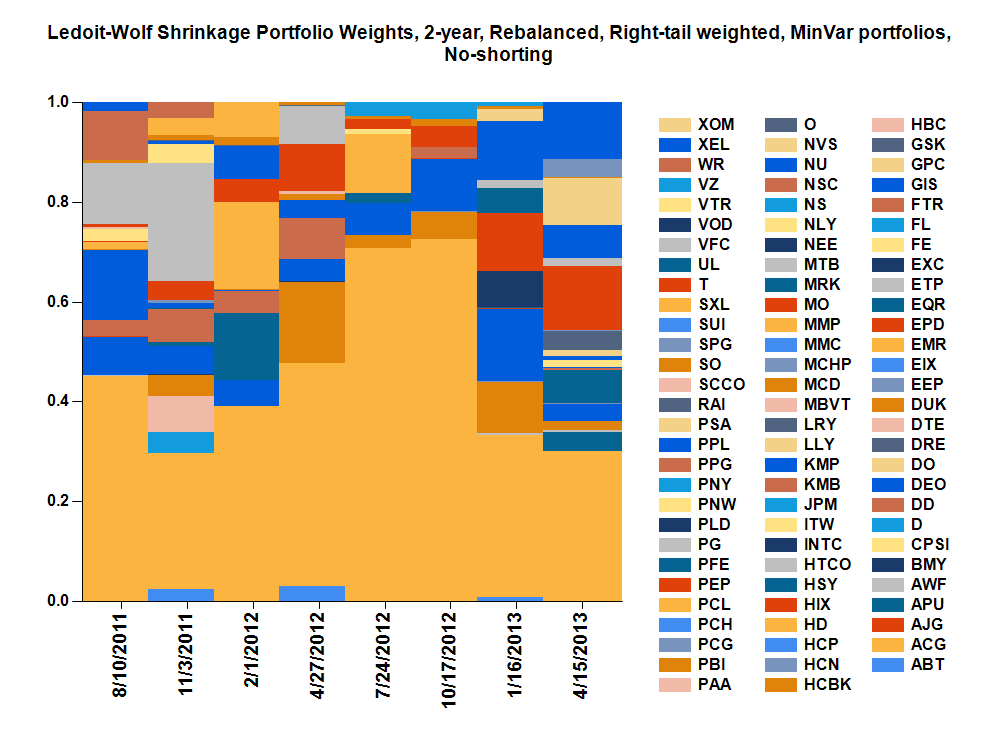

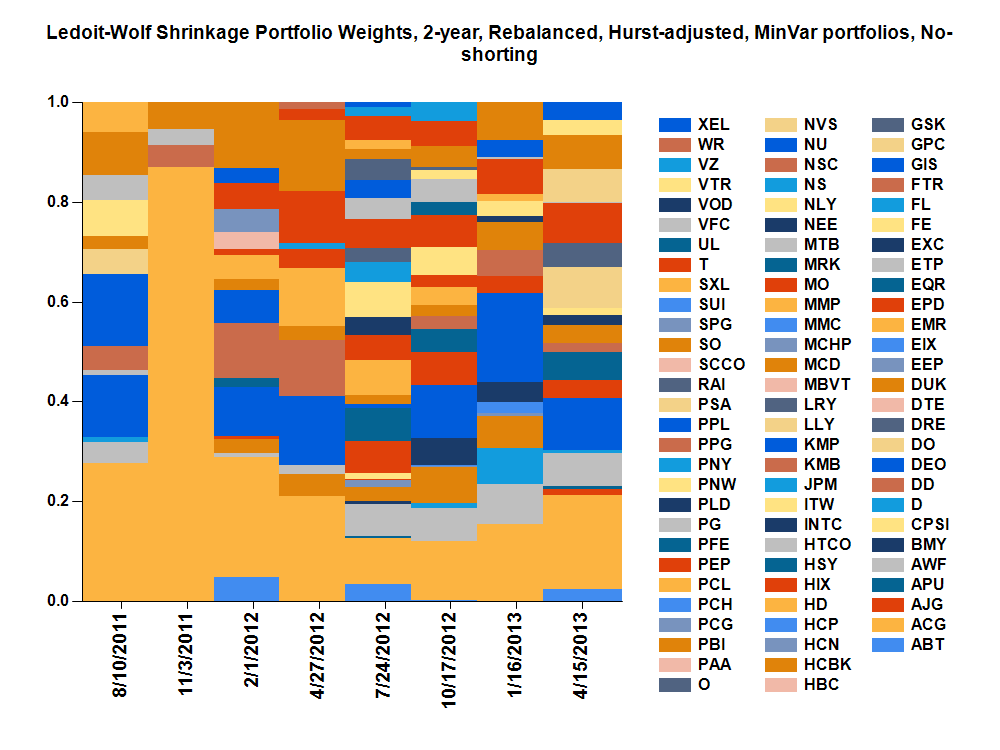

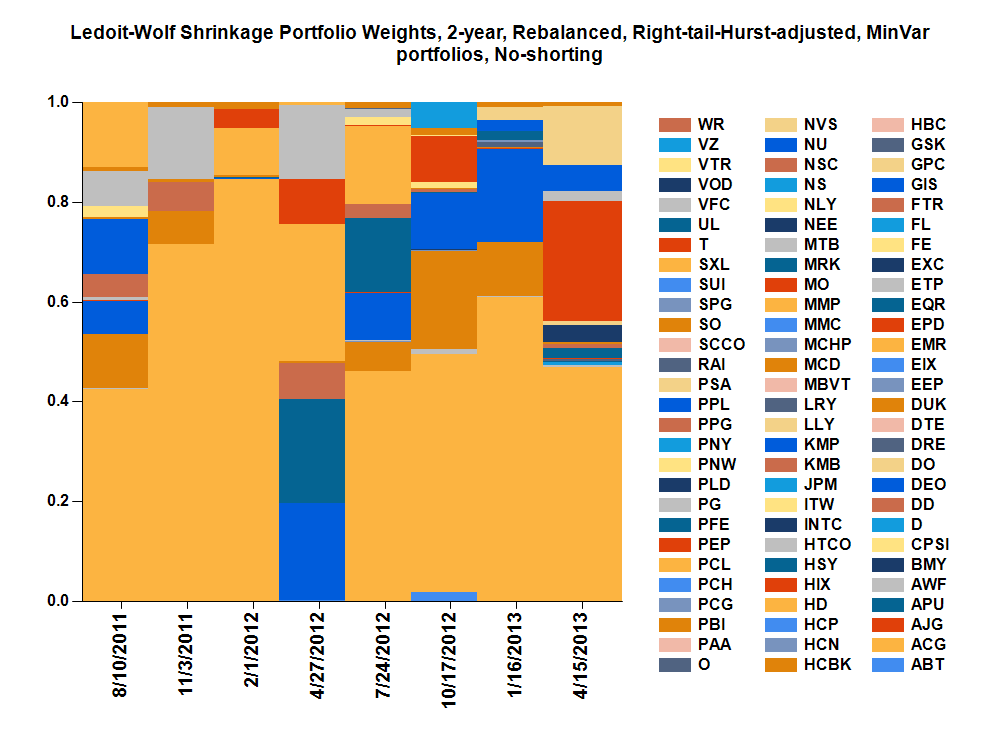

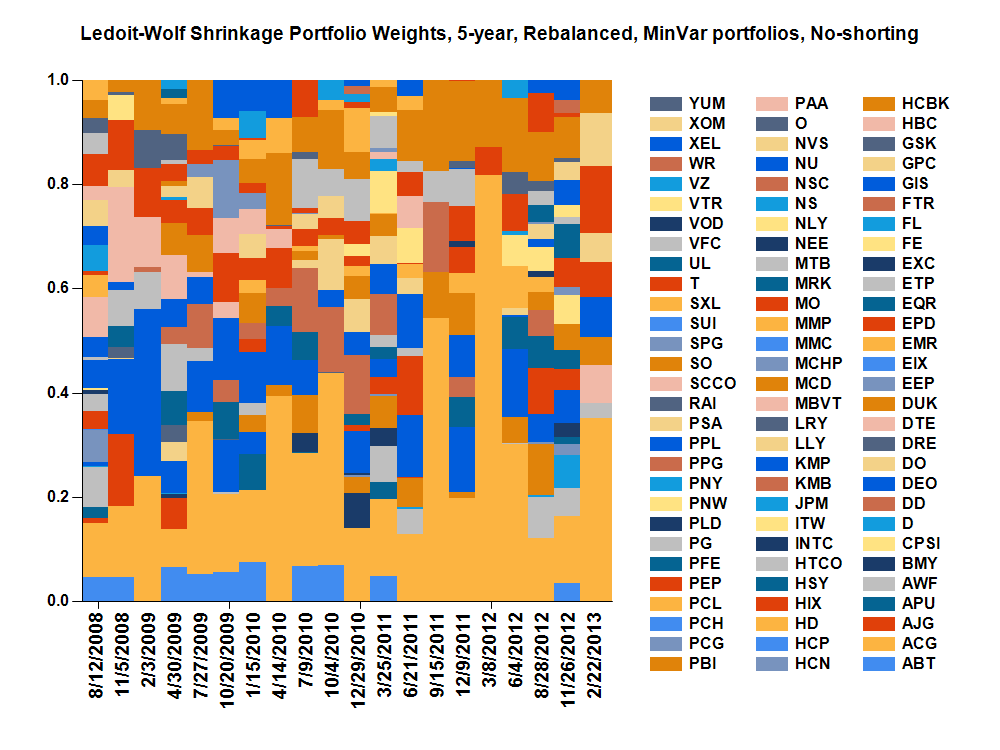

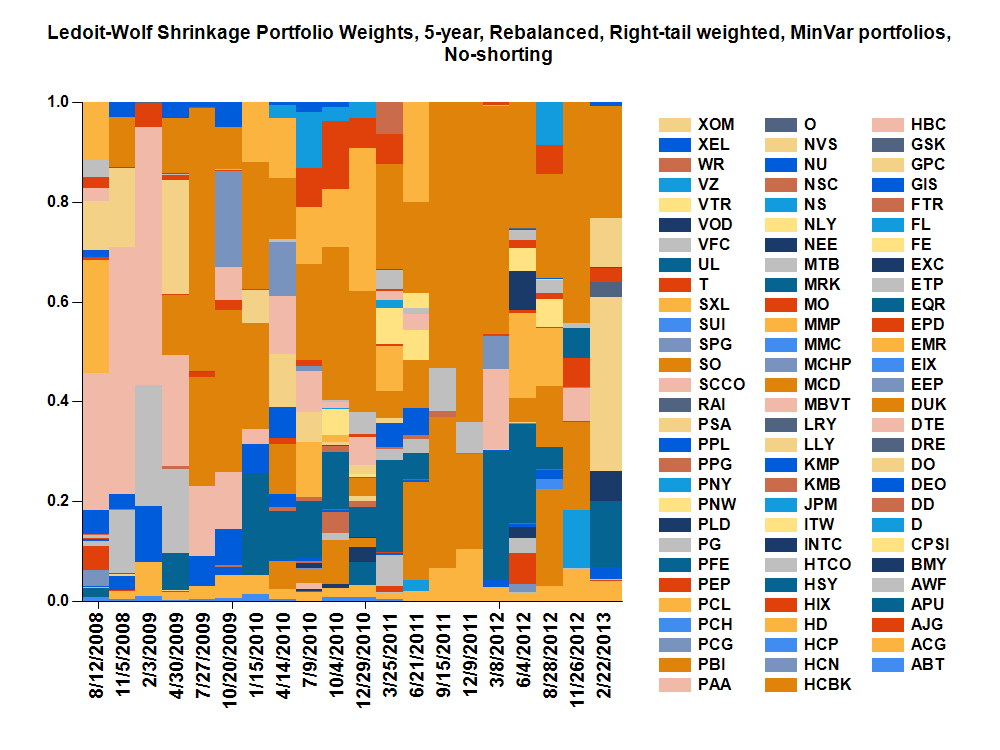

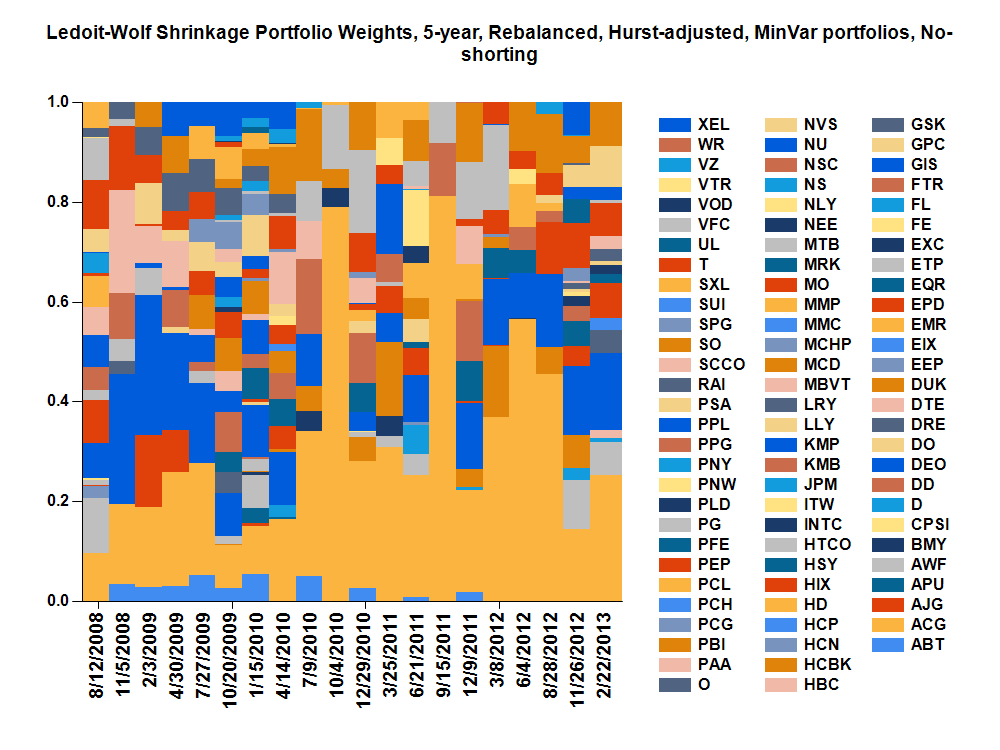

