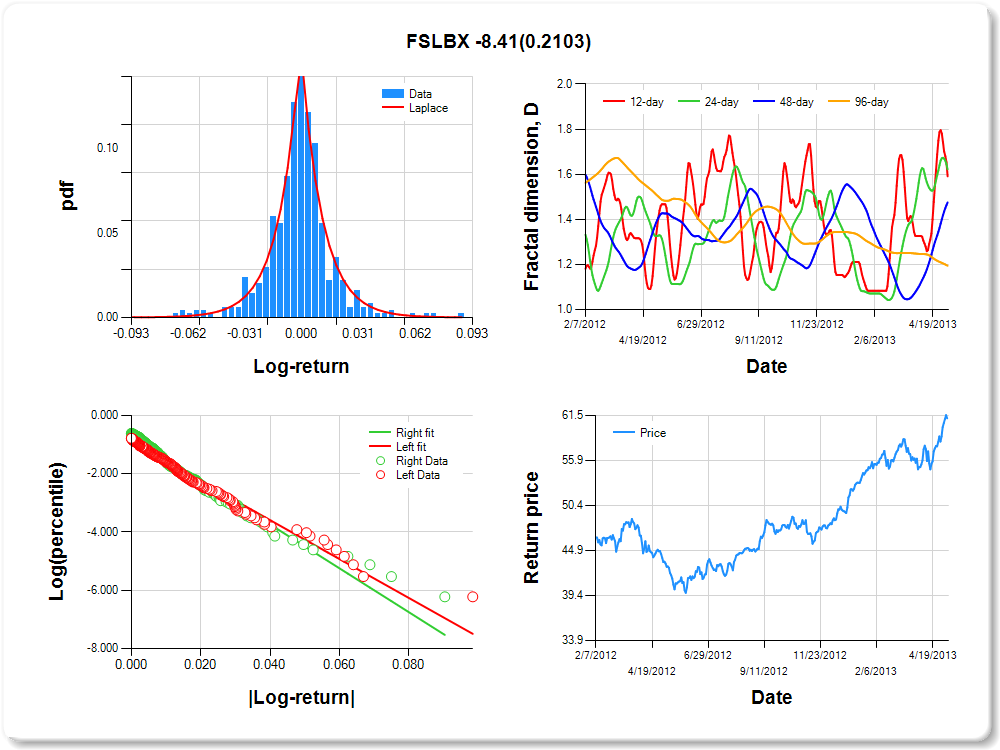

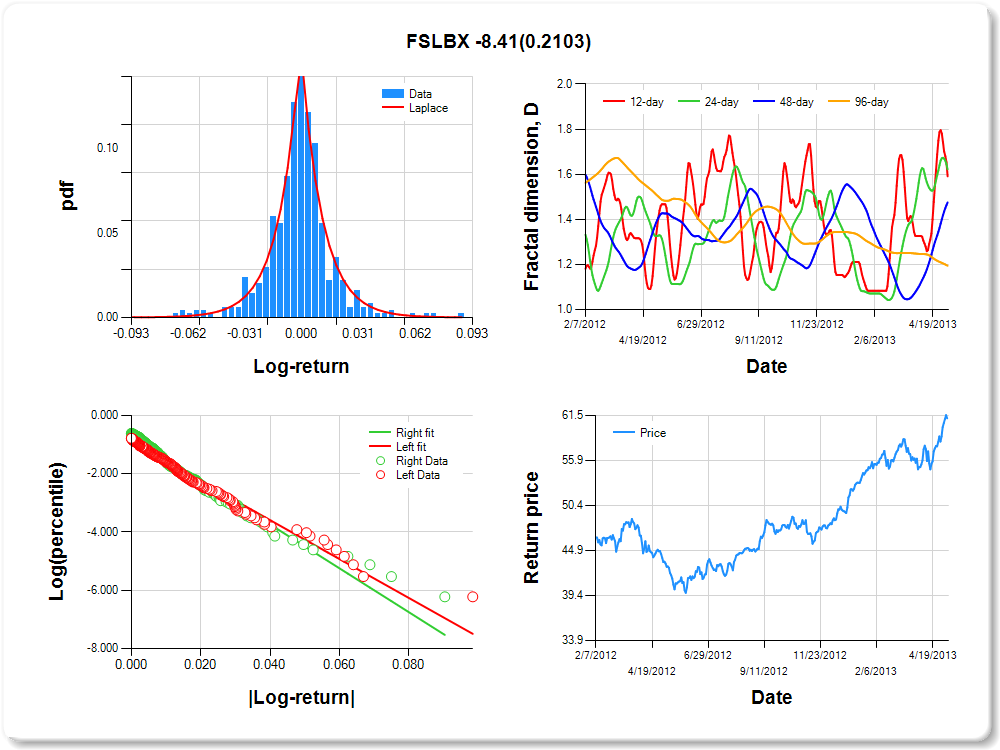

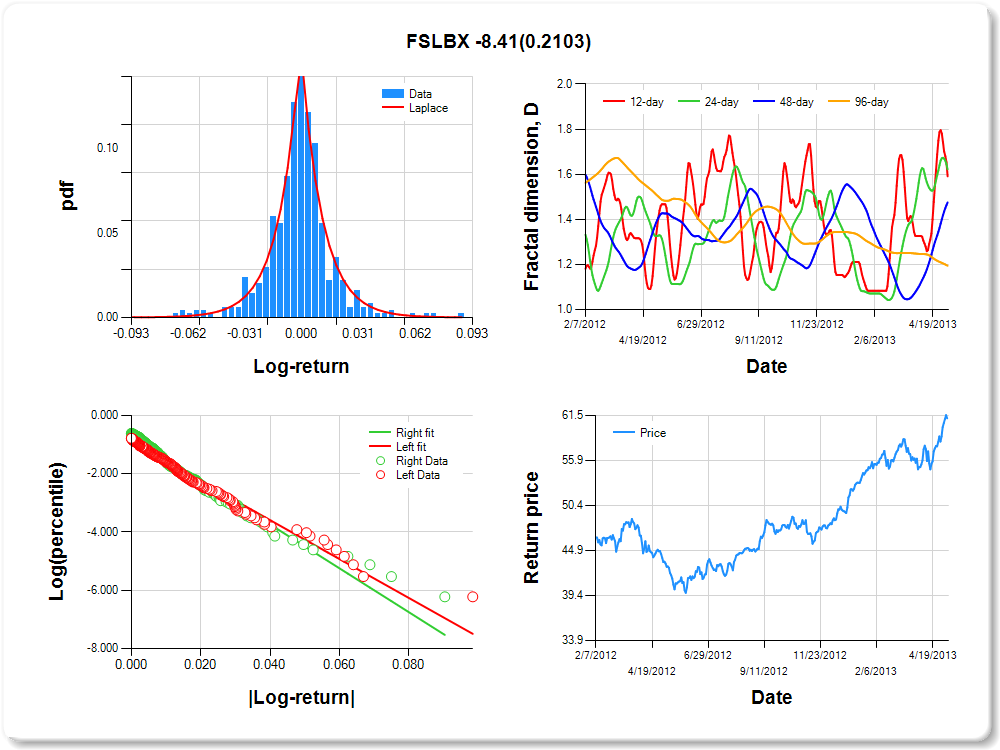

FSLBX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.06 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.06 |

