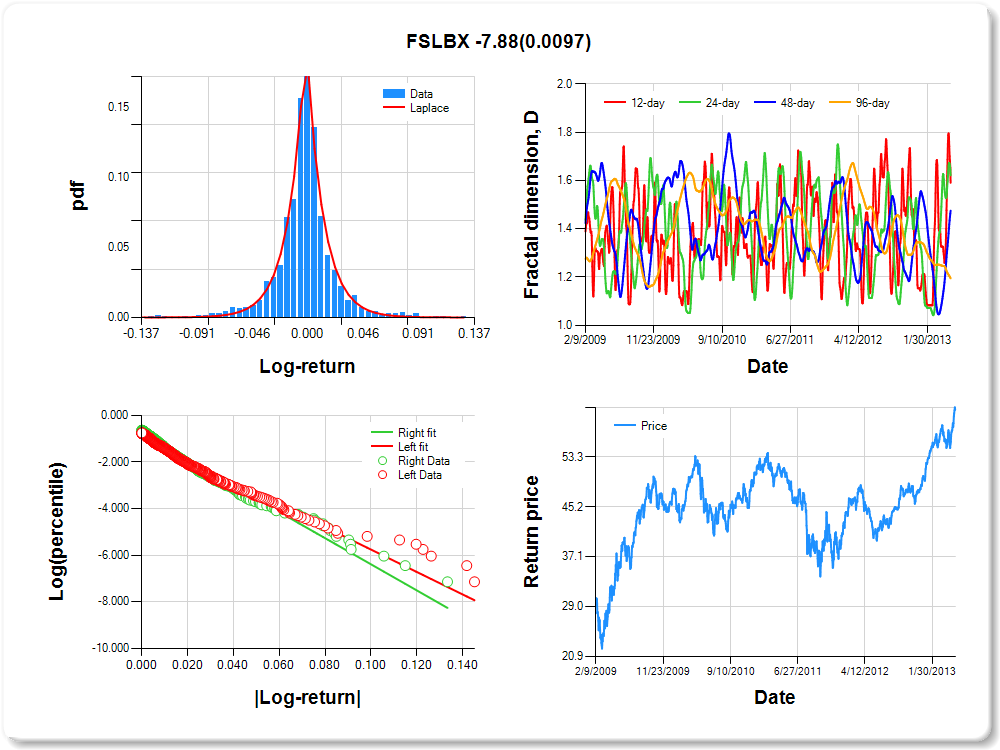

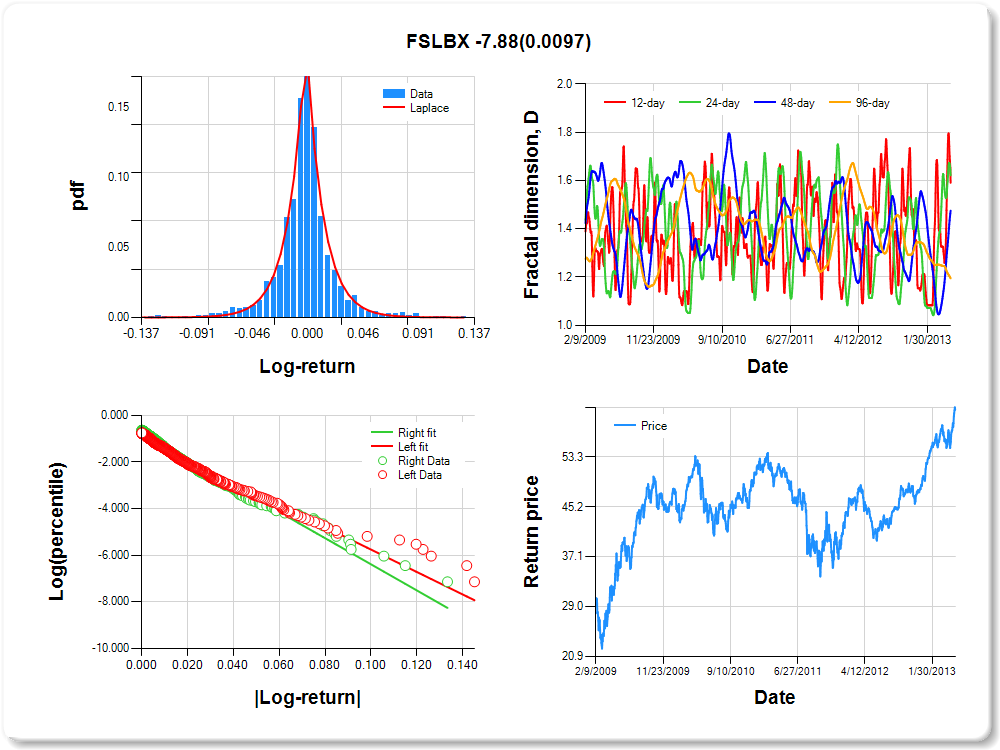

FSLBX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.11 |

-0.07 |

-0.04 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.04 |

0.08 |

0.09 |

0.68 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.084 |

0.171 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.945 |

0.054 |

-17.547 |

0.0000 |

|log-return| |

-48.050 |

2.056 |

-23.375 |

0.0000 |

I(right-tail) |

0.158 |

0.075 |

2.118 |

0.0344 |

|log-return|*I(right-tail) |

-7.883 |

3.042 |

-2.591 |

0.0097 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.409 |

0.378 |

0.525 |

0.806 |

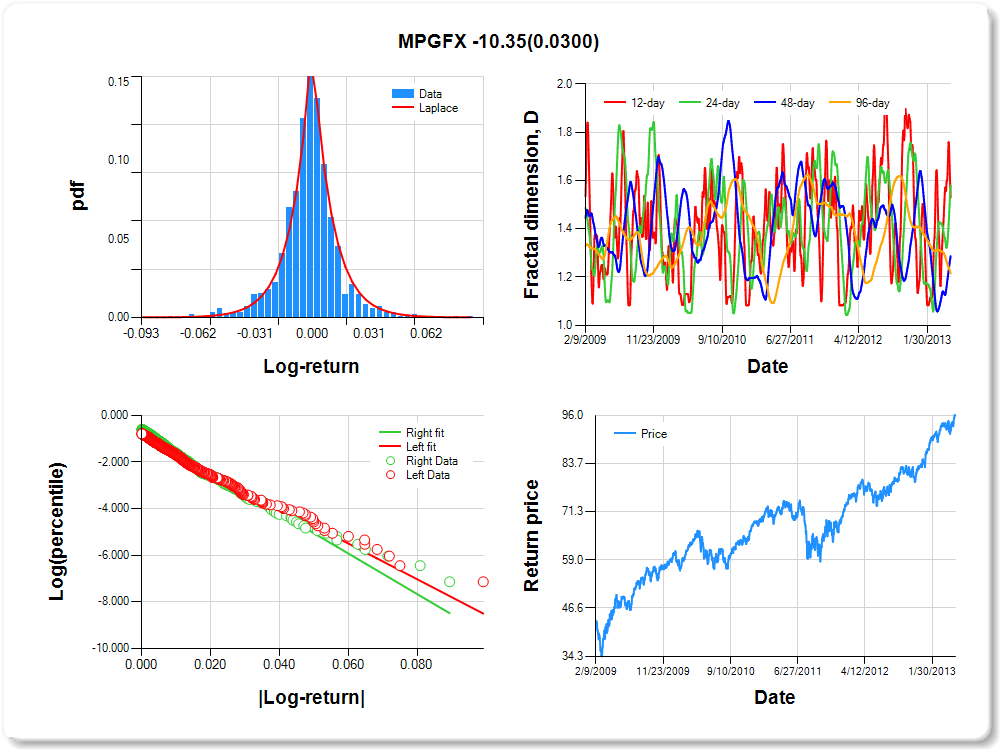

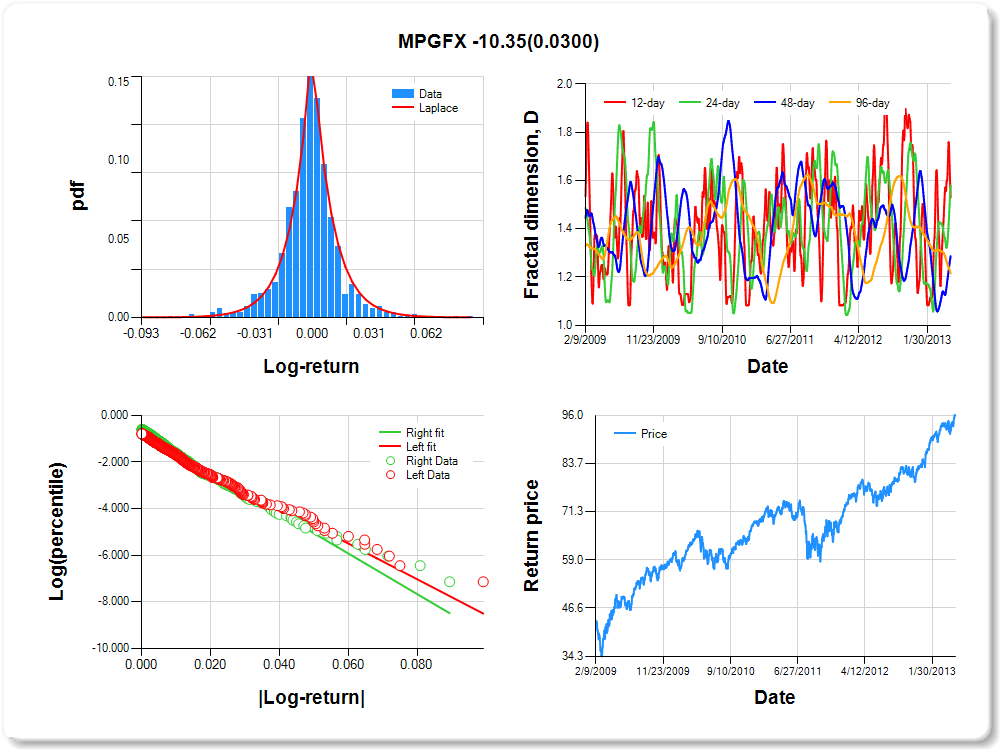

MPGFX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.05 |

0.06 |

0.43 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.118 |

0.192 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.901 |

0.057 |

-15.814 |

0.0000 |

|log-return| |

-76.550 |

3.312 |

-23.114 |

0.0000 |

I(right-tail) |

0.194 |

0.077 |

2.515 |

0.0120 |

|log-return|*I(right-tail) |

-10.350 |

4.765 |

-2.172 |

0.0300 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.470 |

0.421 |

0.713 |

0.785 |

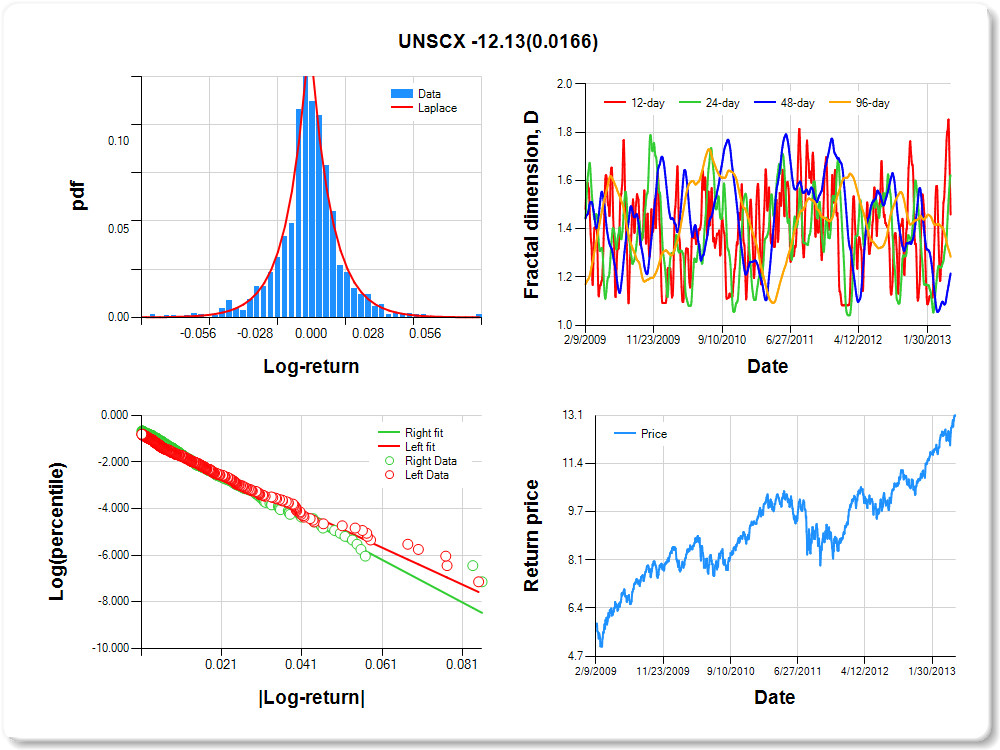

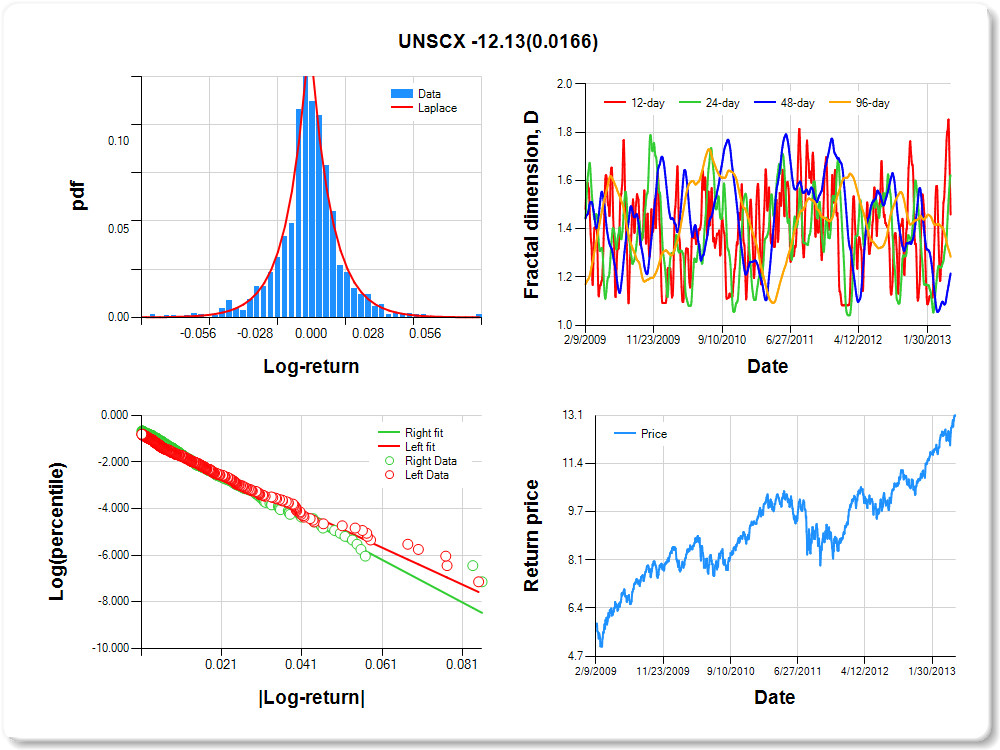

UNSCX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.04 |

-0.02 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

0.90 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.001 |