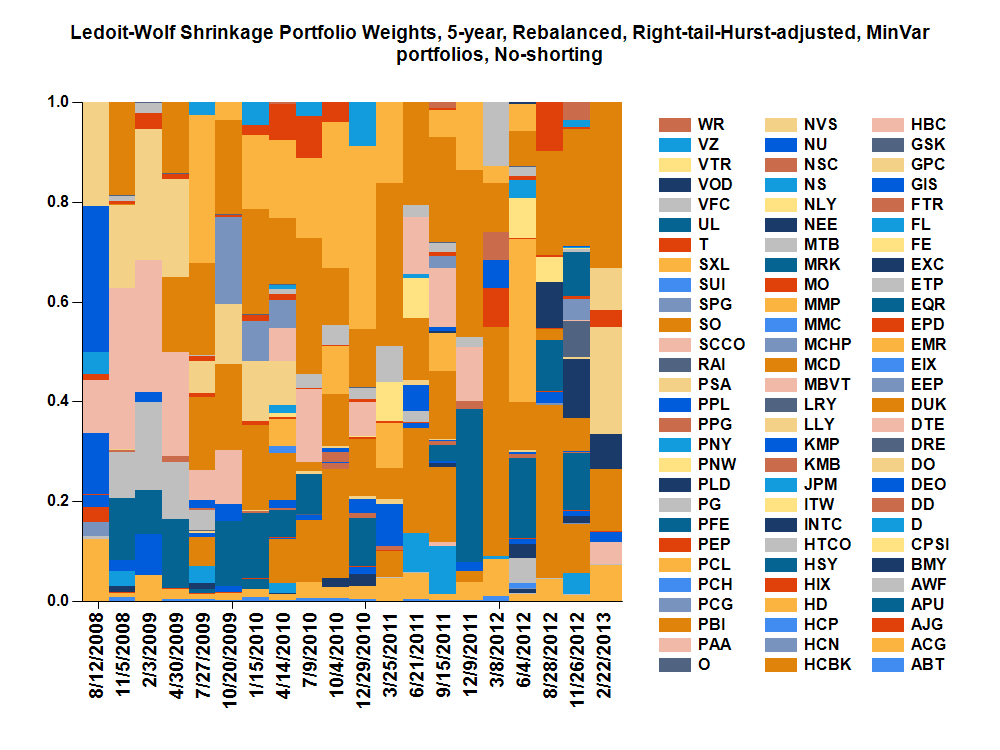

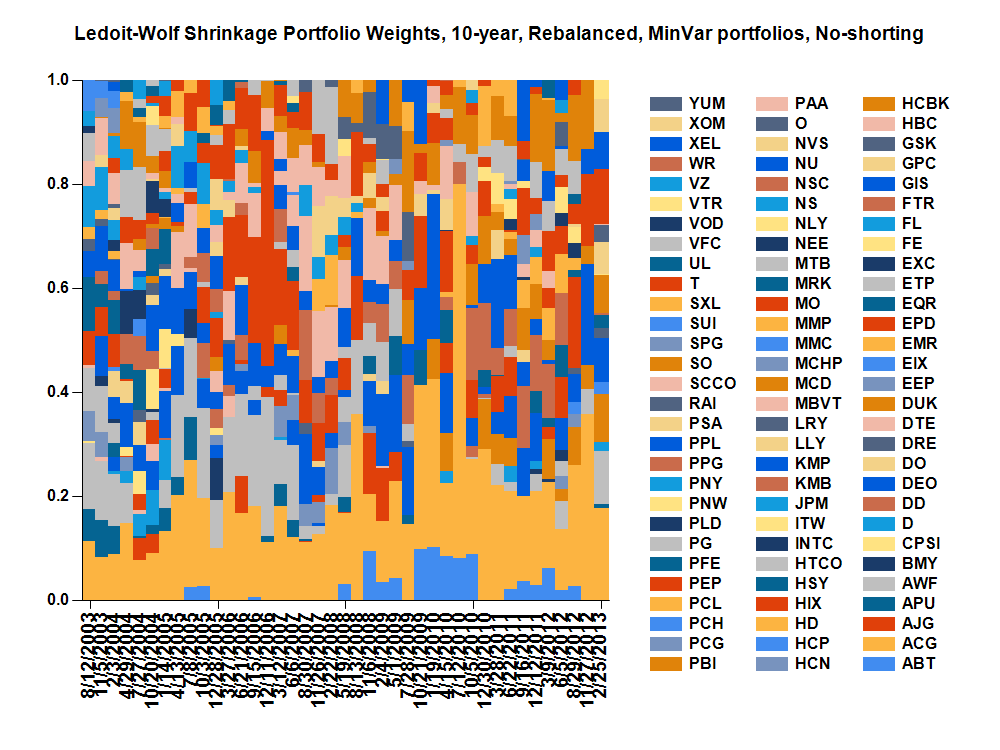

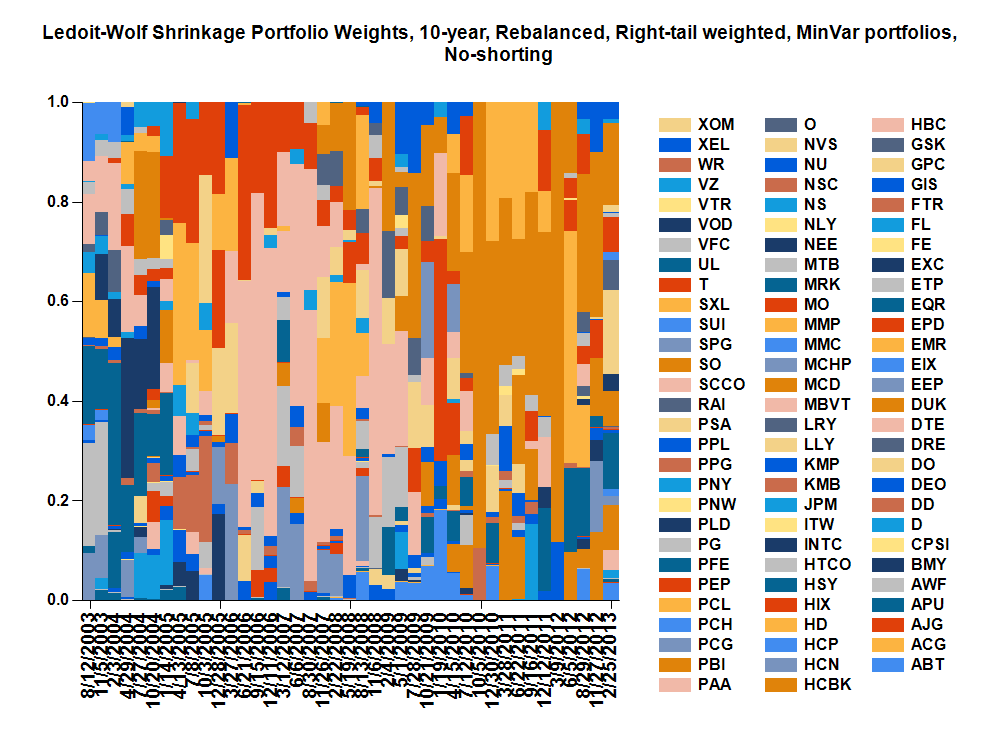

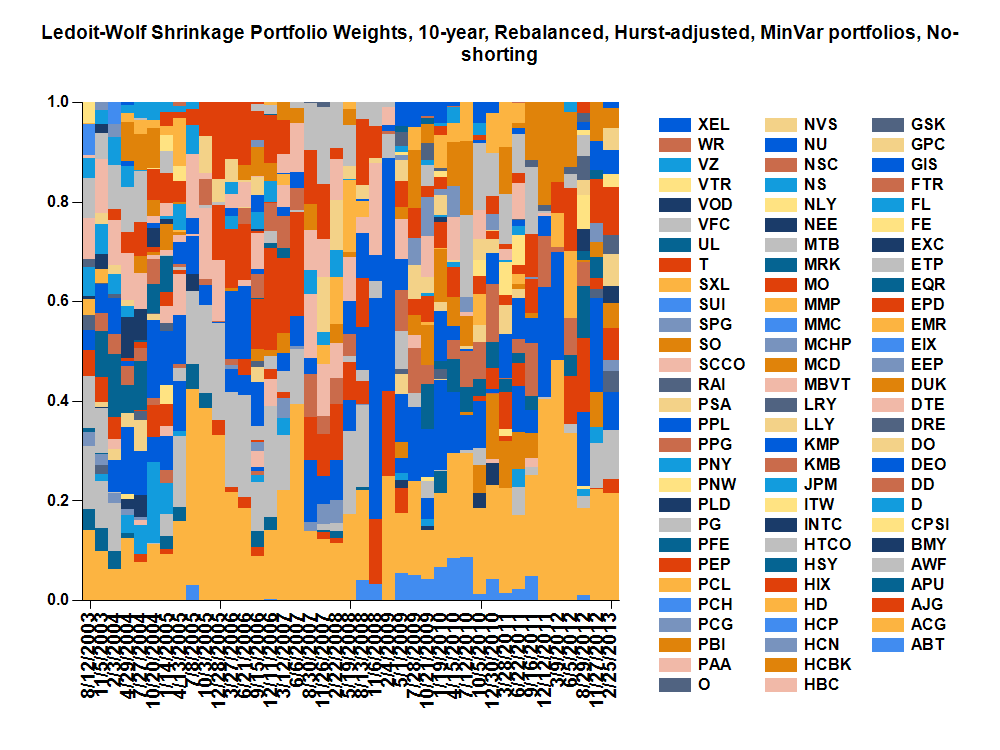

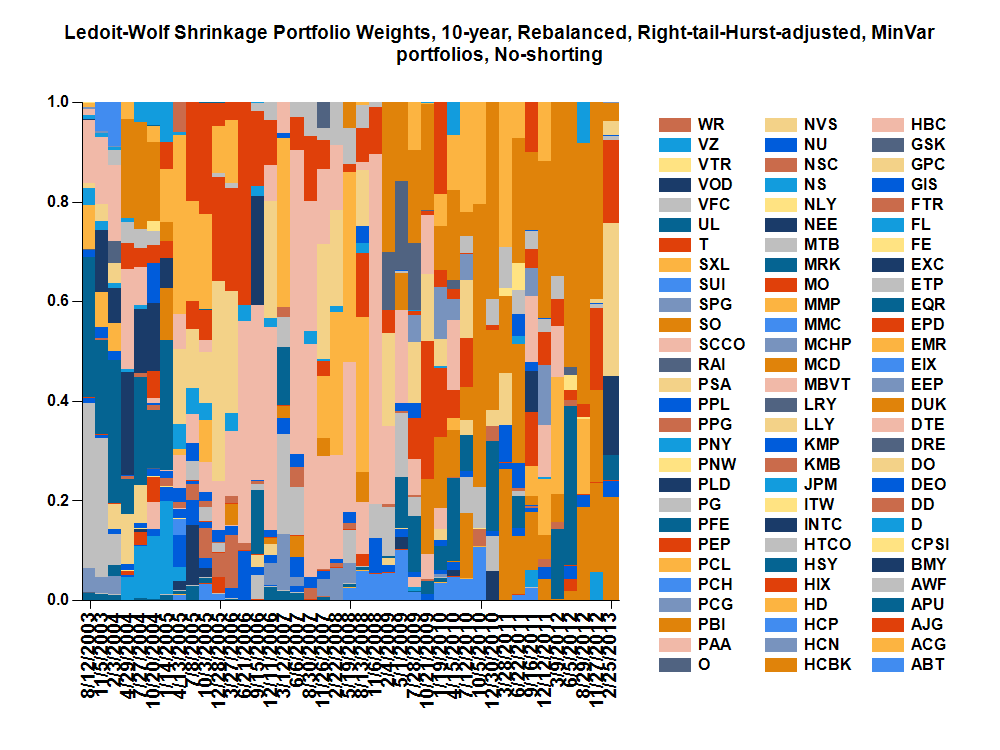

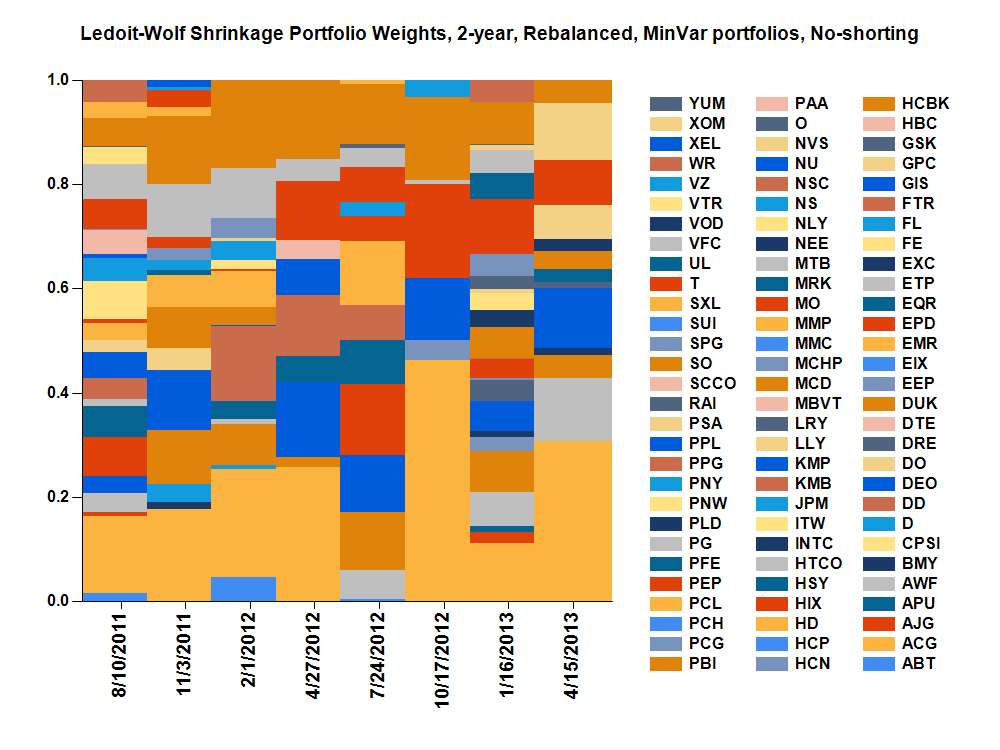