1.06 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.093 |

0.212 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.916 |

0.089 |

-10.252 |

0.0000 |

|log-return| |

-66.780 |

4.662 |

-14.325 |

0.0000 |

I(right-tail) |

0.188 |

0.122 |

1.541 |

0.1240 |

|log-return|*I(right-tail) |

-8.413 |

6.706 |

-1.254 |

0.2103 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.409 |

0.378 |

0.525 |

0.806 |

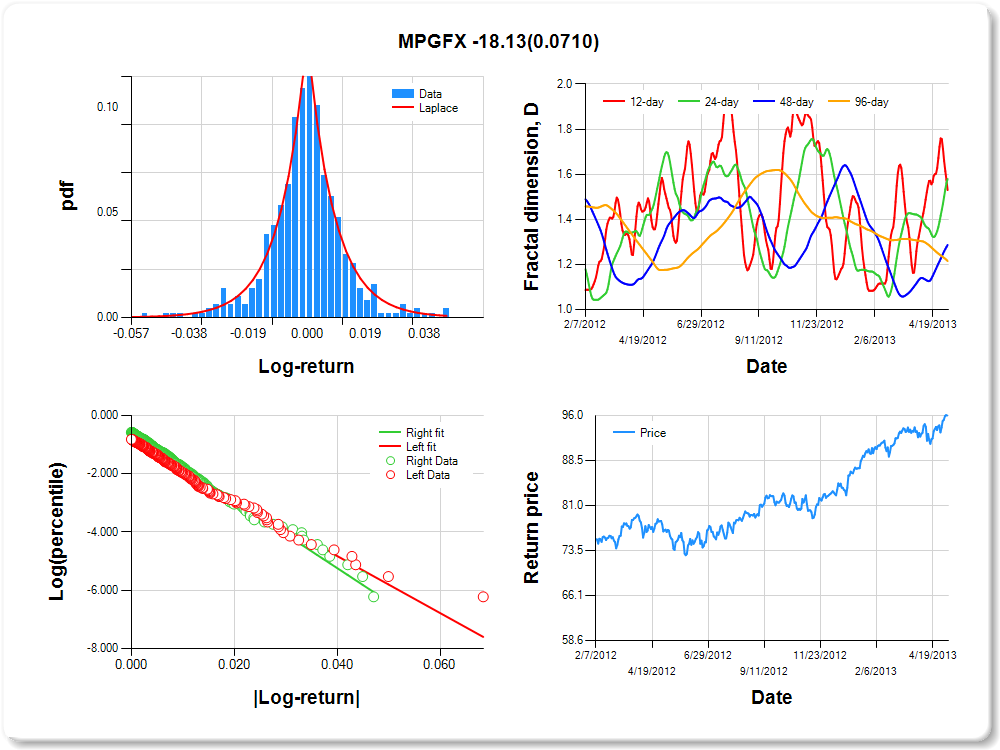

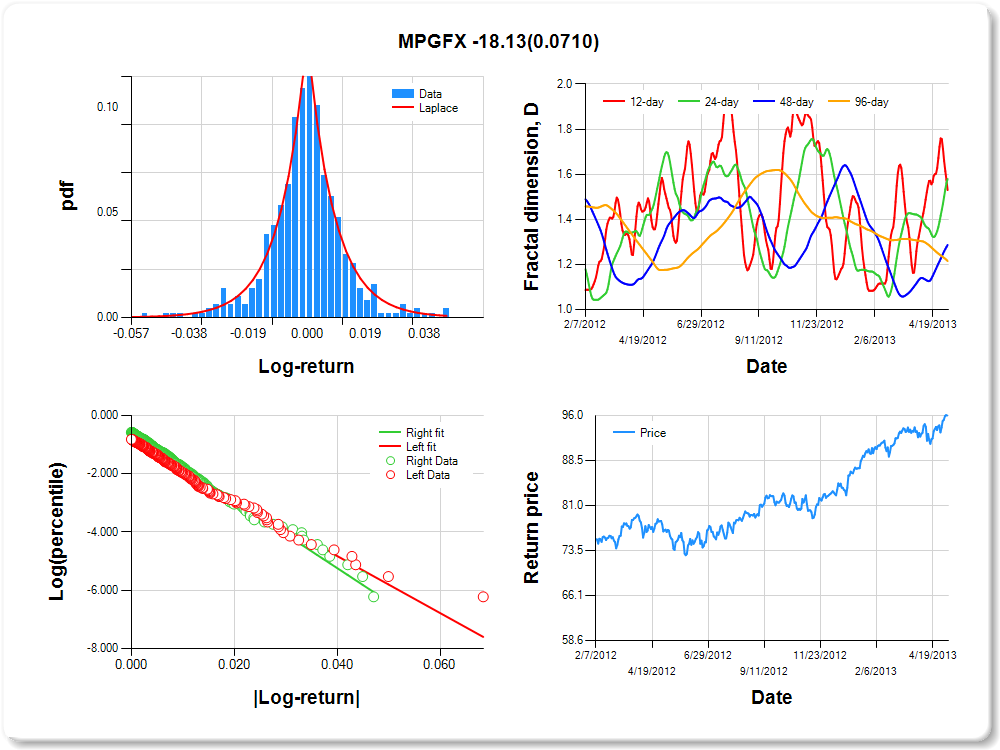

MPGFX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.04 |

-0.04 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.04 |

0.00 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.349 |

0.257 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.910 |

0.093 |

-9.787 |

0.0000 |

|log-return| |

-97.767 |

6.956 |

-14.055 |

0.0000 |

I(right-tail) |

0.313 |

0.126 |

2.480 |

0.0135 |

|log-return|*I(right-tail) |

-18.135 |

10.021 |

-1.810 |

0.0710 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.470 |

0.421 |

0.713 |

0.785 |

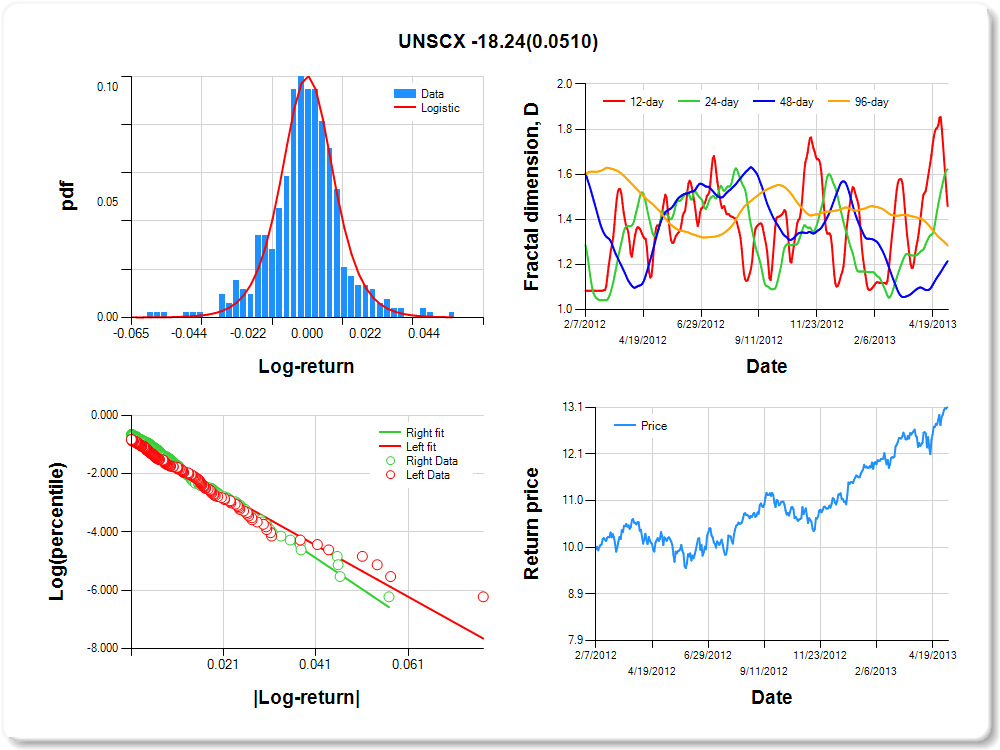

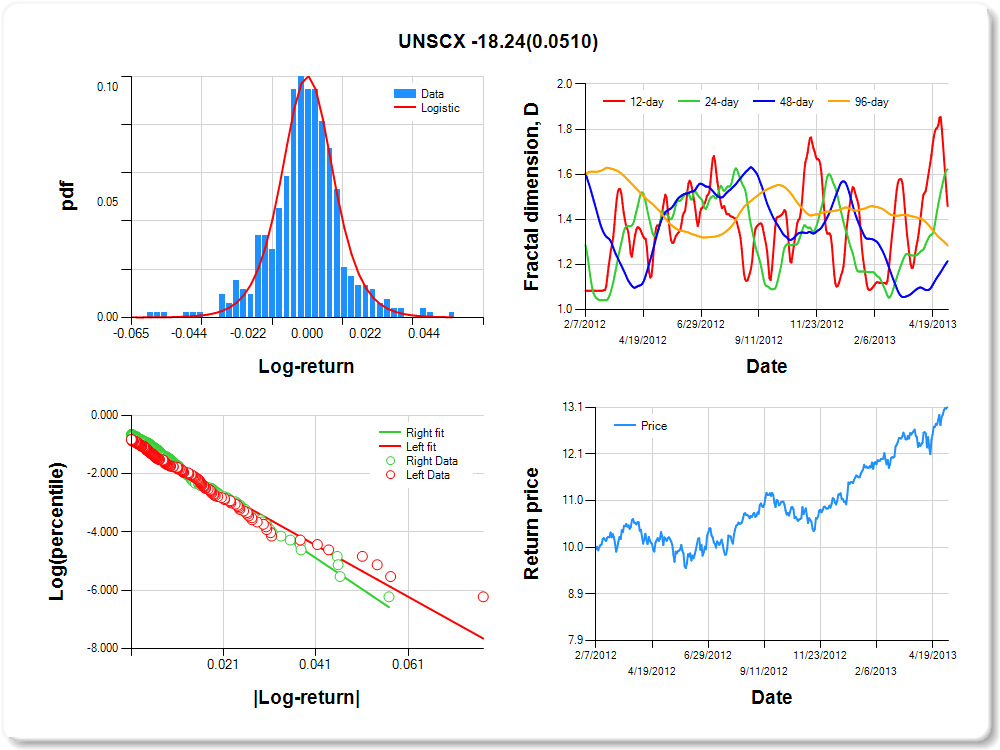

UNSCX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

2.03 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.298 |

0.163 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.874 |

0.095 |

-9.172 |

0.0000 |

|log-return| |

-88.125 |

6.306 |

-13.975 |

0.0000 |

I(right-tail) |

0.306 |

0.133 |

2.297 |

0.0221 |

