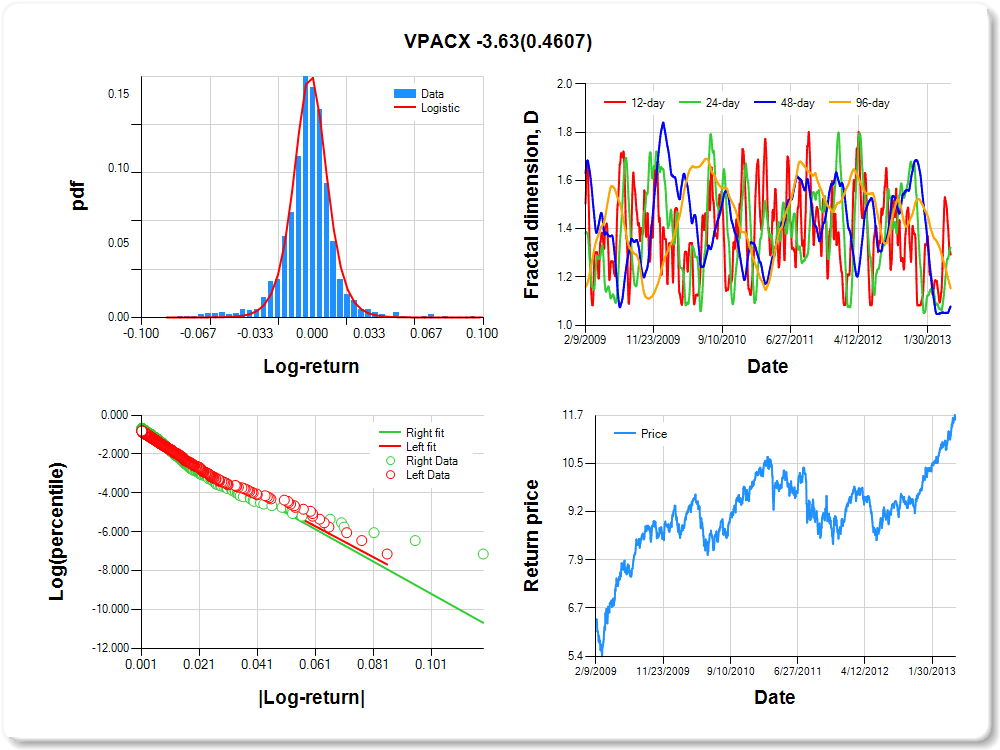

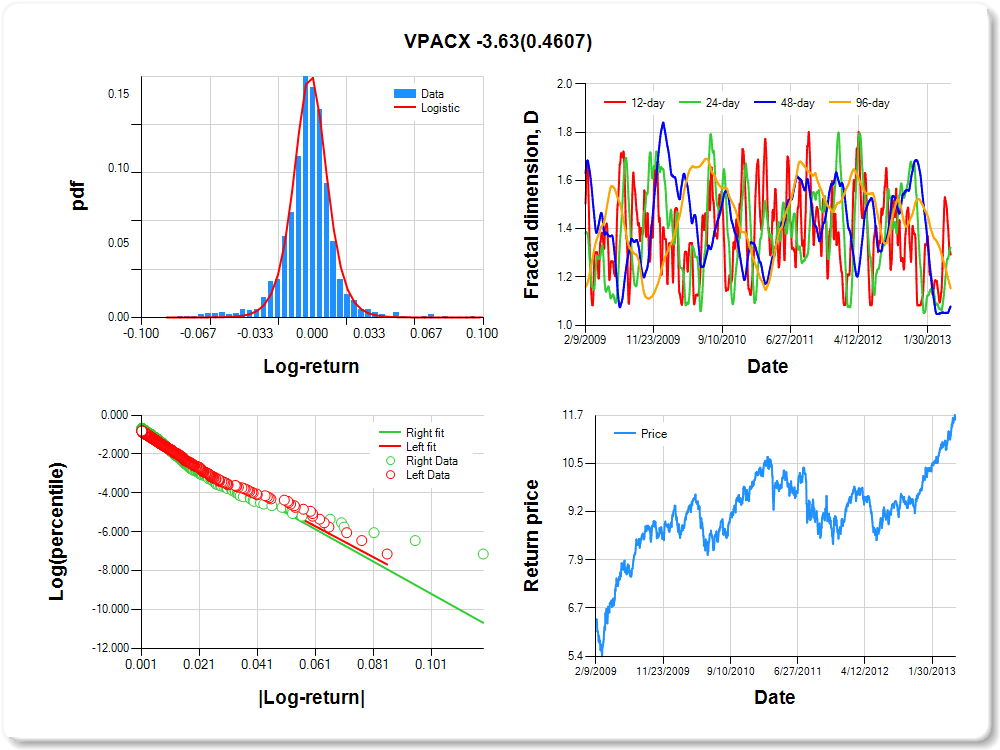

VPACX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.05 |

-0.02 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.06 |

0.88 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.265 |

0.105 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.885 |

0.058 |

-15.161 |

0.0000 |

|log-return| |

-79.328 |

3.469 |

-22.871 |

0.0000 |

I(right-tail) |

0.065 |

0.079 |

0.819 |

0.4128 |

|log-return|*I(right-tail) |

-3.629 |

4.919 |

-0.738 |

0.4607 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.707 |

0.678 |

0.922 |

0.847 |

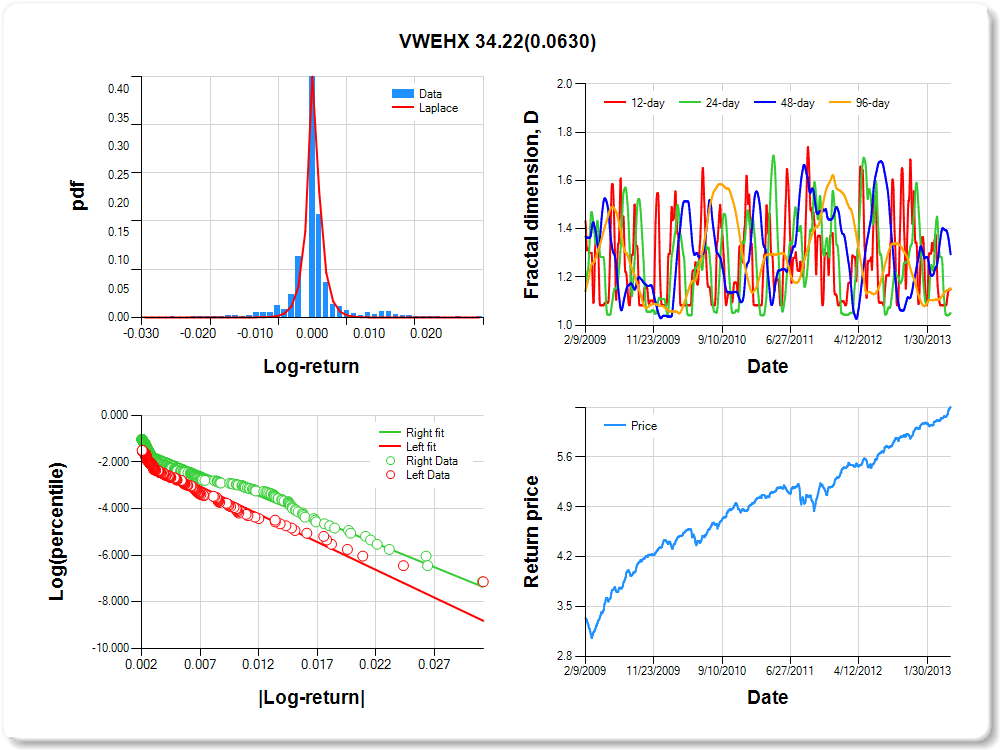

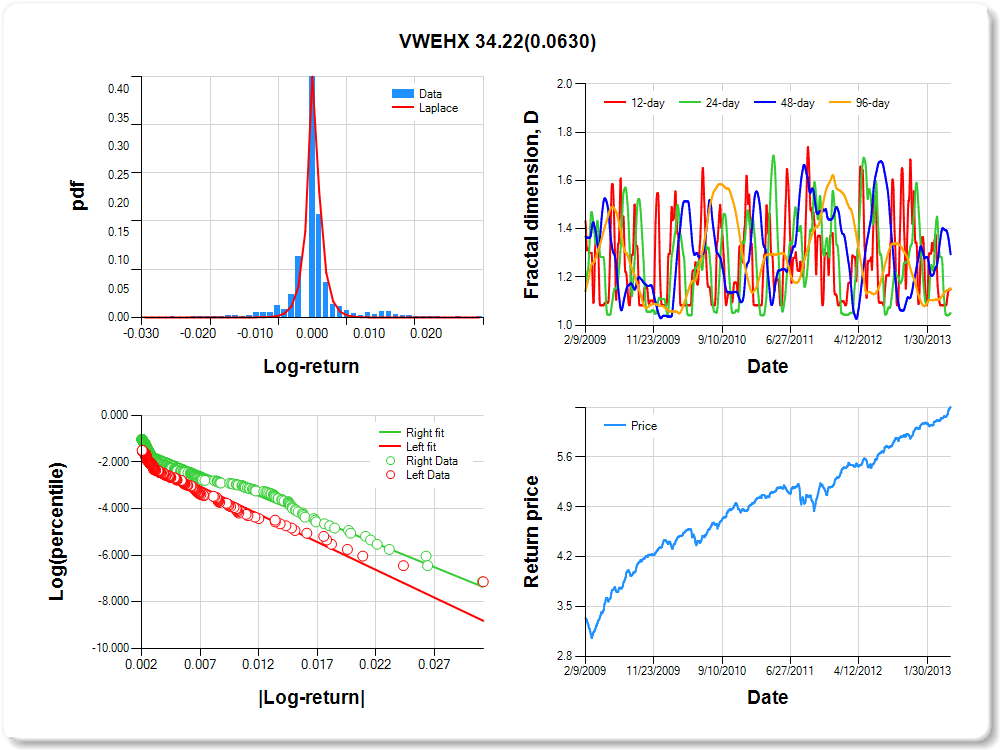

VWEHX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.02 |

-0.01 |

-0.01 |

0.00 |

0.00 |

0.00 |

0.00 |

0.01 |

0.02 |

0.02 |

0.00 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.047 |

0.067 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-1.487 |

0.088 |

-16.858 |

0.0000 |

|log-return| |

-238.060 |

15.283 |

-15.577 |

0.0000 |

I(right-tail) |

0.395 |

0.110 |

3.575 |

0.0004 |

|log-return|*I(right-tail) |

34.221 |

18.375 |

1.862 |

0.0630 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.851 |

0.949 |

0.706 |

0.847 |

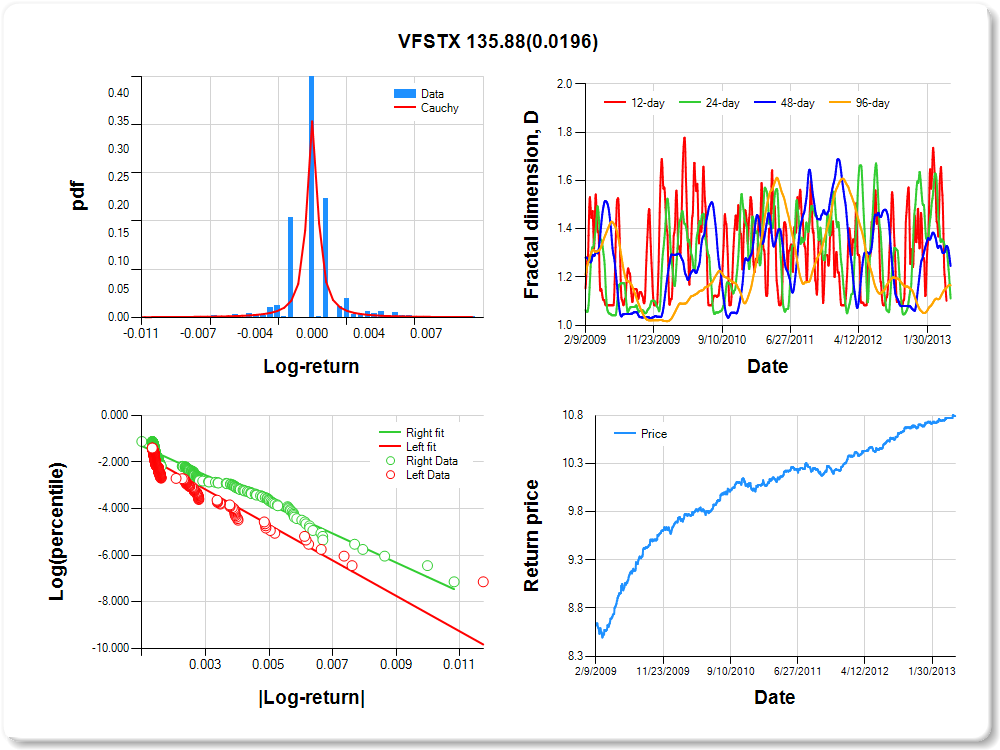

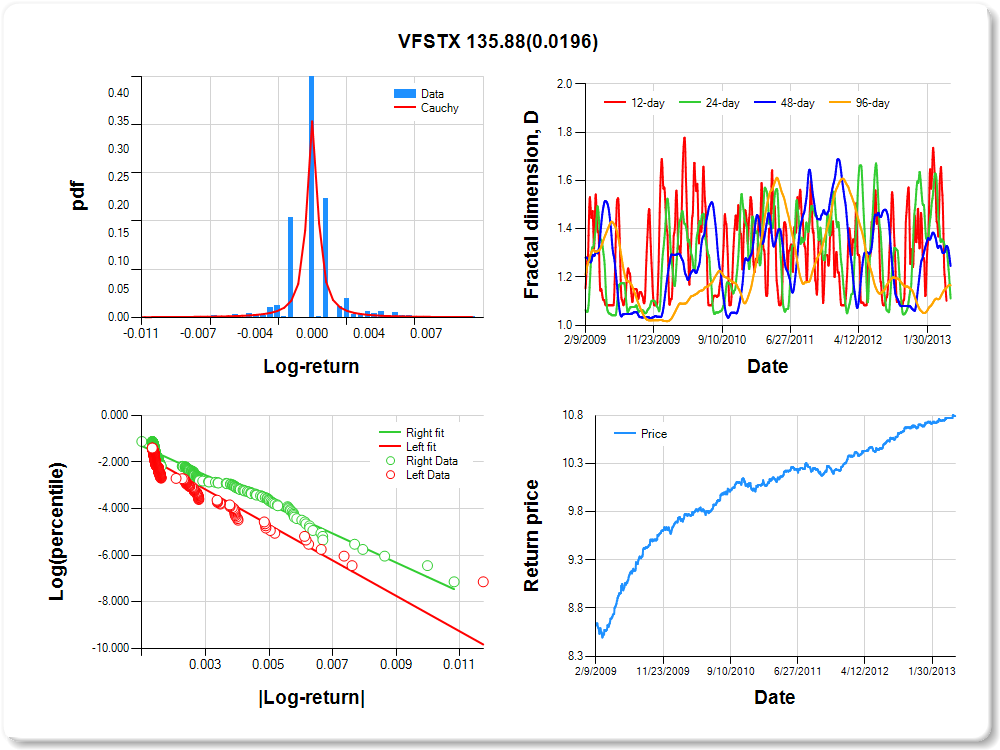

VFSTX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.01 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.01 |

