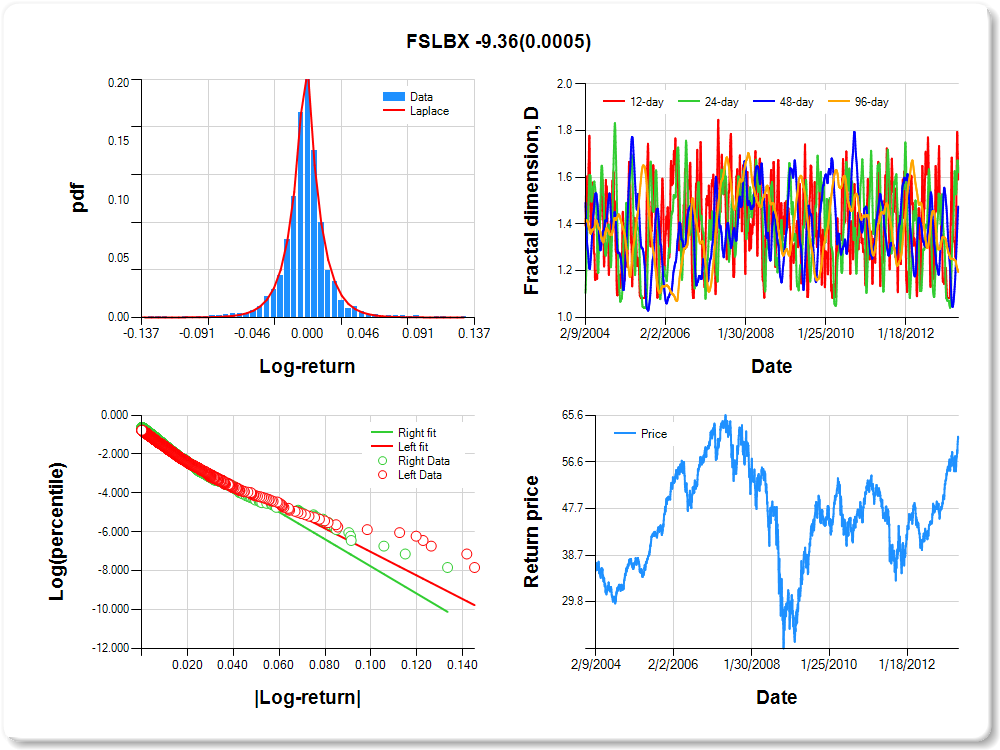

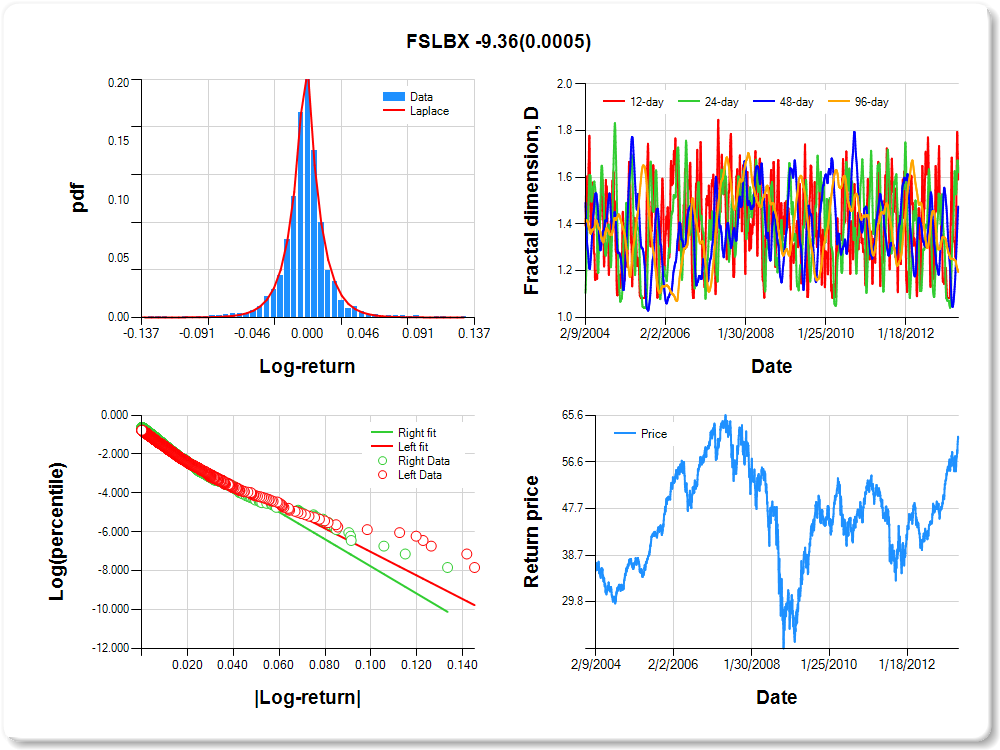

FSLBX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.07 |

-0.06 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.06 |

0.08 |

0.58 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.082 |

0.141 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.977 |

0.038 |

-25.675 |

0.0000 |

|log-return| |

-60.479 |

1.846 |

-32.770 |

0.0000 |

I(right-tail) |

0.192 |

0.052 |

3.653 |

0.0003 |

|log-return|*I(right-tail) |

-9.359 |

2.698 |

-3.468 |

0.0005 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.409 |

0.378 |

0.525 |

0.806 |

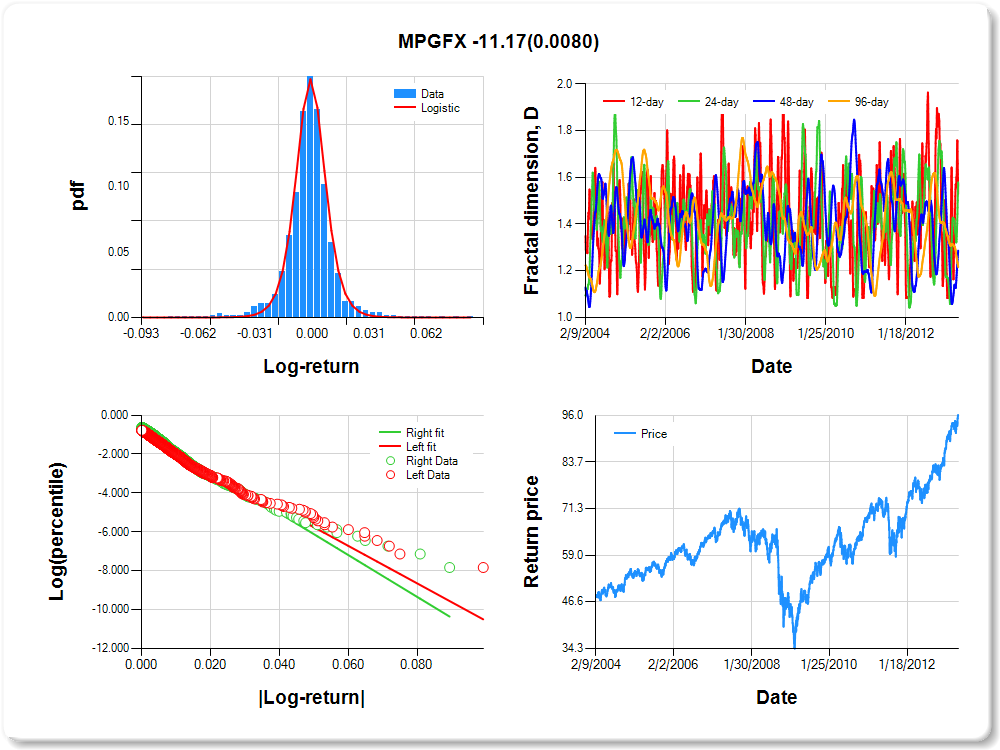

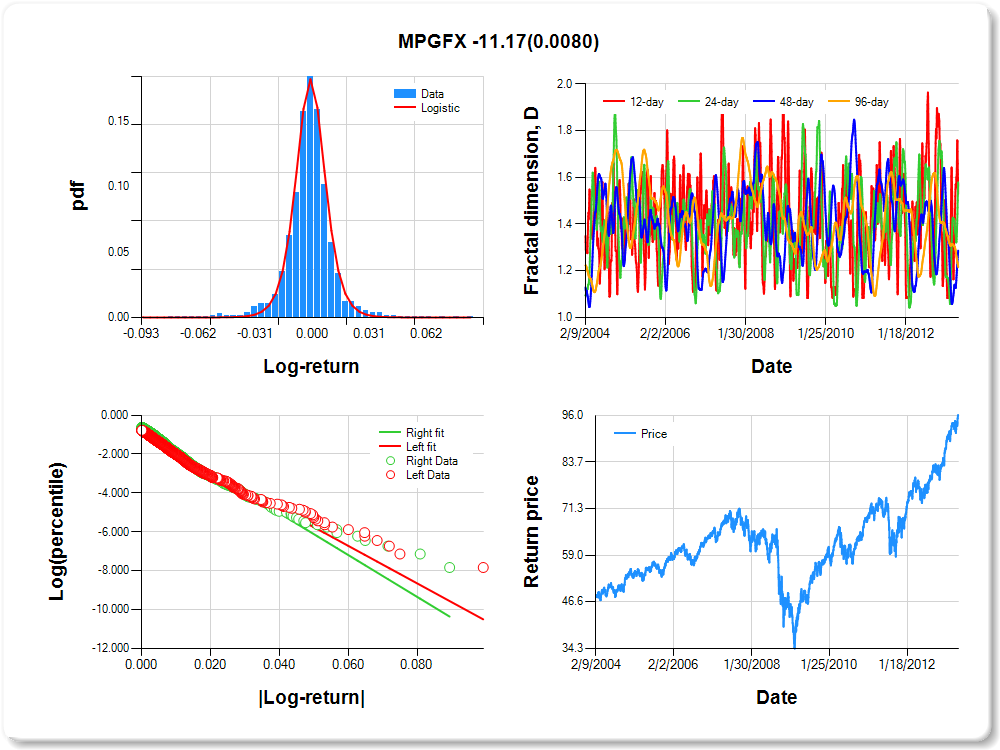

MPGFX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

0.39 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.104 |

0.094 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.930 |

0.039 |

-23.837 |

0.0000 |

|log-return| |

-96.388 |

2.925 |

-32.949 |

0.0000 |

I(right-tail) |

0.199 |

0.054 |

3.687 |

0.0002 |

|log-return|*I(right-tail) |

-11.166 |

4.210 |

-2.652 |

0.0080 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.470 |

0.421 |

0.713 |

0.785 |

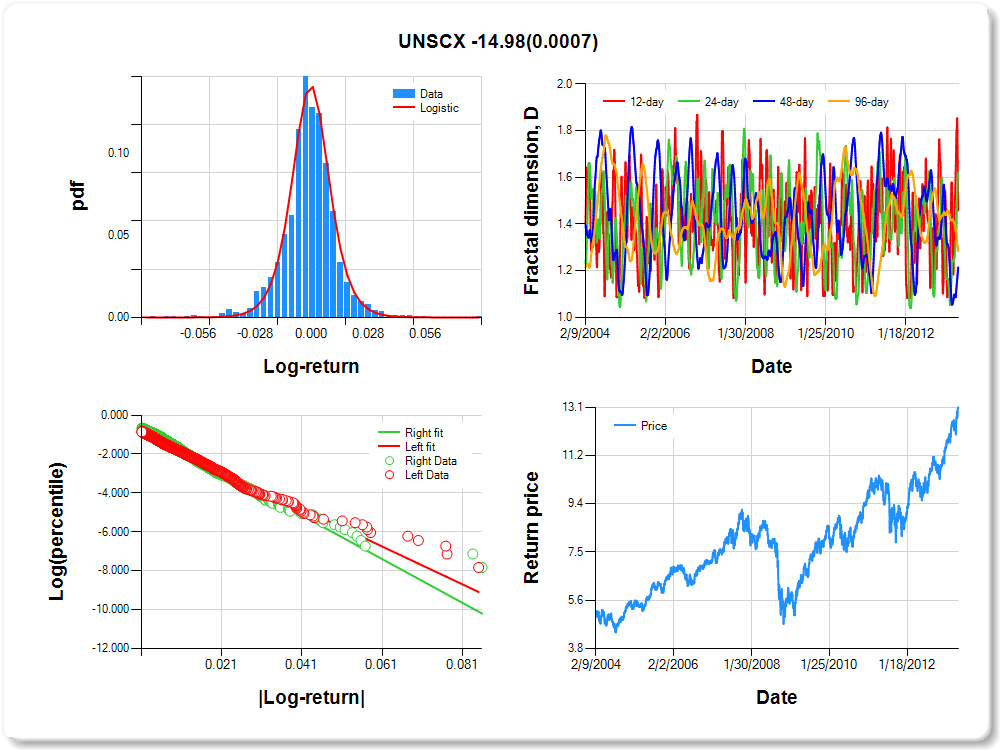

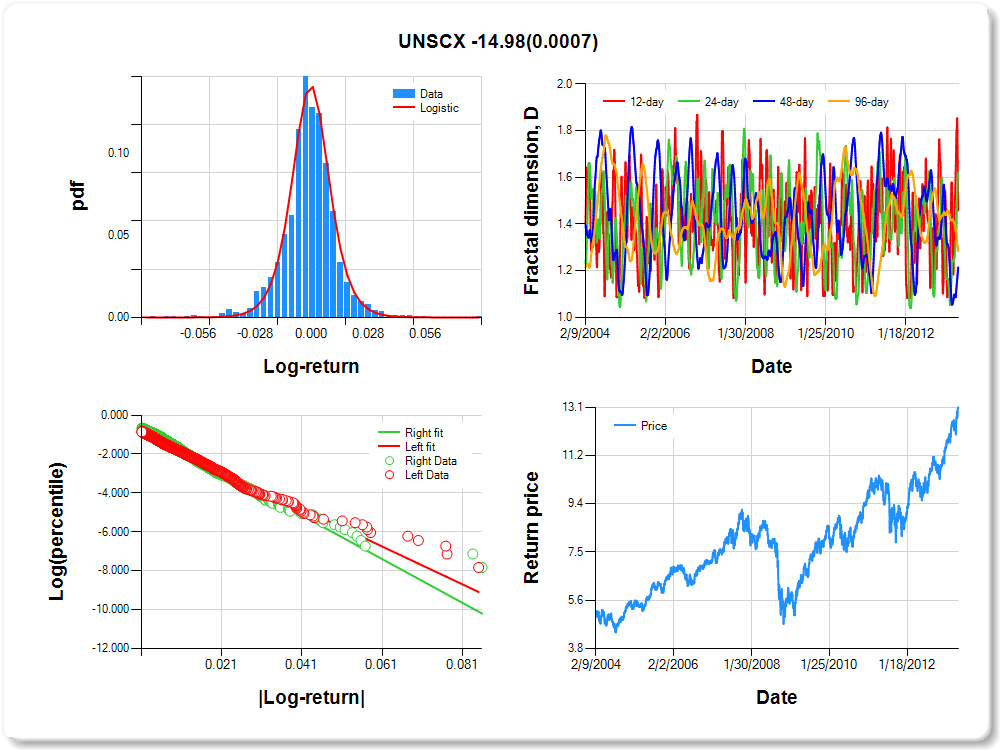

UNSCX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.04 |

-0.04 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.04 |