|log-return|*I(right-tail) |

-18.237 |

9.321 |

-1.957 |

0.0510 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.541 |

0.378 |

0.785 |

0.716 |

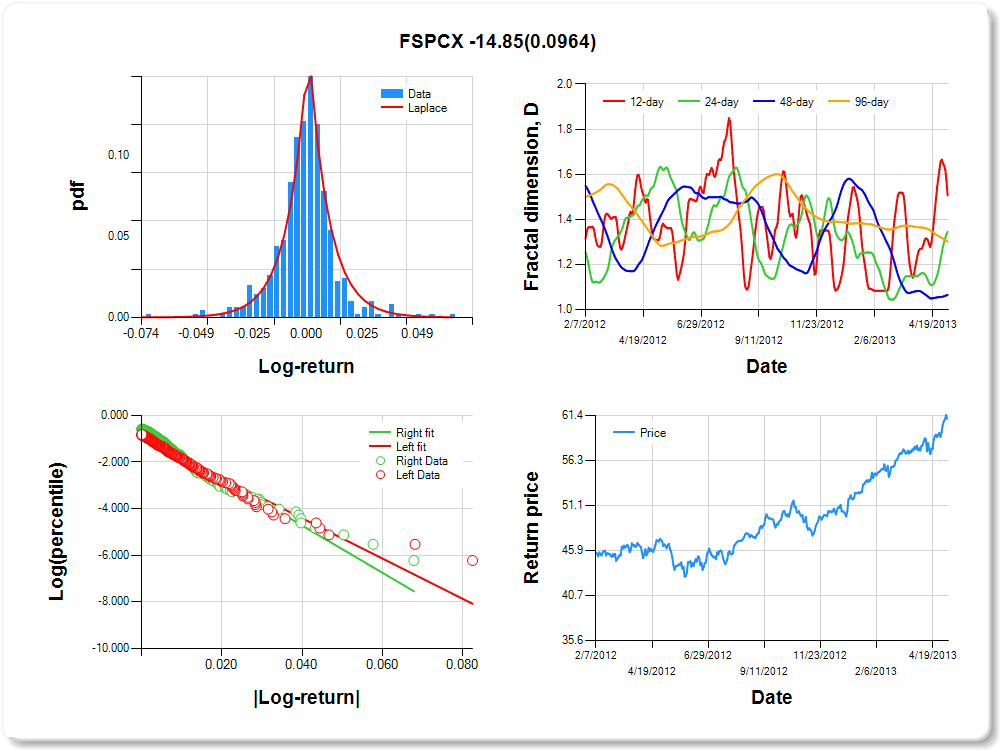

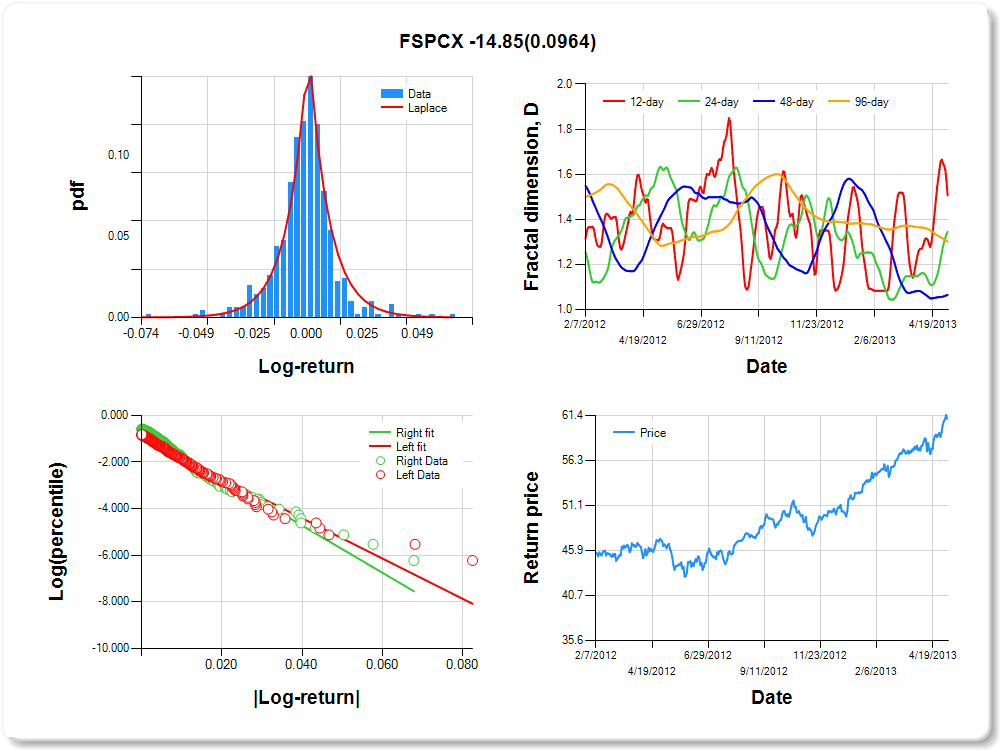

FSPCX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.04 |

3.06 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.214 |

0.204 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.956 |

0.091 |

-10.481 |

0.0000 |

|log-return| |

-86.197 |

6.208 |

-13.885 |

0.0000 |

I(right-tail) |

0.285 |

0.123 |

2.309 |

0.0213 |

|log-return|*I(right-tail) |

-14.851 |

8.915 |

-1.666 |

0.0964 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.493 |

0.655 |

0.935 |

0.699 |

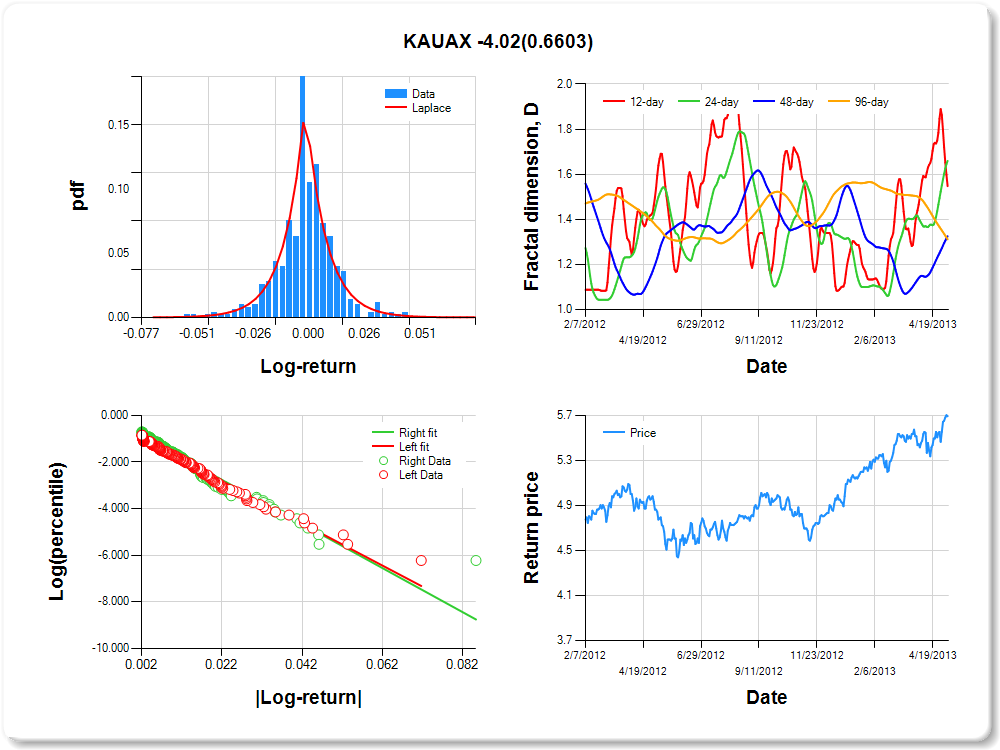

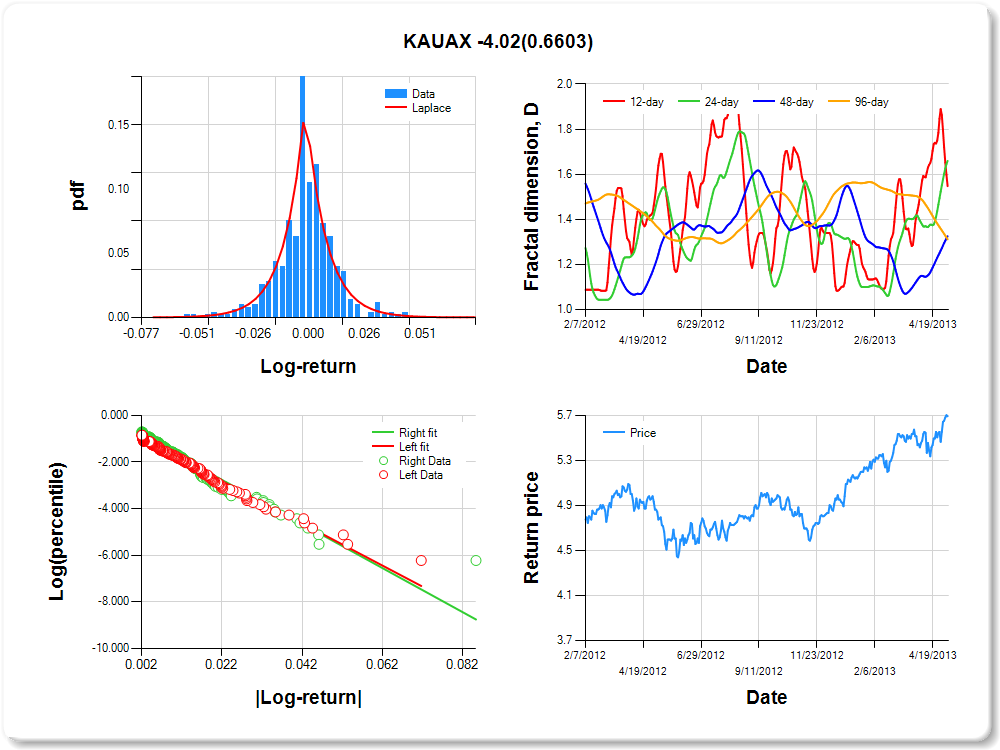

KAUAX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.04 |

2.01 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.150 |

0.204 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.862 |

0.098 |

-8.797 |

0.0000 |

|log-return| |

-90.380 |

6.508 |

-13.887 |

0.0000 |

I(right-tail) |

0.142 |

0.135 |

1.054 |

0.2924 |

|log-return|*I(right-tail) |

-4.023 |

9.148 |

-0.440 |

0.6603 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.453 |

0.340 |

0.675 |

0.688 |

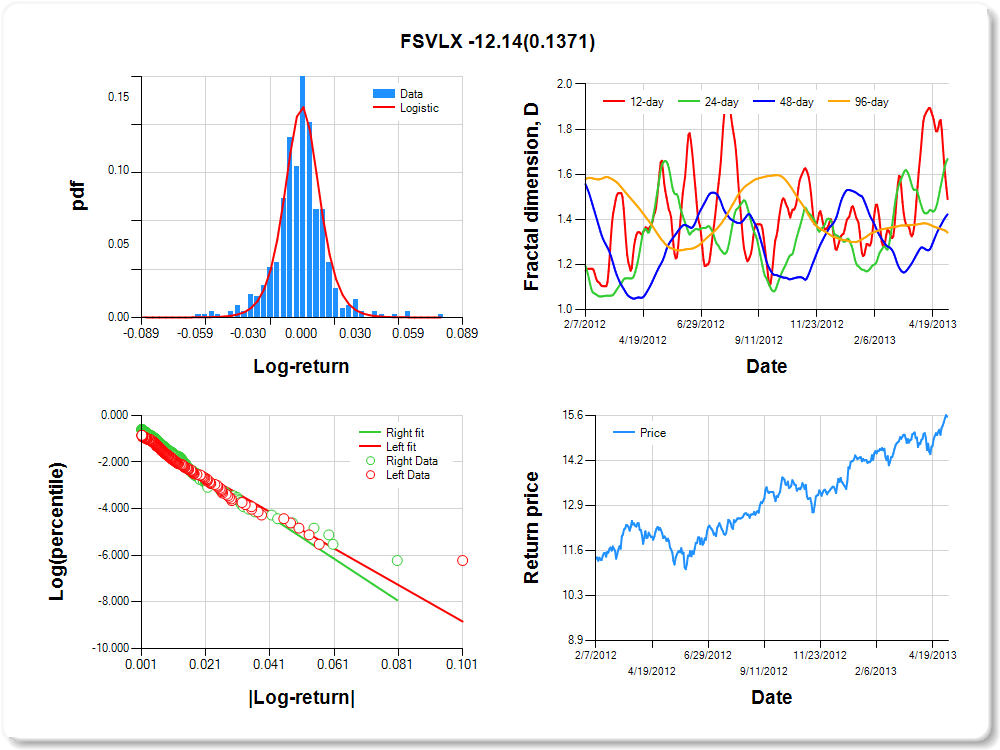

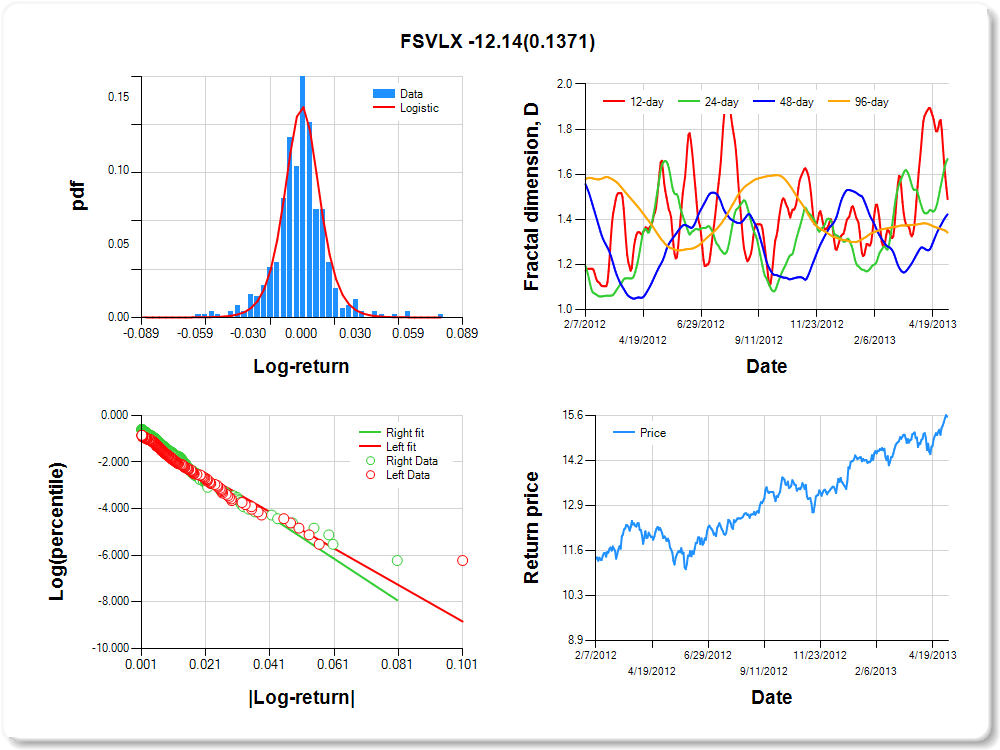

FSVLX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.05 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.06 |