0.01 |

0.84 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Cauchy |

0.105 |

0.047 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-1.206 |

0.094 |

-12.817 |

0.0000 |

|log-return| |

-761.247 |

47.985 |

-15.864 |

0.0000 |

I(right-tail) |

0.259 |

0.123 |

2.111 |

0.0351 |

|log-return|*I(right-tail) |

135.881 |

58.112 |

2.338 |

0.0196 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| NaN |

0.889 |

0.754 |

0.834 |

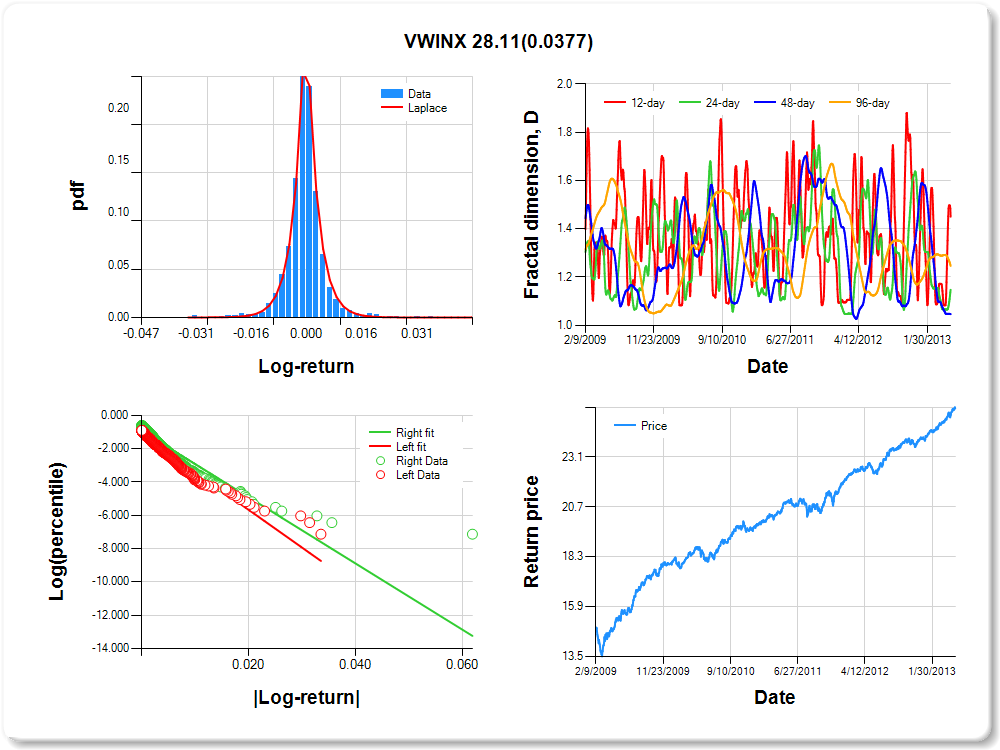

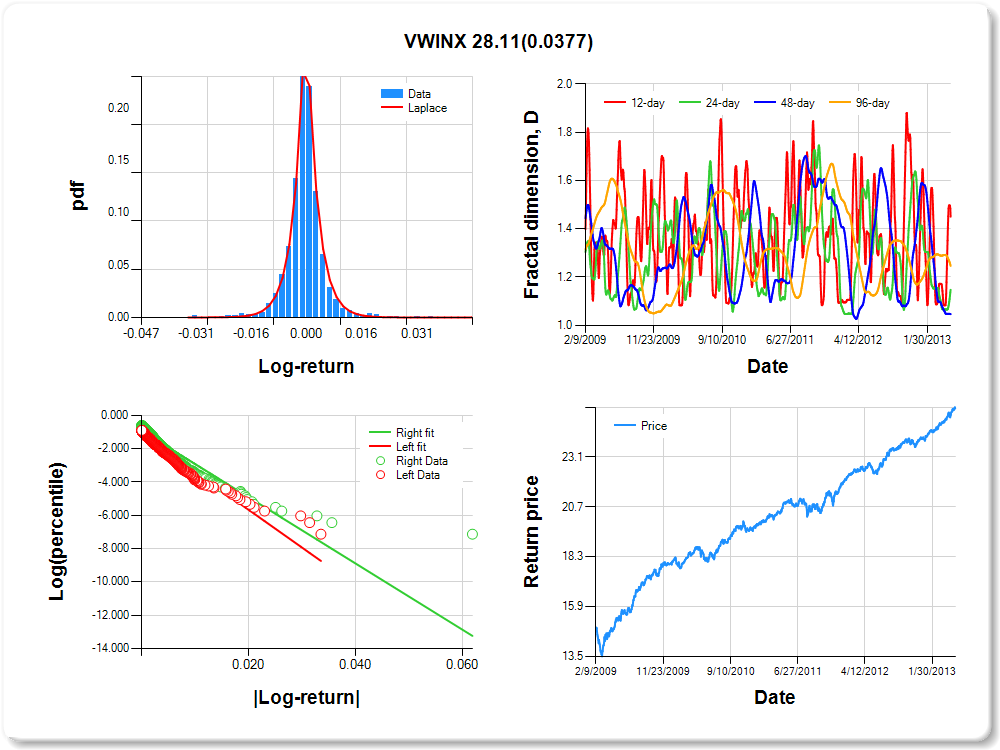

VWINX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.02 |

-0.02 |

-0.01 |

0.00 |

0.00 |

0.00 |

0.00 |

0.01 |

0.02 |

0.02 |

0.90 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.484 |

0.113 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-1.053 |

0.059 |

-17.720 |

0.0000 |

|log-return| |

-226.901 |

10.591 |

-21.423 |

0.0000 |

I(right-tail) |

0.183 |

0.077 |

2.359 |

0.0185 |

|log-return|*I(right-tail) |

28.107 |

13.511 |

2.080 |

0.0377 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.550 |

0.853 |

0.954 |

0.754 |

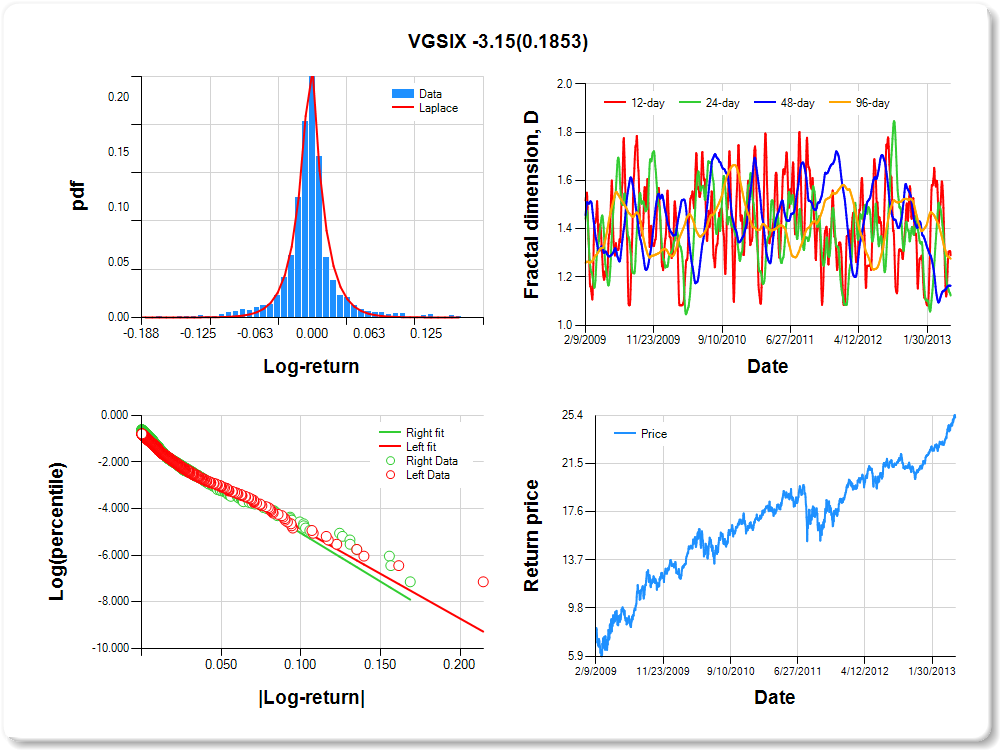

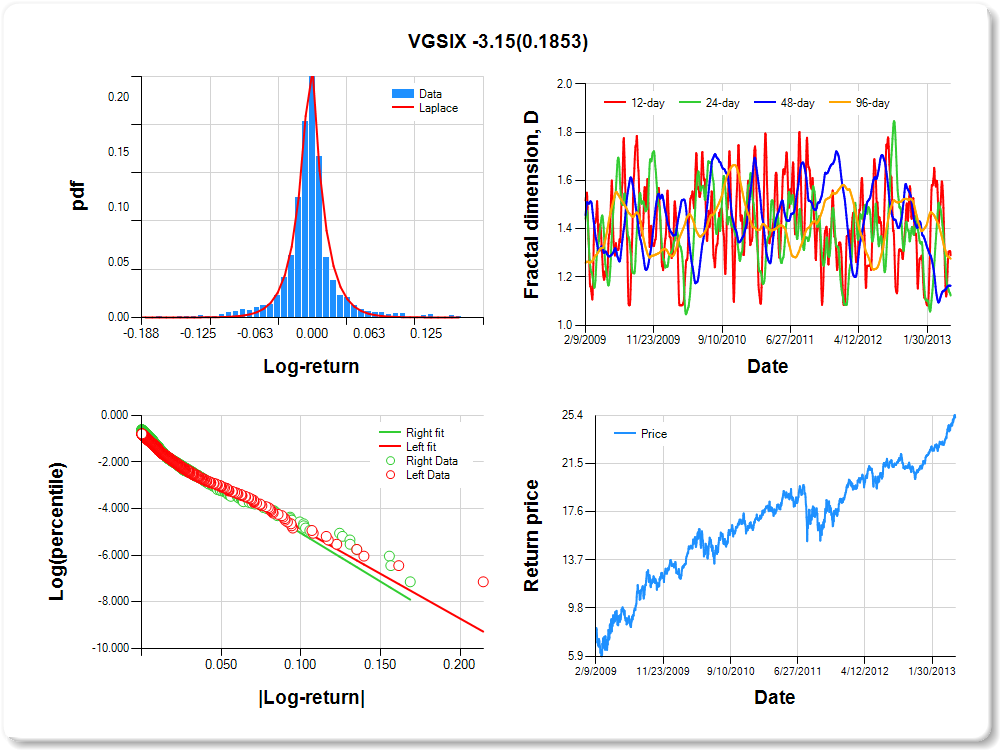

VGSIX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.11 |

-0.09 |

-0.05 |

-0.03 |

-0.01 |

0.00 |

0.01 |

0.05 |

0.10 |

0.13 |

0.35 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.219 |

0.131 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-1.024 |

0.054 |