0.71 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.013 |

0.121 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.846 |

0.044 |

-19.268 |

0.0000 |

|log-return| |

-97.218 |

3.039 |

-31.988 |

0.0000 |

I(right-tail) |

0.260 |

0.060 |

4.305 |

0.0000 |

|log-return|*I(right-tail) |

-14.978 |

4.411 |

-3.396 |

0.0007 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.541 |

0.378 |

0.785 |

0.716 |

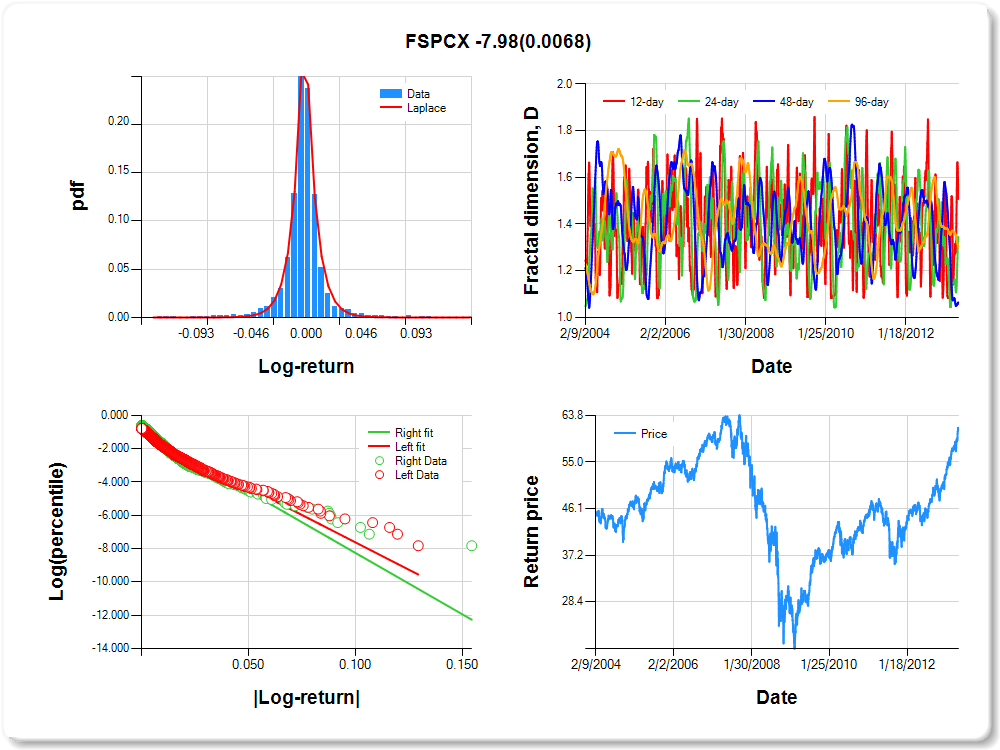

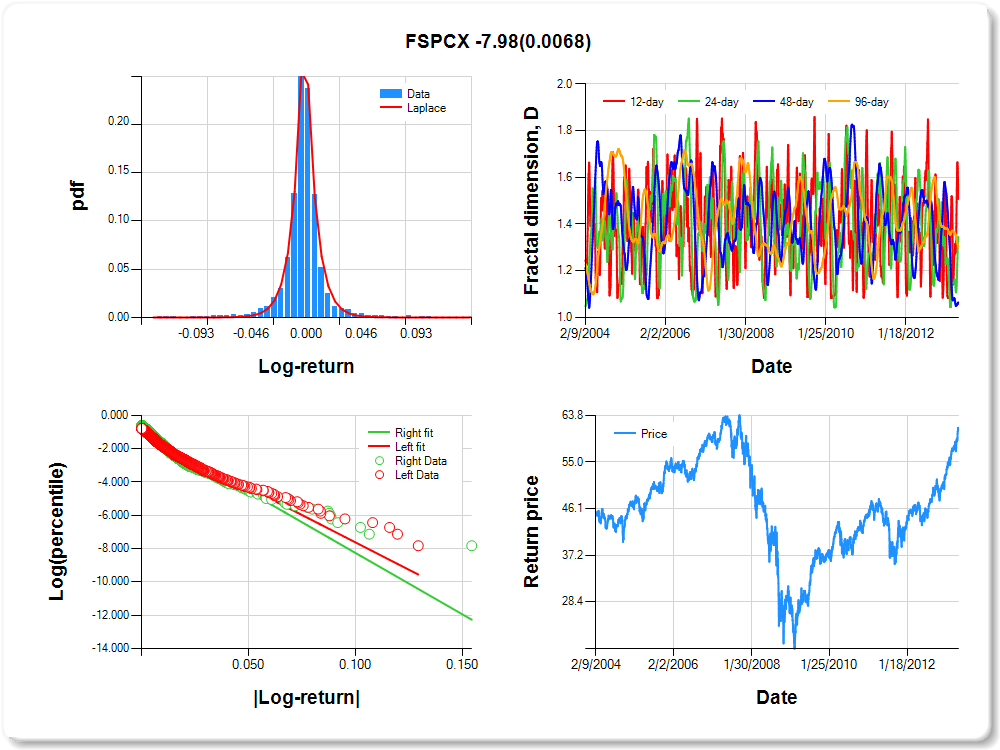

FSPCX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.07 |

-0.06 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.05 |

0.07 |

0.51 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.140 |

0.103 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-1.058 |

0.037 |

-28.232 |

0.0000 |

|log-return| |

-65.697 |

2.038 |

-32.232 |

0.0000 |

I(right-tail) |

0.164 |

0.051 |

3.234 |

0.0012 |

|log-return|*I(right-tail) |

-7.977 |

2.942 |

-2.711 |

0.0068 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.493 |

0.655 |

0.935 |

0.699 |

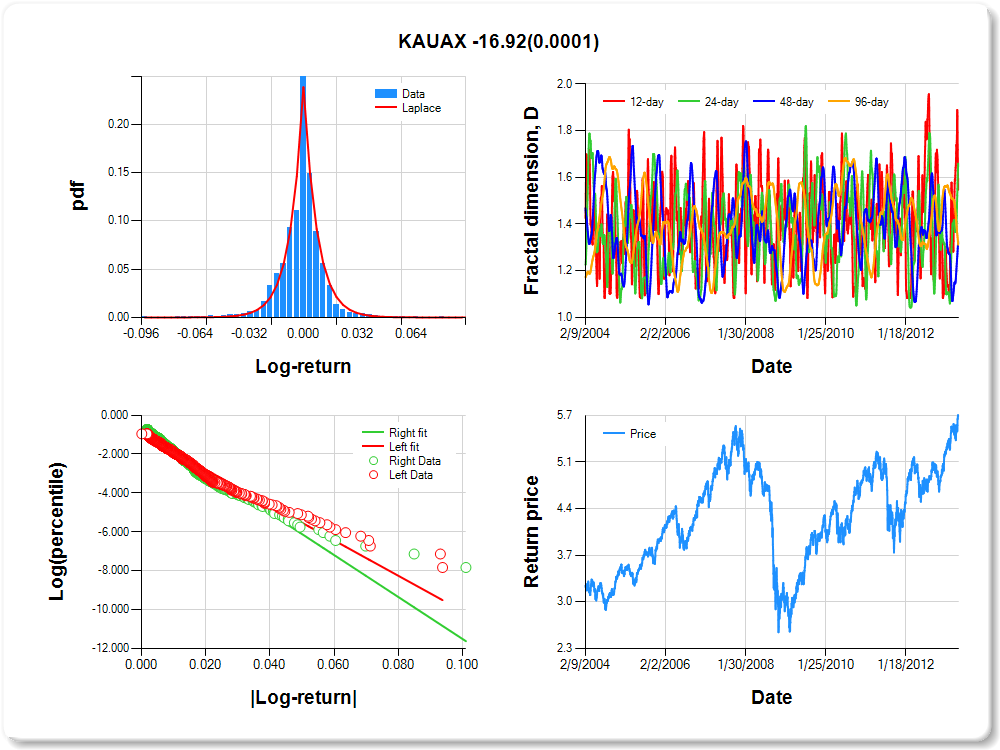

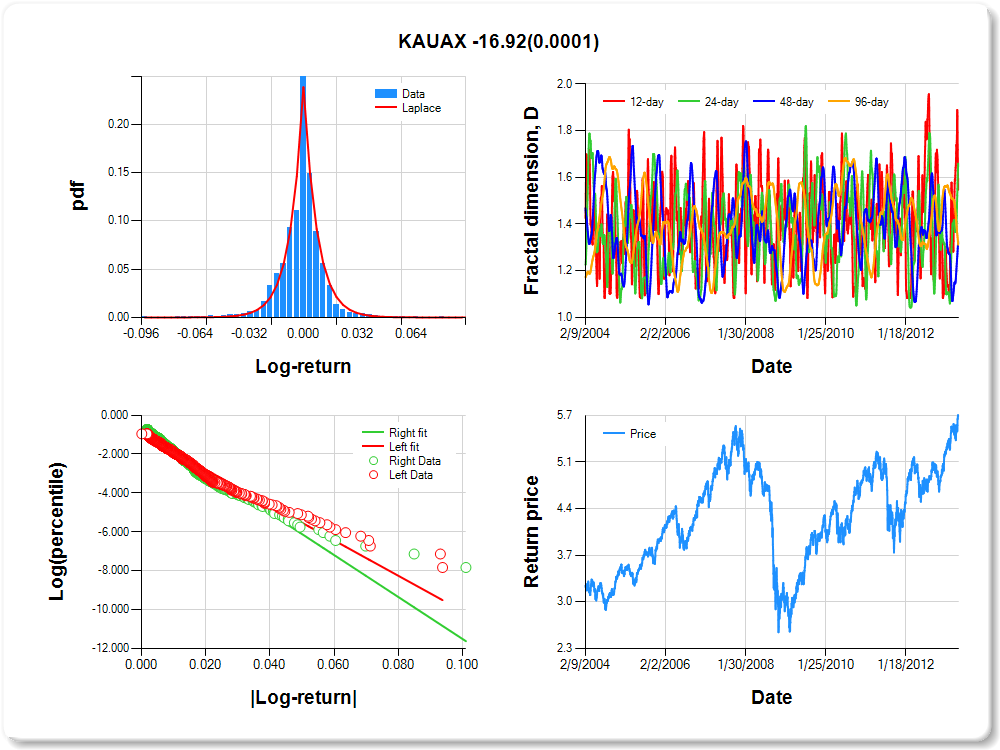

KAUAX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

0.22 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.033 |

0.140 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.975 |

0.046 |

-21.314 |