2.07 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.225 |

0.119 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.975 |

0.094 |

-10.404 |

0.0000 |

|log-return| |

-78.059 |

5.765 |

-13.539 |

0.0000 |

I(right-tail) |

0.297 |

0.126 |

2.357 |

0.0188 |

|log-return|*I(right-tail) |

-12.142 |

8.154 |

-1.489 |

0.1371 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.510 |

0.332 |

0.577 |

0.659 |

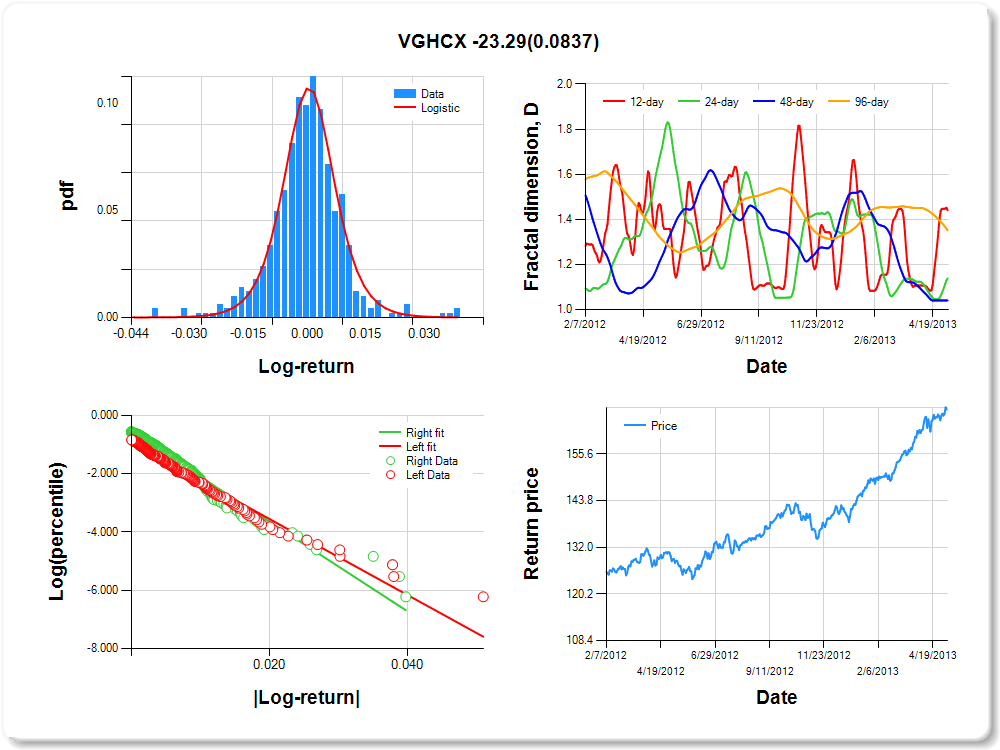

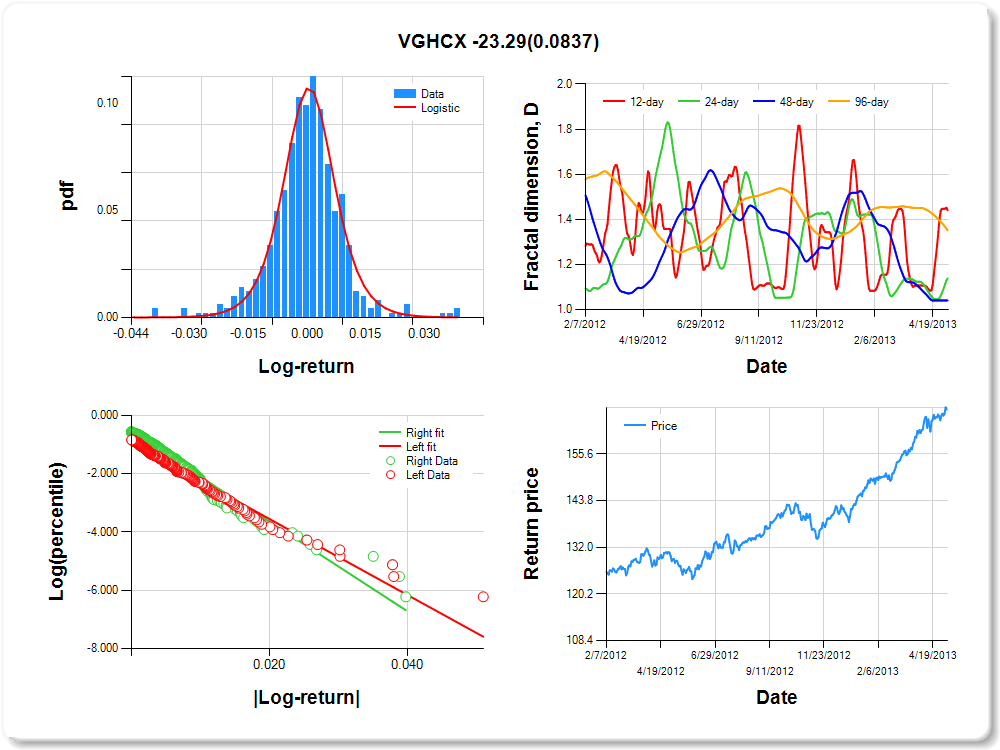

VGHCX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.04 |

-0.03 |

-0.01 |

-0.01 |

0.00 |

0.00 |

0.01 |

0.01 |

0.03 |

0.04 |

0.00 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.263 |

0.159 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.942 |

0.093 |

-10.095 |

0.0000 |

|log-return| |

-130.468 |

9.396 |

-13.886 |

0.0000 |

I(right-tail) |

0.374 |

0.126 |

2.959 |

0.0032 |

|log-return|*I(right-tail) |

-23.289 |

13.439 |

-1.733 |

0.0837 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.559 |

0.862 |

0.959 |

0.649 |

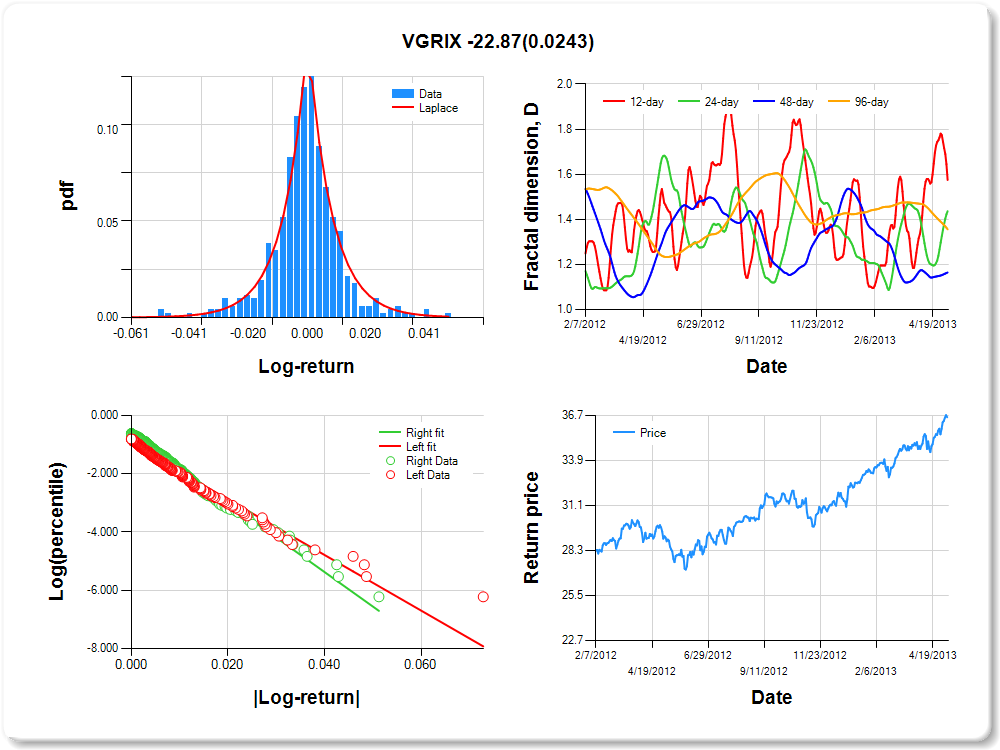

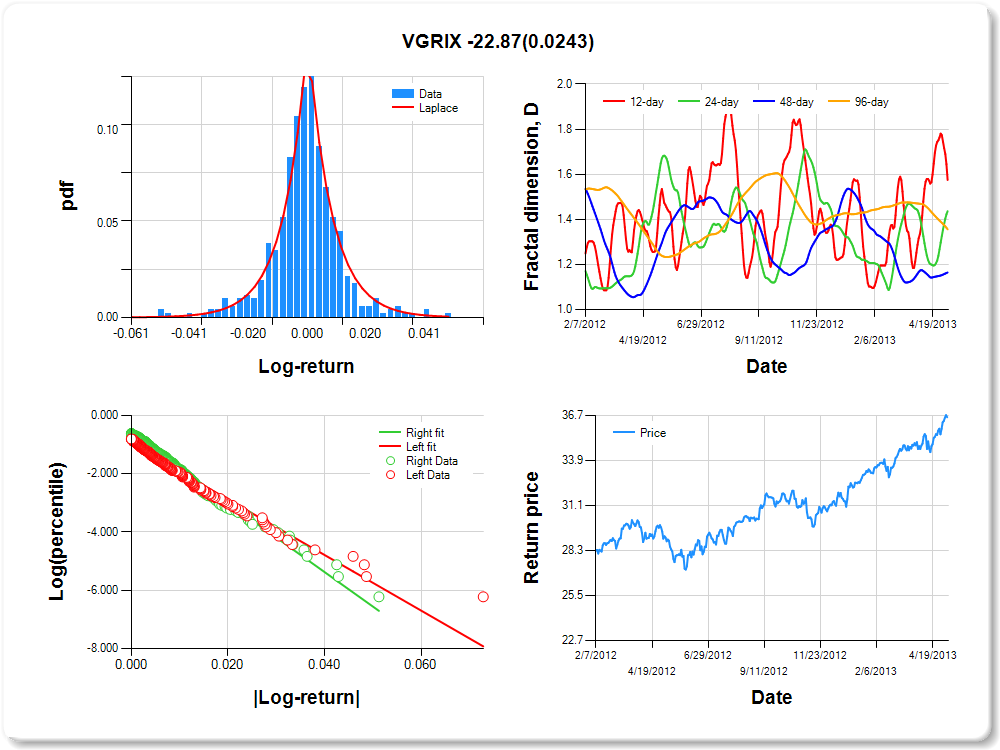

VGRIX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.01 |

0.00 |

0.00 |

0.01 |

0.02 |

0.03 |

0.04 |

2.11 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.337 |

0.229 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.950 |

0.090 |

-10.553 |

0.0000 |

|log-return| |

-95.378 |

6.770 |

-14.088 |

0.0000 |

I(right-tail) |

0.336 |