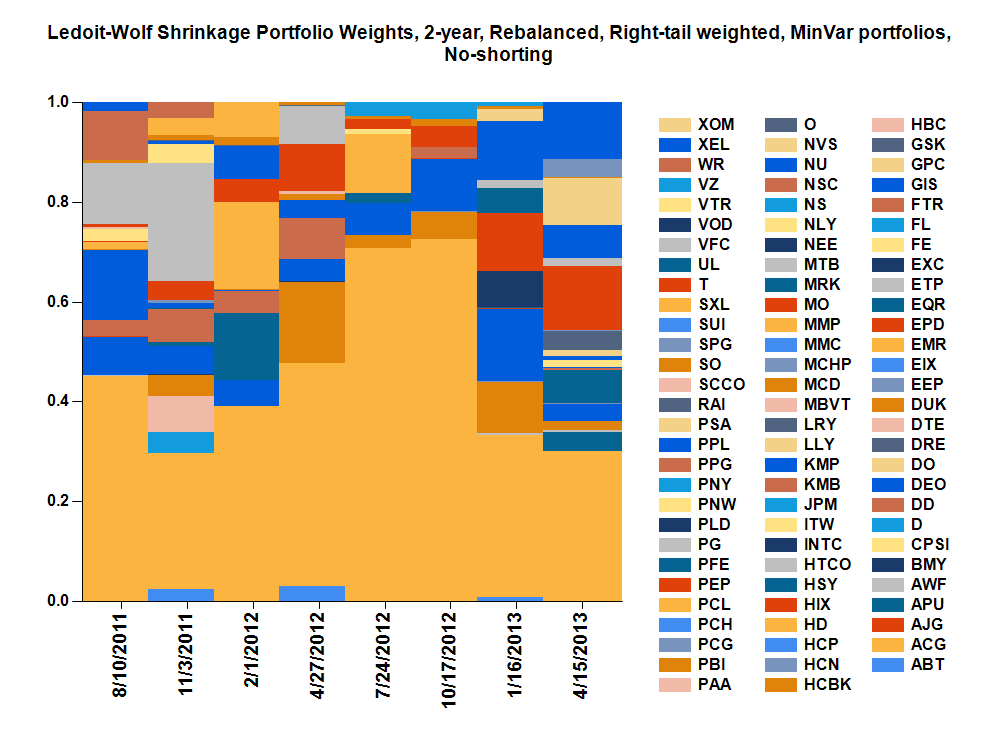

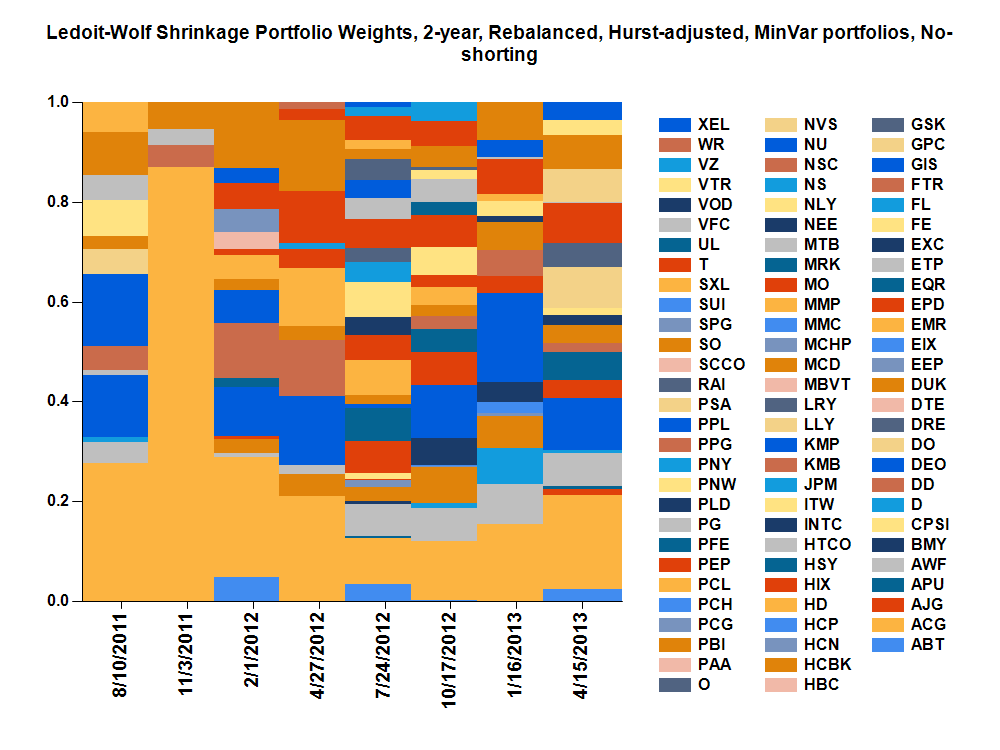

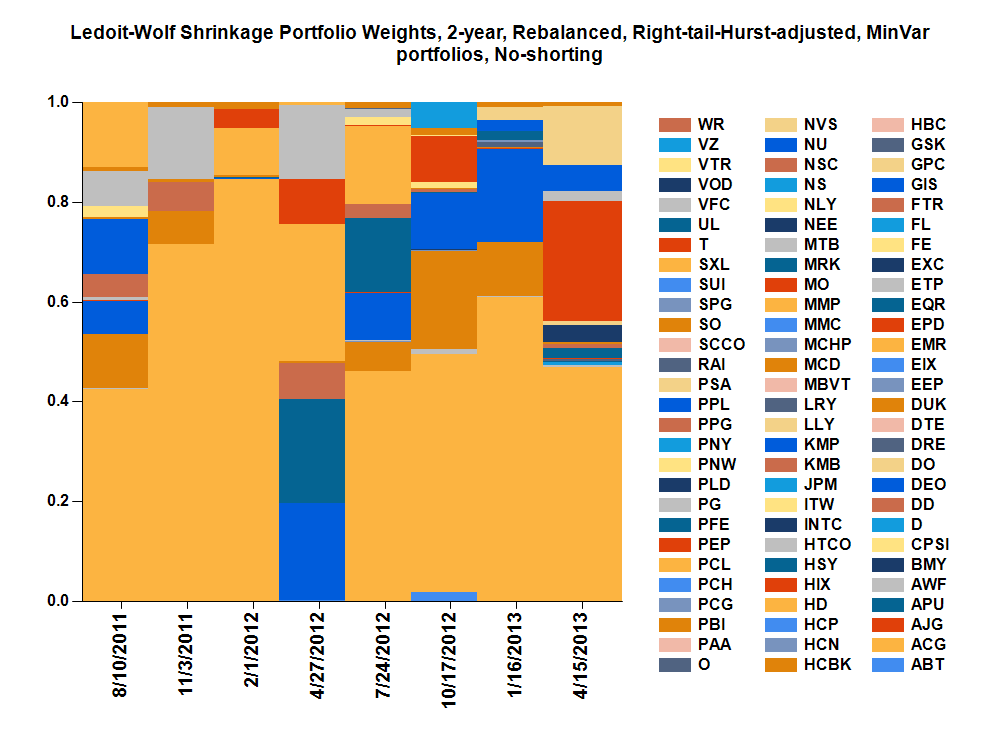

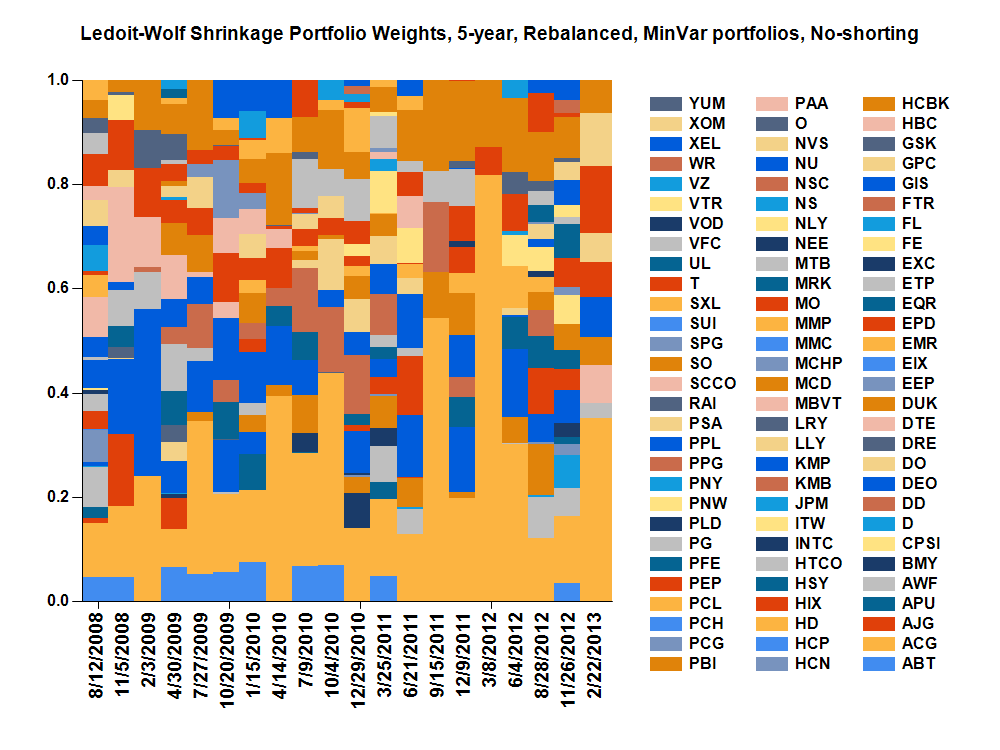

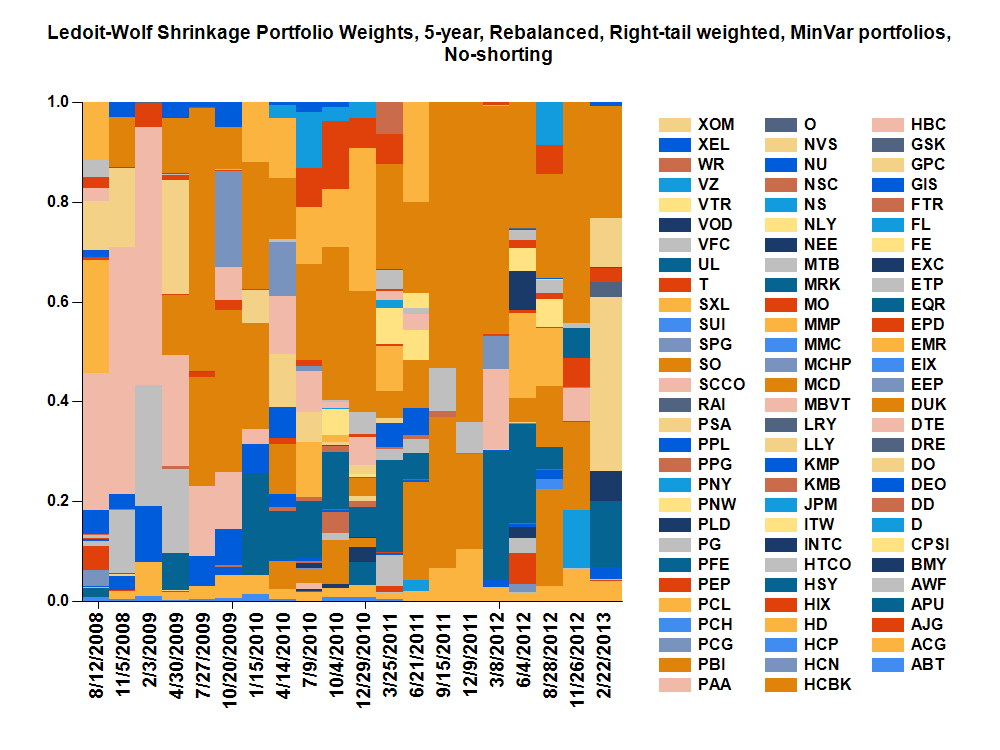

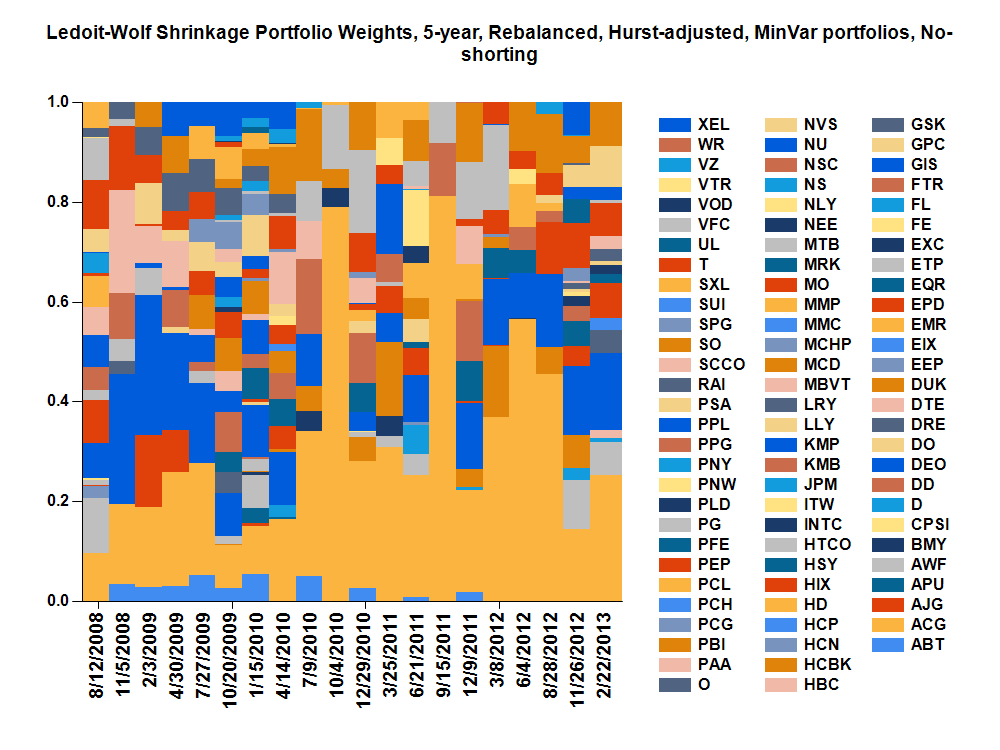