0.0000 |

|log-return| |

-90.849 |

3.018 |

-30.103 |

0.0000 |

I(right-tail) |

0.266 |

0.062 |

4.288 |

0.0000 |

|log-return|*I(right-tail) |

-16.917 |

4.406 |

-3.840 |

0.0001 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.453 |

0.340 |

0.675 |

0.688 |

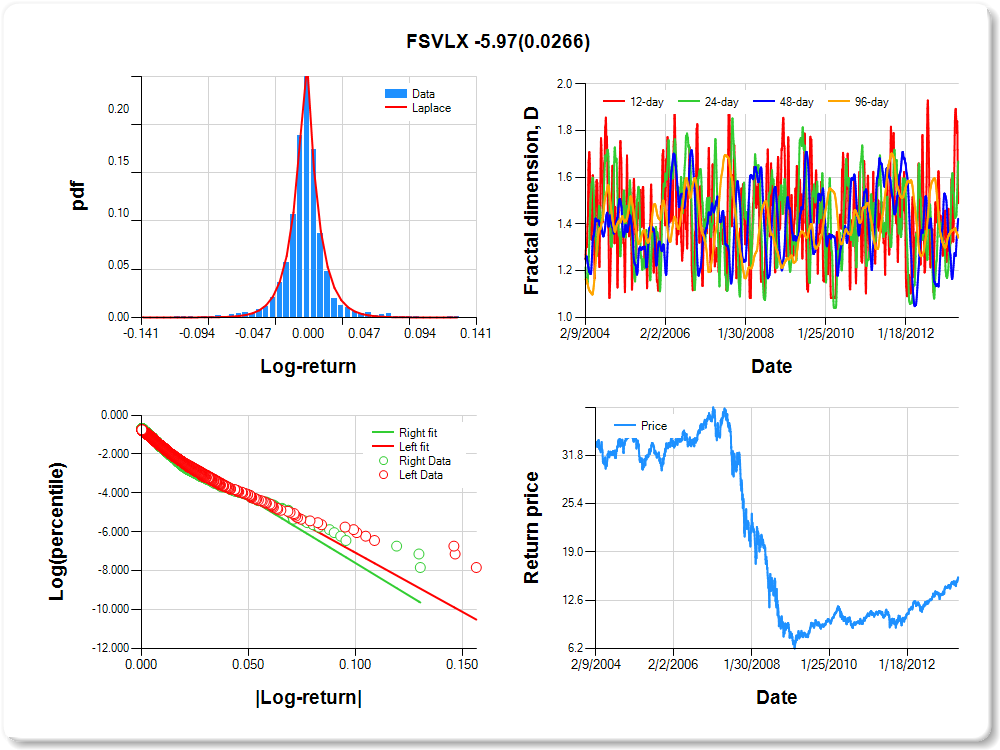

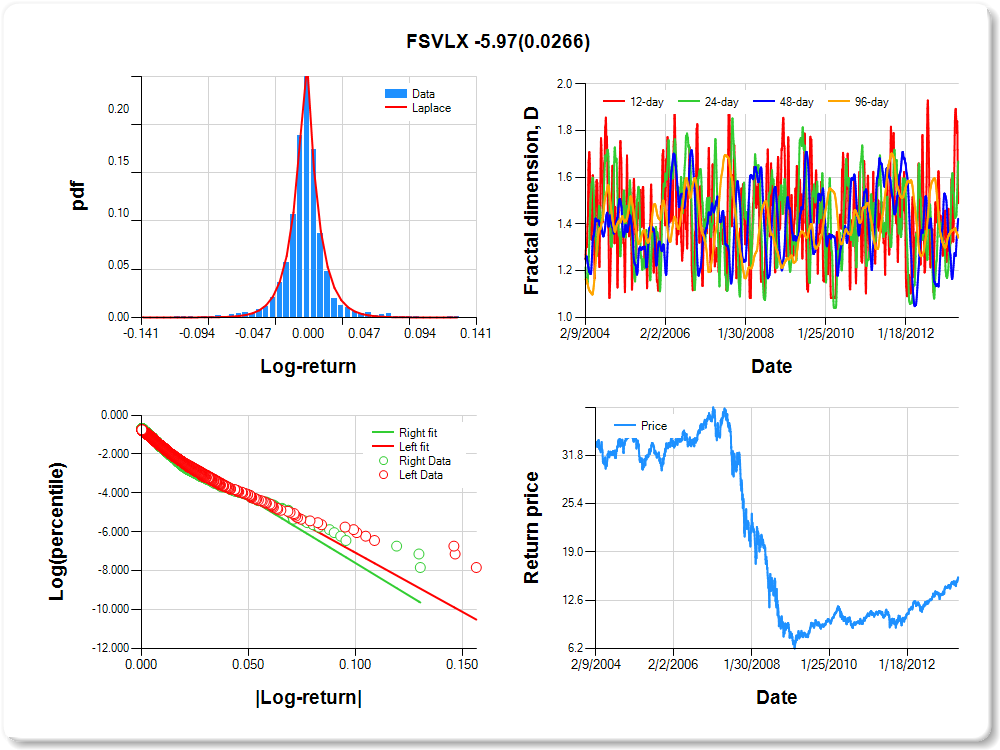

FSVLX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.07 |

-0.06 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.06 |

0.07 |

0.16 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.159 |

0.128 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.978 |

0.037 |

-26.334 |

0.0000 |

|log-return| |

-60.849 |

1.844 |

-32.991 |

0.0000 |

I(right-tail) |

0.066 |

0.052 |

1.279 |

0.2009 |

|log-return|*I(right-tail) |

-5.965 |

2.689 |

-2.219 |

0.0266 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.510 |

0.332 |

0.577 |

0.659 |

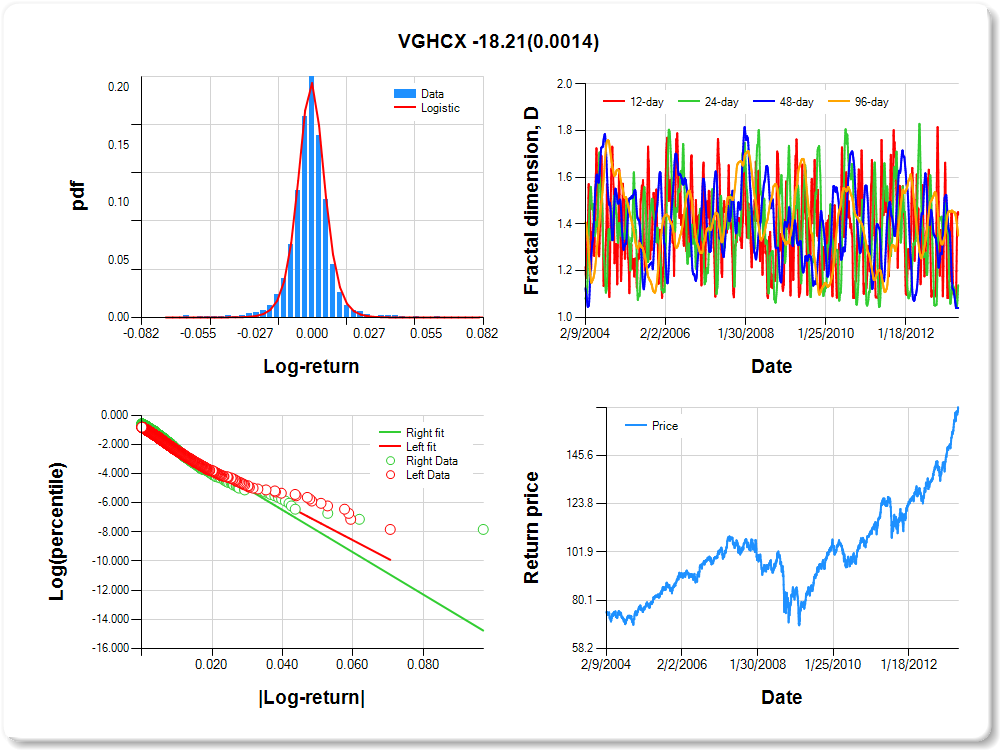

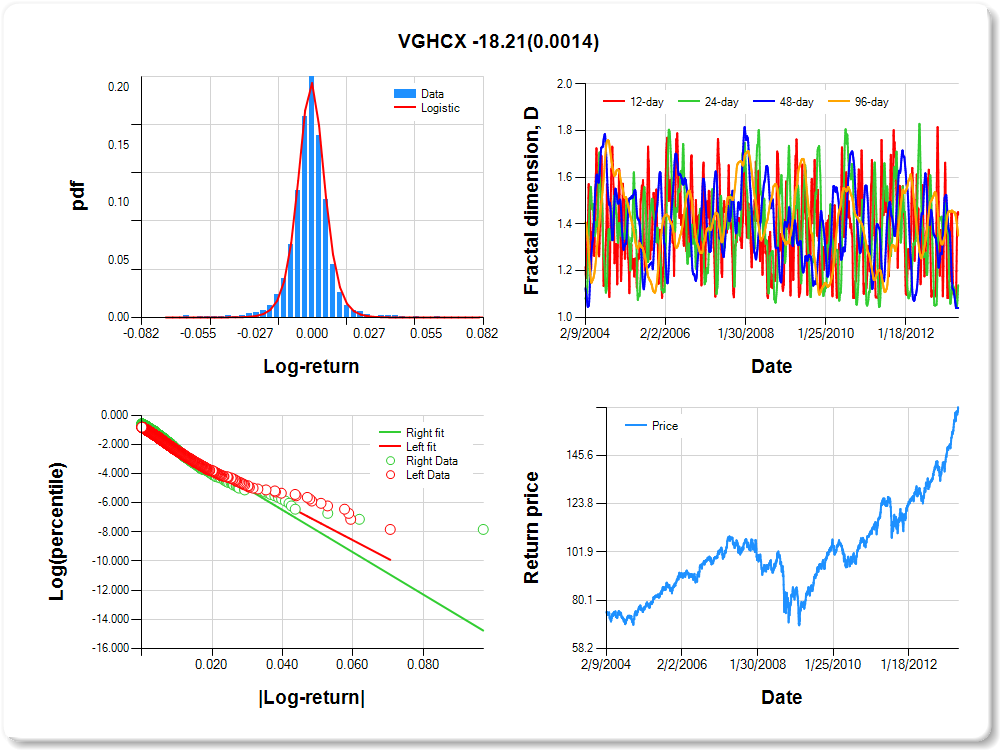

VGHCX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.04 |

-0.03 |

-0.01 |

-0.01 |

0.00 |

0.00 |

0.01 |

0.01 |

0.02 |

0.03 |

0.00 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.248 |

0.084 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.961 |

0.040 |

-23.844 |

0.0000 |

|log-return| |

-126.745 |

3.959 |

-32.017 |

0.0000 |

I(right-tail) |

0.266 |

0.055 |