-19.039 |

0.0000 |

|log-return| |

-38.401 |

1.680 |

-22.860 |

0.0000 |

I(right-tail) |

0.140 |

0.072 |

1.933 |

0.0534 |

|log-return|*I(right-tail) |

-3.146 |

2.373 |

-1.325 |

0.1853 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.710 |

0.876 |

0.836 |

0.724 |

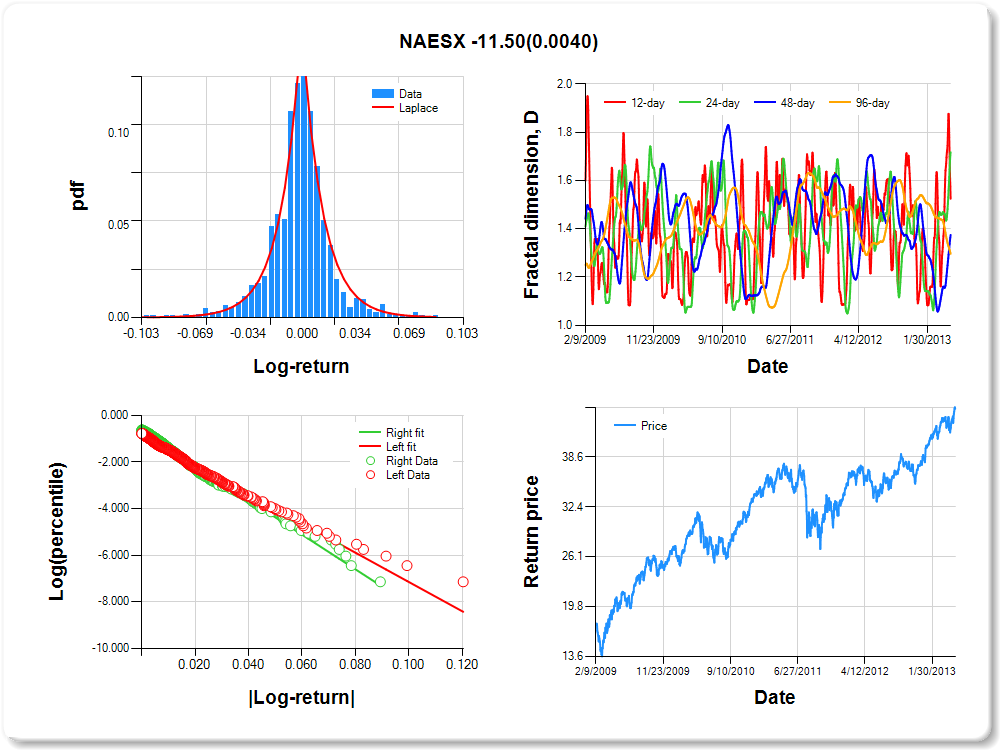

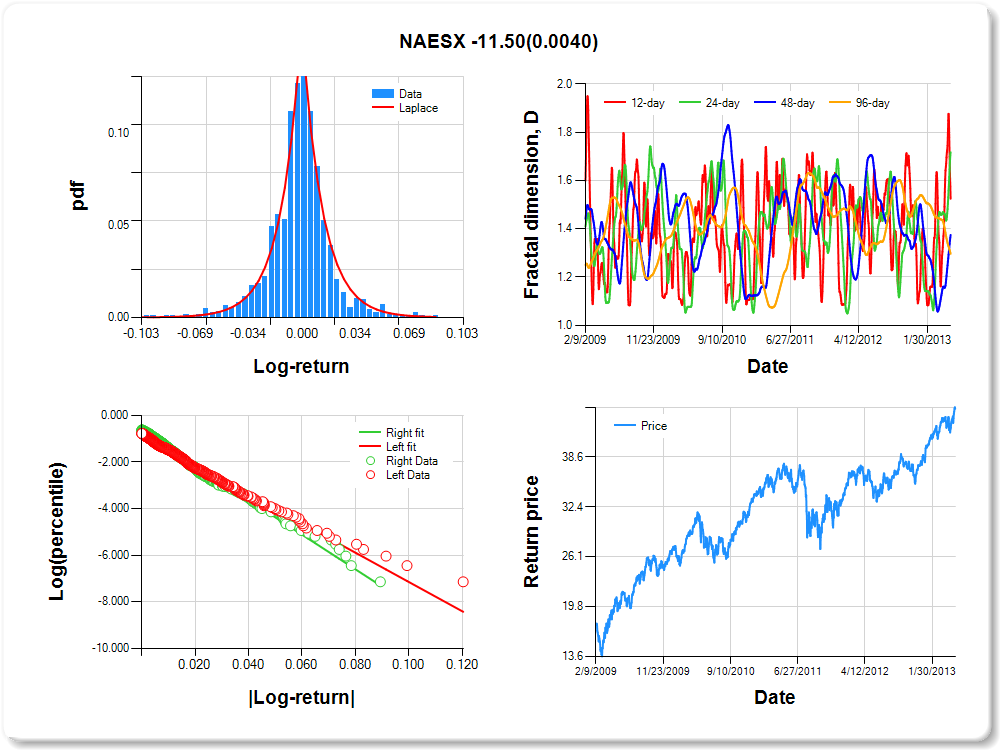

NAESX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.07 |

-0.06 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.06 |

0.07 |

0.93 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.279 |

0.217 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.863 |

0.057 |

-15.089 |

0.0000 |

|log-return| |

-62.725 |

2.687 |

-23.343 |

0.0000 |

I(right-tail) |

0.212 |

0.079 |

2.677 |

0.0075 |

|log-return|*I(right-tail) |

-11.500 |

3.984 |

-2.887 |

0.0040 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.475 |

0.283 |

0.625 |

0.704 |

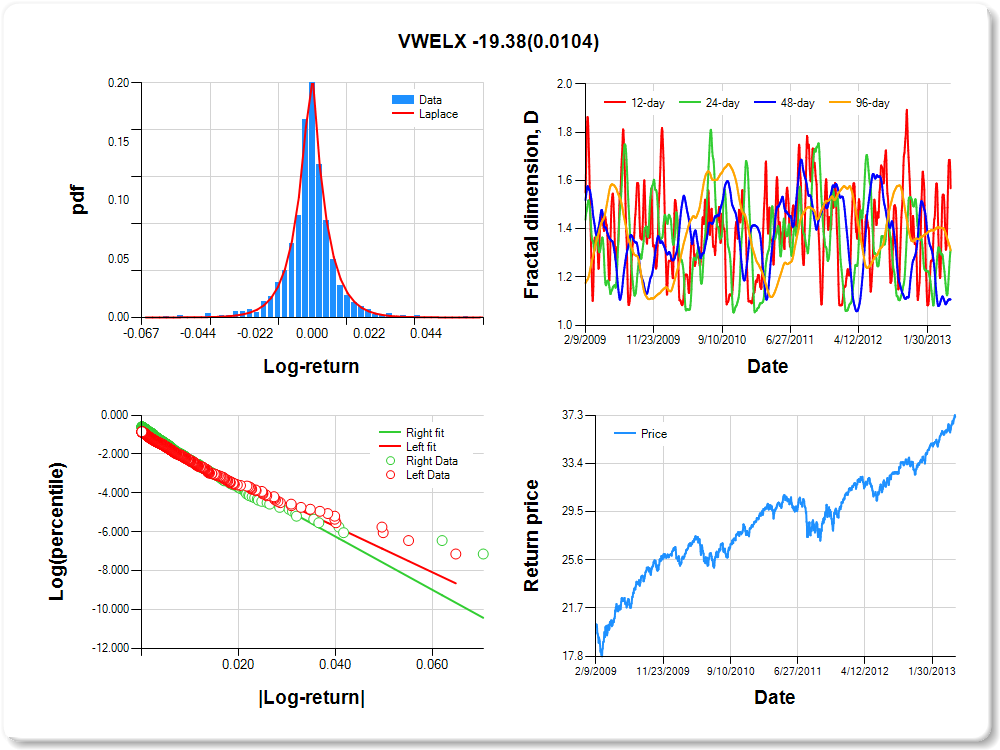

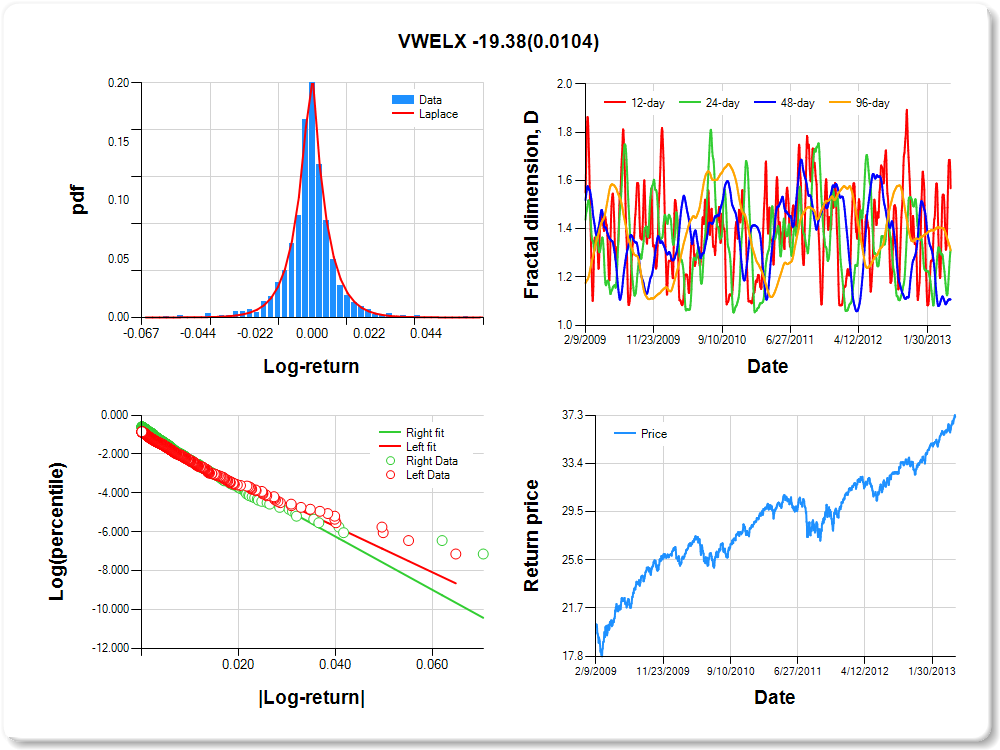

VWELX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.04 |

-0.03 |

-0.01 |

-0.01 |

0.00 |

0.00 |

0.00 |

0.01 |

0.03 |

0.03 |

0.00 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.051 |

0.150 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.997 |

0.057 |

-17.458 |

0.0000 |

|log-return| |

-117.531 |

5.248 |

-22.394 |

0.0000 |

I(right-tail) |

0.265 |

0.077 |

3.459 |

0.0006 |

|log-return|*I(right-tail) |