0.126 |

2.671 |

0.0078 |

|log-return|*I(right-tail) |

-22.869 |

10.123 |

-2.259 |

0.0243 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.425 |

0.564 |

0.836 |

0.644 |

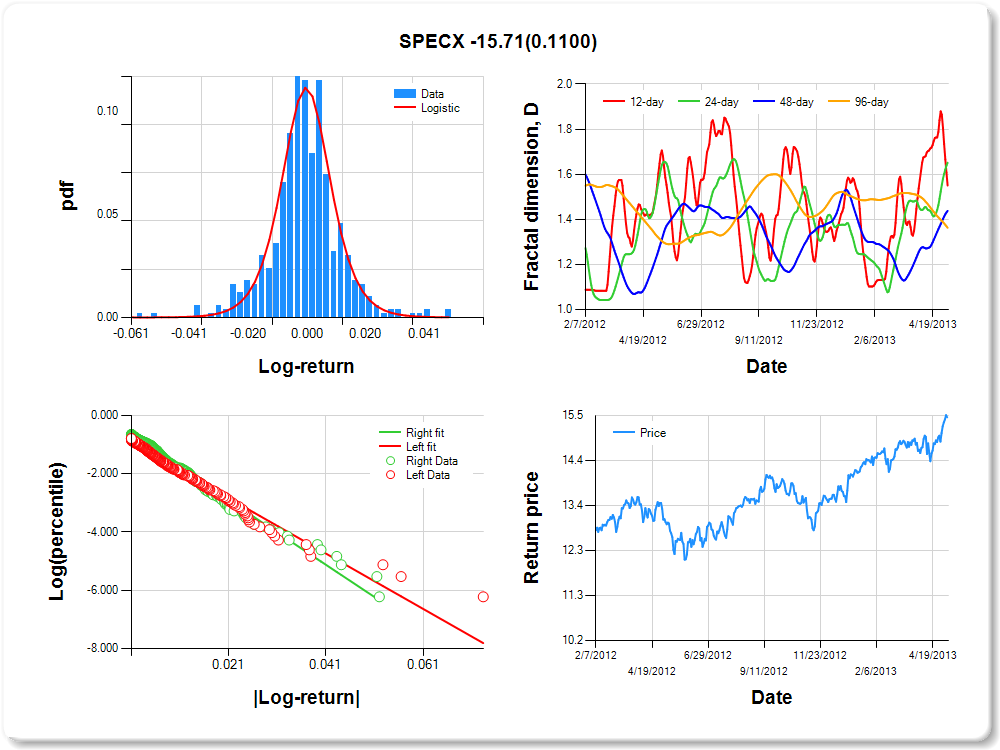

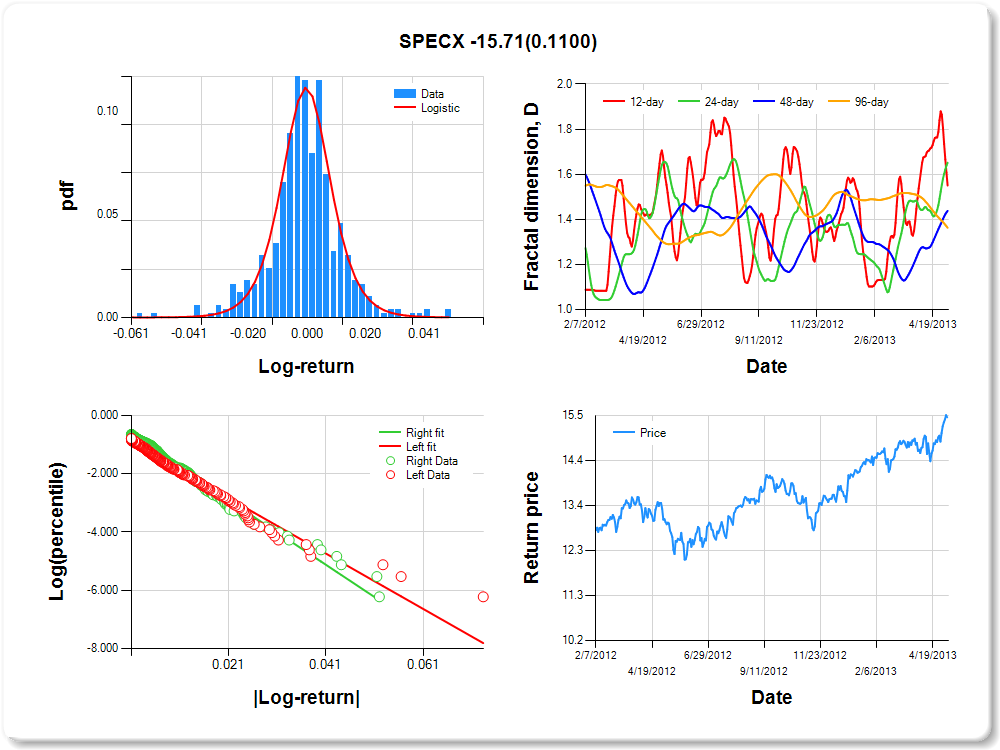

SPECX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.04 |

3.37 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.316 |

0.154 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.882 |

0.092 |

-9.586 |

0.0000 |

|log-return| |

-95.039 |

6.697 |

-14.190 |

0.0000 |

I(right-tail) |

0.254 |

0.129 |

1.970 |

0.0494 |

|log-return|*I(right-tail) |

-15.710 |

9.812 |

-1.601 |

0.1100 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.450 |

0.349 |

0.562 |

0.637 |

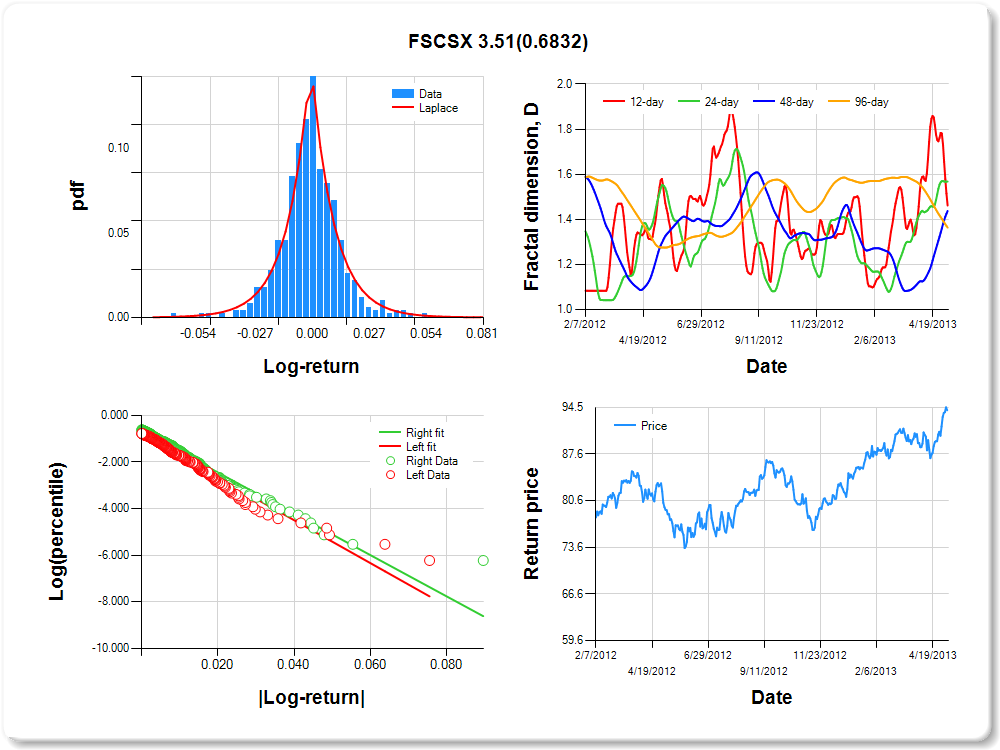

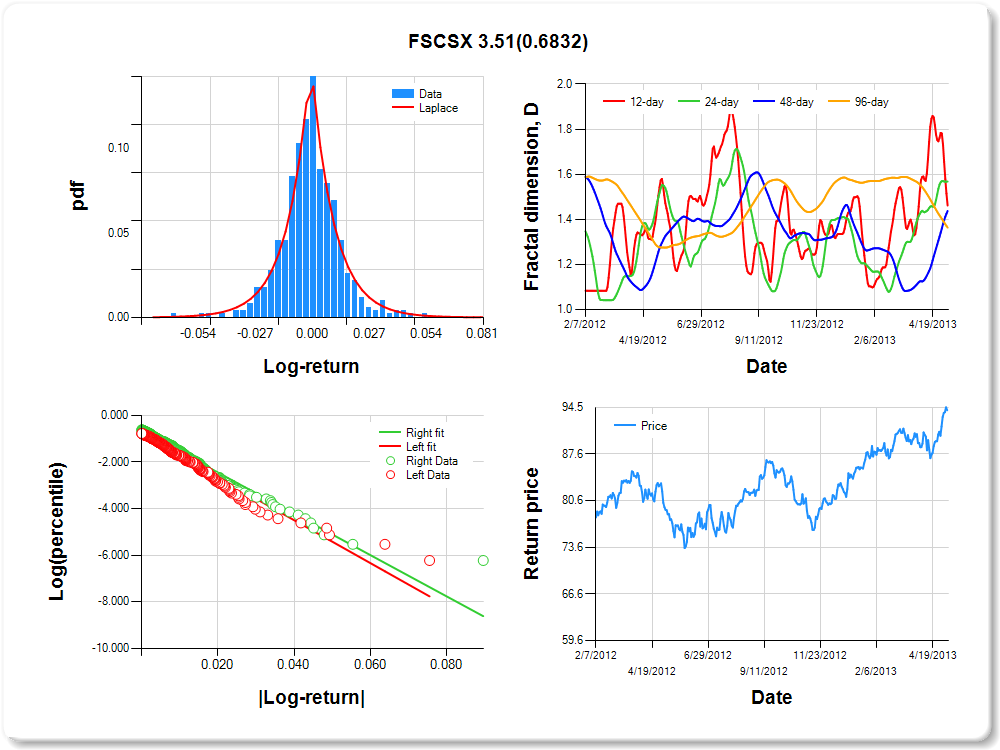

FSCSX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

0.37 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.129 |

0.225 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.817 |

0.094 |

-8.719 |

0.0000 |

|log-return| |

-91.905 |

6.437 |

-14.278 |

0.0000 |

I(right-tail) |

0.132 |

0.127 |

1.045 |

0.2967 |

|log-return|*I(right-tail) |

3.512 |

8.599 |

0.408 |

0.6832 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.539 |

0.432 |

0.563 |

0.637 |

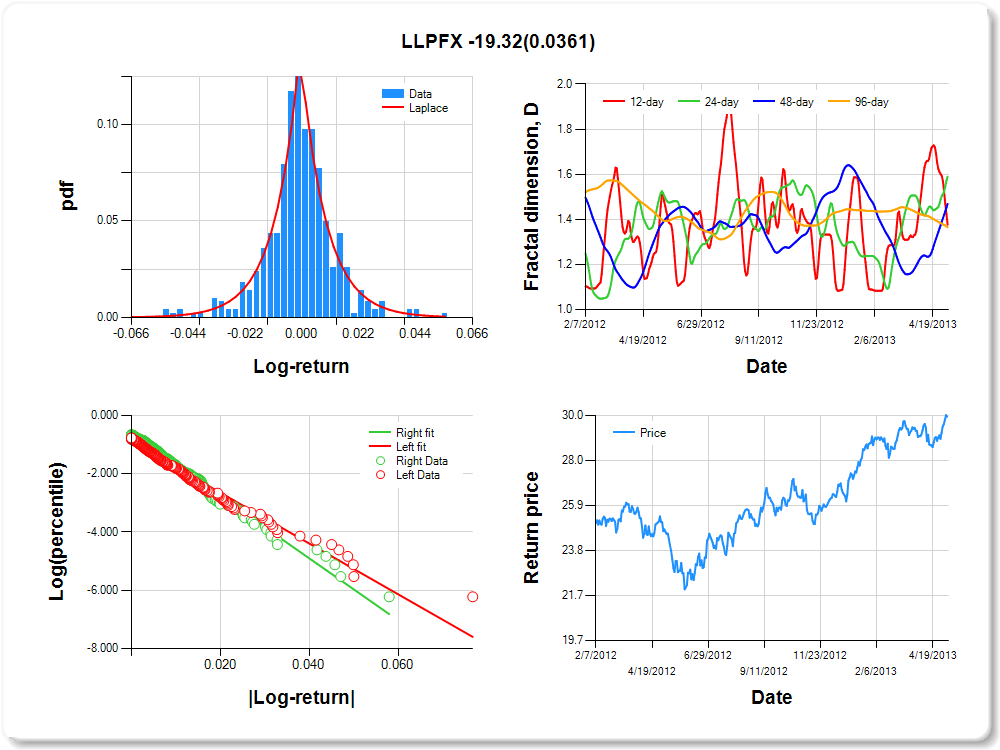

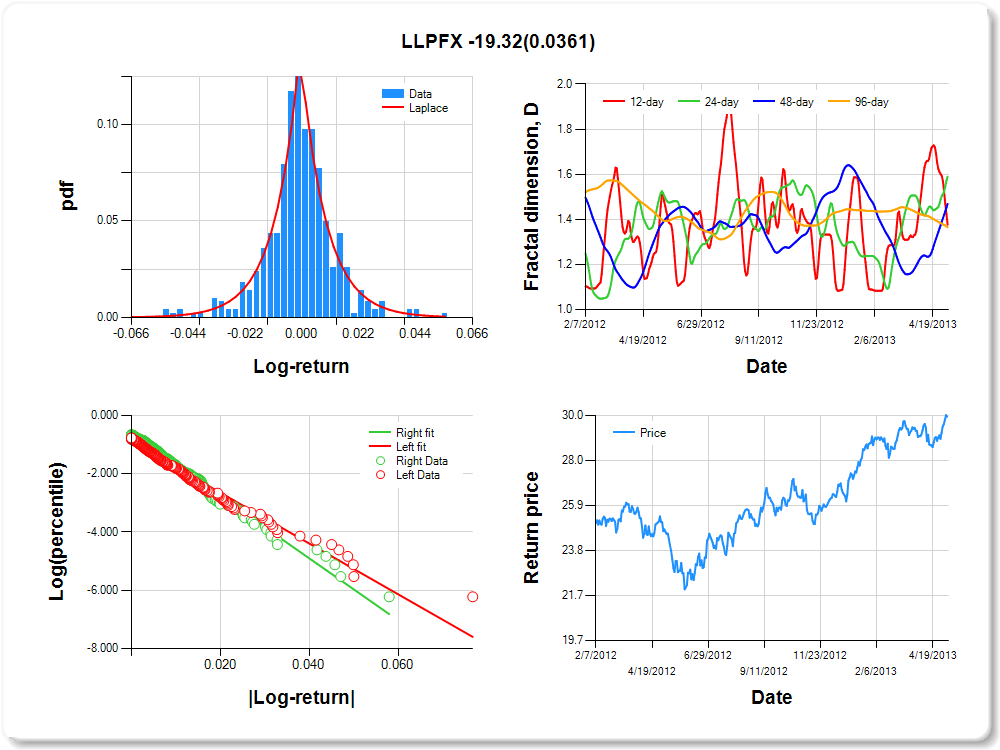

LLPFX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.05 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.03 |