4.878 |

0.0000 |

|log-return|*I(right-tail) |

-18.210 |

5.694 |

-3.198 |

0.0014 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.559 |

0.862 |

0.959 |

0.649 |

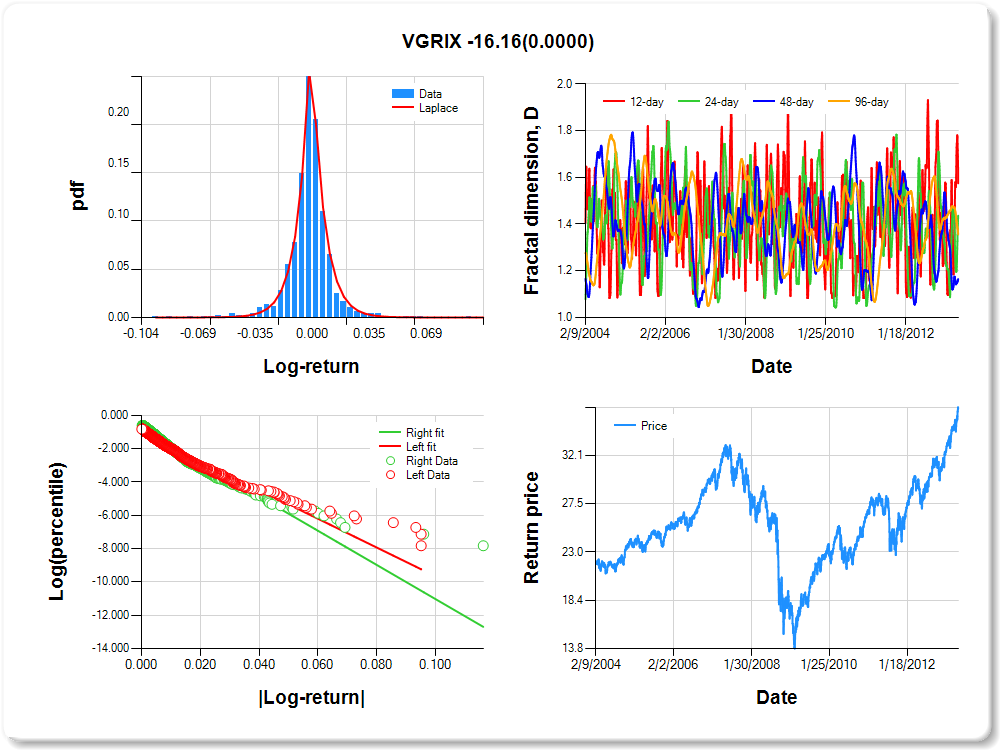

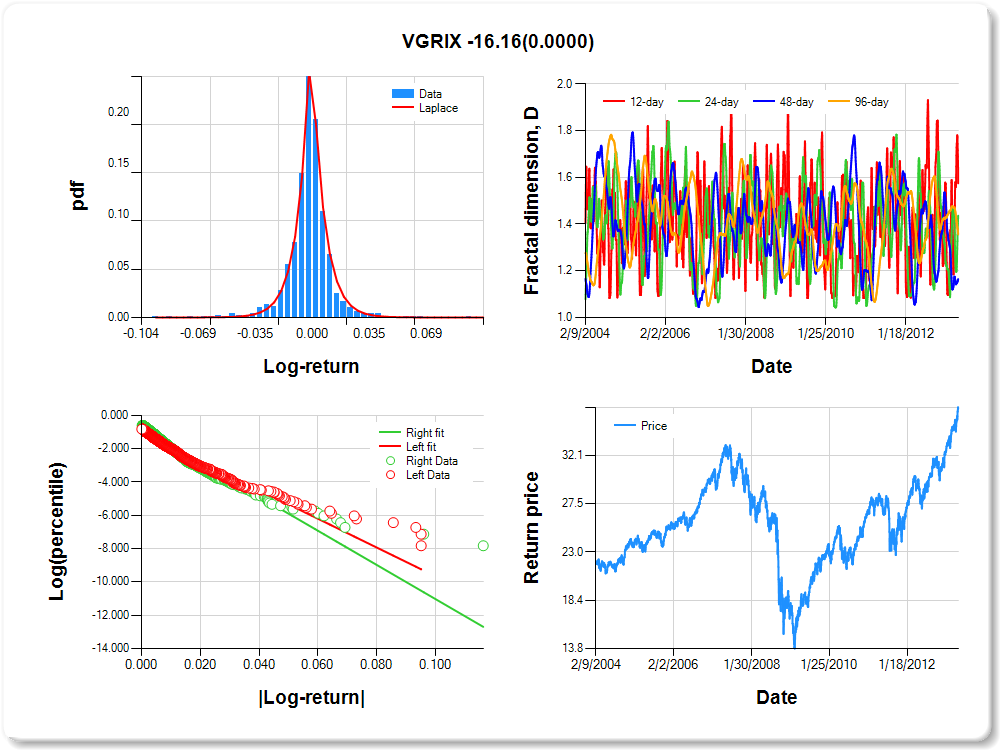

VGRIX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.01 |

0.00 |

0.00 |

0.01 |

0.02 |

0.04 |

0.04 |

0.78 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.152 |

0.123 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-1.038 |

0.039 |

-26.526 |

0.0000 |

|log-return| |

-86.246 |

2.708 |

-31.853 |

0.0000 |

I(right-tail) |

0.248 |

0.053 |

4.674 |

0.0000 |

|log-return|*I(right-tail) |

-16.158 |

3.972 |

-4.068 |

0.0000 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.425 |

0.564 |

0.836 |

0.644 |

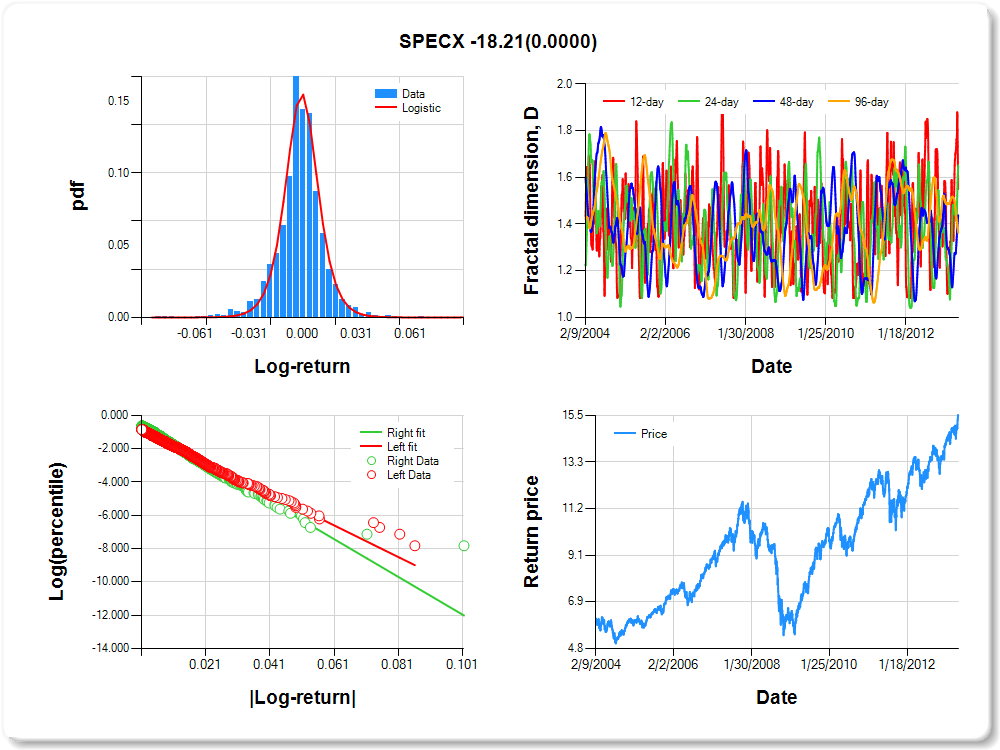

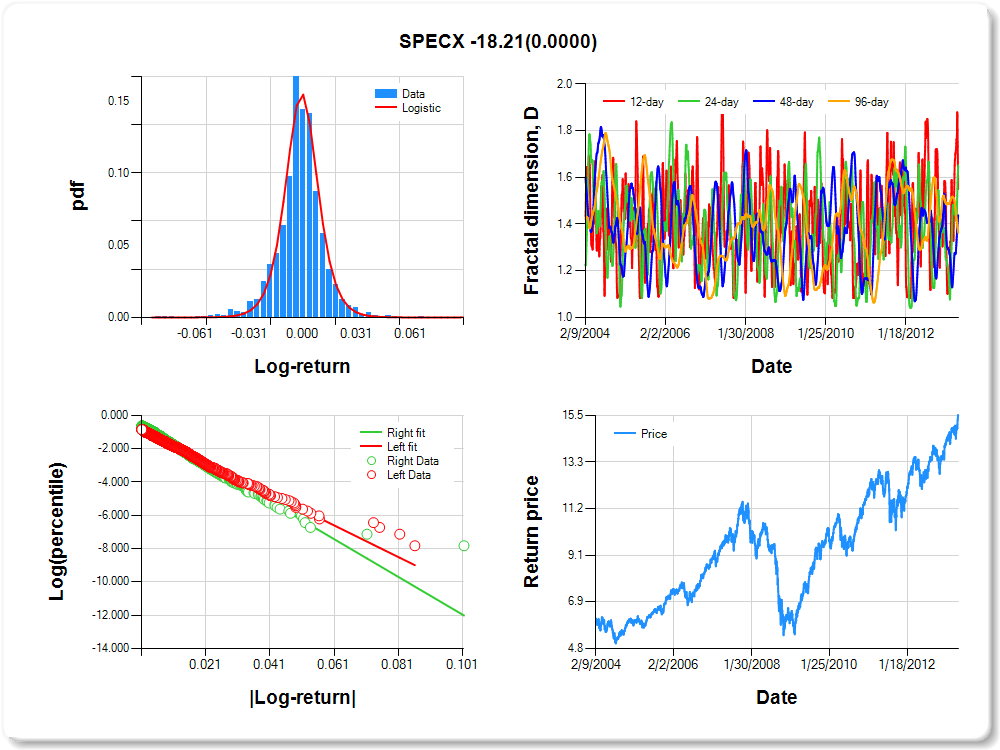

SPECX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.03 |

0.04 |

0.86 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.119 |

0.111 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.857 |

0.044 |

-19.550 |

0.0000 |

|log-return| |

-94.849 |

2.966 |

-31.980 |

0.0000 |

I(right-tail) |

0.279 |

0.060 |

4.660 |

0.0000 |

|log-return|*I(right-tail) |

-18.209 |

4.351 |

-4.185 |

0.0000 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.450 |

0.349 |

0.562 |

0.637 |

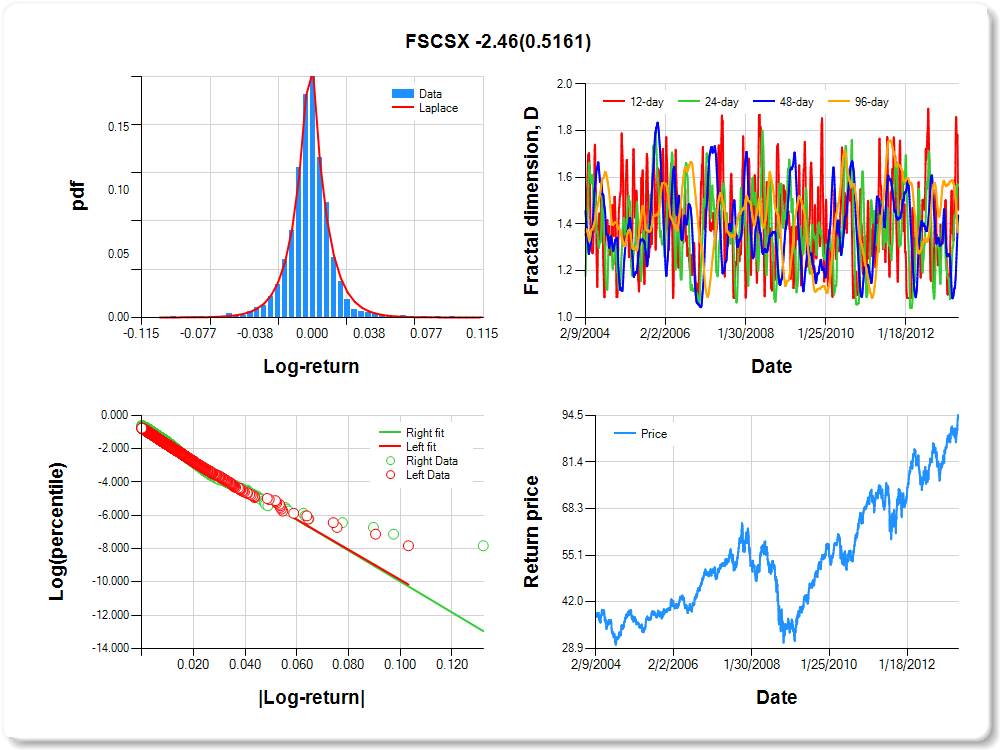