-19.380 |

7.555 |

-2.565 |

0.0104 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.432 |

0.688 |

0.893 |

0.690 |

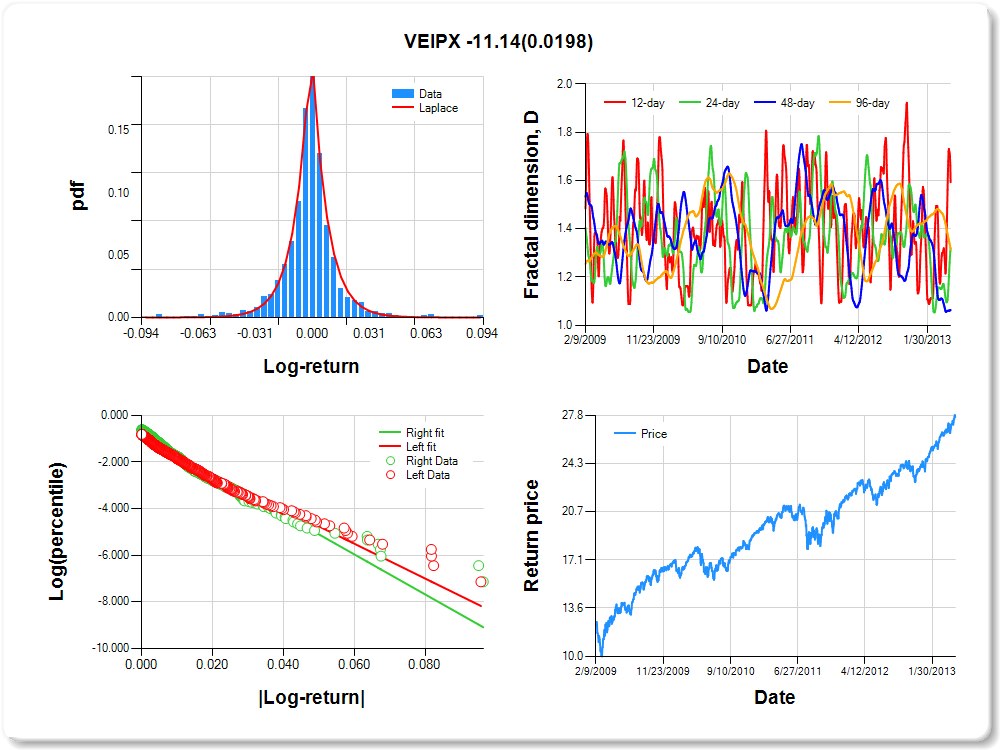

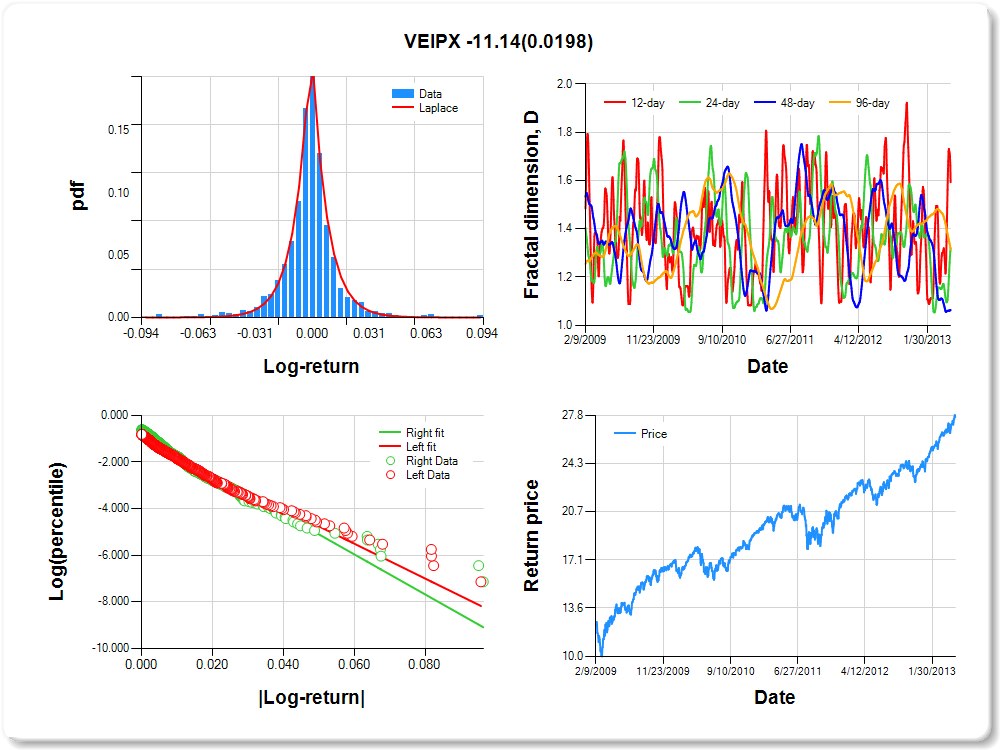

VEIPX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.05 |

-0.02 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.07 |

0.04 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.014 |

0.152 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-1.002 |

0.056 |

-18.002 |

0.0000 |

|log-return| |

-74.672 |

3.297 |

-22.646 |

0.0000 |

I(right-tail) |

0.215 |

0.075 |

2.848 |

0.0045 |

|log-return|*I(right-tail) |

-11.143 |

4.775 |

-2.333 |

0.0198 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.407 |

0.681 |

0.937 |

0.686 |

VTI

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.05 |

0.06 |

0.27 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.152 |

0.144 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.967 |

0.056 |

-17.157 |

0.0000 |

|log-return| |

-72.491 |

3.174 |

-22.837 |

0.0000 |

I(right-tail) |

0.209 |

0.076 |

2.763 |

0.0058 |

|log-return|*I(right-tail) |

-11.767 |

4.618 |

-2.548 |

0.0110 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.431 |

0.500 |

0.829 |

0.686 |

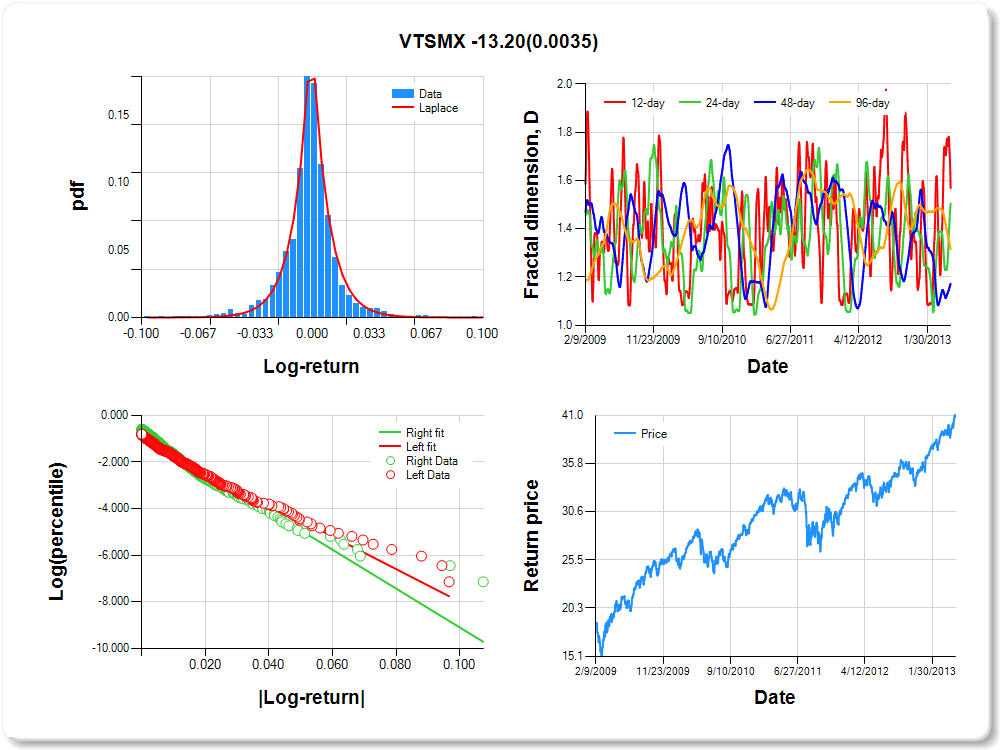

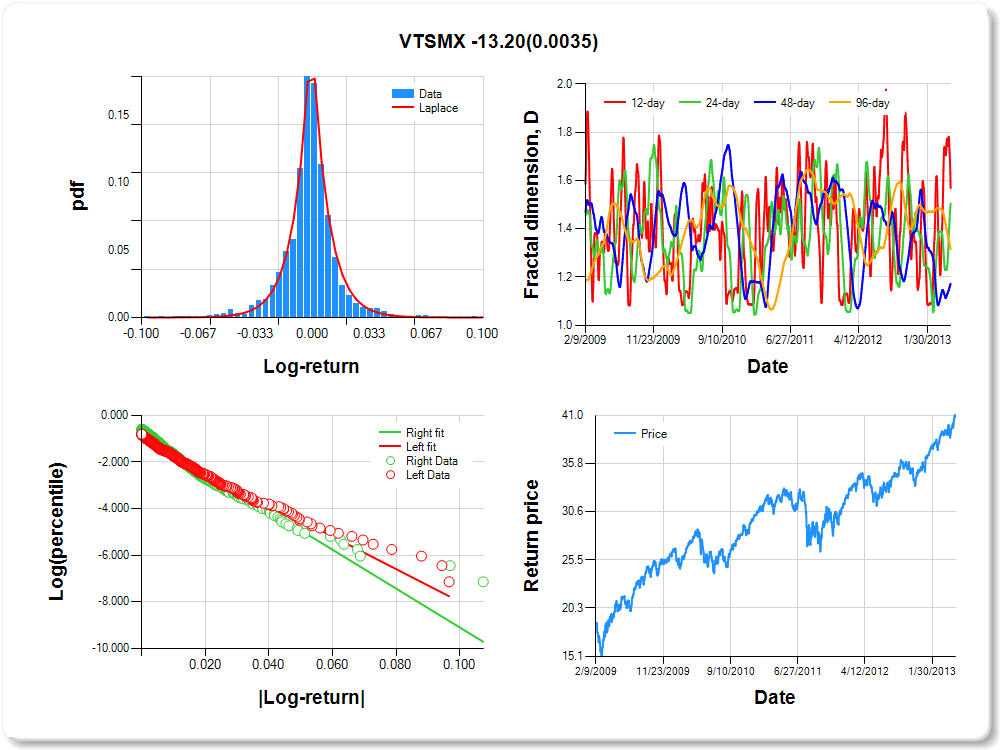

VTSMX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.07 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.05 |