0.210 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.877 |

0.059 |

-14.943 |

0.0000 |

|log-return| |

-78.990 |

3.444 |

-22.936 |

0.0000 |

I(right-tail) |

0.214 |

0.082 |

2.620 |

0.0089 |

|log-return|*I(right-tail) |

-12.134 |

5.058 |

-2.399 |

0.0166 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.541 |

0.378 |

0.785 |

0.716 |

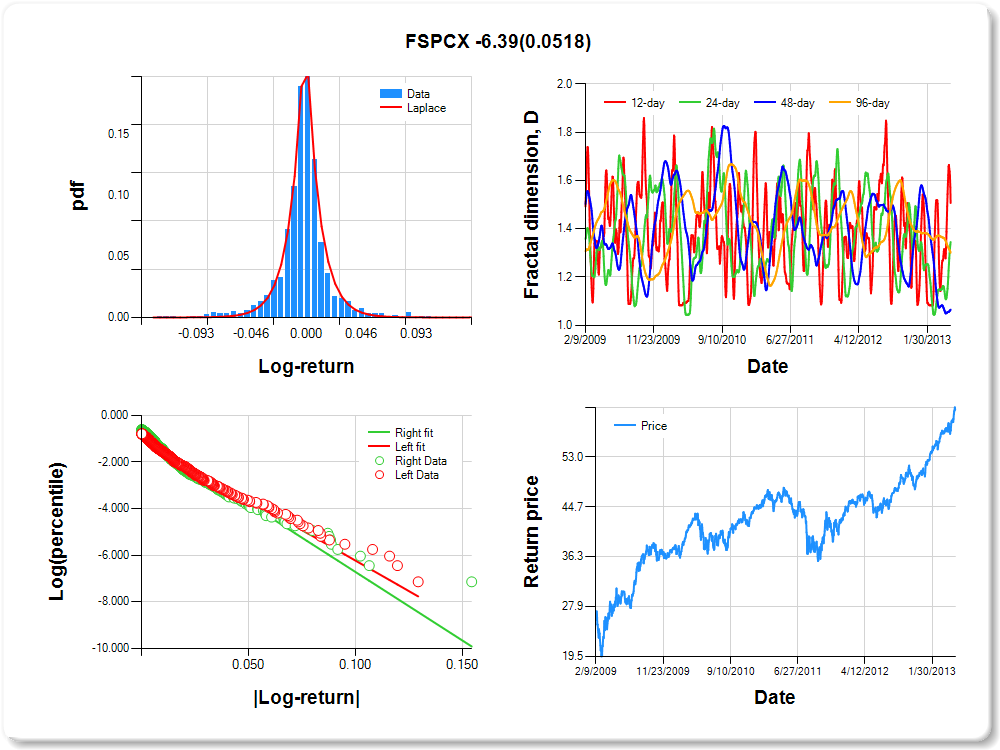

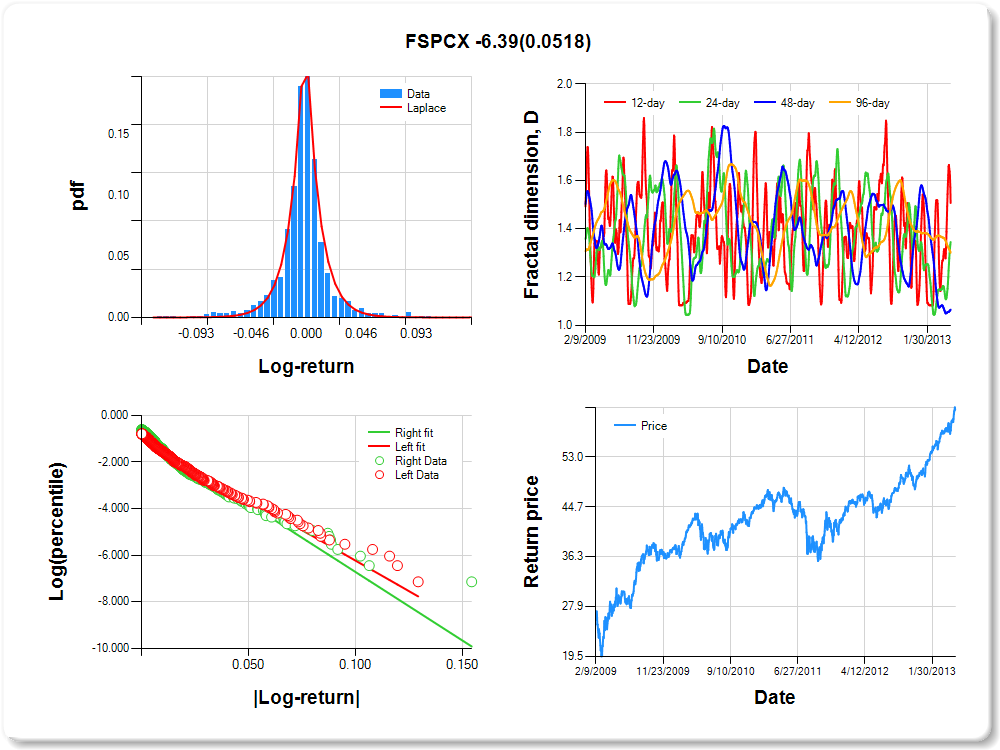

FSPCX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.08 |

-0.07 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.07 |

0.09 |

0.75 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.133 |

0.139 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.994 |

0.054 |

-18.266 |

0.0000 |

|log-return| |

-52.332 |

2.278 |

-22.972 |

0.0000 |

I(right-tail) |

0.152 |

0.074 |

2.070 |

0.0386 |

|log-return|*I(right-tail) |

-6.393 |

3.284 |

-1.946 |

0.0518 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.493 |

0.655 |

0.935 |

0.699 |

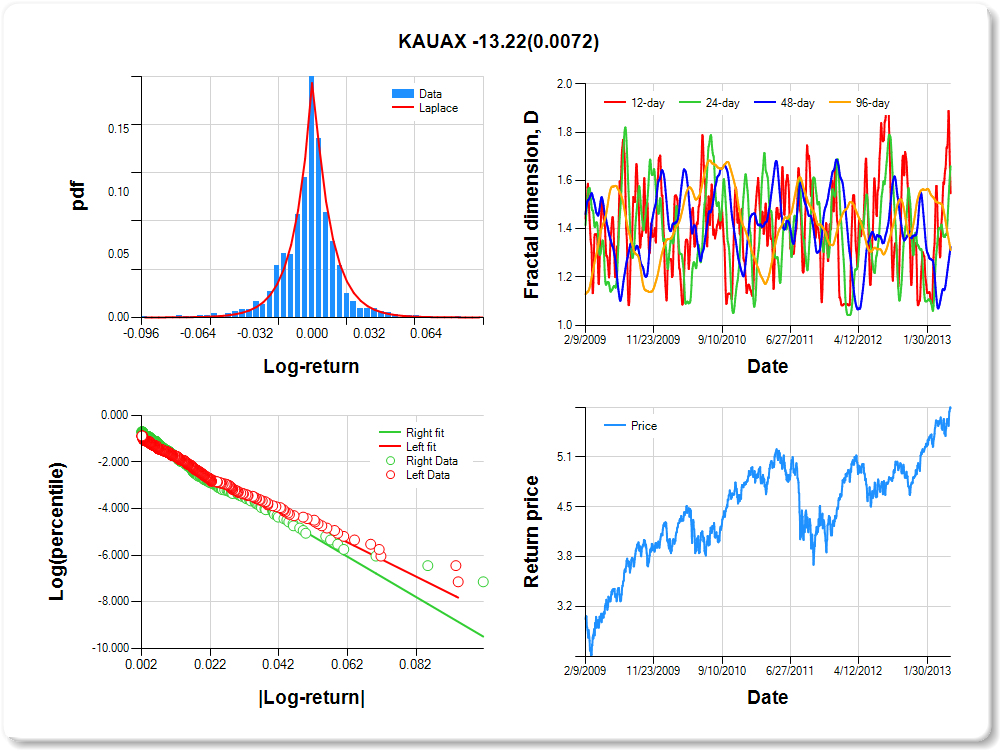

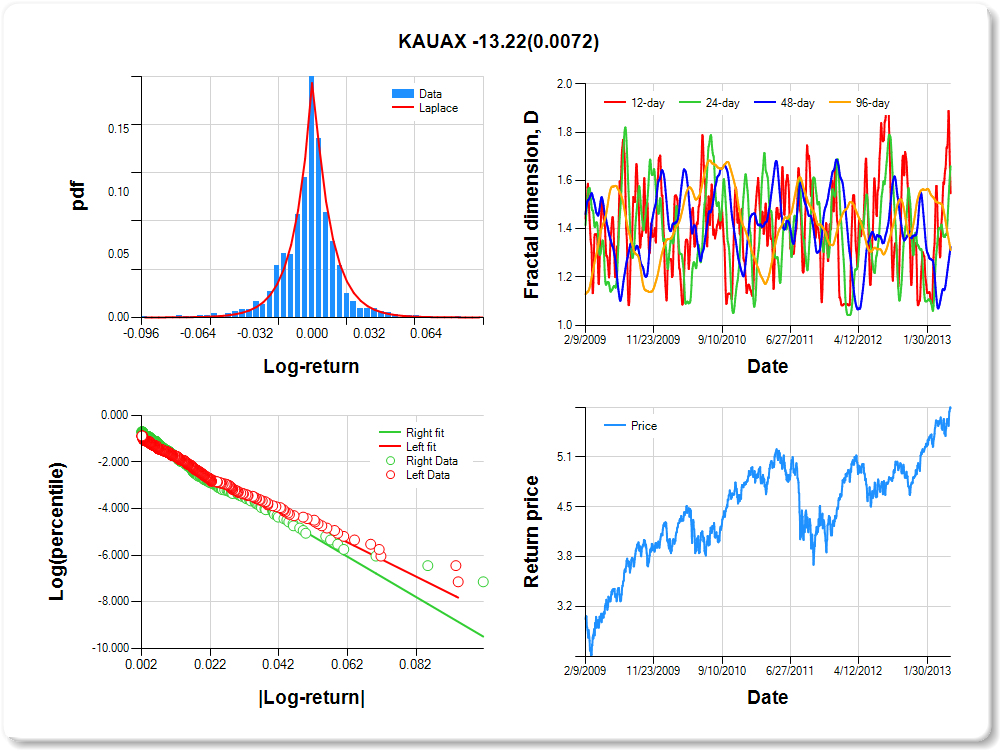

KAUAX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.05 |

0.06 |

0.30 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.027 |

0.176 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.928 |

0.062 |

-15.049 |

0.0000 |

|log-return| |

-73.298 |

3.325 |

-22.042 |

0.0000 |

I(right-tail) |

0.203 |

0.084 |

2.413 |

0.0160 |

|log-return|*I(right-tail) |

-13.223 |

4.908 |

-2.694 |

0.0072 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.453 |