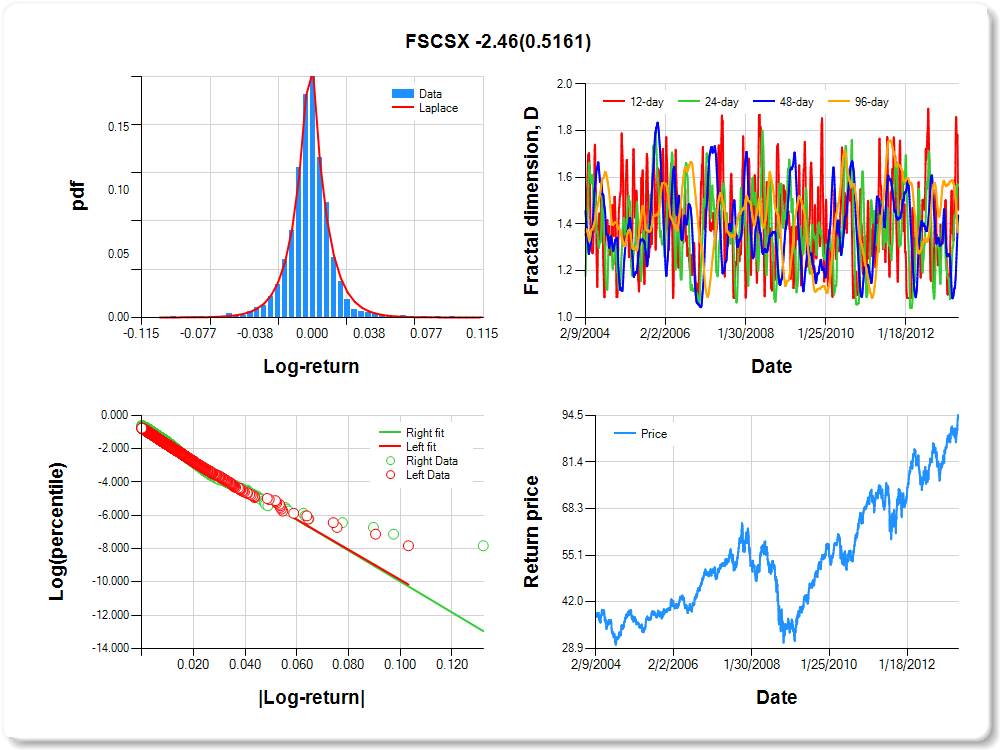

FSCSX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

1.05 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.198 |

0.149 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.844 |

0.041 |

-20.801 |

0.0000 |

|log-return| |

-90.237 |

2.712 |

-33.270 |

0.0000 |

I(right-tail) |

0.142 |

0.056 |

2.548 |

0.0109 |

|log-return|*I(right-tail) |

-2.456 |

3.781 |

-0.650 |

0.5161 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.539 |

0.432 |

0.563 |

0.637 |

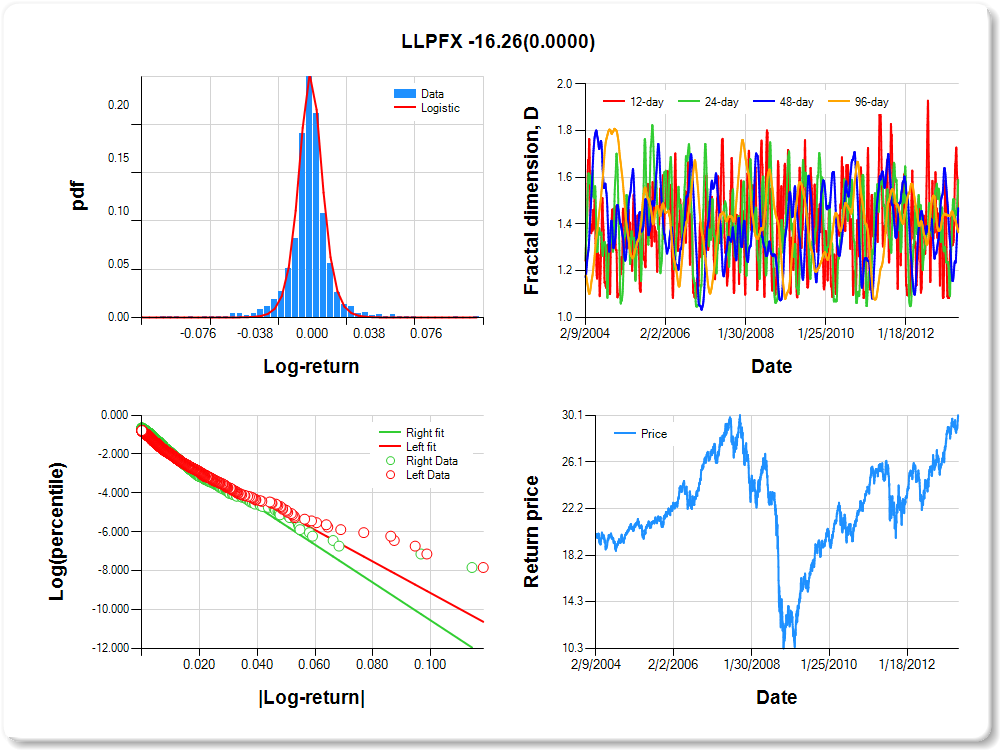

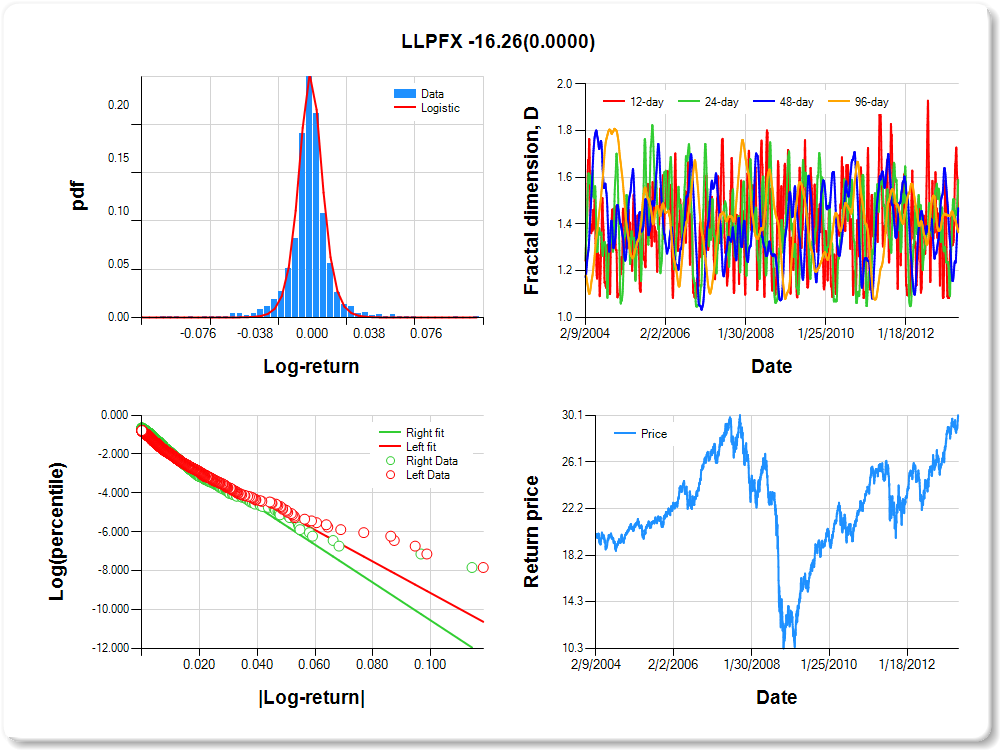

LLPFX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.05 |

-0.02 |

-0.01 |

0.00 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

0.39 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.042 |

0.075 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-1.017 |

0.038 |

-26.852 |

0.0000 |

|log-return| |

-81.112 |

2.498 |

-32.465 |

0.0000 |

I(right-tail) |

0.223 |

0.053 |

4.201 |

0.0000 |

|log-return|*I(right-tail) |

-16.263 |

3.758 |

-4.328 |

0.0000 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.624 |

0.410 |

0.531 |

0.635 |

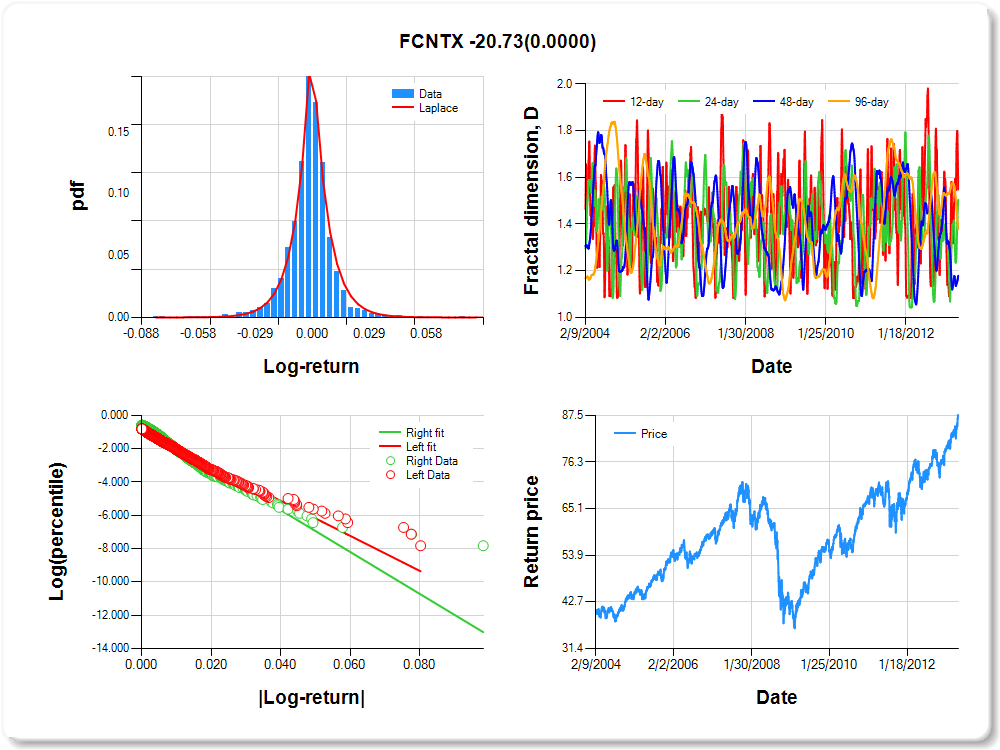

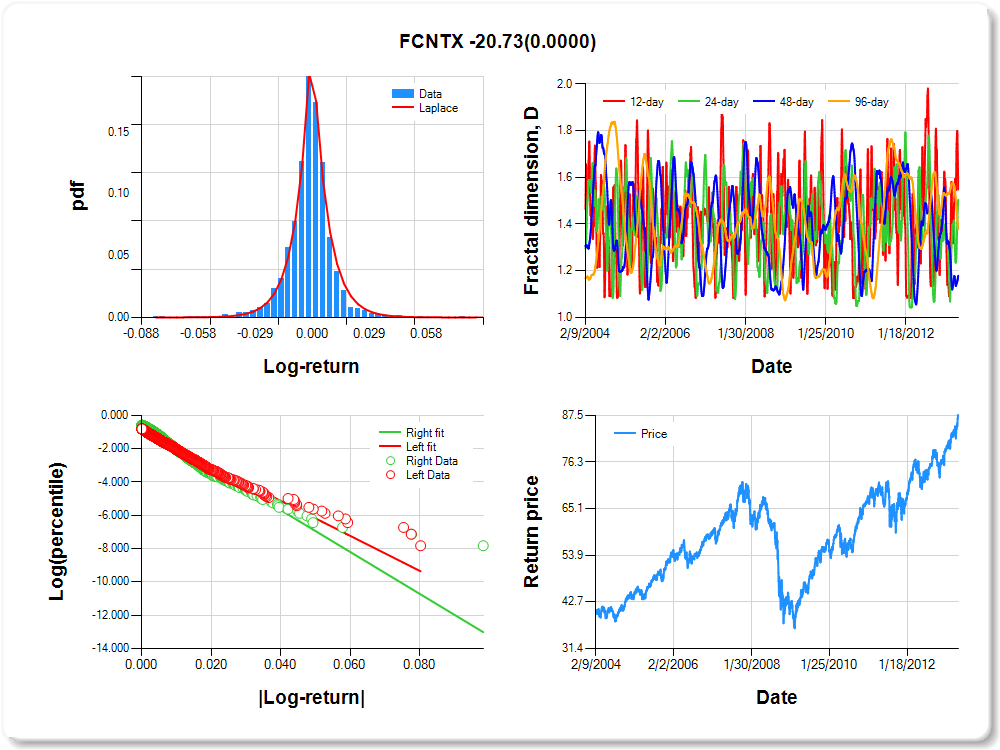

FCNTX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.04 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.00 |