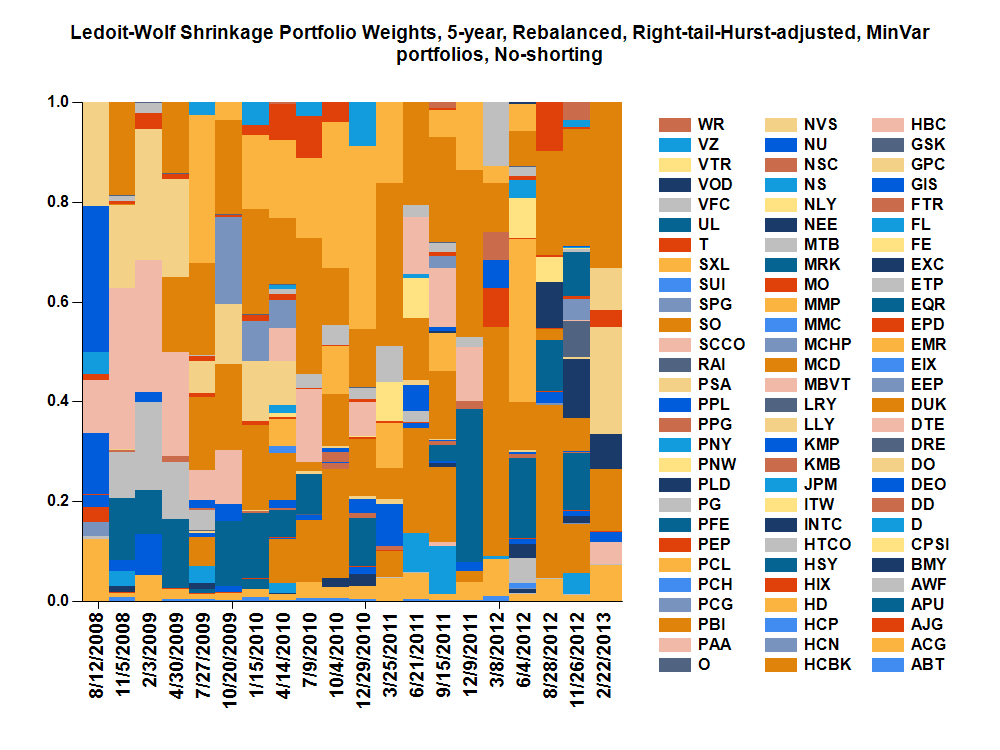

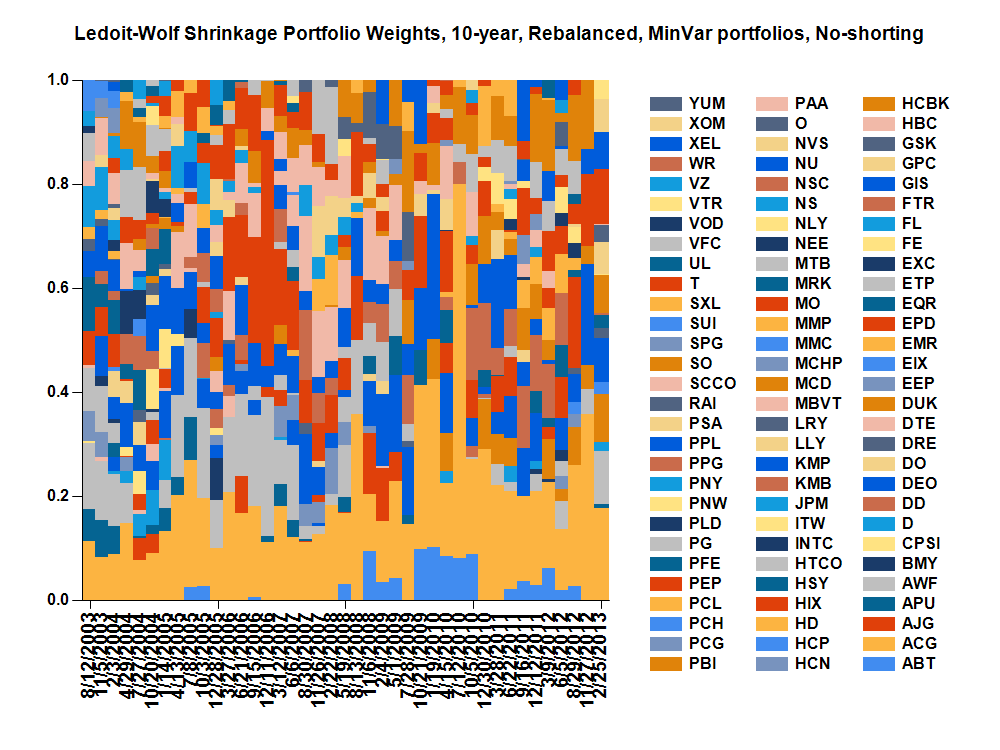

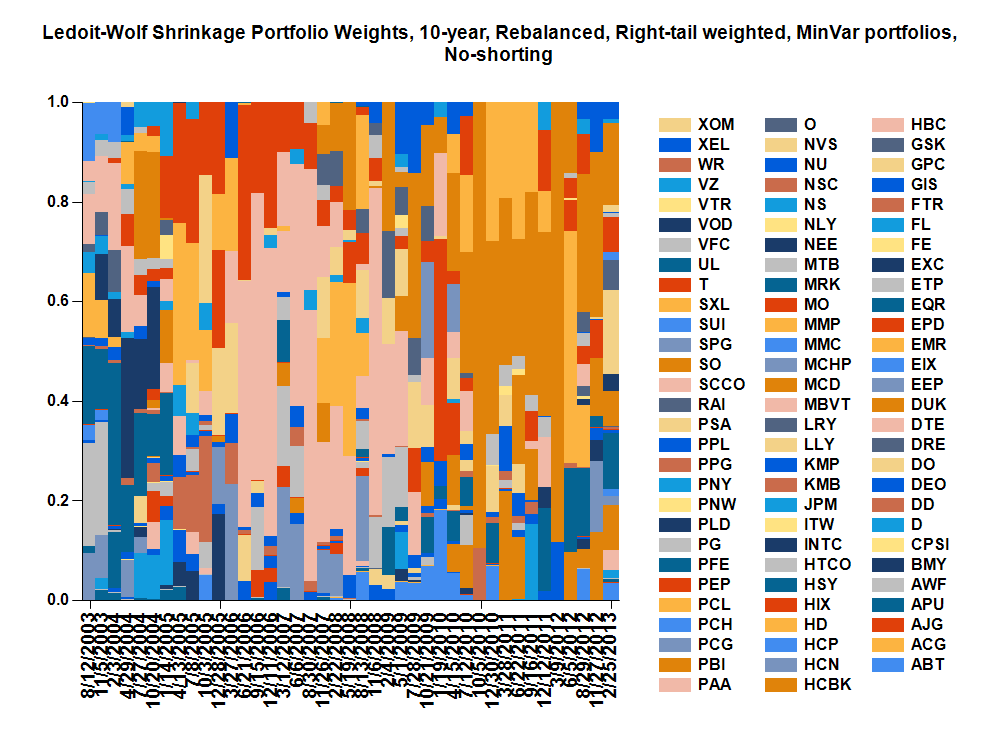

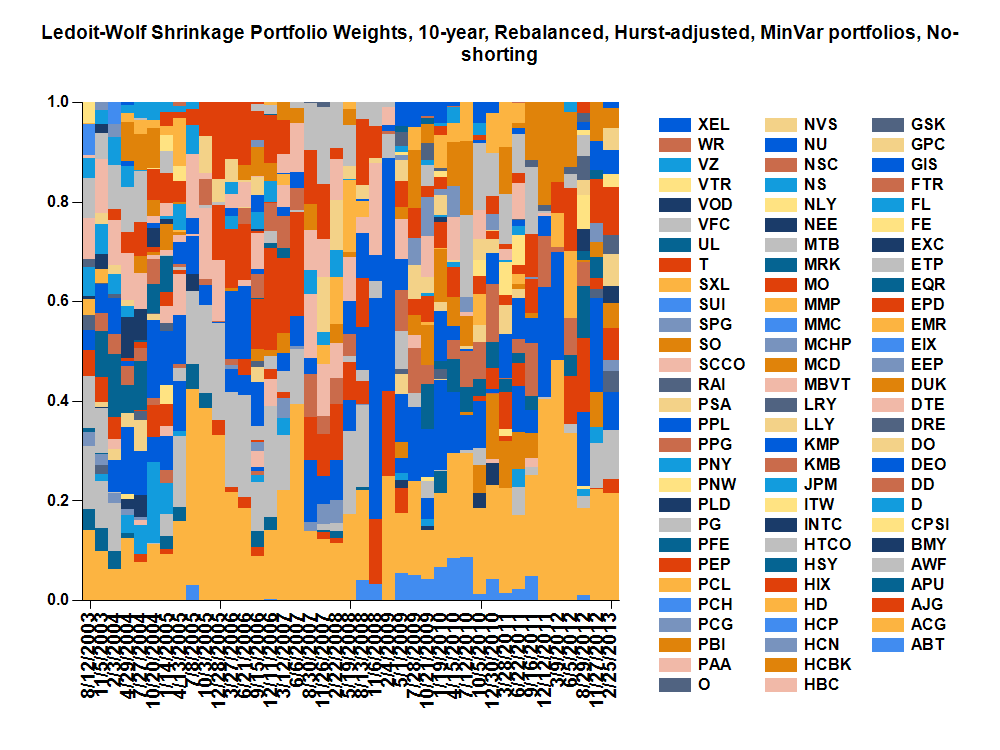

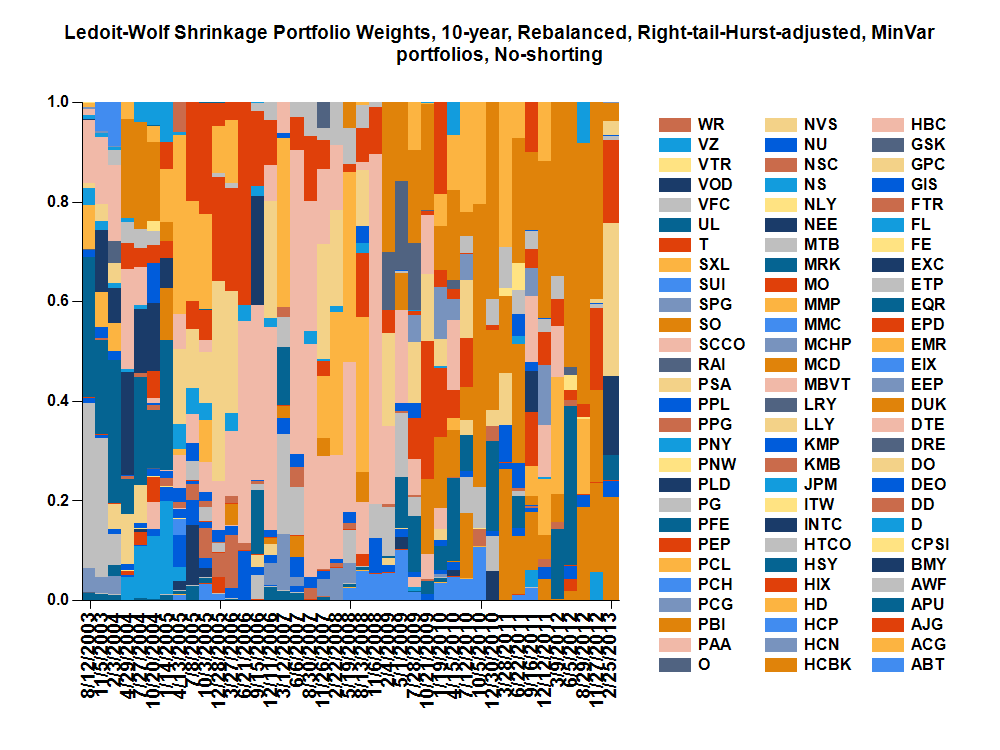

-LW - Ledoit-Wolf shrinkage of correlation matrix.