0.340 |

0.675 |

0.688 |

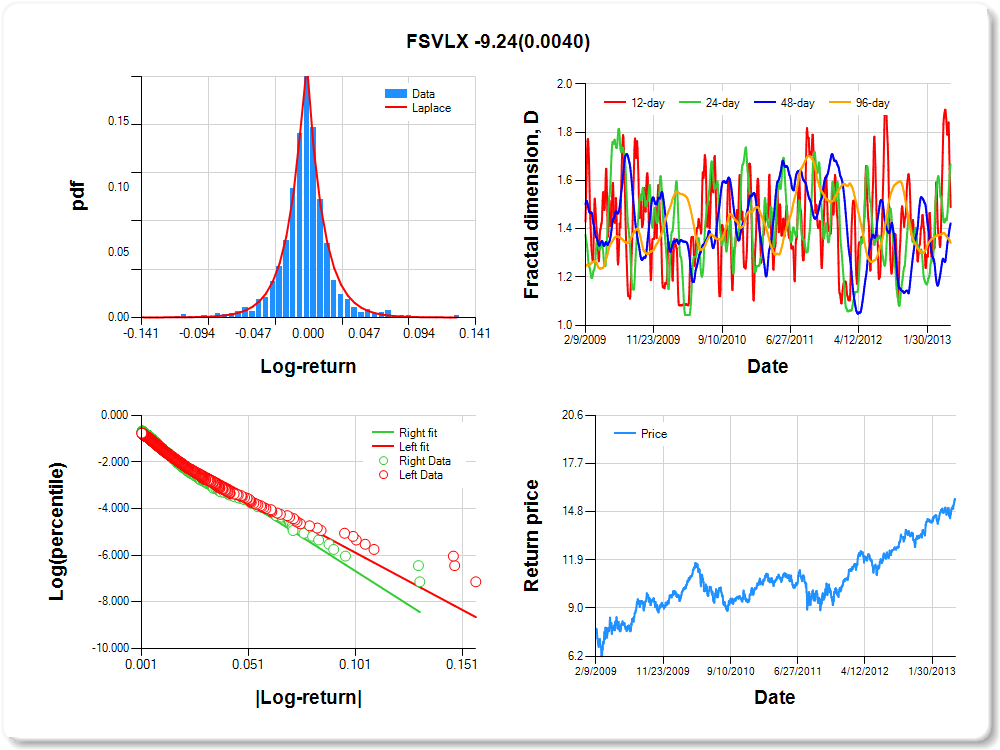

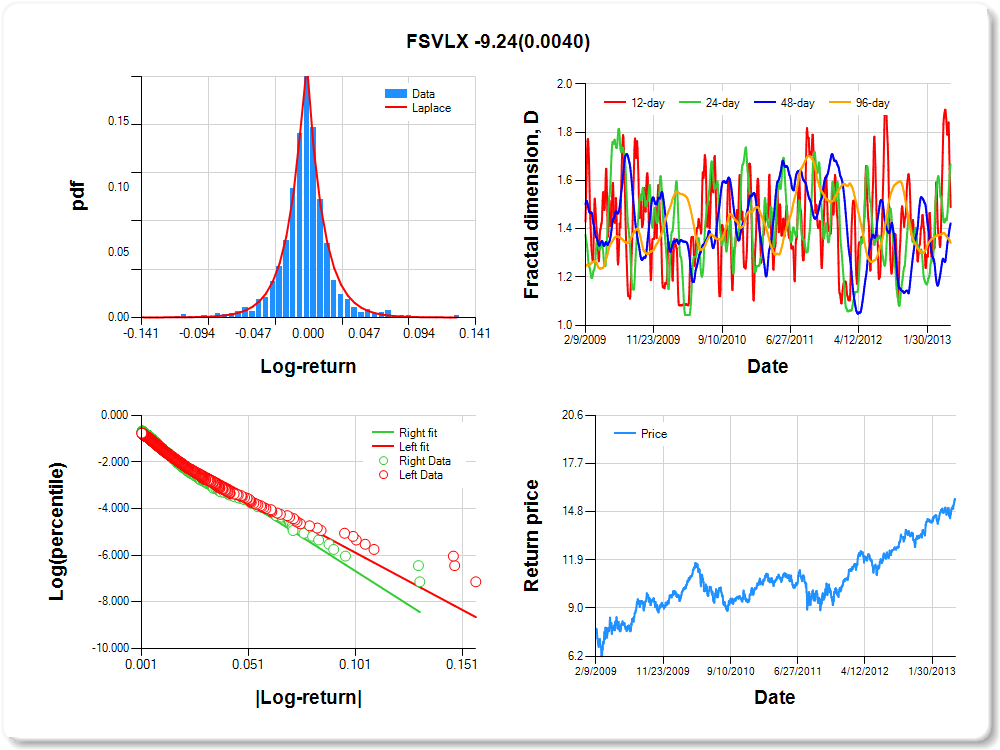

FSVLX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.10 |

-0.07 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.07 |

0.08 |

0.29 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.164 |

0.168 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.966 |

0.054 |

-17.876 |

0.0000 |

|log-return| |

-49.069 |

2.131 |

-23.026 |

0.0000 |

I(right-tail) |

0.138 |

0.075 |

1.833 |

0.0671 |

|log-return|*I(right-tail) |

-9.239 |

3.208 |

-2.880 |

0.0040 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.510 |

0.332 |

0.577 |

0.659 |

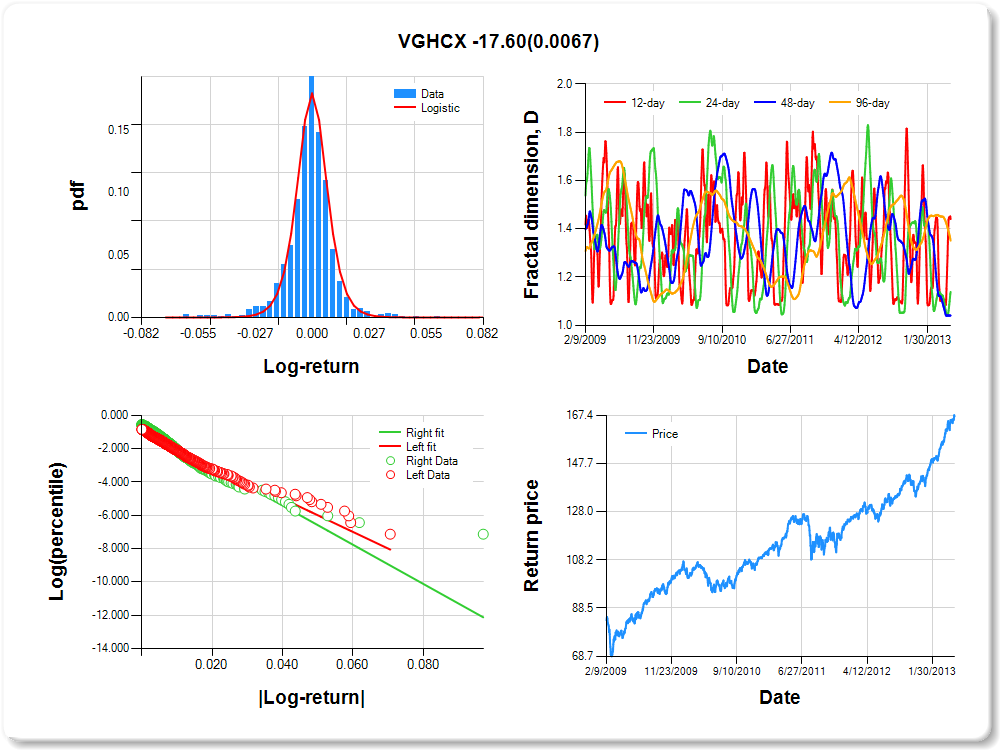

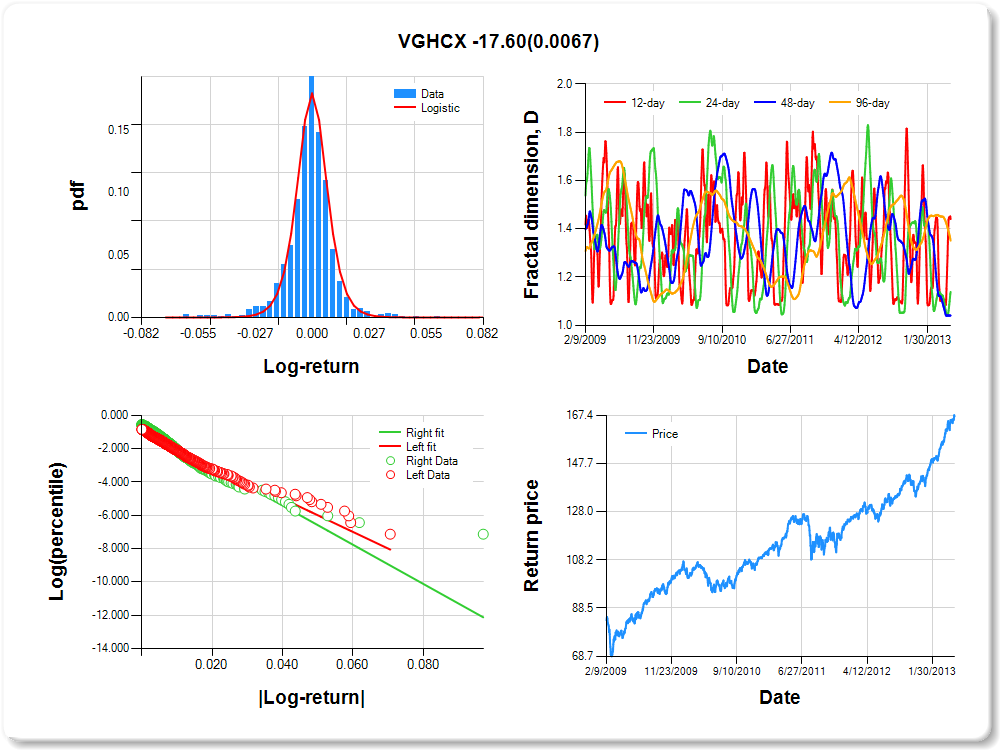

VGHCX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.01 |

0.00 |

0.00 |

0.01 |

0.02 |

0.03 |

0.04 |

0.00 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.240 |

0.096 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.995 |

0.058 |

-17.308 |

0.0000 |

|log-return| |

-100.017 |

4.485 |

-22.301 |

0.0000 |

I(right-tail) |

0.288 |

0.077 |

3.753 |

0.0002 |

|log-return|*I(right-tail) |

-17.597 |

6.482 |

-2.715 |

0.0067 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.559 |

0.862 |

0.959 |

0.649 |

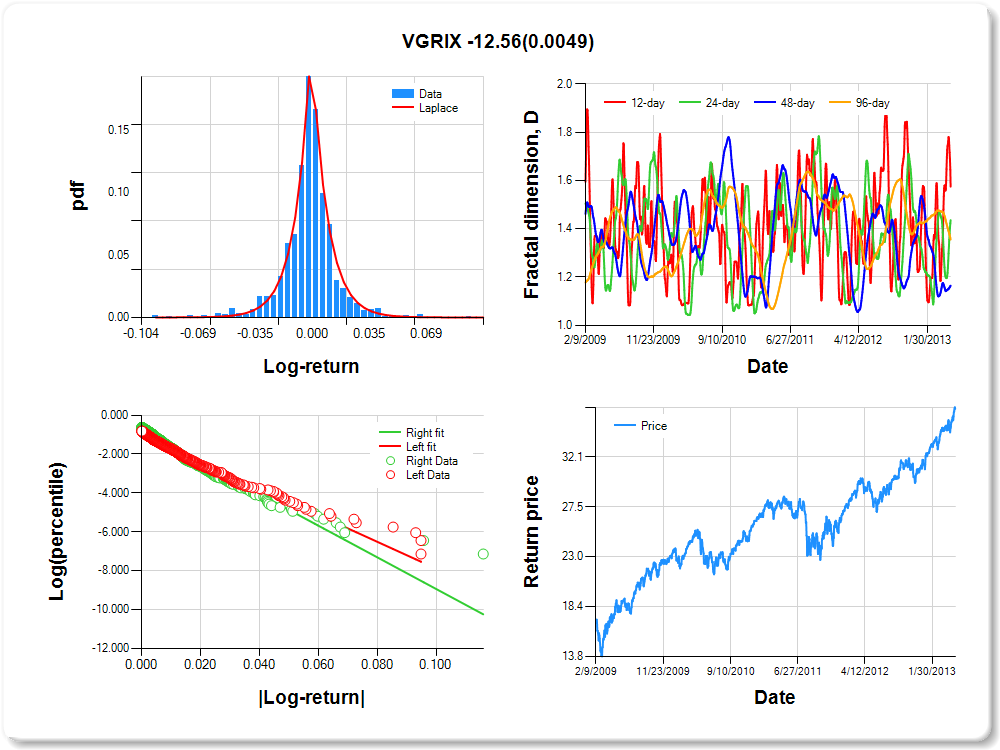

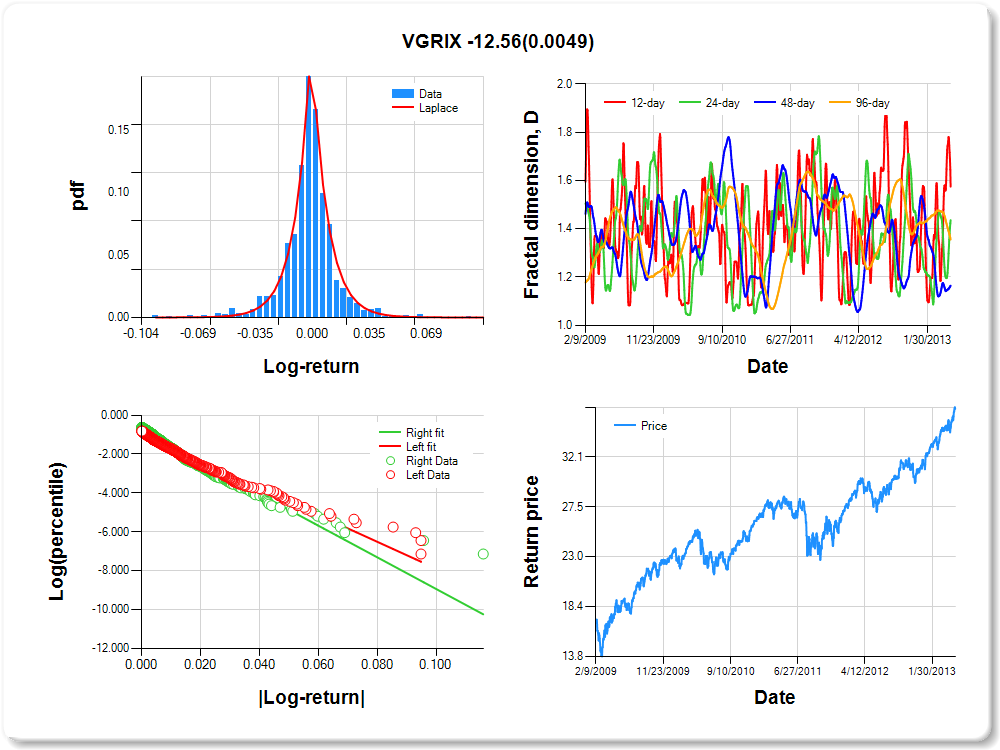

VGRIX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.07 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.06 |