0.05 |

2.23 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.253 |

0.247 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.886 |

0.090 |

-9.893 |

0.0000 |

|log-return| |

-87.104 |

6.045 |

-14.409 |

0.0000 |

I(right-tail) |

0.272 |

0.128 |

2.118 |

0.0347 |

|log-return|*I(right-tail) |

-19.317 |

9.189 |

-2.102 |

0.0361 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.624 |

0.410 |

0.531 |

0.635 |

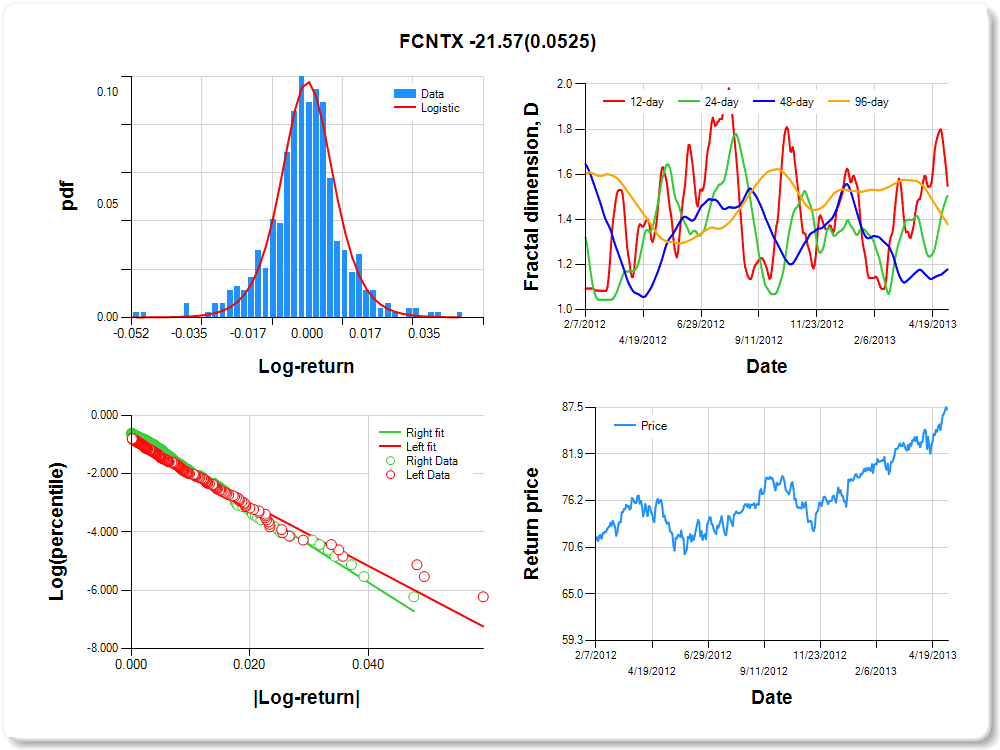

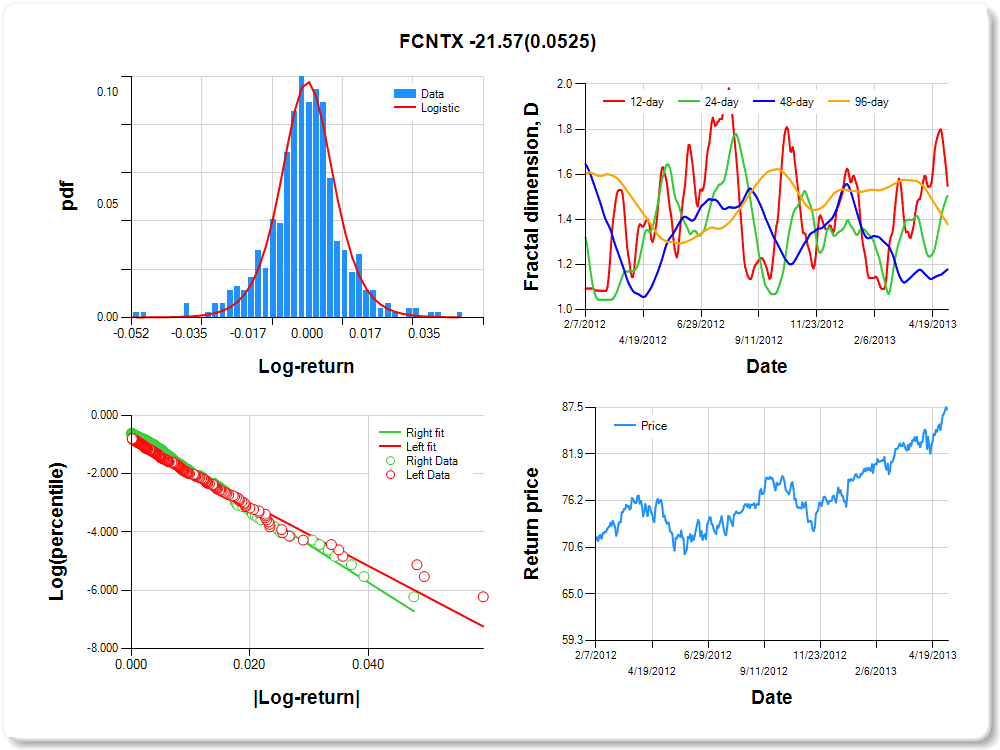

FCNTX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.00 |

0.01 |

0.02 |

0.03 |

0.04 |

1.44 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.223 |

0.164 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.873 |

0.093 |

-9.430 |

0.0000 |

|log-return| |

-107.225 |

7.536 |

-14.228 |

0.0000 |

I(right-tail) |

0.298 |

0.128 |

2.319 |

0.0208 |

|log-return|*I(right-tail) |

-21.567 |

11.097 |

-1.944 |

0.0525 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.452 |

0.496 |

0.821 |

0.622 |

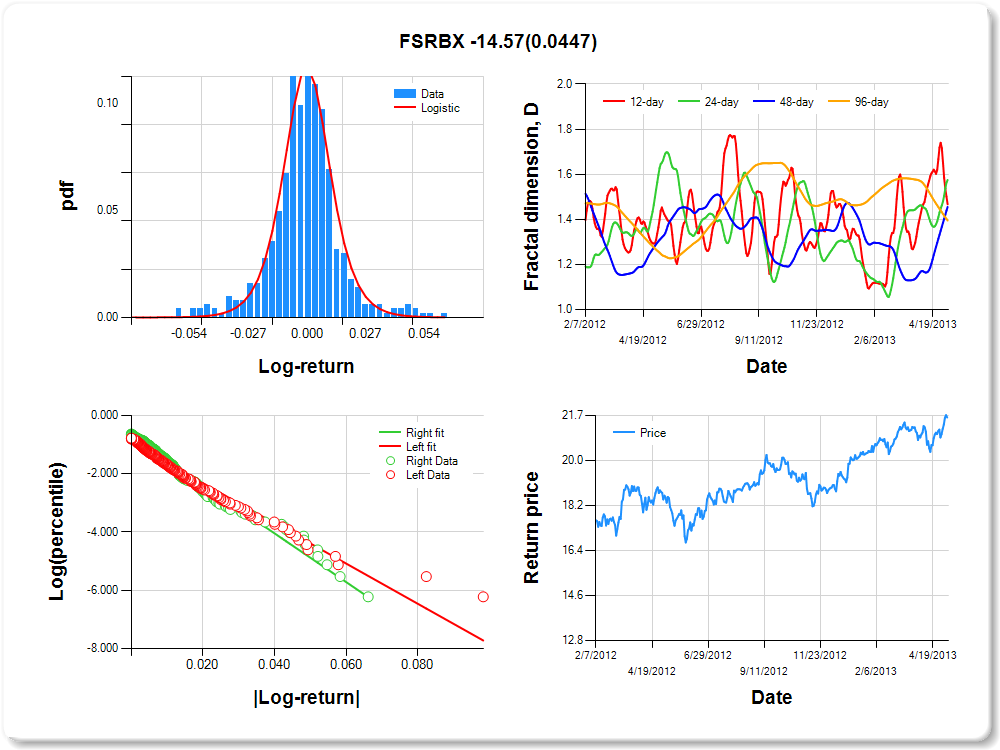

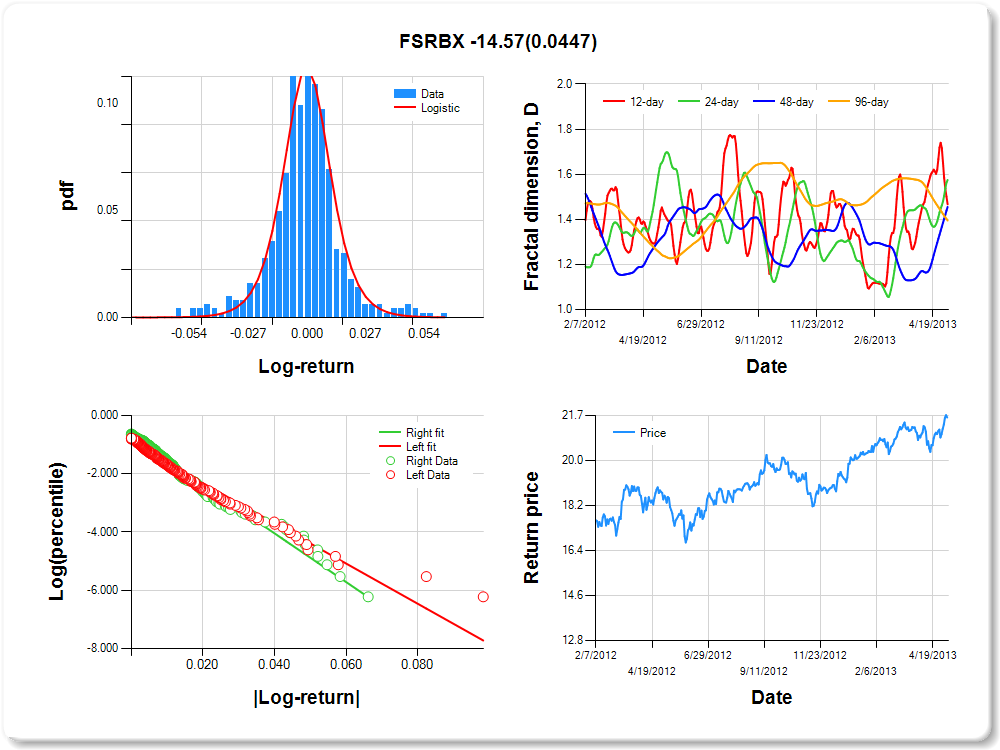

FSRBX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.05 |

0.05 |

1.90 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.363 |

0.147 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.919 |

0.089 |

-10.329 |

0.0000 |

|log-return| |

-68.954 |

4.830 |

-14.276 |

0.0000 |

I(right-tail) |

0.246 |