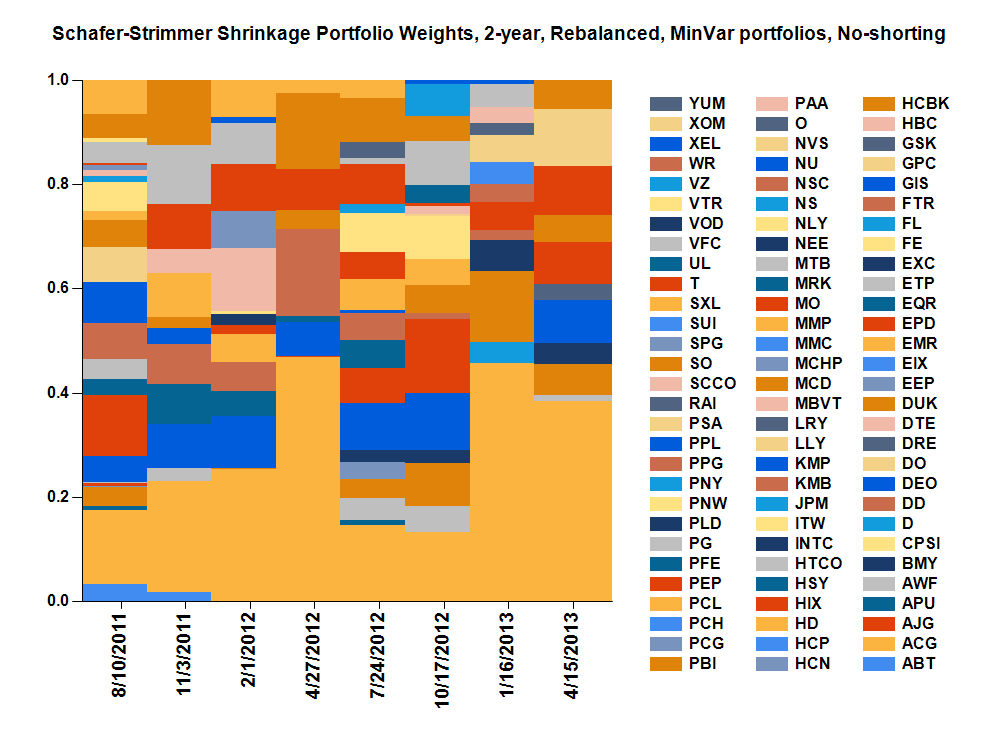

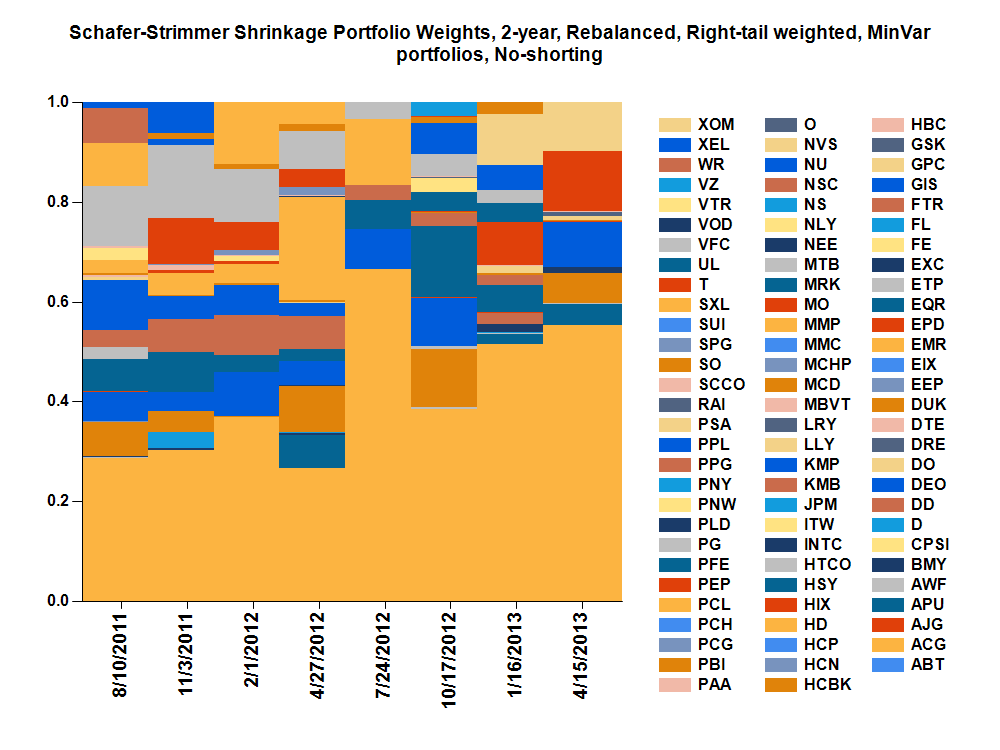

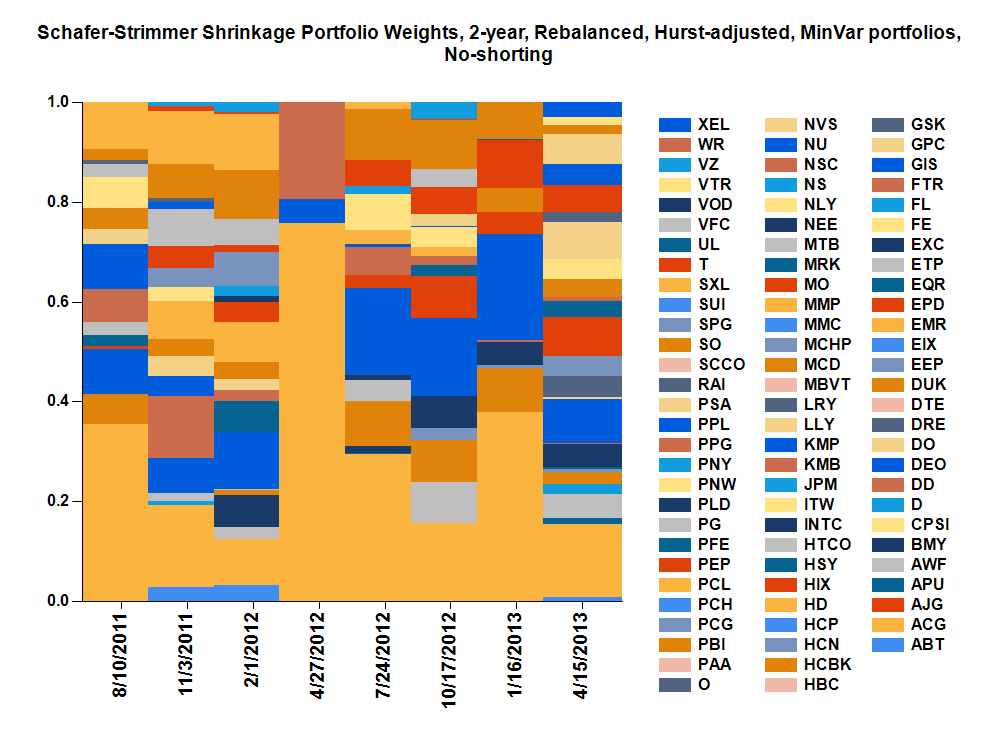

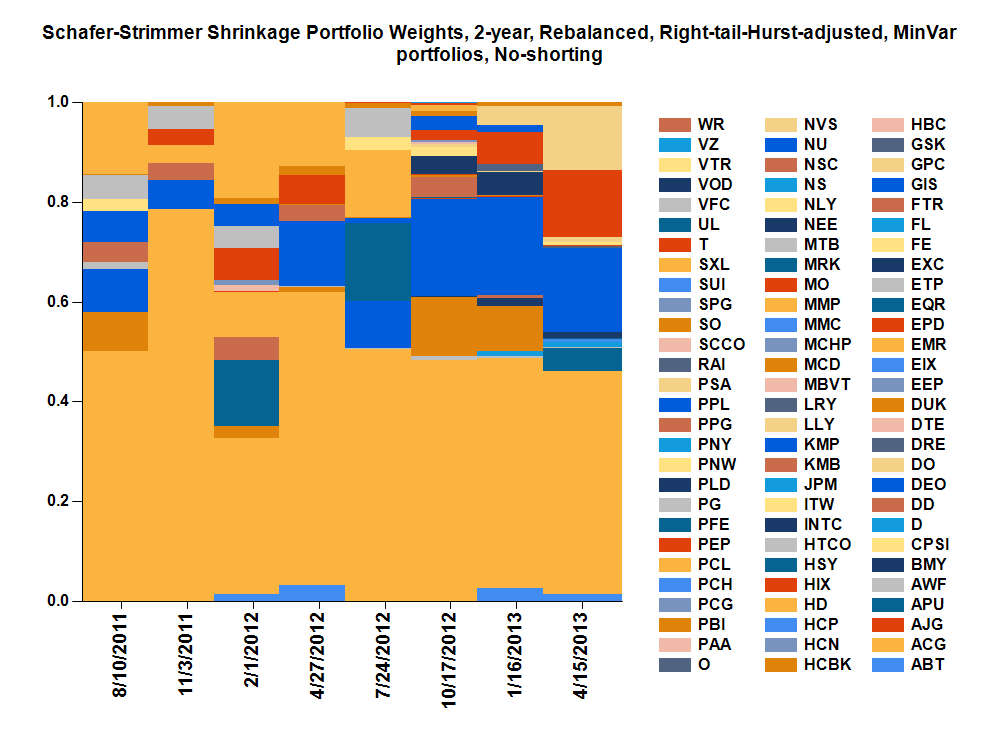

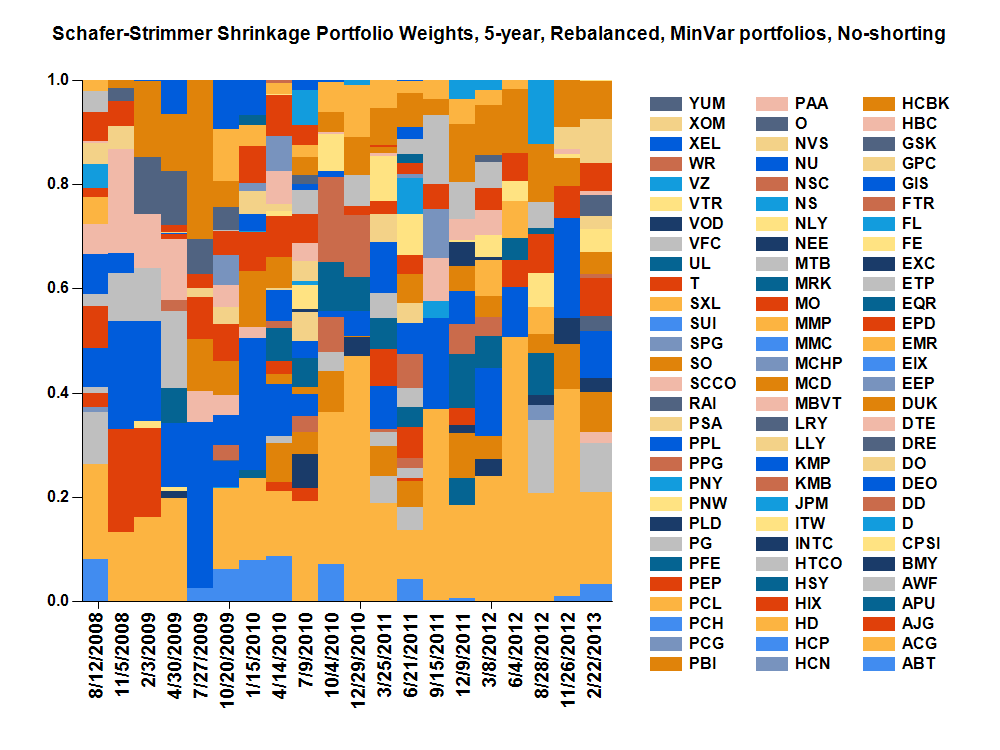

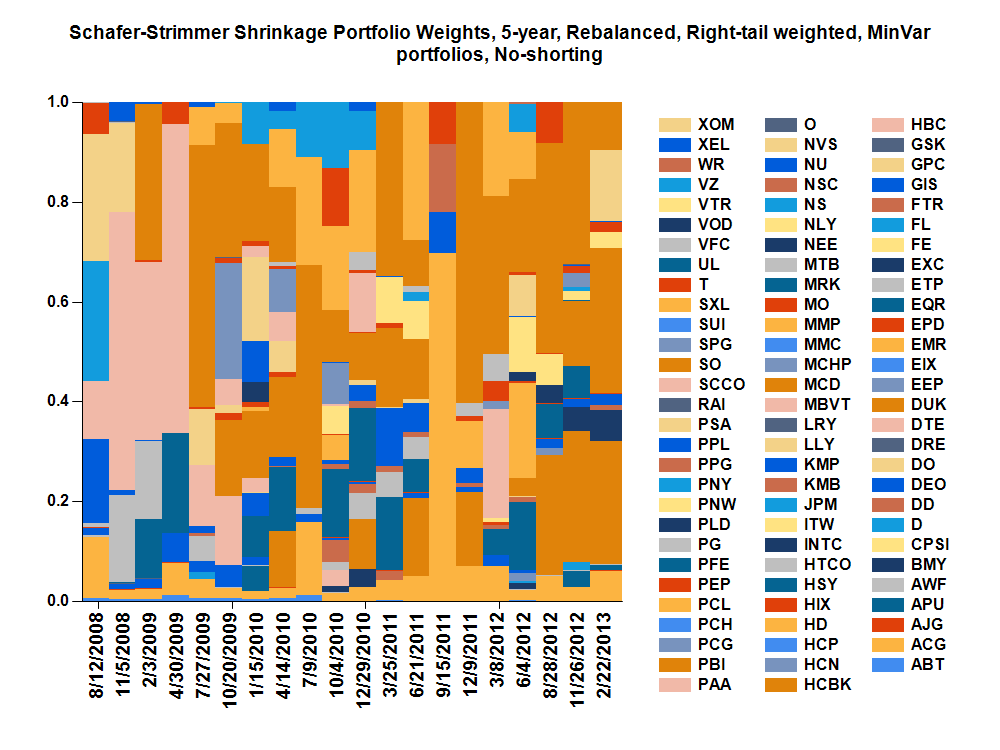