1.30 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.149 |

0.155 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.985 |

0.056 |

-17.661 |

0.0000 |

|log-return| |

-68.835 |

3.022 |

-22.778 |

0.0000 |

I(right-tail) |

0.209 |

0.076 |

2.760 |

0.0059 |

|log-return|*I(right-tail) |

-12.556 |

4.456 |

-2.818 |

0.0049 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.425 |

0.564 |

0.836 |

0.644 |

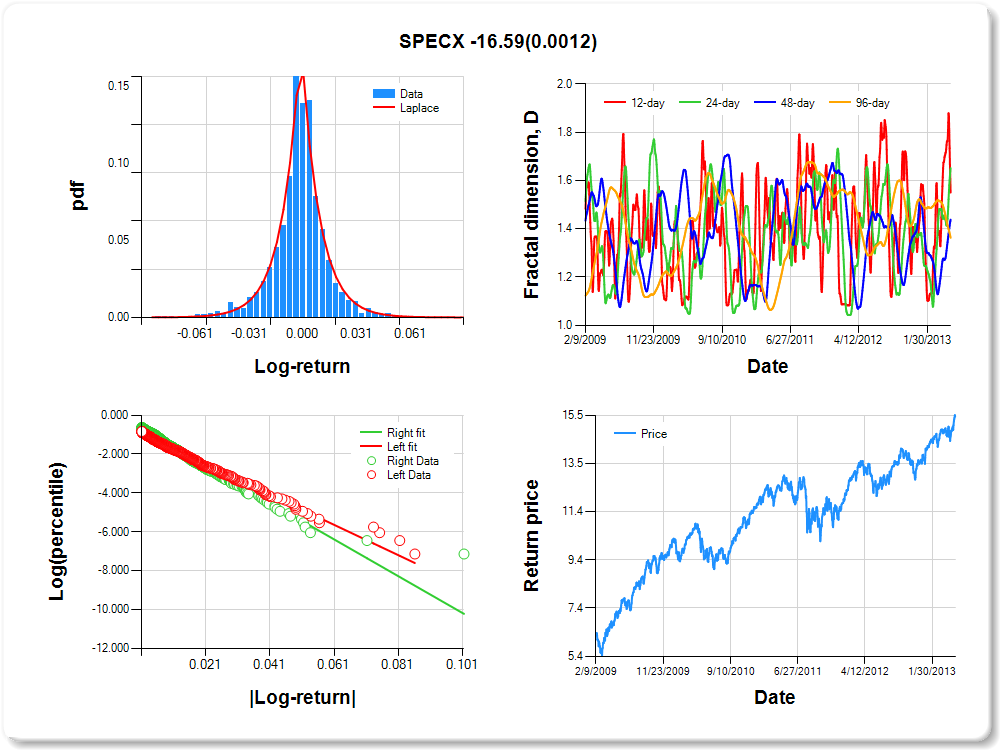

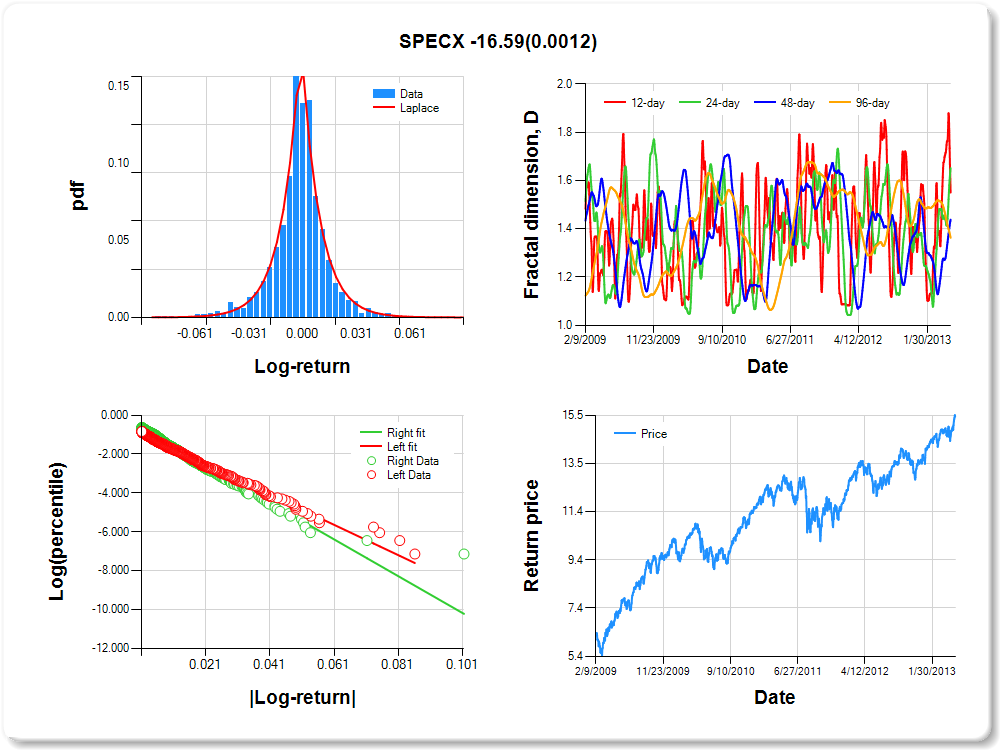

SPECX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

1.02 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.128 |

0.190 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.910 |

0.059 |

-15.413 |

0.0000 |

|log-return| |

-77.950 |

3.432 |

-22.710 |

0.0000 |

I(right-tail) |

0.258 |

0.081 |

3.196 |

0.0014 |

|log-return|*I(right-tail) |

-16.590 |

5.106 |

-3.249 |

0.0012 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.450 |

0.349 |

0.562 |

0.637 |

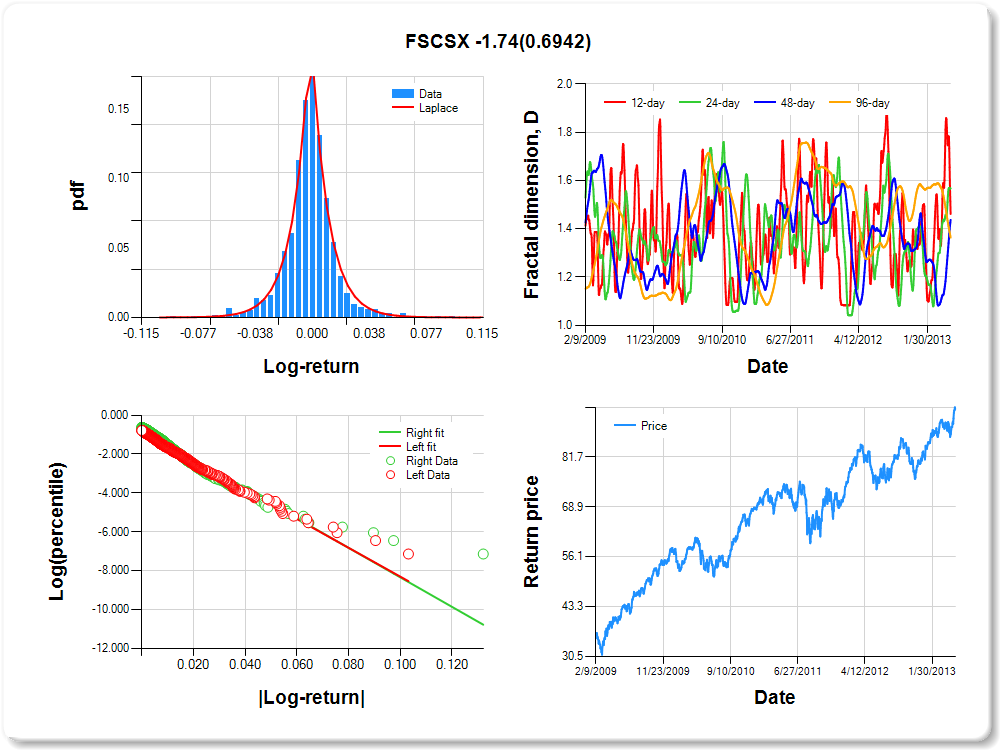

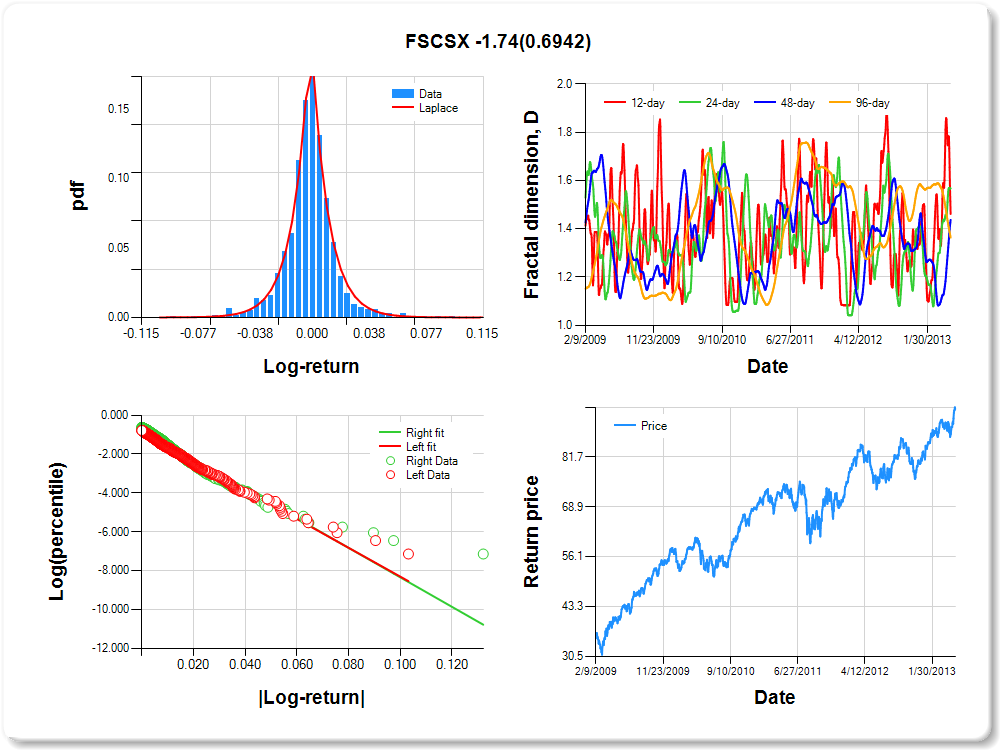

FSCSX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.06 |

1.56 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.195 |