0.06 |

1.06 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.068 |

0.158 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.981 |

0.056 |

-17.607 |

0.0000 |

|log-return| |

-69.966 |

3.063 |

-22.843 |

0.0000 |

I(right-tail) |

0.224 |

0.075 |

2.969 |

0.0030 |

|log-return|*I(right-tail) |

-13.200 |

4.509 |

-2.927 |

0.0035 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.431 |

0.495 |

0.828 |

0.685 |

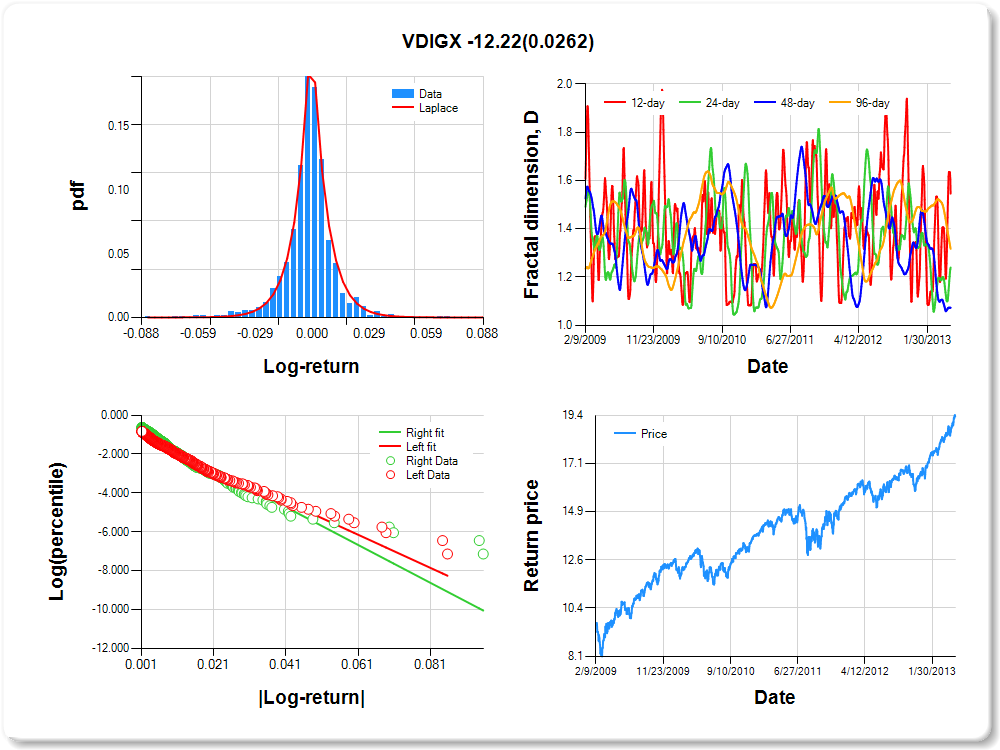

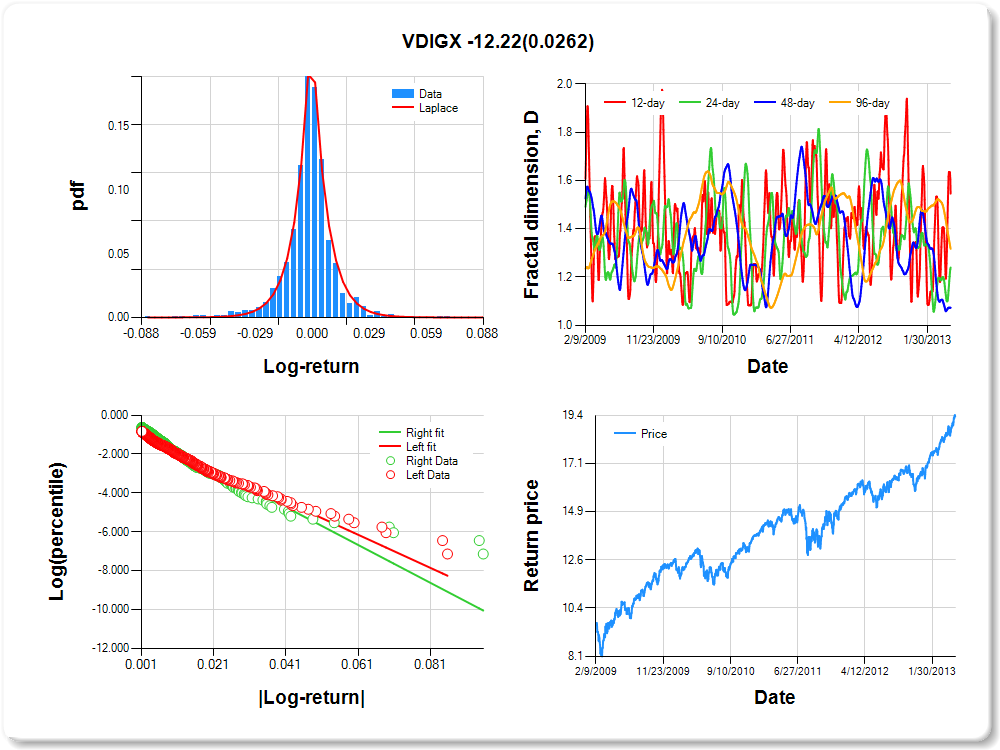

VDIGX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.04 |

-0.02 |

-0.01 |

0.00 |

0.00 |

0.01 |

0.02 |

0.04 |

0.04 |

1.03 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.071 |

0.146 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-1.006 |

0.056 |

-17.942 |

0.0000 |

|log-return| |

-84.983 |

3.773 |

-22.522 |

0.0000 |

I(right-tail) |

0.215 |

0.076 |

2.825 |

0.0048 |

|log-return|*I(right-tail) |

-12.223 |

5.491 |

-2.226 |

0.0262 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.454 |

0.760 |

0.927 |

0.683 |

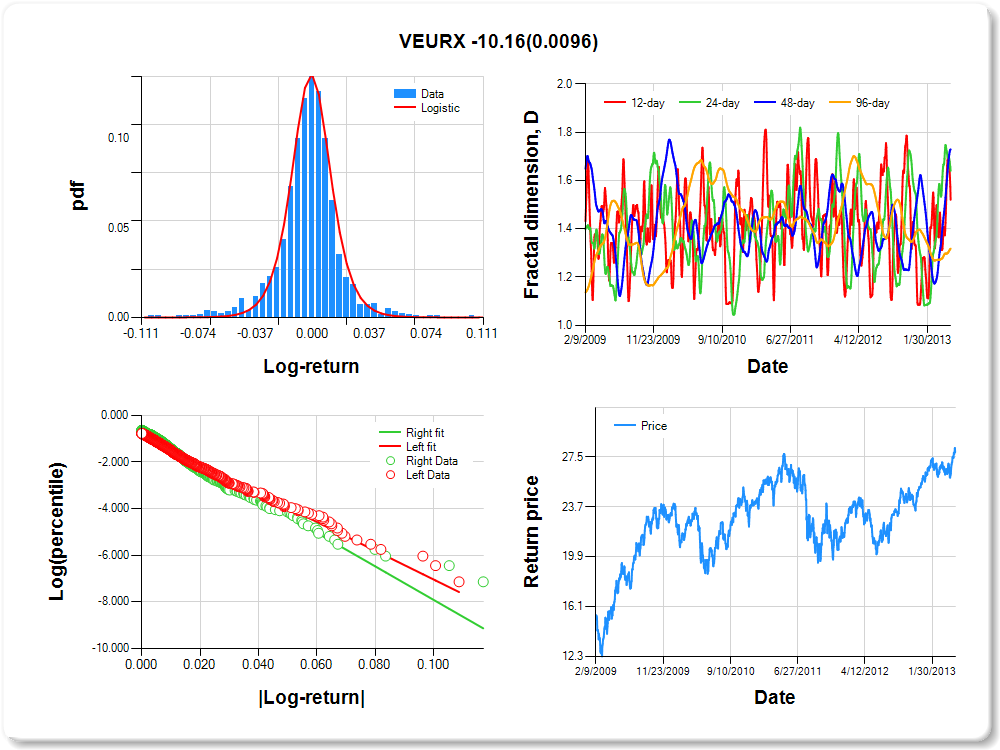

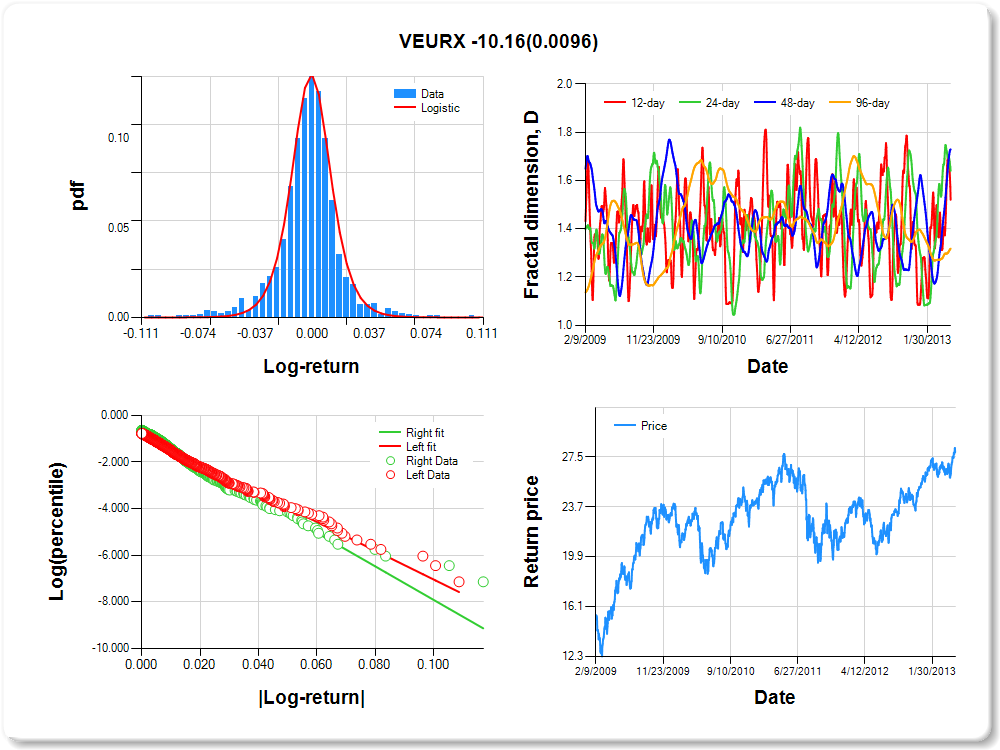

VEURX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.07 |

-0.06 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.06 |

0.07 |

2.55 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.041 |

0.126 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.855 |