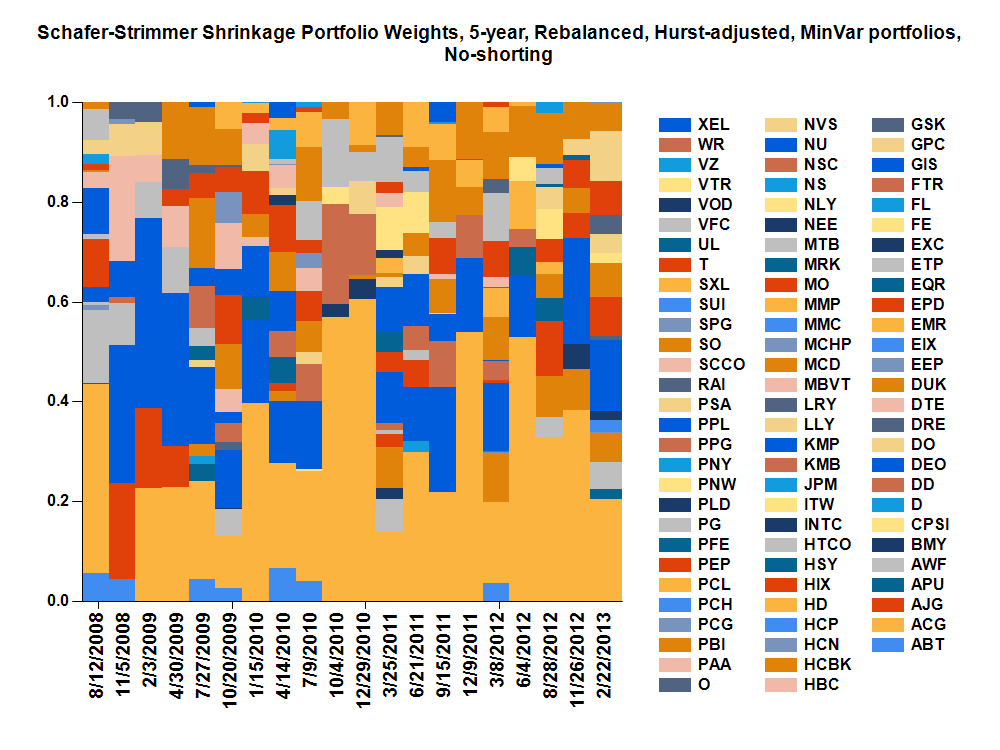

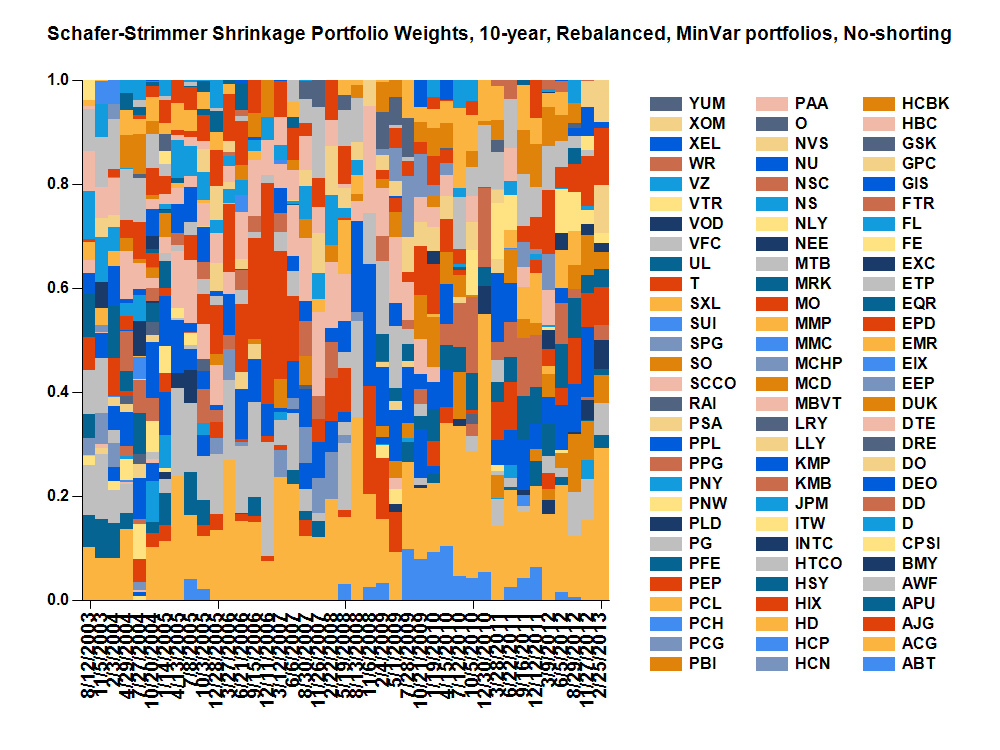

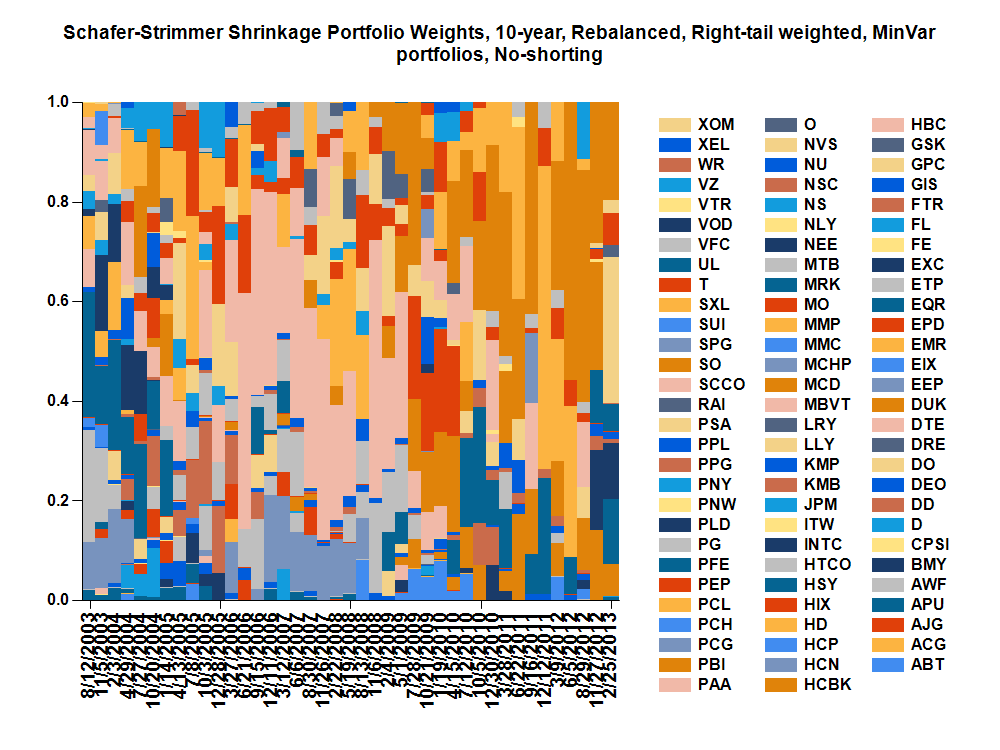

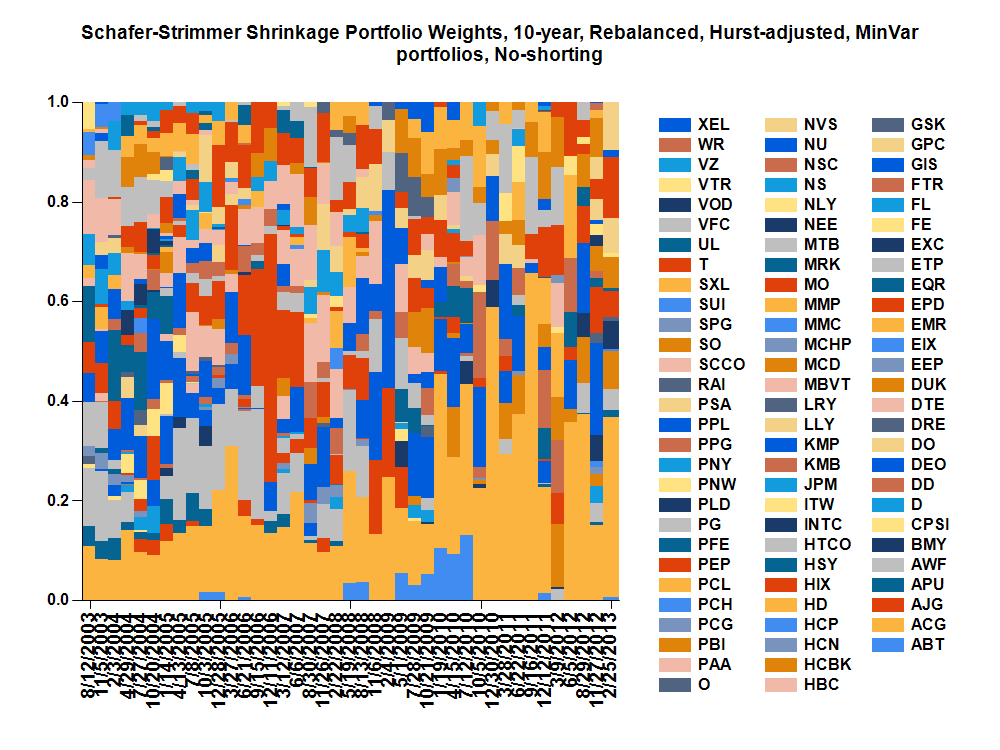

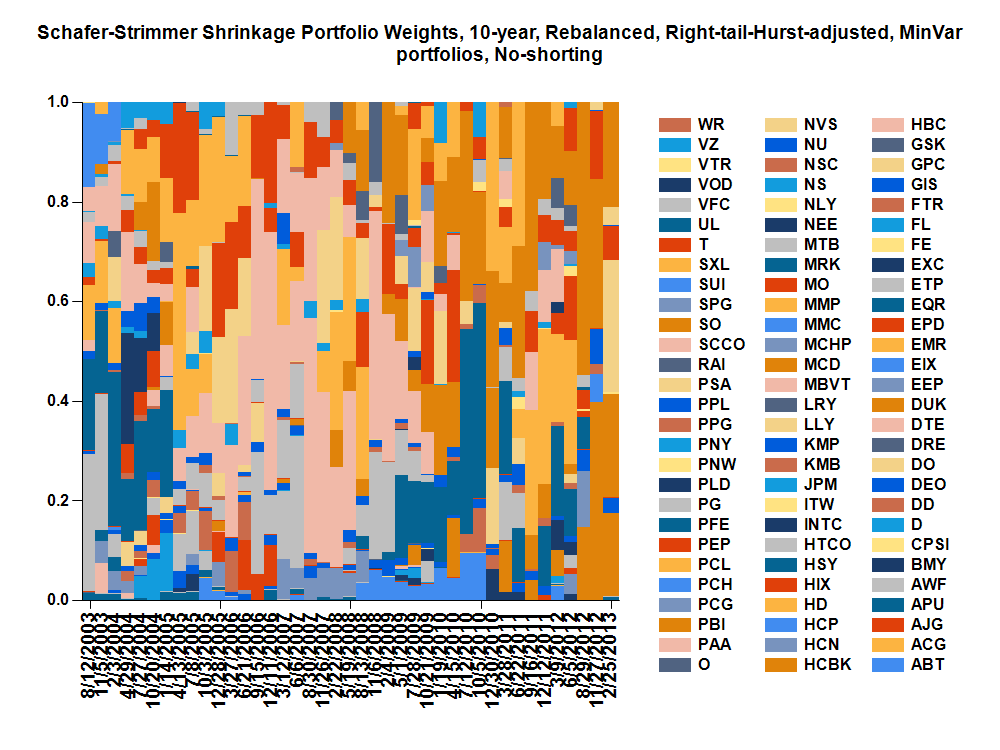

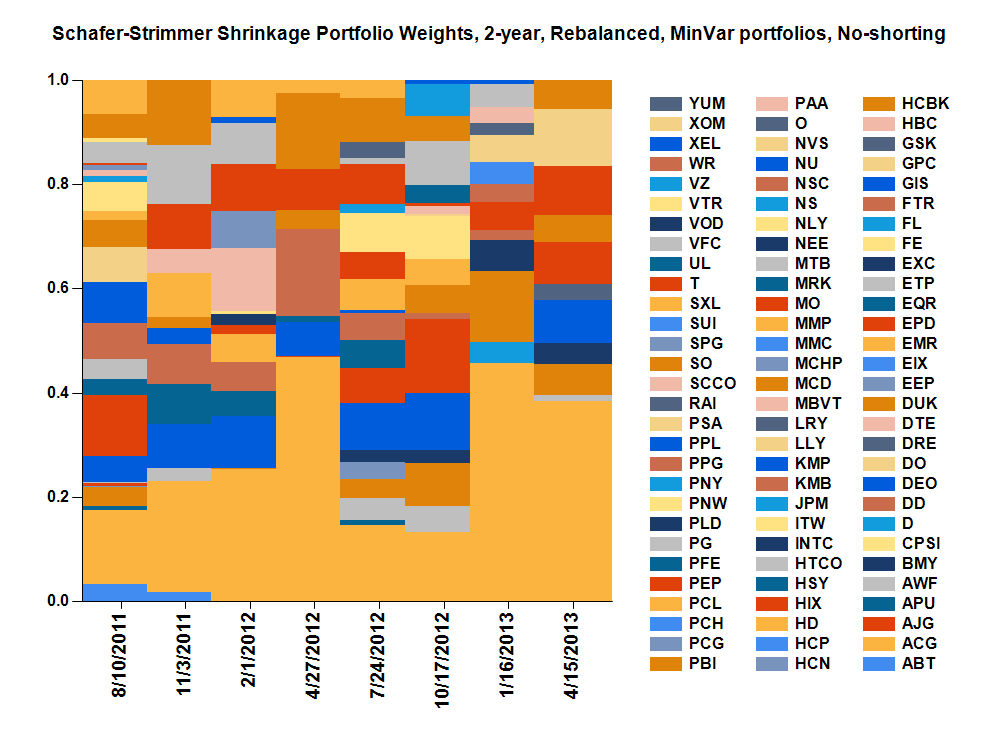

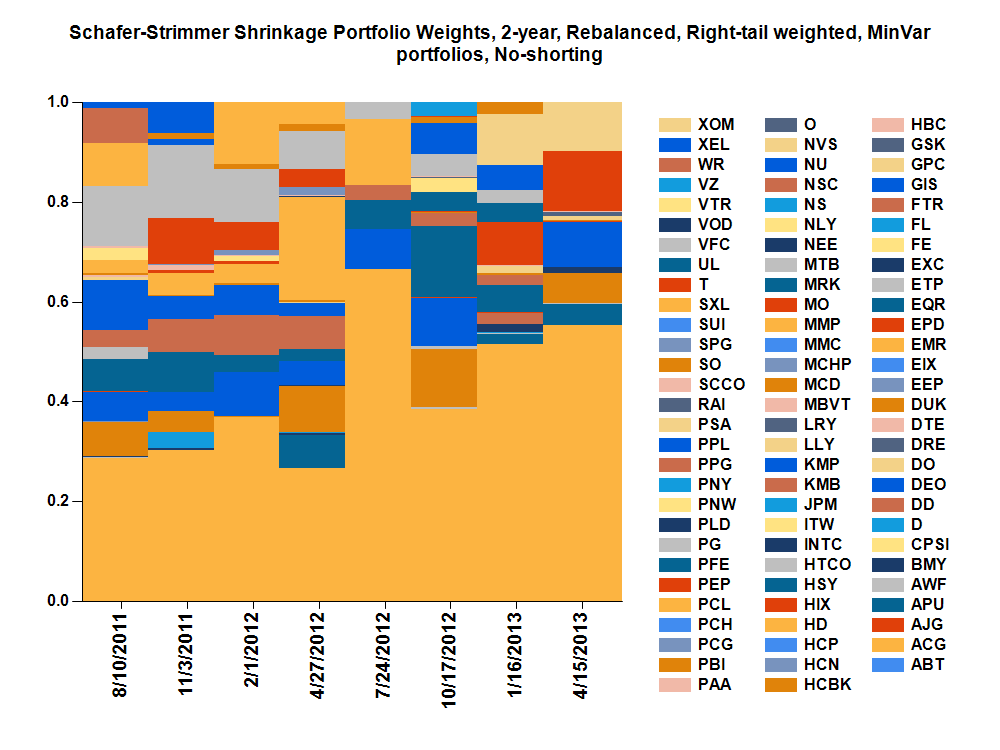