0.166 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.882 |

0.057 |

-15.522 |

0.0000 |

|log-return| |

-74.132 |

3.189 |

-23.247 |

0.0000 |

I(right-tail) |

0.135 |

0.077 |

1.756 |

0.0793 |

|log-return|*I(right-tail) |

-1.739 |

4.421 |

-0.393 |

0.6942 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.539 |

0.432 |

0.563 |

0.637 |

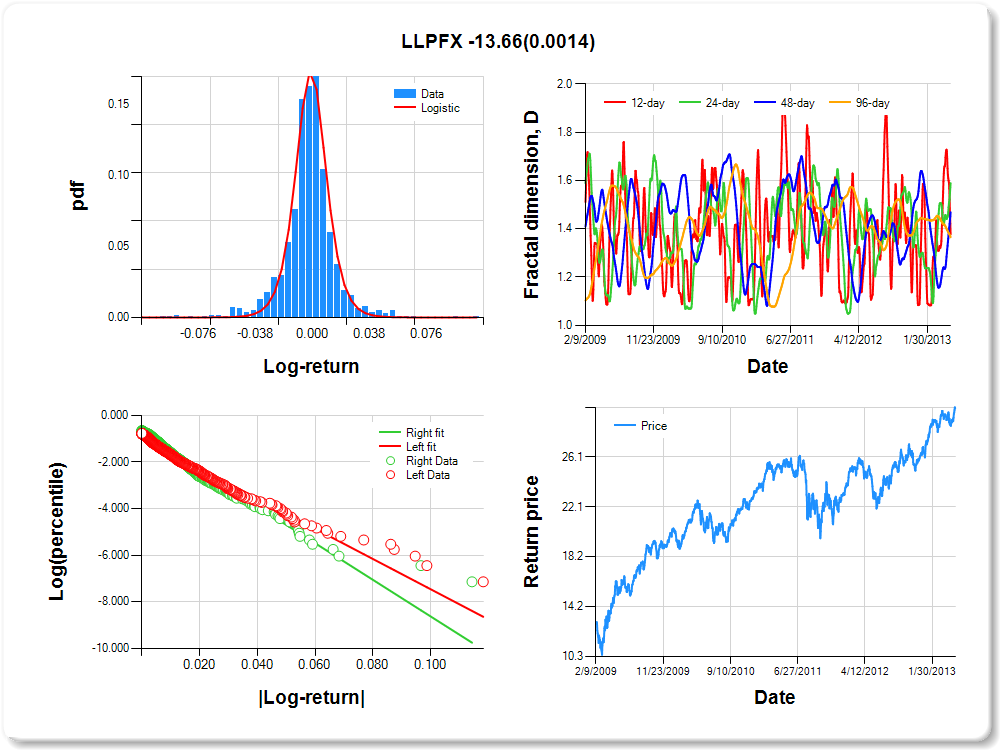

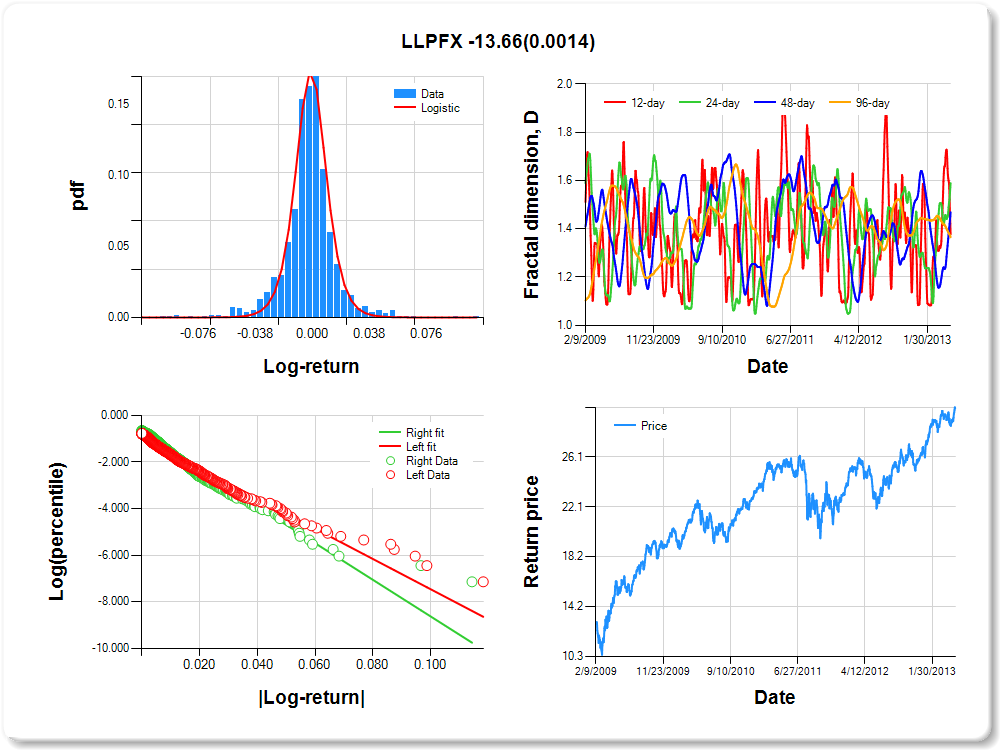

LLPFX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.07 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.06 |

0.65 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.047 |

0.099 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.954 |

0.054 |

-17.503 |

0.0000 |

|log-return| |

-64.887 |

2.798 |

-23.188 |

0.0000 |

I(right-tail) |

0.203 |

0.077 |

2.643 |

0.0083 |

|log-return|*I(right-tail) |

-13.662 |

4.255 |

-3.210 |

0.0014 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.624 |

0.410 |

0.531 |

0.635 |

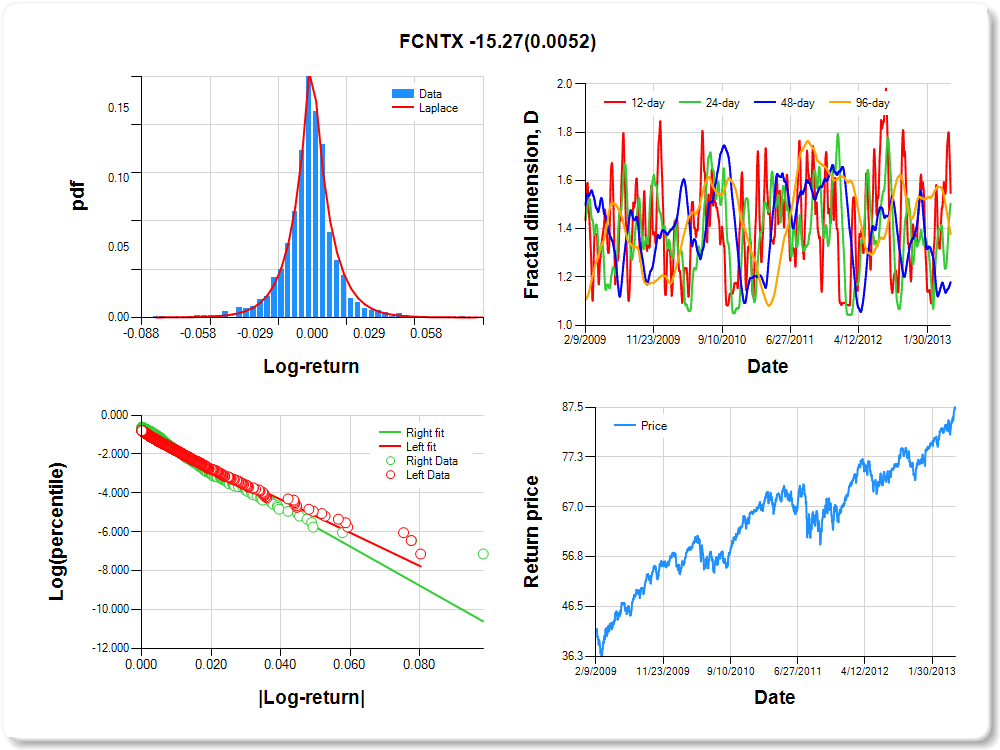

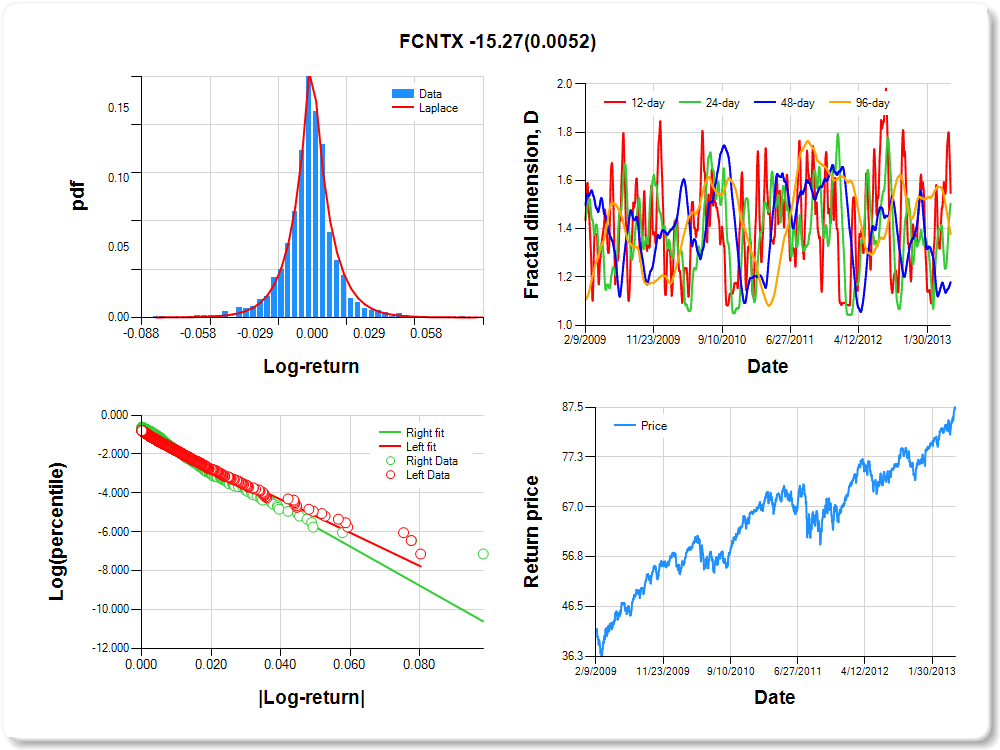

FCNTX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.04 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