0.125 |

1.974 |

0.0490 |

|log-return|*I(right-tail) |

-14.574 |

7.241 |

-2.013 |

0.0447 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.533 |

0.425 |

0.545 |

0.605 |

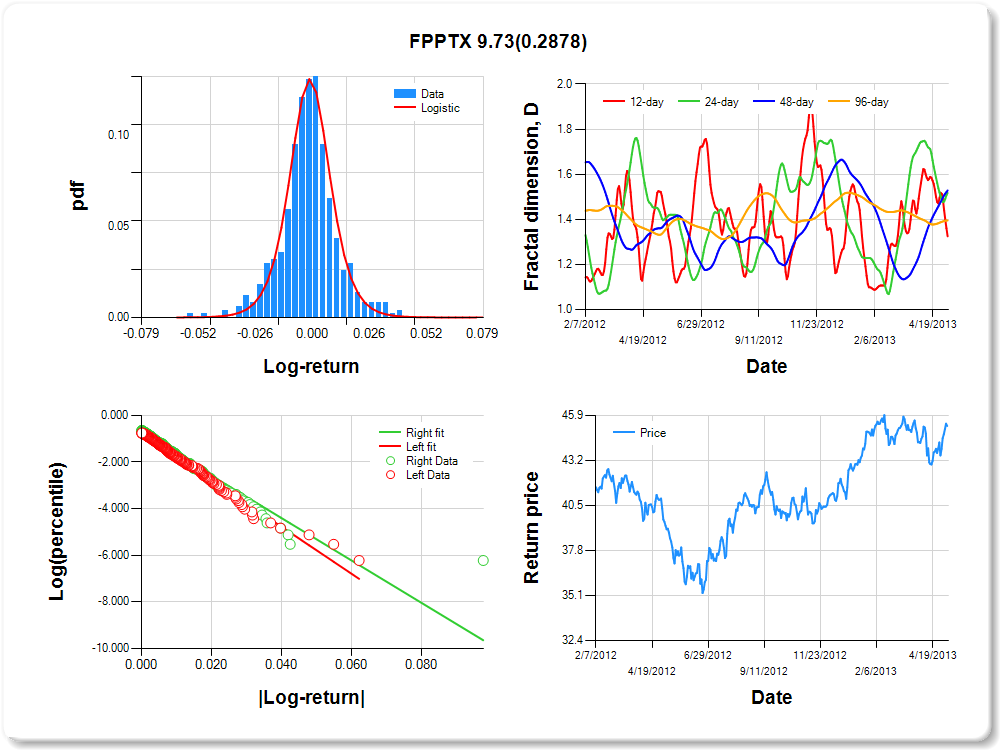

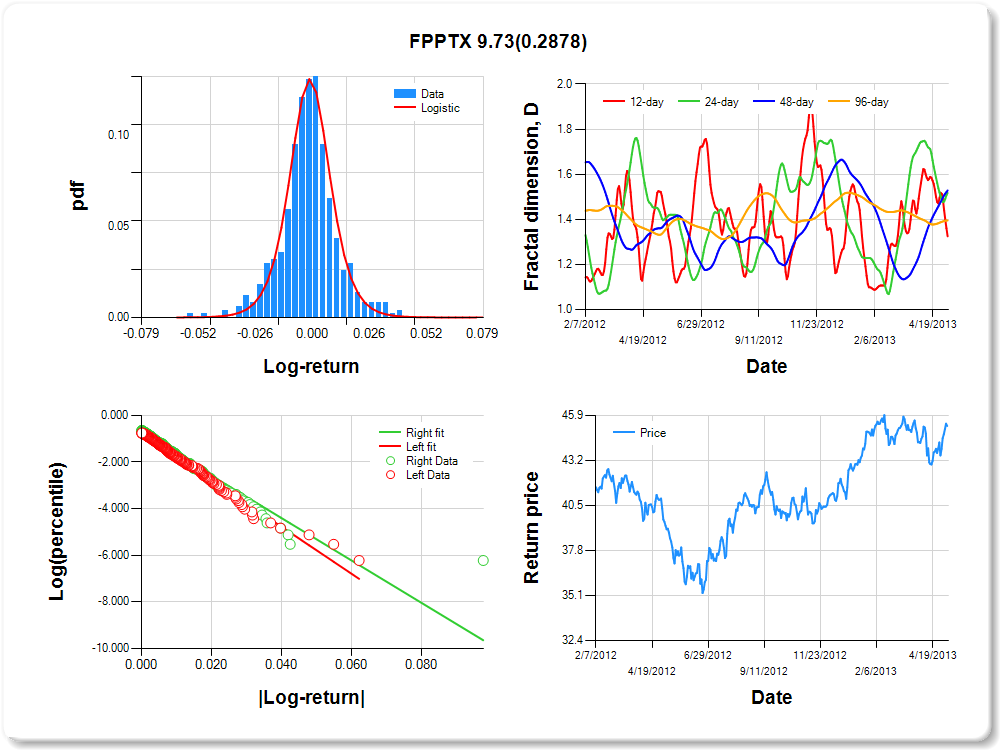

FPPTX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.04 |

4.83 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.372 |

0.131 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.746 |

0.094 |

-7.897 |

0.0000 |

|log-return| |

-100.419 |

6.868 |

-14.622 |

0.0000 |

I(right-tail) |

-0.016 |

0.127 |

-0.128 |

0.8978 |

|log-return|*I(right-tail) |

9.729 |

9.144 |

1.064 |

0.2878 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.675 |

0.483 |

0.472 |

0.604 |

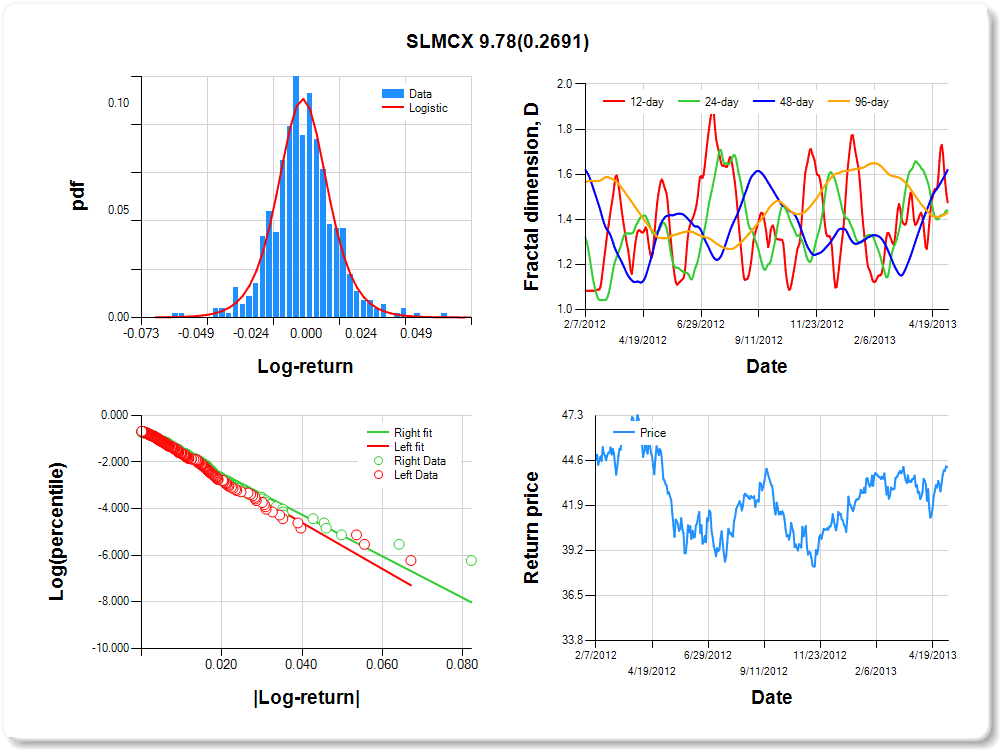

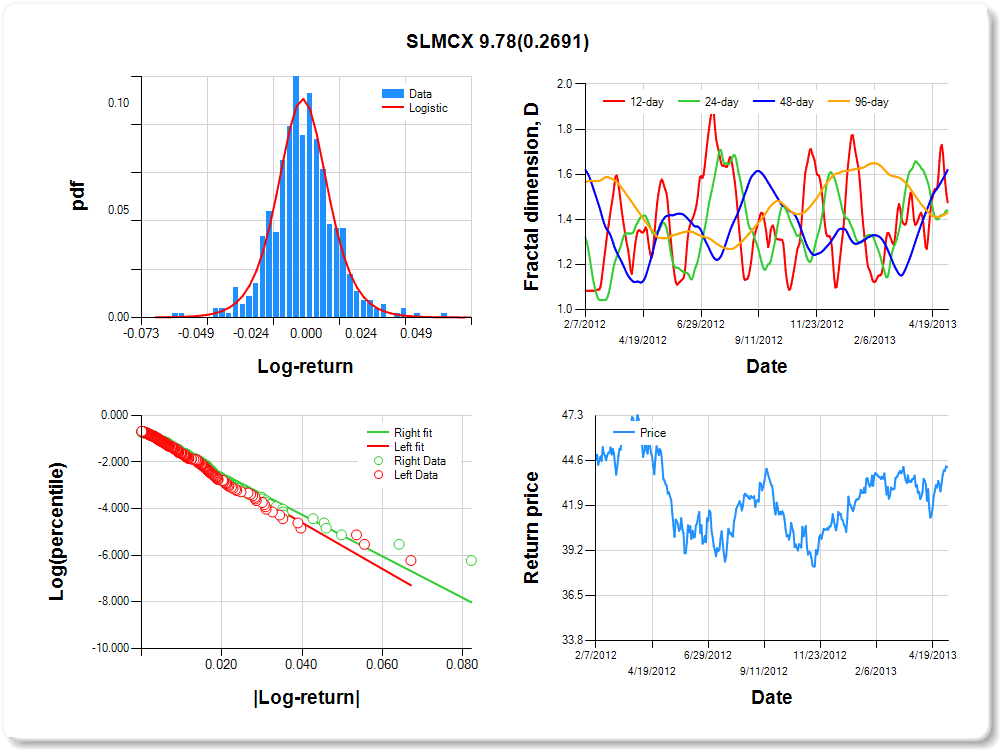

SLMCX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

2.19 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.178 |

0.168 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.646 |

0.092 |

-6.994 |

0.0000 |

|log-return| |

-98.671 |

6.506 |

-15.166 |

0.0000 |

I(right-tail) |

-0.049 |

0.131 |

-0.375 |

0.7077 |

|log-return|*I(right-tail) |

9.779 |

8.839 |

1.106 |

0.2691 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.525 |

0.562 |

0.380 |

0.569 |

ETHSX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.03 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.01 |