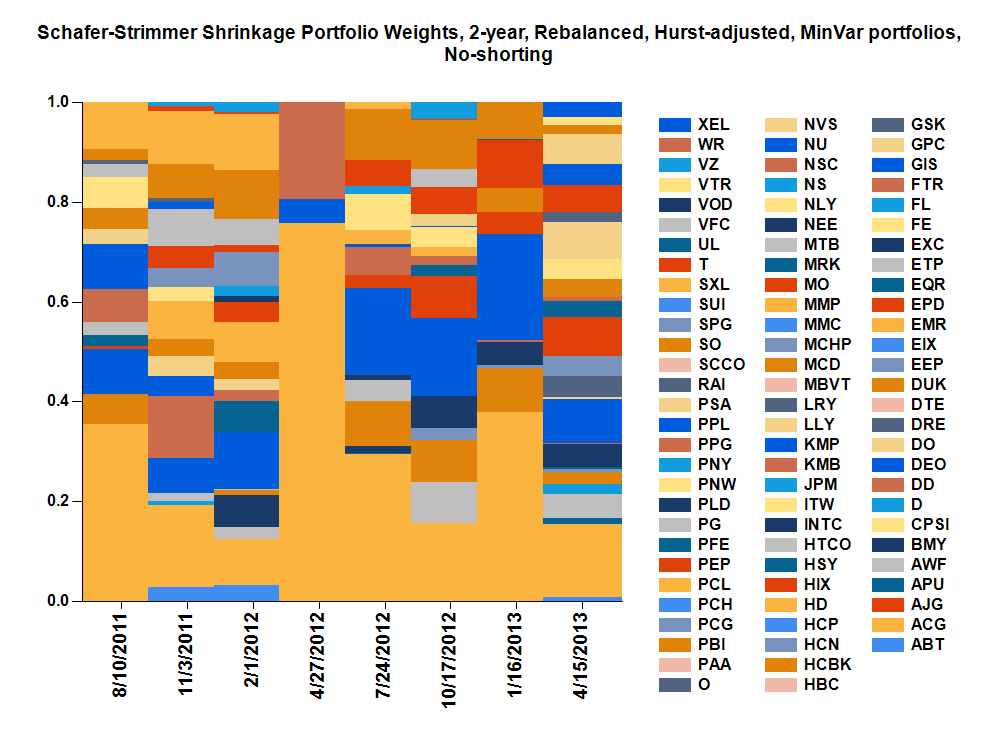

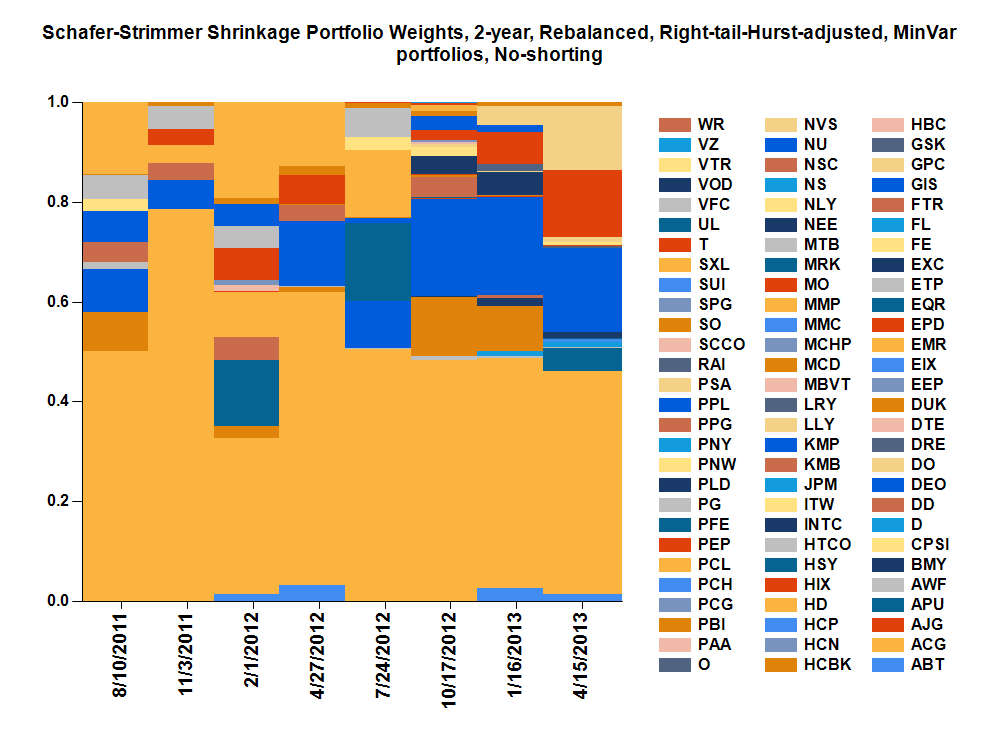

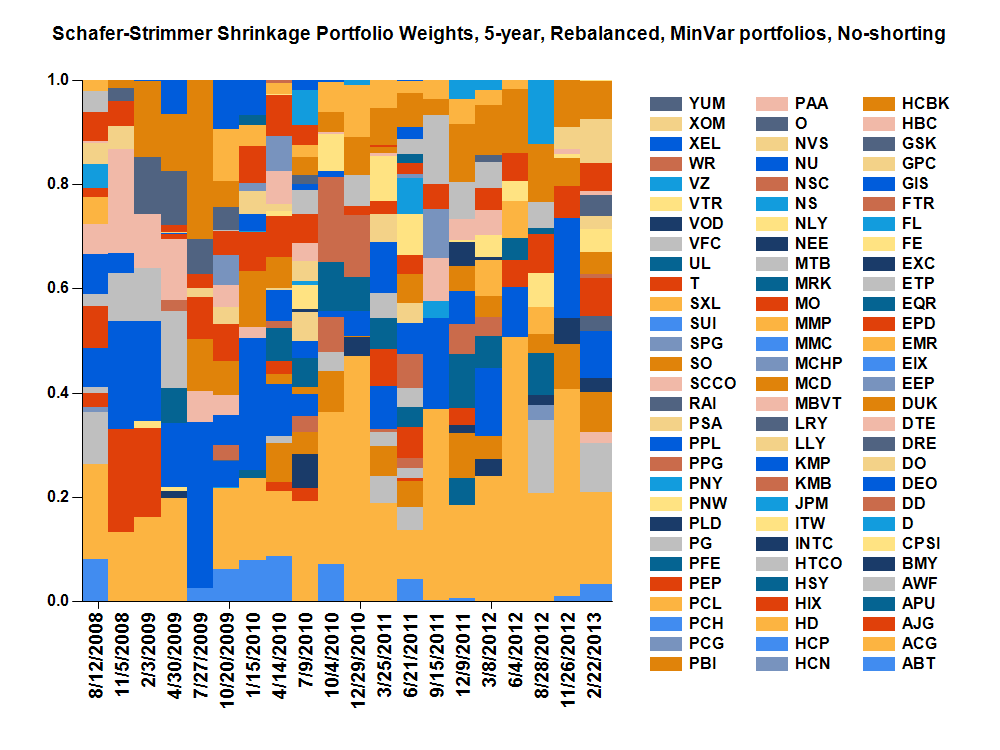

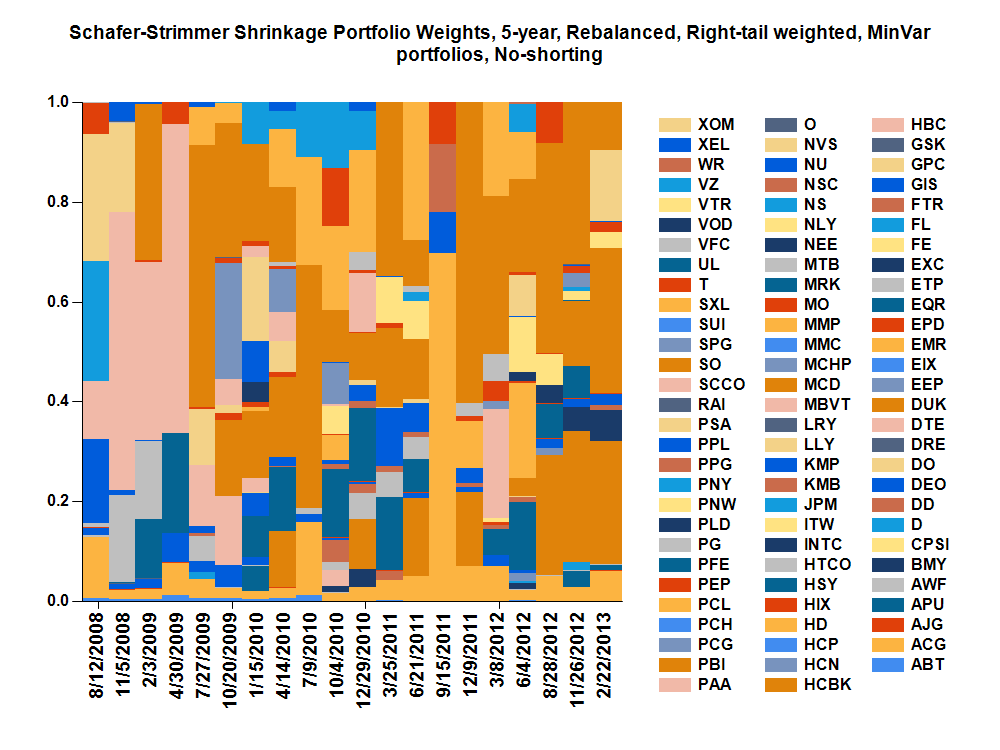

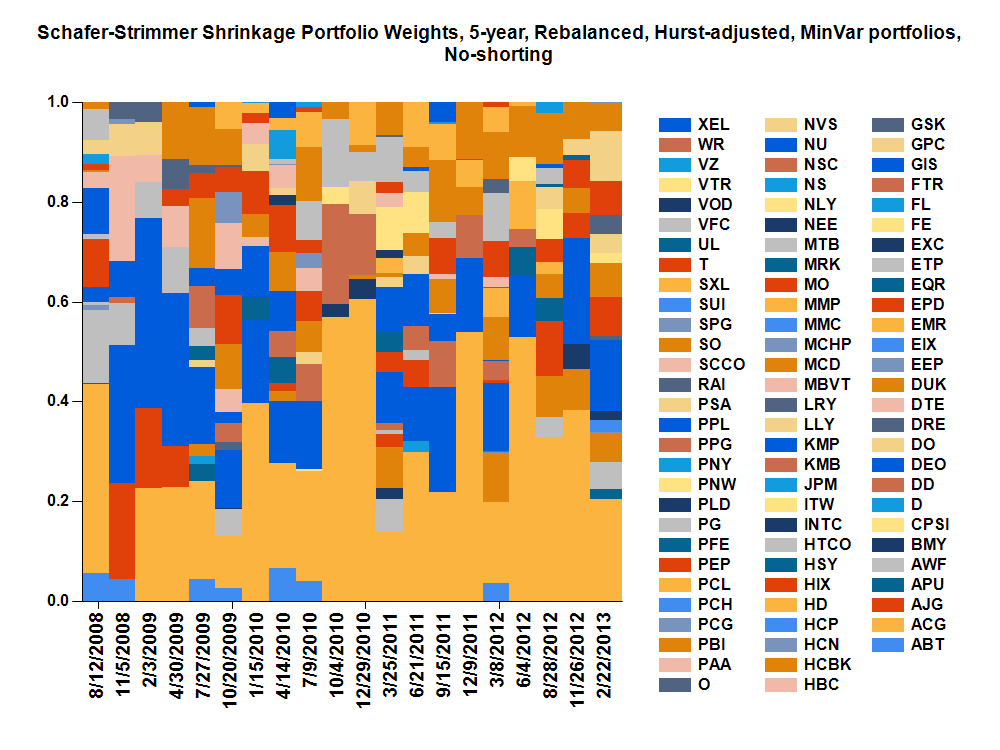

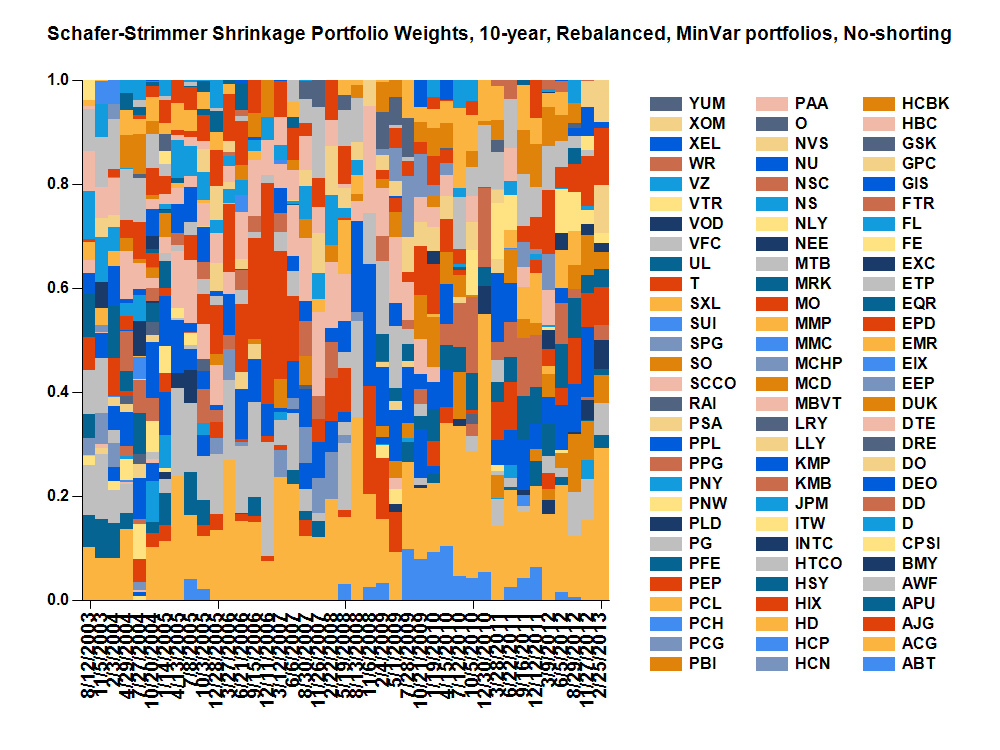