0.76 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.148 |

0.171 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.918 |

0.056 |

-16.351 |

0.0000 |

|log-return| |

-85.267 |

3.679 |

-23.179 |

0.0000 |

I(right-tail) |

0.208 |

0.077 |

2.701 |

0.0070 |

|log-return|*I(right-tail) |

-15.270 |

5.450 |

-2.802 |

0.0052 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.452 |

0.496 |

0.821 |

0.622 |

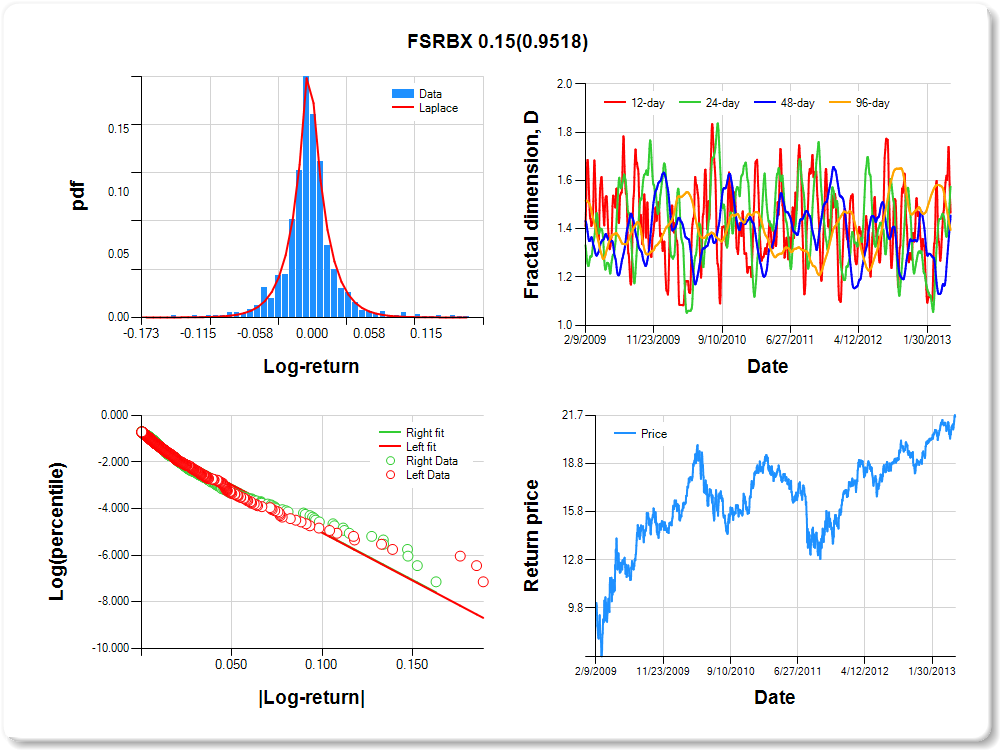

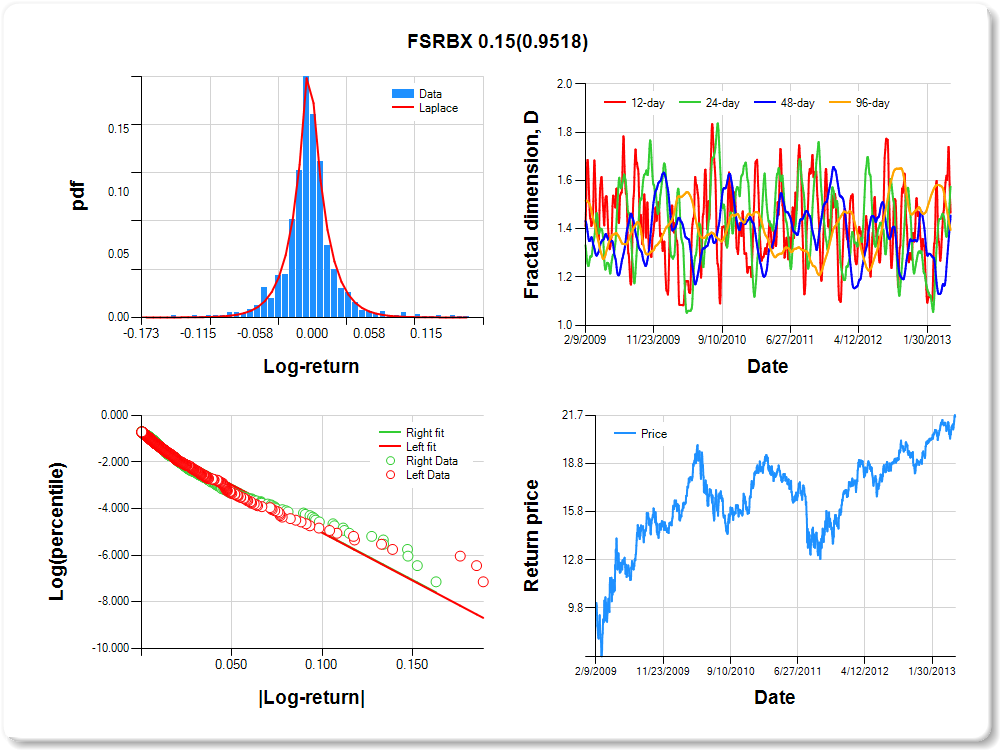

FSRBX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.11 |

-0.08 |

-0.04 |

-0.03 |

-0.01 |

0.00 |

0.01 |

0.04 |

0.10 |

0.14 |

1.41 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.129 |

0.153 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.931 |

0.052 |

-17.896 |

0.0000 |

|log-return| |

-40.860 |

1.725 |

-23.683 |

0.0000 |

I(right-tail) |

0.000 |

0.073 |

-0.001 |

0.9989 |

|log-return|*I(right-tail) |

0.147 |

2.432 |

0.061 |

0.9518 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.533 |

0.425 |

0.545 |

0.605 |

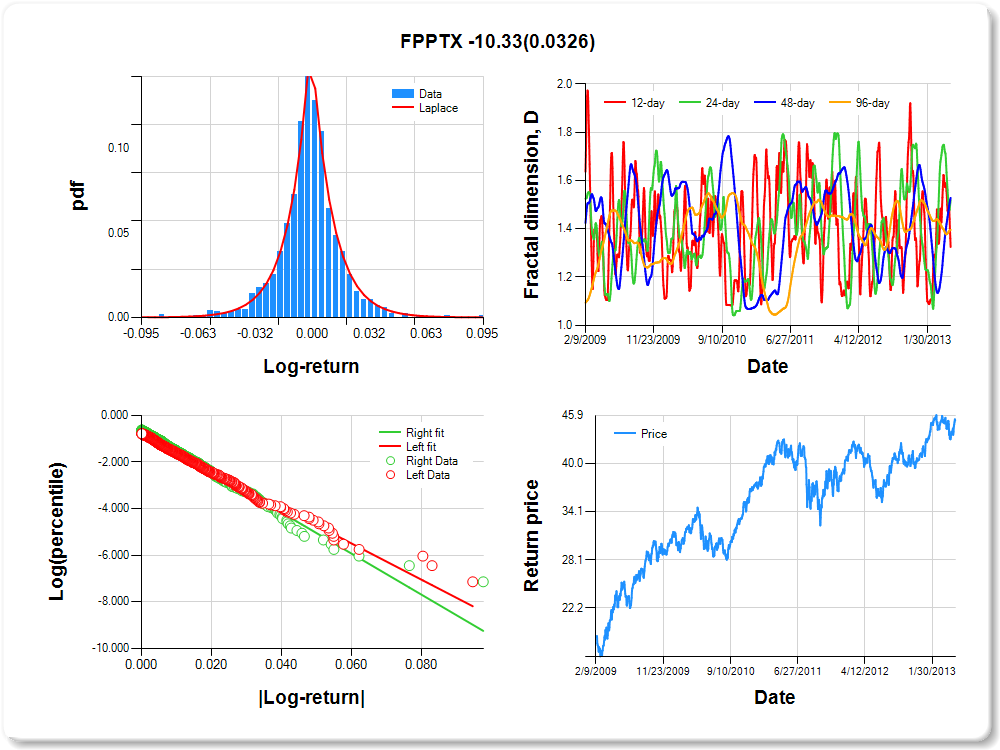

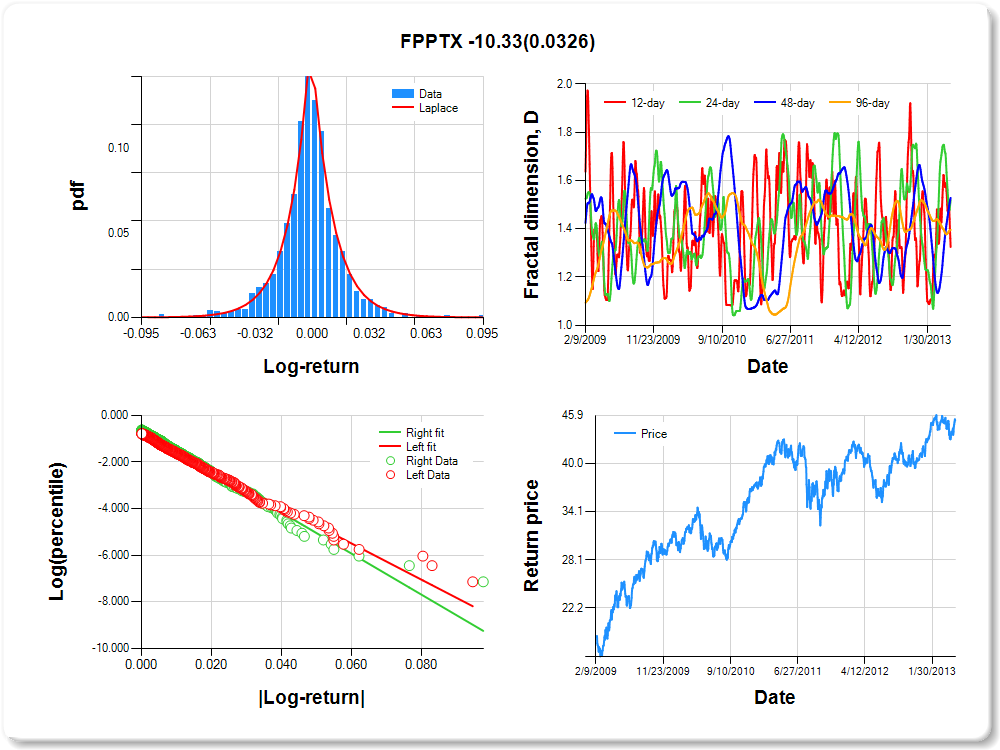

FPPTX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.04 |

0.05 |

1.13 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.008 |

0.207 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.826 |

0.059 |

-14.066 |

0.0000 |

|log-return| |

-77.540 |

3.335 |

-23.247 |

0.0000 |

I(right-tail) |

0.187 |

0.081 |

2.325 |

0.0202 |