0.01 |

0.02 |

0.03 |

0.04 |

0.63 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.146 |

0.148 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.935 |

0.041 |

-23.050 |

0.0000 |

|log-return| |

-104.857 |

3.233 |

-32.435 |

0.0000 |

I(right-tail) |

0.279 |

0.055 |

5.046 |

0.0000 |

|log-return|*I(right-tail) |

-20.726 |

4.768 |

-4.347 |

0.0000 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.452 |

0.496 |

0.821 |

0.622 |

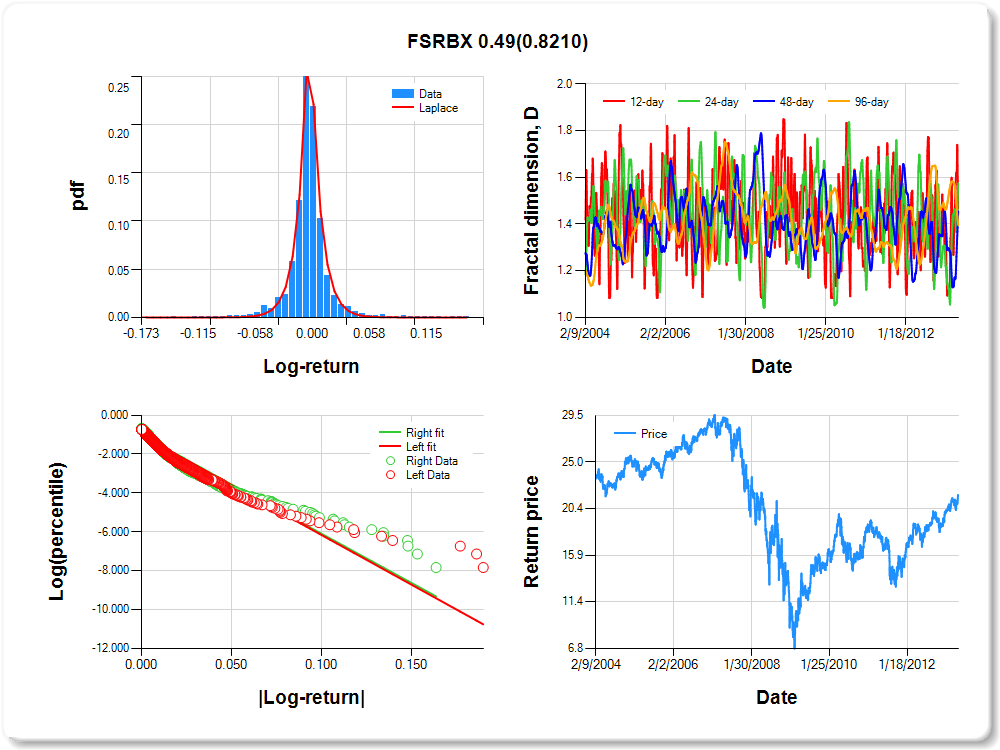

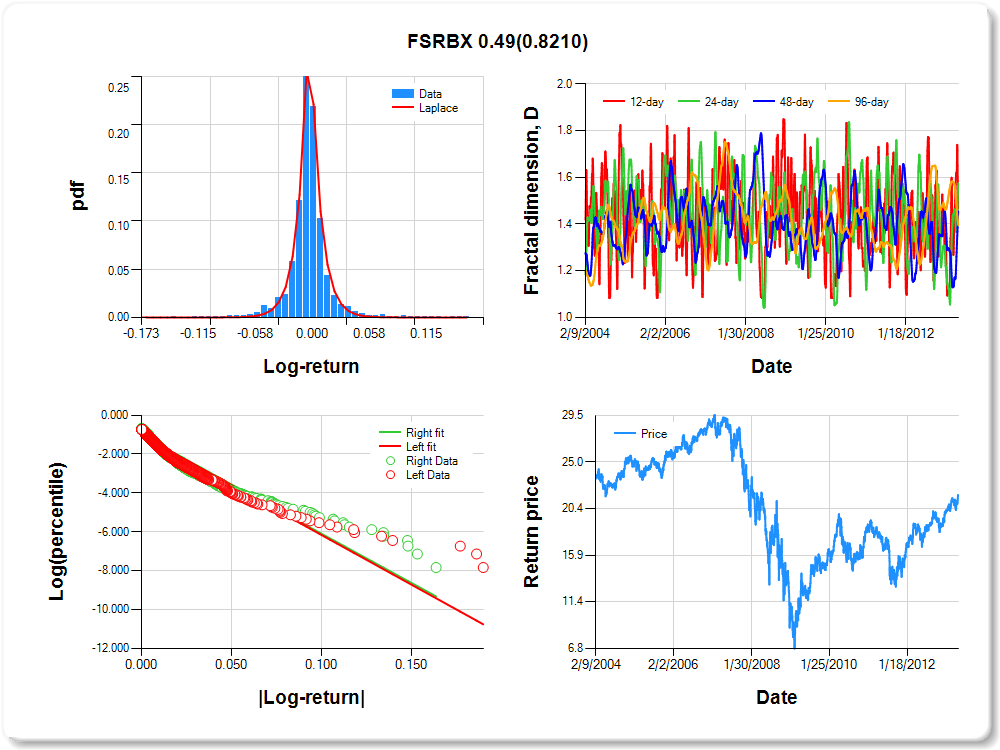

FSRBX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.08 |

-0.06 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.08 |

0.10 |

1.08 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.130 |

0.098 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-1.040 |

0.036 |

-29.292 |

0.0000 |

|log-return| |

-51.179 |

1.558 |

-32.843 |

0.0000 |

I(right-tail) |

0.014 |

0.050 |

0.285 |

0.7755 |

|log-return|*I(right-tail) |

0.493 |

2.178 |

0.226 |

0.8210 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.533 |

0.425 |

0.545 |

0.605 |

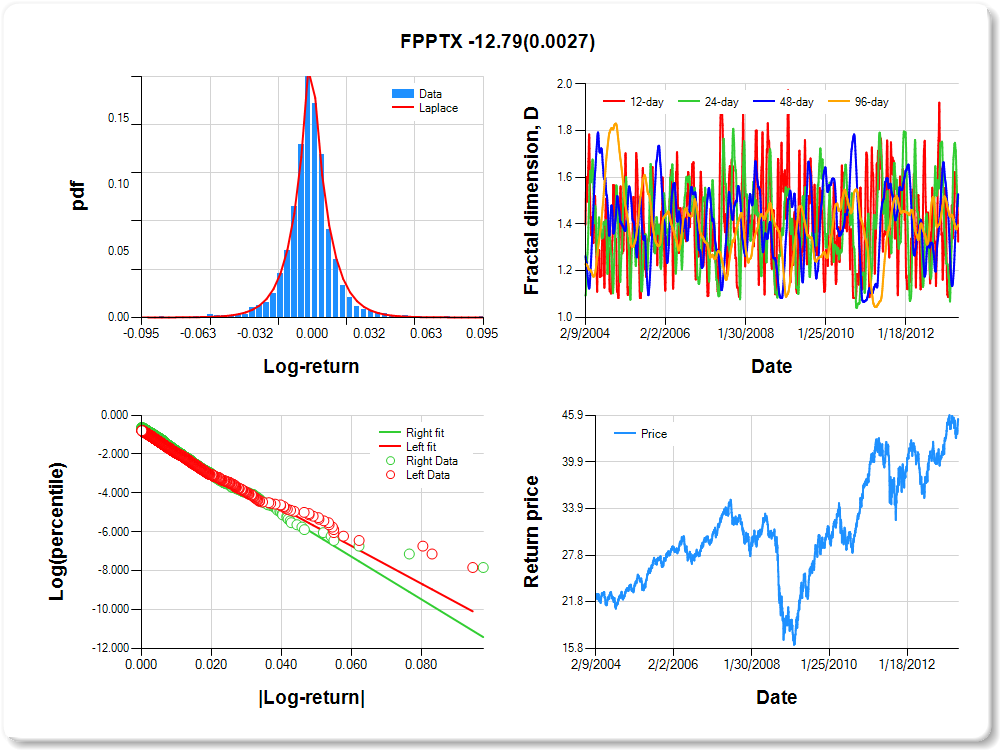

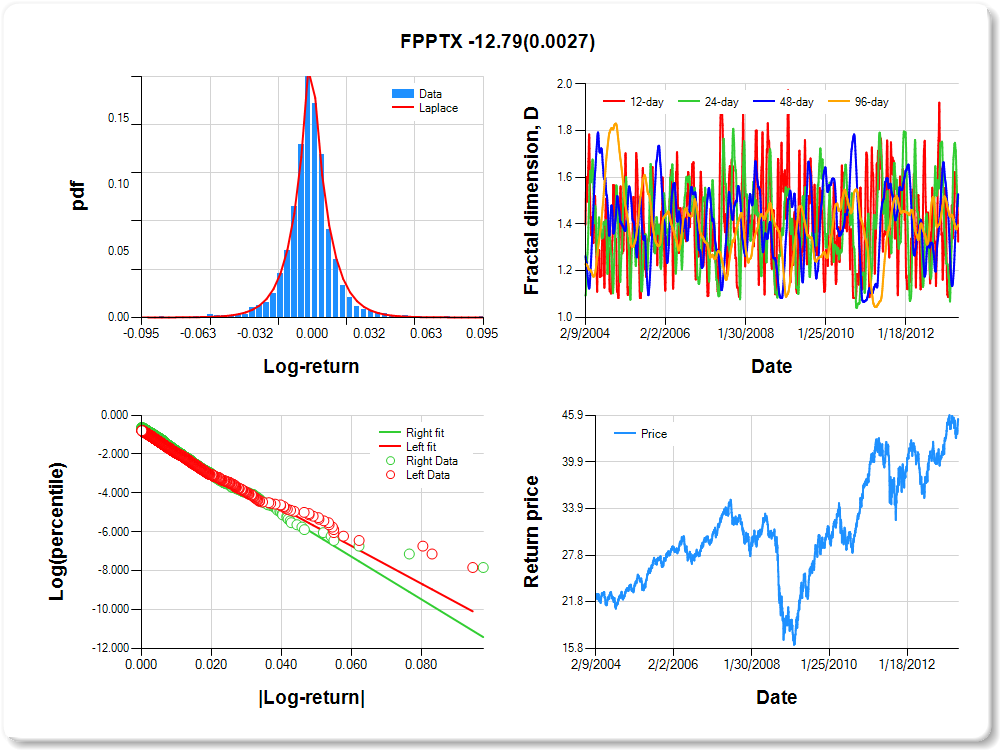

FPPTX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.04 |

0.70 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.009 |

0.158 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.891 |

0.040 |

-22.064 |

0.0000 |

|log-return| |

-96.866 |

2.950 |

-32.835 |

0.0000 |

I(right-tail) |

0.221 |

0.056 |

3.945 |

0.0001 |

|log-return|*I(right-tail) |

-12.794 |

4.267 |

-2.999 |