0.03 |

0.03 |

1.37 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Skew Normal |

-0.716 |

0.158 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.898 |

0.102 |

-8.817 |

0.0000 |

|log-return| |

-116.374 |

8.742 |

-13.313 |

0.0000 |

I(right-tail) |

-0.196 |

0.126 |

-1.561 |

0.1191 |

|log-return|*I(right-tail) |

54.908 |

10.087 |

5.443 |

0.0000 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.631 |

0.859 |

0.943 |

0.556 |

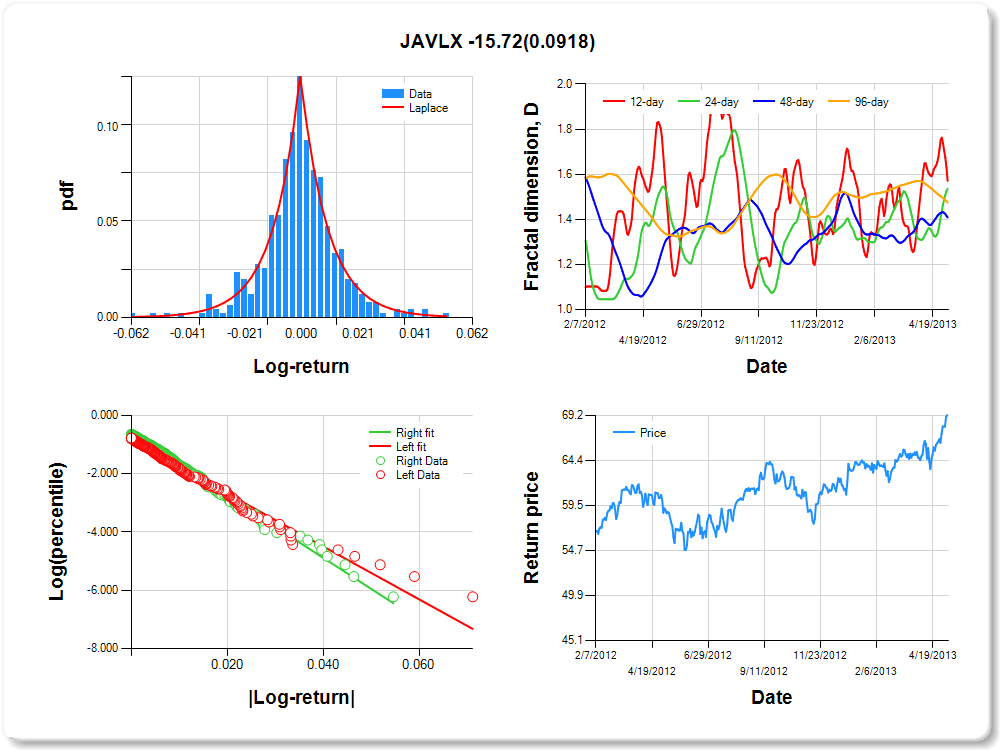

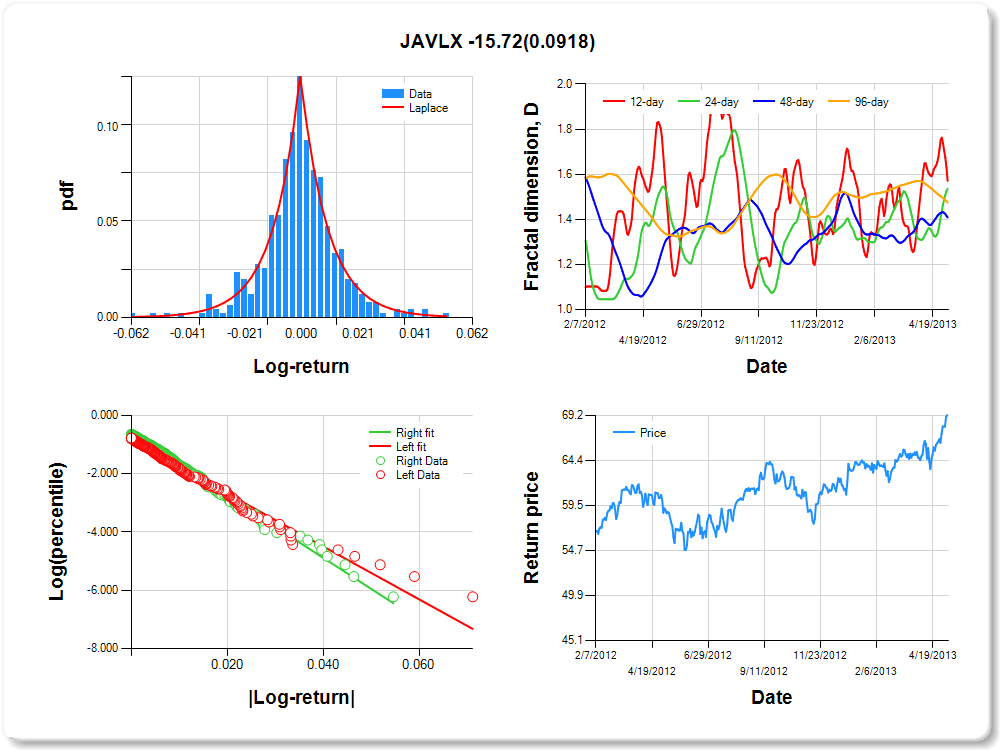

JAVLX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.04 |

3.60 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.243 |

0.267 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.858 |

0.091 |

-9.411 |

0.0000 |

|log-return| |

-90.748 |

6.300 |

-14.405 |

0.0000 |

I(right-tail) |

0.241 |

0.128 |

1.880 |

0.0607 |

|log-return|*I(right-tail) |

-15.724 |

9.308 |

-1.689 |

0.0918 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.429 |

0.464 |

0.592 |

0.526 |

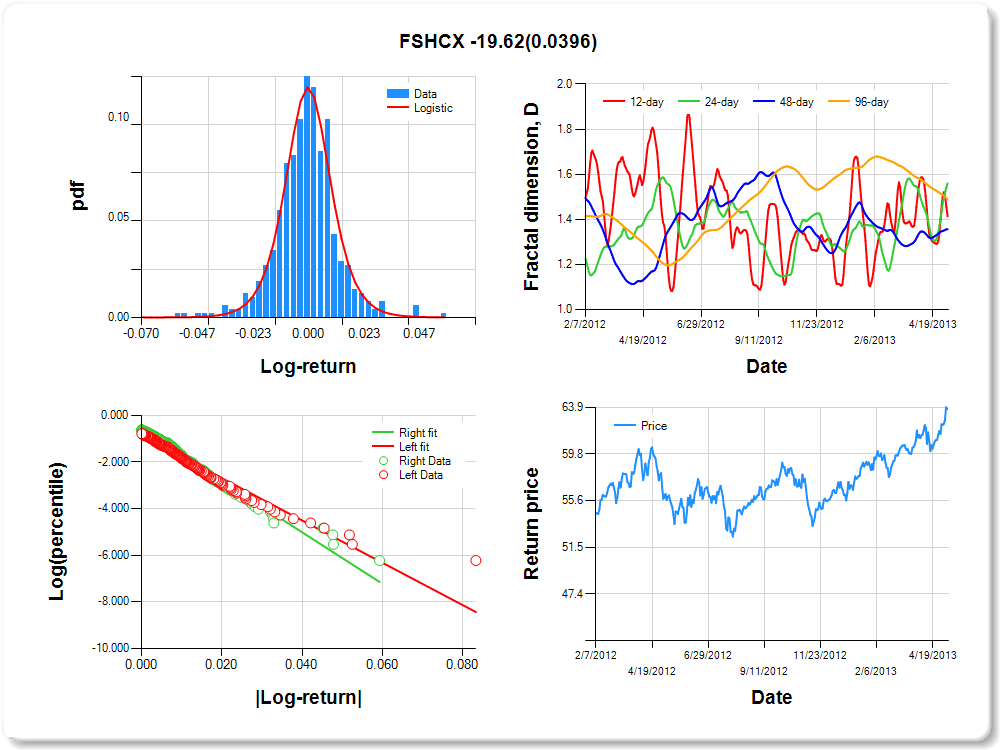

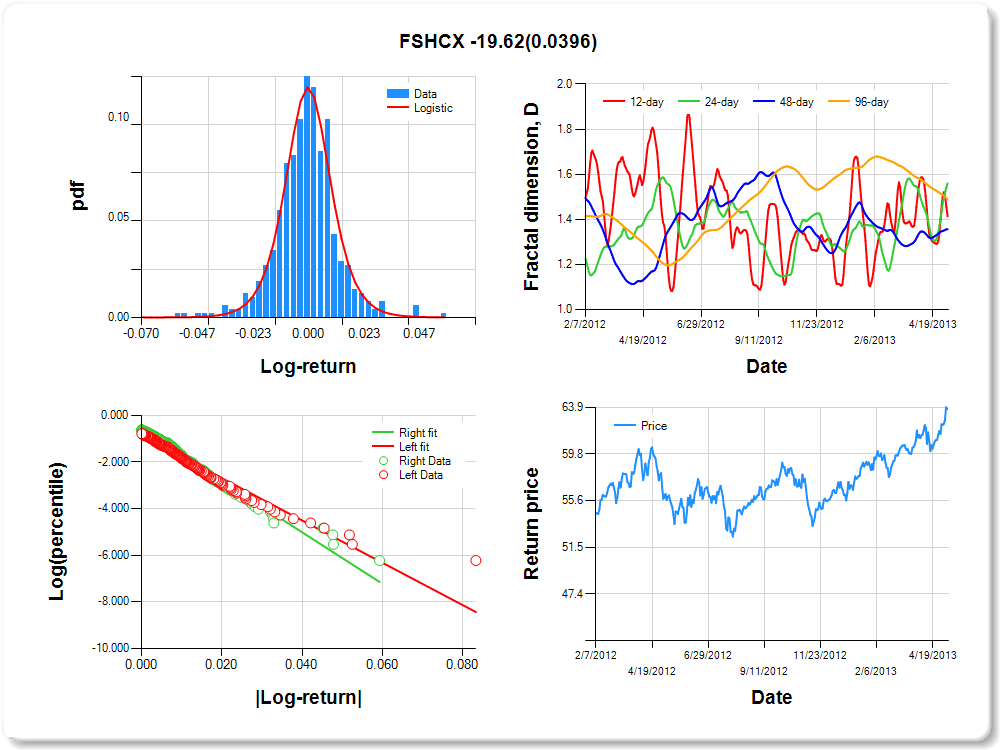

FSHCX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.03 |

0.05 |

3.00 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.315 |

0.149 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.872 |

0.092 |

-9.496 |

0.0000 |

|log-return| |

-90.609 |

6.396 |

-14.168 |

0.0000 |

I(right-tail) |

0.280 |

0.128 |

2.184 |

0.0294 |

|log-return|*I(right-tail) |

-19.618 |

9.510 |

-2.063 |

0.0396 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.586 |

0.440 |

0.644 |

0.512 |

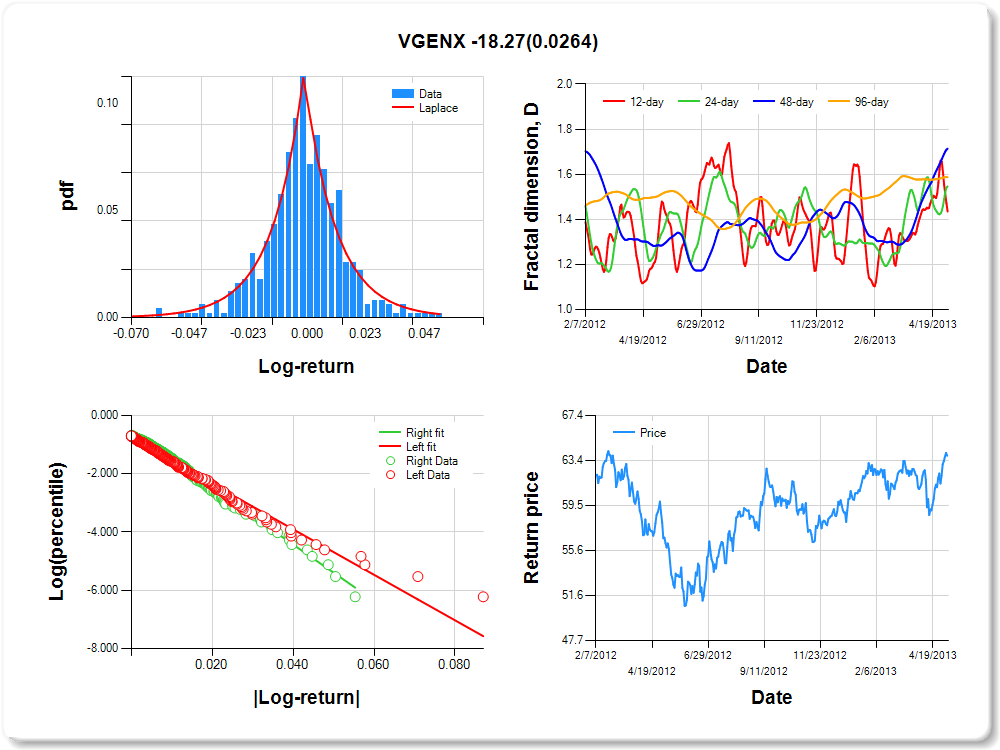

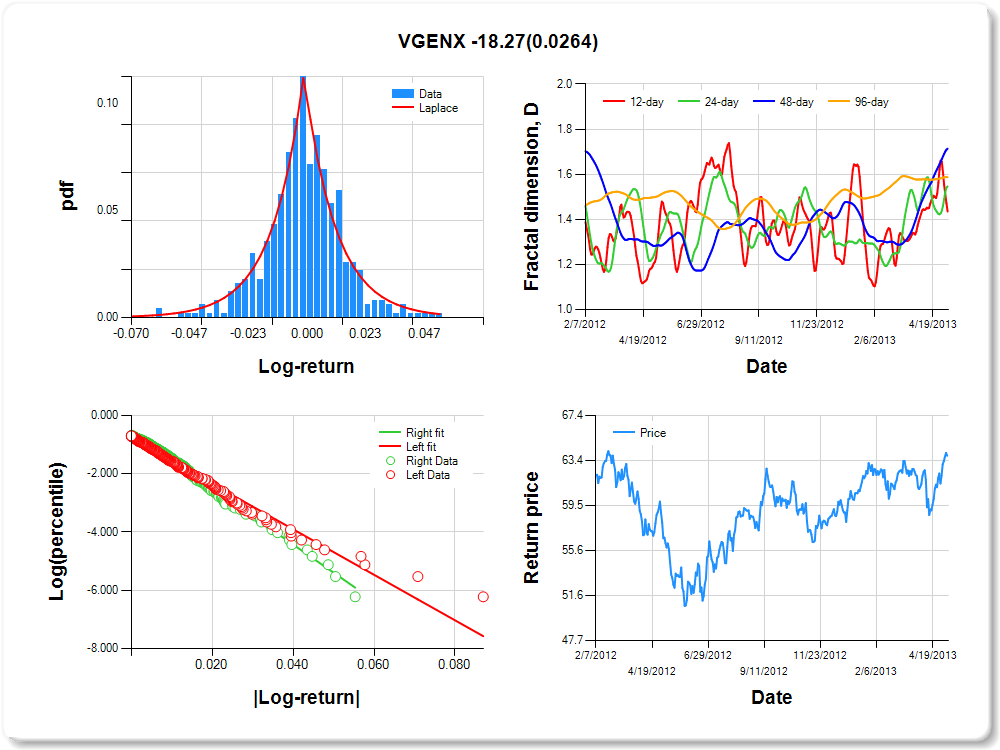

VGENX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

1.22 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.383 |

0.302 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.781 |

0.088 |

-8.878 |

0.0000 |

|log-return| |

-78.023 |

5.206 |

-14.986 |

0.0000 |

I(right-tail) |

0.210 |

0.131 |

1.604 |

0.1093 |

|log-return|*I(right-tail) |

-18.266 |

8.204 |

-2.227 |

0.0264 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.565 |

0.454 |

0.286 |

0.413 |