|log-return|*I(right-tail) |

-10.326 |

4.827 |

-2.139 |

0.0326 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.675 |

0.483 |

0.472 |

0.604 |

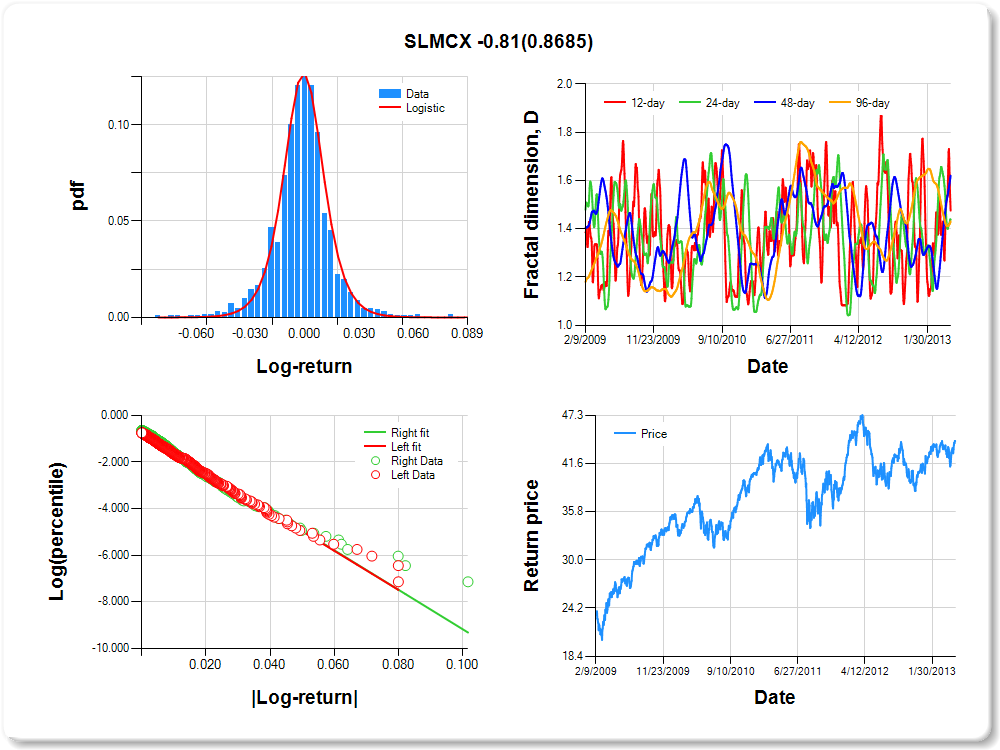

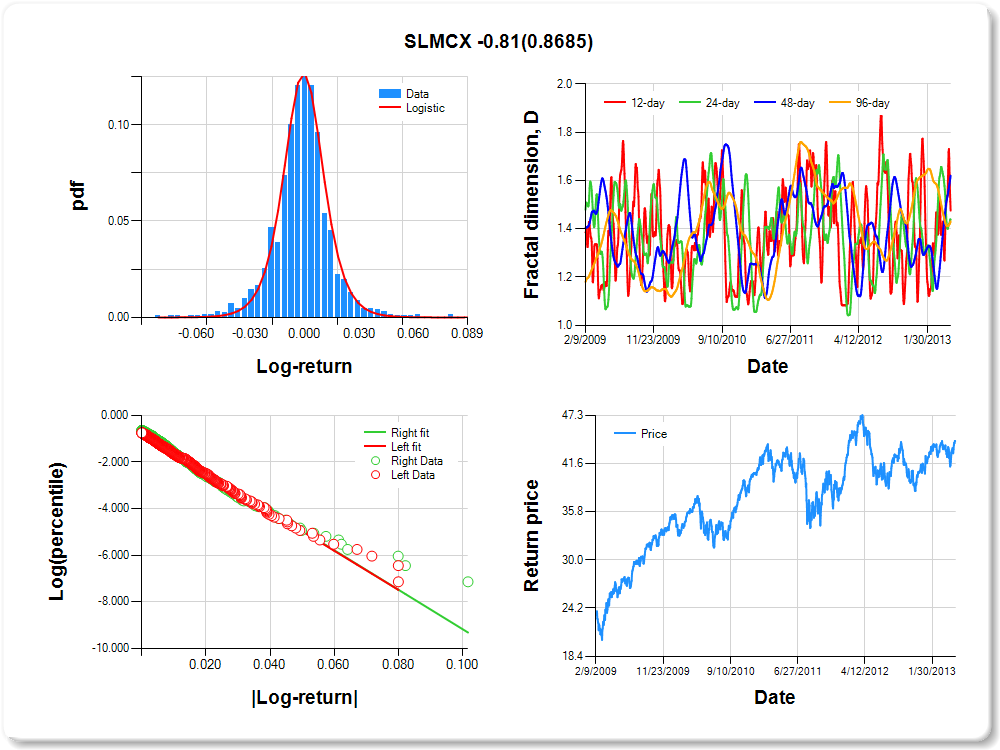

SLMCX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.06 |

1.63 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.184 |

0.135 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.772 |

0.058 |

-13.294 |

0.0000 |

|log-return| |

-83.680 |

3.525 |

-23.738 |

0.0000 |

I(right-tail) |

0.070 |

0.080 |

0.875 |

0.3817 |

|log-return|*I(right-tail) |

-0.812 |

4.905 |

-0.166 |

0.8685 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.525 |

0.562 |

0.380 |

0.569 |

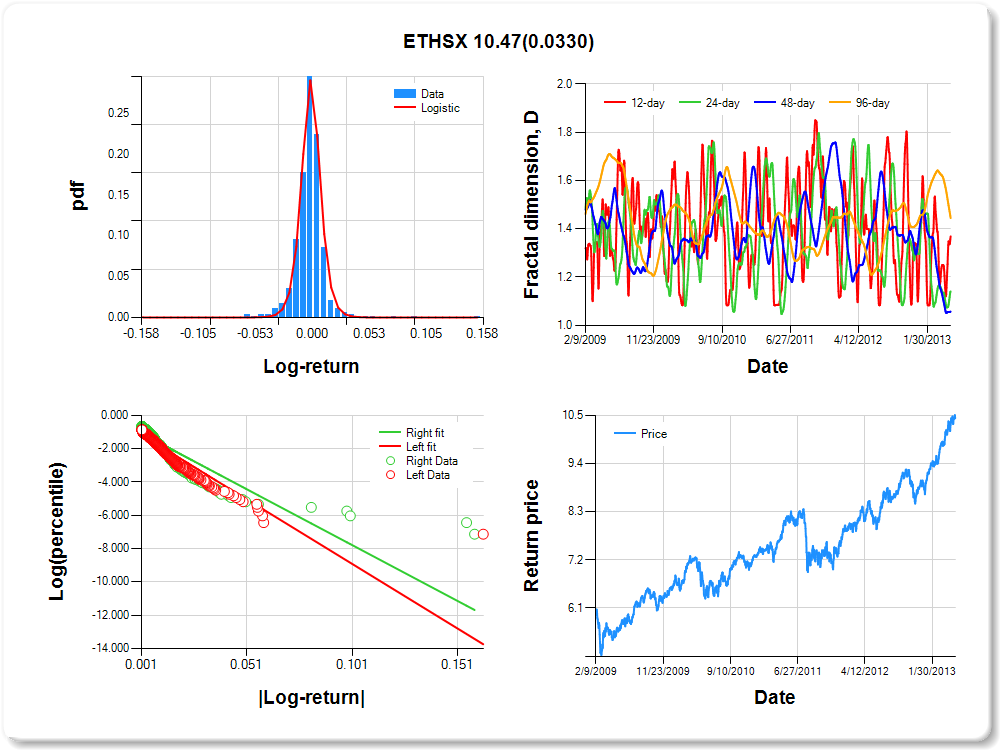

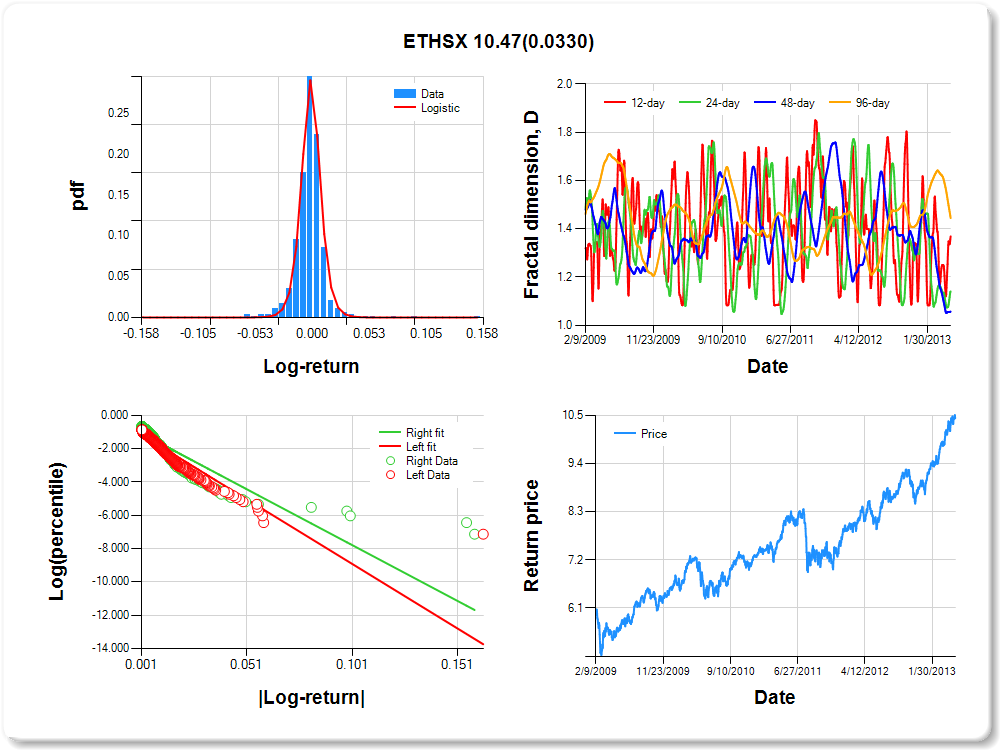

ETHSX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

1.55 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.040 |

0.059 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-1.109 |

0.057 |

-19.374 |

0.0000 |

|log-return| |

-77.416 |

3.767 |

-20.551 |

0.0000 |

I(right-tail) |

0.072 |

0.075 |

0.955 |

0.3400 |

|log-return|*I(right-tail) |

10.471 |

4.905 |

2.135 |

0.0330 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.631 |

0.859 |

0.943 |

0.556 |

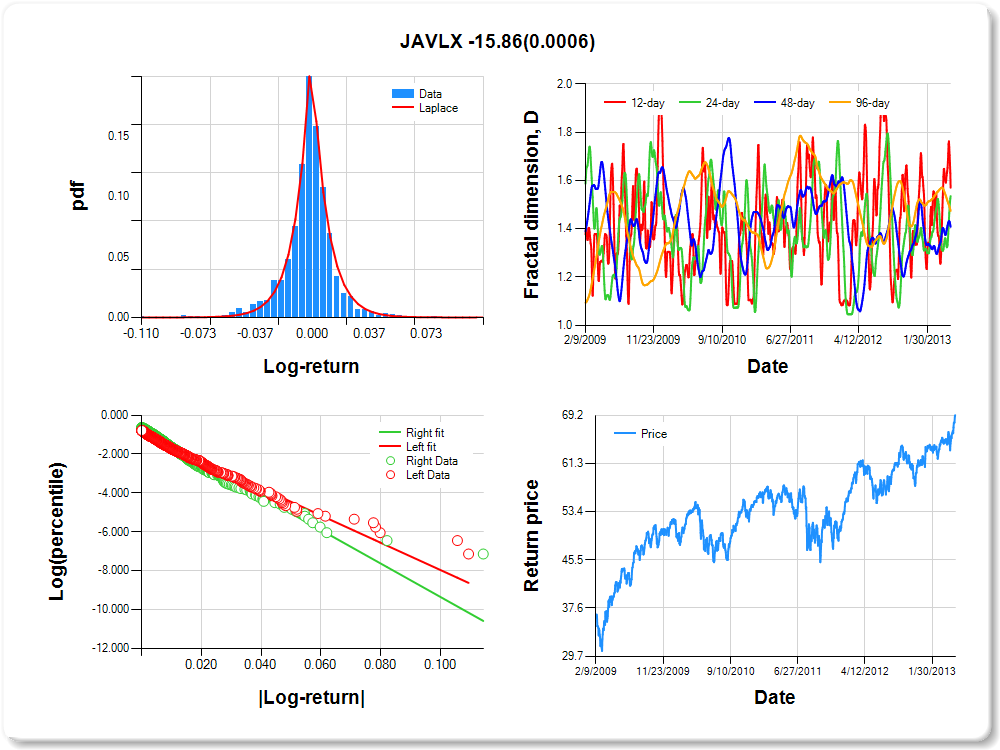

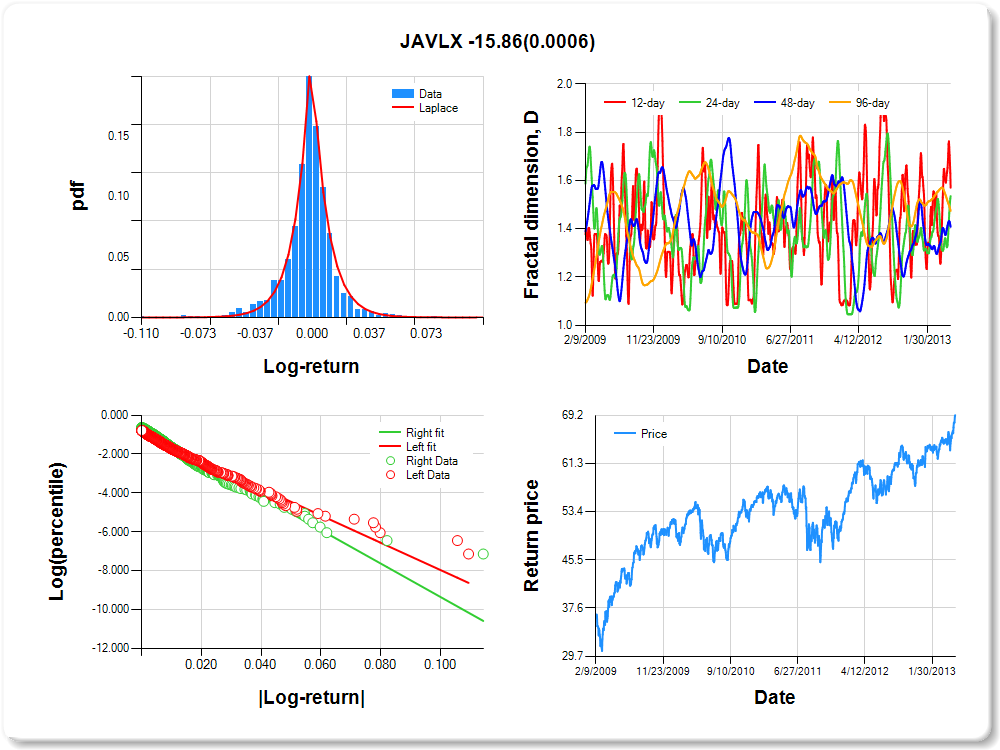

JAVLX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.07 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.05 |