0.057 |

-14.956 |

0.0000 |

|log-return| |

-61.627 |

2.636 |

-23.379 |

0.0000 |

I(right-tail) |

0.147 |

0.079 |

1.865 |

0.0625 |

|log-return|*I(right-tail) |

-10.155 |

3.912 |

-2.596 |

0.0096 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.480 |

0.359 |

0.271 |

0.682 |

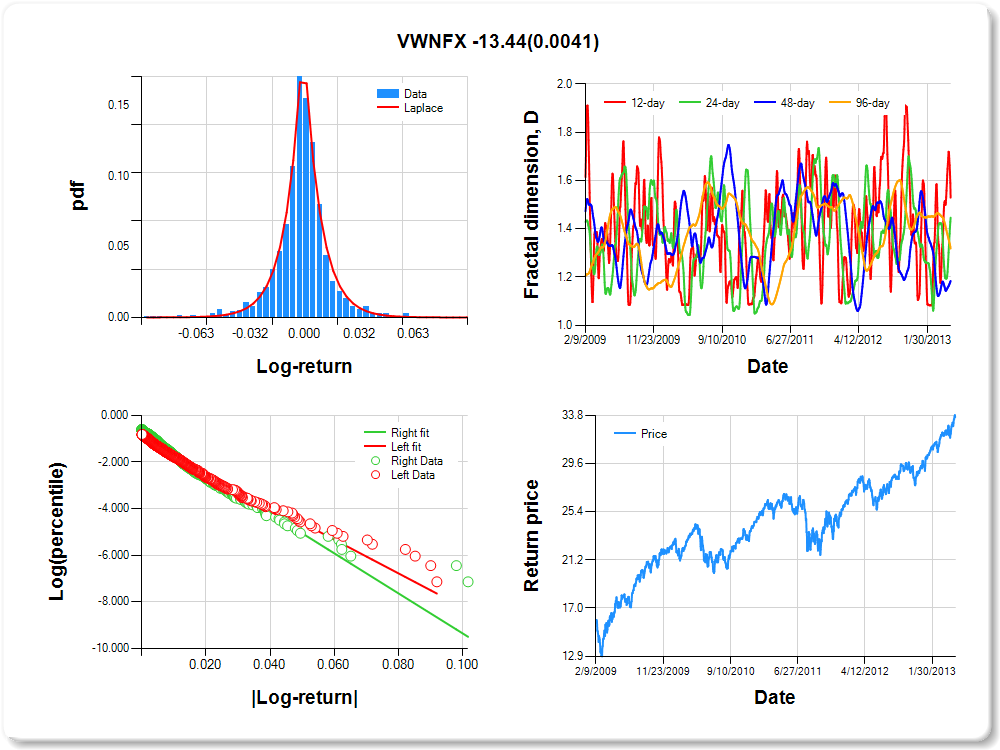

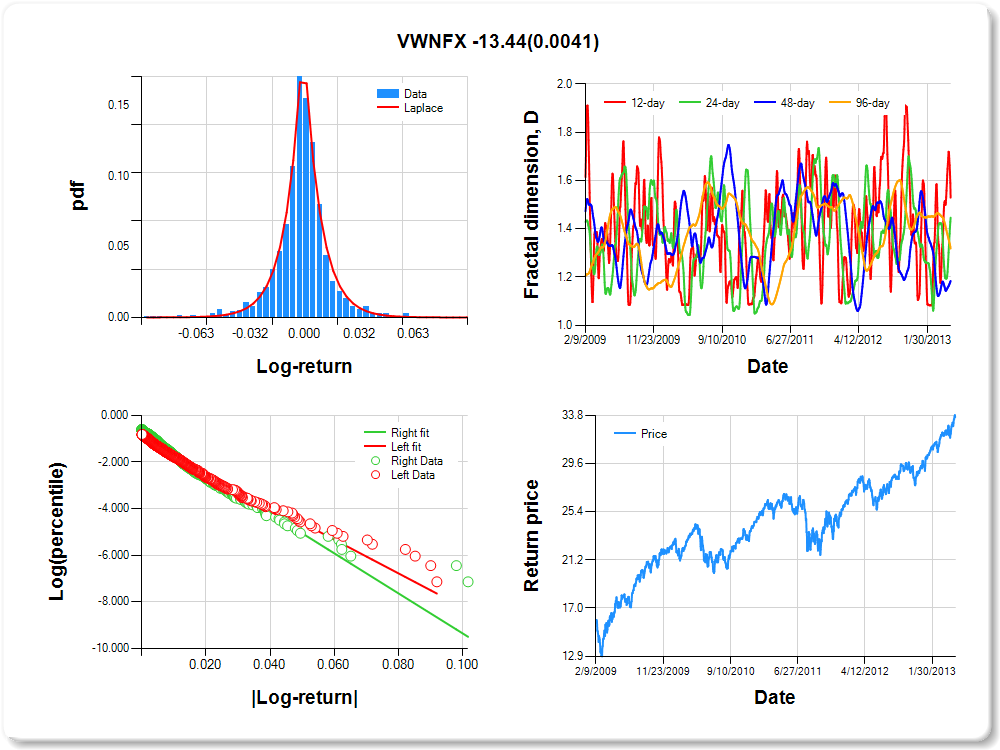

VWNFX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.07 |

-0.05 |

-0.02 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.06 |

0.68 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.069 |

0.170 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.972 |

0.057 |

-17.191 |

0.0000 |

|log-return| |

-72.284 |

3.186 |

-22.690 |

0.0000 |

I(right-tail) |

0.223 |

0.076 |

2.919 |

0.0036 |

|log-return|*I(right-tail) |

-13.445 |

4.673 |

-2.877 |

0.0041 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.471 |

0.554 |

0.816 |

0.682 |

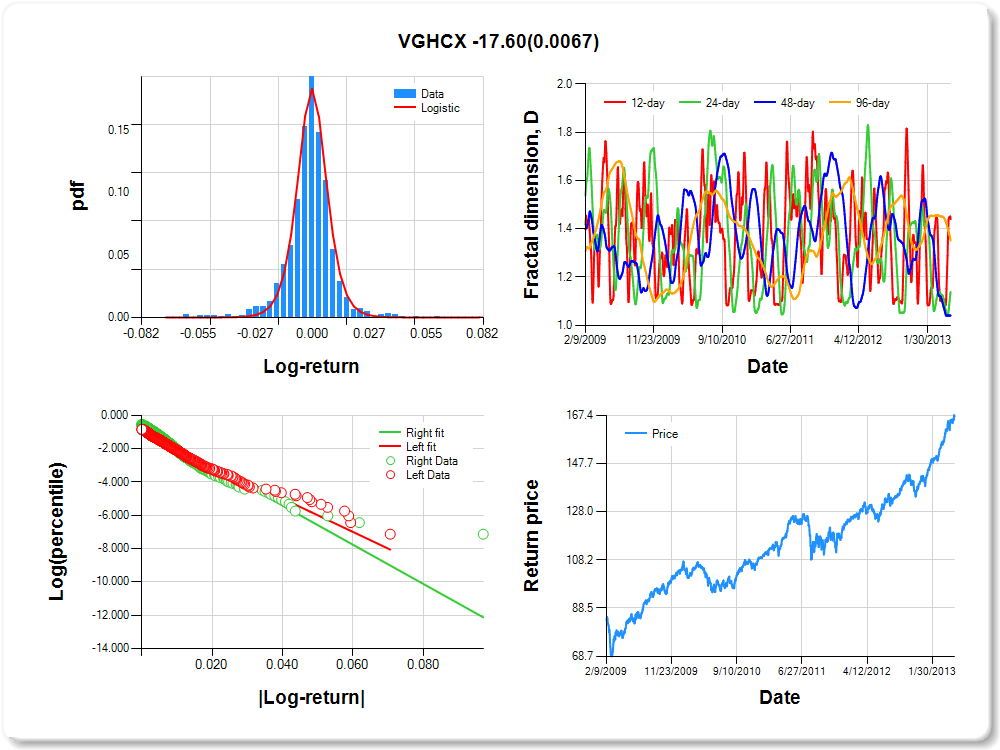

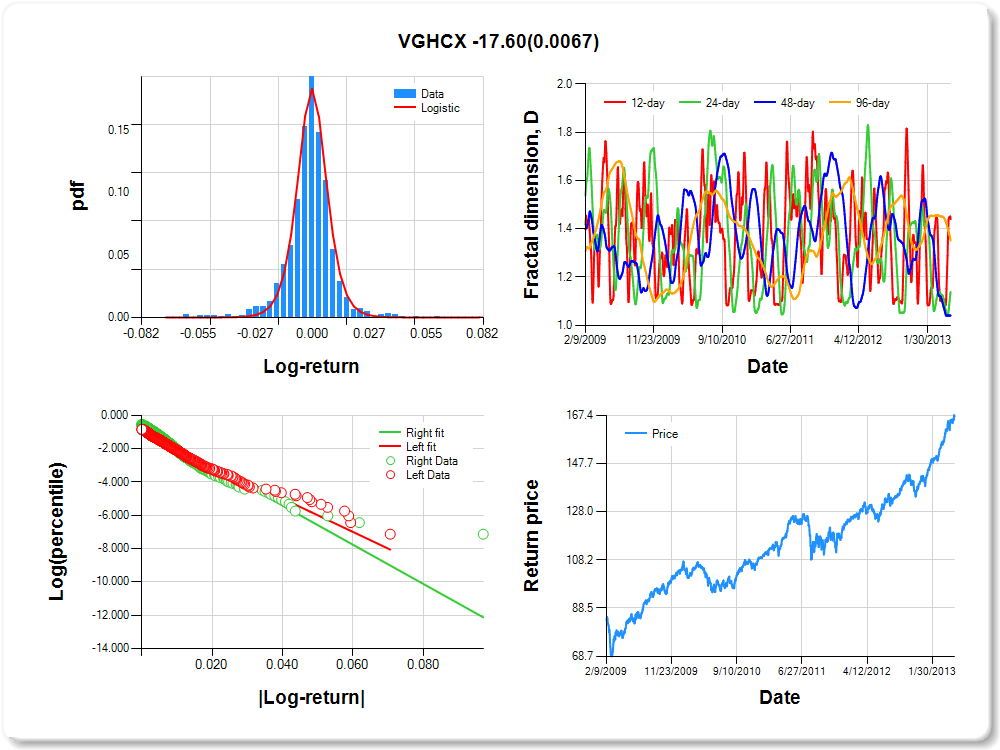

VGHCX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.01 |

0.00 |

0.00 |

0.01 |

0.02 |

0.03 |

0.04 |

0.82 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.241 |

0.094 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.995 |

0.058 |

-17.308 |

0.0000 |

|log-return| |

-100.017 |

4.485 |

-22.301 |

0.0000 |

I(right-tail) |