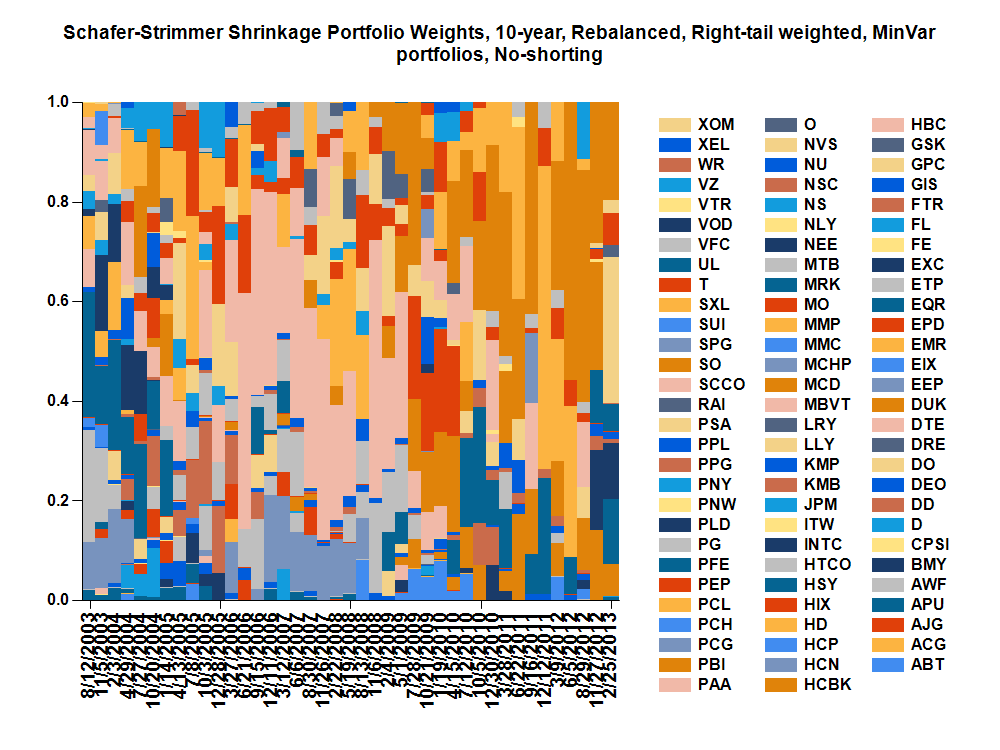

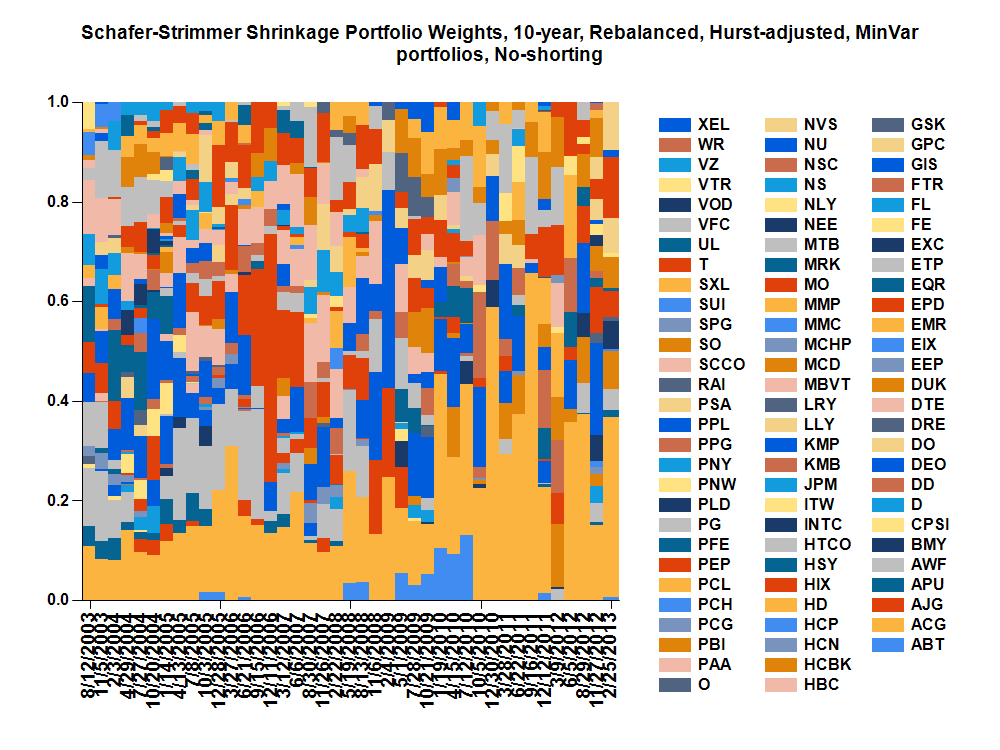

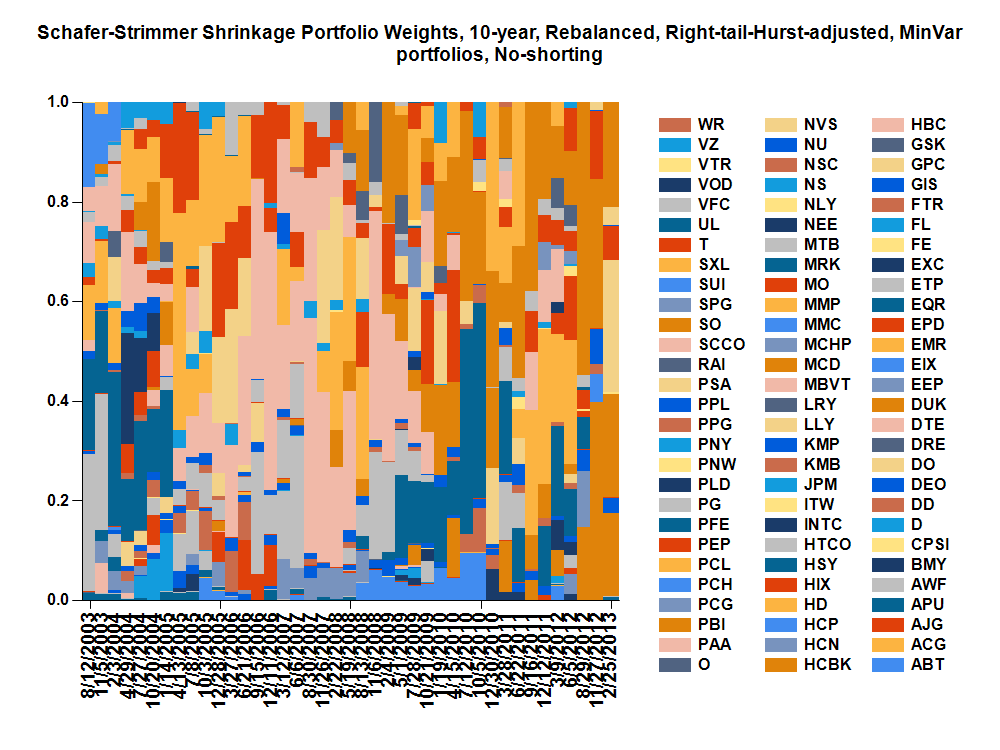

-SS - Schafer-Strimmer shrinkage of correlation matrix.

-^GSPC - S&P 500 index.

-Dividends applied to all portfolios.

© 2019 NXG Logic, LLC