0.06 |

1.75 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.016 |

0.153 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.939 |

0.055 |

-16.983 |

0.0000 |

|log-return| |

-70.117 |

3.028 |

-23.153 |

0.0000 |

I(right-tail) |

0.203 |

0.077 |

2.651 |

0.0081 |

|log-return|*I(right-tail) |

-15.856 |

4.602 |

-3.446 |

0.0006 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.429 |

0.464 |

0.592 |

0.526 |

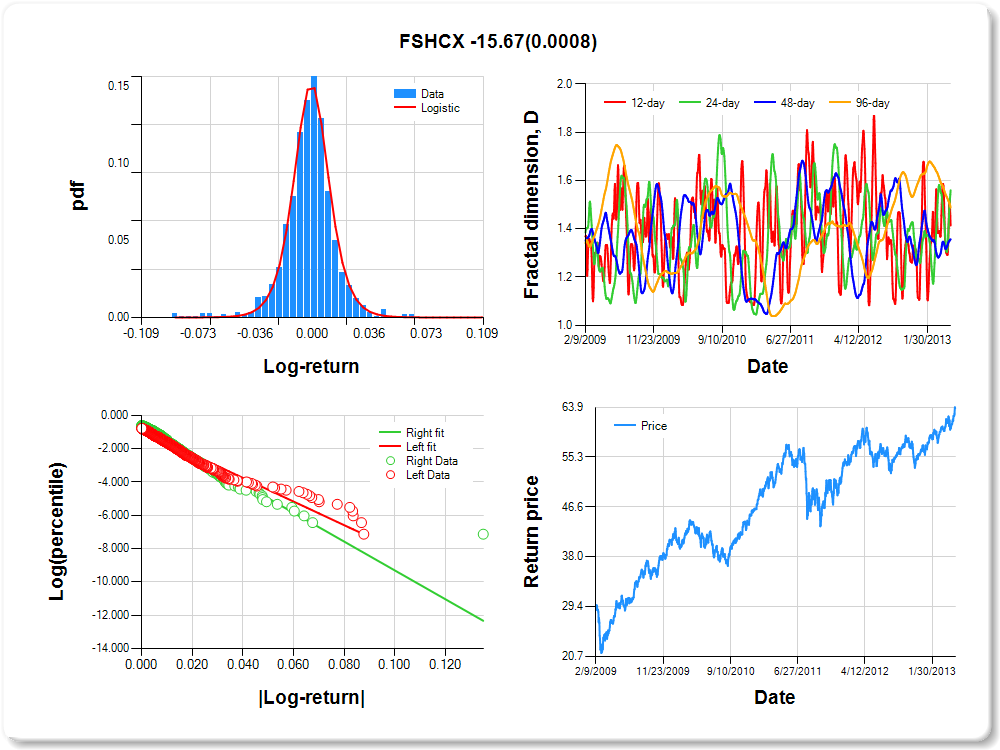

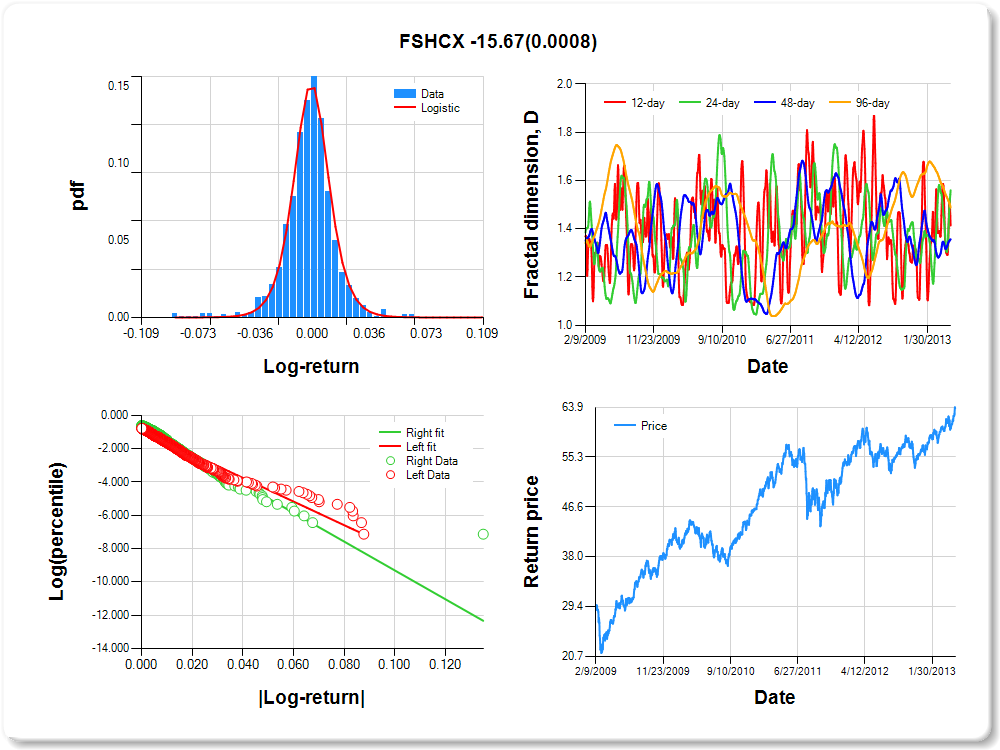

FSHCX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.07 |

-0.06 |

-0.02 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

0.76 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.341 |

0.113 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.923 |

0.056 |

-16.400 |

0.0000 |

|log-return| |

-70.803 |

3.096 |

-22.867 |

0.0000 |

I(right-tail) |

0.268 |

0.079 |

3.410 |

0.0007 |

|log-return|*I(right-tail) |

-15.666 |

4.674 |

-3.352 |

0.0008 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.586 |

0.440 |

0.644 |

0.512 |

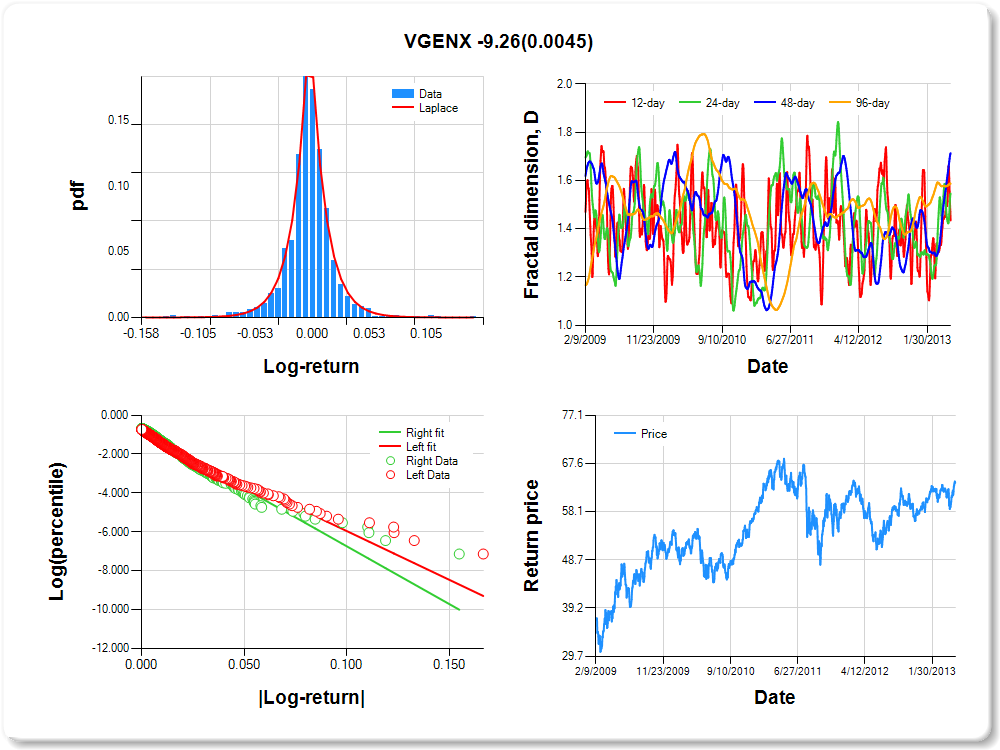

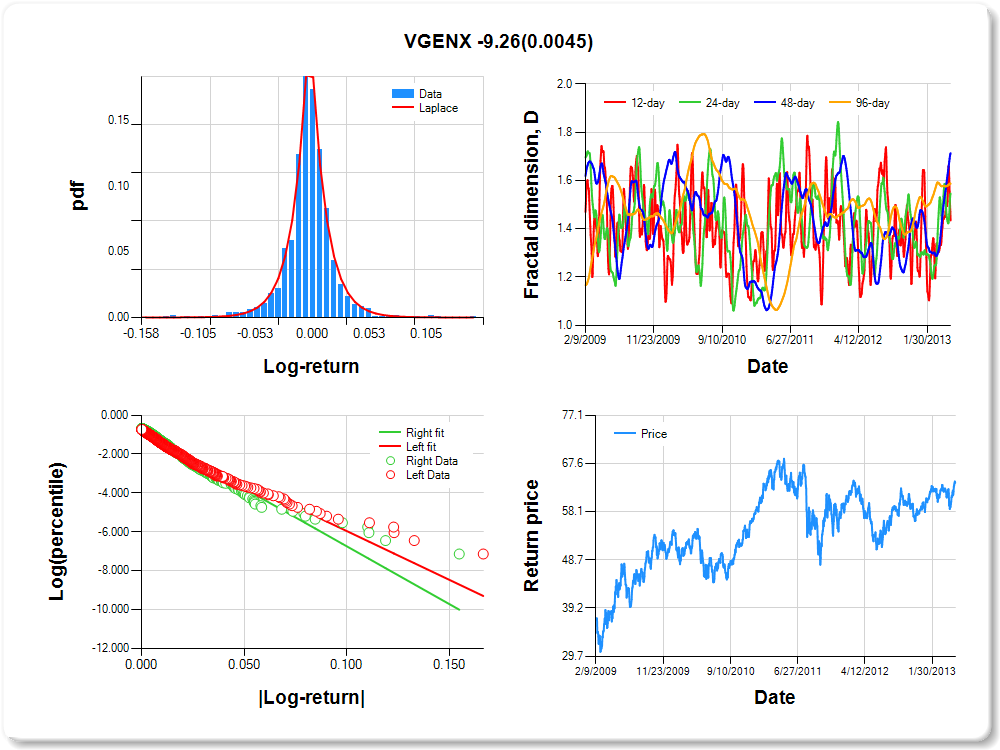

VGENX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.09 |

-0.07 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.06 |

0.08 |

1.19 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.068 |

0.150 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.938 |

0.053 |

-17.834 |

0.0000 |

|log-return| |

-50.170 |

2.130 |

-23.559 |

0.0000 |

I(right-tail) |

0.144 |

0.075 |

1.915 |

0.0558 |

|log-return|*I(right-tail) |

-9.265 |

3.252 |

-2.849 |

0.0045 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.565 |

0.454 |

0.286 |

0.413 |