0.0027 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.675 |

0.483 |

0.472 |

0.604 |

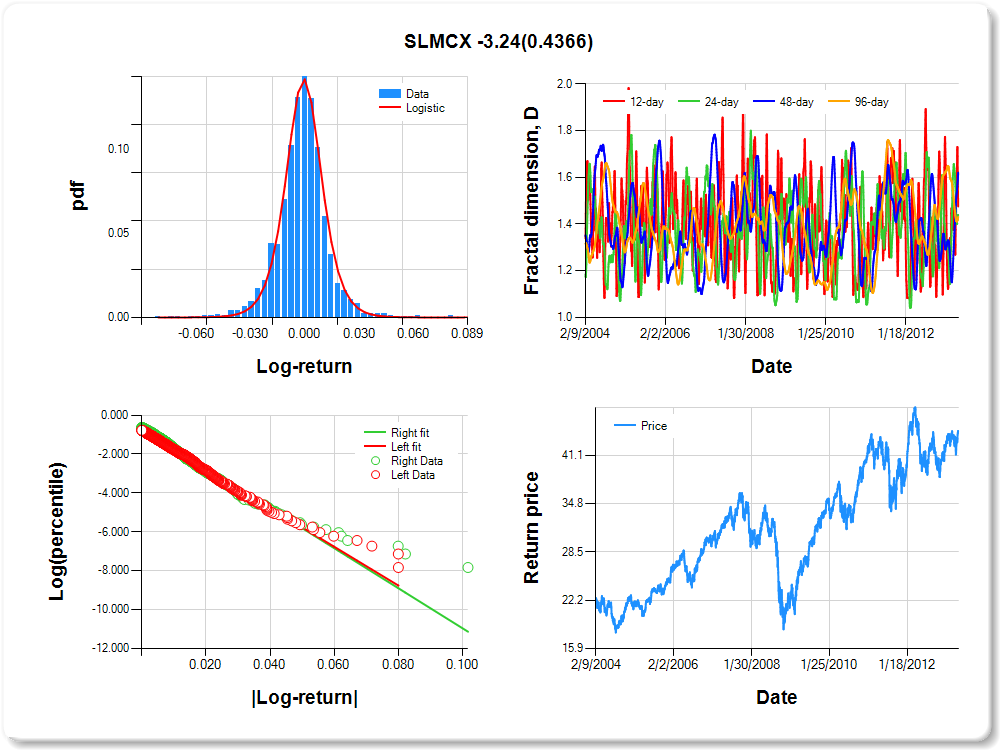

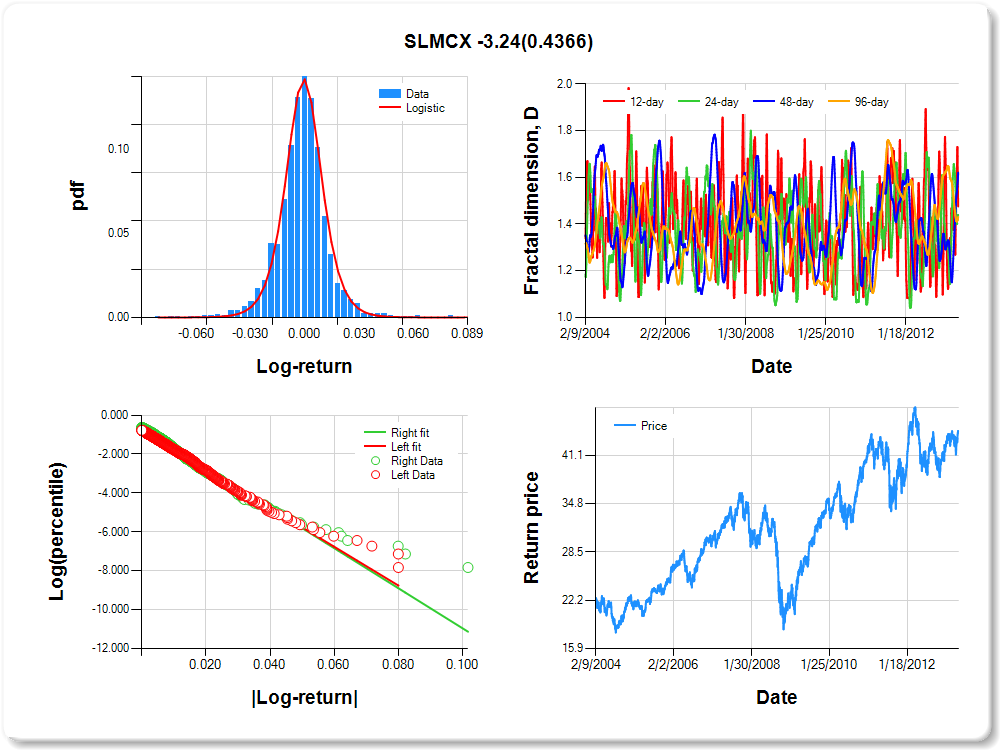

SLMCX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.04 |

-0.04 |

-0.02 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

0.92 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.181 |

0.121 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.760 |

0.042 |

-17.990 |

0.0000 |

|log-return| |

-99.758 |

2.984 |

-33.426 |

0.0000 |

I(right-tail) |

0.122 |

0.058 |

2.112 |

0.0348 |

|log-return|*I(right-tail) |

-3.238 |

4.162 |

-0.778 |

0.4366 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.525 |

0.562 |

0.380 |

0.569 |

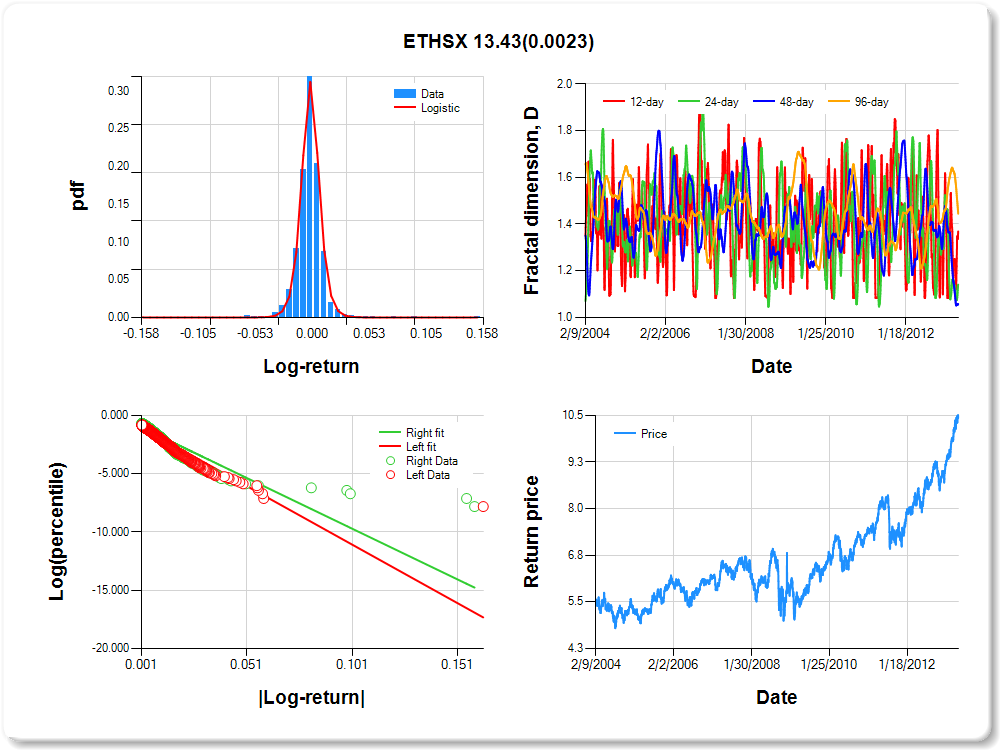

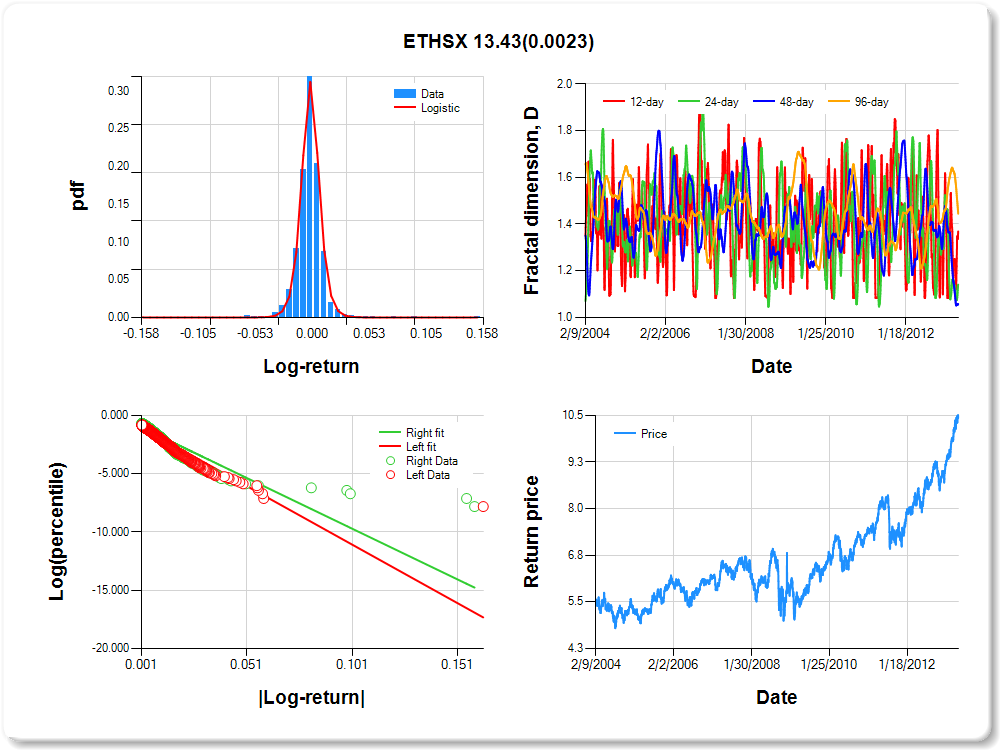

ETHSX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.04 |

-0.03 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.03 |

0.04 |

1.11 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.035 |

0.055 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.976 |

0.042 |

-23.354 |

0.0000 |

|log-return| |

-100.242 |

3.322 |

-30.179 |

0.0000 |

I(right-tail) |

0.010 |

0.056 |

0.171 |

0.8639 |

|log-return|*I(right-tail) |

13.425 |

4.390 |

3.058 |

0.0023 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.631 |

0.859 |

0.943 |

0.556 |

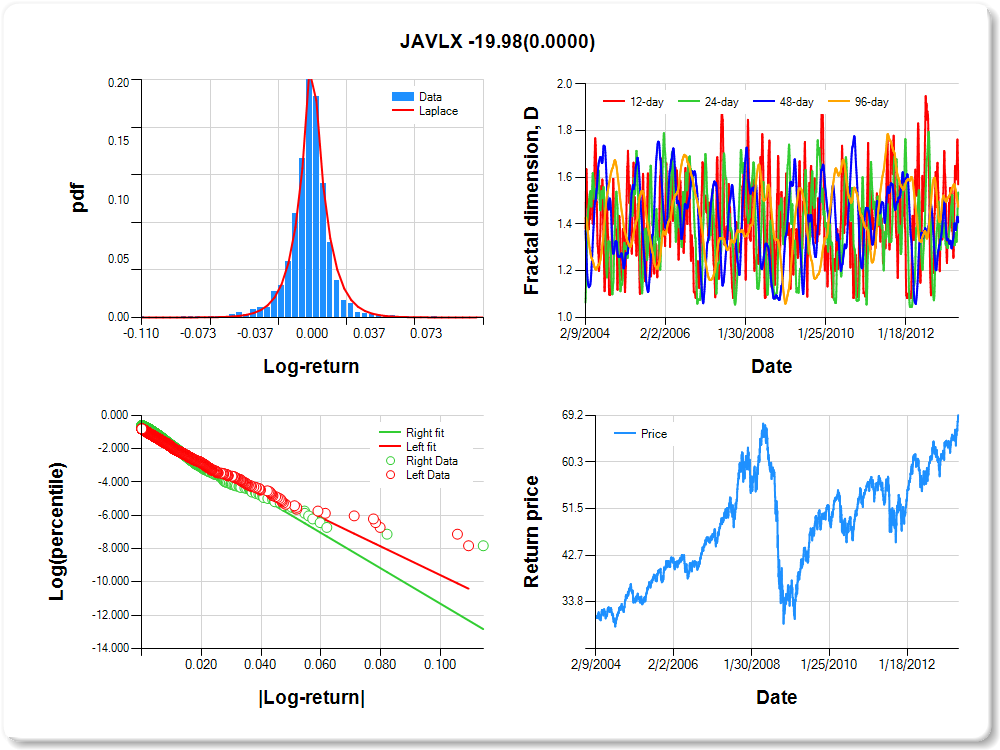

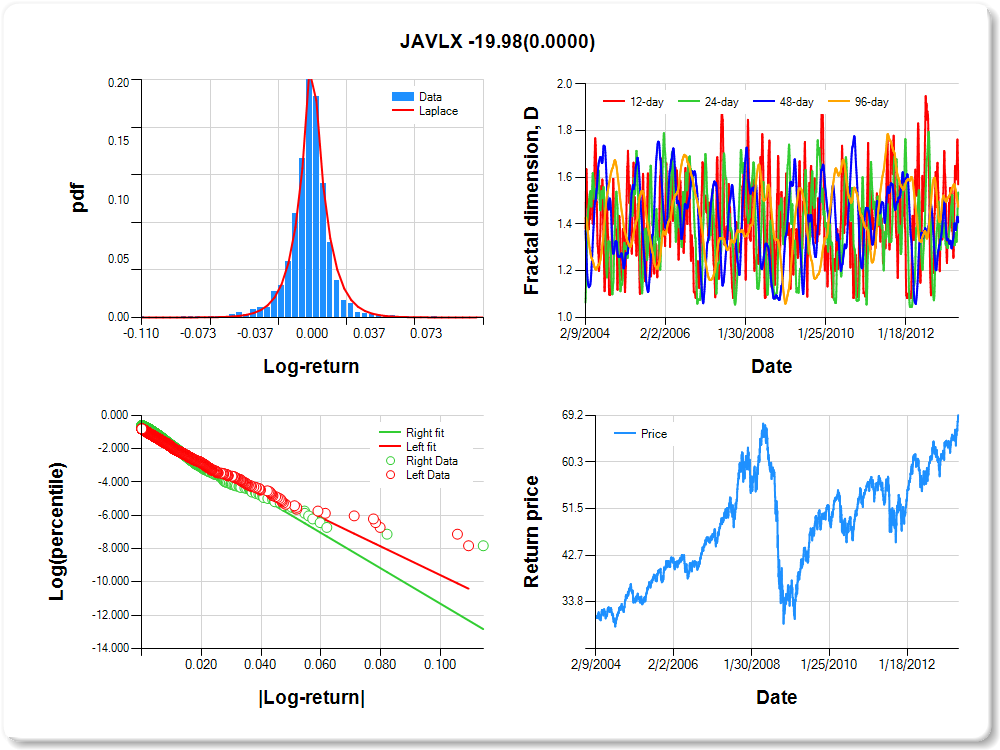

JAVLX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

0.83 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.009 |

0.136 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.957 |