0.288 |

0.077 |

3.753 |

0.0002 |

|log-return|*I(right-tail) |

-17.597 |

6.482 |

-2.715 |

0.0067 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.559 |

0.862 |

0.959 |

0.649 |

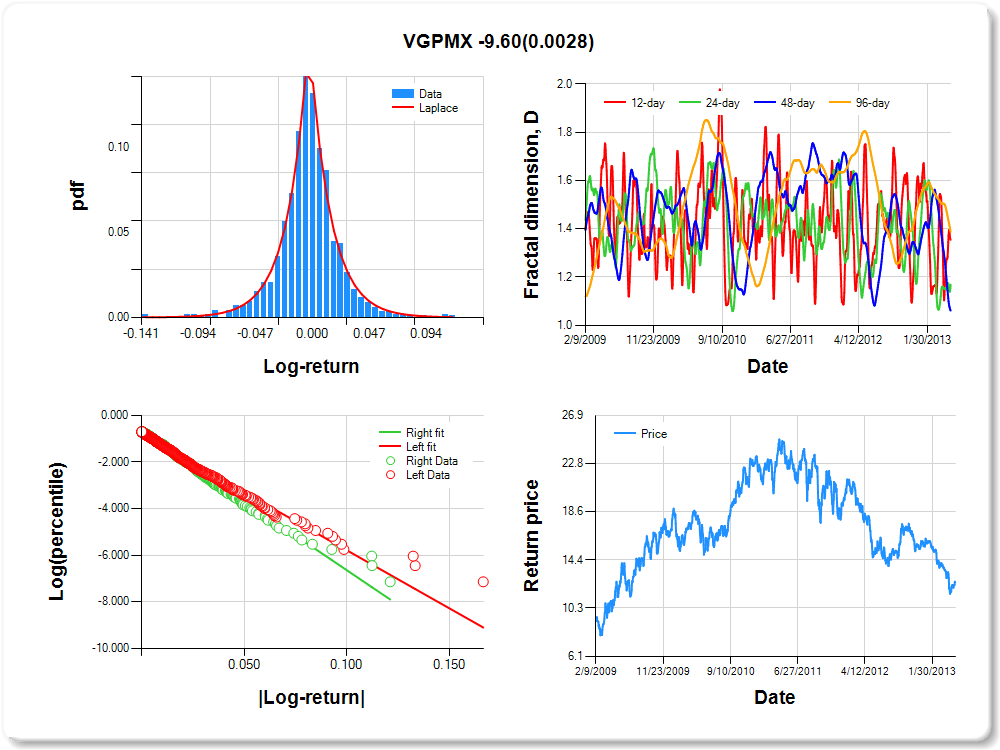

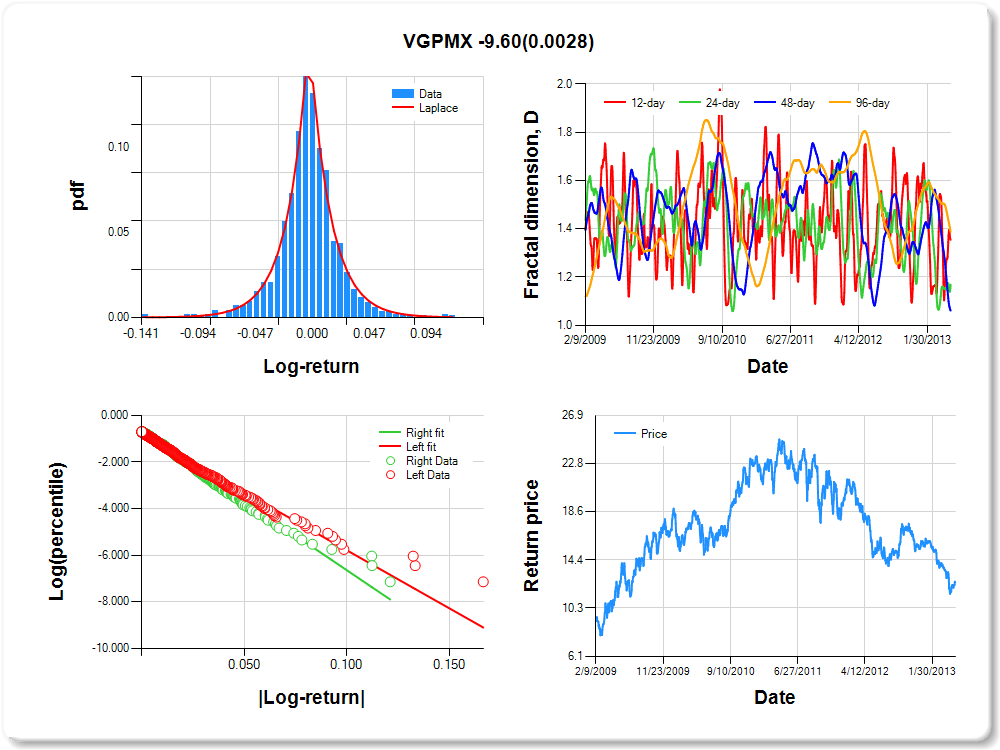

VGPMX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.09 |

-0.08 |

-0.04 |

-0.03 |

-0.01 |

0.00 |

0.01 |

0.04 |

0.06 |

0.08 |

1.28 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.270 |

0.207 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.795 |

0.055 |

-14.517 |

0.0000 |

|log-return| |

-49.758 |

2.056 |

-24.196 |

0.0000 |

I(right-tail) |

0.108 |

0.080 |

1.351 |

0.1770 |

|log-return|*I(right-tail) |

-9.595 |

3.204 |

-2.995 |

0.0028 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.645 |

0.832 |

0.939 |

0.613 |

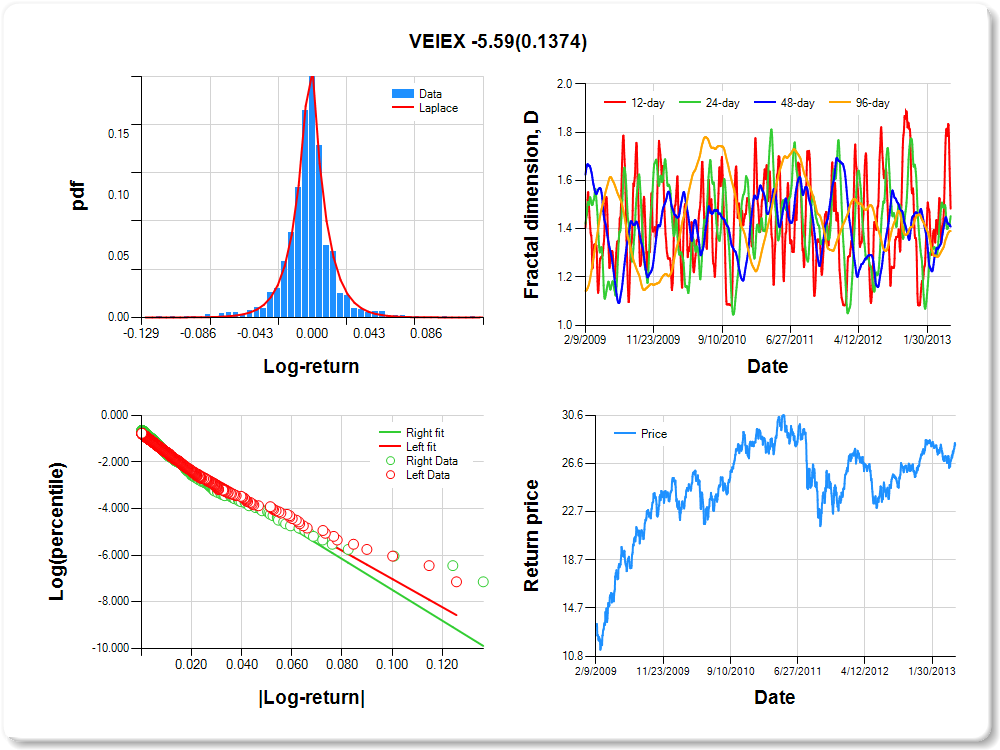

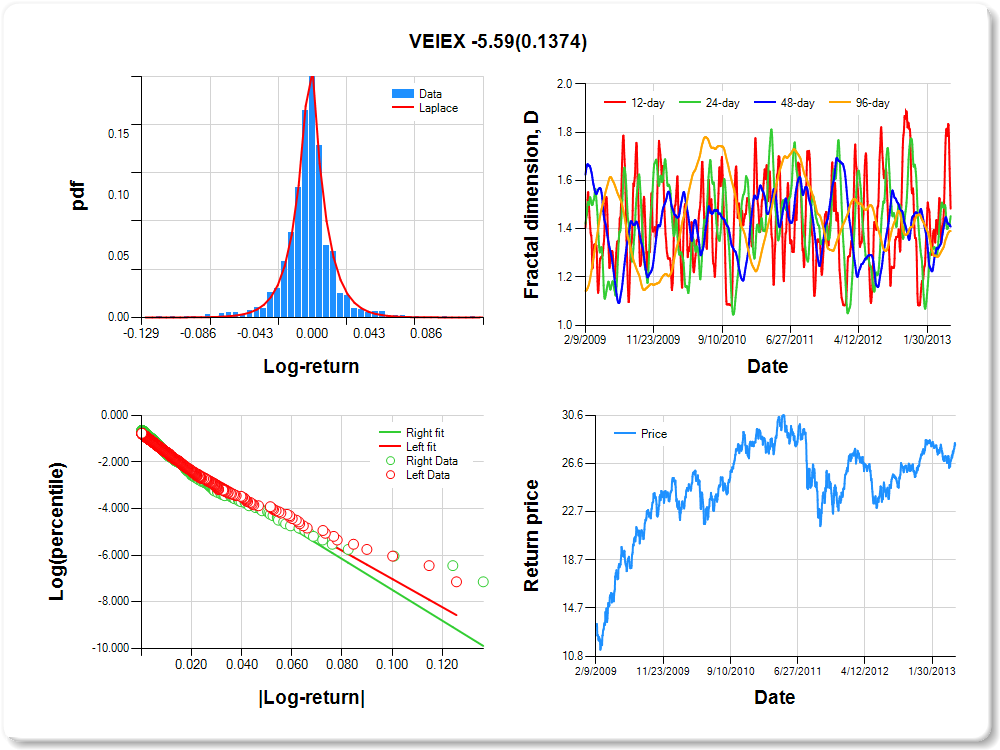

VEIEX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.08 |

-0.06 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.06 |

0.07 |

0.33 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.058 |

0.146 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.951 |

0.054 |

-17.503 |

0.0000 |

|log-return| |

-60.448 |

2.608 |

-23.179 |

0.0000 |

I(right-tail) |

0.093 |

0.074 |

1.253 |

0.2104 |

|log-return|*I(right-tail) |

-5.593 |

3.763 |

-1.486 |

0.1374 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.516 |

0.547 |

0.591 |

0.609 |

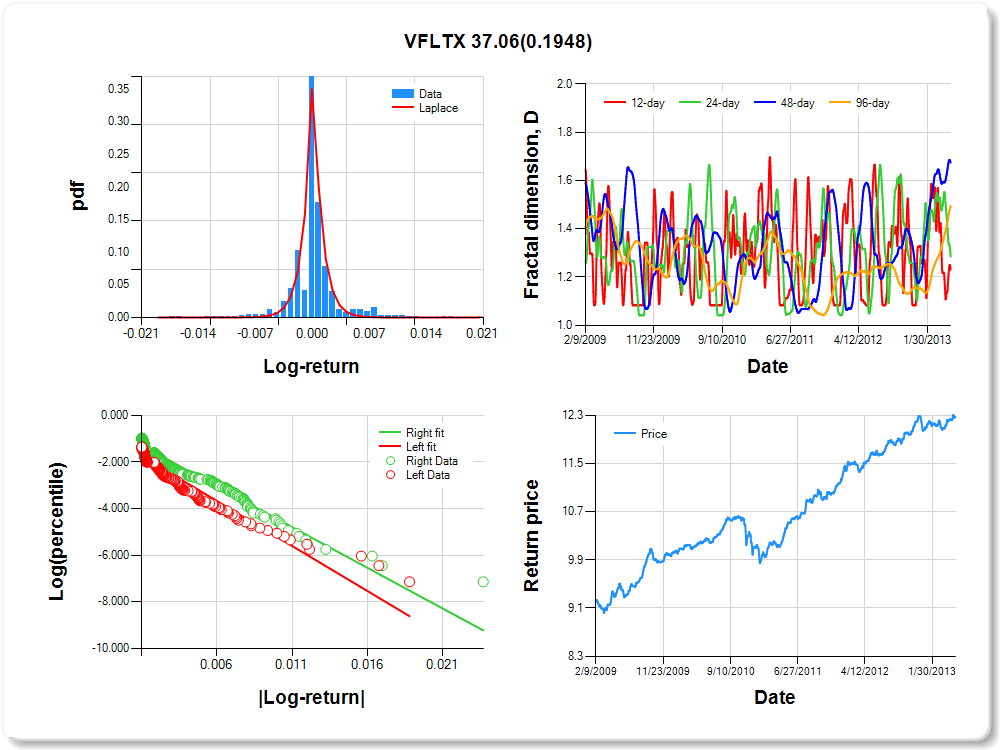

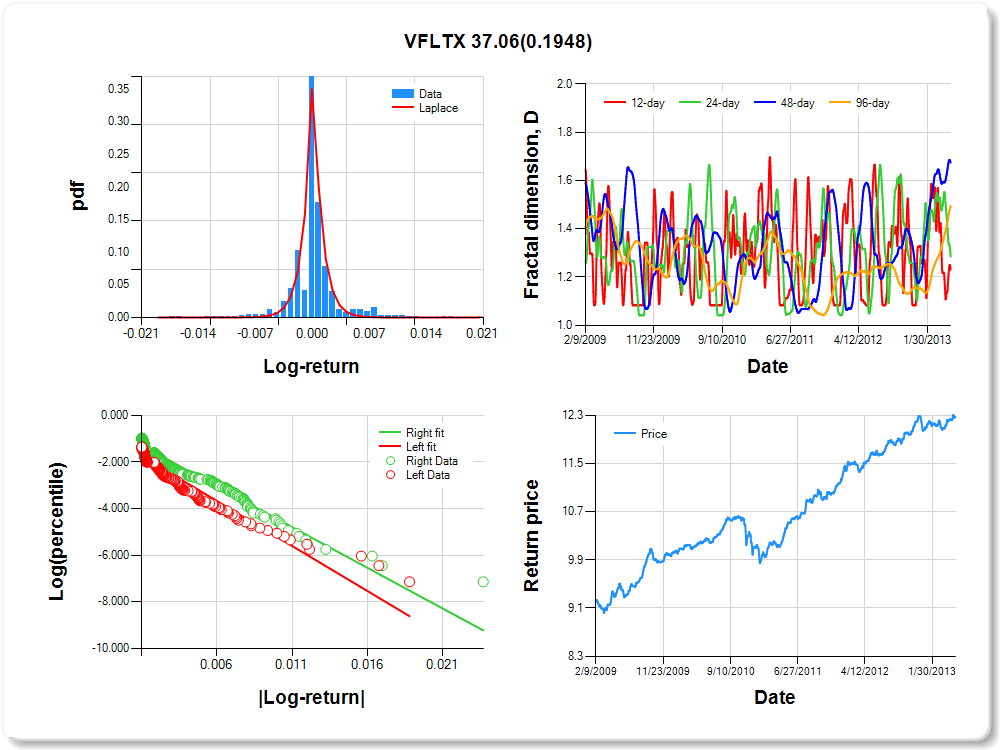

VFLTX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.01 |

-0.01 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.01 |

0.01 |

0.01 |

0.29 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.162 |

0.087 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-1.441 |

0.078 |

-18.410 |

0.0000 |

|log-return| |

-385.102 |

23.096 |

-16.674 |

0.0000 |

I(right-tail) |

0.407 |

0.101 |

4.012 |

0.0001 |

|log-return|*I(right-tail) |

37.057 |

28.558 |

1.298 |

0.1948 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.769 |

0.715 |

0.325 |

0.505 |

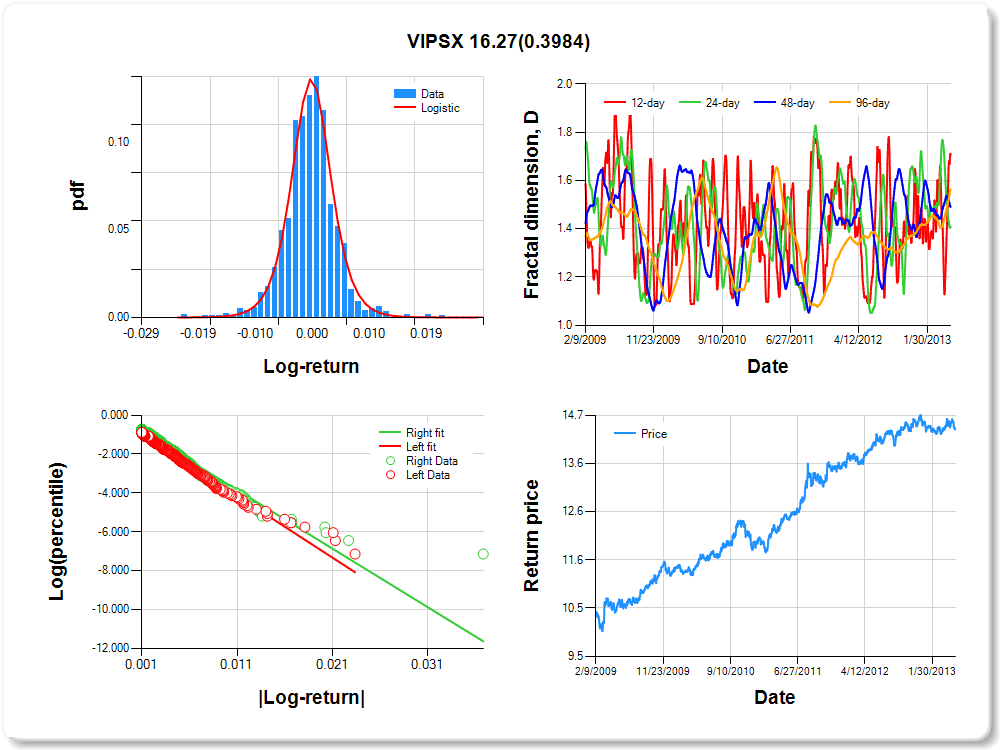

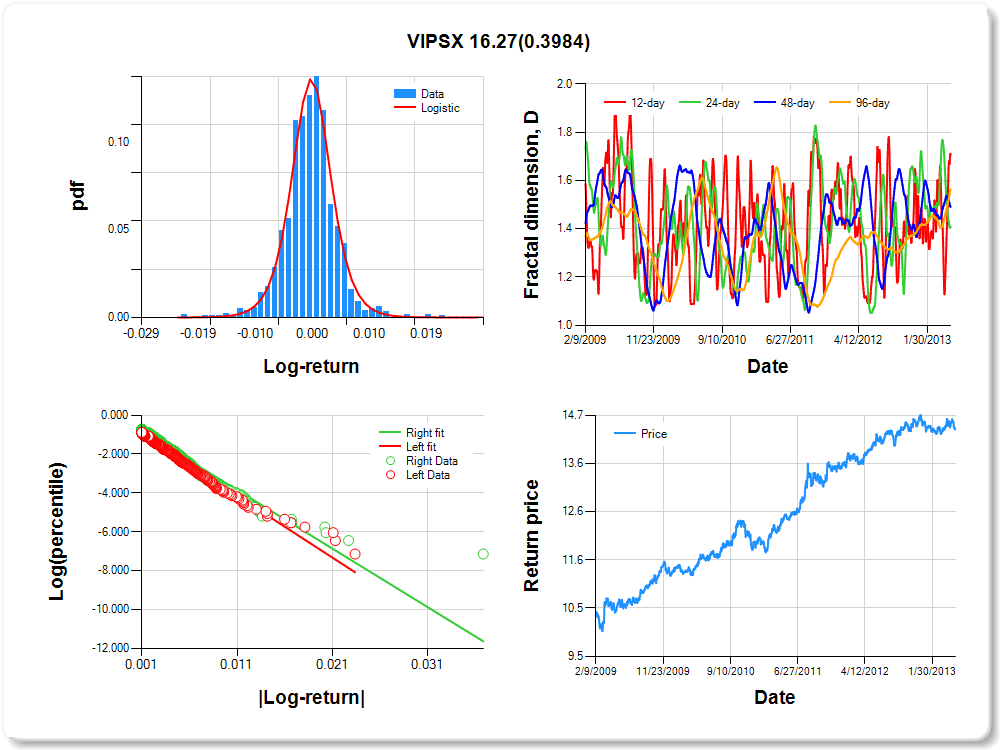

VIPSX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.02 |

-0.01 |

-0.01 |

0.00 |

0.00 |

0.00 |

0.00 |

0.01 |

0.01 |

0.01 |

0.42 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.364 |

0.126 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.758 |

0.067 |

-11.357 |

0.0000 |

|log-return| |

-317.833 |

14.362 |

-22.131 |

0.0000 |

I(right-tail) |

0.127 |

0.091 |

1.405 |

0.1602 |

|log-return|*I(right-tail) |

16.269 |

19.257 |

0.845 |

0.3984 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.293 |

0.591 |

0.508 |

0.435 |