0.040 |

-23.975 |

0.0000 |

|log-return| |

-86.246 |

2.665 |

-32.366 |

0.0000 |

I(right-tail) |

0.286 |

0.055 |

5.209 |

0.0000 |

|log-return|*I(right-tail) |

-19.985 |

3.993 |

-5.005 |

0.0000 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.429 |

0.464 |

0.592 |

0.526 |

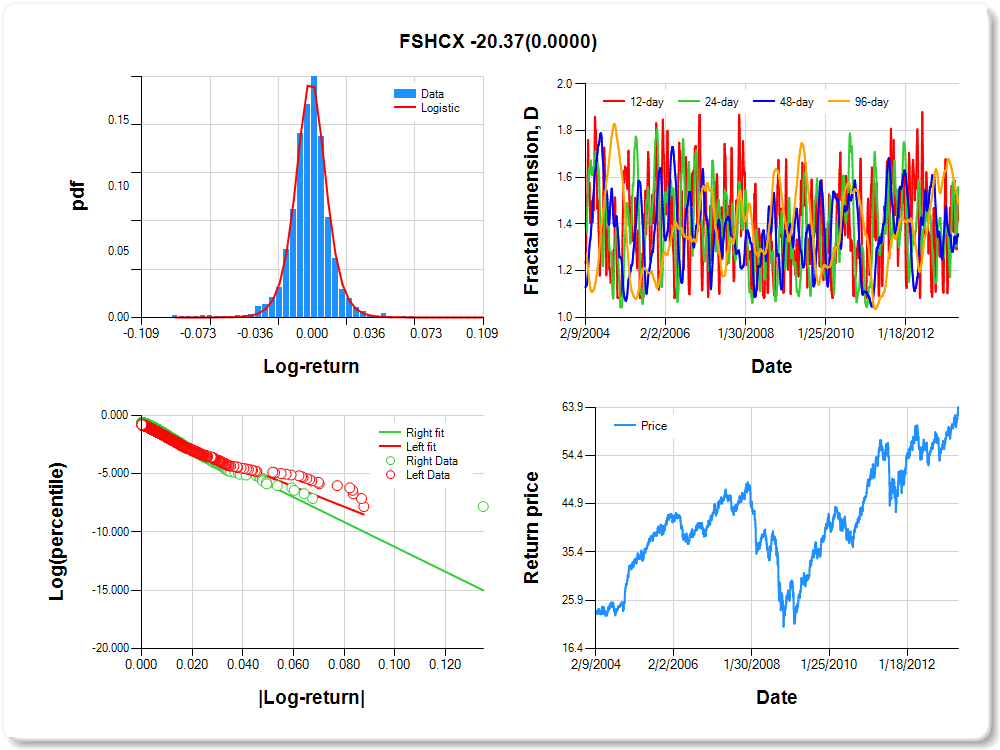

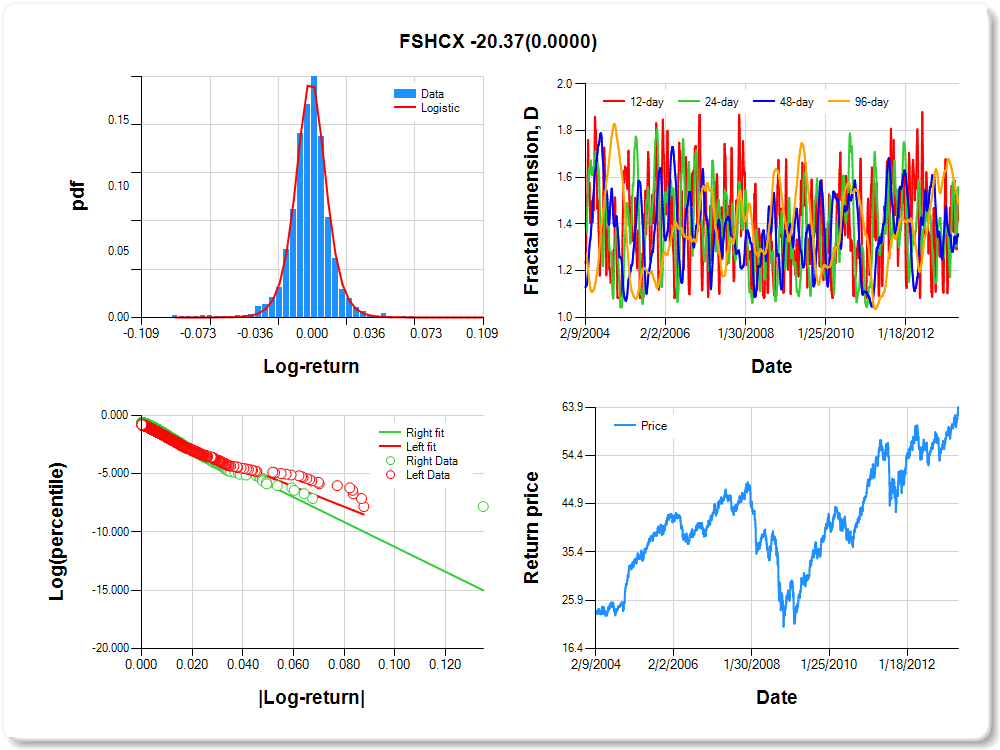

FSHCX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.04 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.03 |

0.05 |

0.55 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.345 |

0.095 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.945 |

0.040 |

-23.568 |

0.0000 |

|log-return| |

-86.099 |

2.679 |

-32.140 |

0.0000 |

I(right-tail) |

0.321 |

0.056 |

5.730 |

0.0000 |

|log-return|*I(right-tail) |

-20.374 |

4.030 |

-5.055 |

0.0000 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.586 |

0.440 |

0.644 |

0.512 |

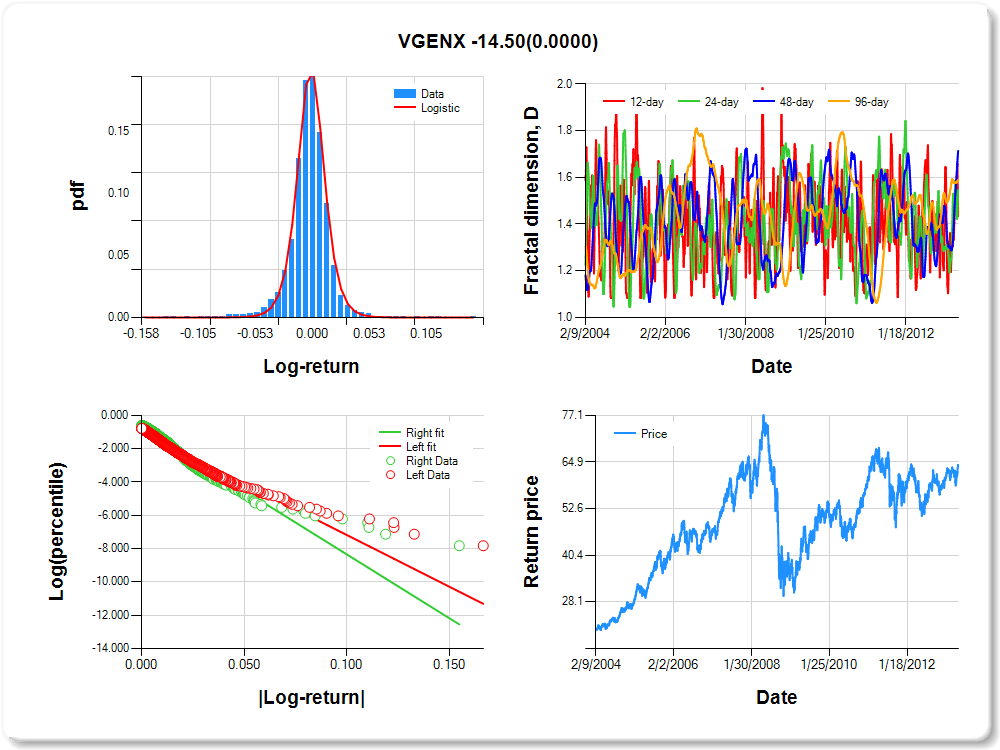

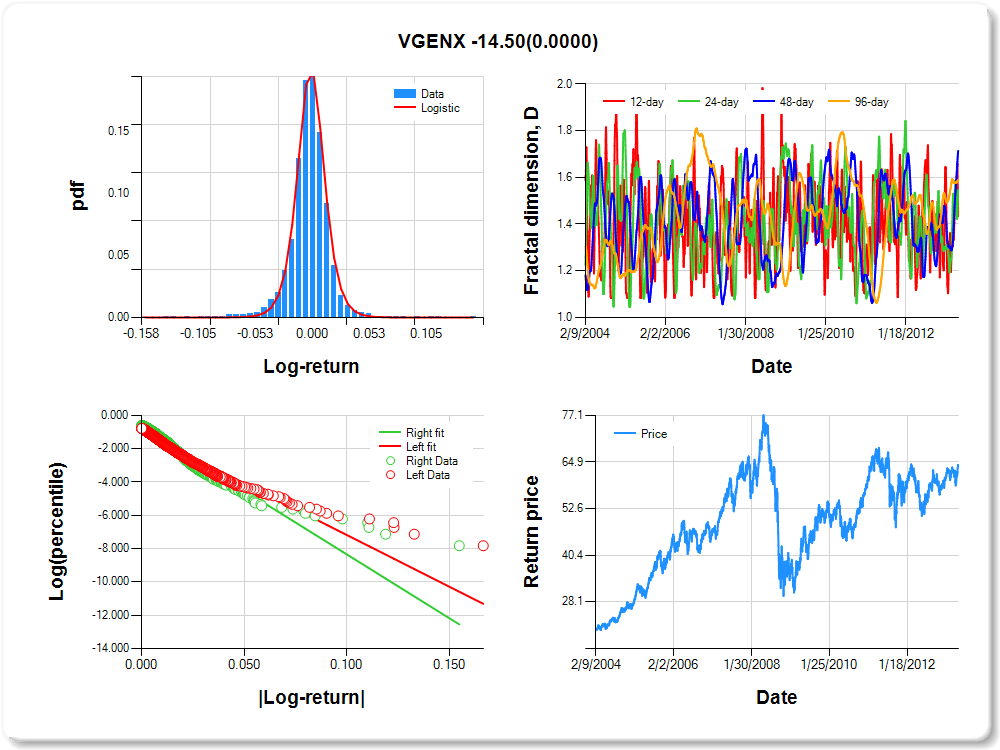

VGENX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.07 |

-0.06 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.05 |

0.06 |

0.84 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.081 |

0.085 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.974 |

0.039 |

-25.054 |

0.0000 |

|log-return| |

-62.086 |

1.918 |

-32.375 |

0.0000 |

I(right-tail) |

0.286 |

0.054 |

5.256 |

0.0000 |

|log-return|*I(right-tail) |

-14.503 |

2.908 |

-4.988 |

0.0000 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.565 |

0.454 |

0.286 |

0.413 |